Transport Direct Market Research Programme -

Summary report

Contents

Front cover...2

1. Introduction ...3

2. MR01 End-legs and Interchanges...4

3. MR02 travelling by car ...7

4 MR03 ticket purchase, real-time information and willingness to pay ...11

5 MR04 positioning products in the information market place...16

6 Implications for Transport Direct ...28

Front cover

Market Research Programme:

Requirements from, demand for and reactions to Transport Direct Transport Direct Market Research Programme:

Findings and Implications from Phase 1 by Glenn Lyons

1. Introduction

This report summarises the outcomes of the first phase of a programme of market research commissioned by the Department for Transport as part of its Transport Direct Programme.

Transport Direct was announced in July 2000 as part of the Government's ten year spending plan for transport. It is an ambitious Programme to provide the U.K. with a travel information service that can present the public with the opportunity to compare travel options across public and private transport modes. Using the Internet as its principal delivery medium it seeks to offer a one-stop-shop journey planning, booking and payment service, complemented with real-time update information.

For Transport Direct to be effective as an information service it will need to be useful, usable and used. To be useful it will have to provide access to information that is of relevance and value to end users. To be usable it will need to provide a service structure and interface that is intuitive and easy to use providing quick and convenient access to information sought. To be used the public will need to be aware of its existence, know how to access it, have the means to access it and consider it their preferred service in an information marketplace that is already well populated with a range of different types of travel information services.

Delivering Transport Direct will encompass many other challenges and considerations relating to data needs, sources and management, technical requirements, partnering and organisational issues, funding and a business case. From the outset there has been a recognition that key stakeholders necessary to deliver the Transport Direct service will themselves be assessing the merits and nature of their participation in fulfilling the Transport Direct vision. Private sector organisations (particularly public transport operators) will wish to establish whether a credible business case can be made for their participation. Public authorities will be looking for a return in terms of a shift in travel patterns and mode use commensurate with Government's transport policies brought about through Transport Direct.

The then DTLR commissioned a comprehensive review of previous, current and planned research in many of these key areas of relevance to Transport Direct. With completion of the review, a number of issues were highlighted and recommendations for Transport Direct research needs made. The full report from this commission is available online1. Further to this, a market research programme was

initiated with the intention of addressing two overarching and inter-related questions:

1. What specific characteristics and features should the Transport Direct service possess in order to satisfy the requirements of its prospective users?

2. What demand will there be for such a service and what will it be used for?

Phase 1 of the programme has seen four market research (MR) projects subsequently undertaken and completed, under the guidance of a stakeholder steering group.

A separate report is available for each of these projects and can be obtained from the Transport Direct Programme website2. The aim of this report is to draw together the findings across the four projects

and consider the implications for the development of the Transport Direct service, including what further research might be necessary.

2. MR01 End-legs and Interchanges

2.1 Project overview

Recent developments in information services providing journey planning support have been substantial in relation to air, rail, coach, bus and car. Less attention has been given to modes which support a journey principally made by public transport - modes that can prove critical as the 'glue' that determines whether individuals feel capable of, confident and inclined to negotiate a multi-stage journey with interchange(s). This project has sought to consider the role of car, taxi, walking and cycling in facilitating a journey made principally by public transport. Its aim has been to assess to what extent these modes are perceived as a barrier to considering public transport overall as an option for a journey and to what extent, and what types of information concerning these modes might enhance confidence and (perception of) convenience of public transport.

Qualitative research was undertaken in two phases:

a series of depth interviews (4 with families and 8 with individuals) 7 focus groups

2.2 Results

End legs

The traveller is often left to find out for themselves how to reach the origin station/stop. There is therefore a potential unmet information need to advise on modal choice on the first/end stages of multimodal journeys. This research has examined the extent to which quality of information concerning end-legs of multi-modal journeys influences modal choice.

The extent of pre-journey planning varies considerably with many having a 'turn up and go' attitude assuming that they will find out the relevant information as they go along, while for others every detail is ascertained for each leg, with contingency plans for missed connections.

Across all ages and lifestyles there are those for whom travel information is seen as of little value, with reliance on their own knowledge , the use of road atlases, and asking people en-route. Even where there is pre-planning of the outward journey, almost no consideration is given to the return leg with people assuming that they can just do the same journey in reverse which does not always work "I got a taxi there, but when I left there were no taxis, we had to walk miles down a road and ended up at a hotel to order a taxi".

In general little consideration is given to end legs of journeys when planning a journey and choosing the main journey mode. For many, information on the main mode is considered both adequate and sufficient - with cost and time being the key deciding factors plus the degree of stress likely to be encountered. In most cases there is a heavy reliance upon getting a taxi and indeed asking for directions at the station of arrival. Taxis or lifts are cited as the most natural choice of end leg in access/agree from a bus, coach or train station. Buses are considered too unreliable to use as the start mode, with only the young and less affluent considering buses, both at the beginning and end of their journey.

Concerns on end legs only arise when significant inconvenience may arise such as by a mother encumbered with several young children or an elderly person carrying luggage or delay in arriving for a pre-arranged meeting. Access/egress modes are of particular concern to the disabled.

Information needed for end legs

contact number of taxi companies

In terms of car information, maps giving the location of stations/stops are considered useful for arranging where to be dropped/picked up.

For those parking at a station and continuing their journey by rail, the key information requirements are:

likelihood of getting a space at a given time of day parking charges

whether a maximum parking time limit applies

In terms of walking, concern over taking an unknown route and actual distance (and perhaps laziness) prohibits many from walking to their destinations, with a taxi being chosen as the risk-free solution to reach an unknown destination. Maps showing egress points from stations are found by some to be confusing. This is a particular concern when exiting from tube stations where the orientation of the map is found to be difficult "It doesn't look the same on the street...If they said 'turn left at the Costa Coffee' that would help"

For buses, low awareness of bus routes, both within people's own local area and at their destination is a barrier to use of this mode and an area where improved information could help.

Interchanges

Most people are not 'put off' a public transport journey simply because it requires an interchange as long as they know where they need to go to make the connection and what this transfer will involve. Interchanges cause anxiety because of the level of 'unknowns':

Which platform to wait for the next train, where the bus will stop? How long it will take to get to this new boarding point?

Will you have to carry heavy luggage up flights of stairs?

Whether the connecting service will be missed due to a late arrival of the first? Will it be easy to find a taxi to get to the coach/railway station?

Will there be easy to follow maps and signs?

Will there be navigational aids, such as electronic guidance points and 'trail markers'?

