www.danskeresearch.com

Danish Covered Bond Handbook

The covered bond handbook of mortgage banks in Denmark

14 May 2013

In this document, we describe the Danish mortgage credit market and its pass-through bonds, including a description of the security underlying the bonds. Until 2007, issuance of Danish covered bonds (mortgage bonds) in Denmark was done through specialist mortgage banks where the general feature was a pass-through product. However, the significant revision of the law in 2007 opened the way for non-specialist banks to issue covered bonds.

Covered bonds issued out of Denmark fall into two categories: traditional Danish mortgage bonds (the pure pass-through product) and euro-style covered bonds in a jumbo format (similar to what we see in euroland). The pass-through products are tapped on a daily basis in the domestic market and form the largest residential covered bond market in Europe. Currently, only Danske Bank has established an EMTN covered bond programme and issued euro-style covered bonds.

Chapter 1 briefly outlines the history of the Danish mortgage credit system. Chapter 2 explains the legal framework of the Danish mortgage credit system and the security aspects of Danish covered bonds.

Chapter 3 describes the Danish mortgage banks and Chapter 4 provides an overview of the current ratings of each institution and its rated capital centres. Chapter 5 gives a detailed description of the characteristics of Danish covered bonds.

Moving to prepayments, Chapter 6 describes how covered bonds can be refinanced and shows different types of remortgaging strategies. Chapter 7 explains how to estimate the prepayment rates for callable covered bonds.

Chapter 8 gives an overview of investor distribution. Chapter 9 presents different ways of measuring the yield pickup of Danish covered bonds and introduces the option-adjusted figures for yield spreads (OAS) and durations.

In Chapter 10 we describe the Danske Markets’ Danish Mortgage Bond Index. In Chapter 11, we describe the bond futures on Danish covered bonds.

Finally, Chapter 12 summarises the available data on Danish covered bonds and Chapter 13 gives an overview of trading and issuing.

For more information on the euro-style Danish covered bond, see Danske Bank Markets’ publication Nordic Covered Bond Handbook 2012/2013, September 2012.

Senior Analyst Christina Falch +45 45 12 71 52

chfa@danskebank.dk Chief Analyst Jens Peter Sørensen +45 45 12 85 17

jenssr@danskebank.dk Senior Analyst Jan Weber Østergaard +45 45 13 07 89

jast@danskebank.dk Senior Analyst Søren Skov Hansen +45 45 12 84 30 srha@danskebank.dk Senior Analyst Sverre Holbek +45 45 14 88 82 holb@danskebank.dk

Danish Covered Bond

Handbook 2013

2 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Contents

1. Historical background ... 3

2. The mortgage credit system ... 6

3. Mortgage banks... 14

Realkredit Danmark ... 17

Danske Bank ... 19

Nykredit/Totalkredit ... 21

Nordea Kredit ... 23

BRFkredit ... 25

DLR Kredit ... 27

4. Rating ... 29

5. Bond types ... 35

6. Issuing and trading Danish covered bonds ... 46

7. Prepayment ... 49

8. Estimating prepayments ... 53

9. Portfolio composition ... 56

10. Performance ... 58

11. Danske Bank Markets Bond Indices ... 62

12. Futures on Danish covered bonds ... 64

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

In 1795, a very large fire in Copenhagen burned one in four houses in the city to the ground. Funding was needed to rebuild the city but provision of credit was scarce. Lenders formed a mortgage association to provide loans secured by mortgages on real property on the basis of joint and several liability to enhance credit quality.

To fund the loans, the first Danish mortgage bonds were issued and thus a more than 200-year tradition of mortgage bond issuance in Denmark commenced.

Market profile

Over the past 200-plus years, the Danish mortgage credit system has gone through a number of stages and survived several occasions of economic and political turmoil, including the bankruptcy of the Kingdom of Denmark in the early-19th century and the depression of the 1930s, with no record of a default.

This unblemished record is attributable mainly to the strong legislative framework, which, from an early stage in the development of the market, has put great emphasis on the protection of the mortgage bond investor by imposing strict limits on the risk taking of the mortgage banks. In 1850, a long tradition of strict regulation of the activities of mortgage banks commenced with the passing of the first Mortgage Bond Act. The legal framework has been amended several times. However, guiding principles such as the balance and investor protection principles have remained unchallenged (Chapter 2 describes the present Mortgage Credit Act in detail).

During its first 100 years, the Danish mortgage credit sector consisted of many mortgage credit associations, where mutuality was in focus. Mutuality, however, contributed to a very restricted lending policy, as the most important duty of a mortgage credit association was to safeguard the interests of its members.

At the end of the 1950s, the Danish government took the initiative to establish independent mortgage banks. Commitment to mutuality gradually disappeared and institutions with independent means were established. This resulted in a more liberal lending policy.

Since 1970, there have been several reforms of Denmark’s mortgage credit legislation. In search of economies of scale, the mortgage credit reform in 1970 introduced a provision that future new mortgage banks were only to be approved if there was an apparent need. The number of mortgage banks was subsequently reduced from 24 to seven. Another important change in 1970 was the switch from a three-tier to a two-tier system – ordinary and special mortgage credit loans. This subsequently led to the 1980 reform, which introduced the use of only one tier known as the ‘unity’ mortgage credit system. In 1989 deregulation resulting from EU directives enabled commercial and savings banks to establish mortgage banks – formed as limited companies. Traditional mortgage banks were allowed to convert into limited companies as well. New lenders entered the market and fierce competition ensued, resulting in consolidation within the sector.

Since 2000, the merger of Danske Kredit, BG Kredit and Realkredit Danmark and that of Nykredit and Totalkredit have intensified competition even further to form the market today. Danish covered bonds (mortgage bonds) are issued by a comparatively small number of mortgage banks (MCIs) – at present seven – adding to the liquidity of the bonds issued. Furthermore, market concentration is high, with Nykredit/Totalkredit and Realkredit Danmark accounting for 68.0% of all Danish krone covered bonds issued and 49.5% of all Danish euro covered bonds issues (see table below).

No record of mortgage bond default

First mortgage bond act in 1850

Legislation amended several times but basic elements remain the same

Deregulation in 1989 prompted fierce competition, which led to consolidation in the sector

Low level of repossessed dwellings/ loans in arrears in Denmark

4 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Table 1. Volumes and market shares of Danish MCIs, end-2012

DKK bonds EUR bonds Total volume Market

Volume (EURbn) Share (%) Volume (EURbn) Share (%) (EURbn) share (%)

Nykredit/Totalkredit 137.7 40.6% 15.6 36.2% 153.3 40.1% Realkredit Danmark 92.9 27.4% 5.8 13.4% 98.7 25.8% Nordea Kredit 40.9 12.1% 1.5 3.6% 42.5 11.1% Danske Bank 25.3 7.5% 14.8 34.4% 40.1 10.5% BRFkredit 26.9 7.9% 0.2 0.4% 27.1 7.1% DLR Kredit 13.7 4.0% 5.2 12.1% 18.9 4.9% LRF 1.9 0.6% 1.9 0.5% FIH Realkredit 0.02 0.0% 0.02 0.0% Total 339.4 100.0% 43.0 100.0% 382.5 100.0%

Source: Danske Bank Markets

The current mortgage credit market

On 1 July 2007, an amendment to the legal framework came into force offering universal banks access to covered bond funding alongside the established specialist mortgage banks.

