Fossil-fuels, bio-fuels and food: Raking

priorities

Dias, Guilherme Leite da Silva and Guilhoto, Joaquim José

Martins

University of São Paulo

2010

Online at

https://mpra.ub.uni-muenchen.de/30733/

Guilherme Leite da Silva Dias

Department of Economics, FEA - University of São Paulo E-mail: guildias@usp.br

Joaquim José Martins Guilhoto

Department of Economics, FEA - University of São Paulo REAL, University of Illinois; and CNPq Scholar

E-mail: guilhoto@usp.br

Abstract

This paper deals with the question of the trade-offs between bio-fuels, fossil-fuels, and food. To do so an analysis is conducted taking into consideration the differences in relative prices and in the productive structure among the countries. The results shows that in general food puts a greater stress over the economies than energy does, and mainly in the developing economies. As a consequence of that, the possibilities for the growing use of bio-fuels is limited and restrict to countries where it is possible to have an expansion of bio-fuel production without compromising the production of food and without putting more stress over the environment. This, by its turn, restricts the possibilities for a world policy of bio-fuels with the consequence that bilateral agreements would be the dominant ones.

1. Is There a Possible Common Policy for Bio-fuels?

The answer is no, because bio-fuel demand and supply is commanded by a set of

country specific restrictions. Rising food cost is a very sensitive issue for low income

countries, also in countries that have experienced famine due to social or political

upheavals. Global energy crisis increases average cost of energy everywhere but

uncertainty about energy supply has many different forms according to the availability

of alternative primary sources and access to traded complementary sources. Global

Warming awareness is becoming another constraint on fossil fuels and energy

efficiency but widely different between countries. A further complication draws upon

the fact that those three restrictions are not independent, for any change in one of them

as for instance the rising cost of oil, the impact upon food supply is negative and many

countries will make more use of coal as an alternative source for thermal electricity.

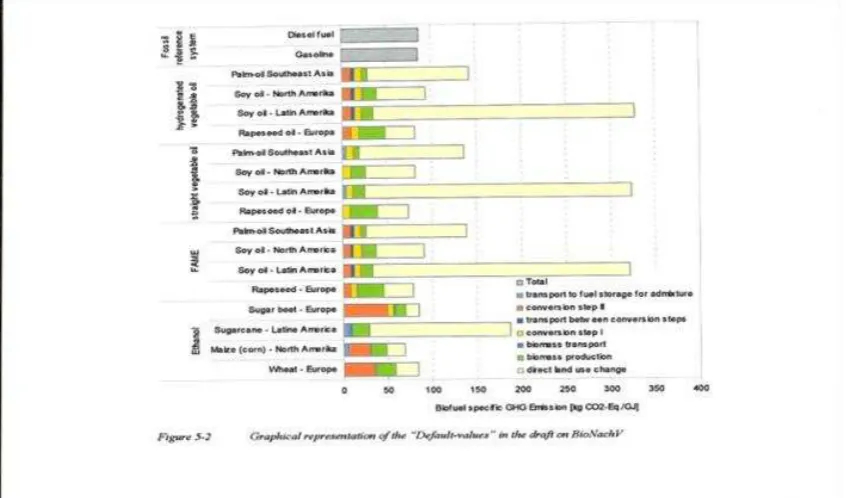

The implications of biofuels production on emission of green house gases and

the net effect of the substitution of fossil fuels cannot be underestimated. By the end of

2007 German government issued a draft of the biomass sustainability ordinance, with

the inclusion of a first assessment of land use changes following recommendations from

the IPCC report. Given a certain set of default values and the assumption that sugar

cane and soybean expansion in Latin America comes from conversion of savannah soils

to cropland, and palm oil in Southeast Asia from rainforest, an amazing set of results

depicted in Figure 1 below, contributed to a halt on fiscal incentives to bio-fuel

production in Germany and imports without previous certification.

Many other countries followed suit and to complicate matters further the bubble

on food market prices created a dismal picture for bio-fuels. The two following sections

deals with pricing bio-fuels as a substitute for fossil fuels and the wide dispersion

between countries on the role of food and energy sectors suggesting that bilateral trade

agreements is a better strategic alternative to Brazil than the current choice of a globally

Figure 1 - Green House Emissions by Alternative Bio-fuels

2. Trade Opportunities

In this section we address the issue of bio-fuels prospective trade opportunities

or, in another way to put it, can bio-fuels become commodities regularly traded in spot

and future markets?

