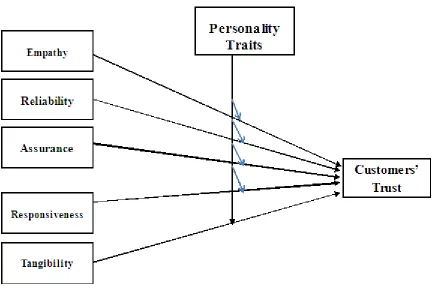

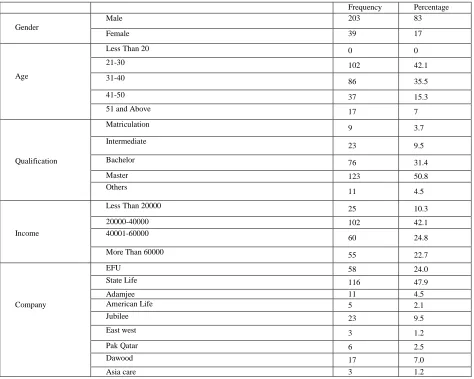

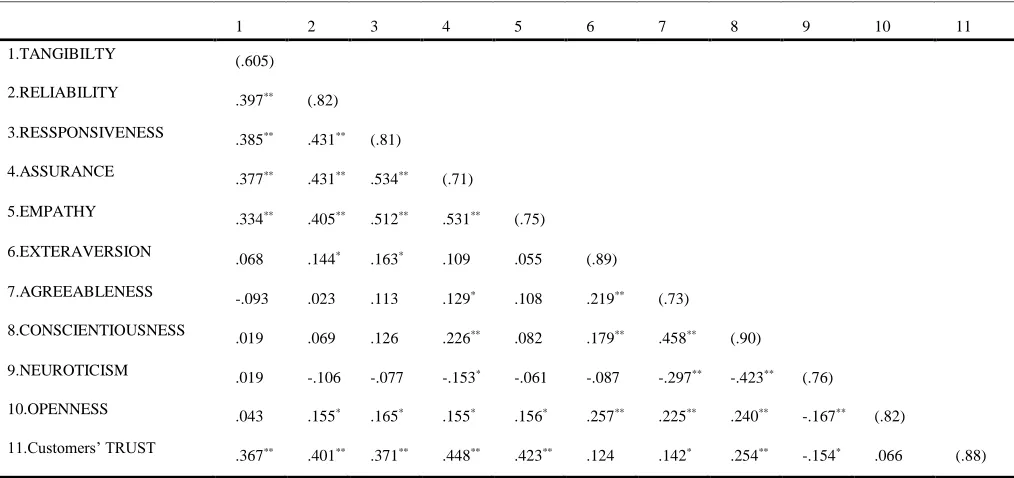

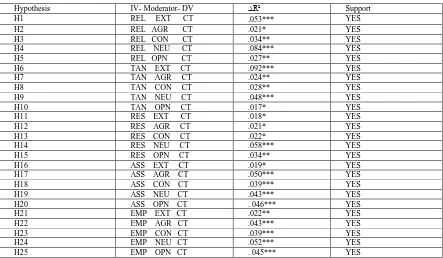

Service quality and customers trust, moderating role of personality traits

Full text

Figure

Related documents

Consistent with a model of a farm household with a binding subsistence constraint, we show that adverse agricultural productivity shocks increased both male migration to the US

The effects of volume fraction of nanoparticles, inclination angle, Re and Ri on the details of the flow, the average Nusselt number, entropy generation and temperature

for Data Centers A la carte applications Operations Energy Operation Online Energy Operation Advanced Data Center Operation Asset Operation Control Power Monitoring Expert

The study is followed the pseudo-first-order rate kinetics and is found that the sorption data fit well the Lagergren equation.The main mechanisms involved in the removal of

GOURMET TRUFFLES - A decadent confection made with pure, fresh cream and rich chocolate in the classic European tradition..

Twenty-five percent of our respondents listed unilateral hearing loss as an indication for BAHA im- plantation, and only 17% routinely offered this treatment to children with

Based on the purpose of this study is to analyze more in depth about the quality of exam questions even semester 2015/2016 school year in Biology Education study

Once the student has received approval from the field education committee, the field instructor in partnership with the field director and field liaison assure that the student’s