A STUDY ON INVESTOR’S BEHAVIOUR TOWARDS MUTUAL FUND

Full text

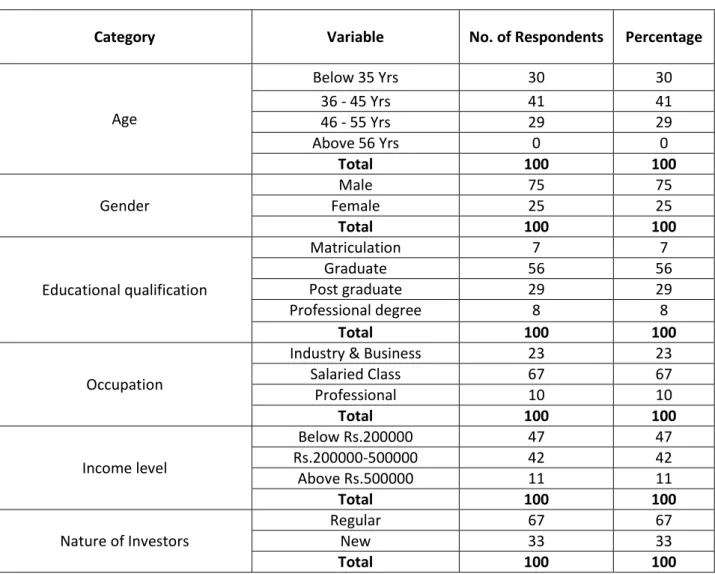

Figure

Related documents

Table 5: χ 2 test of MF: Safe medium of investment (occupation-wise) Value df Asymp. Now, see following table 6, which describes about the question asked to the respondents

Source: Own elaboration. The data come from The Global Competitive Report 2018. Innovation Ecosystem Source: Own elaboration.. Figure 2 shows that there is a linear

The Eastspring Investments Asia Investor Behaviour Study is an annual survey designed to track current asset allocation and investment attitudes of mutual fund investors,

Chakravarti, Amitav, Fishbach, Ayelet, Ülkümen, Gülden, and Chris Janiszewski, “The Licensing Effects of Screening on Choices between Relative Virtues and Vices,” (Working

Boyd, "Compensation of multimode fiber dispersion using adaptive optics via convex optimization," Journal of Lightwave technology, vol.. Moser, "Delivery

You can know as you worship God and stand in the gap for your loved ones, exercising your authority in Christ, that you release angels to perform God’s Word in their lives, to

Source: Eastspring Investments – Hong Kong Mutual Fund Investor Behavior Study July 2013 Base: Current income mutual fund holders (122).. INVESTOR CONFIDENCE IN DIFFERENT ASSET

The data set constructed for this paper contains all the variables in the two equations underlying the BLR approach —namely, initial per capita income, per capita GDP growth