(

·-.'

iC1

CANADA PENSION PLAN AND QUEBEC PENSION PLAN TABS. PAGE1 PARTICIPANT

Canada Pension Plan and

Quebec Pension Plan

()

()

\ \._)

CANADA PENSION PLAN AND QUEBEC PENSION PLAN TAB8.PAGE2

PARTICIPANT

Canada Pension Plan and

Quebec Pension Plan

:>

When the Canada Pension Plan (CPP) and Quebec Pension Plan (QPP) came into effect on January 1 , 1966, the contribution rates under the federal pension plans were coordinated with those under the CPP or QPP.:>

Your contributions and future benefits are coordinated between your federal pension plan and the CPP or QPP.CANADA PENSION PLAN AND 0UEBEC PENSION PLAN TAB8.PAGE3

PARTICIPANT

(J

CONTRIBUTORY PERIOD:>

The total span of time during your life when you may contribute to the CPP orQPP is called your contributory period (starting at age 18 or after January 1st,

1966).

:>

The minimum amount you must earn yearly to contribute to CPP or QPP is $3,500.:>

The contributory period is used in calculating benefits. The contributory period for CPP and QPP is different.:>

In Quebec, prior to the reform, workers who reached age 70 stopped contributing even if they didn't ask for their benefits.:>

Now, wtth the reform, all Quebec workers contribute to the QPP, even those whoC)

have reached age 70. So, if you are over 70 years old and still working, you mustnow continue to contribute to the QPP, provided you earn more than the general exemption ($3,500).

()

c

J

CANADA PENSION PLAN AND 0UEBEC PENSION PLAN TAB8.PAGE4

PARTICIPANT

CONTRIBUTIONS

~ Prior to January 181, 2000, you were contributing a total of 7.5% of your

pensionable earnings to the Public Service Superannuation Plan and the Canada Pension Plan or the Quebec Pension Plan.

3.0% superannuation contribution 3.5% CPP or QPP contribution 1.0% indexation

[7.5%

~ Between 2002 and 2003 the Federal Government legislated a gradual increase

of the CPP/QPP.

Year Contribution Set Out Contribution on Contribution to the CPPP

intheCPPP Eligible Earnings Plan and the CPP/QPP

Under the CPP/QPP

2000 4% 3.9% 7.9%

2001 4% 4.3% 8.3%

2002 4% 4.7% 8.7%

2003 4% 4.95% 8.95%

2004 4.4% 4.95% 9.35%

2005 4.8% 4.95% 9.75%

2006 5.2% 4.95% 10.15%

2007 5.6% 4.95% 10.55%

2008 5.77% 4.95% 10.72%

2009 5.7% 4.95% 10.65%

2010 5. 7% (no change) 4.95% 10.65%

2011 6.1% 4.95% 11.05%

2012 6.5% 4.95% 11.45%

2013 6.8 4.95% 11.75%

2013: July 7.5 4.95% 12.45

('

)CANADA PENSION PLAN AND QUEBEC PENSION PLAN TAB 8. PAGE 5

PARTICIPANT

:>

In 2012 the Federal Government made changes to the Pension Plan. The cost sharing changed from 60% ER funded/40% EE funded to a 50/50 cost sharing. Further, they eliminated the cap on the rate of increase (previously .4% per year). In 2013 there was a .3% increase in January and a further .7% increase in July of 2013.Examples of annual contributions in 2014

Employment Employee's Self-employed

income for 2014 contribution worker's

deducted

at

source contributions$

$

$

5,000 74.28 148.56

10,000 321.72 643.44

15,000 569.28 1138.56

20,000 816.72 1633.44

25,000 1064.28 2128.56

30,000 1311.84 2623.68

35,000 1559.28 3118.56

40,000 1806.75 3613.50

42,100 1910.70 3821.40

43,700 1989.90 3979.80

44,900 2049.30 4098.60

46,300 2118.60 4237.20

47,200 2163.15 4326.30

48,300 2217.60 4435.20

50,100 2306.70 4613,70

51' 100 2356.20 4712.40

CANADA PENSION PLAN AND QUEBEC PENSION PLAN TAB8.PAGE6

PARTICIPANT

( ) NOT WORKING DURING EARLY RETIREMENT

()

()

~ If you wish to receive CPP/QPP retirement benefits between age 60 and 65, you

must show that you are no longer receiving salary from paid employment or self-employment once you start receiving benefits.