So far, only one universal bank has issued covered bonds. In mid-December 2007, Danske Bank issued the first covered bond in the form of a DKK10bn Danish-krone-denominated covered bond with a floating rate. The first euro-Danish-krone-denominated benchmark bond was issued in mid-April 2008. As at the end of 2012, the volume of Danske Bank’s DKK- and EUR-denominated covered bonds was EUR25.3bn and EUR14.8bn, respectively.

House prices in Denmark experienced a gradual increase over the decades leading up to the beginning of the financial crisis in 2007. During the financial crisis, house prices fell quite significantly until the beginning of 2009, when we saw a stabilisation in house prices (see the chart below).

Chart 1. House prices in selected countries 2004-11 (index 100= 2004)

Source: Reuters EcoWin

Between the peak in 2007 and Q3 12, house prices in Denmark declined by almost 20%. In France, Norway and Sweden we have seen house prices rising by 2.5%, 28.4% and 9.6% respectively since year-end 2007. In Spain and the UK house prices have declined by 23% and 11%, respectively, over this period.

80 100 120 140 160 180 200 '04 '05 '06 '07 '08 '09 '10 '11 '12

Germany Denmark Spain France

UK Norway Sweden

New Mortgage Act in July 2007

Historical development in house prices

Low level of repossessed dwellings/ loans in arrears in Denmark

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

repossessed dwellings and loans in arrears has been very low. This is due to the low unemployment rate in Denmark and the strong mortgage legislation.

Chart 2. Repossessed dwellings and loans in arrears

Source: Association of Danish Mortgage Bonds

0 1000 2000 3000 4000 5000 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 Loan in arrears Reposessed dwellings (rhs.)

6 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

2. The mortgage credit system

Danish mortgage banks provide mortgage lending at a very competitive cost. This has led to persistent demand for mortgage lending from property owners (residential, commercial and public sector real estate) in Denmark and makes the Danish mortgage market the largest in the world compared with GDP and the second largest in Europe in absolute terms – exceeded only by the German Pfandbrief market.

Until 1 July 2007, the Danish mortgage market was characterised by two main features. Only specialist mortgage banks (MCIs) were allowed to issue Realkreditobligationer (covered bonds).

All MCIs followed a strict balance principle, where the loan to the household was matched exactly by the bond bought by the investor. A pure pass-through system as shown below, where the MCI did not take interest rate, volatility, FX or liquidity risks.

Chart 3. Pass-through system

Source: Danske Bank Markets

On 1 July 2007, an amendment to the legal framework came into force. The purpose of the amendment was twofold.

To render the Danish covered bond system compliant with the covered bond criteria in the EU Capital Requirement Directive (CRD).

To give Danish universal banks access to covered bond funding of eligible assets. To meet its purpose the amendment introduced different bond types, three of which could be called covered bonds as they fulfilled UCITS and CRD.

SDO – særligt dækkede obligationer.

SDRO – særligt dækkede realkreditobligationer. Realkreditobligationer issued before 31 December 2007.

SDO, SDRO and Realkreditobligationer issued before 31 December 2007 are all classified as covered bonds and are CRD compliant and thus carry low risk weights. The single difference between the SDOs and SDROs is that SDROs may be issued by specialist mortgage banks only, whereas SDOs may be issued by both universal banks and specialist mortgage banks.

Finally, the amendments allowed the MCIs to issue Realkreditobligationer but Realkreditobligationer issued after 31 December 2007 are not CRD compliant and high risk weights apply for these bonds relative to SDOs/SDROs. Furthermore, the amendments gave the MCIs as well as the universal banks the possibility to issue under two different balance principles.

The specific balance principle, which is very close to the old balance principle. The general balance principle, which is more in line with what we see in euroland.

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

regard to the type of covered bond and the type of balance principle. A more thorough description of the two balance principles is found at the end of this chapter.

The two specialised mortgage banks Nordea Kredit and Realkredit Danmark, which are owned by the two large banks Nordea and Danske Bank, respectively, are the only ones that issue covered bonds in the SDRO format and adhere to the specific balance principle. The specialist agricultural mortgage bank DLR Kredit also adheres to the specific balance principle. The message from these issuers is therefore clear: they are sticking to their traditional pass-through mortgage business.

Table 2. Danish issuer positions

Issuer Type Balance principle Issuing principle

BRFkredit SDO General principle Pass through Danske Bank SDO General principle Euro style DLR Kredit SDO Specific principle Pass through Nordea Kredit SDRO Specific principle Pass through Nykredit/Totalkredit SDO General principle Pass through Realkredit Danmark SDRO Specific principle Pass through

Source: Danske Bank Markets

BRFkredit and Nykredit/Totalkredit have opted for the general balance principle and issue covered bonds in the SDO format – as does DLR Kredit. The primary reasons for doing this are to have the option to carry out joint funding, to benefit from the slightly more flexible balance principle and to have the option to include a broader range of collateral in the cover pool.

Not being a specialised mortgage bank, Danske Bank is allowed to issue only covered bonds in the form of SDOs and, being a universal bank, the general balance principle within the ALM suits it best. So far, as we see it, Danske Bank is the only bank issuing covered bonds in Euroland through syndicated deals in EUR among the Danish covered bond issuers. The traditional Danish mortgage banks still rely on daily tap issuance as well as two to four refinancing auctions per year.

Legislation

Danish mortgage banking is supported by restrictive and detailed regulations designed to protect covered bond investors. Mortgage banking in Denmark is regulated subject to the general Financial Business Act, the specific Mortgage-Credit Loans and Mortgage-Credit Bonds Act and a number of Ministerial Orders.

Key elements of the regulation are as follows.

Specialist mortgage banks must operate subject to the balance principle limiting the market risk exposure of the issuer to a minimum.

Bonds issued and collateral must be assigned to specific capital centres within the specialist mortgage banks.

Each capital centre is regulated subject to a balance principle – either the general or the specific principle – at the decision of the issuer.

Mortgage loans and securities serving as collateral must meet restrictive eligibility criteria, including loan-to-value (LTV) limits and valuation of property requirements.

8 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Investors have a privileged position in the case of bankruptcy, rendering covered bond bankruptcy remote.

The mandatory overcollateralisation of the cover pool is subject to the selection of either the general or the specific balance principle.

Mortgage banks are closely supervised by the Danish FSA.

Mortgage collateral will observe LTV limits at single loan levels at all times.

A key feature of the Danish system is very well-defined property rights through a general register of all properties in Denmark. This is called the Danish title number and land registration systems and efficient compulsory sale procedures. The title and land registration systems ensure that ownership and encumbrances on individual properties are easily identified and that the information is available to the public. Furthermore, if a borrower defaults on a payment, the mortgage bank can take over the house and the compulsory sale procedure would ensure that a mortgage bank could sell the house in the real estate market or through a forced sale. The period from default to a forced sale being completed may be as short as six months. Hence, the Danish title number and land registration systems add investor protection.

