Munich Personal RePEc Archive

Incidental emotions and risk-taking: An

experimental analysis

Colasante, Annarita and Marini, Matteo M. and Russo,

Alberto

Laboratori d’Economia Experimental, Universitat Jaume I,

Castellon (Spain);, Department of Economics, Università degli Studi

dell’Insubria, Varese (Italy);, Department of Management,

Università Politecnica delle Marche, Ancona (Italy).

21 February 2017

Online at

https://mpra.ub.uni-muenchen.de/82767/

Incidental emotions and risk-taking: An

experimental analysis

Annarita Colasante

1, Matteo M. Marini

2, and Alberto Russo

∗31Laboratori d’Economia Experimental, Universitat Jaume I, Castellon, Spain

2

Department of Economics, Universit`a degli Studi dell’Insubria, Varese, Italy

3

Department of Management, Universit`a Politecnica delle Marche, Ancona, Italy

Abstract

In this paper we run a laboratory experiment in order to investigate the impact of incidental emotions on individual risk-taking. In partic-ular, we induce sadness and happiness by means of audiovisual stimuli and compare the subsequent risky choices with the baseline thanks to a between-subjects design. A tweaked version of the Multiple Price List method is used to elicit individual risk preferences in the context of three different lotteries. As main result, the experimental sub-jects exhibit greater risk aversion under sadness or happiness, than under neutral conditions. Therefore, we explain the findings through the theory of ego depletion, whereby controlling emotions so as to subsequently process information consumes a limited self-regulatory resource, which is necessary to take risks as well. The outcome is detected in the first lottery but not from the second lottery onwards, probably due to unchecked order effect.

Keywords: laboratory experiment, audiovisual stimulus, emotions, preference elicitation, risk aversion, ego depletion.

JEL classification codes: C91, D81.

PsycINFO Classification codes: 2360, 2260.

∗Department of Management, Universit`a Politecnica delle Marche, Piazzale Martelli 8,

1

Introduction

Nowadays, choice behavior is undoubtedly regarded as the fruit of two inter-acting processes: the former more deliberative and rational, whereas the lat-ter more impulsive and driven by emotions (Kahneman and Frederick (2002); Loewenstein et al. (2015)). As far as risky decision making is concerned, scholars have been mainly interested in modelling choice behavior by consid-ering only the rational part of the story, such as in the case of the Expected Utility Theory. However, in the last decades some elements belonging to the affective sphere have been included thanks to Prospect Theory (Kahneman and Tversky (1979); Tversky and Kahneman (1992)), like insensitivity to probabilities and loss aversion. Within such a model, Brandst¨atter et al. (2002) further tried to explain the inverse S-shape of the probability weight-ing function as a result from anticipatweight-ing emotion related to the future realiz-ation of a risky payoff. Anyway, modelling emotions unrelated to the decision at hand becomes even trickier, especially if we consider the disagreement of the existing experimental literature about the effect of the specific type of emotion on the behavioral outcome.

Thus, this paper aims at reaching a better understanding of how dis-crete incidental emotions can influence risky decision making, given that far-reaching implications for organizational contexts could derive from this strand of literature: transient feelings are capable of directing the behavioral outcome over time. Indeed, after a certain decision is made under the influ-ence of emotion and this feeling vanishes, yet individuals keep on making new choices consistent with the initial decision driven by the incidental emotion (Andrade and Ariely, 2009).

through an ordered logit model, we find that both sad and happy individuals are more risk-averse than those in a neutral mood. In the end, we speculate that the emotions experienced before the lotteries deplete the psychological resources required to take risks, in accordance with a past application of

ego depletion theory (Unger and Stahlberg, 2011). The result is detected in the first lottery but vanishes from the second lottery onwards, presum-ably because of unchecked order effect. Since salient financial incentives are provided, finally each participant is paid according to the decisions made during the lottery-choice tasks.

The rest of the paper is organized as follows. Section 2 provides a dis-cussion on the possible sources of disagreeement within the literature, by bringing up topics like the definition of emotion and the existing methods to elicit risk aversion. Section 3 describes the experimental design. The results are presented in Section 4, where, after checking for the effectiveness of the emotion induction procedure, we propose two analyses of risk behavior as well as discuss possible explanations. Section 5 concludes.

2

Kinds of affect and methods to elicit risk

preferences

to change negative emotional state and take more risks. Having a look at the experimental evidence, we observe a really mixed context and findings at odds with each other: some authors, like Nygren et al. (1996) and Chou et al. (2007), encounter positive correlation between good mood and risk taking behavior; instead other works, like Chuang and Lin (2007) as well as Kliger and Levy (2003), show opposite results that support the MMH. Finally, it is not uncommon to come across intermediate conclusions, such as the case of Conte et al. (2016) who show that both positive and negative emotions increase the willingness to take risks, or Drichoutis and Nayga Jr (2013) reaching an opposite conclusion.