All are in agreement that regardless of modern technologies, there is peace of mind from having a hard copy of information that can be taken and, if necessary, may be consulted enroute.

Several participants voiced the desire to have real time information on the actual journey, possibly by text message to a mobile phone, informing them of delays to connections or offering alternative connecting services if the original connection is likely to be missed.

It is generally recognised that the actual platform that a train leaves from can vary at the last minute so advanced information on platforms is not expected. Having some idea of the layout and relative distances between platforms, however, is seen as useful:

"At Clapham Junction there are loads of platforms, and I thought 'Oh my God! What do I do? So, I was panicking thinking I will miss my connection. So it would just be nice if there was plenty of staff to sort of say, go there or whatever"

Reactions to Transport Direct

Will the information be accurate and reliable?

How long will it take to get the information you want? Why bother changing from travel websites already used?

Of particular note in relation to the role of end-leg and interchange information in Transport Direct is that, whilst a number of information needs associated with end-legs and interchanges have been identified in this research, in nearly all cases such information is classed as a 'nice to have' for some people. In other words, the information is not considered essential, certainly in the context of the choice of main mode pre-trip. It might be concluded that such information is perceived as important to a significant minority. Nevertheless, others, if presented with the information, may have their

confidence in multi-stage public transport journeys improved.

There is some concern about the quality and accuracy of information that could be provided by Transport Direct, particularly at the local level: "personally I think it is a great idea, but if it is not updated all the time it is useless....It doesn't make any sense to have internet for the buses"

2.3 Key findings

in general there is little consideration given to end legs of journeys when planning a journey and choosing the main journey mode - many people consider information on the main mode to be both adequate and sufficient at the pre-trip stage

concerns regarding end legs only arise when significant inconvenience may arise such as by a mother encumbered with several young children or an elderly person carrying luggage or delay in arriving for a pre-arranged meeting - access/egress modes are also of particular concern to the disabled

most people are not 'put off' a public transport journey simply because it requires an interchange as long as they know where they need to go to make the connection and what this transfer will involve

several participants voiced the desire to have real time information on the actual journey possibly by text message to a mobile phone

3. MR02 travelling by car

3.1 Project overview

This project is based on the premise that Transport Direct should seek to ensure that the public can compare different options for their journeys and that this takes place on a 'level playing field'. Journey planners for travel by car typically provide crude indications of journey time and cost, unlike their public transport counterparts. This implies that the playing field is not level. It also suggests that the information needs of those planning to travel by car are not being fully met. This project has explored and distinguished between car journey information that would (i) assist in journey planning where the decision to travel by car has already been made and (ii) assist in mode choice. The former concerns the ease with which a car journey can be made. The latter concerns the means by which car use can be compared against alternative travel options.

The research involved a series of seven focus groups with individuals deliberately selected to be car users principally with some respondents in each group occasionally using public transport, mostly for travelling into major cities for shopping or business.

3.2 Results

Car versus public transport

All groups found driving on local roads to be stressful (perhaps enhanced by the road closures and roadworks in place in the area at the time of the focus groups). However, despite having complaints about heavy traffic and delays, none of the groups considered switching to public transport for everyday journeys. The main reason for choosing to travel primarily by car over public transport related to concerns over public transport reliability, speed and convenience, comfort and safety. Respondents claimed to know their public transport options (for regular journeys) and in this context did not cite the lack of information as a reason for not making journeys by public transport.

Response to Transport Direct was positive however there was some scepticism about whether the public transport network would be reliable enough to deliver the services on offer and a feeling that it would need to be more integrated in order to make Transport Direct useful in the sense of raising awareness of alternatives to the car. One of the main reasons cited by male drivers at retirement age for not using trains was the lack of information on local public transport connections at either end. For disabled drivers, mode choice was influenced by lack of assistance in getting on and off buses and trains, inability to easily carry any luggage and the distance to the nearest bus stop or train station. Whilst these are problems with the transport service, where these are not problems it is important that the information service makes this clear (or indeed makes it clear when it is a problem).

Cost was given as a factor that discourages some people from using public transport, especially families or single parents with children. This suggests that there is merit in specifically including information on family railcards and other discount schemes associated with concessions for group travel.

Information needs of car users

The main form of journey planning for car users involved using a road atlas. Internet journey planners were found useful and trustworthy by those who had experience of using them. However, they were seen to lack the following that would be of added-value or interest to car users:

real-time information on congestion and roadworks;

junction details on approaches to motorways;

information on disabled parking bays and other accessibility features; and images of road signs encountered en-route.

Requests for information on specific features of a journey such as parking facilities (for Blue Badge holders, or otherwise), taxi availability and Park and Ride also featured prominently during the discussions.

Transport Direct could encourage modal shift amongst Internet users who express no (initial) interest in travelling on public transport. By providing high quality route planning information for motorists (including the specific types of information requested by participants in the focus groups - landmarks, motorway junctions, disabled access facilities) Transport Direct might attract a loyal group of

motorists from other route planning sites. As users of Transport Direct, such individuals will also encounter (the opportunity to consider) information on alternatives to the car. As a consequence some motorists may elect to consider the alternatives. (Equally there is the possibility that some individuals upon using Transport Direct may alter their initial intention to travel by public transport and instead choose to go by car.)

Access media

Almost half of all the group discussants did not own a computer or have access to the Internet. It was pointed out that especially to those with little experience of using the Internet, it would be important for Transport Direct to have a simple and accessible format. Non Internet users were particularly concerned that they would not benefit from Transport Direct if it is an Internet based system. They suggested other media sources that would be more publicly accessible: teletext, call centres, mobile phones (via text messaging) and on-street public terminals.

There was very little support for WAP as a medium for information delivery. In contrast, support for the use of text messaging (SMS) was very clear, highlighting the need for or opportunities of

capitalising on what people are already familiar with. The appeal of text messaging in addition to familiarity, relates to the convenience of access and the point of delivery. Being able to access information about road conditions before making a trip was desirable but even Internet users felt that the process of logging on to the Internet to obtain such information was too time consuming. They suggested quicker ways of making such information available to them only when there is a problem on their route, for example by text message or email (though of course the latter also requires logging on to the Internet). One of the most popular requests was for real-time information on congestion and hold-ups, with suggestions for alternative routes that could be relayed as a text message to a mobile phone. Some respondents were also prepared to pay for text messages providing real time information on train times for regular journeys.

