Determinants of Capital structure: Pecking order theory Evidence from Mongolian listed firms

Full text

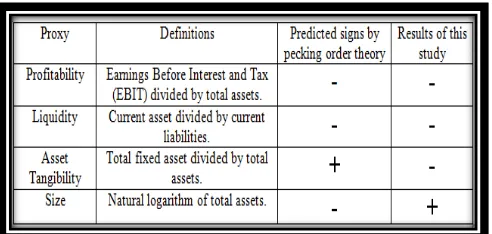

Figure

Related documents

The goal of small size and high gain can be obtained using some optimization techniques such as Genetic Algorithm (GA) For broadband wireless applications, sectorial

According to preliminary results from the most recent OECD survey on regulatory quality indicators, 13 OECD countries used public meetings as a form of consultation by 2005, but

√ Assume responsibility for all official department correspondence and

primary purpose of enhancing the access to high quality learning opportunities and value-added career development of New Brunswickers and others “from away”. The colleges

OCTpy automates peak area comparisons of suggested analytes between comparative samples from the SC feature in LECO ® ChromaTOF ® software, thereby facilitating analyte selection

Although we cannot quantify how successful we were in attaining this goal, the small variations in the day-to-day measures of volume, value, and rates relative to the target

เมื่อใชเมาสคลิกคําวาเพิ่มขาวประชาสัมพันธ จะไดหนาเว็บไซตดังภาพ พิมพหัวขอขาวประชาสัมพันธ ในชอง หัวขอขาว พิมพรายละเอียดขาวประชาสัมพันธ ในชอง

Procedure-Limitations on Actions. On June 6, 1978, a group of heirs brought suit against the two independent co-execu- trices of the estate to set aside the will on