This conflicting evidence could be due to two main causes, that is, the difference in meaning between mood and emotion, and the various risk elicit-ation methods. Indeed, scholars have broadly used the terms mood, emotion

and affect as synonyms, but there is a clear distinction as far as Psychology is concerned. According to Robbins and Judge (2012),affect defines a broad range of feelings that people experience, including both emotion as an in-tense short feeling coming from a specific stimulus, and mood, depicted as a less intense feeling which lasts for longer time. Anyway, since our experiment includes a multisensory stimulus, herein we focus on emotions.

Going through the research area of decision making under risk, the mean-ingful distinction between anticipated or expected emotion and immediate emotion is to be pointed out. As in Rick and Loewenstein (2008), the former refers to predictions about the emotion that agents will experience after knowing the outcome of their own choice, whereas the latter corresponds to the immediate reaction at the time of decision making, and in turn falls into one of two categories. Indeed, even if connected with the consequences of one’s decision, integral emotion is experienced at the time of decision making and provides individuals with more thorough information about their own tastes. Finally, incidental emotion is felt during decision making but totally unrelated to the choice at hand, and represents the object of this paper.

usu-ally all classified as “negative emotion”, impinge differently on risk aversion with respect to each other. Accordingly, in order to avoid typical ambiguity of the valence-based approach (Zeelenberg and Pieters, 2006), in the current work we prefer to focus on specific feelings, that is, sadness and happiness.

The second reason why the previous literature disagrees could be asso-ciated with the different experimental methodologies used for eliciting indi-vidual risk aversion. In accordance with Charness et al. (2013), we can cite among them:

• The Balloon Analogue Risk Task (BART) (Lejuez et al., 2002). In this kind of experiment the only task is to pump a series of virtual balls. For each pump the participant wins 5 cents in a temporary account and, at whatever moment of game, she can decide to move the amount in a permanent account. In this case a new small ball appears. Instead, if the balloon bursts before moving the money, then the player loses the amount in the temporary account and a new balloon appears. On the one hand, the larger becomes the ball, the higher is the amount in the temporary account; on the other hand, the burst probability increases with the dimension of the ball. The measure of risk aversion is the adjusted number of pumps, whereby a high number of pumps denotes risk-seeking behavior.

• The Gneezy and Potters Method (Gneezy and Potters, 1997). In this game players receive a certain amount and have to decide how much to invest in a risky option which offers a certain dividend. The difference between the initial amount and the investment in the risky choice is kept by the player. The higher the investment, the lower the risk aversion level.

specific coefficient of relative risk aversion, which is computed under the assumption of a specific form of the utility function, namely, preferences are modeled according to a Constant Relative Risk Aversion utility function (CRRA).

Since this is merely an exemplifying list, we refer the reader to Andersen et al. (2006) for a review of the most relevant risk elicitation methods.

To sum up, studies grounded on different kinds of affect or different risk elicitation methods have led to dissimilar findings, and comparisons among them are questionable as well.

Therefore, some caveats about these two features are necessary before moving on. Even though for the sake of simplicity we are going to employ the terms emotion and mood without distinction throughout the paper, we are actually interested in understanding the impact of incidental sadness and happiness on risk aversion, by using a MPL method to elicit risk preferences1

.

3

Experimental design

We conduct four different treatments in four different sessions, following the same scheme in each one: (i) a first stage in which, after a brief socioeconomic questionnaire is filled in, we convey a specific audiovisual stimulus and check for its efficacy, (ii) a second stage in which the participants make risky choices by using our version of the Multiple Price List method.

Since we are interested in analyzing the effect of different kinds of emotion on risk aversion, we use the audiovisual stimulus as control variable and employ four treatments that can be distinguished just on the basis of it. According to the existing literature, several techniques are suitable to elicit a specific emotion, as Westermann et al. (1996) also highlighted. Indeed, each mood induction procedure can be classified as simple if only one of the techniques is used, or combined in case more techniques are implemented together. Following some useful advice (Mayer et al., 1995), we combine two of the eleven existent methods, namely, images in addition to music, in

1

order to avoid ineffective induction procedures. In particular, referring to the communicative theory of emotions (Johnson-Laird and Oatley, 2008), we assume that only fourbasic emotions (happiness, sadness, anxiety and anger) can be evoked through music. Therefore, we focus on sadness and happiness in addition to two control treatments, selecting musical pieces which are supposed to induce negative, positive or neutral conditions; moreover, we choose sad, happy or neutral pictures to be shown during the listening phase of the respective treatments, in order to enhance the wished emotions.

Therefore, we run four different sessions:

• the N-treatment (negative treatment), in which the participants listen to few minutes of the musical piece “Polymorphia” by Penderecki ac-companied by negative images, so that they can experience sadness;

• the P-treatment (positive treatment) in which we select Bernstein’s track “Mambo” and some positive pictures, in order to induce happi-ness;

• the CS-treatment (control treatment with audiovisual stimulus), in which we propose an excerpt from the neutral piece “Symphony n.40” by Mozart2

in addition to a few neutral images; and finally

• the C-treatment (control treatment), without music or pictures.

In the following sections, sometimes we will cluster the observations coming from the N-treatment and the P-treatment, and refer to them as Emotional treatments. In the same way, we will name Baseline the data combined from the CS-treatment and the C-treatment.