Balance principle

The balance principle is a guiding principle of Danish mortgage banking, which restrictively regulates the market risk exposure of the mortgage banks. The principle imposes a number of tests, which must be passed at all times and the mortgage bank must choose to adhere to one of two balance principles: the general balance principle or the specific balance principle.

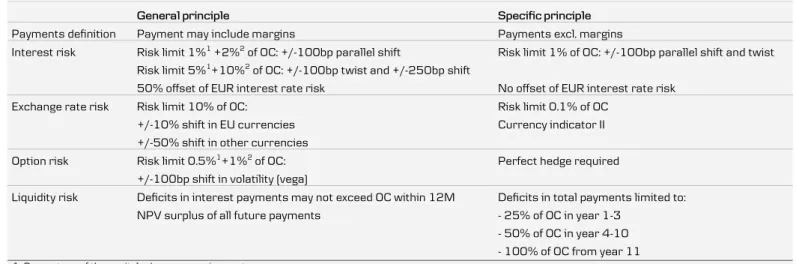

Table 3. Balance principles

General principle Specific principle

Payments definition Payment may include margins Payments excl. margins

Interest risk Risk limit 1%1 +2%2 of OC: +/-100bp parallel shift Risk limit 1% of OC: +/-100bp parallel shift and twist

Risk limit 5%1+10%2 of OC: +/-100bp twist and +/-250bp shift

50% offset of EUR interest rate risk No offset of EUR interest rate risk Exchange rate risk Risk limit 10% of OC: Risk limit 0.1% of OC

+/-10% shift in EU currencies Currency indicator II +/-50% shift in other currencies

Option risk Risk limit 0.5%1+1%2 of OC: Perfect hedge required

+/-100bp shift in volatility (vega)

Liquidity risk Deficits in interest payments may not exceed OC within 12M NPV surplus of all future payments

Deficits in total payments limited to: - 25% of OC in year 1-3

- 50% of OC in year 4-10 - 100% of OC from year 11

1. Percentage of the capital adequacy requirement

2. Percentage of the additional excess cover for mortgage banks Note: OC = overcollateralisation

Source: The Danish FSA, Danske Bank Markets

The balance principle is enforced by the Danish FSA. If a mortgage bank does not pass the tests, the FSA must be informed immediately. In addition, mortgage banks must report their market risk exposure to the FSA on a quarterly basis.

Interest rate risk is tested in scenarios of both yield curve shifts and yield curve twists. The diversity of scenarios implies that duration matching of a loan and funding portfolio will not be sufficient to pass the test.

Property registration and the compulsory sale system

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Source: Danske Bank Markets

Currency risk is tested in scenarios of shifts in the currencies in which the bonds have been issued to comply with the general principle.

Currency risk is tested employing an empirical measure of the greatest loss suffered within a 10-day period with a 0.99 probability (Currency Indicator II) to comply with the specific principle. The measure is calculated by the Danish FSA.

Option risk is tested in scenarios of shifts in the volatility (vega) to comply with the general principle.

Employing the pass-through principle to comply with the general principle, the issuer remains unaffected by borrowers calling the loan at par.

The cover of future payments to covered bond investors is tested to limit the liquidity and funding risk of mortgage banks. In passing this test, mortgage banks will have sufficient liquidity to meet future payments on mortgages.

Specialist bank principle

The specialist bank principle confines the activities of mortgage banks to mortgage lending based on the issuance of covered bonds.

The principle implies that mortgage banks are prohibited from granting loans that do not meet the eligibility criteria imposed by legislation. Similarly, the sources of funding are confined to issuing covered bonds, i.e. collecting deposits is not an applicable source of funding for Danish mortgage banks.

The principle implies that mortgage banks operate as monoline businesses, which adds to the transparency of investing in covered bonds.

Asset eligibility criteria

Mortgage loans and securities serving as collateral must meet restrictive eligibility criteria including LTV limits and valuation of property requirements laid down in the legislation. Eligibility criteria for mortgage loans are subject to the type of bond issued.

Current curve Parallel shifts Twisted shifts

Currency rate test

Option risk

Liquidity risk

10 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Table 4. Eligibility criteria for mortgage loans

RO SDO/SDRO

Collateral assets Real property Real property, public loans, derivatives and substitutions assets LTV calculations At time of granting the loan Frequency to comply with FSA recommendations

Source: The Danish FSA, Danske Bank Markets

Table 5. Eligibility criteria for mortgage loans – maximum LTV

Property type RO SDO/SDRO

Private residential property 80% 80% (75%*) Residential rental property 80% 80% (75%*) Office and shop property 60% 60% (70%**)

Industrial property 60% 60% (70%**)

Agricultural property 70% 60% (70%**)

Loans covered by municipal guarantee 80-100% 80%

* The maximum LTV is 75%, if the loan has a 30Y year interest-only period

** The maximum LTV can be raised to 70%, if supplementary collateral is provided of no less than 10% for the part of the loan that exceeds 60% of the value of the property

Source: The Danish FSA, Danske Bank Markets

Ships are not eligible for SDROs under the specific Mortgage-Credit Loans and Mortgage-Credit Bonds Act. Ships are funded by Danish Ship Finance under the Act on a ship finance institute.

Eligibility criteria for realkreditobligationer (RO) are as follows.

Terms may not exceed 35 years for mortgage loans guaranteed by municipalities and 30 years for all other mortgage loans.

Private residential and leisure home mortgages may not be repaid more slowly than a 30-year annuity with an option for interest-only periods of a maximum of 10 years. Eligibility criteria for all bond types are as follows.

Market value of pledged property must be assessed by the mortgage bank.

In general, the pledged property must be valued subject to an inspection of the property by a valuation officer of the mortgage banks. However, the majority of the Danish mortgage banks, for example Realkredit Danmark, Nykredit/Totalkredit, BRFkredit and Nordea kredit, have developed a valuation model based on extensive data on property prices in Denmark. The Danish FSA has reviewed the reliability of the models. Based on this, the FSA has granted an exemption from the inspection requirement for properties meeting certain criteria. Nykredit/Totalkredit has introduced two-tier lending for commercial borrowers (in 2009) and residential borrowers (in 2012) where the upper part of the mortgage (LTV above 45% for commercial borrowers and 60% for private borrowers) is issued as a RO (realkreditobligation) bond whereas the lower part of the mortgage is issued as a SDO covered bond. In practice, customers are offered two loans. As such, there will be two loan offers and two mortgage deeds, so the loans can be refinanced independently. Securities may only serve as collateral temporarily. Proceeds from issuing covered bonds must be invested in mortgage loans within 90 days of the issue. Similarly, proceeds from borrower payments exceeding payments to covered bond investors must be invested in mortgage loans or be used to redeem circulating covered bonds within 12 months. Hence, covered bonds are primarily collateralised by mortgages on real property.

Nykredit’s two-tier mortgage lending

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Government bonds and deposits with central banks issued by OECD member states. Covered bonds issued by mortgage banks in OECD member states.

Deposits in commercial banks with a maximum term of 12 months.

