VoIP over WLAN has received considerable press coverage lately. In a recent white paper1 Northstream concluded that VoIP in general consti-tutes an evolution of the way operators implement the services, rather than a revolution of user behaviour. This document examines VoIP over WLAN in further detail to determine which use cases are expected to generate revenue for mobile operators and wireless service providers. There are three distinct areas where VoIP over WLAN could potentially play a role: public hotspots, homes, and enterprise offices. These three will be examined below.

First, however, let us agree on what VoIP over WLAN (or VoWLAN) is. VoIP is any technology that transmits voice calls over packet-switched IP networks as opposed to dedicated, circuit-switched telecom net-works. The potential benefits from this technology include more efficient use of network resources (e.g., not transmitting silence), management of a single network rather than both a data and a voice network, and possibly lower investment costs for network equipment. Traditionally, VoIP has suffered from quality problems, but these are increasingly being solved.

WLAN is a set of radio technologies commonly used to connect lap-tops wirelessly to enterprise networks. WLAN is now a well-proven technology for in-office data communications. The beauty of WLAN is that volume production has driven equipment prices down to a level that makes the technology

affor-dable to the residential mass-market buyers.

In this white paper, the discus-sion is confined to the European market and the aim is to under-stand where VoWLAN could be feasible from a market perspec-tive.

Weighing in: VoIP

over WLAN for Europe

In what class will it play?

About Northstream

Northstream provides high-impact strategic technology and business advice to the wireless industry. Northstream has assembled a multinational team with some of the world’s best experts and analysts on wireless communication and technology that supports many of the industry’s leading companies in their strategic and tactical challenges towards continued growth. Through its parent company, US based inCode Wireless, Northstream has a strong global presence and client base. For more information please contact info@northstream.se

or visit us at: www.northstream.se and www.incodewireless.com.

1 Northstream, “VoIP – a Threat and an Opportunity for Mobile Operators,” February 2005. The document can be downloaded from www.northstream.se.

Public hotspots – Northstream sees little, if any, VoIP revenue for hotspot service providers

WLAN is often associated with public hotspots, where service providers offer flat-rate WLAN access for a day or a month at locations where business people gather. The business case behind public hotspots in Europe has been weak. Not many service providers or mobile operators have revealed what revenues or profits they make from this service2. Some observers say adding a chargeable voice service to leverage existing hotspot infrastructure would be a good idea for these companies. But is it really? Unfortunately for some, we can see at least six reasons why this is unlikely to generate any substantial additional revenues.

1. Usability. Compared to cellular networks, WLAN has weaker billing, user authentication, mobility among hotspots, and quality of service capabili-ties. Hotspot users often spend several minutes to set up their computers to find the right WLAN, obtain access credentials, log on to the Internet service, and so on3. For a voice service like VoWLAN, these are drawbacks, since they all encourage the potential user to pick up a traditional mobile phone here and now instead.

2. Coverage. While cellular networks have been designed to cover large service areas, WLAN technologies were designed to provide small spa-ces with high data speeds. For voice calls high data speed is not important. In addition, it is highly unlikely that people will search their sur-roundings to find a WLAN hotspot to place a voice call when it is so much easier to use a mobile phone from where they are located. Further, a WLAN access point provides limited coverage so even business hotels often provide WLAN only in the lobby, and not in guest rooms or on other floors.

3. Cellular phones are ubiquitous. The ubiquity of voice-enabled cellular phones further reinforces the weight of the above-mentioned usability and coverage arguments. Any wireless voice techno-logy taking on cellular networks really fights an Contents

Public hotspots – Northstream sees little, if any, VoIP revenue for hotspot service providers ... 2 In-home WLAN deployed as extension to broadband VoIP; has to fight DECT ... 3

UMA – a mobile-operator driven approach to in-home VoWLAN ... 4 Enterprise offices – VoWLAN driven by enterprise VoIP networking, WLAN,

and application integration ... 5 Conclusion: VoWLAN more interesting for WLAN & VoIP infrastructure providers than for service providers ... 6

2 A Northstream whitepaper from January 2003 concludes that although the WLAN equipment industry develops well, there is

little revenue for WLAN public-hotspot service providers (also for data services). Northstream still supports this view. The white paper “Public WLAN services – Low profitability but potential strategic value?” can be downloaded from www.northstream.se.