A summary of the whole mood induction procedure is shown in Table 1, whereas a description of the manipulation check is contained in subsection 4.1.

Moving to the second phase, the risk aversion elicitation task consists of three lotteries based on a MPL method similar to that one proposed by Abdellaoui (2000), Ding et al. (2010) and Abdellaoui et al. (2011), namely,

2

Table 1: Treatments

Emotional Treatments Baseline

N-treatment P-treatment CS-treatment C-treatment

Participants 35 30 30 28

Emotion Negative Positive Neutral Neutral

Stimulus yes yes yes no

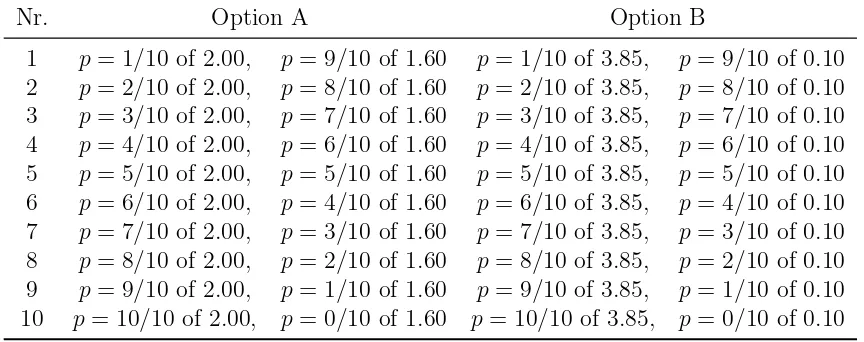

a list in which players can choose ten times either a risky option (i.e., a fixed probability to win an amount of money), or a safe amount. The main difference between our game and Holt and Laury (2002)’s version lies in the fact that Holt and Laury considered a list of paired risky options, as shown in Table 2. Indeed, in that case the safe choice is represented by Option A, whose payoffs are less variable than Option B but still risky.

The MPL method is one of the most used formats to elicit individual risk aversion, and its pros and cons are highlighted by Andersen et al. (2006). His popularity is due to simplicity of the structure and the possibility to gather lots of observations and pay just one of the choices by random selection, without decreasing the salience of payments (Laury, 2005). Going back to Table 2, by the last row any subject should cross over to Option B, thereby making manifest her own risk preferences. In contrast, the main disadvantage of this format arises from the occurence of multiple switch points, which according to Charness et al. (2013) could be due to misunderstanding of the instructions and, accordingly, seen as inconsistent behavior.3

Andersen et al. (2006), instead, argue that such a conduct can be considered as indifference between choices. All in all, since in our setting we include an explicit choice for indifference between the safe and the risky choices (i.e., a specific row of the table where to cross over to the other option) and we still observe inconsistent choices, the occurrence of multiple switch points is probably due to lack of attention or scarce comprehension of the instructions. However,

3

Table 2: Ten paired lottery proposed by Holt and Laury (2002)

Nr. Option A Option B

1 p= 1/10 of 2.00, p= 9/10 of 1.60 p= 1/10 of 3.85, p= 9/10 of 0.10 2 p= 2/10 of 2.00, p= 8/10 of 1.60 p= 2/10 of 3.85, p= 8/10 of 0.10 3 p= 3/10 of 2.00, p= 7/10 of 1.60 p= 3/10 of 3.85, p= 7/10 of 0.10 4 p= 4/10 of 2.00, p= 6/10 of 1.60 p= 4/10 of 3.85, p= 6/10 of 0.10 5 p= 5/10 of 2.00, p= 5/10 of 1.60 p= 5/10 of 3.85, p= 5/10 of 0.10 6 p= 6/10 of 2.00, p= 4/10 of 1.60 p= 6/10 of 3.85, p= 4/10 of 0.10 7 p= 7/10 of 2.00, p= 3/10 of 1.60 p= 7/10 of 3.85, p= 3/10 of 0.10 8 p= 8/10 of 2.00, p= 2/10 of 1.60 p= 8/10 of 3.85, p= 2/10 of 0.10 9 p= 9/10 of 2.00, p= 1/10 of 1.60 p= 9/10 of 3.85, p= 1/10 of 0.10 10 p= 10/10 of 2.00, p= 0/10 of 1.60 p= 10/10 of 3.85, p= 0/10 of 0.10

as far as our analysis is concerned, the issue of multiple switch points is not relevant, as we are going to clarify in Section 4.

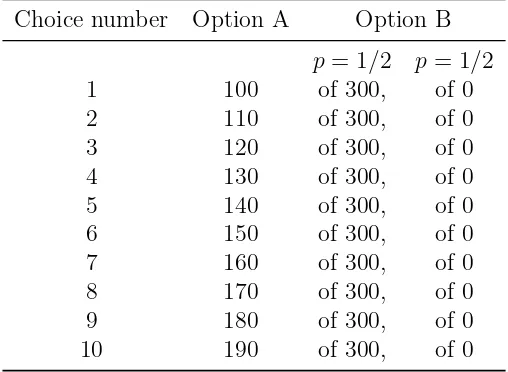

Our three lotteries, whose specifications are shown respectively in Table 3, Table 4 and Table 5, have the following peculiarities:

• Lottery 1: the safe choices (Option A) range from 100 to 190, while the amount and the win probability of the risky choices (Option B) are constant.

