EMPEROR INTERNATIONAL JOURNAL OF

FINANCE AND MANAGEMENT RESEARCH

[EIJFMR]

ISSN : 2395-5929

Founder | Publisher | Editor

Dr. R. MAYAKKANNAN,

Assistant Professor of Commerce, Sri Sankara Arts & Science College,

Enathur, Kanchipuram, Tamilnadu, India.

Chief Editor

Dr. C. THIRUCHELVAM,

Head & Associate Professor of Commerce H.H.The Rajah’s College (Autonomous),

Pudukkottai, Tamilnadu.

Volume-II Issue-05 May- 2016

Mayas Publication™

45/5, Unathur & Post, Attur Tk., Salem Dt. Tamilnadu, India – 636112

Emperor International Journal of Finance and Management Research [EIJFMR]

Published by

Mayas Publication™

# 45/5 Unathur. Post Attur. Tk, Salem. Dt Tamilnadu, India

Board of Editor’s

SCHOOL OF COMMERCE, MANAGEMENT, ECONOMICS

Dr.Balakrishnan

Department of International Business, Administration,

Nizwa College of Applied Science, Sultanate of Oman

Dr.Pratapsingh Chauhan

Dean and Syndicate Member, Saurashtra University, Rajkot, Gujarat. India

Dr.Kuppusamy Singaravelloo

Department of Administrative Studies and Politics,

Faculty of Economics and Administration,

University of Malaya, Malaysia.

Dr. Bharati Pathak

Professor, School of Commerce, Gujarat University, Ahmadabad, India

Dr. Mohan

Professor of Commerce,

Management and Information Sciences, Sri Venkateswara University, Thirupati, Andhra Pradesh, India

Dr.Meenu Meheshwari

Assistant Professor,

Department of Commerce and Management, University of Kota, Kota

Dr. G. Raju

Professor of Commerce,

School of Management Studies, University of Kerala

Thiruvanathapuram- 695 581 Kerala, India

Dr.Vijaya

Professor of Commerce, Gulbarga University, Gulbarga, Karnataka state

Dr. R. Periyasamy

Head & Assistant Professor, Department of Commerce,

Barathiyar University Constitutional College, Coimbatore, Tamilnadu, India

Dr.T.J.Arun

Associate Professor of Commerce, Annamalai University, Chidambaram, Tamilnadu,India.

www.eijfmr.com

maya1984kannan@gmail.comChief Editor

Dr. C. THIRUCHELVAM,

Head & Associate Professor of Commerce

H.H.The Rajah’s College (Autonomous), Pudukkottai, Tamilnadu

Editor & Founder

Dr. R. MAYAKKANNAN,

Assistant Professor of Commerce,

Sri Sankara Arts & Science College,

Dr.A.Ravikumar

Associate Professor of Commerce, Bishop Heber College (Autonomous), Puttur, Trichy-17

Dr.N.Bharathidhasan

Assistant Professor in Commerce, Dr.Ambedkar Goverment Arts College (Autonomous),Vyasarpadi, Chennai. Tamilnadu

Dr.Leela

Professor of Commerce, T.S.Narayanaswami College, Chennai, Tamilnadu

Dr .K.Krishnamurthy

Assistant Professor of Commerce, Periyar Government Arts College,

Cuddalore

Dr. C. Saraswathy

Assistant Professor of Commerce, VELS University, Chennai, Tamilnadu

Dr. R. Mathavan

Assistant Professor of Commerce, Kandaswami Kandar’s College, P.Velur, Namakkal (DT) Tamilnadu

Dr. S.Prabhu

Head & Assistant Professor of Commerce Bharthi College of Arts and Science, Thanjavur -613 007 Tamilnadu

Dr.F.Elayaraja

HOD of Commerce TKU Arts College Karanthai, Thanjavur, Tamilnadu.

Dr. R. Hariharan

Associate Professor of Commerce, National College,

Trichy, Tamilnadu

Dr. L.Gomathy

Assistant Professor of Commerce, Agurchand Manmull Jain College, Meenambakkam, Chennai – 600114

Dr.S.Raju

Assistant Professor of Commerce A.V.V.M Sri Pushpam College (Autonomous)

Poondi-613503, Thanjavur.

Dr.V.Dheenadhayalan

Assistant Professor in Commerce, Annamalai University, Chidambaram.

