Management and Resolution methods of Non performing loans: A Review of the Literature

Full text

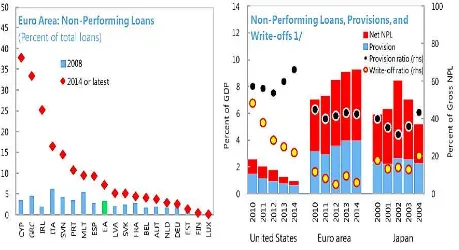

Figure

Related documents

The specific objectives of the study were: to find out the trend of non-performing loans in commercial banks since the adoption of the multicurrency regime, to

Keywords: Non-performing loans, Commercial banks, Bank-specific variables, Macro-economic variables, Credit risk, Sri Lanka.. JEL Classification:

commercial banks in Kenya. The study's specific objective was to establish the effect of government ownership structure on non-performing loans of commercial banks in Nairobi

This paper uses dynamic panel data methods to examine the determinants of non- performing loans (NPLs) in the Greek banking sector, separately for each type of loan (consumer,

The financial crisis was one of the factors that affected the increase in non-performing loans, as the crisis influenced the economic growth, unemployment,

In particular, sets out the regulatory and legal framework for NPLs in Greece either to be managed by specialized Non-Performing Loan Asset Management Companies

In view of this, the current study thus examines the following; the non-performing loan levels between local and foreign banks; and the relationship between

Data on dependent variable (non-performing loans) and independent variables, such as economic growth, energy crisis, exchange rate, share prices and interest rates, is