Bankruptcy regulation

Covered bond investors are awarded a privileged position in a bankruptcy scenario. The privileged position ensures that covered bond investors will only in exceptional cases be affected in a bankruptcy scenario, rendering the chances of covered bond bankruptcy remote. The bankruptcy regulation specifies detailed guidelines, which must be observed in a bankruptcy scenario. Key points of the guidelines are as follows.

A trustee will be appointed by the Danish FSA to manage all financial transactions of the mortgage bank.

The trustee will be instructed to meet all payment obligations on covered bonds issued in due time notwithstanding a suspension of payments of the mortgage bank.

All new lending activities of the mortgage bank will be ceased.

The trustee has the option of issuing refinancing bonds for the refinancing maturing covered bond debt. Refinancing debt will be comprised by the bankruptcy privilege on equal terms with covered bond debt. The trustee has the further option of issuing unsecured debt.

Payments on loans will not be accelerated. Hence, payments from borrowers will fall due according to the original payment scheme.

The trustee may not pay other creditors before all payment obligations on issued covered bonds have been met in full.

The guidelines have been thoroughly investigated by Moody's and Standard & Poor's. They have concluded that the guidelines provide for a sufficient protection of covered bond investors in a bankruptcy scenario and therefore the chances of a Danish covered bond bankruptcy are remote.

Mandatory overcollateralisation

Mortgage banks must observe capital requirements as defined in applicable EU Directives, i.e. the capital base of mortgage banks must be a minimum of 8% of risk-weighted assets.

The mandatory overcollateralisation of mortgage banks falls within the scope of the privileged position of covered bond investors in a bankruptcy scenario. The trustee will be instructed to employ the mandatory overcollateralisation exclusively to meet the payment obligations on covered bonds issued. The mandatory overcollateralisation may not be employed for any other purpose.

Under Danish mortgage credit legislation, excess funds from an issue of mortgage bonds may be placed in low-risk and marketable securities according to paragraph 152c in the Danish Mortgage Act (see below).

12 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Paragraph 152c of the Danish Mortgage Act

152c.(1) The following types of assets may be included as collateral for the issue of covered bonds:

1. Loans secured by registered mortgages on real estate, see section 152d.

2. Loans secured by liens on ships registered in the Danish Ship Register, the Danish International Ship Register or any other internationally recognised ship register offering equivalent security, see section 152f, and loans for the purpose of funding the building or renovation of ships granted without liens on ships.

3. Bonds or instruments of debt issued by or guaranteed by central governments, central banks, public entities, regional or local authorities in a country within the European Union or in a country with which the Community has entered into an agreement for the financial area. 4. Bonds or instruments of debt issued by or guaranteed by central governments, central banks, public entities, regional or local authorities in a country outside the European Union with which the Community has not entered into an agreement for the financial area, multilateral development banks or international organisations, if a calculation of the risk-weighted items weights the non-subordinated and unsecured debt of the issuers concerned by 0%, see Annex VI of the Directive relating to the taking up and pursuit of the business of credit institution. 5. Bonds or instruments of debt issued by entities referred to in nos. 3 and 4 hereof and where a calculation of the risk-weighted items weights the issuer’s non-subordinated and unsecured debt at 20%, see Annex VI of the Directive relating to the taking up and pursuit of the business of credit institutions. It is a condition that the value by which these assets are included does not exceed 20% of the nominal value of the issuer’s outstanding covered bonds.

6. Bonds or instruments of debt issued by credit institutions, if a calculation of the risk-weighted items weights the non-subordinated and unsecured debt of the relevant credit institutions at 20%, see Annex VI of the Directive relating to the taking up and pursuit of the business of credit institutions. Bonds or instruments of debt issued by a credit institution in a country within the European Union or in a country with which the Community has entered into an agreement for the financial area that have an original term of 100 days or less may be included if a calculation of the risk-weighted items weights the non-subordinated and unsecured debt of the relevant credit institution at not more than 50%, see Annex VI of the Directive relating to the taking up and pursuit of the business of credit institutions. The value by which the assets referred to in the first and second sentences hereof are included may not exceed 15% of the nominal value of the issuer’s outstanding covered bonds. This condition does not apply to receivables arising from instalment and interest payments on or repayments of loans secured by mortgages on real estate.

7. Other non-subordinated receivables from credit institutions as referred to in no. 6 hereof. It is a condition that the value at which these receivables from the said credit institutions are included does not exceed 15% of the nominal value of the issuer’s outstanding covered bonds. This condition does not apply to receivables arising from payments of instalment and interest on or repayments of loans secured by mortgages on real estate.

Source: The Danish FSA

FSA supervision

The risk profile of mortgage banks is closely monitored by the Danish FSA.

Property valuations are reported directly to the FSA for control purposes. If the value of a pledged property is set too high, the FSA will carry out a second valuation. If the second valuation confirms that the value is set too high, the FSA will instruct the mortgage bank to reduce the size of the loan to observe the maximum LTV ratio.

Reports to the FSA are prepared on a quarterly basis on the following. Credit risk exposures.

Market risk exposures. Solvency.

Inspections of mortgage banks by the FSA are performed on a regular basis. During inspections the FSA will monitor if risk mitigating procedures are sufficient and adhered to.

Property valuations are reported to the FSA

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Danish covered bonds in euro and Danish kroner are repo eligible in Danmarks Nationalbank and some are also repo eligible at Sveriges Riksbank, Norges Bank and the Swiss central bank.

Realkredit Danmark, Nykredit, Nordea Kredit, BRF and DLR have issued EUR-denominated covered bonds – non-callables and floaters – through a Luxembourg-based central securities depositary (VP Luxembourg). These bonds have LU isin codes and some are ECB eligible. The bonds are listed for quotation on OMX The Nordic Exchange. The issuance of bonds via VP Luxembourg does not limit investor capability to use Værdipapircentralen A/S for custody services.

Danish covered bonds issued out of Luxembourg repo eligible in ECB

14 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

3. Mortgage banks

In this chapter we focus exclusively on mortgage banks. The specialist bank principle confines the activity of mortgage banks to mortgage lending funded by the issuance of covered bonds (mortgage bonds). Activities not directly linked to mortgage lending and mortgage bond funding are prohibited.

In return, mortgage banks are awarded the privilege of issuing covered bonds. Entities that are not licensed as mortgage banks do not have access to covered bond funding. Mortgage banks are thus specialised monolines completely focused on property finance.

Mortgage banking market

Persistent demand for housing finance in Denmark has made the Danish covered bond market one of the largest in the world. On covered bonds, Denmark is the second-largest country, beaten only by Spain. Overall, taking into account covered bonds with public loans as collateral, Denmark ranks fourth.

