Audi AG’s Liquidity Risk and Corporate Governance

Full text

Figure

Related documents

Table 2 shows results of Indian firms for the dependent variable, as accounting calculated Return on equity a firm performance tool, the association between the dependent

Keywords: AIA Bhd., Corporate Governance, Performance, Risk, Insurance, Return on Asset, Liquidity Risk, Credit Risk, Operational Risk, Market Risk, Current Ratio, Quick Ratio,

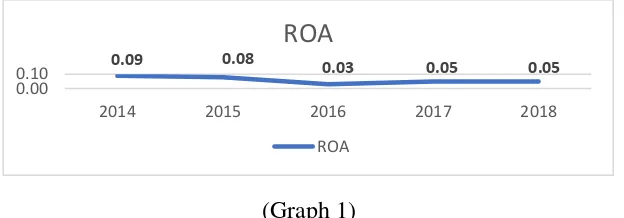

Completion of objectives, internal factors (credit risk, corporate performance and corporate governance) and external factors (market risk, inflation, gross domestic product,

The result is consistent with the pass study done by Hanaffie Bin Md Yusoff (2017), stated that the liquidity ratio has a significant effect in the course of operation in which

While for liquidity and operational ratio was negative result relationship between inflation rate and. also for gross

On mutually in the above table, it is known that the value of r squared of 77.2% meaning that the variable current ratio, leverage ratio, inflation and the exchange

The dependent variable of our study is Loan Loss Provision (LLP), which is a proxy for credit risk, and measured according to the ratio of LLPs to gross loans.. Gross

The study used multiple regression model in which exchange rate was taken as dependent variable while Inflation, interest rate, Foreign exchange reserves, trade