Fossil fuels although traded regularly have a substantial share traded under long

term contracts to give enough security on the issue of access, even though contracted

price may fluctuate according to some formulae related to spot and future market

references. The majority of fossil fuel reserves are state property or state controlled corporation’s property. Market uncertainty is not left to speculation by economic agents but handled as a national security affair consequently it is priced and supplied by a

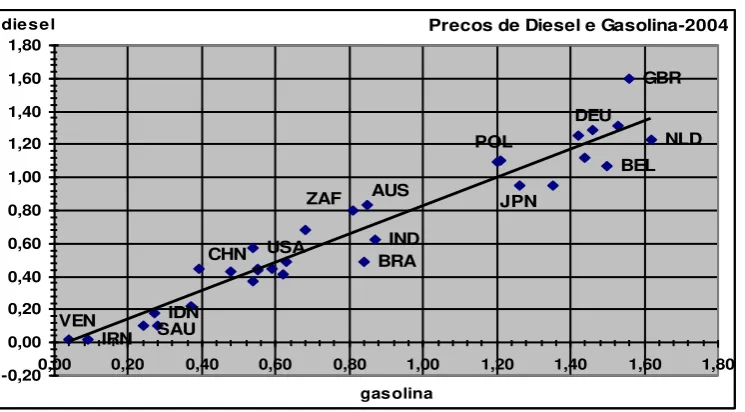

myriad of alternative structures in each nation. Average prices collected on an annual

basis reflect this diversity as in Figure 2 below, domestic indirect taxation more than

Figure 2 – WDI / Diesel & Gasoline Prices, 34 Countries.

Precos de Diesel e Gasolina-2004

POL BEL VEN SAU CHN DEU BRA USA IRN NLD GBR IDN ZAF IND JPN AUS -0,20 0,00 0,20 0,40 0,60 0,80 1,00 1,20 1,40 1,60 1,80

0,00 0,20 0,40 0,60 0,80 1,00 1,20 1,40 1,60 1,80

gasolina diesel

This sample of 34 countries adds to 85% of the world consumption of energy.

The lowest prices are found in typical oil exporting economies, for a $0,20 per gallon of

diesel gasoline is priced at $ 0,28; in a middle group of countries (Brazil and USA

included), for a diesel of $ 0,60 gasoline is at $ 0,76; for the group of high priced liquid

fuels, diesel goes for $1,20 and gasoline for $1,44. This is not the kind of price

dispersion that we expect from a level playing field type of market structure but is a real

picture of a crystallized diverse set of national regulated markets.

The current generation of biofuels consists of basic agricultural products

subjected to well known transformation procedures, mostly fermentation and chemical

reaction. It is essentially a joint production system of multiple products, that could be

organized as a regular market system. Most used agricultural products- sugar cane, maize, wheat, soybean,….- have only been traded under a global market system since the Uruguay Round (1995), for fifty years after the II World War the spectrum of

chronic starvation prevented most nations to abandon the objective of self sufficiency

and protectionism. Against the uncertainty of agricultural production many countries

have shown a preference for building stocks of basic food products and occasionally

getting rid of their high cost of maintenance by exporting at subsidized prices. Food

uncertainties around market access in exchange for domestic inefficient production and

failures in the pursuit of self sufficiency.

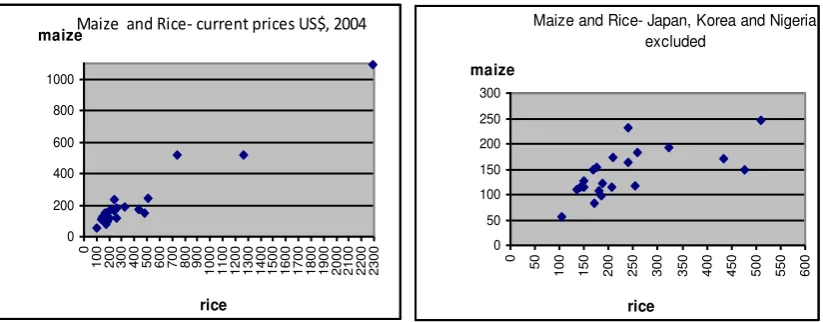

Price dispersion among basic agricultural commodities is not as wide as with

fossil fuels but still far away from normally traded manufactured products. Figures 3, 4

and 5 show alternative ways for comparison. Excluding Japan, Korea and Nigeria (most

protected agricultural markets) in a three fold range of prices we find 25 wheat

producing countries (out of those 34 countries seen before), in a five fold range we

include another 24 maize producing countries, and in a ten fold range we include 19 rice

producing countries. Ten years after the Uruguay Round what we have is still a diverse

set of national regulated markets

[image:6.595.97.509.339.500.2]