Public reactions to information provision

Key observations from the different groups consulted were as follows:

men under 25 - they are least likely to change their travel behaviour in response to travel information provision - all stated that they used cars for all journeys; and they made fewer long distance journeys - when they did make such journeys they felt sufficiently familiar with the road network and confident to rely on maps and road signs for necessary information.

women aged 35-55 - some in the group (those already occasional public transport users) felt that the Transport Direct concept might encourage them to use public transport more but would be unlikely to use an Internet service; one primary car user would now consider using rail having discussed

Transport Direct.

women of retirement age - they were less enthusiastic about Transport Direct than other groups because the majority of the group were not computer literate or familiar with using the Internet - many were willing to travel more by train but would prefer to use call centres and ticket offices for

information.

men of retirement age - they tend to already be well prepared for journeys and hence less dependent on new information sources; group members could recall when public transport was the only option and Internet users in the group were open to the idea of changing travel modes; and they noted that because they are retired they have the flexibility and free time to change their leisure destinations if they are informed of hold-ups on their preferred routes.

disabled drivers - they recognised the potential of Transport Direct to provide information on accessible transport which some currently find difficult to find; there was enthusiasm for the concept but a strong feeling that public transport itself needs to be more accessible in order to encourage them to use it.

Overall the groups expressed a feeling that pre-trip information on public transport would not greatly influence their travel patterns and choice of mode, as for them travelling by car is most convenient, comfortable, safe, accessible and reliable. However, in each group there were respondents who expressed an interest in travelling by public transport, especially long-distance train journeys. Such observations highlight the potential of Transport Direct to encourage modest but significant levels of travel behaviour change, particularly concerning longer distance journeys. Nevertheless, most groups indicated that improvements need to be made to public transport in terms of making services more reliable, comfortable, more accessible to disabled people, cheaper and clean for them to consider changing modes.

The availability of roadworks information through Transport Direct coupled with comparative advice on travel alternatives was positively received amongst the groups and initial reactions suggested a propensity to consider changing modes. However, further thought led to a general preference for information to enable a route change to avoid roadworks rather than a mode change. This suggests that Transport Direct should aim to provide information on roadworks and in so doing will yield benefits in either helping drivers to avoid congestion or encouraging/promoting consideration of alternatives. Roadworks information is, of course, a means of highlighting the unreliable nature of car travel. Added to this, as investment in infrastructure building and maintenance is set to be substantial over the next few years, disruption due to roadworks is likely to be more commonplace.

The screening survey successfully recruited some respondents because they use public transport for some journeys and some because they were individuals who primarily used their cars for travel. However, it emerged that experience of using the Internet (rather than an allegiance to public or private transport) was a crucial factor in dividing people within the groups into those who supported Transport Direct and those who did not. In terms of potential travel behaviour change, those who had recent experience of using public transport were more disposed to the idea of considering public transport for unfamiliar journeys.

In all the groups participants stressed that the daily journeys they make are very familiar to them and felt that information about public transport alternatives is not the most crucial factor in encouraging them to make a modal shift to public transport as most of them felt that they knew what alternatives there were.

The importance of a level playing field

3.3 Key Findings

preference for car use over public transport use is in terms of choosing the lesser of two evils - the public are frustrated by traffic conditions during their car journeys but perceive the overall

situation for the public transport alternative to be worse

in light of the above, information concerning road network disruptions is valued and should be a priority feature for Transport Direct alongside other car travel information items that have the prospect of offering added-value to existing driver information services - by attracting those seeking driver information to Transport Direct there is then the prospect of them being exposed to information on alternative travel modes

habitual car use and patterns of travel leads to a lack of need to seek information when making many journeys, this being especially true for young and old male car users

notwithstanding the point above, a modest but potentially significant proportion of travellers appear prepared to review their travel choices

the concept of Transport Direct was generally well received by car users though many remain unconvinced that the public transport systems themselves can deliver in line with the information provided, there is also concern that the service must be transparent and offer a level playing field in its provision of information

4 MR03 ticket purchase, real-time information and willingness to pay

4.1 Project overview

This project has had three tasks. Firstly to assess in its own terms, and in relative terms (when compared against other requirements from Transport Direct), how important the opportunity to book and pay for tickets as part of a Transport Direct service is to the public and how important it is to 'clinching the deal' when an individual might otherwise be inclined to renege on their intent to travel by public transport rather than by car. Secondly, to explore public reactions concerning the role of real-time information within Transport Direct and its absolute and relative importance. Thirdly, to consider public attitudes concerning the value to them of different elements of Transport Direct and the extent to which and how they would be prepared to pay for them.

Six in-depth focus groups were undertaken involving extended discussion, interspersed with various activities (ranking, scoring and comparative exercises) guided by a team of two moderators. The groups were introduced to a range of real-time information services/systems to encourage informed discussion. Each group dealt with all the above tasks. All groups were based in or around the Bristol area. For the purposes of the research, geographic location was considered less important than key factors such as age, experience of the public transport network and level of income. Such factors were used in selection of participants for the group sessions.

4.2 Results

Booking and payment

Features looked for in a booking and payment system by the public include: avoidance of queuing; speed and ease of use; security and trustworthiness; and a choice of payment methods. While a well designed web-based booking and payment service could provide such features, there is currently a clear preference for use of the telephone - most participants used this as the primary method of planning and paying for journeys from the home, perceiving it as accessible, easy to use and without queues. This concurs with recent ONS Omnibus survey results3 which found that 70 per cent of

people would prefer to access Transport Direct by telephone. Nevertheless, a number of drawbacks with telephone services were highlighted including queuing accompanied by poor music, some distrust of getting the best deal and some poor experiences of call-centre operators.

Other key characteristics that were associated with the 'ideal service' included: ability to compare all modes of transport; being always open; being accurate; being accessible to everyone; and providing advice and recommendations. The ability to ask questions and speak in 'everyday language', features that made staffed counters popular, was also important. A range of participants (from all age and income levels) visited travel counters in person to make reservations in advance of their journey, attracted by: the certainty and security of purchasing the right ticket ('it's in the hand'); the prospect of guidance, suggestions and recommendations; and the opportunity to be face-to-face (enabling

questioning and ensuring trust).

For those with Internet access, it was concern over fraud that was the real barrier to 'clinching the deal' (i.e. booking and paying for travel tickets online having planned the journey). However, similar security concerns were not mentioned by those who book and pay by telephone. Had similar research been carried out in the past when telephone use was relatively new, security concerns may have been raised. This suggests that the current 'trust-gap' over Internet payments is likely to be closed as familiarity increases.