• Lottery 2: the safe choices (Option A) are constant and equal to 100, whereas the win probability of the risky choices (Option B) gradually increases from 0.1 to 1.

• Lottery 3: whilst the safe choices (Option A) are represented by a con-stant loss equal to −20, the risky choices (Option B) involve increasing probability to lose 100.

Table 3: Lottery 1

Choice number Option A Option B

p= 1/2 p= 1/2 1 100 of 300, of 0 2 110 of 300, of 0 3 120 of 300, of 0 4 130 of 300, of 0 5 140 of 300, of 0 6 150 of 300, of 0 7 160 of 300, of 0 8 170 of 300, of 0 9 180 of 300, of 0 10 190 of 300, of 0

game as clear as possible and avoid misunderstandings, as implemented in Plott and Zeiler (2005) and Shupp et al. (2013).

Table 3 shows the lottery in which we vary the riskless amount and fix the gamble: we expect that a risk neutral person will choose Option B six times before switching to Option A.

Table 4 shows the lottery in which we fix the amount of the safe choice, while the probability to win the gamble changes: here we expect that a risk neutral person will choose Option A four times before switching to Option B.

Table 5, finally, shows the lottery defined in the loss domain: players have to choose between a small sure loss and a risky option in which it is possible not to lose anything. In this case, we expect that a risk neutral person will choose Option B two times before switching to Option A.

Table 4: Lottery 2

Choice number Option A Option B

[image:12.595.128.465.491.664.2]1 100 p= 1/10 of 250, p= 9/10 of 0 2 100 p= 2/10 of 250, p= 8/10 of 0 3 100 p= 3/10 of 250, p= 7/10 of 0 4 100 p= 4/10 of 250, p= 6/10 of 0 5 100 p= 5/10 of 250, p= 5/10 of 0 6 100 p= 6/10 of 250, p= 4/10 of 0 7 100 p= 7/10 of 250, p= 3/10 of 0 8 100 p= 8/10 of 250, p= 2/10 of 0 9 100 p= 9/10 of 250, p= 1/10 of 0 10 100 p= 10/10 of 250, p= 0/10 of 0

Table 5: Lottery 3

Choice number Option A Option B

place in the cubicle. After starting the game, the participants read again the instructions in their own screen, filled in the questionnaire and were invited to put on the headphones to get involved in the feeling suggested by music and images. Since salient financial incentives were provided, in the end the players were paid according to the decisions made during the lottery-choice tasks, in order to increase the incentive to behave correctly and reveal true preferences. Indeed, regarding each participant we randomly drew one of her choices in each lottery and paid her in accordance with the sum of these values. The experiment lasted about 40 minutes and the average payment amounted to 8 euro, including a show-up fee of 3 euro.

4

Results

In this section we are going to show and comment on the results of the experiment. Firstly, we test the efficacy of the mood induction procedure. Secondly, the data related to each lottery are analyzed by using the individual number of risky choices as risk-taking indicator. Thirdly, we rely on the ordered logit model as suitable tool for enhancing the study. Finally, a general discussion is provided to shed light on possible explanations.

4.1

Manipulation check

Before moving to the results, a few issues have to be clarified.

Throghout the paper, (i) we always combine the data from the CS-treatment and the C-treatment, assuming that they both fostered neutral conditions. At the same time, (ii) we hypothesize that the N-treatment in-duced sadness, whereas the P-treatment elicited happiness.

In order to test such hypotheses, immediately after the audiovisual stim-ulus and before Lottery 1 we asked players to report a self-evaluation of their own emotion by using a 6-point Likert scale (Matell and Jacoby, 1971) and a series of adjectives.

Table 6: Mood questions after the stimulus

Emotional Treatments Baseline

N-treatment P-treatment CS-treatment C-treatment

How much are Sad Happy Sad Sad

you ... from 0 Worried Carefree Happy Happy

to 5? Scared Serene

Doubtful Determined

we wanted to enhance the impact of music and pictures as well as we were able to avoid experimenter demand effects (Zizzo, 2010), since it is not in-tuitive what risky decisions good (or bad) mood should trigger. In other words, the emotion measurement itself was part of the induction procedure, but preserved validity because at the same time let individuals not give false answers, as in Campos-Vazquez and Cuilty (2014).

Anyway, this design allows us to compare the responses related to sadness and happiness, that are object feelings of study.

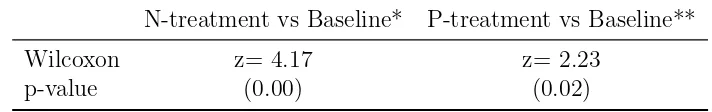

By so doing, in Figure 1 we easily see that the procedure of clustering both the control treatments under the label Baseline is validated, because no differences in moods were found.4

Furthermore, the boxplot in Figure 2 suggests that players in the N-treatment were actually sadder than those in the Baseline. At the same time, individuals in the P-treatment seem to be happier than those in the

Baseline. This impression is supported by the Wilcoxon rank sum test in Table 7.

