Financial liberalization and the development of stock markets in Sub Saharan Africa

Full text

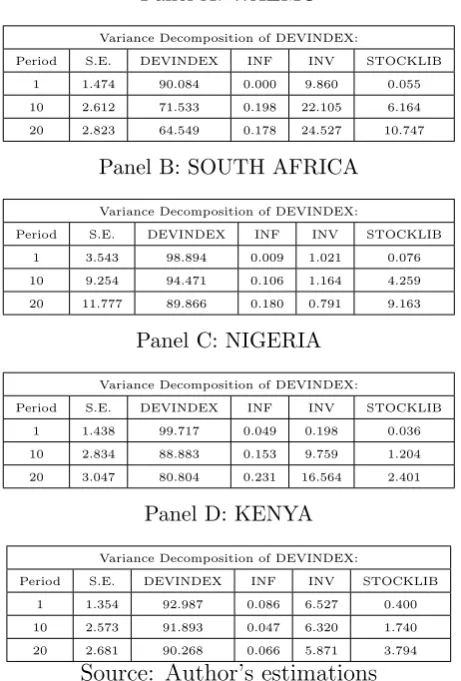

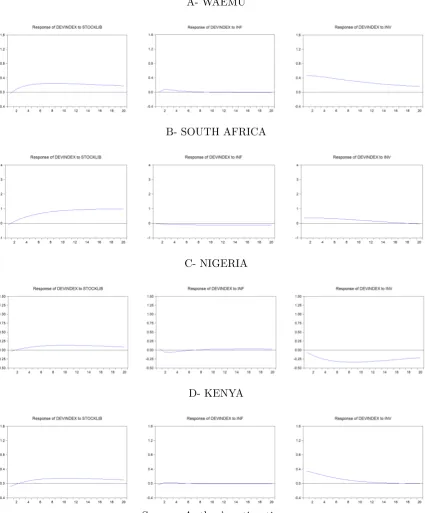

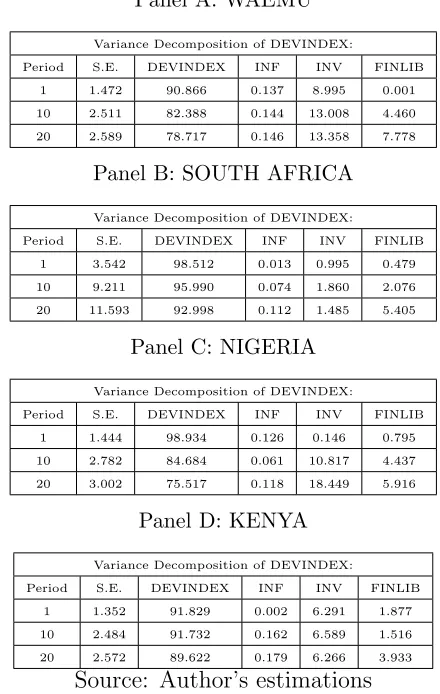

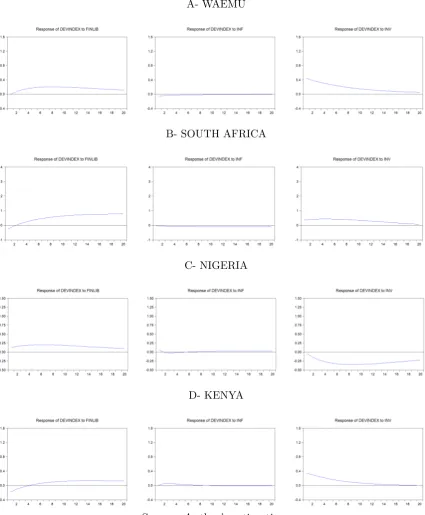

Figure

Related documents

For pastoral care; to notify the church of illnesses, hospitalizations, or deaths; to pass along a prayer request to be remembered in Morning Prayer; or to arrange

At the presentation tier we have our Client-Server and browser-based applications (utilizing Real Time Data Services) accessing the same underlying logical tier. Additionally,

While unconditional risk models are at odds with momentum profits, stock market predictability and time- varying expected returns explain a large part of the momentum payoffs,

ช่องป้อนข้อมูล และสูตร ( Formula Bar ) ใช้ส ำหรับป้อนข้อควำม ตัวเลข และสูตรค ำนวณทำง คณิตศำสตร์ 5...

The infrequent rebalancing model developed in Section 1.3.3 provides a repeated shock explanation for return predictability, although variation in unconditional expected returns

Previously reported measurements related to the effects of a backward-facing step on laminar – turbulent transition in a swept- wing boundary layer were extended in terms of

The percent complete for each Division of Work shall be the estimated amount of work complete for that task (0 when no work has been performed on the specific division of work and

Moreover, the proposed classification can also be a relevant tool for supporting the future innovation (e.g. restructuring) of IEM curricular programs. It offers a