From the discussions, the following potential design features for Transport Direct were suggested to reassure users and help them make the final payment-step:

a clear and simple explanation of how the payment process works (i.e. answering 'where does my information go?');

feedback on the payment process - a step-by-step approach, with user confirmation at each stage (this was a feature well-liked by the Internet users in the group);

guarantees against loss from credit card fraud, for users of the site;

strong brand development which concentrates on building trust, so potential customers feel the organisation will take care of their money; and

telephone support for those making bookings and payment: to talk through the on-line process or take payment.

Features of a web service that should be promoted by Transport Direct include: the perceived objectiveness of information;

time savings and convenience of research at home; benefits of checking all information and prices; and

the ability for each step of the booking and payment process to be controlled and confirmed by the user and dealt with at their own pace.

The above factors came out strongly from a range of participants, across the age and income levels.

Real-time information needs

Participants considered real-time information on actual service conditions and personalised updates (with alternative routes etc.) potentially useful in a range of travel situations, for example:

avoiding road works and congestion when travelling by car;

taking an earlier (coach) service to allow for road works on the route to an airport; cancelling a leisure journey, rearranged to another day; and

calling ahead so that the person/appointment at the destination would know.

Planning around problems was most applicable to local public transport and car journeys. Most of the participants who used public transport for longer journeys did so for leisure purposes, with seat reservations and advanced booking. They therefore felt financially discouraged from changing services even if they were to know of an alternative.

Planning the return journey was generally less important than knowing about the outward trip (an issue that also emerged from MR01). The low levels of return journey planning might actually provide an opportunity for Transport Direct: if travellers plan fewer return journey legs then the need for information on the move is presumably greater, as is the freedom to react to updates and suggested itineraries.

A key message was that real-time information has to be accurate to have value. Inaccurate systems merely added to the perception of an inefficient and frustrating-to-use service for all modes (car and public transport).

Real-time information access

most people's daily routine. The growth in broadband 'always on' Internet access could reduce this barrier over time.

Information during the journey for public transport modes (in-trip) was thought best provided using mobile phones (voice or text messaging).

Overall, public transport users tended to want information via television for pre-trip and at bus stops and stations or via mobile phones (SMS) during journeys. Younger participants (in particular) saw benefits in being able to choose between bus services at different stops and make the choice to walk in some cases in order to 'keep their journey moving'. Car drivers tended to want in-trip information via the radio or from mobile telephones (via hands-free kits).

There is some reluctance in being contacted too often by a travel service, and 'pushed' information would have to be relevant and accurate. Mobile telephones are not always kept switched on, particularly by older participants, who disliked being called in public spaces. For these persons an information service which they called would be preferable. Younger participants were more interested in 'push' media, but would like to register particular routes or trips so that the information sent is relevant and controlled quite tightly. This ties in well with the interest in receiving text messages.

Ranking of service elements

A ranking exercise was done to gauge the importance of booking and payment compared to other Transport Direct service elements. Overall, booking and payment came middle to low in the groups' priorities, with timetables and fares information placed in the top positions. However, this tended to be because many (alternative) payment and booking options are already available and, crucially, other Transport Direct services were more interesting.

Real-time information, by comparison with booking and payment, tended to be rated quite highly across the groups and more so than most other elements with the exception of fares and timetable information, because:

the idea of avoiding wasted time appealed to people;

personal security was important, particularly when using public transport at night;

a feeling of confidence is derived from knowing the actual travel time, or the best route to take; they would be able to alert those they were planning to meet at their destination if delays were expected; and

information may provide the opportunity to change mode (e.g. to walking) and keep moving.

Willingness to pay

The service elements that some participants in each group would be prepared to pay for were real-time information and journey updates and tourist information.

Participants were quite specific about the value of real-time information and updates. Many were not keen to pay for 'bad news' - particularly if they had no choice but to continue to use that mode and suffer the consequences of delays. Willingness to pay was associated with updates that provided alternative routes round the problem rather than simply alerting them to the problem or that compared route choices and quantified the time savings.

The proportion of participants who were willing to pay for information was not found to be out of line with the ONS Omnibus survey results4. This found around a quarter would pay for personal alerts

before the journey and one third during the journey, with smaller proportions willing to pay for information about service/network status in general.

Further suggestions were made about specific value-added service elements, and included: independent tourist information for the destination (at guide-book standard); and

integrated real-time information packaged with route maps for destination and interchange points. A range of factors were found to be behind the value placed on information, or the principal of paying, based on personal circumstances and views. These included whether:

the information concerned a long journey for leisure purposes, made infrequently, or everyday trips when the costs of information access would mount up;

the information was available elsewhere free of charge;

real-time information was also bundled together with additional related information including custom maps and destination information;

the information concerned a work-related journey in which case the employer would probably pay;

the information concerned travelling to an appointment when it was important to arrive on time; and

the information concerned travelling by road when it was easier to respond to the information by, for example, changing route (compared to the more limited flexibility associated with reserved train travel).

A range of specific payment values were suggested across the groups, from 10 pence to 1 pound per 'information item' or 'journey registered'. While not a robust quantitative result, the value of around 40 to 50 pence did seem to be most commonly volunteered. Subscription to the service was not a popular option, as people were not willing to commit to using it at this time. This is not thought to reflect the true demand for a subscription service, which might be requested after a prototype or trial service is available. The idea of a free trial to evaluate the service was thought important to a number of participants.

4.2 Key Findings

Booking and Payment

Transport Direct should include booking and payment, but if it is to attract customers from the substantial population who value reassurance and 'face-to-face' contact, it should incorporate some advice, support and recommendations - perhaps via a complementary telephone service an Internet-based information service is attractive in terms of avoiding queues, planning from the home etc. but because of (current) concerns over payment fraud there could also be a significant barrier to 'clinching the deal'

the delivery of Transport Direct through interactive TV should be investigated in order to benefit from the familiarity and spontaneity of access and for those not owning a PC

Real-time information

a push-media aspect to real-time information would be welcomed but should be user-configurable so that information is relevant, as well as timely

pre-booked public transport journeys have fixed routes and times which are a strong disincentive to planning around problems and hence the perceived value of real-time information can be devalued

the most popular pre-trip delivery mechanisms for real-time information are the television and telephone - Internet access of real-time information is currently low

for in-trip information, mobile phones and SMS are the preferred choice and should be

investigated in parallel as complimentary delivery mechanisms for the Transport Direct Internet-based service.