Therefore, we theorize that the emotion induction procedure was success-ful and the behavioral outcomes in subsections 4.2 and 4.3 are due to the different emotions experienced at the time of decision making.

4

0 1 2 3 4 5

Sad Happy Sad Happy

[image:15.595.128.466.138.364.2]CS-treatment C-treatment

Figure 1: Intensity of moods in the control treatments

0 1 2 3 4 5

Sad Happy Sad Happy

N-treatment P-treatment Baseline

[image:15.595.127.468.442.664.2]Table 7: Comparison of inducted moods distributions

Nonparametric test

N-treatment vs Baseline* P-treatment vs Baseline**

Wilcoxon z= 4.17 z= 2.23

p-value (0.00) (0.02)

*Sadness is compared. **Happiness is compared.

4.2

The individual number of risky choices as

risk-taking indicator

As stated in Section 3, in this phase of the experiment we use a tweaked version of the MPL format due to its simplicity and appropriateness for eliciting individual risk preferences. When highlighting the pros and cons of this approach, Andersen et al. (2006) stress the understandability of the structure as well as its flexibility to incentives as main advantages, whereas they indicate the possibility of multiple switch points as chief drawback. On the one hand, the same authors argue that this kind of behavior can be seen as indifference between choices, but on the other hand Charness et al. (2013) suggest that the occurrence of multiple switch points is due to misunderstanding of the instructions.

As said before, since in our design we include an explicit choice for in-difference between the safe and the risky choices (i.e., a specific row of the table where to cross over to the other option) and we still observe incon-sistent choices, our conclusion is that the inconincon-sistent behavior is arguably due to lack of attention or scarce comprehension of the instructions. Indeed, if we pool all the observations, in the first lottery 49 out of 123 subjects (39.84%) make inconsistent choices, but the trend decreases to 19 parti-cipants (15.45%) in the second lottery and 33 individuals (26.83%) in the third one, thanks to the learning effect. This evidence is highlighted in Fig-ure 3, where the proportion of inconsistent subjects is represented by the dark blue bars.

0% 20% 40% 60% 80% 100%

Lottery 1 Lottery 2 Lottery 3

[image:17.595.114.479.161.361.2]Inconsistent subjects Consistent subjects

Figure 3: Proportion of inconsistent subjects in each lottery

since the total number of safe (risky) choices within a single lottery can be used as individual risk aversion (risk-taking) indicator, as Holt and Laury (2002) point out.

Focusing on the first lottery, we remind the reader that the probability of winning the risky option is held constant and equal to 50%, while the amount of the safe option gradually increases from 100 to 190. Therefore, a risk neutral person is expected to chooseOption B six times, before switching to Option A.

In Figure 4, we show the proportion of risky choices made by the players in each decision. Having drawn a grey line to indicate the prediction under the hypothesis of risk neutrality, the percentage of risky choices falls very quickly after the fifth choice both in theN-treatment and in theP-treatment. Whereas, in the Baseline more than 30% of the participants still prefer the risky option until the last choice.

0 0.2 0.4 0.6 0.8 1

1 2 3 4 5 6 7 8 9 10

Decision N-treatment

[image:18.595.132.466.132.382.2]P-treatment Baseline Risk-neutral prediction

Figure 4: Proportion of risky choices in each decision - Lottery 1

emotions increased risk aversion.

In order to check if our graphical analysis is significant, we compare our treatments with respect to the individual number of risky choices by running the Wilcoxon rank sum test, whose results are shown in Table 8 together with the summary statistics. The nonparametric test rejects the null hypothesis, underlining that the participants in a positive or negative mood are actually more risk averse than the individuals in a neutral mood.

Furthermore, no noteworthy results come out of the comparison between the N-treatment and theP-treatment.5

The second lottery differs from the previous one with respect to two peculiarities: in this case the amount of the safe option is held constant and equal to 100, while the probability of winning the risky option increases from 0.1 to 1. Moreover, the risk-neutral prediction involves going for the safe option four times, before switching to the risky one.

5

Table 8: Comparison of risky choices distributions - Lottery 1

Summary statistics

N-treatment P-treatment Baseline

Mean 4.66 5.13 5.79

Median 5 5 6

Standard deviation 1.71 1.59 2.21

Nonparametric test

N-treatment vs Baseline P-treatment vs Baseline

Wilcoxon z= -2.96 z= -1.88

p-value (0.00) (0.05)

0 0.2 0.4 0.6 0.8 1

1 2 3 4 5 6 7 8 9 10

Decision

[image:19.595.131.466.419.673.2]N-treatment P-treatment Baseline Risk-neutral prediction

Table 9: Comparison of risky choices distributions - Lottery 2

Summary statistics

N-treatment P-treatment Baseline

Mean 4.91 5.17 5.28

Median 5 5 5.5

Standard deviation 1.40 1.51 1.93

Nonparametric test

N-treatment vs Baseline P-treatment vs Baseline

Wilcoxon z= -0.95 z= -0.25

p-value (0.34) (0.81)

Taking into account these modifications, in Figure 5 we illustrate the risky choices made by players in each decision. This time, at first sight nothing can be said about potential divergent patterns of behavior among treatments, since no line seems to stand out from the maze. Such an impression is confirmed by the Wilcoxon rank sum test in Table 9, where we also display the summary statistics and find no differences between groups.6

Finally, the third lottery is defined in the loss domain: the amount corres-ponding to the safe option is fixed and equal to -20, whereas the probability of losing money in the risky option gradually increases from 0.1 to 1. This time, any risk-neutral subject is expected to choose Option B twice, before crossing over to Option A.