3 For a descriptive real-world experience, which many WLAN hotspot users will no doubt find familiar, read the text of Qualcomm’s

VP Marketing, Jeffrey K. Belk: “Discussion: A Real-World Observation of Wi-Fi,” downloadable from http://www.qualcomm.com/ enterprise/pdf/Wi-Fi_Real_World_Observations_JBelk_5-12-04.pdf

uphill battle. Ubiquity is the reason why people increasingly prefer trying the mobile number first – the fixed number second – when they wish to reach someone. Once VoIP has become ubiquitous in fixed networks, it is likely that mobile opera-tors will provide comparable service offers over cellular networks (be it real VoIP or simply more competitive pricing), to avoid losing customers. Any real value add of WLAN to a voice conversa-tion in a public place is then difficult to discern. 4. Standardisation. VoWLAN puts new requirements

on WLAN quality of service, especially on rapid handover among WLAN access points4 and on maximum latency. An industry standard is being developed in this area, but has not yet been com-pleted. Fast handover among access points (requi-red if you move around inside an airport or a hotel) may require approximately another year and a half of standardisation work5. Proprietary solu-tions address the handover latency issue, but since they are proprietary they cannot be used in a public environment where hotspot providers and users may have WLAN products from different vendors.

5. Willingness to pay. It is likely that most hotspot users also own a mobile phone. This means that the price that can be charged for hotspot voice calls on top of the WLAN data charge is limited by mobile telephony call prices. It is even unlikely that calls will be placed using a hotspot provider’s VoWLAN service if there is an additional charge for the voice call at all, since VoIP applications like Skype provide this for free or at low cost. An inde-pendent WLAN hotspot provider would possibly have to be a very large player to negotiate call termination (interconnect) fees down to the levels of mobile or fixed operators. The business case for hotspot providers is therefore not substantially improved by offering VoWLAN.

6. Unnatural combination. Would users want to subs-cribe to a combined WLAN plus VoIP service? In our opinion, it is more likely that users would prefer to use a separate VoIP subscription so they could use the same phone number/address when they are at home, at the office, and in a hotspot. If this proves correct, the WLAN hotspot supplier could effectively be limited to providing bit pipe

services or at most charging a tiny premium for voice-grade quality-of-service transport over the WLAN and backhaul.

A look at history supports the belief that VoWLAN and public hotspots will likely be a limited phenome-non and not bring any substantial revenue for Euro-pean hotspot service providers. One could imagine using VoWLAN as a kind of poor man’s mobile phone. This was tried in the 90s using the CT-2 tech-nology in the United Kingdom, France, and the Netherlands without commercial success. In Japan, PHS has always had a tough situation, due to compe-tition from cellular: Even the biggest Japanese PHS operators frequently have had difficulties in moving their PHS services into black. In China, on the other hand, PHS is successful, but then at fixed-line prices. These experiences indicate what kind of per-minute revenue a hotspot provider could, at best, hope to make albeit at much lower call volumes than for country-wide PHS operators.

In-home WLAN deployed as extension to broadband VoIP; has to fight DECT

WLAN equipment prices are now at levels where the technology becomes affordable to install in European homes. Together with increasing European broad-band penetration and a related surge in popularity of broadband VoIP (due to cheaper VoIP rates for long-distance and international calls), VoWLAN has become a threat to both mobile and fixed telephony operators.

There are two obvious cases for a VoIP user with a residential broadband connection: If a user already has a cordless DECT phone installed, he or she needs to purchase a VoIP-to-DECT phone adapter to install at the DECT base station. Technically, this is not VoIP over the air, but from a user perspective there is no major difference. If a user does not already own a DECT phone, he or she might opt for WLAN hand-sets and access points (with, for the time being, pro-prietary QoS support) and run both VoIP and other IP traffic over the same home-networking infrastructure.

Which one of these technologies will dominate the residential use case in the long term? This likely boils down to a question of price. On the one hand, DECT, which has strong resistance to interference, is a very powerful technology for use in uncontrolled (not radio-planned) environments and has a large in-stalled base. On the other hand, from a user-mindset

4 WLAN frequently needs several hundred milliseconds to hand over a session from one access point to another. For voice services,

this time should preferably be below 150 ms.

5 Standardisation work in this area is being performed in the IEEE 802.11r working group. Once the standard becomes finalized, the

perspective, once both fixed broadband is in place and one has started to use fixed VoIP, the step to VoWLAN is small.

Dell’Oro Group estimates that 25 percent of all residential broadband subscribers worldwide have installed WLAN6. According to Ovum, the consumer VoIP market is estimated to grow from almost 15 mil-lion users at the end of 2004 to 197 milmil-lion at the end of 2008. This is an important development, since we believe the major hurdle for VoWLAN is the adoption of plain VoIP (which in turn depends on increased user awareness, regulatory unbundling of Digital Subscriber Line (DSL) and fixed-telephony lines, pricing, and other factors). Once there is a large base of VoIP users, there are two other hurdles to VoWLAN usage in homes: First, to provide a user experience comparable to DECT or fixed telephony, dedicated WLAN handsets are a key necessity. We expect any significant VoWLAN call volumes to be generated using a physical VoWLAN telephone rather than a combination of PC, software, and headset. Such WLAN handsets are challenging to find at affordable prices today. Second, although conceptually simple, VoWLAN equipment is difficult for mainstream customers to install and configure. The complexity of VoWLAN technology is higher than that of WLAN itself. Unless installation is made significantly easier7, VoWLAN risks remaining confined to the limited segment of the highly technology literate.