Willingness to pay

(initial) provision of free information within Transport Direct is likely to prove valuable in building demand for the service, reassurance and trust

real-time operational performance and personalised updates are the area where Transport Direct has scope to charge for its services, with some possible scope also for destination information for tourism purposes

5 MR04 positioning products in the information market place

5.1 Project overview

Transport Direct will be entering a busy market place rather than a vacuum. This project has therefore sought to develop greater insight regarding the positioning of the various information services within this market place in the UK. It has sought to explore the relative strengths, overlaps and unique selling points of the different services and has assessed how the public compare and choose between different services. Beyond this it has assessed reactions to the introduction of Transport Direct into the

marketplace alongside reactions specifically to traveline. The research has involved two stages. Firstly, service providers were consulted to ascertain their understanding of their product positions in the marketplace and intended future developments. 30 in-depth interviews were undertaken with providers who either currently have a website or who have a prototype of a website in existence. Respondents were senior members of staff who had a responsibility for promoting and marketing their own organisation and hence were directly or indirectly responsible for the content of their

organisation's web site. It was felt that this person would have a full awareness of the rationale behind the current website contents and would also be conversant on what future developments were being planned for the web site.

Secondly 1200 members of the public were consulted via a telephone interview survey. This research aimed to ascertain the public awareness and use of, and opinions regarding, different currently existing information services. It also presented respondents with information on Transport Direct and traveline asking them to offer their thoughts on these information systems and, in particular, on the characteristics and features that Transport Direct should include in order to encourage greater usage. For the survey, an information source was defined as "any telephone or internet-based information source that assists respondents reaching their destination or advising them on certain aspects of their journey eg the cost, times of travel, suggested means of travel". Respondents were divided,

accordingly, into information source users and non-users and guided through different questionnaire interviews. The main recruitment criterion was that in the last year respondents had to have made an unfamiliar journey. It was felt by the research team that those who did not make unfamiliar journeys would be unlikely (or far less likely) to need to access transport information and hence would be unable to contribute to this research. The sample included individuals in England, Scotland and Wales.

5.2 Results from transport providers consultation

Understanding their customers

For some providers, especially the bus operators, there is a very pragmatic appreciation that their customers may have very little choice about their mode of travel relying on the bus, and perhaps one operator, as their only method of transportation. Rail and light rail/metro/tram providers were more likely to provide a combination of reasons for why people chose their service including because it was less hassle than using alternative means of transportation, there was a high frequency of service, that the service was reliable, it was possible to cover long distances, that people had the opportunity to move around whilst travelling and that they were able to travel in comfort.

considered too low to be financially viable. However, some providers such as Blazefield were offering combined tickets, for example, users could purchase from the rail provider a bus add-on to their ticket.

The rationale for a website

For most providers having a web presence was seen as an essential part of information provision and information communication, enabling them to 'put their products more firmly in the marketplace' and branding their company. For some more local operators this meant ensuring that people were aware of the company being "a very local company, owned by the directors and staff... providing a strong emotional link with the area" (Bus Provider), whilst for others this meant emphasising the national nature of the company.

For many the creation of the website was seen as a way of making providers more accessible by establishing a two-way communication process with members of the public who could now raise issues, complain or make enquiries with service providers. Trent/Barton Buses suggested that their site was also a consultation tool.

For some coach and rail providers the web also opened up their service provision to non-UK based respondents who could book their journeys before arriving in the country.

Most providers stated that it was difficult for them to ascertain the actual impact on their business through having a website, although those that tried felt that the impact was more in permitting passengers to have a better knowledge of the services on offer than in directly increasing revenue. Undeniably it was felt that a website was now a necessary business requirement but to be able to put a tangible value on it, was considered to be difficult.

A need for multi-channel information provision

Providers believed that passengers would wish to access information in a range of ways, including by telephone, the web and printed media, and not rely exclusively on one particular mode. Most

providers were keen to point out the importance still of paper based information sources such as timetables, especially dedicated route planners, posters, information boards at stations, local newspapers (especially for local bus and rail) and local travel information centres.

Whilst some providers believed that people preferred the reassurance of a printed document that they could take with them and consult as they travelled, other providers felt that in the future the web site would be the main media, with people perhaps printing information from it. However, the consensus appears to be that however it is produced, printed media is king and that it would not be superseded by exclusively electronic information. Hence, in terms of Transport Direct portal design, a unique selling point might be that documents are easily downloadable and that the format is retained when printed from the web.

Unique Selling Points

For most providers who had a journey planner this was considered, perhaps unsurprisingly, to be the best aspect of their website as it permitted potential passengers to ascertain how to make a certain journey, where to interchange and how long the journey would take. Other aspects of the websites that were rated highly were concise information provision, the ability to locate timetabling information swiftly and easily and the speed of information retrieval of the website. For some providers there were particular aspects of their website that they were proud of, for example, National Express stated that customers can search by location and if there is no local coach stop the passenger will be informed of the nearest one.

Providers were asked to define the unique selling points of competitor websites (or in their terms identify good or effective aspects of competitor sites).

As was the case for their own web sites, providers valued speedy, customer friendly and easy to access websites. They also appreciated websites that offered different styles of presentation and were updated regularly to keep them dynamic and fresh looking. They also rated highly simplicity of design, the ability to purchase tickets online and consistency of presentation across the site. Some providers were impressed when another website was supported by a high-profile provider whose support they felt offered it a note of authority.

Joined-up information

Most providers had included links to other 'related' websites on their own sites. Websites were chosen to link to because they were felt to have something in common with the providers own site, they offered a service in addition to the providers own or they were felt to have a similar company profile. Links tended to be created if it was felt that the website would add value to the provider's web site. Bus providers were supportive of the idea of seamless access to other travel modes but this support was tempered with a pragmatic understanding that people do not always wish to make interchanges between different transportation modes and would endeavour to avoid it.

Bus and rail providers believed that whilst buses and trains were complementary modes of

transportation people who have, for example, just completed a long train journey were more likely to jump in a taxi than take a bus. One rail provider felt that it was not worthwhile integrating buses into the system as "they form such a small part of long distance travel". Rather he felt that "local initiatives should be undertaken at stations and other interchanges".

Reactions to Transport Direct

Twenty-four of the thirty providers that were interviewed had heard of Transport Direct prior to the interview, although it was apparent that some had greater knowledge of the detail of it than others. The main word providers used to describe Transport Direct was 'ambitious'. On the whole this was viewed as a positive description with providers hoping for its success. Bus providers were most sceptical about the aspirations of Transport Direct believing that they were more feasible for other public transport provider services. This was felt to be especially true of areas such as fare information, real-time information and travel options.

