FEDERAL AID AND STATE ECONOMIES:

EVALUATING THE OBAMA STIMULUS

Gerald Carlino

Federal Reserve Bank, Philadelphia

Robert Inman

Wharton School, University of Pennsylvania

OVERVIEW

I. U.S. States as “Agents” for Federal Policy

C

What Do US States Do for the Federal Government?

II. The Obama Stimulus: A

Bailout

?

C

Stimulus and State Assistance

C

A Reward for Past Fiscal “Indiscretions”?

III. How Will the States (As Agents) Spend the Stimulus?

C

Evidence from Past (1975-2005)Agents’ Behavior

C

Is the Past a Valid Guide for this Event?

IV. Will the Stimulus Work?

C

Macro Impact on National GDP and UE

0 .2 .4 .6 .8 1 % S ha re 1940 1960 1980 2000 2020 Year

Fed Share of All Gov't Service Provision (Non-Defense)

0 .2 .4 .6 .8 1 % S h a re 1940 1960 1980 2000 2020 Year

0 .2 .4 .6 .8 1 % S ha re 1940 1960 1980 2000 2020 Year

Fed Aid as Share of State/Local Revenue

0 20 0 40 0 60 0 $/ P er s o n 1940 1960 1980 2000 2020 Year

TOTAL Non Welfare Aid

I. U.S. States as “Agents” for Federal Policy

L

U.S. States as

Primary Providers

of Non-Defense Services

C

Education, Transportation, Health Care, Welfare, Protection,

Recreation, Environment, UE Insurance.

(FIGURE 1)

L

Federal Government as

Primary Financier

of Redistribution

C

Federal Administered

: Income Support for Elderly, Health

Insurance for Elderly.

C

State Administered

: Income Support for Poor, Health

Insurance for Poor, Low-Income Housing.

(FIGURE 2)

L

Federal Government as an

Important Financier

of Services

C

Service Aid as a Marginal Dollar: The Flypaper Effect

C

Service Aid as a Fraction of State Revenues:

.06

C

Service Aid as a Fraction of State Incomes:

.02

(FIGURES 3 AND 4)

L

The Agents in Trouble: 2009

C

States Budgets Reveal a Serious Fiscal Gap

TABLE 1:

STATE BUDGETS in 2009

(Working Through an Example for An Average State)

NORMAL TIMES

OWN CURRENT REV. OWN CURRENT EXP. OWN SURPLUS/DEFICIT NON-WELFARE AID FINAL SURPLUS

$3000/person $3516/person -$516/person $544/person $28/person

THIS RECESSION

OWN CURRENT REV. OWN CURRENT EXP. OWN SURPLUS/DEFICIT NON-WELFARE AID FINAL SURPLUS

$2800/person $3679/person -$879/person $544/person -$335/person*

EXHIBIT: California’s 2009 Budget Gap per Person = $997/person

IT’S EASY TO SEE W HY THE STATES CALLED FOR:

HELP

(!)

II. The Obama Stimulus: A Bailout?

L

How Much Federal Money for the States?

The American

Recovery

and

Reinvestment

Act:

3 YEAR (TOTAL) = $223.2 Billion

3 YEAR (

Recovery =

Stabilization + Welfare) = $101.4 Billion

3 YEAR (

Reinvestment =

Program + Projects) = $121.8 Billion

Approximate Annual Dollars Per Capita

TOTAL = $240/person

Recovery = $109/person

Reinvestment = $131/person

(Table 2)

L

Does ARRA State Assistance “Look Like” a Bailout?

C

Recovery Aid

Correlated with

Budget Gap

and

Poverty

C

Reinvestment Aid

Correlated with

Budget Gap

and

Politics

(Table 3)

C

Budget Gap

Correlated with

2009 UE Only

(Table 4)

TABLE 2

:

AMERICAN RECOVERY AND REINVESTMENT ACT

(Billions of 2009 Dollars)

PROGRAM 3 Year Allocation (Billions)

TOTAL ARRA ASSISTANCE $787 Billion

TOTAL STATE ASSISTANCE $223.2 Billion

NON-WELFARE ASSISTANCE

Stabilization Fund: General Purpose $8.8

Stabilization Fund: Education $39.7

State Fiscal Relief: Title I (Education) $12.9

State Fiscal Relief: Special Education $12.1

Transportation $34.3

Miscellaneous $14.9

SUB-TOTAL: Non-Welfare Assistance $122.7 Billion

EXHIBIT: Per Capita Non-Welfare Assistance $396/person

WELFARE ASSISTANCE

TANF $5.0

Unemployment $7.0

Health Insurance: MEDICAID $80.6

Public Housing $7.8

SUB-TOTAL: Welfare Assistance $100.4

EXHIBIT: Per Capita Welfare Assistance $324/person

AVERAGE ANNUAL NEW FEDERAL AID:

