How Do Different Oil Price Shocks Affect the Relationship Between Oil and Stock Markets?

Full text

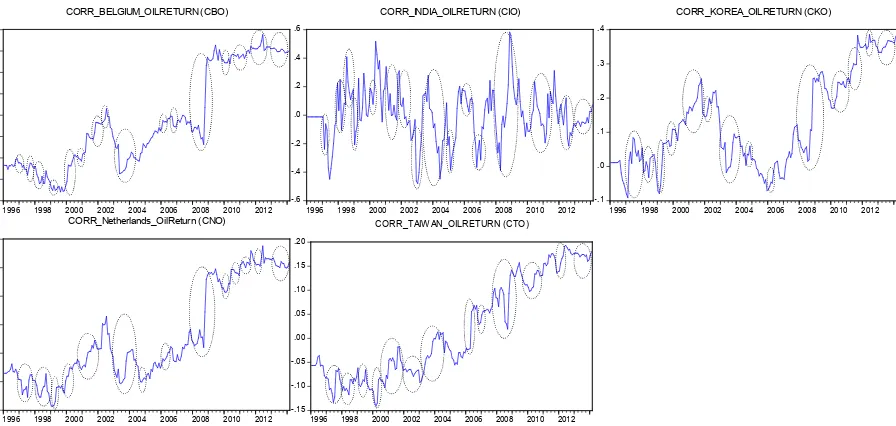

Figure

Related documents

Lore magnim do odolobo eetum vel eumsandre consectetum dolesed exer alis nullaor raesequis nisi tetum iusto odit iriurer suscin hent nonisi tetum iusto odit iriurer suscin hent

Pollitt identifies these factors using a table-format which is replicated below (table 8.1) and which I have adapted to include an educational context, which is derived from my

The predicted response variable was the daily stock price of BHP Billi- ton Ltd (BHP.AX). The sentiment scoring construction was very similar to the previ- ous approach. The model

Inside Sales gives you the power & knowledge that you are the smartest person and company in your business... The Driving Factors

But the bandpass OBT method has the highest fault coverage and controllability of oscil- lation conditions and amplitude of oscillation due to the inclusion of all filter

Bentley Collection at the Boston Public Library, May 15 through June 15, 1992," The Accounting Historians Notebook : Vol... ACCOUNTING

In contrast to the superiority of the pension tax near retirement, the wage tax is more efficient for younger unemployed workers (more than 5 years to retirement): at these

Statistics regarding the human trafficking phenomenon in Egypt were minimal; as a result, UN agencies, the International Organization for Migration (IOM), and the Egyptian