Some providers felt that passengers wishing to undertake a search to ascertain how to get from A to B might not wish to be presented with too many choices as this might be perceived as confusing. Bus providers felt that passengers would prefer to be presented solely with cost-effective or direct routes rather than with a vast range of alternative journey possibilities.

One bus provider made clear the concern about the continuing need for others sites alongside Transport Direct in order to deliver the necessary local knowledge:

"Transport Direct will not be a substitute for good local knowledge. I will continue to run my own information services, even if Transport Direct is launched. Transport Direct will be good for multi journeys from major towns to major towns but it cannot be successful at a micro level within local areas."

There was also a concern expressed by PTEs and Local Authorities that Transport Direct, whilst suitable for long journeys, may not be as suitable for shorter journeys:

"The system will not be good for local journeys as the latter need very detailed local knowledge, which Transport Direct will not have."

Others felt that Transport Direct could also serve to highlight the problems inherent in the public transport system eg the need to make interchanges that would encourage potential users to use their cars.

On the whole, coach providers were more positive about the role of Transport Direct than bus providers. However, they warned, "it will have to be perfect otherwise it will be discredited." Some companies were quick to point out the importance of their brand, the time and money they had spent in building these images, and their wish for this branding to continue and not merely to be subsumed under the umbrella of Transport Direct.

Worries were expressed about getting the detail correct which enabled users to be offered sensible journey plans:

"By experience there will be a lot of 'sillies'; for example it may say that the journey from London to Cambridge will involve changes at Norwich. It will be difficult to get all the options right. This may only be because the user put the wrong information in his request. There will also be the tendency to allow overly prudent interchange times between trains or between modes. This can lead to very extended and possibly unappealing journey times." (Rail provider)

Some rail providers felt that Transport Direct should be a portal directing users to appropriate sites rather than a single, standalone site.

Non-public transport providers were fairly positive about the role of Transport Direct especially for new and unfamiliar journeys but emphasised that it will need to be well advertised with added features, for example, real-time information, to encourage usage.

Some non-public transport providers also believed that they should be compensated for sharing information rather than providing funding.

Views on traveline

Opinions are divided as to whether traveline currently provides a worthwhile travel information service. Some of the local bus providers rate traveline very highly, whilst some national bus providers are more sceptical of its usefulness. These providers point to the problems that traveline still

experiences, noting that some of the call centres are arguably better than others at handling calls. There is also the warning from some providers that Transport Direct will need to be perceived to work better than traveline currently does otherwise there will be worries over its credibility.

5.3 Results from Telephone Survey of General Public

Sample characteristics

Sample selection and subsequent weighting of data sets was designed to obtain a representative sample of the GB population according to age and sex in each of England, Scotland and Wales. A substantially greater proportion of respondents had access to the Internet at home (ABC1 - 76%; C2DE - 44%) than at work (ABC1 - 42%; C2DE - 16%).

Respondents with Internet access were more likely to use the train more often than those without access. Respondents classified as social grade C2DE (82%) were more likely to state they used the train less than once a month in comparison to those of social grade ABC1 (70%).

67% of respondents in England, and 64% and 52% of those in Wales and Scotland respectively, consult a telephone or internet-based information source, i.e. are classed in the survey as information source users. Approximately three quarters of respondents aged 16 to 54 consulted either telephone or internet-based travel information sources, whilst just under half (49%) of those aged 55+ did.

Non information users

Overall, nearly half of 'non-information users' saw no advantage in using telephone or internet-based travel information sources. However this varied with country (England - 47%; Wales - 30%; and Scotland - 27%) and with age (16-34 - 17%; 35-54 - 28%; and 55+ - 65%). It would seem that for this (minority) section of the overall population, it will be difficult if not impossible to persuade them to use Transport Direct.

The remaining findings all refer to information users.

Information sought by journey purpose

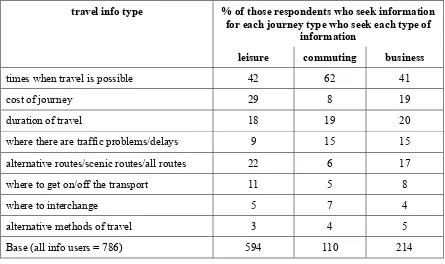

[image:20.595.66.511.364.628.2]72% of information users sought information for leisure travel compared to 21% and 29% for commuting and business respectively. This rank order is intuitively sensible and yet the proportion seeking information for commuting is perhaps surprisingly high. For each of these journey purposes, Table 1 identifies more specifically the types of information sought. 'Times when travel is possible' (i.e. timetable-based journey planning information) is the most sought information. 'Cost of journey' information is more important for leisure travel than business travel.

Table 1: Information types sought by journey purpose

travel info type % of those respondents who seek information for each journey type who seek each type of

information

leisure commuting business

times when travel is possible 42 62 41

cost of journey 29 8 19

duration of travel 18 19 20

where there are traffic problems/delays 9 15 15

alternative routes/scenic routes/all routes 22 6 17

where to get on/off the transport 11 5 8

where to interchange 5 7 4

alternative methods of travel 3 4 5

Base (all info users = 786) 594 110 214

Importance of different information types

Table 2 provides an indication of the relative importance across all information users, and irrespective of journey purpose, of different selected information types.

Table 2: Information types considered essential to have

Information users

(%)

The ability to plan journeys 80

The time taken to travel by modes(s) 73

The overall cost 66

The ability to buy a ticket 56

The cost comparison by means of travel 54

Suggestions on different means of travel 43

Base 786

When considering the importance of different aspects of travel information sources, information accuracy stands out as the top concern. Ease of use is also important to a significant minority (10-15%).

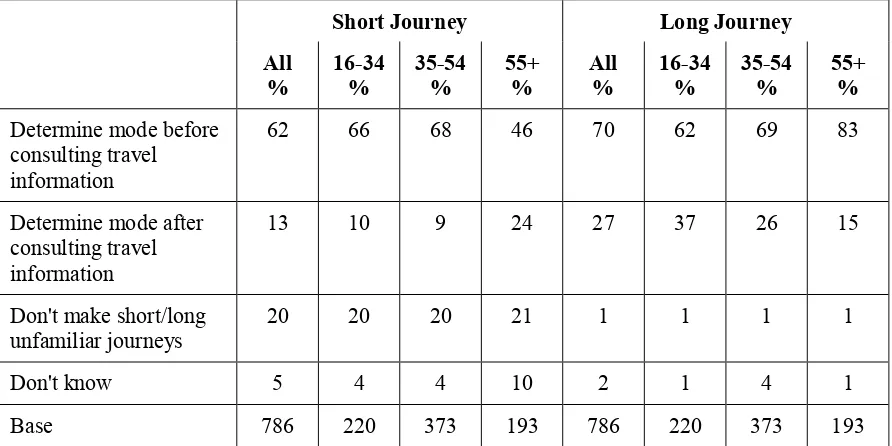

The point of mode choice decision for unfamiliar short and long journeys

For unfamiliar short journeys (where short is defined as '5 miles or less'), approximately two thirds of respondents (62%) determined the mode of travel before consulting a travel information source. 13% determined it after (this seems quite high and yet it is not know how often people make unfamiliar short journeys). It is hypothesised that most of the 13% are urban dwellers who expect to have more than one viable means of travel for such journeys.