Table 6. Volume outstanding covered bonds end-2011 (EURm)

Public Sector Mortgage Ships Mixed Assets Total

Australia 0 2,142 0 0 2,142 Austria 27,223 12,547 0 0 39,770 Canada 0 38,610 0 0 38,610 Cyprus 0 5,200 0 0 5,200 Czech Republic 0 8,546 0 0 8,546 Denmark 0 345,529 5,999 0 351,528 Finland 0 18,758 0 0 18,758 France 77,835 198,395 0 89,768 365,998 Germany 355,673 223,676 6,641 0 585,990 Greece 0 19,750 0 0 19,750 Hungary 0 5,175 0 0 5,175 Ireland 31,760 30,007 0 0 61,767 Italy 12,999 50,768 0 0 63,767 Latvia 0 37 0 0 37 Luxembourg 26,700 0 0 0 26,700 Netherlands 0 54,243 0 0 54,243 New Zealand 0 3,656 0 0 3,656 Norway 3,759 91,852 0 0 95,611 Poland 112 527 0 0 639 Portugal 1,400 32,283 0 0 33,683 Slovakia 0 3,768 0 0 3,768 Spain 32,657 369,208 0 0 401,865 Sweden 0 208,894 0 0 208,894 Switzerland 0 71,881 0 0 71,881 United Kingdom 3,656 194,783 0 0 198,439 United States 0 9,546 0 0 9,546 EU-27 570,015 1,782,093 12,640 89,768 2,454,516 Total 573,774 1,999,780 12,640 89,768 2,675,962

Source: ECBC European Covered Bond Fact Book 2012

In percentage of GDP, the Danish covered bond market is by far the largest covered bond market in Europe.

The specialist bank principle

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Total Covered Bonds Outstanding (backed by mortgages), (EURm)

Covered Bonds as % GDP Residential Mortgage Debt to GDP ratio (in %)

Residential Mortgage Debt per Capita, (thousand EUR)

Austria 12,547 4.2 27.8 9.98

Belgium n/a n/a 47.2 15.9

Bulgaria n/a n/a 11.7 0.6

Cyprus n/a n/a 71.3 15.74

Czech Republic 8,546 5.5 13 1.91

Denmark 345,529 144.1 100.9 43.52

Estonia n/a n/a 36.7 4.38

Finland 18,758 9.8 42.7 15.21 France 243,279 12.2 42.4 12.96 Germany 223,676 8.7 45.3 14.24 Greece 19,750 9.2 36.4 6.93 Hungary 5,175 5.1 22.5 2.28 Ireland 30,007 19.2 83.5 29.14 Italy 50,768 3.2 22.9 5.98 Latvia 37 0.2 30 2.7

Lithuania n/a n/a 19.3 1.83

Luxembourg n/a n/a 47.3 39.57

Malta n/a n/a 45.2 6.93

Netherlands 54,243 9 106.2 38.4

Poland 527 0.1 19.6 1.9

Portugal 32,283 18.9 66.6 10.71

Romania n/a n/a 5.5 0.35

Slovakia 3,768 5.5 17.8 2.16

Slovenia n/a n/a 14.5 2.52

Spain 369,208 34.4 62.1 14.45

Sweden 208,894 54 78.1 32.12

UK 194,783 11.2 83.7 23.29

EU 27 1,821,777 51.7 13.01

Iceland n/a n/a n/a n/a

Norway 91,852 26.3 68.6 48.64

Russia n/a n/a 2.6 0.25

Turkey n/a n/a 5.8 0.43

Ukraine n/a n/a 5.6 0.15

USA 9,546 0.1 76.1 26.4

Source: European Mortgage Federation

Covered bonds in circulation by issuer

Danish covered bonds are issued by a total of seven mortgage banks, of which three specialise in commercial lending. The fairly low number of issuers adds to the liquidity of the bonds issued.

In addition, market concentration is high, with Nykredit/Totalkredit and Realkredit Danmark accounting for more than 66% of all covered bonds issued.

16 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Table 8. Volumes and market shares of Danish MCIs, end of 2012

DKK bonds EUR bonds Total volume Market Volume (EURbn) Share (%) Volume (EURbn) Share (%) (EURbn) share (%)

Nykredit/Totalkredit 137.7 40.6% 15.6 36.2% 153.3 40.1% Realkredit Danmark 92.9 27.4% 5.8 13.4% 98.7 25.8% Nordea Kredit 40.9 12.1% 1.5 3.6% 42.5 11.1% Danske Bank 25.3 7.5% 14.8 34.4% 40.1 10.5% BRFkredit 26.9 7.9% 0.2 0.4% 27.1 7.1% DLR Kredit 13.7 4.0% 5.2 12.1% 18.9 4.9% LRF 1.9 0.6% 1.9 0.5% FIH Realkredit 0.02 0.0% 0.02 0.0% Total 339.4 100.0% 43.0 100.0% 382.5 100.0%

Source: Danske Bank Markets

Portfolio segmentation

Mortgages on a variety of categories of real property are eligible as collateral for mortgage bonds. However, mortgages on residential property dominate most collateral pools.

The Danish mortgage market is dominated by mortgages on residential property and there have only been minor changes in the borrower composition in the last decade. In 2012 loans secured by mortgages on residential property accounted for 58% of total net new lending.

Chart 5. Lending segments 2002 and 2012 in loan portfolio, by property category

Source: The Association of Danish Mortgage Banks

58% 7% 11% 10% 10% 2% 2% 58% 12% 11% 7% 7% 3% 2% Owner-occ. housing Subsidised housing Aggricultural property Office/non-resident Private rental Manufact. industries Other End 2002 End 2012

Residential property mortgages dominate collateral pools

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Realkredit Danmark

Company profile

Realkredit Danmark (RD) is a wholly-owned subsidiary of Danske Bank, the largest financial institution in Denmark, originated in 1871. Today, Danske Bank is a global bank with activities in northern Europe and the Baltic region under various brands. In 2006 Danske Bank acquired Sampo Bank in Finland. Its main business areas are retail banking, corporate banking, asset management, life insurance and pensions and mortgage finance. RD was established in 1851 under the name Østifternes Kreditforening. In 2001 RD merged with Danske Kredit A/S and BG Kredit A/S following the merger of Danske Bank A/S and RealDanmark A/S. RD is the continuing mortgage credit arm of the Danske Bank Group and the second-largest specialist mortgage bank in Denmark, with a loan portfolio market share of 26%. RD was the first to issue CRD-compliant covered bonds under the revised Danish Covered Bond Act.

On 23 June 2011 RD announced that it had terminated its collaboration with Moody’s. The decision came after Moody’s, as a result of model calculations, demanded that RD provide additional excess cover of DKK32.5bn. In the same statement, RD announced the opening of a new capital centre for the financing of adjustable rate mortgages (ARM). RD also announced that existing ARMs – issued out of RD’s Capital Centre S – were to be refinanced into the new Capital Centre T starting from the refinancing auctions set for December 2011.

RD’s covered bonds issued out of Capital Centre S and T and the General Capital Centre are rated AAA by Standard & Poor’s. Capital Centre S is rated AAA and Capital Centre T is rated AA+ by Fitch. For more rating details, see Chapter 4.

Financial performance

Danske Bank reported an operating profit of DKK8.6bn in 2012, an increase from DKK4.2bn in 2011. Net interest income increased from DKK33.3bn to DKK35.0bn. Pricing initiatives increased net interest income but the effect was partly offset by a general fall in interest rate levels. Expenses were up slightly from the level in 2011. The cost/income ratio improved from 60% in 2011 to 57% in 2012. Underlying cost levels are on level with those of 2011, partly as a result of the staff reduction. Loan losses and provisions fell from DKK13.2bn to DKK12.5bn.