As we see in Figure 6, the relative trend of risk choices is quite similar to the previous lottery despite the different framework, in the sense that the proportion of risky choices in each decision falls in a homogeneous way, and does not seem to be affected by the specific emotional state. The insight is demonstrated in Table 10, where we fail to reject the null hypothesis of significantly different distributions.7

6

No difference is also detected between the twoEmotional treatments(z = 0.53; p-value = 0.59).

7

0 0.2 0.4 0.6 0.8 1

1 2 3 4 5 6 7 8 9 10

Decision

[image:21.595.130.467.150.396.2]N-treatment P-treatment Baseline Risk-neutral prediction

[image:21.595.139.455.516.587.2]Figure 6: Proportion of risky choices in each decision - Lottery 3

Table 10: Comparison of risky choices distributions - Lottery 3

Summary statistics

N-treatment P-treatment Baseline

Mean 3.17 3.23 3.26

Median 3 3 3

Standard deviation 1.67 1.52 1.90

Nonparametric test

N-treatment vs Baseline P-treatment vs Baseline

Wilcoxon z= 0.14 z= 0.18

Table 11: Comparison of invested sum distributions

Summary statistics

N-treatment P-treatment Baseline

Mean 160.66 152.60 221.33

Median 80 80 100

Standard deviation 217.68 213.11 276.44

Nonparametric test

N-treatm vs Baseline P-treatm vs Baseline N-treatm vs P-treatm

Wilcoxon z= -0.98 z= -0.86 z= 0.05

p-value (0.33) (0.39) (0.96)

Summing up, in Lottery 1 both participants in a good mood and subjects in a bad mood were more risk averse than people in a neutral mood, but this evidence disappeared from Lottery 2 onwards.

In order to understand whether our findings can actually be attributed to the emotions experienced, we rely on the initial questionnaire and check for the risk preferences that we had elicited before the mood induction procedure through the following question:

• “You are given the opportunity to buy a financial product which with the same probability allows you to win 1000 euro or to lose the invested sum. How much are you willing to pay for such a financial product?”

As depicted in Table 11, when we compare the answers to the question by treatment, the Wilcoxon rank sum test finds no differences between groups: the subjects in the Emotional treatments seem to be initially as risk-averse as the players in theBaseline, unlike results in Lottery 1. This fact enhances the results of the study.

4.3

The ordered logit model

As further proof in favour of the previous findings, in this subsection we include the ordered logit model as appropriate tool to describe our data. In-deed, for each lottery we cumulate all the 123 observations, thereby obtaining three models. In each of them, the dependent variable is represented by:

• our Risk-taking indicator, which consists of a sum of risky choices ran-ging from 0 to 10. Therefore, it is a discrete ordinal variable whereby we assume that higher values correspond to higher risk-seeking. This measurement is carried out after the mood induction procedure, if any.

Moreover, we include the following variables as regressors:

• Emotions: it is a dummy assuming the value of 1, in case the subject belongs to either the N-treatment or the P-treatment. Otherwise it is equal to 0, denoting neutral emotion. In this way, we equalize both the individuals in a good mood and the players in a bad mood, following the results in subsection 4.2. Therefore, our hypothesis is that such a variable is statistically significant in Lottery 1, but not from Lottery 2 onwards.

• Invested sum: it is a continuous variable displaying the answer to the risk-related question that we reported in the previous subsection. That question, contained in the initial socioeconomic questionnaire, aimed at measuring risk aversion before the mood induction procedure. There-fore, by including this variable in the model, we try to isolate the effect of Emotions from the individual endowment of risk aversion.

• Female: it is a dummy equal to 1 in case gender is feminine, and 0 otherwise. In this way, we control any possible gender effect on the dependent variable.

In Table 12 we calculate the coefficients via maximum likelihood estima-tion (MLE) for all the three lotteries.

Table 12: Ordered logit models

Dependent variable: Risk-taking indicator

Lottery 1 Lottery 2 Lottery 3

Emotions -0.967*** -0.193 0.248 (0.342) (0.327) (0.328)

Invested sum 0.001 0.001* 0.002*** (0.001) (0.001) (0.001)

Female -0.047 -0.522 0.892*** (0.324) (0.326) (0.334)

Observations 123 123 123

Log-likelihood -239.643 -225.429 -226.2066

LR test χ2

(3) = 51.86 χ2

(3) = 50.23 χ2

(3) = 51.46 p-value (0.00) (0.00) (0.00)

***Significant at the 1 percent level **Significant at the 5 percent level *Significant at the 10 percent level

lower Risk-taking indicator, that is, it makes the subject more risk-averse. The related significance at the 1 percent level leads us to conclude that the previous findings are confirmed. Indeed, neither Lottery 2 nor Lottery 3 displays significance of Emotions.