Figure 3 - FAO/Maize&Rice Prices for 19 Countries

Figure 4 – FAO / Maize & Wheat Prices, 25 Countries

Maize and Wheat-current prices US$, 2004 NGA KOR JPN 50 250 450 650 850 1050

50 250 450 650 850 1050 1250

wheat maize 50 100 150 200 250

50 100 150 200 250 300

Maize and Wheat - Japan, Korea and Nigeria excluded

Maize and Rice- Japan, Korea and Nigeria excluded 0 50 100 150 200 250 300 0 50

100 150 200 250 300 350 400 450 500 550 600

rice maize 0 200 400 600 800 1000 0

100 200 300 400 500 600 700 800 900 1000 1100 1200 1300 1400 1500 1600 1700 1800 1900 2000 2100 2200 2300

rice

[image:6.595.89.509.557.744.2]Figure 5 – FAO / Rice & Wheat Prices, 24 Countries

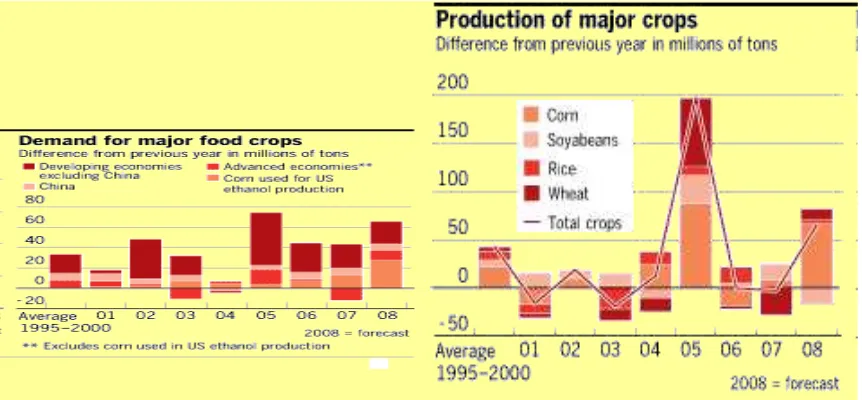

Recent market volatility is reminding us of how limited is food security under a

free market framework. Global demand for food was raised to unprecedented level due

to the dominant role played by emerging economies and global supply did not respond

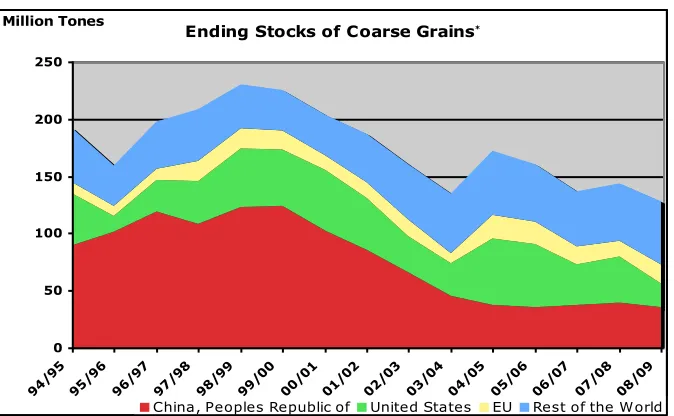

in order to keep inventories at a safe level; Figure 6 reports data on demand by group of

countries, demand for corn by ethanol producers, and on global supply of major crops.

Figure 6 - World Demand and Supply of Major Crops

Inventories decreased for almost a decade, prices became more volatile since

2002/2003 and extremely speculative in 2007/2008 when a few countries raised export

NGA KOR

JPN

100 300 500 700 900 1100 1300 1500 1700 1900 2100 2300

50 250 450 650 850 1050 1250

Rice and Wheat- current prices US$, 2004

50 100 150 200 250 300 350 400 450 500 550

50 100 150 200 250 300

Rice and Wheat, Japan, Korea and Nigeria excluded

[image:7.595.85.516.489.689.2]restrictions (Central Europe on wheat, and South Asian countries on rice), Figure 7

below. One explanation points to a major fault in WTO regulation, because it lacks in

safeguard clauses when global inventories are at extremely low levels, requiring from major suppliers’, government supported prices above international market prices in order to induce inventory accumulation. There is no built in incentive for individual

countries to behave in a manner consistent with global common interest, they have to

[image:8.595.90.427.267.475.2]bare the costs of inventory build up and collect no benefit from doing it.