The core capital ratio increased from 16.0% as of 31 December 2011 to 18.9% as of 31 December 2012 and the total capital ratio increased from 17.9% to 21.3%. The arrears rate (three months) for RD increased marginally from 0.46% as at end-2011 to 0.49% as at end-2012. The number of repossessed properties decreased from 161 to 156.

Business model and funding profile

RD is a specialist mortgage bank subject to supervision by the Danish FSA. RD’s objective is to carry out business as a mortgage bank, including any kind of business permitted by the Danish Mortgage Act. RD’s principal market is Denmark. In addition, RD provides loans secured on real estate in the Faroe Islands, Greenland and Sweden and has previously provided loans secured on property in France, the UK and Germany. In 2012 RD started issuing loans in Norway to large corporate customers who are already customers in Danske Bank.

Table 9. Ratings (M/S/F) - RD

Covered bond rating – CC S WR/AAA/AAA Covered bond rating – CC T WR/AAA/AA+ Issuer rating -/A-/A

Source: Rating agencies, Danske Bank Markets

Table 10. Financial information (Danske Bank)

DKKm 2012 2011

Net interest income 35,003 33,341 Fees and commissions 8,233 7,726 Net gains/losses 12,735 -3,326 Pre-provision income 21,097 17,390 Loan losses and provisions 12,529 13,185 Operating profit 8,568 4,205 Cost/income ratio 57% 60% Core capital ratio 18.9% 16.0% Total capital ratio 21.3% 17.9% Arrears rate (RD) 0.49% 0.46% Repossessed properties 156 161

Source: Danske Bank

Table 11. Further information

Bond ticker RDKRE Websites www.danskebank.com www.rd.dk

18 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

RD’s core markets in Denmark are residential housing – defined as lending for the financing of owner-occupied housing and holiday homes – and the corporate market, which comprises loans to customers with property in urban trade, agriculture and residential rental property.

All mortgages included in the cover pool are distributed through the branch networks of Danske Bank, the joint finance centres and the wholly-owned real estate agent ‘home’ in Denmark.

A management agreement exists between RD and Danske Bank, stating the following. The branch that originated the mortgages is responsible for all handling of customers. Danske Bank covers all losses (with a LTV of 60-80%) on mortgages originated at Danske Bank branches.

RD receives all payments directly from customers. In turn, RD pays provisions to Danske Bank.

As at the end of 2012, loss guarantees issued by Danske Bank amounted to DKK51bn. This amount includes DKK13bn in the form of supplementary collateral for mortgage covered bonds. All mortgages are transparent (pass-through), which means that consumers have a delivery option on the underlying bonds. Interest-reset loans are funded by a portfolio of fixed-rate non-callable bonds, while other types of mortgages are funded individually by issuing bonds with exactly the same characteristics as the mortgages. Mortgages backing covered bonds issued by RD are divided into different cover registers (capital centres). According to the revised Mortgage Act, new SDROs must be issued out of separate capital centres. Therefore, since July 2007, SDROs have been issued out of Capital Centre S. Existing RO series in the General Capital Centre have been closed since end of 2007 and are grandfathered according to the Capital Requirement Directive (CRD). RD have since 2011 issued all new interest-reset loans out of Capital Centre T and a large part of the interest-reset loans in capital centre S have been refinanced into the new Capital Centre T, starting from the refinancing auctions set for December 2011. Today the majority of the entire mortgage book is included in Capital Centre S and T.

Cover pool and asset quality

As at end-2012, the cover pool for Capital Centre S and T totalled DKK208bn and DKK313bn, respectively. These are secured on private (69% and 52%), rental residential (18% and 14%) and commercial mortgages (10% and 22%). Of the assets in capital centre S, 55% carry a fixed interest rate whereas the assets in capital centre T only consist of ARM and floating rate loans. The IO loans in Capital Centre S and T amount to 48% and 66%, respectively. Geographically, the pool is well diversified across Denmark, with 37% of the loan portfolio located in the Copenhagen area. The average LTV ratio for all capital centres in Realkredit Danmark was 72.5% in Q4 2012. The LTV is capped at 80% for residential and 60% for commercial mortgages.

Table 12. Funding profile (Danske Bank)

Retail deposits 29% Corporate deposits 13%

Market funds 27%

Trading portfolio liabilities 15% Liab. under insurance contracts 8%

Other 2%

Subordinated debt 2%

Equity 4%

Source: Danske Bank

Table 13. Cover pool info – CC S Capital Centre S DKK208bn

Junior covered bonds DKK4.0bn WA Indexed LTV (Total RD) 73% LTV

LTV > 80% 8%

OC (mandatory) 9.5% (8%)

IO-mortgages 48%

Fixed rate loans 55%

Geography Primarily Denmark - Copenhagen area 37% - Other Zealand 19% - Western region 25% - Southern region 18% - Other area 0% Asset type - Private 69% - Rental residential 18% - Commercial 10% - Agriculture 3%

Source: Risk report Q4 12 from Realkredit Danmark

Table 14. Cover pool info – CC T Capital Centre T DKK313bn

Junior covered bonds DKK17.5bn WA Indexed LTV (Total RD) 73% LTV

LTV > 80% 7%

OC (mandatory) 11.6% (8%)

IO-mortgages 66%

Fixed rate loans 0%

Geography Primarily Denmark - Copenhagen area 37% - Other Zealand 16% - Western region 26% - Southern region 19% - Other area 2% Asset type - Private 52% - Rental residential 14% - Commercial 22% - Agriculture 12%

Source: Risk report Q4 12 from Realkredit Danmark

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Danske Bank

Company profile

The history of Danske Bank includes the history of three of the first large banks in Denmark, which came to be known as Den Danske Bank (Danske Bank). Danske Bank originated in the late 19th century with the establishment of Den Danske Landmandsbank (later Den Danske Bank) in 1871 and Handelsbanken in 1873. Between 1960 and 1990, the Danish banking sector was rationalised. A further key to Den Danske Bank’s development was the liberalisation of the country’s banking laws, which resulted in less restrictions on marketing, product development and continual technological innovation. Indirectly, the result of this development was that Den Danske Bank, Handelsbanken and Provinsbanken merged to form Den Danske Bank in 1990. From 2000, Den Danske Bank was renamed Danske Bank, merging with several domestic and Nordic banks. The latest merger occurred in 2007 when Danske Bank acquired Sampo Bank of Finland. Today Danske Bank is active in all Nordic countries as well as Ireland, Northern Ireland, Luxembourg, Germany, Poland and the Baltics. In 2012 it was decided to structure the bank in three business units and use the Danske Bank name for all banking operations. Danske Bank provides a wide range of banking products and services to retail, corporate and institutional clients. Domestically, Danske Bank offers mortgages through mortgage subsidiary Realkredit Danmark and pension plans and life insurance through subsidiary Danica Pension. It has 228 retail branches as of end-2012 in Denmark and several corporate branches. Most of the bank’s credit exposure is related to retail banking in Denmark (40% of total credit exposure from lending by 31 December 2012), followed by Danske Markets and Treasury (20%), and Corporate & Institutional Banking (10%). Danske Bank benefits from a shared IT platform and shared business procedures in all markets. Danske Bank has a dominant position in Denmark with a retail market share of approximately 30%. The group is one of the largest banking groups in Scandinavia. Danske Bank’s issuer (fundamental) ratings from Moody’s, S&P and Fitch are Baa1, A- and A, respectively. Danske Bank’s covered bonds issued out of cover pool D, I and C are rated AAA by S&P and Fitch.