Dr.Bama Sampath

Assistant Professor of Commerce Dr.Ambedkar Govt. Arts College Chennai-39.

Dr. R. Vasudevan

Assistant Professor in Corporate Secretary

Ship, D. G. Vaishnav College, Chennai

Dr.A.L.Mallika

Associate Professor and Head, Department of Management Studies, Mother Teresa Women’s University, Kodaikanal.

Dr. P. Uma Meheshwari

Assistant Professor of Economics Barathiyar University College, Coimbatore, Tamilnadu, India

Dr.Dhanalakshmi Acharya

Bangalore Business School, Andhrhalli Main Road, Bangalore

Dr.A.Vijaykanth

Assistant Professor of Economics, Dr.Ambedkar Government Arts College (Autonomous),

Dr. V. Rengarajan

Assistant Professor, Management Studies SASTRA University, Thanjavur.

Dr.Ramanathan,

Principal and Head,

Nethaji Subbash Chandra Bose College,

Tiruvaurur

Dr.P.Arunachalam

HOD , Department of applied Economics, Cochin University, Kerala.

Dr.S.R.Keshava

Professor of Economics

Bangalore University, Bangalore.

Dr.S.Chinnammai

Associate Professor of Economics, University of Madras, Chennai,

Dr.A.Ranga Reddy

Professor Emeritus,

Sri Venkateshwara University Andhra Pradesh.

Dr. V.Vijay Durga Prasad

Professor and Head Department of Management Studies

PSCMR College of Engineering and Technology

Kothapet, Vijayawada -520 001 A.P

Dr.A.Alagumalai

Associate Professor of Political Science, P.T.M.T.M.College Kamudhi, 623 604

Ch. Anjaneyulu

Assistant Professor

Department of Business Management Telangana University

Dichpally—Nizamabad, Telangana—India

Dr .Ishwara P

Professor in Commerce Department of Commerce, Mangalore University Karnataka

Dr.G.Parimalarani

Associate Professor

Department of Bank Management Alagappa University

Karaikudi, Tamilnadu

Dr.Rambabu Gopisetti

Chairman, Board of Studies in Commerce Department of Commerce

Telangana University Dichpally, Nizamabad Telangana State -503322

Ms.Bhagyshreehiremath

Assistant Professor of Economics

Indian Institute of Information Technology Dharwad

Prof.M.Yadagiri

Head & Dean

Faculty of Commerce Telangana University

Dichpally--Nizamabad--503322 Telangana State – India

Dr. C. Theerthalingam

Head & Assistant Professor of Economics, Government Arts College (Men),

Krishnagiri – 635001

Dr.G. Uppili Srinivasan,

SCHOOL OF COMPUTER SCIENCE, ENGINEERING & TECHNOLOGY

Prof. Naveen Kumar

Associate Professor

Department of Computer Science, University of Delhi, India-110007

Dr. Rakesh Kumar

Mandal Secretary, CSI, Siliguri Chapter Assistant Professor

School of Computer Science & Application North Bengal University P.O.

Darjeeling West Bengal – 734013

Dr. D. Roy Chowdhury

Assistant Professor

School of Computer Science & Application University of North Bengal

Dr. Ardhendu Mandal

Assistant Professor

School of Computer Science and Application

University of North Bengal (N.B.U)

Dr. Ms. Bhagyashree D. Hiremath

Assistant Professor

Department of Computer Science and Engineering

SCHOOL OF AGRICULTURAL & RURAL DEVELOPMENT AND EDUCATIONAL TECHNOLOGY, ENVIRONMENTAL SCIENCE

Dr.V.M.Indumathi

Assistant Professor

Dept. of Agricultural and Rural Management

Tamil Nadu Agricultural University, Coimbatore - 641 003

Dr. M.Mirunalini

Assistant Professor

Department of Educational Technology Bharathidasan University,

Khajamalai Campus Thruchirappalli – 620 023

Dr.S.Angles

Assistant Professor

Department of Agricultural Economics, Tamil Nadu Agricultural University, Coimbatore, Tamil Nadu, India Pin Code – 641003

Dr. K. Boomiraj

Assistant Professor

Department of Environmental Sciences, Tamil Nadu Agricultural University, Coimbatore- 3.