WORKING WHILE YOU RECEIVE CPPIQPP BENEFITS

~ If you continue to work after age 65, you can, once you have reached age 65,

apply to receive CPP/QPP benefits.

TO RECEIVE YOUR BENEFITS, YOU MUST APPLY!

~ To receive pension plan benefits, you must apply (six months in advance, if

possible).

RETROACTIVITY

~ Before age 65: Benefits will only be paid to you starting in the month that follows

receipt of your application or the month that follows the date you stopped working.

~ After age 65: Benefits may be paid to you retroactively as of the date you

0

CANADA PENSION PLAN AND 0UEBEC PENSION PLAN TAB B. PAGEl

PARTICIPANT

CPP/QPP Early Retirement

Benefits

SHOULD YouAPPLYOR WAtT?

~ If you retire prior to your 651h birthday and receive benefits from your pension

plan, you must decide whether or not to receive early CPP/QPP benefits.

EARLY BENEFITS ARE REDUCED

~ Full CPP/QPP benefits are available at age 65. However, you may opt to receive

CPP/QPP benefits at age 60.

~ The benefits will be reduced by 6% for each year prior to age 65.

For example:

A person at age 60 will receive 70% of the benefits he or she would receive if he or she waited until 65 to receive benefits.

CANADA PENSION PLAN AND 0UEBEC PENSION PLAN TAB8.PAGE8

PARTICIPANT

n

EARLY BENEFITS ARE INDEXEDC)

:>

The reduction in benefits for workers choosing early CPP/QPP pensions is lessened because the CPP/QPP is indexed from the time it is received.For example:

~ Those who opt for CPP/QPP pension benefits at age 60 will receive an initial

pension of 70% of what they would receive if they waited until age 65. However, the reduced pension they receive at age 60 will be increased each year to reflect the changes in the Consumer Price Index, which occur during the five years between age 60 and 65.

~ If inflation averaged 3% per year during this period, a worker opting for early

CPP/QPP benefits at age 60 would, at age 65, receive 81.1% of what they would have received if they waited until age 65.

FACTORS TO CONSIDER WHEN DECIDING WHETHER OR NOT TO OPT FOR EARLY (REDUCED) CPP!QPP BENEFITS

1. Health and life expectancy

2. Financial situation

3. Inflation rate

4. Immediate needs and family situation

()

CANADA PENSION PLAN AND QUEBEC PENSION PLAN TAB8.PAGE9 PARTICIPANT QUEBEC PENSION PLAN FIGURES

You will find below some basic information on the Quebec Pension Plan and the maximum pensions and death benefit paid under the Plan for the last 3 years.

:>

Information 2011 ABasic information

Maximum Pensionable Earnings Basic Exemption

Contribution rate

Maximum contribution for workers and employers (4.95 %)

Maximum contrigbution for self-employed workers (9.9 %)

Indexation rate for benefits as at 1 January 2011

Maximum amounts for pensions beginning in 2011 <1)

Retirement pension -age 65

- age 60 (70%) -age 72 (130%) Disability pension

Orphan's pension and pension for a disabled person's child Surviving spouse's pension (2)

- Beneficiary under age 45

- Without dependent children, not disabled - With dependent children, not disabled - Disabled, with or without dependent - Between ages of 45 and 64

- Age 65 or over

Amount for the death benefit

$48,300.00 $3,500.00 9.9% $2,217.60 $4,435.20 1.7% $960.00 $672.00 $1,248.00 $1,153.34 $69.38 $470.98 $762.35 $793.34 $793.34 $576.00 $2,500.00

n

(_)

I I

")

CANADA PENSION PLAN AND QUEBEC PENSION PLAN TAB 8, PAGE 10

PARTICIPANT

NOTE: Before starting the sections "Calculation Formula for CPP/QPP Benefits" and "How is your retirement pension reduction calculated?", let's examine the meaning of the following terms:

MAXIMUM PENSIONABLE EARNINGS

~ Maximum pensionable earnings means:

The maximum earnings on which it is possible to contribute and also the maximum earnings used under the CPP/QPP to calculate your benefits.