Figure 7 - End of the Year Inventories of Coarse Grains.

Ending Stocks of Coarse Grains*

0 50 100 150 200 250

94/9 5

95/9 6

96/9 7

97/9 8

98/9 9

99/0 0

00/0 1

01/0 2

02/0 3

03/0 4

04/0 5

05/0 6

06/0 7

07/0 8

08/0 9

Million Tones

China, Peoples Republic of United States EU Rest of the W orld

Bio-fuels are close substitutes to fossil-fuels as such subjected to specific

national market structures. Mandatory blending requirements are common for biodiesel

and ethanol, standards of energy efficiency and environment protection must be similar

to fossil fuels. Pricing must also be consistent to the regulatory framework applied to

fossil fuels, which differs widely between countries. Food security and agricultural price

policy are part of an independent set of regulatory framework, both with a strong

historical heritage. There is a lot of work to be done in order to make these two sets of

regulations consistent within each country, much more so between countries.

As an example from Germany, in July 2007, pump average price of diesel was

US$ 1.62 per liter (at current exchange rate); assuming that the highest share for

vegetable oil cost is 72% of pump price in order to warrant a good profit for industry

(0.92 kg of vegetable oil for 1 liter of biodiesel). Soon after the northern hemisphere

harvest, CBOT future price for soybean was just above the $1300 level. After March of

2008, when most subsidies where abandoned in Europe, price began to fall

dramatically.

3. Food, Energy, Prices and Productive Structure

There is a close relation between the role that food and energy play in the

productive structure of the countries and how the countries will react to policies related

to fossil-fuel, bio-fuels and food.

To better analyze this relation we have select eight countries with different

levels of development and which are important players in the world in terms of food and

energy consumption and production. The selected countries are Argentina, Brazil,

China, India, United States, France, Germany and Japan.

The basis for the analysis are the comparable Input-Output Matrices released by

OECD (see OECD, 2006), and which refers to the year of 2000 for Brazil, China, USA,

France, Germany and Japan, the year of 1997 for Argentina, and the year of 1998/99 for

India.

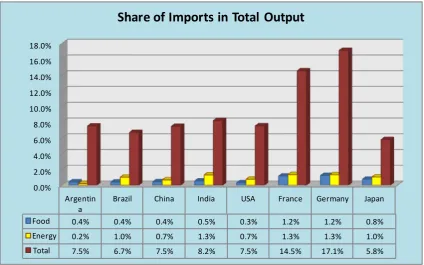

Figure 8 shows the shares of total value of imports, food imports, and energy

imports in the total value of production of the select countries, while Figure 9 shows the

share of food and energy in total imports. From these figures it is possible to see that

France and Germany are the more opened economies, with imports representing

respectively 14.5% and 17.1% of their total output, while for the other economies the

share of imports varies between 5.8% and 8.2%. As for food and energy imports, they

represent a small share of the total value o production, between 0.4% and 1.2% for food

and between 0.2% and 1.3% for energy. In all the other countries being analyzed, with

the exception of Argentina, the share of energy imports are higher than the share of food

imports, and in the cases of Brazil, India and USA energy has more than the double of

importance of the food imports.

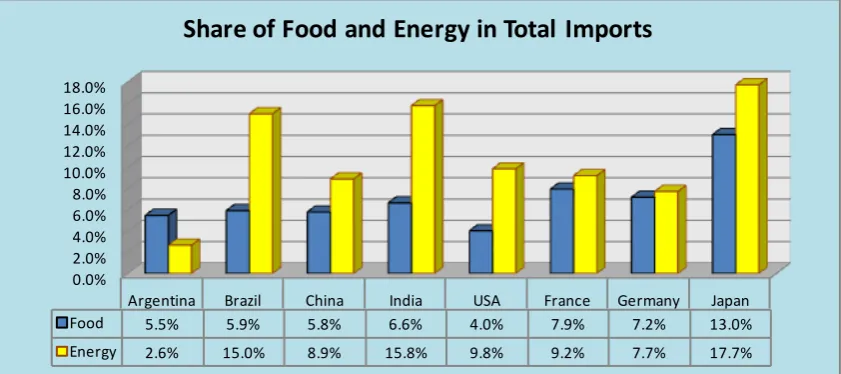

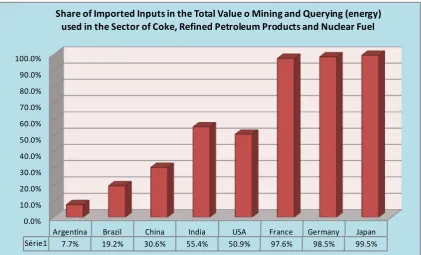

Figure 10 shows the role played by imports of food and energy in total

disposable food and energy, while Figure 11 shows the share of imported inputs in the