NON-WELFARE: $132/person

WELFARE: $108/person

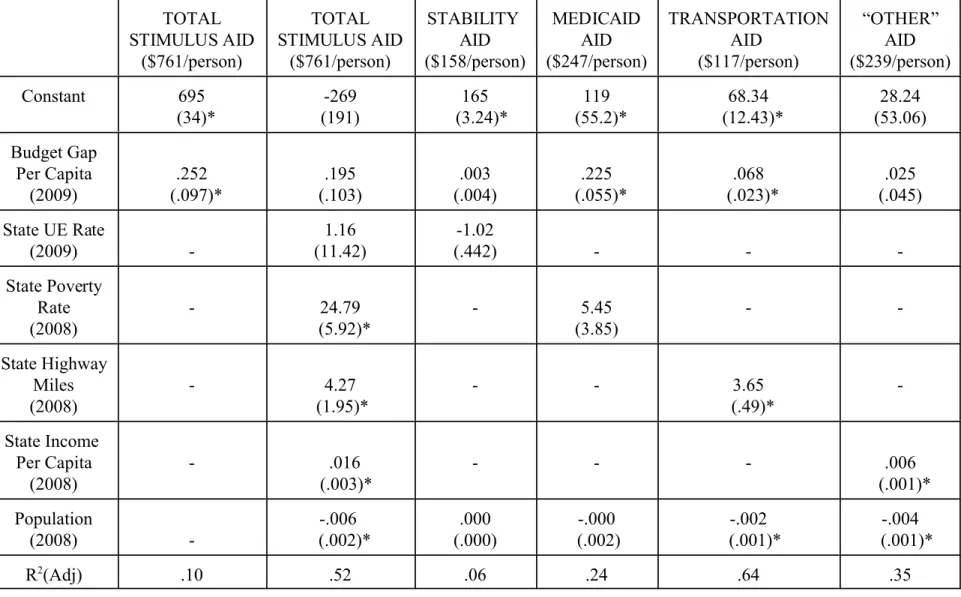

TABLE 3: CORRELATES OF OBAM A STIMULUS AID

TOTAL STIMULUS AID ($761/person) TOTAL STIMULUS AID ($761/person) STABILITY AID ($158/person) MEDICAID AID ($247/person) TRANSPORTATION AID ($117/person) “OTHER” AID ($239/person) Constant 695 (34)* -269 (191) 165 (3.24)* 119 (55.2)* 68.34 (12.43)* 28.24 (53.06) Budget Gap Per Capita (2009) .252 (.097)* .195 (.103) .003 (.004) .225 (.055)* .068 (.023)* .025 (.045) State UE Rate (2009) -1.16 (11.42) -1.02 (.442) - - -State Poverty Rate (2008) - 24.79 (5.92)* - 5.45 (3.85) - -State Highway Miles (2008) - 4.27 (1.95)* - - 3.65 (.49)* -State Income Per Capita (2008) - .016 (.003)* - - - .006 (.001)* Population (2008) --.006 (.002)* .000 (.000) -.000 (.002) -.002 (.001)* -.004 (.001)* R2 (Adj) .10 .52 .06 .24 .64 .35 *TABLE 4: CORRELATES OF THE 2009 “BUDGET GAP”

BUDGET GAP ($257) BUDGET GAP ($257) BUDGET GAP ($257) BUDGET GAP ($257) Constant -124 (123) -145 (157) -400 (244) -375 (231) State UE Rate (2009) 47.76 (14.96)* 44.57 (16.51)* 43.46 (16.38)* 47.63 (15.70)*State Own Surplus Per Capita (2005) - -.03 (.23) - -State “Cash” Per Capita (2005) - .01 (.03) -.01 (.03) -.02 (.03) State Expenditure Per Capita (2005) - - .109 (.239) .274 (.256)

State Own Revenue Per Capita (2005) - - .044 (.240) .027 (.255) Exp SD/Income (2005) - - --29520 (18022) Rev SD/Income (2005) - - -3045 (18181) R2 (Adj) .16 .10 .12 .22 *

III. How W ill the States (As Agents) Spend the Stimulus?

L

AGENT: GOVERNOR AS AGENDA-SETTER TO HOUSEHOLDS/LEGISLATURE

Maximize:

V =

"

[U(g, t) + (1-

N

)

C

*

rCU

(a, k

#

C

0, D

0, K

0)] + (1 -

"

)[P(g) +

N

C

*

pCU

(a, k

#

C

0, D

0, K

0)]

Subject to:

AID + t = g + k + a, where a = (c - d)

Yields a Demand System for Services (g), income (-t), investment (k), future income (d and c).

