Paper #1-9

NATURAL GAS INFRASTRUCTURE

Prepared by the Gas Infrastructure Subgroup

of the

Resource & Supply Task Group

On September 15, 2011, The National Petroleum Council (NPC) in approving its report,

Prudent Development: Realizing the Potential of North America’s Abundant Natural Gas

and Oil Resources, also approved the making available of certain materials used in the

study process, including detailed, specific subject matter papers prepared or used by the study’s Task Groups and/or Subgroups. These Topic and White Papers were working documents that were part of the analyses that led to development of the summary results presented in the report’s Executive Summary and Chapters.

These Topic and White Papers represent the views and conclusions of the authors. The National Petroleum Council has not endorsed or approved the statements and conclusions contained in these documents, but approved the publication of these materials as part of the study process.

The NPC believes that these papers will be of interest to the readers of the report and will help them better understand the results. These materials are being made available in the interest of transparency.

The attached paper is one of 57 such working documents used in the study analyses. Also included is a roster of the Subgroup that developed or submitted this paper. Appendix C of the final NPC report provides a complete list of the 57 Topic and White Papers and an abstract for each. The full papers can be viewed and downloaded from the report section of the NPC website (www.npc.org).

Gas Infrastructure Subgroup

ChairGregory J. W. Zwick Director, Energy Market

Analysis TransCanada PipeLines Limited

Members

Cynthia Armstrong Director of Marketing and

Business Development Portland Natural Gas Transmission System John Bridges Manager, Market Analysis TransCanada PipeLines

Limited

William D. Wible Manager, Strategy El Paso Energy Services Company

Jeff C. Wright Director, Office on Energy Projects

Federal Energy Regulatory Commission

Overview

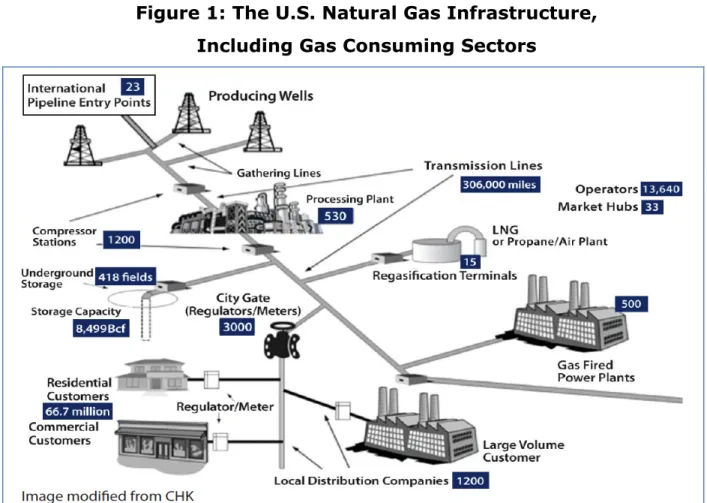

The US natural gas infrastructure system is comprised of a network of buried transmission, gathering and local distribution pipelines, natural gas processing, liquefied natural gas (LNG) and storage facilities. Natural gas gathering and processing facilities are necessarily located close to sources of production. They gather gas from producing wells and remove water, volatile components and contaminants before the gas is fed into transmission pipelines, which transport natural gas from producing regions to consuming regions. Storage facilities are located in both production areas and near market areas, subject to geological limitations and market forces. LNG facilities also represent major infrastructure investments, but will be covered in another section.

Figure 1: The U.S. Natural Gas Infrastructure, Including Gas Consuming Sectors

North American natural gas infrastructure developed over time to link regions of supply with those of demand. Major production basins in the Gulf of Mexico, Appalachia, Western Canada and the Rocky Mountains connect to population centers in the Northeast, Upper Midwest, West Coast and Southeast Markets. Natural gas infrastructure is continuing to develop which reflects both increases in overall demand as well as changes in the location of supply sources and the types of supply sources. Of particular note is the rapid development of shale gas, much of which comes from regions that have not historically been major sources of gas supply.

This study will look at the current state of natural gas infrastructure, current issues facing the industry, and the need for new infrastructure in the following industry segments:

• Gathering systems and processing facilities

• Gas transmission pipelines

• Storage facilities

2. Existing Infrastructure

Gathering and Processing

Natural gas gathering and processing infrastructure collects natural gas from producers, processes it to meet the specifications of pipeline quality gas, and delivers it into the pipeline grid. Production, or “wet”, gas consists of mostly methane and commonly contains lesser quantities of other hydrocarbons such as ethane, propane and butane, referred to collectively as Natural Gas Liquids (NGLs); and small

quantities of carbon dioxide, hydrogen sulphide and water. Pipeline quality gas has been processed to remove these substances from the

gas stream. If not processed, gas with a high NGL concentration could have a heat content that is too high to be used reliably in end-use applications. High heat content or “hot” gas is sometimes blended into other lower-Btu gas supply to meet the overall gas quality

requirements in a pipeline system.

There are currently 38,000 miles of gas gathering infrastructure in the United States and approximately 85 Bcf/day of gas processing

capacity. Gathering and processing facilities are generally subject to oversight by state regulators.

Processing gas for delivery to transmission pipelines can use a range of technologies, depending on the chemical content of the gas stream and other factors. In some cases simple dehydration equipment is sufficient, while in others advanced processing plants extract a full range of NGLs, which are used in a variety of products and processes. Ethane is a hydrocarbon with a molecular structure containing two

carbon atoms (C2) that is produced predominantly from natural gas

processing plants. It is a valuable product used in the petrochemical industry to make polyethylene, a building block for many plastics. The petrochemical industry is situated principally in the Gulf Coast States, the Midwest and Western Canada. The expected increase in natural gas production from the Marcellus Shale gas resource will alter the Northeast region’s ethane supply/demand balance. The ethane content of the Marcellus Shale gas is variable; however the western reaches of this region contain relatively high concentrations of ethane, which would increase the heating value of the gas to levels that exceed the pipeline gas specifications. At low local natural gas production rates, this “hot” gas can be blended into other natural gas supply entering

the region or inert gases such as nitrogen. However, it is expected that the rising production of ethane in this region will eventually have to be extracted and transported by pipeline to a region where it can be used. The economics of ethane extraction are driven by its relative value as a petrochemical feedstock and its heating content, if left in the

remaining pipeline-quality sales gas.