~ Maximum pensionable earnings under the CPP/QPP over the past five years

were:

¢ $52,500 for 2014

¢ $51,100 for2013

¢ $50, 1 00 for 2012

¢ $48,300 for 2011

()

C)

CANADA PENSION PLAN AND 0UEBEC PENSION PLAN TAB8.PAGE11 PARTICIPANT

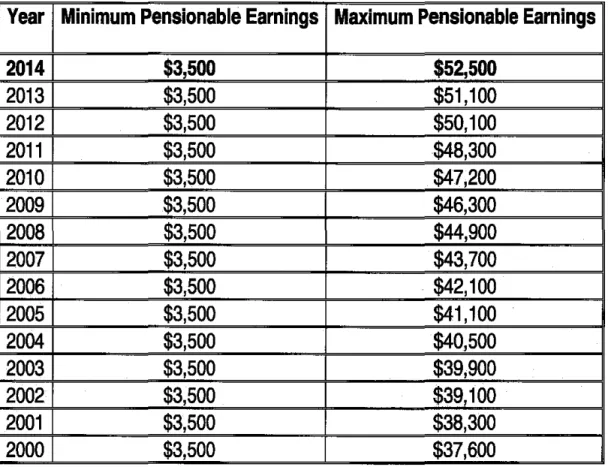

TABLE OF MAXIMUM PENSIONABLE EARNINGS

FOR CPP/QPP FROM 2000 TO PRESENT

!) The table indicates for each year since the CPP/QPP came into effect the minimum and

maximum pensionable earnings.

Year Minimum Pensionable Earnings Maximum Pensionable Earnings

2014 $3,500 $52,500

2013 $3,500 $51,100

2012 $3,500 $50,100

2011 $3,500 $48,300

2010 $3,500 $47,200

2009 $3,500 $46,300

2008 $3,500 $44,900

2007 $3,500 $43,700

2006 $3,500 . $42,100

2005 $3,500 $41,100

2004 $3,500 $40,500

2003 $3,500 $39,900

2002 $3,500 $39,100

2001 $3,500 $38,300

CANADA PENSION PLAN AND 0UEBEC PENSION PLAN TAB 8. PAGE 12

PARTICIPANT

n

Average Maximum Pensionable

()

Earnings

~ The calculation is based on average earnings (maximum under the CPP/QPP)

over five years. For example:

A) The maximum pensionable earnings are:

¢ $52,500 for 2014

¢ $51,100 for2013

¢ $50, 1 00 for 2012

¢ $48,300 for 2011

¢ $47,200 for 2010

Total $249,200

B) $230,400

+

5 (years)=

$49,840()

()

CANADA PENSION PLAN AND QUEBEC PENSION PLAN TABS. PAGE 13

PARTICIPANT

CPP/QPP

CALCULATION FORMULA

Calculation formula for monthly CPP/QPP benefits:

25% X 1/12 X average maximum pensionable earnings

=

or

average maximum pensionable earnings X 0.25 . 12

=

For example:

Should your average maximum pensionable earnings reach $49,840.

25% X 1/12 X $49,840

=

$1038.33or

$49,840 X 0.25

+

12=

$1038 .. 33,-\ \ )

CANADA PENSION PLAN AND QUEBEC PENSION PLAN TAB 8. PAGE 14

When Does the Bridge

Pension Go Away?

PARTICIPANT

:>

Because of the co-ordination with CPP/QPP, your pension plan benefits arereduced on the first of the month following your 65th birthday.

:>

This reduction applies regardless of whether or not you have applied to receive benefits under the CPP or QPP. Please note that you must apply for CPP orQPP benefits at age 65 or earlier. Apply six months before you want to receive

benefits.

:>

The reduction in your pension plan benefits is lower than the total amount ofC)

additional benefits you will receive under the CPP/QPP.:>

If you become entitled to disability benefits under the CPP or QPP before youreach age 65, your pension plan benefits will be reduced immediately.