[image:21.595.66.509.72.221.2]Just over two thirds of respondents (70%) determine the mode of travel for long journeys before consulting a travel information source, whilst just over a quarter (27%) determine the mode of travel afterwards.

Table 3a: Last time a journey was made to a new or unfamiliar destination whether the means of travel was determined before or after consulting a travel information source

Short Journey Long Journey

All %

16-34 %

35-54 %

55+ %

All %

16-34 %

35-54 %

55+ % Determine mode before

consulting travel information

62 66 68 46 70 62 69 83

Determine mode after consulting travel information

13 10 9 24 27 37 26 15

Don't make short/long

unfamiliar journeys 20 20 20 21 1 1 1 1

Don't know 5 4 4 10 2 1 4 1

Base 786 220 373 193 786 220 373 193

[image:21.595.67.513.438.661.2]Short journey Long journey All % Internet access % No Internet access % All % Internet access % No Internet access %

Determine mode before consulting travel information

62 66 24 70 69 74

Determine mode after consulting travel information

13 8 55 27 28 23

Don't make short/long unfamiliar journeys

20 20 20 1 1 1

Don't know 5 6 1 2 2 1

Base 786 688 98 786 688 98

As shown in Table 3b, Internet users are much more likely to determine their mode choice before rather than after consulting a travel information source. The reverse is true for non-Internet users. Over and above all other reasons (but followed by 'cost' and 'journey duration'), the main reason for deciding upon travel mode after consulting a travel information source was to make the journey easy (69% for short journeys [base=66] and 41% for long journeys [base=226]). What is meant by easy is not clear. Neverthless Table 3 shows that for short unfamiliar journeys and to a greater extent for long unfamiliar journeys, a significant minority of the travelling public would not have decided on their means of travel prior to consulting an information service. Hence, there is potential for a service such as Transport Direct which provides information on travel choices, to influence the chosen means of travel. It should be remembered, however, that these results refer to unfamiliar trips as opposed to regular, familiar, repeated trips which make up the vast majority of total travel.

Mode specific or multimodal information provision for unfamiliar journeys

Respondents were presented with the scenario of travelling to a new or unfamiliar destination, and asked if they would prefer to consult a mode-specific transport information source, i.e. a source that could only provide information on one means of travel, or an information source covering all modes. They were also asked to explain the advantages of consulting either a mode-specific or multi-modal information source.

Almost seven in ten respondents (69%) stated that they would prefer to consult a multi-modal travel information source. This is perhaps surprising, given that many respondents either choose to travel exclusively by car or feel that they have little choice about their method of travel. This may suggest either that respondents wish to validate their choice of travel mode or, alternatively, check out other modes for journey viability.

Perceived advantages (by 270 respondents who would prefer to consult a mode specific information source) of consulting a mode-specific information sources were: 'only mode I am interested in' (44%), 'easier to find information required / less confusing' (25%), 'quicker to complete enquiry/find

information' (16%), and 'accuracy' (15%). These are therefore key considerations for the Transport Direct portal to address and thereby challenge the tendency to approach mode specific website. These results also highlight the importance of usability.

considered to be a one-stop shop and hence felt to be comprehensive (25%), that it was quicker than consulting different sources (11%) and that it was convenient (11%).

Use of information sources for different modes of travel

[image:23.595.67.513.208.534.2]Table 4 shows that the modes for which both telephone and web-based services are most frequently consulted by travellers are rail, coach, bus, car and air. High levels of web-based service use are seen for rail, car and air. For car and air, web-based services are more likely to be used than telephone services.

Table 4: Travel modes for which different information services are used to find travel information

Telephone-based service

%

Web-based service %

Rail 63 45

Coach 15 9

Bus 22 7

Light rail, Underground and Metro 3 4

Car/private vehicle transporters 9 44

Air 14 38

Taxis 8 1

Bicycles 1 1

Ferries 5 5

Other 2 1

None 17 10

Base 786 688*

*only those with Internet access

Degree of brand loyalty in the information marketplace

Percentages below refer to the proportion of those with web access and who were able to mention a website they used for the mode concerned.

17% use 'Virgin Trains' as their main web-based source for rail information while 15% use

'TheTrainLine'. It is suggested that these are one and the same but identified by the public in different ways. Likewise, 20% use 'National Rail / National Rail Enquiry Service' as their main web-based source for rail information while 16% use Railtrack. It is suggested that in many instances those referring to the former may in fact be referring to Railtrack which itself mentions NRES in its query results to the user. This could suggest confusion over branding in the marketplace.

Respondents were asked if there was one website that they consulted more than any other for different modes of travel. Where this was the case they were then asked to identify aspects of their preferred site that attract them and aspects which they disliked. The results are shown in Tables 5, 6 and 7 below.

Mode Yes %

No %

Base

Coach 100 0 35 Bus 98 2 26 Rail 95 4 230 Car 90 9 178

[image:24.595.67.511.66.563.2]Air 68 32 221

Table 6: Selected (main) aspects of preferred site that are attractive

Aspect Coach Bus Rail Car Air

Nothing 10 9 16 16 7

Only one I know of / always use it 38 27 43 N/A 18

Comprehensive 22 12 12 19 17

Easy to search 10 19 23 40 24

Cheaper/cost 8 N/A 2 N/A 29

Base 37 26 225 166 152

Table 7: Selected (main) aspects of preferred site that are disliked

Aspect Coach Bus Rail Car Air

Nothing 65 45 51 72 65

Confusing/difficult to find information 16 16 11 7 18

Slow 14 4 13 9 5

Doesn't have all information 4 16 9 6 7

Inaccurate/gives wrong information N/A N/A 2 N/A N/A

Base 37 26 225 166 152

There is an overwhelming brand loyalty in the marketplace for mode-specific information sources, particularly for public transport information. Concerns about respondents 'favourite' sites are limited, with, in the case of all modes except bus, the majority of site users having no dislikes about each site. Frustration for other respondents comes from difficulty in accessing the required information or the speed of access (usability of the site) or from a lack of the required information. Given the importance attached to accuracy of information identified earlier, it is interesting to note the high degree of satisfaction concerning the accuracy of rail information from web-based sources.