L

Estimated over 1976-2005 with Year and State Fixed Effects:

C

How Will $132 of Stimulus Aid be Allocated by the States?

)OWN SURPLUS )s = t - g - T )CURRENT RE V. (-t) )CURRENT EXP . (g) )OWN WELFARE EX P. (T) )CAPITAL OU TL AY S: k )DEBT INC UR RE D: d )CASH AN D S EC UR ITIES : c -$69/person -$59/person $10/person(Imposed*)

- $0 $8/person - $4/person

(Imp osed *)

$51/person

* Adding-up requires: )s + AID = [ t - g - T] + $132 = current accounts surplus = allocation to capital accounts = k + c - d.

C

Unexpected UE shocks Reduce Own Surplus, Lower Own Investment, and Increase LT Debt

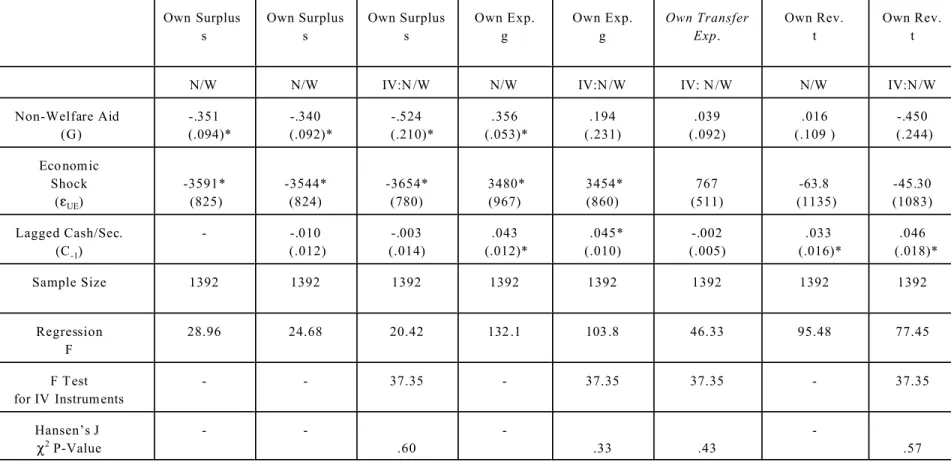

TABLE 5: Federal Aid and State Budgeting: Current Accounts

(1976-2005)† Own Surplus s Own Surplus s Own Surplus s Own Exp. g Own Exp. g Own Transfer Exp. Own Rev. t Own Rev. tN/W N/W IV:N /W N/W IV:N /W IV: N /W N/W IV:N /W

Non-Welfare Aid (G) -.351 (.094)* -.340 (.092)* -.524 (.210)* .356 (.053)* .194 (.231) .039 (.092) .016 (.109 ) -.450 (.244) Eco nom ic Shock (gUE) -3591* (825) -3544* (824) -3654* (780) 3480* (967) 3454* (860) 767 (511) -63.8 (1135) -45.30 (1083) Lagged Cash/Sec. (C-1) - -.010 (.012) -.003 (.014) .043 (.012)* .045* (.010) -.002 (.005) .033 (.016)* .046 (.018)* Sample Size 1392 1392 1392 1392 1392 1392 1392 1392 Regression F 28.96 24.68 20.42 132 .1 103 .8 46.33 95.48 77.45 F T est for IV Instrum ents

- - 37.35 - 37.35 37.35 - 37.35 Hansen’s J P2 P-Value - -.60 -.33 .43 -.57 †

All regressions include year and state fixed effects. Estimation uses the Newey-West (N/W) estimator for standard errors robust to heteroskedasticity and autocorrelation.

