In the dedicated pursuit of dedicated capital: restoring an indigenous investment ethic to British capitalism

Full text

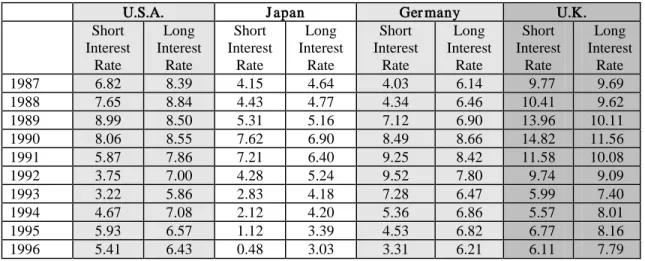

Figure

Related documents

Request approval to 1) accept a grant award from, and enter into a grant agreement with, the American Psychological Association Board of Educational Affairs to pursue accreditation

The State of California, Department of Insurance (CDI) has awarded the District Attorney¶s Office (DA) $4,700,955 for the Automobile Insurance Fraud (AIF) Program, $2,121,829 for

Combining Properties and Evidence to Support Overall Confor- mance Claims: Safety-critical system development increasingly relies on using a diverse set of verification

If you’re a beer buff, take a guided tour at Deschutes Brewery to learn more about how the craft beer scene got its start in Central Oregon, then visit a few.. of the city’s

Sales location, product type, number of advertising methods used, high-speed Internet connection, land tenure arrangement, and gross farm sales is found to be significantly related

A multiplexer is also called data selector , since is selects one of many inputs and steers the binary information to the output line.. The AND gates and inverters

Indian geothermal provinces have the capacity to produce 10,600 MW of power- a figure which is five time greater than the combined power being produced from non-conventional

American Chemical Society Division of Analytical Chemistry Award—Since 1967, the American Chemical Society, Division of Analytical Chemistry, has presented this undergraduate award