Propane is a hydrocarbon with a molecular structure containing three

carbon atoms (C3) and is sourced from natural gas processing plants

and refineries. The primary end-use applications for propane are as a heating fuel and as a vehicular fuel. The other main use for propane is petrochemical feedstock in the manufacture of polyethylene and other chemicals. Since propane supplies from gas plants are extracted in conjunction with ethane, it is often transported as an ethane/propane mix. Pipelines that would be built to move surplus ethane for the Marcellus Shale region would ship the total NGL mix produced by local gas plants.

Butane is a hydrocarbon with a molecular structure containing four

carbon atoms (C4) and is sourced from natural gas processing plants

and refineries. Butane continues to be used in gasoline blending during the winter months, but this use has been significantly reduced in recent years. The other main use for normal butane is to produce isobutane, which is used by refineries for the production of alkylate, which in turn is used in the production of gasoline. As natural gas production from the Marcellus Shale gas resource begins to increase, production of normal butane and isobutane from gas processing plants should steadily rise. These new supplies should offset current import requirements in the region.

Pentanes plus is a mixture of light hydrocarbons with molecular

structures containing five or more carbon atoms (C5+) produced from

natural gas processing plants. In the U.S. it is primarily used by refineries in gasoline blending, but has a lower economic value than gasoline due to its lower octane value and somewhat higher vapor pressure. The use of pentanes plus in producing gasoline has also been affected by the increased use of ethanol and could be further impacted by evolving biofuel policy. As higher quantities of ethanol are blended into gasoline, lower quantities of pentanes plus can be used. It is also used as a chemical feedstock and is increasingly in demand as a diluent for the rising production of heavy oil in Canada. Exports to Canada have increased rapidly in recent years as the quantity of pentanes plus produced in Canada has declined in conjunction with overall gas production.

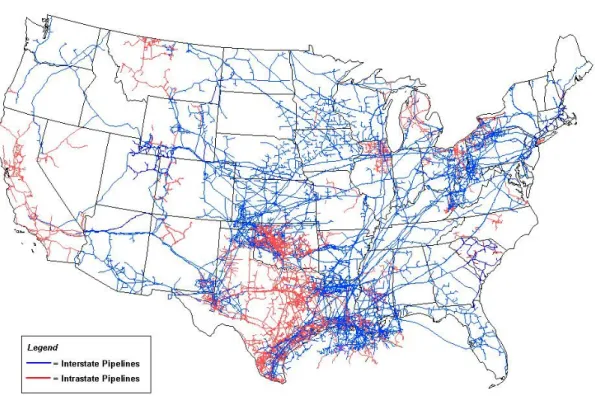

Natural Gas Pipelines

Natural gas transmission pipelines serve the purpose of transporting natural gas from production areas to market areas. Transmission pipelines receive gas from the midstream facilities (i.e., gathering or processing facilities) and deliver this gas either to end users, local distribution companies, or to other transmission pipelines for further downstream transportation. The Federal Energy Regulatory

Commission (“FERC”) is charged with approving the construction and operation of interstate natural gas pipeline facilities which operate as common carriers. Currently, there are approximately 220,000 miles of interstate pipeline in service in the United States with an estimated

capacity of 183 billion cubic feet (Bcf) per day.1 In addition, the

Energy Information Administration (“EIA”) of the U.S. Department of

Energy estimates that there are over 76,000 miles of intrastate pipeline in operation with an estimated capacity of over 32 Bcf per day. Construction and operation of intrastate pipelines is regulated by

the states in which the pipelines are located.2 The major interstate

and intrastate pipelines are shown in Figure 2.

Figure 2: Major U.S. Gas Transmission Pipelines

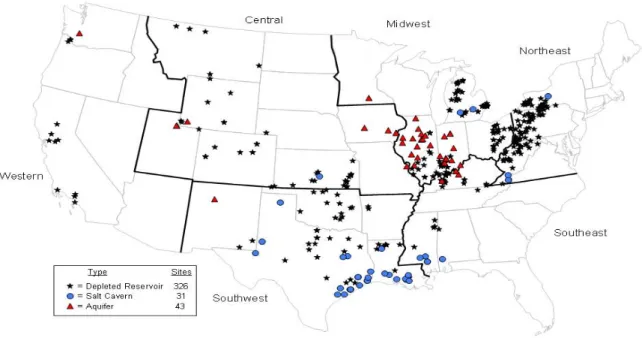

Natural Gas Storage

Natural gas storage facilities are used to meet gas demand peaks which can sometimes exceed production and long-haul pipeline throughput. Storage helps mitigate pipeline imbalance charges and daily and seasonal price volatility. When cold weather or other market conditions create more demand for gas than domestic production or imports can satisfy, storage gas can be withdrawn to make up the

2 Energy Information Administration, “Expansion of the U.S. Natural Gas Pipeline Network: Additions in 2008

difference. Likewise, when supplies of natural gas are in excess of demand (e.g. those periods of time between seasonal peak demands), storage allows gas producers to continue production without

interruptions. This reduces the need to severely cut back on

production or to shut in wells, which could permanently damage their integrity.

