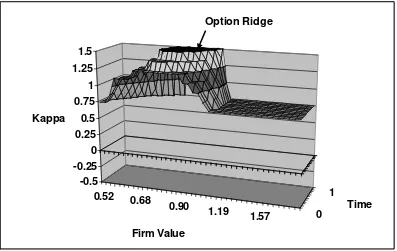

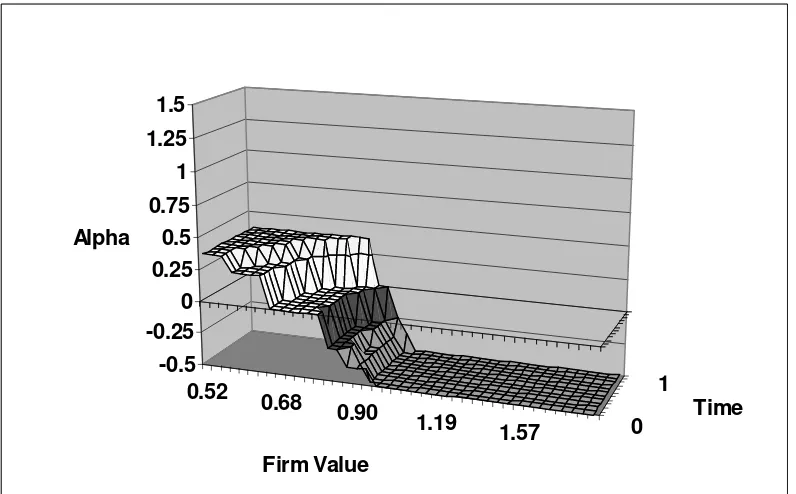

Managerial Responses to Incentives: Control of Firm Risk, Derivative Pricing Implications, and Outside Wealth Management

Full text

Figure

Outline

Related documents

Though risk for condyloma was reduced for all girls and young women under study, greater risk reductions were seen in those younger at vaccination initiation with a

1) Tune each head evenly: Choose any drum (other than the snare drum...we'll save it for last) and loosen all of the tuning rods on one side then retighten them finger tight.

While collective future work selves can form the basis of proactive behavior aimed at shaping the future of a team or organization, social identities can also restrict

clear and convincing evidence-that the alien is a flight risk or a danger to the community. In that decision, Judge Tashima was primarily discussing the burden of proof

5 Paul Hain Historical Society Maria Spandri Veteran's Park Commission Item Number: C. MEET ING DAT E:

With this, according to the Framework for the National Legal System (PP-KSHN) and the Long Term Legal Development Plan (RPHJP), 17 it is stated that “the national

Due to the inherent discrepancy between the motivations of those two distinct participants in the global trade and negotiations of uniform contract law regimes the

Article 26 Partial factors for the verification of geotechnical bearing capacity of piles loaded in tension, based on results from pile load tests, shall be selected in