UMA – a mobile-operator driven approach to in-home VoWLAN

If WLAN technology is installed by consumers them-selves, there is no additional revenue potential for mobile service providers (this applies to both the VoIP/DECT and VoIP/WLAN cases). Recently, how-ever, mobile operators have been looking into how WLAN could be integrated into GSM core networks, potentially allowing mobile operators to play a more important role in homes and elsewhere. The initiative is called Unlicensed Mobile Access (UMA) and allows for handover between the two technologies and for keeping a single user identity, the Subscriber Identity Module (SIM), across both networks. In-home WLAN infrastructure could be integrated into mobile ope-rator networks with backhaul over the end-user’s residential broadband line. Combined mobile and fixed-broadband operators are the key players to have an advantage here, since they control the back-haul8. Partnerships between mobile operators and cable TV operators can also be expected.

The scenario is interesting, since it allows the end-user to have only one handset, both at home and else-where. First however, the technical and economical challenges of WLAN chipset size, chipset price, and WLAN battery consumption must be overcome. In 2004, approximately 113,000 WLAN handsets were sold worldwide, including 8,000 WLAN/GSM dual-mode units (the latter became commercially available

6 Among these, VoIP users are just a fraction of course.

7 Interestingly, South Korean operator KT a few years ago took a service-oriented approach to residential WLAN, successfully

offe-ring WLAN as a service package called Nespot, including installation of WLAN access points in private homes, service, integration, and customer support. This concept could potentially be extended to VoWLAN.

8 Combined fixed and mobile operators might, however, face other challenges: UMA is likely to be seen as cannibalising fixed call

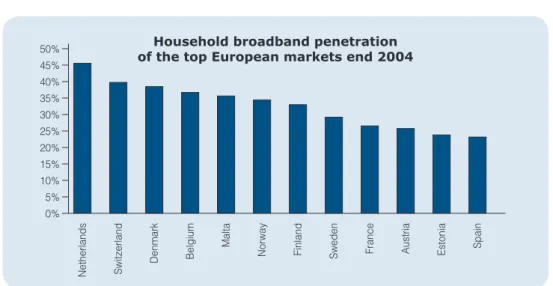

volumes, and might for political reasons be tougher to introduce than what appears at first glance. Figure 1. Source: Baskerville, Broadband Subscriber Database. Netherlands Switzerland

Denmark Belgium

Malta

Norway Finland Sweden France Austria Estonia Spain

50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0%

Household broadband penetration of the top European markets end 2004

during the fourth quarter)9. This development is obviously early and we are still waiting for low-cost WLAN/GSM dual-mode handsets with an accept-able stand-by time. Analysts estimate 2009 shipments of WLAN/GSM dual-mode handsets to 50 million units or about 7 percent of handsets sold10, which suggests that the mentioned challenges would have been overcome well before then.

All in all, VoWLAN indeed has a space to conquer in private homes. However, for European mobile operators to seize a share of this revenue, they need to embrace UMA, prove its business case, prove its usability, and prove that they can overcome internal resistance and field price schemes that end-users deem attractive.

Enterprise offices – VoWLAN driven by enterprise VoIP networking, WLAN, and application integration

From an end-user perspective, VoWLAN in an enter-prise setting is a substitute for DECT telephony and partly for Virtual Wireless Private Branch Exchange (PBX) services offered by mobile operators. These are in turn substitutes for ordinary fixed telephony and PBX equipment (i.e. office switchboard systems), respectively. Drivers behind a transition towards VoWLAN in enterprises include:

• WLAN penetration. As the presence of WLAN increases11, the operational costs of maintaining double wireless networks – WLAN & DECT – become apparent. Since DECT still has several strong advantages over WLAN for voice telephony, we do not expect companies to throw out their existing DECT systems12. Likely first-movers to VoWLAN are companies setting up new offices. These enterprises could achieve savings by instal-ling network infrastructure including cabinstal-ling for one single instead of two networks.