In North America, gas is typically injected during the summer season (April to October) and withdrawn in the winter season (November to March). Storage can be used for seasonal system supply or for peak intraday demands. A winter of significantly colder than normal weather can increase demand for storage capacity by as much as 25% relative to a normal year (NPC 2003).

The FERC has jurisdiction over any underground storage project that is owned by an interstate pipeline and integrated into its system. Also, independently operated storage projects that offer storage services in interstate commerce are under the FERC’s jurisdiction. EIA reports that there are 401 active underground natural gas storage fields with a

total working gas capacity of approximately 4.2 Tcf. 3 Of that amount,

2.6 Tcf is in interstate commerce. 4

The vast majority of natural gas in the U.S. is stored underground.5

There are three types of underground storage facilities: depleted oil/gas reservoirs, salt caverns, and aquifers.

3 Energy Information Administration, EIA-Form 191A. Working gas capacity is the amount of gas that can

practically be injected or withdrawn from a field.

4 From FERC data.

5 LNG is used in gas storage in aboveground facilities. There are over 100 of these facilities in the U.S. (this

does not include LNG import/export terminals. These facilities are small in nature and are owned primarily by LDC’s to meet daily peaking needs. There are several LNG storage facilities that are interstate in nature and subject to the jurisdiction of the FERC.

Figure 3: Underground Storage Fields in the U.S.

The most common underground gas storage facilities are those that use deep underground natural gas or oil reservoirs that have been depleted through earlier production (depleted reservoir storage). An underground gas storage field or reservoir is a permeable underground rock formation (average of 1,000 to 5,000 feet thick) that is confined by impermeable rock and/or water barriers and is identified by a single natural formation pressure. These reservoirs are naturally occurring and their potential as secure containers has been proven by

containment of their original deposits of oil and gas. The working gas capacity is typically 50 percent of the total capacity, with the rest of the capacity maintained to ensure adequate deliverability (also called cushion, pad or base gas).

As of 2008, there were 326 storage fields in the U.S. that store gas in depleted reservoirs. These account for 85 percent (3.6 Tcf) of the total

working gas capacity in storage.6 These fields are necessarily located

in areas of gas production, which are typically remote from high density population areas or electric generation facilities.

High deliverability storage can be developed from underground salt caverns (salt cavern storage). These facilities use caverns that are leached or mined out of underground salt deposits such as salt domes or other salt formations. Salt cavern capacity typically is 20 percent to 30 percent cushion gas, with the remaining capacity being working gas. Working gas can generally be cycled 10-12 times a year in this type of storage facility. These facilities are characterized by high deliverability and injection capabilities and are mainly used for short peak-day deliverability purposes (e.g. for fuelling the

hourly-fluctuating loads of electric power plants). The average salt

cavern/dome facility is twice as large as the average reservoir storage facility. They tend to cost roughly 20% - 30% more to develop than reservoir storage. They contain gas at much higher pressure, allowing greater deliverability from a smaller inventory. They also require very little cushion gas. A downside is that the caverns are created by

dissolving the salt in water. This creates a brine that must be properly disposed. Development of some potential sites has been foregone due to the disposal issue (APPA, Aspen Environmental Group, July 2010). The high growth rate in electric generation demand has increased seasonal peaks and therefore increased the need for this type of

multiple cycle storage facility. The increase of summer peaking electric generation results in competition for pipeline gas that otherwise would have gone into filling reservoir-type storage. For the electricity

industry to broadly switch its coal-fired units to natural gas, it will also need more gas storage capability to meet the increased demand.

Some reservoirs are bound partly or completely by water-bearing rocks called aquifers (aquifer storage). The nature of the water in the aquifer may vary from fresh to nearly saturated brines. Aquifer storage facilities typically have high cushion gas requirements, ranging from 50 percent to 80 percent. However, they achieve high deliverability rates, with gas injected in the summer season and withdrawn in the winter.

Currently, there is approximately 8 Tcf of natural gas storage capacity (5 Tcf of working gas) in the United States and Canada. Only about 5% of this amount is high deliverability salt-cavern storage.

3. Current Issues in Natural Gas Infrastructure

Gathering and Processing

The rapid growth of shale gas production and its transformative effect on North American gas supply is the key driver of the changing

gathering and processing industry. Existing infrastructure will come under pressure in some regions, particularly regions with higher supply costs that are unable to maintain or grow production in competition with lower cost shale gas. Shifting gas supply will result in the closure of some processing facilities and may drive business closures and consolidations in some regions. In other regions new infrastructure will be required. This will consist of gathering pipelines and processing plants in producing regions, and possibly new pipelines to transport ethane and other natural gas liquids.

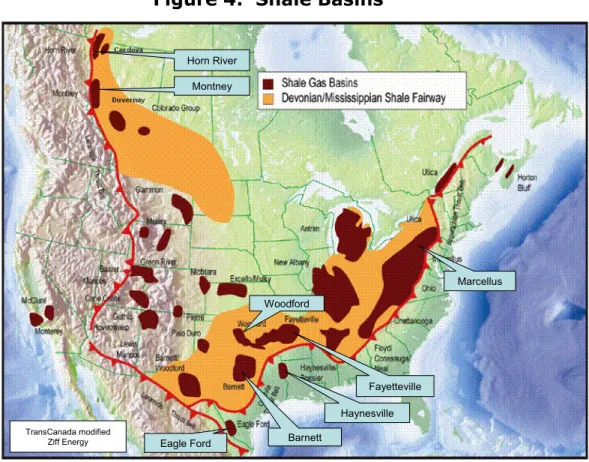

Shale gas production will be an increasingly important source of new production. The major shale basins are shown in Figure 4. The growth

in shale gas development also has increased the recognized reserves of NGLs in the U.S. However, the growth in liquids from all gas shale plays is not uniformly distributed across the country. NGL content is a function of source rock geo-chemistry and maturity. The NGL rich gas plays are the Barnett in Texas, the western portion of the Marcellus in Pennsylvania, the Woodford in Oklahoma, the Eagle Ford play in

southern Texas, and the Niobrara play in Colorado, Nebraska, and Kansas. The Fayetteville in Arkansas, the Haynesville in Louisiana and the Horn River in Western Canada are quite dry by comparison. The value of natural gas liquids in some of the liquids-rich plays can be as much as $1.00 to $2.00 per Mcf. This significantly improves the production economics and is driving activity towards the liquids-rich plays.

