How America Saves A report on Vanguard 2013 defined contribution plan data

Full text

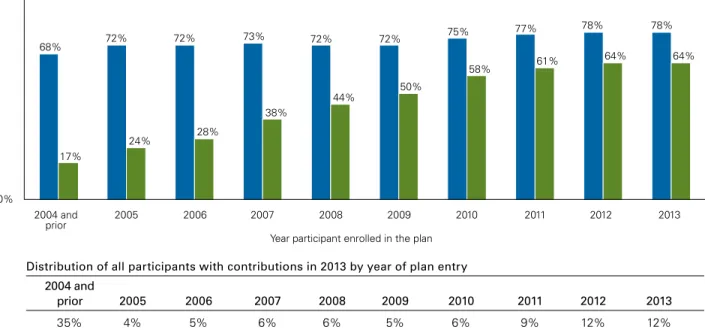

Figure

Related documents

Your Raymond James financial advisor has the tools and resources available to assist your company with defined benefit plans, defined contribution plans, stock option

To model adherence benefits, predicted event risks were multiplied by relative risk reductions expected with full adherence to antihypertensive and statin therapy.. In ASCOT– LLA,

However, 1% of that contribution and the 14%** employer contributions fund a defined benefit portion of the plan — invested by STRS Ohio investment professionals — to pay for

If an employer causes employee retirement plans to be overly concentrated in high risk company stock or does not diversify the assets owned by the plans to mitigate the

It should be noted that although Patel et al (1995) found no mydriatic induced glaucoma in their study, they found that 38 patients of the 1,770 who were referred for definitive

As the employer sponsoring an ESOP for your employees, your contributions to the plan (whether in the form of company stock, or cash that is used to purchase company stock)

If your company retirement account includes highly appreciated company stock, an option is to withdraw the stock, pay tax on it now, and roll the balance of the plan assets to an