Trade finance and international currency

Full text

Figure

Related documents

Case 3: Hedging currency risks in international portfolios (portfolios.doc, portfolios_ex.xls), due two weeks after the course ends.

Rose (2000) used historical data in the gravity model of international trade to estimate the effect of adopting a common currency on trade using data before currency

When exporting fi rms in the dominant sector of the large country price in the exporter’s currency, the consumer price index of the small country rises when their currency

By integrating trade finance and financial intermediation to the currency choice in international trade, our paper provides a novel, tractable, and unified framework to study

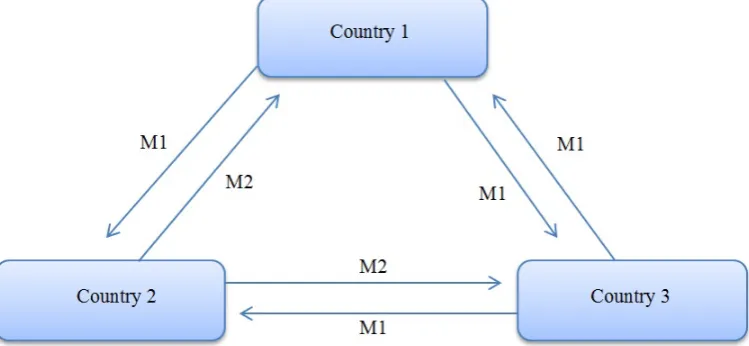

We show that the depth of the foreign exchange market of the partner country’s currency increases third currency use in Dutch exports, whereas a greater world trade share of the

The share of international bond issuance denominated in a given currency tends to be greater for strong currencies, for those boasting relatively high long-term bond yields, and

___ This Central American country uses currency called the lempira?. ___ This Central American country uses the

● The EER (Effective Exchange Rate) captures the movement of home currency against a basket of currencies of trade partners.. ● Nominal Effective Exchange Rate (NEER) is the