The shale basins located in the well established producing regions, such as the U.S. Gulf Coast, have access to existing infrastructure for NGL processing and markets. Thus, while new field supply connections and gas processing plants may be required, the existing network of NGL pipelines and downstream connections, with some modifications and growth, will likely be sufficient to serve the market. However, shale basins in new regions, such as the Marcellus in the Northeast and mid-Atlantic, will require an entirely new set of NGL pipelines to connect to markets. Also, the public in some of this region is not accustomed to, and may be actively opposed to, production and

processing facilities. Effective consultation will be a key component of successful development.

Figure 4: Shale Basins

The connection of gas from Alaska’s North Slope to the integrated gas infrastructure grid would significantly impact the gathering and

processing industry. It would provide a large new source of NGLs and could potentially address underutilization issues in Western Canadian processing facilities.

The relative prices of oil and gas are also impacting the industry. Some natural gas liquids can be left in the gas stream and producers receive value for the energy they provide. Producers must weigh the costs of further processing the gas to extract more of the NGLs against the additional value they will receive for the extracted liquids. The value they receive for the extracted liquids is tied to the price of oil, while the value of the liquids left in the gas stream is tied to the price of gas. When gas prices are high relative to oil prices it improves the

Horn River Montney Marcellus Fayetteville Haynesville Barnett Eagle Ford Woodford TransCanada modified Ziff Energy Horn River Montney Marcellus Fayetteville Haynesville Barnett Eagle Ford Woodford TransCanada modified Ziff Energy

economics of leaving more of the NGLs in the gas stream. Currently, oil prices are quite strong compared to gas prices, which encourages more extensive extraction of the natural gas liquids.

Natural Gas Pipelines

Since the beginning of 2000, the FERC has approved over 16,000 miles of interstate pipeline and over 5 million horsepower (“HP)” of

compression.7 These projects can be categorized either as greenfield

pipelines (those projects which represent new pipelines in new rights-of-way) or as enhancements (e.g., looping of an existing pipeline, addition of compression, or extensions or laterals of the existing system to effect the delivery of natural gas). During this same time period, nearly 16,000 miles of interstate pipeline and over 5 million HP of compression has been placed into service. The FERC currently has over 2,500 miles of projects pending and about 1,700 miles of pipeline projects that have been announced but not yet approved.

In general, pipeline expansion in the early 2000’s accommodated the expected increase in imported liquefied natural gas, especially in the southeast U.S. The next few years saw the development of two long haul pipelines out of the Rocky Mountain region – the Rockies Express Pipeline and the Cheyenne Plains Pipeline – to flow gas toward markets in the eastern half of the U.S. More recently, the development of the shale basins in the southeast U.S. has spawned a boom in

transmission pipeline construction in that part of the country. Shale gas supplies were connected, via new pipelines, to the traditional long-line pipelong-lines that transport natural gas from the Gulf of Mexico to the mid-Atlantic and northeast U.S. Over 3,000 miles of interstate

7 As natural gas is transported long distances, it loses pressure and the rate of flow decreases. Compression is

pipeline has been approved and has gone into service to haul

southeast U.S. shale gas.8

There are two recently completed major interstate pipelines to

transport Rocky Mountain gas - Ruby Pipeline, 1.5 Bcf per day to the west coast and Bison Pipeline, 0.5 Bcf per day to the Midwest. Looking to the future, pipeline construction will continue in the south central U.S. to access shale gas deposits; however, there should be a major buildout of interstate pipeline capacity in the mid-Atlantic and

northeast U.S. to transport gas from the prolific Marcellus Shale basin to nearby markets. In fact, over 70 miles of interstate pipeline to transport Marcellus Shale basin gas have gone into service, 319 miles of interstate pipeline are approved and under construction, 116 miles are pending, and almost 5,000 miles of potential projects have been announced. An interesting characteristic of the Marcellus Basin area pipelines is that while the total capacity proposed will be large, the mileage will be seemingly small when compared to long haul pipelines in the west. This is due primarily to the proximity of this supply to highly populated east coast markets.

Another important potential source of gas supply for the lower 48 states is the North Slope of Alaska, with approximately 35 trillion cubic feet of gas reserves. Beginning with the passage of the Alaska Natural Gas Transportation Act in 1976, projects have been considered to transport Alaskan gas. In 2004, Congress passed the Alaska Natural Gas Pipeline Act (ANGPA) with the objective to facilitate the timely development of an Alaskan natural gas transportation project to transport natural gas from the North Slope of Alaska to the lower 48 states. ANGPA also confirmed the Commission’s authority to authorize

a pipeline to transport Alaskan natural gas to the lower 48 and

designated the Commission to be the lead agency for processing the National Environmental Policy Act documentation. The TransCanada Alaska Pipeline Project is a joint venture of TransCanada Alaska Company LLC and ExxonMobil. It is designed to transport up to 4.5 Bcf per day of Alaskan North Slope gas to the Alaska-Canada border, approximately 750 miles. The project has a Canadian affiliate that is proposing to construct facilities from the Alaska-Canada border to existing facilities in Alberta. From Alberta, the gas would be

transported through existing facilities to delivery points in the U.S. The controlling or determining factor on when and if Alaskan gas supplies come to the lower 48 may be the development of the shale gas resources. Based on the economics of Alaskan gas versus shale gas, it is problematic that Alaskan gas will be delivered to the lower 48 in the foreseeable future. More likely, in the near to mid-term,

Alaskan North Slope gas will be developed to serve in-state needs and, possibly, for export in the form of liquefied natural gas.