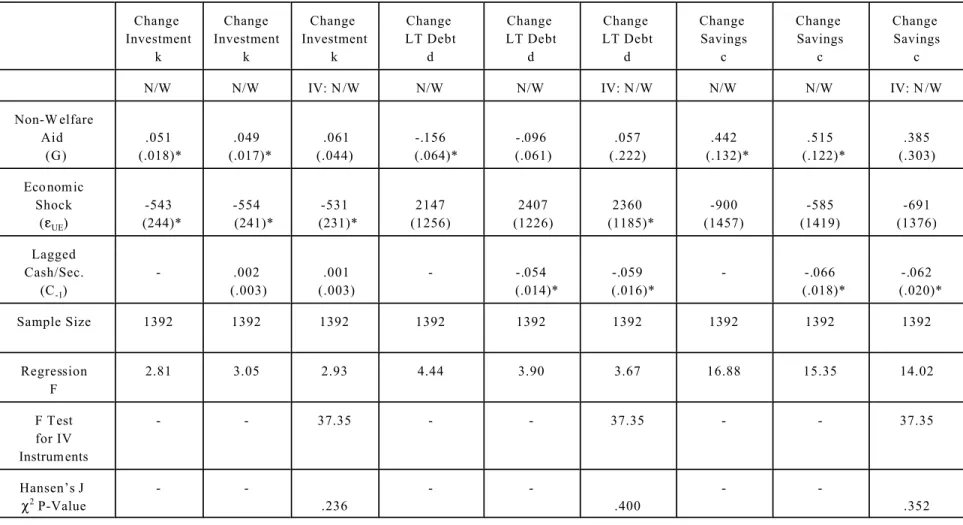

TABLE 6: Federal Aid and State Budgeting: Capital Accounts

(1976-2005)† Change Investment k Change Investment k Change Investment k Change LT Debt d Change LT Debt d Change LT Debt d Change Savings c Change Savings c Change Savings cN/W N/W IV: N /W N/W N/W IV: N /W N/W N/W IV: N /W

Non-W elfare Aid (G) .051 (.018)* .049 (.017)* .061 (.044) -.156 (.064)* -.096 (.061) .057 (.222) .442 (.132)* .515 (.122)* .385 (.303) Eco nom ic Shock (gUE) -543 (244)* -554 (241)* -531 (231)* 2147 (1256) 2407 (1226) 2360 (1185)* -900 (1457) -585 (1419) -691 (1376) Lagged Cash/Sec. (C-1) - .002 (.003) .001 (.003) - -.054 (.014)* -.059 (.016)* - -.066 (.018)* -.062 (.020)* Sample Size 1392 1392 1392 1392 1392 1392 1392 1392 1392 Regression F 2.81 3.05 2.93 4.44 3.90 3.67 16.88 15.35 14.02 F T est for IV Instrum ents - - 37.35 - - 37.35 - - 37.35 Hansen’s J P2 P-Value - -.236 - -.400 - -.352 †

All regressions include year and state fixed effects. Estimation uses the Newey-West (N/W) estimator for standard errors robust to heteroskedasticity and autocorrelation.

IV. Will the Stimulus Work?

L

Macro Impact on UE

and GDP

C

No Impact of State Deficits on State UE

(Table 7)

BEWARE

: FALLACY OF COMPOSITION

C

Estimate of Federal Deficit Financed Aid on GDP & UE

(Work In Progress: Estimation of Structural VAR)

Y

t= {g

fed, t

fed, aid

fed, g

s/R, t

s/R, gdp}

B(L)

C

Y

t=

g

tor

Y

t= B(L)

-1C

g

tor

Y

t= D(L)

C

g

twhere D(L) is the structural impulse response function of Y

tw.r.t.

g

tC

”Back of the Envelope” Estimates Based on Blanchard-Perotti

July 1, 2009:

)

GDP = $17.2 B

July 1, 2010:

)

GDP = $50.7 B

July 1, 2011:

)

GDP = $87.1 B

July 1, 2012:

)

GDP = $69.8 B

INCREASE OVER 3 YEARS OF $220 B STIMULUS = $225 B

TABLE 7:

FEDERAL AID AND STATE (UN)EMPLOYMENT RATES

1. STATE EMPLOYMENT

Employment Rate = (year effects, state effects) + 1.059CEmpRate-1 -.159CEmpRate-2 - .141CEmpRate-3 (.028)* (.041)* (.027)*