:>

If you opt for early (reduced) benefits under CPP/QPP, your pension plan()

CANADA PENSION PLAN AND QuEBEC PENSION PLAN TAB 8. PAGE 15

PARTICIPANT

Example of Co-ordinated Benefits under your

Pension Plan and the CPP/QPP

=

In the event your CPC pension benefits are $31,318 per year, i.e. $2,610 permonth and your CPP/QPP benefits are $1,038 per month and your bridge pension is $872 per month:

~ Pension plan benefit

~ CPP/QPP

~Reduction

NOTE:

$2,610 $1,738

$872

+

$1,038=

=

=

$2,610 per month $1,038 per month $872 per month

=

$1,738=

$2,776Once again, remember that at age 65 you become eli~ible for old age security

benefns in addnion to the above amount. ($2, 776

+

552=

$3,328)'co

1--

....

:z ~1!1-~~

co!lf

11:111. ~ :o!:l ~· ;;!: i1lai

a.:

fd

8:1 ::I~I

0!:~;

:o!:l ~Ia!

a.:

C!i ~ ~.,

~

c

fcr

.,~

_,~

,

.,,

:::1

E

.,

:::1

c

E .2

· -

)( cs

-1-cs

-1-E .,

_,

,:!!

L Q.c

-1-~

_,

c

0

~

Type of benefit Beneficiary's age Rate payable Maximum monthly_ amount

Retirement pension • 60 70% $542.50

61 76% $589.00

62 82% $635.50

63s 88% $682.00

64s 94% $728.50

65 100% $775.00

66 106% $821.50

67 112% $868.00

68 118% $914.50

69 124% $961.00

70 or over 130% $1,007.50

Disability pension Under65 $935.09

Pension for a disabled person's child Under 18 $56.65

Surviving spouse's pension (for the Under45

widow or widower) no dependent children $381.26

with dependent $619.17

disabled $644.47

between 45 and 54 $644.47

between 55 and 64 $690.22

65 or over $465.00

Orphan's pension under 18 $56.65

Death benefit Uniform lump-sum payment $2,500

* It is important to note that amounts may vary depending on the month in which the pension begins between the ages of 60 and 70 .

I

I

I

I

I

I

I

I

I

II

II II II2:!

.2

~

5

~ '() Q) ~ cat5

0).s:

..liC ~ .0..:~

2:!

·-

~

CANADA PENSION PLAN AND QuEBEC PENSION PLAN TAB8.PAGE17

PARTICIPANT

0

Canada Pension Plan Payment Rates

*

January to December 2014

Retirement Age of Beneficiary Rate Paid Maximum Monthly Benefits

Benefits

Calculated at 60years 66.4% $643 0.56% per month

61 years 73.12% $759 62years 79.84% $829 63 years 86.56% $899 64 years 93.28% $969

65 years 100% $1,038

Calculated 66 years 108.4% $1,126

at . 7% per month 67years 116.8% $1,213

C)

68 years 125.2% $1,30069 years 133.6% $1,387 70years 142% $1,474

()

(

,_)

I .

\._)

CANADA PENSION PLAN AND QUEBEC PENSION PLAN TAB 8. PAGE 18

PARTICIPANT

I .. I

a,ovemment Gouvemement T o Canada o;iw CanadaCanada Pension Plan (CPP) -Payment Rates (January to December 2014)

Canada Pension Plan rates are adjusted every January if there are increases in the cost of living as measured by the Consumer Price Indes. The table below lists the maximum and average monthy rates for Canada Pension Plan benefits for 2014, except for the death benefit which is a one-time payment.

More information on CPP rates and the CPI

Canada Pension Plan Payment Rates

Type of benefit Average monthly Maximum

benefit (2014) monthly benefit

2014

Disabili~ ben~fit $896.87 $1,236.35

Retirement gen§ion (at age $633.46 $1,038.33

65)

R~~ .. ~~t~me6fben•rtt'cilt $8.26 $25.96

~ge~$)

Survivors benefit (under age $401.53 $567.91

65)

Survivors benefit (age 65 $302.28 $623.00

and over)

~hildr!i!n Qf disa!;!l~d ' $230.72 $230.72

s;ontri!;!ytors benefit

Children of d!i!s;eased $230.72 $230.72

contributors benefit

Combined survivors & $799.79 $1,038.33

retirement benefit (pension at age 65}

Death benefit $2,285.48 $2,500.00