The U.S. used an average of 66.1 Bcf per day of natural gas in 2010.9

This is in stark contrast to the earlier stated interstate capacity of 183 Bcf per day. Nearly half the capacity we have today was built after the industry achieved its previous peak demand of 22+ Tcf in 1972.

However, due to maintenance, changes in supply sources, changes in demand (seasonal and/or locational) and weather impacts it is

necessary for the companies that operate interstate natural gas

pipelines to design systems that deliver the volumes to which they are

contractually committed. This will necessarily result in some

underutilization of capacity. This abundance of capacity does, nevertheless, make for a robust and reliable transmission system

which meets the demands of natural gas users for the foreseeable future. Note that this redundancy is not evenly distributed across North America. Pockets of constraints and areas of over capacity still exist as a function of localized supply and demand factors.

The transportation of natural gas by pipeline involves some risk to the public in the event of an accident and subsequent release of gas. The greatest hazard is a fire or explosion following a major pipeline

rupture. Methane, the primary component of natural gas, is colorless, odorless, and tasteless. It is not toxic but is classified as a simple asphyxiate, possessing a slight inhalation hazard. If breathed in high concentration, oxygen deficiency can result in serious injury or death. Methane has an ignition temperature of 1,000°F and is flammable at concentrations between 5 and 15 percent in air. Unconfined mixtures of methane in air are not explosive. However, a flammable

concentration within an enclosed space in the presence of an ignition source can explode. It is buoyant at atmospheric temperatures and disperses rapidly in air.

The US Department of Transportation, through its Pipeline and

Hazardous Materials Safety Administration’s Office of Pipeline Safety (PHMSA/OPS) administers the national regulatory program to ensure, among other things, the safe transportation of natural gas. PHMSA develops safety regulations and other approaches to risk management that ensure safety in the design, construction, testing, operation, maintenance, and emergency response of pipeline facilities. Many of the regulations are written as performance standards that set the level of safety to be attained and allow the pipeline operator to use various technologies to achieve safety. This work is shared with state agency partners and others at the federal, state, and local level. Certified

states may make an agreement with USDOT that authorizes them to also participate in the oversight of interstate pipeline transportation. Although OPS may authorize a state to act as its agent to inspect interstate pipelines, it retains responsibility for enforcement of the regulations.

Under a Memorandum of Understanding on Natural Gas Transportation Facilities (MOU) dated January 15, 1993, between USDOT and the FERC, USDOT has the exclusive authority to promulgate federal safety standards used in the transportation of natural gas. FERC accepts this authority and does not impose additional safety standards other than the USDOT standards. If the Commission becomes aware of an

existing or potential safety problem, there is a provision in the MOU to promptly alert USDOT. The MOU also provides for referring complaints and inquiries made by state and local governments and the general public involving safety matters related to a pipeline under the

Commission’s jurisdiction.

The pipeline and aboveground facilities associated with a proposed project must be designed, constructed, operated, and maintained in accordance with the USDOT Minimum Federal Safety Standards. The regulations are intended to ensure adequate protection for the public and to prevent natural gas facility accidents and failures. These regulations specify material selection and qualification, minimum design requirements, and protection from internal, external, and atmospheric corrosion.

The DOT regulations also define area classifications, based on population density in the vicinity of the pipeline, and specify more rigorous safety requirements for populated areas. Class locations

representing more populated areas require higher safety factors in pipeline design, testing, and operation. Pipe wall thickness and pipeline design pressures, hydrostatic test pressures, maximum allowable operating pressure, inspection and testing of welds and frequency of pipeline patrols and leak surveys must also conform to higher standards in more populated areas.

In 2002, Congress passed the Pipeline Safety Improvement Act. That law requires that all gas transmission operators develop and follow a written integrity management program that addresses the risks on each covered transmission pipeline segment.

The DOT regulations also prescribe the minimum standards for

operating and maintaining pipeline facilities, including the requirement to establish a written plan governing these activities. Each pipeline operator must also establish an emergency plan that includes

procedures to minimize the hazards in a natural gas pipeline emergency.

These regulations also require that each operator establish and maintain liaison with appropriate fire, police, and public officials to learn the resources and responsibilities of each organization that may respond to a natural gas pipeline emergency, and to coordinate mutual assistance. The operator must also establish a continuing education program to enable customers, the public, government officials, and those engaged in excavation activities to recognize a gas pipeline emergency and report it to appropriate public officials.

Storage

The FERC has certificated over 1,100 Bcf of new underground storage capacity – either as expansions of existing storage fields or as new storage sites – since the beginning of 2000. Since the beginning of 2001, over 500 Bcf of capacity has actually gone into service. The FERC has pending projects that would add an additional 140 Bcf of storage capacity and is aware of the potential for more storage projects totaling an additional 70 Bcf of capacity. Similar to the pipeline expansion in the early years, storage development has

generally occurred in the south central U.S., first to accommodate the expected increase in imported liquefied natural gas and, more

recently, to store the gas produced from the shale basins. This trend in the location of storage facilities is expected to continue.