the countries it is possible to see that imported energy has a high share in the total

disposable energy for the countries being considered than food has, with special

importance for France (25.1%), Germany (25.6$), and Japan (18.3%), followed by India

(14.0%) and USA (14.2%), an in a lesser scale China (7.2%), Brazil (10.9%) and

Argentina (4.8%). However, it is possible to see the high dependence that France,

Germany and Japan have on imported inputs for energy production, more than 98%,

followed by India (55.4%), USA (50.9%), China (30.6%), Brazil (19.2%), and

Argentina (7.7%). As for food consumption the higher dependence on imports is found

in Germany (20.9%), France (16.2%), and Japan (10.6%), followed by USA (6.7%),

while in the other countries the dependence is less than 4%.

In summary, from the analysis of Figures 8 to 11 it is possible to see that in

terms of imports, energy is more important than food and that, with the exception of

Brazil and Argentina, there is a high dependence of the other economies on imports of

[image:10.595.86.511.412.677.2]primary energy for secondary energy production.

Figure 8 – Share of Imports in Total Output of Selected Developing and Developed Countries

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0%

Argentin a

Brazil China India USA France Germany Japan

Food 0.4% 0.4% 0.4% 0.5% 0.3% 1.2% 1.2% 0.8%

Energy 0.2% 1.0% 0.7% 1.3% 0.7% 1.3% 1.3% 1.0% Total 7.5% 6.7% 7.5% 8.2% 7.5% 14.5% 17.1% 5.8%

Share of Imports in Total Output

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Figure 9 – Share of Food and Energy in Total Imports of Selected Developing and Developed Countries

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0%

Argentina Brazil China India USA France Germany Japan Food 5.5% 5.9% 5.8% 6.6% 4.0% 7.9% 7.2% 13.0% Energy 2.6% 15.0% 8.9% 15.8% 9.8% 9.2% 7.7% 17.7%

Share of Food and Energy in Total Imports

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Source: Estimated from OECD (2006)

Figure 10 – Share of Imported Food and Energy in Total Disposable Food and Energy of Selected Developing and Developed Countries

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0%

Argentina Brazil China India USA France Germany Japan Food 3.9% 2.9% 2.8% 2.2% 6.7% 16.2% 20.9% 10.6% Energy 4.8% 10.9% 7.2% 14.0% 14.2% 25.1% 25.6% 18.3%

Share of Imported Food and Energy in Total Disposable Food and Energy

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

[image:11.595.88.511.425.667.2]Figure 11 – Share of Imported Inputs in the Total Value of Mining and Querying (energy) used in the Sector of Coke, Refined Petroleum Products and Nuclear Fuel of Selected Developing and Developed Countries

0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0%

Argentina Brazil China India USA France Germany Japan Série1 7.7% 19.2% 30.6% 55.4% 50.9% 97.6% 98.5% 99.5%

Share of Imported Inputs in the Total Value o Mining and Querying (energy) used in the Sector of Coke, Refined Petroleum Products and Nuclear Fuel

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Source: Estimated from OECD (2006)

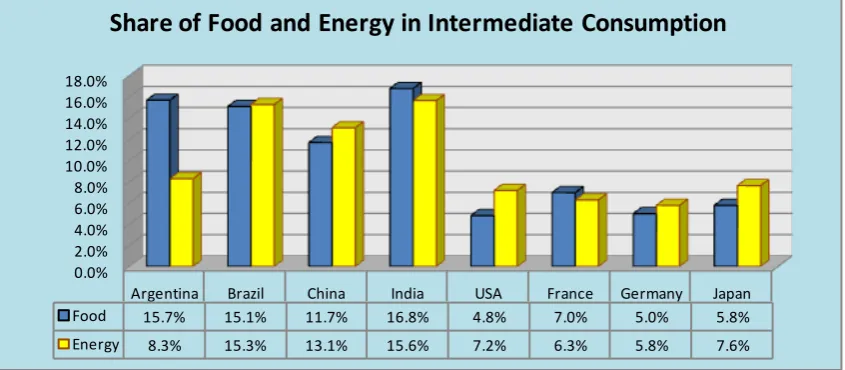

Figures 12 to 14 show the importance of food and energy for production

(intermediate consumption), final demand and in the total output of the economy.