R.Ganesan

Professor and Head, Department of English, Kongu Engineering College,

Perundurai--638 052

Prof. V.Murugaiyan

Assistant Professor

Post Graduate & Research Department of History

H.H.Rajah’s College, Pudukottai.

Dr.P.Bamalin

Assistant Professor of English

Sri Bharathi Arts & Science College for Women

SCHOOL OF MATHEMATICS, PHYSIC, EARTH SCIENCE, BOTANY, CHEMISTRY, MOLECULAR BIOLOGY, ZOOLOGY

Dr. P.K. Omana

Scientist

Ministry of Earth System Science, Government of India

National Centre for Earth Science Studies, Trivandrum, Kerala

Dr. S. Loghambal

Assistant professor

Department of Mathematics V V College of Engineering Tisaiyanvilai – 627 657

Tamil Nadu, South India

Dr. M.Kumaresan

Professor and Head Department of Chemistry,

Erode Sengunthar Engineering College, Perundurai, Erode, Tamilnadu

Dr. Pradip Sarawade

Assistant Professor, School of Physics

University of Mumbai.

Mumbai-400098 India

Prof.B.Vidya vardhini

Professor in Botany

Principal, University College of Science Head, Department of Botany

Telangana University

Dichpally, 503322 Nizamabad Andhra Pradesh, India

Dr. Dhiraj Saha,

Assistant Professor (Senior Scale),

Insect Biochemistry and Molecular Biology Laboratory,

Department of Zoology, University of North

Bengal,

Dr.Biju V

Assistant Professor of Mathematics, College of Natural & Computational Sciences,

Debre Markos University,

Federal Democratic Republic of Ethiopia

Dr.S.Priyan

Assistant Professor,

Department of Mathematics,

MepcoSchlenk Engineering College, Virudhunagar- 626 005

Dr. M. Aruna

Associate Professor & Head Department of Botany Telangana University

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 109

A CRITICAL APPRAISAL OF PROFITABILITY OF CANARA BANK

Mr. V. THAMBIGNANADHAYALAN

Assistant Professor,R.V.S Institute of Management Studies and Computer Application, Karaikal – 609 609.

Mrs. F.MARY JULIA VALARMATHI

Associate Professor of Commerce, Pope John Paul-II College of Education, Reddiyarpalayam, Pondicherry – 605 010.

Abstract

The study has been undertaken to analyse

profitability of Canara bank for the study

period of ten years from 2004-05 to

2013-14. The study required accounting data of

the bank; they were collected from their

annual reports for the above period and

other internet sources. The study used ratio

analysis as financial tool and mean, standard

deviation (SD), co-efficient of variation

(CV) and Compounded Annual Growth Rate

(CAGR) as statistical tools. The results of

the study reported that profitability

performance of the bank was good during

the study period. It was also found that total

interest income and interest expenses of the

bank increased considerably during the

study period, it revealed good operating

performance of the bank. Overall,

profitability of Canara bank was good

during the study period.

Key words: profitability, deposits, interest

income and interest expenses.

Introduction

Banking industry is the bank bone of all

financial activities in a country. In India

both public sector and private sector banks

are performing well. They route the surplus

money from people to the needy persons, it

helps for capital formation and economic

development of a country. Canara bank is

one of the major public sector banks in

India. It has many branches and ATM

centers all over the country next to State

Bank of India. Canara Bank is an Indian

state-owned bank headquartered in

Bangalore, Karnataka. It was established in

1906, making it one of the oldest banks in

the country; the bank was nationalised in

1969. As of July 2014, the bank had a

network of 5111 branches and more than

6000 ATMs spread across India. The bank

also has offices abroad in London, Hong

Kong, Moscow, Shanghai, Doha, Dubai, and

New York. As a major bank it is important

to study financial performance of the bank.

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 110

business activity. Hence the researcher has

undertaken this aspect.

Statement of the Problem

A bank is a financial institution that

provides banking and other financial

services to their customers. A bank is

generally understood as an institution which

provides fundamental banking services such

as accepting deposits and providing loans.

In the sense banking business is

becoming one of the profitable businesses in

India. Until few decades ago public sector

banks were rendering banking services to

people. After allowing, private sector banks

banking sector has become competitive

sector. Primary motive of private banks are

earning profit, hence they started to

introduce innovative banking services and

products to their customers in order to retain

existing customers and attract new

customers. Hence public sector banks also

are pulled into the competitive field.