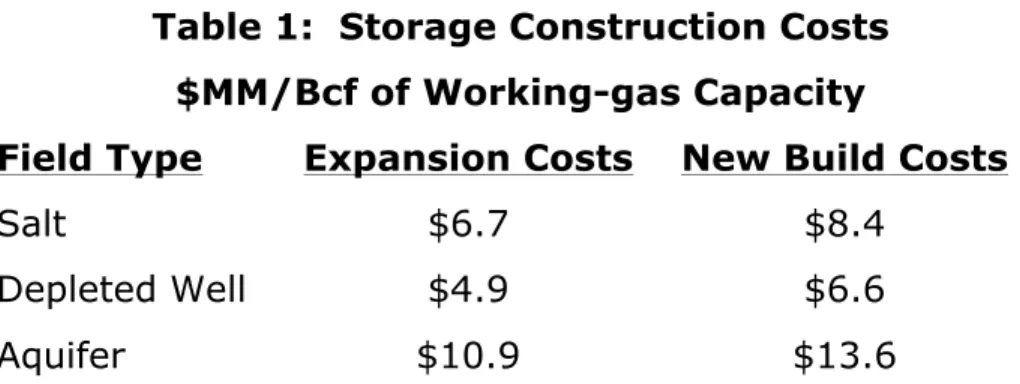

Developers considering the construction of new storage facilities and the expansion of existing facilities must carefully evaluate the tradeoffs between facility performance and cost. While actual costs will be

situation specific, the following is a general indication of the relative costs of different types of storage facilities.

Table 1: Storage Construction Costs $MM/Bcf of Working-gas Capacity

Field Type Expansion Costs New Build Costs

Salt $6.7 $8.4

Depleted Well $4.9 $6.6

Aquifer $10.9 $13.6

Source: Pipelineandgastechnology.com, June 2010

One of the greatest limitations on storage development is the challenge of finding sites with the appropriate combination of

geological features, pipeline proximity, and the ability to obtain land, rights and permitting. Large portions of the U.S., including most of the Northeast, do not have geological structures that are conducive to underground gas storage.

Lack of access to storage can dramatically increase pricing volatility. For example, Rockies producers have virtually no storage of any type available to them. The price volatility at Opal ranged from 99% - 629% in 2005-2008 as compared to 51%-92% at Henry Hub for the same time period. (pipelineandgastechnology, June 2010, p. 24) Strong growth in gas demand for power generation is creating

increased demand for flexible, high-deliverability storage that can be cycled several times during the year. Most of the value that these facilities create comes from short term price volatility rather than the summer/winter price spreads that have underpinned traditional

storage development.

Like interstate pipelines, the safety of the interstate natural gas storage system is the responsibility of PHMSA. However, PHMSA’s jurisdiction only extends to the aboveground facilities associated with

storage. The safety of the underground caverns is the responsibility of the states in which they are located. In a similar manner, the ability to increase the operating pressure in a storage reservoir can improve the efficiency of existing assets. States generally limit the maximum

pressure in a reservoir to the discovery pressure of the reservoir.

4. Future Natural Gas Infrastructure Requirements

Estimating levels of required infrastructure growth requires

consideration of a number of variables that will impact the future supply and demand for natural gas. Successful development of shale gas resources, the potential connection of Alaskan supply, import levels, and the relationship of gas and oil prices will be key supply drivers; while economic growth, gas demand for electric generation, natural gas vehicles, and potential exports will be key demand drivers. Fluctuating levels of supply and demand over time within an integrated market produces prices signals which elicit an infrastructure

investment response across various business segments. For example, if supply develops in a region without sufficient takeaway pipeline capacity a price difference develops between the supply area and downstream demand centers which, if high enough, signals for a pipeline build to occur to alleviate the deliverability capability constraint and consequently reduce the price differential. When

seasonal price spreads develop, a signal is sent to the market to store gas in lower priced periods and extract it when prices are higher. In addition, price volatility signals value for more storage capacity to provide a physical tool for shorter term balancing. Regardless of the absolute result of estimated infrastructure requirements produced by

integrated modeling efforts, it appears that a significant amount of infrastructure additions will be needed over the forecast period to serve the growing market for natural gas.

The Federal Energy Regulatory Commission (FERC) is responsible for the review and authorization of interstate natural gas and storage facilities in the United States. Other federal statutes that affect the construction of interstate natural gas pipelines and storage facilities include the Clean Air Act, the Clean Water Act, the Endangered

Species Act, the Coastal Zone Management Act, the Fish and Wildlife Coordination Act, the Historic Preservation Act, the Rivers and Harbors Act, the Mineral Leasing Act, the Federal Land Policy Management Act, and the Wild and Scenic Rivers Act. Additional state and local

agencies provide approvals for gathering and processing facilities, and may present additional requirements for pipeline and storage projects.

Gathering and Processing

The requirement for new gas gathering infrastructure will be driven by the need to connect large volumes of new gas supply to the existing pipeline grid. Growing shale supply regions will be areas of focus, as

will the offshore Gulf of Mexico. The June 2011 INGAA study10

projects the need for 414,000 miles of gathering mainlines from 2011 to 2035 at a cost of $41.7 billion.

The requirement for new gas processing infrastructure will be driven by the large volumes of new gas production that are expected to be connected over the forecast period, and by the expectation that

relatively strong oil prices will encourage investment in the extraction

of natural gas liquids. INGAA has projected a need for 32.5 Bcf/d of new natural gas processing capacity at a cost of $22 Billion.

New processing capacity in regions that have liquids rich shale gas production, for example the Marcellus, may pose challenges in securing the necessary local permits and approvals, including air quality permits.

Growing liquids production from shale gas activity will create an oversupply of liquids in some regions where new liquids transport pipelines could connect to existing NGL processing centers. There is current interest in liquids pipelines from the western Marcellus region to the Midwest and the Gulf Coast. The Eagle Ford region may also benefit from new liquids pipelines.