Financial performance

Danske Bank reported an operating profit of DKK8.6bn in 2012, an increase from DKK4.2bn in 2011. Net interest income increased from DKK33.3bn to DKK35.0bn. Pricing initiatives increased net interest income but the effect was partly offset by a general fall in interest rate levels. Expenses were up slightly from the level in 2011. The cost/income ratio improved from 60% in 2011 to 57% in 2012. Underlying cost levels are on level with those of 2011, partly as a result of the staff reduction. Loan losses and provisions fell from DKK13.2bn to DKK12.5bn.

The core capital ratio increased from 16.0% as of 31 December 2011 to 18.9% as of 31 December 2012 and the total capital ratio increased from 17.9% to 21.3%.

Table 15. Ratings (M/S/F)

Covered bond rating – D -/AAA/AAA Covered bond rating – I -/AAA/AAA Covered bond rating - C -/AAA/AAA

Issuer rating Baa1/A-/A

Source: Rating agencies, Danske Bank Markets

Table 16. Financial information (Danske Bank)

DKKm 2012 2011

Net interest income 35,003 33,341 Fees and commissions 8,233 7,726 Net gains/losses 12,735 -3,326 Pre-provision income 21,097 17,390 Loan losses and provisions 12,529 13,185 Operating profit 8,568 4,205 Cost/income ratio 57% 60% Core capital ratio 18.9% 16.0% Total capital ratio 21.3% 17.9% Arrears rate (RD) 0.49% 0.46% Repossessed properties 156 161

Source: Danske Bank

Table 17. Further information

Bond ticker DANBNK Websites www.danskebank.com

Source: Danske Bank

Table 18. Funding profile

Retail deposits 29% Corporate deposits 13%

Market funds 27%

Trading portfolio liabilities 15% Liab. under insurance contracts 8%

Other 2%

Subordinated debt 2%

Equity 4%

20 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Business model and funding profile

Danske Bank is a universal bank subject to supervision by the Danish FSA. The bank has a well-diversified funding platform including a solid deposit base. Much of the lending consists of Danish mortgages, financed by Realkredit Danmark (RD) mortgage bonds. Danske Bank has established three cover pools within its EUR30bn covered bond programme. Cover Pool D comprises 100% domestic mortgages while Cover Pool I includes international mortgages originated by Danske Bank, currently stemming from Norway and Sweden. Cover Pool C comprises mainly Swedish loans and is made up from a diverse combination of loan types. Danske Bank is committed to not include Irish mortgages in cover pools C and I before November 2019. The vast majority of the mortgage portfolio comprises adjustable-rate mortgages. Furthermore, in September 2009 Danske Bank established two new cover pools. Cover Pool N comprises only Norwegian residential mortgages and Cover Pool R consists purely of Irish residential mortgages. The two new cover pools are established as part of Danske Bank’s liquidity contingency plans and – at least for the time being – are not for the public market.

Danske Bank issues covered bonds in the SDO format and adheres to the general balance principle, according to the Danish Covered Bond Act.

Cover pool and asset quality

As of 30 January 2013 Cover Pool D totalled DKK41bn and consisted solely of Danish-based residential mortgages. All mortgages in Cover Pool D are floating rate. The overall indexed LTV ratio in Cover Pool D is 64%. The pool is seasoned with an overall weighted seasoning of 61 months. Currently, O/C is 17.7%, well above the committed minimum of 2%. 27% of the cover pool notional has an indexed LTV above 80%. At the same time Cover Pool I amounts to DKK134bn and consists (besides DKK8.7bn of substitute assets) of Norwegian (53%) and Swedish mortgages (47%). All mortgages in Cover Pool I are floating rate. The overall indexed LTV ratio in Cover Pool I is 61%. 17% of the cover pool has an indexed LTV above 80%. The pool has an overall weighted seasoning of 40 months. Currently, O/C is 17.0%.

Cover Pool C stands at DKK33.2bn and comprises Swedish (89%) and Norwegian (11%) floating-rate assets – mainly non-residential with industrial, retail and agricultural assets making up some 71% of the pool. The rest of the pool is rental housing (24%) and co-operative housing (5%). The overall indexed LTV ratio in Cover Pool C is 56%. 10% of the cover pool has an indexed LTV above 80%. Currently, O/C is 40.7%.

Loans in arrears (> 90 days) are not allowed in the cover pools. Furthermore, Danske Bank commits to a voluntary minimum OC of 2% (agreed with the Danish FSA). Approval of mortgages by Danske Bank is based on a strict credit policy, identical to that of Realkredit Danmark.

Table 19. Cover pool info (D)

Cover Pool D DKK41.4bn Average loan size DKK592,729 OC (committed) 17.7% (2%)

WA Indexed LTV 64%

Seasoning 61m

Arrears (> 90 days) None Adjustable-rate loans 100%

Geography Denmark

Greater Copenhagen 35%

South Denmark 25%

Central Jutland 21%

Asset type Residential

-Primary home 93%

-Secondary home 7%

Source: Danske Bank cover pool report Feb 2013

Table 20. Cover pool info (I)

Cover Pool I DKK134.2bn Average loan size DKK949,652 OC (committed) 17.0% (2%) WA Indexed LTV 61% Seasoning Arrears (> 90 days) 40m None Floating-rate mortgages 100% Geography Norway (53%) Sweden (47%) Asset type - Owner occupied 79% - Housing cooperatives - Other 20% 1%

Source: Danske Bank cover pool report Feb 2013

Table 21. Cover pool info (C)

Cover Pool C DKK33.2bn Average loan size DKK5,517,074 OC (committed) 40.7% (2%) WA Indexed LTV 56% Seasoning Arrears (> 90 days) 51m None Floating-rate mortgages 100% Geography Sweden (89%) Norway (11%) Property type -Rental housing 24% -Retail 35% -Industrial 22% - Cooperative housing 5% - Agriculture 14%

d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Nykredit/Totalkredit

Company profile

Nykredit Realkredit (NYK) is a wholly-owned subsidiary of Nykredit Holding, the third-largest financial institution in Denmark. Nykredit Holding is an unlisted holding company owned by Foreningen Nykredit (90%), Industriens Realkreditfond (5%), Foreningen Østifterne (3%) and PRAS (2%). As a mortgage association, NYK originated in 1851. Today, besides mortgage finance, NYK is active in retail and corporate banking, asset management, insurance and real estate. Mortgage finance is the most important business area.