Preference for a local or national information provider

national travel information provider was they felt that it would be more comprehensive offering more information (63%).

Reaction to Transport Direct

Eight in ten respondents stated that Transport Direct was a service they might use to assist them in planning their journey (93% of those aged 16-34; 84% of those aged 35-54; and 63% of those aged 55+). Respondents living in urban areas (87%) were more likely than those living in rural areas (72%) to consider Transport Direct a service that would assist them in journey planning. Younger

respondents (93%) were more likely than the older respondents (63%) to consider Transport Direct a service they might use. Respondents from social grades ABC1 (86%) were more likely than

respondents from social grades C2DE (62%) to consider that they would use Transport Direct. In terms of why respondents might use Transport Direct, the main reason given by a third of respondents was that it would enable respondents to compare across different transport alternatives, whilst just under a third (29%) liked the fact that Transport Direct was a 'one stop shop' and hence comprehensive. The assumption that 'comprehensive' automatically follows from 'one stop shop' is intriguing and perhaps points to the level of expectation that is raised by the introduction of the Transport Direct concept - expectation that will in turn then have to be met. Other reasons for wishing to use Transport Direct include 'up to date/accurate information (16% of respondents); and

'easy/convenient' (18% of respondents). 18% of respondents indicated that nothing appealed about Transport Direct.

The main aspects about Transport Direct that were of concern were 'how accurate and up to date it would be' (17% of respondents); 'too big and unreliable' (9%); 'cost to use' (5%); and 'ease of use/accessibility' (4%). This last figure is low which again suggests expectations are high - i.e. this wonderful service is bound to be comprehensive and as a one-stop-shop will be easy to use. 48% of respondents saw nothing of concern with Transport Direct.

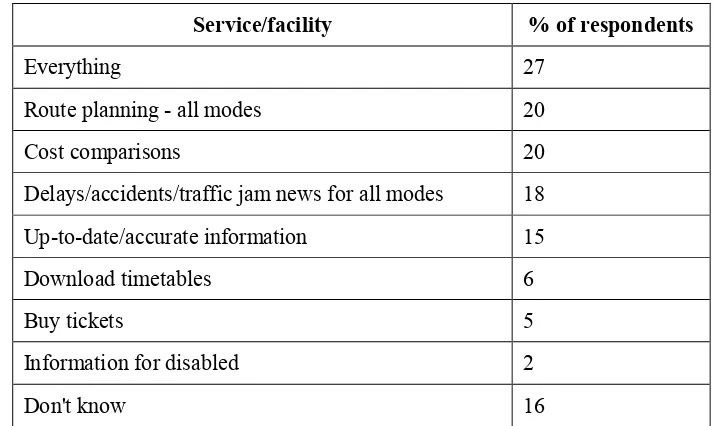

[image:25.595.107.481.463.683.2]Table 8 illustrates the relative public priorities in terms of what information services/facilities Transport Direct should offer.

Table 8: Services or facilities that Transport Direct should offer

Service/facility % of respondents

Everything 27

Route planning - all modes 20

Cost comparisons 20

Delays/accidents/traffic jam news for all modes 18

Up-to-date/accurate information 15

Download timetables 6

Buy tickets 5

Information for disabled 2

Don't know 16

Table 9: Modes of travel for which respondents would consider using Transport Direct as their information source

Total %

Rural %

Urban %

16-34 %

35-54 %

55+ %

Male %

[image:25.595.117.474.464.677.2]Rail 53 55 52 68 56 35 55 52

Coach 13 9 16 8 12 18 10 16

Bus 19 13 23 19 19 18 13 23

Light rail, Underground and

Metro 5 5 5 7 5 3 4 5

Aeroplane 21 22 21 22 27 14 22 20

Car/private vehicle

transportation 47 52 43 49 51 41 47 46

Taxis 3 3 3 1 5 3 2 3

Bicycles 2 1 2 1 3 0 2 1

Ferries 5 5 5 2 7 6 5 6

Other 1 1 1 1 2 1 1 1

None 5 10 1 1 15 4 6

Base 1,196 531 659 323 520 353 502 694

Reactions to traveline

A fifth of the respondents had heard of traveline. The level of interest in traveline was not as marked as for Transport Direct with just under one fifth (19%) of respondents saying it sounded good/useful. Concerns about traveline included that they had not heard of it (14%) and a query about how accurate it would be (14%). Just under four in ten respondents would prefer to access traveline by both

telephone and the web (39%). In order to encourage usage of traveline, a fifth of respondents (20%) suggested that it should be free or cheap to use.

5.4 Key findings

Views from providers

having a web presence is seen by providers as an essential part of information provision and information communication enabling them to 'put their products more firmly in the marketplace' and brand their company

for some more local operators this meant ensuring that people were aware of the company being "a very local company, owned by the directors and staff... providing a strong emotional link with the area" (Bus Provider), whilst for others this meant emphasising the national nature of the company

a web-presence offers a way of making providers more accessible by establishing a two-way communication process with members of the public

most providers stated that it was difficult for them to ascertain the actual impact on their business through having a website

some providers feel that travellers wishing to undertake a search to ascertain how to get from A to B might not wish to be presented with too many choices by Transport Direct as this might be perceived as confusing

Transport Direct generally viewed in a positive way but considered ambitious

there is concern that Transport Direct will not succeed as a substitute for good local knowledge

Views from the public

72% of information users sought information for leisure travel compared to 21% and 29% for commuting and business respectively

information accuracy is the most importance aspect of a travel information source, regardless of the type of enquiry

for short unfamiliar journeys and to a greater extent for long unfamiliar journeys, a significant minority of the travelling public do not decide on their means of travel prior to consulting an information service

almost seven in ten respondents (69%) stated that they would prefer to consult a multi-modal travel information source rather than a mode-specific source when preparing for an unfamiliar journey

there is an overwhelming brand loyalty in the marketplace for mode-specific information sources and in the case of all modes except bus, the majority of site users having no dislikes about their chosen sites

respondents were fairly evenly divided in terms of whether they would prefer a local or a national travel information provider

eight in ten respondents stated that Transport Direct was a service they might use to assist them in planning their journey

approximately half the respondents, in spite of preferences for given existing sites, would consider using Transport Direct for rail and/or car information