Natural Gas Pipelines

There are a number of factors that will necessitate the construction of more natural gas infrastructure transmission pipelines in the future period leading to 2035. Just several years ago, the U.S. was

preoccupied with the construction of LNG terminals and associated infrastructure to accommodate imported LNG to make up the gap between North American gas supply and expected gas demand. As discussed elsewhere in this report, gas production from shale

formations has become both technologically and economically viable. This will not only alter the dynamics of North American gas supply, but also will require the construction of new transmission pipelines to

connect these new gas supply sources to the existing pipeline grid. From a supply-side perspective, future pipeline infrastructure

expansion will be driven by a shift in production from mature basins to areas of unconventional (i.e., shale) natural gas production. It is to be expected that regions with unconventional production growth will

experience the greatest infrastructure investment. A recent MIT study notes that infrastructure development, in particular, is important for

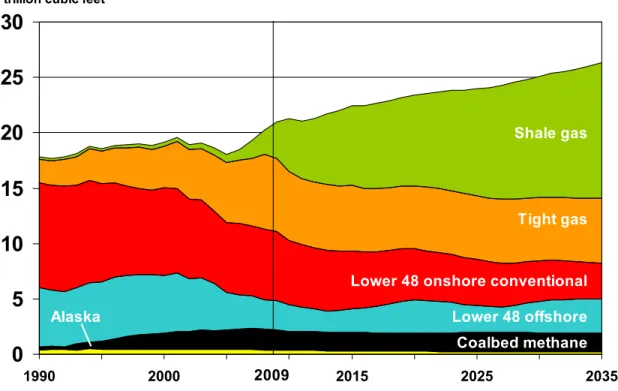

the development of the Marcellus shale gas.11 Figure 5 below shows

that in 2010, 23 percent of the U.S. gas supply came from shale gas; however, in 2035, 47 percent of the U.S. gas supply is expected to come from shale gas.

Figure 5: Natural Gas Production by Source 1990-2035

Source: EIA, Annual Energy Outlook 2011

A demand-side factor that will influence the construction of more transmission pipeline is the expected increase in gas-fired electric generation as coal-fired generation is affected by expected carbon legislation. Gas-fired generation, given the amount of domestic shale gas, will be relatively cheaper than in previous years and will have approximately half the emissions of coal-fired generation. IHS CERA

11 “The Future of Natural Gas,” Massachusetts Institute of Technology, 2010, p. 64.

0

5

10

15

20

25

30

1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 Shale gas Tight gasLower 48 onshore conventional Lower 48 offshore Coalbed methane Alaska

2009

asserts that the expected rise in gas demand for electric generation will be due to “more stringent carbon legislation and less nuclear

capacity…”12 A recent MIT study states that shale gas will make an

important contribution to the reduction of carbon emissions.13 Further,

gas-fired generation will provide a “bridge” to help the U.S. move toward the integration of renewable energy into the electric grid,

assisting in providing both generation to meet demand and to stabilize the variability inherent in renewable energy generation. While carbon capture and sequestration (CCS) is technologically possible when applied to coal-fired generation, “activity around CCS…has been slow to reach the level of demonstration needed to establish utility-scale

sequestration in a timely fashion.”14 By 2035, IHS CERA predicts that

gas demand for power generation will comprise half of all gas demand; in 2009, the demand for natural gas for power generation was 30

percent of all gas demand.15

A lesser, but potentially important demand for natural gas in the future may be for transportation purposes. Transportation powered by

natural gas offers another opportunity to reduce carbon emissions and at a reasonable price due to the abundance of domestic natural gas. The EIA states, “the market that many observers believe to be the most attractive for increasing the use of natural gas” is heavy duty

natural gas vehicles (i.e. heavy trucks).16 The EIA projects that

natural gas demand in the transportation sector will increase from 30 Bcf/year in 2010 to 160 Bcf/year in 2035.

12 Mary Lashley Barcella and Steven Evans, “A New View Toward the Long Run: Revisions to the

Outlook for North American Natural Gas Markets, 2015–35,” IHS CERA Decision Brief, January 2010, p. 5.

13 “The Future of Natural Gas,” p. xii. 14 “The Future of Natural Gas,” p. 77.

15 “North American Natural Gas Market Outlook Data Tables”, IHS CERA, September 2010. 16 Annual Energy Outlook 2010, EIA, p. 33.

The effect of these supply and demand drivers will necessarily require investments in additional transmission pipeline infrastructure. The INGAA Foundation projects that to accommodate anticipated changes in supply and demand, the U.S. and Canada will need to construct 35,600 miles of transmission pipeline by 2035 and 5 million

horsepower of additional compression. The estimated cost of such infrastructure additions will total $107 billion.

Storage

Very few states have suitable depleted reservoirs, aquifers, and salt formations available for practical storage development. Areas without much storage include: Nevada, Idaho and Arizona, the Central Plains states, Missouri and virtually the entire East Coast (except far portions of western New York, western Pennsylvania and West Virginia). Any target storage formation must be reasonably close to a major pipeline before practical storage development can be considered.

Salt cavern storage is expected to dominate new storage development, with the volume of salt cavern storage essentially doubling over the forecast period. The INGAA study estimates that approximately 589 Bcf of new storage capacity is required by 2035 to meet market growth at a cost of $5 billion. Natural gas storage capacity in the producing region along the Gulf Coast increases the most on both an absolute and percentage basis. ICF (2010) projects a need for 371 to 598 Bcf of new storage capacity by 2030 at a cost of $2 to $5 billion, with development focussed in the south central U.S. where the

5. Findings and Recommendations

Growing shale gas supply will create a significant requirement for new gathering, processing, and pipeline infrastructure.