For the intermediate consumption, the economies being considered can be

divided into two groups, the first one consisting of developing economies - Argentina,

Brazil, China, and India – in which the added shares of food and energy into

intermediate consumption are between 24% and 32%, and the developed economies –

USA, France, Germany, and Japan – which the added share are between 12% and 14%,

i.e., less than half of the shares observed for the developing economies. Inside each

country, on general the shares observed for food are close to the ones observed for

energy, with the exception of Argentina (food, 15.7%, and energy, 8.3%), USA (food,

4.8%, and energy, 7.2%), and Japan (food, 5.8%, and energy, 7.6%).

As for the final demand shares, energy in all of the economies being considered

represent less than 3% of the final demand, however, for food, its share goes from 4.1%

in the USA to 28.4% in India. In the developed economies being considered, the share

[image:12.595.88.510.116.371.2]13% for Argentina and Brazil, going to 19.3% in China and 28.4% in India. This

structure shows the importance of food in less developed economies, due to the

structure of consumption of the low income classes where food has a greater relative

importance than the other consumer goods.

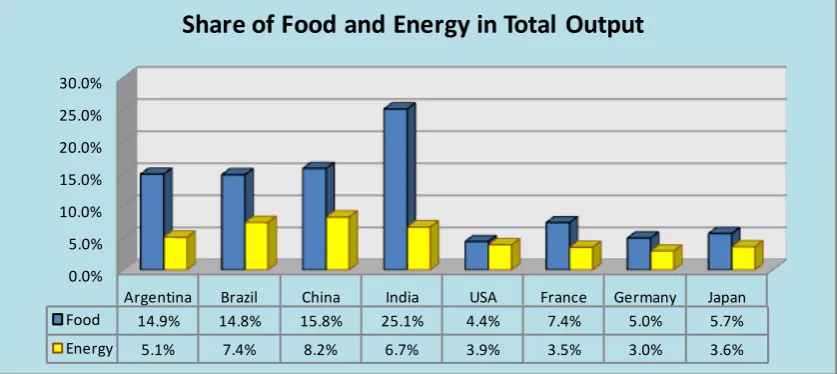

Overall, i.e., considering the total output in the economy, as show in Figure 14,

the share of energy in total output in the developing economies (around 7.0%) is about

double of the one found in developed economies (around 3.5%). As for food, Argentina,

Brazil and China have a share of around 15% of the total output, while for India the

share is of 25.1% and for the developed economies the share is between 4.4% for the

USA and 7.4% for France. This again reinforce the results found above, showing the

relative low importance of food and energy for the developed economies, in terms of

[image:13.595.88.511.389.574.2]value of production, when compared to its importance in less developed economies.

Figure 12 – Share of Food and Energy in Intermediate Consumption of Selected Developing and Developed Countries

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0%

Argentina Brazil China India USA France Germany Japan Food 15.7% 15.1% 11.7% 16.8% 4.8% 7.0% 5.0% 5.8% Energy 8.3% 15.3% 13.1% 15.6% 7.2% 6.3% 5.8% 7.6%

Share of Food and Energy in Intermediate Consumption

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Figure 13 – Share of Food and Energy in Final Demand of Selected Developing and Developed Countries

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0%

Argentina Brazil China India USA France Germany Japan Food 13.1% 12.8% 19.3% 28.4% 4.1% 7.7% 5.5% 6.1% Energy 2.8% 1.8% 1.4% 1.7% 2.2% 2.7% 2.0% 1.9%

Share of Food and Energy in Final Demand

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Source: Estimated from OECD (2006)

Figure 14 – Share of Food and Energy in Total Demand of Selected Developing and Developed Countries

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0%

Argentina Brazil China India USA France Germany Japan Food 14.9% 14.8% 15.8% 25.1% 4.4% 7.4% 5.0% 5.7% Energy 5.1% 7.4% 8.2% 6.7% 3.9% 3.5% 3.0% 3.6%

Share of Food and Energy in Total Output

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Source: Estimated from OECD (2006)

This directly reflects on the disposable value added generated in the economies

being considered here, Figure 15. While for China and India the combined importance

of food and energy is respectively of 31.4% and 35.2%, for Brazil is 18.1%, for

[image:14.595.91.510.424.611.2]exception of the USA, in all the other countries food has a greater share in the economy

than energy.