R2

(Adj.) = .94

2. IS THERE A KEYNESIAN IMPACT OF STATE DEFICITS AT THE STATE LEVEL?

Employment Rate = (year effects, state effects) + 32-tCEmpRate-t + .000003Cs-1 - .0000008Cs-2 (.000002) (.0000010)

R2

(Adj.) = .94

3. WILL THE OBAMA STIMULUS HELP STATE EMPLOYMENT RATES?

Employment Rate = (year effects, state effects) + 32-tCEmpRate-t + .0000011C (.0000039)

R2(Adj.) = .94

F Test for IV Instruments = 49.99; Hansen’s J P2

TABLE 8A: “Back of the Envelope” Estimates of Impact of $1 of Stimulus Aid on GDP

)GDP QUARTER 1 )GDP QUARTER 4 )GDP QUARTER 8 )GDP QUARTER 12 )TAX = -$.45 -.69(-.45) = .31 -.74(-.45) = .33 -.72(-.45) = .32 -.22(-.45) = .10 )SPENDING = $.14 .84(.14) = .12 .45(.14) = .06 .54(.14) = .08 1.13(.14) = .16 TOTAL IMPACT $.43 $.39 $.40 $.26TABLE 8B: “Back of the Envelope” Estimates of Impact of Aggregate Stimulus Aid on GDP

Aggregate Impact by July 1, 2009 Aggregate Impact by July 1, 2010 Aggregate Impact by July 1, 2011 Aggregate Impact by July 1, 2012 $40 Billion March, 2009 $17.2 B $15.6 B $16 B $10.4 B $90 Billion July 1, 2009 - $35.1 B $36 B $23.4 B $90 Billion July 1, 2010 - - $35.1 B $36 B TOTAL AGGREGATE IMPACT $17.2 B $50.7 $87.1 B $69.8 B

IV. Will the Stimulus Work?

L

Micro Impact on State Economies

C

Micro Economic Impact of

Differentially

Good State Fiscal Policies

t

Households Move In, Rents Rise, Wages Fall

t

Firms Move In, Jobs Increase, Rents Rise, Wages Rise

OVERALL EFFECTS:

Population Increases, Jobs Increase, Rents Rise, Wages Uncertain

C

DIFFERENTIAL FEDERAL AID THE STATE’S REAL

ECONOMY

Ann ual Ra te of Net In-Migration

Annual Rate of New Job Creation

Annual Rate of W age G rowth Annual Rate of House Price Appreciation M ean V alue: .002 .021 .013 .014 CONTRIBUTION OF: s - 0 - 0 - 0 - 0 )k .00035 .00029 - 0 .001 )d - 0 - 0 - 0 - 0 )c .0011 .00081 - 0 .002 TOTAL EFFECT .0015 .0011 - 0 .003 % IMPROVEMENT 75% 5.2% 0% 21%

BEWARE, AGAIN

: FALLACY OF COMPOSITION

(Table 9)

TABLE 9: State Budgeting and the State Economy

(1972-2005)† Ne t In-migration n Ne t In-migration n Labor Force Gro wth R Labor Force Gro wth R W age Gro wth w W age Gro wth w Hom e Value Appreciation r Hom e Value Appreciation rN/W IV: N /W N/W IV: N /W N/W IV: N /W N/W IV: N /W

Lagged Change Investm ent: k .000025 (.000008)* - .000021 (.000009)* - -.000003 (.00001) - .000074 (.000023)* -Lagged Change LT Debt: d -.000018 (.000004)* - -.000016 (.000004)* - -.000006 (.000004) - -.000039 (.000013)* -Lagged Change Savin gs: c .000014 (.000003)* - .000010 (.000003)* - .000003 (.000004) - .000025 (.000009)* -Contempo raneous Ln(Prod. Shock) -.002 (.003) -.007 (.003)* .002 (.003) .002 (.004) .013 (.004)* .013 (.005)* .017 (.009) .008 (.011) Non-W elfare Aid G -.000021 (.000019) -.000014 (.000018) -.000027 (.000020) -.00005 (.00004) Sample Size 1632 1440 1632 1536 1632 1536 1632 1440 Regression F 19.81 11.07 44.84 32.53 43.43 35.83 17.78 13.77 F Test for IV In strume nts - 38.29 - 41.27 - 41.27 - 38.29 Hansen’s J P2 P-Value - .83 - .13 - .01 - .93 †

All regressions include year and state fixed effects. Estimation uses the Newey-West (MN/W) estimator for standard errors robust to heteroskedasticity and autocorrelation.