In 2003 NYK acquired Totalkredit (TOT), which is currently a wholly-owned subsidiary of NYK. Following the acquisition of TOT, NYK became the largest specialist mortgage bank in Denmark with a current market share based on outstanding mortgages of 42.6%. There are nearly 100 banks (with over 1,000 branches) in the TOT corporation network, making it crucial for the distribution of NYK mortgages. NYK and both local and regional banks are competitors in agricultural mortgage and non-mortgage markets. In 2008 NYK acquired Forstædernes Bank, which increased NYK’s market share within banking to 5.2%. Forstædernes Bank has subsequently been merged with Nykredit Bank. Nykredit’s covered bonds issued out of Capital Centre E and H are rated AAA by S&P. Nykredit has a Baa2/A+/A long-term rating from Moody’s/S&P/Fitch. Nykredit has terminated the covered bond rating agreement on with Moody’s. For more rating details, see Chapter 4.

Financial performance

Nykredit Group reported operating profit of DKK3.2bn in 2012 – an increase from the 2011 level of DKK1.3bn. Net interest income increased from DKK10.1bn to DKK10.8bn and loan losses and provisions increased from DKK1.4bn to DKK2.1bn.

The core capital ratio increased from 13.9% as of 31 December 2011 to 15.8% as of 31 December 2012 and the total capital ratio increased to 17.1% from 19.1%. The arrears rate (75 days) as of September 2012 was 0.5% – a slight fall from the 2011 level. The number of repossessed properties decreased from 347 to 276.

Business model and funding profile

NYK is a specialist mortgage bank subject to supervision by the Danish FSA. Banking, asset management and insurance activities are carried out by wholly-owned separate subsidiaries of NYK. As mentioned above, TOT is also a wholly-owned subsidiary of NYK. Retail and commercial customers are offered mortgages through Nykredit’s distribution channels, which include 55 customer centres, Nykredit.dk, mobile app downloads, a central customer services centre and the real estate agencies of the Nybolig and Estate chains. Like NYK, TOT is a specialist mortgage bank under the supervision of the Danish FSA.

In 1994 TOT was established as a joint mortgage bank by local and regional banks in Denmark. Since the acquisition of TOT in 2003, NYK has developed a partnership with Danish local and regional banks with substantial distribution networks including over 1,000 branches. Mortgage products under the Totalkredit brand are sold through these local and regional banks. The vast majority of growth in mortgage lending is delivered by local and regional banks.

Table 22. Ratings (M/S/F)

Covered bond rating – CC E: WR/AAA/- Covered bond rating - CC H WR/AAA/-

Issuer rating: Baa2/A+/A

Source: Rating agencies, Danske Bank Markets

Table 23. Financial information

DKKm 2012 2011 2009 2008

Net interest income 10,838 10,103 11,230 7,866

Fees and commissions 221 257 508 108 Net gain/losses -547 -1.935 2,195 -2,921 Loan losses & provisions 2,149 1,414 7,919 3,390 Operating profit 3,205 1,338 179 1,443 Cost/income ratio 57% 62% 62% 0.8%% Core capital ratio 15.8% 13.9% 16.7% 69% Total capital ratio 19.1% 17.1% 17.8% 13.5% Arrears rate 0.5% 0.6%

Repossessed properties 276 347

Source: Nykredit, Danske Bank Markets

Table 24. More info

Bond ticker NYKRE Website www.nykredit.com

22 | 14 May 2013 www.danskeresearch.com re d B o n d H a n db o o k 2 0 1 3 Er ror! A u toT e xt e n try n ot d e fi n e d .

Denmark is the largest market for NYK and TOT. In addition, NYK provides loans secured by residential property in France and Spain and loans secured in commercial property in UK, Sweden and Norway. TOT only offers mortgages secured on residential property, while NYK’s core markets in Denmark are in residential housing and commercial properties, which comprise loans to customers for urban trade, agriculture and residential rental properties.

A management agreement exists between NYK/TOT and the local and regional banks. The agreement states the following.

The branch that originated the mortgage is responsible for all handling of customers. The bank that originated the mortgages covers all losses (LTV between 60% and 80%) on mortgages originated by the said bank.

TOT receives all payments directly from customers. In turn, TOT pays provisions to the banks.

Since 2006 NYK and TOT have been jointly funded, so all mortgages originated by NYK or TOT were funded by covered bonds issued out of NYK Capital Centre D. According to the revised Mortgage Act, new SDOs must be issued out of separate capital centres. Therefore, since 1 January 2008, NYK/TOT has issued SDOs out of a new capital centre E, with existing series in Capital Centre D closed at the end of 2007. The series in Capital Centre D were grandfathered according to the Capital Requirement Directive (CRD). Nykredit announced in June 2011 that existing interest-reset and floating-rate loans – issued out of Capital Centre E – would be refinanced in to the new capital centre H starting from the refinancing auction in September 2011. Hence, going forward, joint funding will be carried out from Capital Centre E for the fixed rate loans and Capital Centre H for the interest-reset and floating-rate loans.

Nykredit has introduced two-tier mortgaging for commercial borrowers (in 2009) and residential borrowers (in Q2 2012), where all new loans will be funded using SDO covered bonds up to a LTV of 45% for commercial real estate and 60% for residential real estate, while the top 15%/20% will be funded using RO bonds. Furthermore, the top loan has to be amortising. Hence, a residential borrower in Nykredit can no longer get an IO-loan for 80% of the value of the house and the loan above 60% (and up 80%) has to be an amortising loan.

This change was made in response to the decline in house prices and the rise in LTVs, where Nykredit needs additional collateral. Given the new model the need for additional capital in the SDO cover pools is expected to decline in coming years.

Cover pool and asset quality

As at the end of 2012, NYK’s Cover Pool E and H totalled DKK314bn and DKK477bn, respectively, of which 97% and 91%, respectively, was Danish-based mortgages. These are secured on residential (76%/63%), agricultural (3%/9%) and commercial properties (8%/13%). The cover pools have a weighted-average LTV of 71% and 67%, respectively. Of all mortgages in Capital Centre E, 51% carry a fixed rate whereas Capital Centre H consists of 100% ARMs.

Table 25. Funding profile

Market funds (match-funded bonds) 77% Corporate deposit 5% Retail deposits 4%

Other 10%

Subordinated debt 1%

Equity 4%

Source: Nykredit, Danske Bank Markets

Table 26. Cover pool info – CC E Capital Centre E DKK314bn

Junior covered bonds DKK24bn

WA LTV 71%

Fixed rate loans 51%

IO-loans 52% Geography -Copenhagen area 27% -Remaining Sealand 9% -Jutland region -Funen 53% 8% -International 3% Asset type -Owner-occupied 76% -Private rental 8% -Non-profit housing 5% -Commercial -Agriculture 8% 3% -Other 1%

Source: Risk report Q4 12 from Nykredit, Danske Bank Markets

Table 27. Cover pool info – CC H Capital Centre H DKK477bn

Junior covered bonds DKK20bn

WA LTV 67%

Fixed rate loans 0%

IO-mortgages 71% Geography -Copenhagen area 26% -Remaining Zealand 8% -Jutland region -Funen 50% 7% -International 9% Asset type -Owner-occupied 63% -Private rental 10% -Non-profit housing 4% -Commercial -Agriculture 13% 9% -Other 1%

Source: Risk report Q4 12 from Nykredit, Danske Bank Markets