As can be seen in Figure 16, the relation between food and energy in the

generation of the disposable domestic value is 0,73 for the USA, around 1,50 for Brazil,

France, Germany, and Japan, around 2,2 for Argentina and China, and of 5,1 for India.

As a consequence of that, one can see that a policy of bio-fuels that would imply a

substitution of food for energy, with the exception of the USA, will put more stress over

the economies than a policy of price increase of energy and/or a policy of substitution of

fossil-fuel energy from other sources than bio-fuels energy.

Figure 15 – Share of Disposable Domestic Value Added of Food and Energy in GDP of Selected Developing and Developed Countries

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0%

Argentina Brazil China India USA France Germany Japan Food 8.6% 10.7% 21.4% 29.4% 2.6% 5.2% 3.7% 5.2% Energy 3.7% 7.4% 10.0% 5.8% 3.6% 3.5% 2.7% 4.2%

Share of Disposable Domestic

Value Added in the GDP

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

[image:15.595.92.486.313.516.2]Figure 16 – Relation of Disposable Domestic Value Added Between Food and Energy of Selected Developing and Developed Countries

0.00 1.00 2.00 3.00 4.00 5.00 6.00

Argentina Brazil China India USA France Germany Japan Série1 2.36 1.46 2.14 5.09 0.73 1.49 1.37 1.26

(VA + VAM - VAE) Relation: Food / Energy

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Source: Estimated from OECD (2006)

The relative importance of food and energy in the economies can also be

estimated by measuring the price transmission effects of a price increase in the

economy, as displayed in Figures 17 and 18 that show the impact of a 10% increase,

respectively, of food and energy over the wholesale price index (WPI) and the consumer

price index (CPI). The results show, as expected, that the increase of food price will

have a greater impact over the CPI while the increase of energy price will have, with the

exception of France and Germany, a greater impact over the WPI. Also, the impact on

the CPI due to an increase of food price is greater than the one due to an increase of

energy price, in all the countries being considered here. As for the impact of food and

energy prices over the WPI, one has that for Argentina and India the impact of food

prices are clearly greater than the impact of energy prices, while for the other countries

being considered, there are only slight differences between the impact of food and

energy prices.

However, it must be stressed that impacts over the developing economies are

greater than the ones in the developed ones. For food, while one has at most an impact

of 1.56% in the WPI of France, for the developing countries it starts at 1.67% in the

WPI of Argentina and goes up through 5.0% in the CPI of China. For an increase in the

energy prices, the impact over Brazil, China and India are clearly greater than the one

[image:16.595.87.485.102.270.2]As a reflect of this, there is enough room for the developed countries being

considered here, mainly France, Germany and Japan to practice polices of high prices

on the energy with lower impact over the economy, as they are used to do.

Special attention need to be paid to China, due to its size and important role in

the world trade. From the above analysis it is clear the importance of cheap food and

energy for the development of China and the adverse impacts that an increase in their

prices will have over the Chinese economy, internally and in its competitivity in the

[image:17.595.87.510.302.541.2]international market.

Figure 17 – Impact of a 10% Change on the Price of Food on the Wholesale Price Index (WPI) and on the Consumer Price Index of Selected Developing and Developed Countries

0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00

Argentina Brazil China India USA France Germany Japan WPI 1.67 1.78 2.18 2.83 0.58 0.86 0.62 0.69 CPI 1.79 2.32 5.00 4.84 0.78 1.56 1.27 1.42

Impact of a 10% Change on the Price of Food on the

Wholesale Price Index (WPI) and on the Consumer Price Index (CPI)

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Figure 18 – Impact of a 10% Change on the Price of Energy on the Wholesale Price Index (WPI) and on the Consumer Price Index of Selected Developing and Developed Countries

0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00

Argentina Brazil China India USA France Germany Japan WPI 0.86 1.72 2.35 1.50 0.73 0.66 0.65 0.84

CPI 0.57 1.25 1.36 0.93 0.62 0.78 0.73 0.72 Impact of a 10% Change on the Price of Energy on the

Wholesale Price Index (WPI) and on the Consumer Price Index (CPI

Note: Argentina refers to 1997; Brazil, China, USA, France, Germany, and Japan to 2000; and India to 1998/99.

