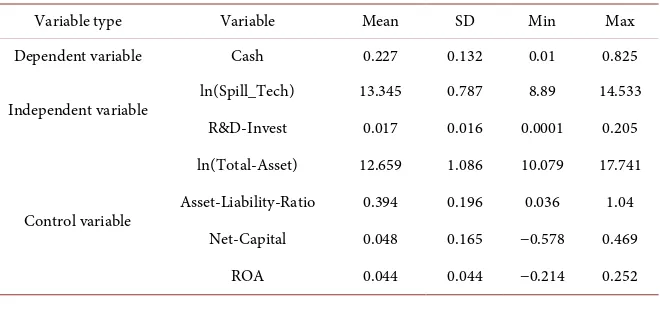

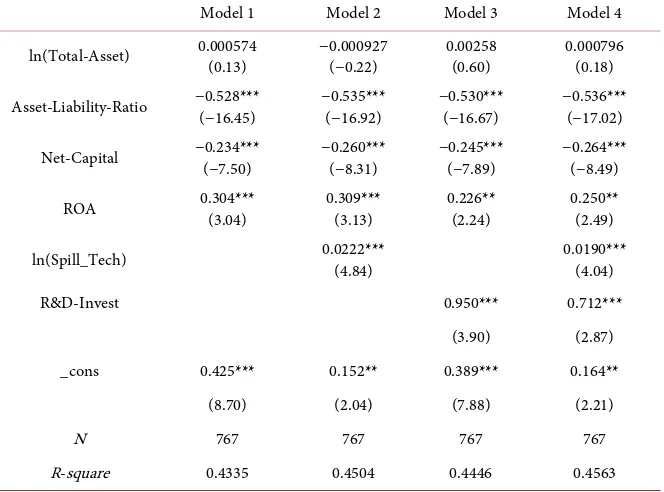

A Study on the Relationship among Technology Spillovers, R&D Investment and Firms’ Cash Holdings

Full text

Figure

Related documents

gy re;jh;g;gq;fspy; xU fhg;GWjp epWtdj;jpd; xg;ge;jq;fis ,d;DnkhU epWtdk; thq;fpf; nfhs;Sk; epiyikf;F my;yJ mtw;wpid Vida epWtdq;fSf;F tpw;gid nra;J nfhs;s Ntz;Lk; vd;w

The undersigned Luca Scano, born in Cagliari on 30 January 1971, Tax Code SCNLCU71A30B354L, indicated as candidate for the office of Director of Tiscali SpA (the “Company”),

Application of IAS 1 presentation, and IAS 7 cash flows and IFRS 8 segment reporting Influence on presentation of past practices and regulatory listing requirements Introduction

The results show that a countercyclical LTV ratio responding to aggregate debt-to-GDP growth is welfare improving and optimal in both homogeneous and heterogeneous case. However,

We explore how current traditional applications in multimedia indexing can evolve into fully-fledged knowledge management systems in which multimedia content, au- dio, video and

Our large-scale epidemiology evidence showed that Chinese children and adolescents have a significantly higher prevalence of abnormal body posture, girls and older

María del Carmen Arau Ribeiro (Instituto Politécnico da Guarda), Manuel da Silva (Instituto Superior de Contabilidade e Administração do Porto), Ana Gonçalves (Escola Superior