As additional result, it comes out that in Lottery 3, when it is possible to make a loss, females want to avoid safe losses at all costs and accordingly take more risks. In this final lottery, the behavioral outcome is driven by the initial willingness to gamble, rather than the emotions experienced.8

4.4

Discussion

At this point, solid ground is present to visualize how sadness and happiness impacted on risk-taking. Accordingly, we search for possible explanations:

• on the one hand, the Affect Infusion Model (AIM) (Forgas, 1995) is

8

consistent with pronounced risk aversion of sad individuals, but fails to account for similar risk attitude of happy subjects;

• on the other hand, the Mood Maintenance Hypothesis (MMH) (Isen and Patrick, 1983) justifies caution shown by players in a good mood, but is not consistent with the reduced risks taken under the influence of sadness.

Clearly, these two theories do not explain our data, and it is necessary to look for alternative explanations.

Therefore, we theorize that the phenomenon known as ego depletion

(Baumeister et al., 1998) played a crucial role during risky decision making. According to this theory, controlling emotions and processing information are only two of some activities consuming a limited self-regulatory resource, which can be seen as kind of energy. Once this resource is even partly used, subsequent performance on self-control-related tasks will be undermined.

Concerning the consequences on risky decision making, we follow the approach proposed by Unger and Stahlberg (2011), whereby two types of risk behavior should be distinguished. If the decision task is represented by a gamble without perceived control over the final outcomes, like in the case of playing roulette, then ego depletion conditions are expected to increase risk-taking. Whereas, if the task at hand is embodied by a responsible economic decision involving the selection of several options different with respect to outcome probabilities and payoffs, then ego depletion leads to risk aversion. However, both the negative and the positive potential consequences of the decision have to materialize immediately, and not only in the distant future. Otherwise, reduced self-control fosters risk-seeking behavior like in the case of smoking, whose negative effects arise after ages but emotional rewards are instantaneous.

Indeed, according to Fischer et al. (2007) subjects under ego depletion become less optimistic about their own chances. The authors show that the construction of positive views of the self requires the same above-mentioned self-regulatory resource, because such positive illusions can need “activit-ies such as defending own standpoints, biased memory encoding and re-trieval, suppression of threatening information, or selective devaluation of self-inconsistent evidence”(Fischer et al., 2007, p. 1307). Therefore, lack of optimism triggered by ego depletion could further explain the greater risk aversion observed in the Emotional treatments in Lottery 1.

Finally, as far as the different findings in Lottery 2 and Lottery 3 are concerned, we speculate that possible order effects represent the limit of this investigation, and could have influenced the final outcomes. Indeed, our design confounded order and treatment effects because all the three lotteries were always carried out in the same order, making arduous any possible interpretation.

Also for this reason, supplementary investigations are desirable to cor-roborate the fascinating ego-depletion story.

5

Conclusions

which could have led them to greater risk-averse behavior through less op-timistic expectations about the future (Fischer et al., 2007). The result is detected in the first lottery but vanishes from the second lottery onwards, presumably due to unchecked order effect.

In any case, these findings add new empirical evidence to a literature which is still in its infancy, given that the two chief psychological theories of emotions and risk-taking (AIM and MMH) are not supported. Definitely, additional research is needed to have a firm grasp of the role of emotions in risky decision making.

Acknowledgments

References

Abdellaoui, M. (2000). Parameter-free elicitation of utility and probability weighting functions. Management Science, 46(11):1497–1512.

Abdellaoui, M., Driouchi, A., and L´ Haridon, O. (2011). Risk aversion elicitation: reconciling tractability and bias minimization. Theory and Decision, 71(1):63–80.

Andersen, S., Harrison, G. W., Lau, M. I., and Rutstr¨om, E. E. (2006). Elicit-ation using multiple price list formats. Experimental Economics, 9(4):383– 405.

Andrade, E. B. and Ariely, D. (2009). The enduring impact of transient emo-tions on decision making. Organizational Behavior and Human Decision Processes, 109(1):1–8.

Baumeister, R. F., Bratlavsky, E., Muraven, M., and Tice, D. M. (1998). Ego depletion: Is the active self a limited resource? Journal of Personality and Social Psychology, 74(5):1252–1265.

Binswanger, H. P. (1980). Attitudes toward risk: Experimental measurement in rural india. American journal of agricultural economics, 62(3):395–407.

Brandst¨atter, E., K¨uhberger, A., and Schneider, F. (2002). A cognitive-emotional account of the shape of the probability weighting function.

Journal of Behavioral Decision Making, 15(2):79–100.

Campos-Vazquez, R. M. and Cuilty, E. (2014). The role of emotions on risk aversion: a prospect theory experiment. Journal of Behavioral and Experimental Economics, 50:1–9.

Charness, G., Gneezy, U., and Imas, A. (2013). Experimental methods: Eliciting risk preferences. Journal of Economic Behavior & Organization, 87:43–51.