Among them Canara bank is one of the

leading public sector banks which has a

wide network across India even in rural

areas. Hence the researcher has studied

profitability of the bank.

Objectives

The study has been undertaken with the

following objectives.

1. To study the trend of net profit of Canara

bank for the study period and

2. To analyse profitability performance of

Canara bank in terms of various selected

ratios.

Methodology

The study has been undertaken to analyse

profitability of Canara bank for the study

period of ten years from 2004-05 to

2013-14. The study required accounting data of

the bank, they were collected from their

annual reports for the above period and

other internet sources. The study used ratio

analysis as financial tool and mean, standard

deviation (SD), co-efficient of variation

(CV) and Compounded Annual Growth Rate

(CAGR) as statistical tools.

Results and Interpretation

Net Profit and its Trend

Net profit is the common indicator to

measure the overall performance of any type

of business. Table 1 gives the results of net

profit of Canara bank and its percentage

change over previous year for the study

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 111 Table 1

Trend of Net profit

Rs. in crore

Year Net Profit % Change over previous Year

2004-2005 1109.05 -

2005-2006 1343.22 21.11 2006-2007 1420.81 5.78 2007-2008 1565.01 10.15 2008-2009 2072.42 32.42 2009-2010 3021.43 45.79 2010-2011 4025.89 33.24 2011-2012 3282.71 -18.46 2012-2013 3672.1 11.86 2013-2014 3063.2 -16.58 Mean 2457.58

SD 1073.96

CV 43.70

CAGR 10.69

Source: Computed from Secondary Data It was known from table 1 that Net profit of

Canara Bank for the study period had grown

except during 2011-12 and 2013-14. Net

profit of the bank ranged from Rs.1109.05

crore to 4025.89 crore over the study period.

Net profit of the bank increased at high rate

during 2009-10 by 45.79 per cent followed

by 2010-11 and 2008-09 by 33.24 per cent

and 32.42 per cent respectively. During the

years 2011-12 and 2013-14 net profit of the

bank decreased by 18.46 per cent and 16.58

per cent respectively. The results of mean,

standard deviation and co-efficient of

variation of net profit of Canara bank stood

at Rs. 2457.58 crore, Rs. 1073.96 crore and

43.70 per cent, it showed that there was

moderate level of fluctuation in net profit

during the study period. The calculated

value of CAGR of net profit of Canara bank

stood at 10.69 per cent, it seems to be

considerable and profit earning performance

of the bank was good.

Return on Assets (ROA)

ROA is defined as net profit divided by

average total assets. This ratio measures a

banks profit per currency unit of assets. This

is the main indicator of profitability used in

international comparisons and it is one

among the guidelines of RBI for balance

sheet analysis of banks. The return on assets

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 112 Table 2

Return on Assets

Rs. in crore

Year Net Profit Total Assets Return on Assets (%)

2004-2005 1109.05 110,188.24 1.01 2005-2006 1343.22 132,708.48 1.01 2006-2007 1420.81 163,718.17 0.87 2007-2008 1565.01 178,323.83 0.88 2008-2009 2072.42 217,477.64 0.95 2009-2010 3021.43 264741.08 1.14 2010-2011 4025.89 335944.86 1.20 2011-2012 3282.71 374160.19 0.88 2012-2013 3672.10 412342.61 0.89 2013-2014 3063.20 491921.85 0.62 Mean 2457.58 268152.70

SD 1073.96 129764.76

CV 43.70 48.39

CAGR 10.69 16.14

Source: Computed from Secondary Data

Return on assets of Canara bank was found low during all the years of the study period. But

during first two years and during 2009-10 and 2010-11 it was more than one and during other

years it was less than one per cent. The results of mean, standard deviation and co-efficient of

variation of total assets of Canara bank showed that there was moderate level of variation in total

assets over the study period from its mean value. The calculated value of CAGR of total assets

stood at 16.14 per cent, it was considered high and there was high growth in total assets of the

bank, where as CAGR of net profit of the bank was lower than the growth rate of total assets. It

was summarized that the performance of Canara bank was not good in terms of return on assets

during the study period.