• VoIP penetration. Enterprise VoIP has been used for some time to send voice calls between the PBXs of geographically dispersed company offices. By using IP leased lines for both data and voice, companies can save on OPEX, especially network administration, maintenance, and toll charges for long-distance and international calls. Some companies have gone further and installed IP

tele-phony solutions, taking VoIP all the way out to the individual fixed terminals (IP telephones). From there, an extension to VoWLAN is natural since it reuses the existing VoIP infrastructure. • Application integration. An evolution where today’s

systems for email, personal information manage-ment, central address directories, and collabora-tion (such as Microsoft Exchange and Lotus Domino) merge with PBX functionality can be discerned. This type of IT/telecom integration can add substantial improvements in end-user benefits and usability for fixed-line phones (inclu-ding PC soft-phones), while retaining control of telephony within the company. To the degree that WLAN telephony is an extension of fixed telephony, many of these benefits can be expected to apply to VoWLAN, further driving this techno-logy. Application integration is a typical IT-world advantage, which might push the lever in the direction of IT-type networking, such as WLAN, at the expense of telecom-type networking, like DECT or indoor GSM.

• WLAN integration with mobile networks. The above-mentioned UMA technology is a potentially powerful tool for mobile operators in addressing certain enterprise segments, in particular small-to-medium sized enterprises that also let their operator run a Virtual Wireless PBX service for them. UMA is therefore a potential threat to pure fixed operators. For larger enterprises, however, we expect UMA to be of less interest, since it is operator controlled and since it does not integrate well with corporate PBX equipment. Large enter-prises are likely to opt for Session Initiation Protocol (SIP) based VoIP solutions.

Due to unfinished standards, a necessary enabler for VoWLAN is control over both network equipment and terminals, regardless of whether the latter are handsets or PC software clients. Contrary to the case for public hotspots, discussed above, this total con-trol is present in an enterprise setting. This means enterprises can go for proprietary solutions to address the QoS, in-call cell handover, and security short-comings of today’s WLAN standards.

Since European companies tend to have in-house IT competence, it is likely that these IT departments

9 Source: Infonetics Research, “Wi-Fi Phones Annual Worldwide Market Size and Forecast,” February 2005. 10 Source: ABI Research, 22 April 2005

11 Morgan Stanley predicts the worldwide growth rate for WLAN equipment revenue to 14 percent during 2005 (26 percent during

2004).

will choose to control VoWLAN equipment and ser-vices themselves, thereby effectively barring the ope-rator (mobile or fixed) from extending its sphere of influence onto the corporate customer’s premises. We expect to see a slow transition to VoWLAN in enter-prises, but this will not bring substantial operator revenue, as operators will remain in the roles they have today, essentially kept at arm’s length from in-office WLAN and in-enterprise VoIP systems. The UMA initiative is a wildcard, with a potential role in targeting smaller companies and in catalyzing a trend where the PBX equipment market is increasingly put under attack by operator-managed Virtual Wireless PBX services.

Conclusion: VoWLAN more interesting for WLAN & VoIP infrastructure providers than for service providers

There are obvious benefits for end users, which to some extent are likely to transition to VoWLAN in homes in the mid-term and to a larger extent at the office in the mid- to long-term. A substantial share of European mobile calls are made at home (33 percent) and at work (24 percent)13. This suggests that mobile operators need to manage the substitution risk.

To sum up this discourse, we see clear reasons for WLAN and VoIP infrastructure vendors to push for

VoWLAN technology: the development towards VoWLAN extends the market of WLAN as a techno-logy. WLAN sales are still growing in terms of reve-nue, although the growth rate is declining. DECT will continue to live for a substantial period of time, thanks to its large installed base, low costs and very powerful features for deployment in uncontrolled environments.

For wireless service providers and mobile opera-tors there is less reason to cheer the entrance of VoWLAN. The two scenarios where VoWLAN is expected to succeed – home and office – are difficult to control for mobile players. Although operator- managed services for these segments are offered in some countries, we believe the revenue potential in Europe from these market segments is small. The UMA initiative might change this situation by provi-ding users with the convenience of having a single wireless handset both at home and away. However, the calls placed over the WLAN infrastructure can likely only be charged at a much lower rate than nor-mal cellular calls, raising the question as to whether this will create any additional mobile-operator reve-nue. UMA might become popular among European fixed-mobile operators as a defensive move to protect call volumes in an industry where fixed-mobile convergence and broadband VoIP steadily bring in new competitors.

Contact

VoWLAN is just one example of what is happening as the mobile, fixed, broadband, and cable TV operator industries converge. To assess the impact on a specific type of industry player, one needs to analyze and understand how that industry structure will evolve. Northstream regularly assists enterprises with this kind of consulting service by providing a useful multi-perspective understanding of the telecoms and IT industries. For requests related to this whitepaper, please contact Rickard Andersson at +46 8 564 84 807 or by email: rickard.andersson@northstream.se. For general enquiries about the services provided by Northstream and the inCode Wireless Group, please contact info@northstream.se or call +46 8 564 84 800.