Chuang, S.-C. and Lin, H.-M. (2007). The effect of induced positive and negative emotion and openess-to-feeling in student’s consumer decision making. Journal of Business and Psychology, 22(1):65–78.

Conte, A., Levati, M. V., and Nardi, C. (2016). Risk preferences and the role of emotions. Economica, forthcoming.

Ding, X., Hartog, J., and Sun, Y. (2010). Can we measure individual risk attitudes in a survey? Technical report, Tinbergen Institute Discussion Paper.

Drichoutis, A. C. and Nayga Jr, R. M. (2013). Eliciting risk and time prefer-ences under induced mood states. The Journal of Socio-Economics, 45:18– 27.

Fischer, P., Greitemeyer, T., and Frey, D. (2007). Ego depletion and positive illusions: Does the construction of positivity require regulatory resources?

Personality and Social Psychology Bulletin, 33(9):1306–1321.

Forgas, J. P. (1995). Mood and judgment: the affect infusion model (aim).

Psychological bulletin, 117(1):39.

Gneezy, U. and Potters, J. (1997). An experiment on risk taking and evalu-ation periods. The Quarterly Journal of Economics, pages 631–645.

Holt, C. A. and Laury, S. K. (2002). Risk aversion and incentive effects.

American economic review, 92(5):1644–1655.

Isen, A. M. and Patrick, R. (1983). The effect of positive feelings on risk taking: When the chips are down. Organizational Behavior and Human Performance, 31(2):194–202.

Jacobson, S. and Petrie, R. (2009). Learning from mistakes: What do in-consistent choices over risk tell us? Journal of Risk and Uncertainty, 38(2):143–158.

Kahneman, D. and Frederick, S. (2002). Representativeness revisited: At-tribute substitution in intuitive judgment. In Gilovich, T., Griffin, D., and Kahneman, D., editors, Heuristics & biases: The psychology of intuitive judgment. New York: Cambridge University Press.

Kahneman, D. and Tversky, A. (1979). Prospect theory: an analysis of decision under risk. Econometrica: Journal of the Econometric Society, 47(2):263–292.

Kliger, D. and Levy, O. (2003). Mood-induced variation in risk preferences.

Journal of economic behavior & organization, 52(4):573–584.

Laury, S. K. (2005). Pay one or pay all: Random selection of one choice for payment. Working Paper 06-13, Andrew Young School of Policy Studies, Georgia State University.

Lejuez, C., Read, J. P., Kahler, C. W., Richards, J. B., Ramsey, S. E., Stuart, G. L., Strong, D. R., and Brown, R. A. (2002). Evaluation of a behavioral measure of risk taking: the balloon analogue risk task (bart). Journal of Experimental Psychology: Applied, 8(2):75–84.

Lerner, J. S. and Keltner, D. (2001). Fear, anger, and risk. Journal of personality and social psychology, 81(1):146.

Loewenstein, G., O’Donoghue, T., and Bhatia, S. (2015). Modeling the interplay between affect and deliberation. Decision, 2(2):55–81.

Matell, M. and Jacoby, J. (1971). Is there an optimal number of alternat-ives for likert scale items? Educational and Psychological Measurement, 31:657–674.

Mayer, J. D., Allen, I. P., and Beauregard, K. (1995). Mood inductions for four specific moods: A procedure employing guided imagery. Journal of Mental imagery, 19(1-2):133–150.

Plott, C. R. and Zeiler, K. (2005). The willingness to pay–willingness to accept gap, the. The American Economic Review, 95(3):530–545.

Raghunathan, R. and Pham, M. T. (1999). All negative moods are not equal: Motivational influences of anxiety and sadness on decision making.

Organizational behavior and human decision processes, 79(1):56–77.

Rick, S. and Loewenstein, G. (2008). The role of emotion in economic be-havior. In Lewis, M., Haviland-Jones, J. M., and Barrett, L. F., editors,

Handbook of emotions 3rd Edition. The Guilford Press.

Robbins, S. P. and Judge, T. A. (2012). Emotions and moods. In Robbins, S. P. and Judge, T. A., editors, Organizational Behavior 15th Edition. Prentice Hall.

Shupp, R., Sheremeta, R. M., Schmidt, D., and Walker, J. (2013). Resource allocation contests: Experimental evidence. Journal of Economic Psycho-logy, 39:257–267.

Tversky, A. and Kahneman, D. (1992). Advances in prospect theory: Cu-mulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4):297–323.

Unger, A. and Stahlberg, D. (2011). Ego-depletion and risk behavior: Too exhausted to take a risk. Social Psychology, 42(1):28–38.

V¨astfj¨all, D. (2002). Emotion induction through music: A review of the musical mood induction procedure. Musicae Scientiae, Special issue 2001-2002:173–211.

Westermann, R., Spies, K., Stahl, G., and Hesse, F. W. (1996). Relative effectiveness and validity of mood induction procedures: A meta-analysis.

European Journal of Social Psychology, 26(4):557–580.

Zizzo, D. J. (2010). Experimenter demand effects in economic experiments.