Net Profit to Total Income Ratio

Net profit is the total revenue and gains minus the expenses and losses. For companies that are

not in the financial industry. Table 3.3 gives the details of net profit, total income and the ratio

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 113 Table 3

Net Profit to Total Income Ratio

Rs. in Crore

Year Net Profit Total Income Net Profit To Total Income Ratio

2004-2005 1109.05 9115.80 12.17 2005-2006 1343.22 10089.02 13.31 2006-2007 1420.81 12876.36 11.03

2007-2008 1565.01 16509.05 9.48

2008-2009 2072.42 19546.15 10.60 2009-2010 3021.43 21752.78 13.89 2010-2011 4025.89 25890.99 15.55

2011-2012 3282.71 33800.37 9.71

2012-2013 3672.10 37230.94 9.86

2013-2014 3063.20 43480.37 7.04

Mean 2457.58 23029.18

SD 1073.96 11853.42

CV 43.70 51.47

CAGR 10.69 16.91

Source: Computed from Secondary Data Table 3 indicates that net profit of the bank

increased at a considerable rate during the

study period as shown by CAGR. Total

income of the bank stood at Rs.9115.80

crore during 2004-05 and it increased to Rs.

43480.37 crore during 2013-14. The

calculated values of mean, standard

deviation and co-efficient of variation of

total income of Canara bank stood at

Rs.23029.18 crore, Rs.11853.42 crore and

51.47 per cent respectively, it showed there

was moderate level of deviation in total

assets of the bank from its mean value. The

calculated value of CAGR of total income of

the bank was 16.91 per cent, it was

considered high and therefore there was high

growth in total income of the bank during

the study period, growth rate of total income

was higher than growth rate of net profit, it

indicated high increase of expenses by the

bank. The ratio of net profit to total income

of the bank was in decreasing trend over the

study period. The ratio ranged between 7.04

and 15.55 per cent. The performance of

Canara bank in terms of net profit to total

income was found to be considerable.

Net Profit to Total Deposits

Table 4 is demonstrating the results related

to net profit to total deposits of Canara bank.

This ratio is a direct measure to know the

returns to total deposits and can be

calculated as the percentage of net profit to

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 114 Table 4

Net Profit to Total Deposits Ratio

Rs. in crore

Year Net Profit Total Deposits

Net Profit to Total Deposits Ratio (%)

2004-2005 1109.05 96908.42 1.14 2005-2006 1343.22 116,803.23 1.15 2006-2007 1420.81 142,381.45 1.00 2007-2008 1565.01 154,072.42 1.02 2008-2009 2072.42 186,892.51 1.11 2009-2010 3021.43 234651.44 1.29 2010-2011 4025.89 293436.64 1.37 2011-2012 3282.71 327053.73 1.00 2012-2013 3672.10 355855.99 1.03 2013-2014 3063.20 420722.82 0.73

Mean 2457.58 232877.87 SD 1073.96 111267.70 CV 43.70 47.78 CAGR 10.69 15.81

Source: Computed from Secondary Data It was noted from table 4 that net profit of

Canara bank increased considerably during

the study period as shown by the result of

CAGR. Total deposit of the bank was in

increasing trend over the study period. The

amount of total deposit increased from

Rs.96908.42 crore during 2004-05 to

Rs.420722.82 crore during 2013-14.

Calculated value of mean of total deposits

stood at Rs.232877.87 crore, its standard

deviation and co-efficient of variation were

Rs.111267.70 crore and 47.78 per cent

respectively, they showed moderate level of

deviation in total deposits of the bank from

its mean value. The result of CAGR of total

deposits (15.81 per cent) showed good

growth during the study period. The ratio of

net profit to total deposits of Canara bank

was found to be low during the study period.

It ranged from 0.73 per cent to 1.37 per cent.

The ratio stood at 1.29 per cent during

2009-10, it went up to 1.37 per cent during

2010-11, during 2011-12 it met a slight decrease

and stood at 1 per cent, even though during

2012-13 the ratio met an increase to 1.03 per

cent during 2013-14 the ratio went down to

0.73 per cent due to major decrease in net

profit during such year. The performance of

Canara bank in terms of net profit to total

deposit was not good during the study

period.

