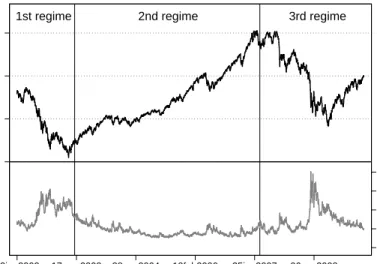

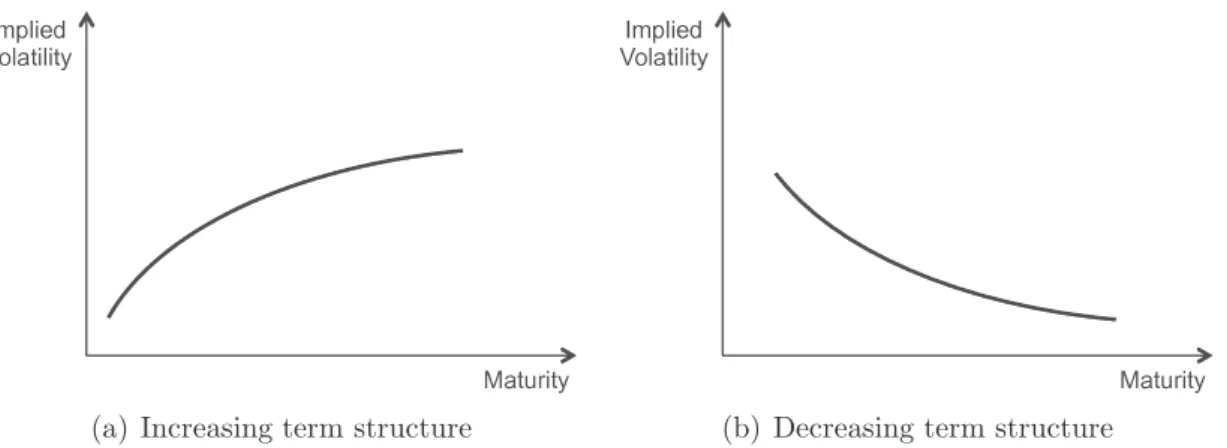

Forecasting DAX Volatility: A Comparison of Time Series Models and Implied Volatilities

Full text

Figure

Related documents

Medical device manufacturers can achieve much in the sustainable development of their manufacturing processes, all of which has a positive environmental impact which the company

Pricing does not include transition services to a subsequent service provider. ARRA funds will not be utilized to fund this

On the basis of 16S rRNA gene sequence comparisons and physiological characteristics, strain Olac 40 T is proposed to be assigned to a novel species of the genus Desulfocurvus ,

The goal of visual analytics (VA) systems is to solve complex problems by integrating automated data analysis methods, such as machine learning (ML) algorithms, with

In this dissertation, a semi-automatic segmentation method based on a statistical shape model is proposed to reduce the time spent building a VR model of the normal female

The objective of this study was to evaluate changes in the average net farm income, debt-to-asset ratio, cash rent, and cropland prices for the representative farms under

Critical Contact Critical Contact Critical Contact Critical Contact Critical Contact Contact Process Competitor Trigger Contact Outcome Situational Influential

intellectual intelligence and cultural intelligence has a positive effect on firm international performance, provided that global mind set of an SME is independent