Source: Estimated from OECD (2006)

The above also implies that the substitution of fossil-fuel for bio-fuel will be

only feasible in countries that have enough land to expand the bio-fuel production

without compromising the production of food or putting more stress over the

environment. In the Brazilian case, Figures 19 to 21 that display, respectively, the stress

over the Brazilian territory of cattle, soybean, and sugar cane production in 1995 and

2006, show that the cattle production is putting a stress over the Amazon forest, and the

land left behind, due to its expansion, are being occupied by soybean production. On the

other hand, the sugar cane production seems to have its own pattern of growth without

putting much stress over the environment, and food production, in the period being

[image:18.595.89.509.103.346.2]Figure 19 – Cattle Production Stress over the Brazilian Territory – 1995 and 2006

Legenda

Numero de cabeças 4 - 50,000

50,001 - 150,000

150,001 - 250,000

250,001 - 400,000

400,001 - 600,000

600,001 - 800,000

800,001 - 1,200,000

1,200,001 - 2,000,000

Bovinocultura

Ano 1995

Fonte: Adaptado de Pesquisa Pecuária Municipal - IBGE

Visão Tridimensional

Legenda

Numero de cabeças 4 - 50,000

50,001 - 150,000

150,001 - 250,000

250,001 - 400,000

400,001 - 600,000

600,001 - 800,000

800,001 - 1,200,000

1,200,001 - 2,000,000

Bovinocultura

Ano 2006

Fonte: Adaptado de Pesquisa Pecuária Municipal - IBGE

Figure 20 – Soybean Production Stress over the Brazilian Territory – 1995 and 2006

Soja

Ano 1995

Fonte: Adaptado de Pesquisa Agrícola Municipal - IBGE

Visão Tridimensional

Legenda

Quantidade em Toneladas

0 - 30,000

30,001 - 80,000

80,001 - 150,000

150,001 - 250,000

250,001 - 400,000

400,001 - 700,000

700,001 - 1,100,000

1,100,001 - 1,800,000

Soja

Ano 2006

Fonte: Adaptado de Pesquisa Agrícola Municipal - IBGE

Visão Tridimensional

Legenda

Quantidade em Toneladas 0 - 30,000

30,001 - 80,000

80,001 - 150,000

150,001 - 250,000

250,001 - 400,000

400,001 - 700,000

700,001 - 1,100,000

Figure 21 – Sugar Cane Production Stress over the Brazilian Territory – 1995 and 2006

Cana de Açúcar

Ano 1995

Fonte: Adaptado de Pesquisa Agrícola Municipal - IBGE

Visão Tridimensional

Legenda

Quantidade em Toneladas

0 - 50,000

50,001 - 100,000

100,001 - 250,000

250,001 - 500,000

500,001 - 1,000,000

1,000,001 - 1,800,000

1,800,001 - 3,000,000

3,000,001 - 5,300,000

Cana de Açúcar

Ano 2006

Fonte: Adaptado de Pesquisa Agrícola Municipal - IBGE

Visão Tridimensional

Legenda

Quantidade em Toneladas

0 - 50,000

50,001 - 100,000

100,001 - 250,000

250,001 - 500,000

500,001 - 1,000,000

1,000,001 - 1,800,000

1,800,001 - 3,000,000

4. Concluding Remark

The above analysis has show that in general food puts a greater stress over the

economies than energy does, and mainly in the developing economies. As a

consequence of that, the possibilities for the growing use of bio-fuels is limited and

restrict to countries where it is possible to have an expansion of bio-fuel production

without compromising the production of food and without putting more stress over the

environment. This, by its turn, restricts the possibilities for a world policy of bio-fuels

with the consequence that bilateral agreements would be the dominant ones. As so, an

implication for a world policy would be to start the process of negotiation with bilateral

agreements, than slowly evolving into regional trade, as it is a more realistic framework

for a safe development of bio-fuels markets.

5. References

German Biomass Sustainability Ordinance- commentary paper to the draft, Institute for Energy and Environment, Leipzig, January 2008.

OECD (2006). The OECD Input-Output Database as presented by Norihiko Yamano and Nadim Ahmad (2006), “The OECD Input-Output Database: 2006 Edition”. STI Working Paper 2006/8. Statistical Analysis of Science, Technology and Industry.