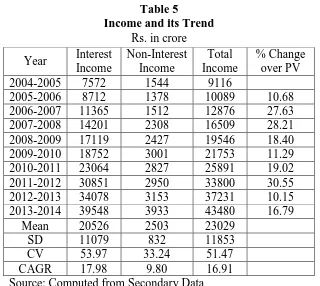

Income and its Trend

Table 5 gives the results of income, its

components and its trend of Canara bank for

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 115 Table 5

Income and its Trend

Rs. in crore

Year Interest Income

Non-Interest Income

Total Income

% Change over PV 2004-2005 7572 1544 9116

2005-2006 8712 1378 10089 10.68 2006-2007 11365 1512 12876 27.63 2007-2008 14201 2308 16509 28.21 2008-2009 17119 2427 19546 18.40 2009-2010 18752 3001 21753 11.29 2010-2011 23064 2827 25891 19.02 2011-2012 30851 2950 33800 30.55 2012-2013 34078 3153 37231 10.15 2013-2014 39548 3933 43480 16.79

Mean 20526 2503 23029

SD 11079 832 11853

CV 53.97 33.24 51.47

CAGR 17.98 9.80 16.91 Source: Computed from Secondary Data Table 5 shows that interest income was the

major component of total income of Canara

bank during all the years of the study period.

Both interest income and non-interest

income of the bank were in increasing trend

during the study period. The calculated

value of CAGR of interest income (17.98

per cent) was higher than CAGR of

non-interest income (9.80 per cent) of the bank.

It showed good operating efficiency of

Canara bank during the study period. Total

income of the bank increased more than

double over the study period. The amount

of total income of Canara bank increased

from Rs.9116 crore in 2004-05 to

Rs.43480.37 crore in 2013-14. Total

income of the bank increased at high rate

during 2011-12, 2006-07 and 2007-08.

During all the years total income of the bank

increased over the previous year.

Expenses and its Trend

Table 6 gives the results of expenses, its

components and its trend of Canara bank for

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 116

Table 6

Expenses and its Trend

Rs. in crore

Year Interest Expenses

Non-Interest Expenses

Total Expenses

% Change over PV

2004-2005 4422 3585 8007

2005-2006 5,130 3616 8,746 9.24

2006-2007 7,338 4118 11,456 30.98 2007-2008 10,663 4281 14,944 30.45 2008-2009 12,401 5073 17,474 16.93

2009-2010 13071 5660 18731 7.19

2010-2011 15241 6624 21865 16.73 2011-2012 20040 10478 30518 39.57

2012-2013 26199 7360 33559 9.96

2013-2014 30603 9814 40417 20.44

Mean 14511 6061 20572

SD 8751 2490 10998

CV 60.31 41.08 53.46

CAGR 21.34 10.60 17.57

Source: Computed from Secondary Data Table 6 indicates that both interest expenses

and non-interest expenses of Canara bank

increased over the study period. The growth

rate as per the results of CAGR of interest

income (21.34 per cent) was higher than

CAGR of non-interest expenses (10.60 per

cent), these results showed that Canara bank

increased its deposits from its customers

over the study period. It is also a sign of

good operating performance of Canara bank

during the study period. Total expenditure

of the bank increased around five times

during the study period. Total expenses of

the bank increased at high rates during

2011-12, 2006-07 and 2007-08. The result

of CAGR of total expenses of Canara bank

was 17.57 per cent, it was considered high

and there was high rate of growth in total

expenses of the bank.

Conclusion

Canara bank is one of the leading public

sector banks in India next to State Bank of

India. It has branches in all nook and

corners of the country. As a major banking

company in India, the researcher has

analysed profitability of the bank for the

period of ten years from 2004-05 to

2013-14. The study has dealt with various

profitability ratios and tested its profitability

performance. The results of the study

reported that profitability performance of the

bank was good during the study period. It

was also found that total interest income and

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929

Emperor International Journal of Finance and Management Research [EIJFMR] ISSN: 2395-5929 Page 117

considerably during the study period, it

revealed good operating performance of the

bank. Overall, profitability of Canara bank

was good during the study period.

References

1. Annual reports of Canara bank from

2004-05 to 2013-14.

2. www.rbi.org.in

3. Panda, J. and Lall, G.S. (1991), “A

Critical Appraisal on the Profitability of

Commercial Banks,” Indian Journal of

Banking and Finance, Vol.5, No.2, pp.

40-44.

4. Dash, D.K., (2000), “Financial

Performance Evaluation through Ratio

Analysis – A Case of Nawanozar

Cooperative Bank, Jamnagar (Gujrat),”

Indian Cooperative Review, Vol. 37, No.