The EIA projects strong growth in U.S. shale gas supply, growing from 13.2 Bcf/d in 2010 (23% of U.S. gas supply) to 33.6 Bcf/d in 2035 (47% of gas supply). Strong growth is also expected from shale supply in western Canada. Processing requirements for growing gas supply grow by 32.5 Bcf/d of capacity at a cost of $22 billion by 2035. Connecting this supply to the pipeline grid is expected to require

414,000 miles of gas gathering mainlines at a cost of $41.7 Billion. Gathering and processing investment will be focused in the areas of unconventional supply growth. Existing pipeline capacity can be used to move some of this gas to market, but there will also be a need for 35,600 miles of new transmission pipelines and 5 million horsepower of additional compression at a cost of $107 billion.

New storage requirements for the growing natural gas market are relatively modest.

Storage infrastructure is expected to grow at a slower rate than gathering, processing, and pipelines. New storage requirements of 589 Bcf by 2035 reflect growth of only 7% above current levels. Similarly the $5 billion of new storage investment is dwarfed by

expected investment in the other sectors. New storage infrastructure development is expected to be dominated by salt cavern storage.

Strong oil prices relative to gas prices is driving development to liquids-rich areas and creating a strong need for new

processing infrastructure.

The EIA projects that oil prices will average $110/bbl (low sulphur light crude, real 2009 $) to 2035 while gas prices are expected to average $5.61/MMbtu (Henry Hub, real 2009 $). This reflects a stronger ratio of oil to gas prices than has historically been the case. This pricing is expected to drive unconventional gas development to liquids-rich shale plays such as the western portion of the Marcellus, the Woodford, the Eagle Ford, and the Niobrara. It also encourages extensive extraction of natural gas liquids as opposed to leaving more of the liquids in the gas stream and drives strong levels of investment in gas processing facilities located in areas of unconventional supply growth. Approval and permitting of these facilities may prove challenging, particularly in highly populated areas.

New transport pipelines may be required to move natural gas liquids from producing areas to established markets.

The expected growth in unconventional gas supply will also

significantly increase reserves and production of natural gas liquids, but significant variations in the liquids content of North American shale plays means that this growth will be disproportionately concentrated in some regions. This is expected to create an oversupply of liquids in some regions and potential shortages in others that can be addressed with new liquids transport pipelines. Of particular note is interest in building liquids pipelines to move ethane and other NGLs from the western portion of the Marcellus supply region to established NGL markets in the Midwest and the Gulf Coast.

Development of shale supply will put pressure on existing infrastructure in high cost supply regions.

The shift to unconventional gas supply creates an expectation of lower gas prices which will drive lower levels of gas supply in high cost

regions, putting pressure on existing gathering, processing, pipeline and storage infrastructure. This will result in the retirement of some facilities and may drive business closures and consolidations.

Existing infrastructure should be used, when practical, to reduce capital requirements and environmental impacts.

The growing gas network will require significant levels of capital investment over the next several years. However, the level of

investment will be lower if existing infrastructure is effectively used. The environmental impact is also reduced due to lower levels of

construction and fewer new facilities and right-of-ways. In some cases the existing infrastructure can be used in a way that closely mimics its original use, but in other cases this infrastructure will have to be used in new ways that may include flow reversals or conversion to transport different commodities.

Development of a pipeline from Alaska’s North Slope to the integrated North American market would require significant investment and is unlikely, given expected low gas prices.

The proposal to build a pipeline from Alaska’s North Slope is

challenged by the strong growth of unconventional supply and the relatively low gas prices that result. If a pipeline from Alaska does proceed, it would require 1700 miles of pipeline with a capacity out of Alaska of 4.5 Bcf/d, at an estimated cost of $32 to $41 billion.

would support utilization of existing pipeline and processing infrastructure.

The growing gas infrastructure grid can support significant switching from coal to gas in electric generation and underpin the use of natural gas as a transport fuel.

A number of recent studies (INGAA, ICF, MIT) have projected strong growth in natural gas demand in the U.S. and Canada, in large part due to increased natural gas use in electric generation. INGAA projects growth in natural gas consumption of 35 Bcf/d by 2035, 26 Bcf/d of which is due to power generation.

These studies show that the natural gas infrastructure grid, as it is expanded to access growing unconventional gas supply, can support strong growth in gas fired generation with relatively minor additions in market area infrastructure. In pursuing its goal of reducing carbon emissions, the Federal government should take advantage of the safe and reliable natural gas infrastructure network by implementing

aggressive policies to replace inefficient, high-carbon coal generation facilities with natural gas. The reliability of the gas infrastructure network can also be used to underpin the use of natural gas as a transportation fuel.

The development of shale gas supply further increases the reliability of the natural gas infrastructure grid by increasing production from regions not prone to hurricanes, and by geographically diversifying natural gas supply.

The addition of new infrastructure to connect shale gas supply will enhance the system reliability of the natural gas infrastructure network

by diversifying gas supply into a number of new regions of the U.S. These are almost exclusively onshore regions not prone to hurricanes. Shale gas supply is expected to grow from 23% of U.S. supply in 2010 to 47% in 2035.

The governments should ensure that efficient siting and other regulatory process are in place to underpin the necessary infrastructure investment

The industry has a strong history of efficiently building new

infrastructure in response to changing market conditions. This has been seen most recently in the rapid expansion of pipeline capacity in response to shale gas development. The industry can be relied on to do it again if appropriate policies and regulatory structures are in place.

Policies should promote efficient long-term outcomes, even when they do not align with short-term signals and needs. Effective policy can help to bridge that gap with the aim of achieving the most efficient long-term result.

Regulatory structures should provide predictable results and response times to aid the market’s ability to function efficiently. Avoiding and overcoming a highly politicized process should be the aim of policy makers to help achieve predictable results.

The government should ensure that federal authority delegated to state approval (e.g. Coastal Zone Management Act determinations) be performed in a timely and consistent manner. The Energy Policy Act of 2005 recognized the need to streamline siting, and can continue to

be fine-tuned so that infrastructure can be analyzed and permitted in a timely manner.