Abstract

Purpose: The present study examine implied volatility spillover and transmission between emerging (India) and mature stock markets (US, France, Germany and Switzerland), measured by their respective implied volatility indices i.e. IVIX, VIX, VCAC, VDAX and VSMI. Methodology: The asymmetries in Implied Volatility (IV) indices of selected countries are examined using Engle and Ng (1993) test. The spillovers and transmission are examined in multivariate-GARCH framework using BEKK and DCC model. The analysis is done using weekly data for period spanning from Nov, 2007 to Oct, 2011March.

Findings: The main findings of study document asymmetries in the IV indices exist for the Indian, American and French markets. The BEKK-GARCH model results show that conditional variances of implied VI of India, Germany, French and Switzerland strongly affected by their own past shocks and volatility effects. The DCC model reveals that there is a moderate-level of correlation between the selected markets.

Practical Implications: The results of the present study can be used by the portfolio managers and market participant for yielding the diversification benefits in short-run by including IV indices as an asset in their portfolio.

Keywords: Implied Volatility Index, Indian Stock Market, BEKK-GARCH, DCC, VIX, VSMI

Mature Markets Implied Volatility Indices

Karam Pal Narwal*, Ved Pal Sheera**, Ruhee Mittal***

* Professor, Haryana School of Business, Guru Jambheshwar University of Science and Technology, Hisar (Haryana). Author can be contacted at email-id: karampalhsb@gmail.com (Corresponding Author)

** Professor, Haryana School of Business, Guru Jambheshwar University of Science & Technology, Hisar, Haryana *** JRF, Haryana School of Business, Guru Jambheshwar University of Science & Technology, Hisar, Haryana

1. Introduction

The study of dynamic spillovers and transmission of the large shocks between the international stock markets is becoming essential to understand the mechanism of market integration, cycles of boom and stress and analysis

of financial crisis. Majority of studies in the past have

focused on the price of an asset, thus innovations in price of volatility is becoming a promising area to explore. (Wagner

and Szimayer, 2004). The price of an option reflects market

participants’ consensus views about the expected future volatility of an underlying asset over its remaining life. The implied volatility imbedded in the option prices acts as a forward-looking measure of the expected volatility and help in the assessment of the risk over a given time

period (Mayhew, 1995). Thus, on the basis of the past

literature, it can be derived that the information content of implied volatilities is considered to be superior over ex post measures of volatilities (Fleming, Ostdiek, & Whaley,

1995; Moraux, Navettte, & Villa, 1999; Christensen & Prabbala, 1998 and Poon, & Taylor, 2001).

In 1993, Chicago Board of Options Exchange (CBOE)

launched an implied volatility index (hereafter VI), based

on the implied volatilities of OEX options. VI provides

not only short term stock volatility but also offers market volatility “standard” upon which derivatives contracts

may be written (Whaley, 1993). This index soon became

a benchmark for measuring risk in the US equity markets. A valuation model proposed by Whaley was used for

the computation of the VIX; it is called a non-model free methodology. In 2003, CBOE introduced a new methodology for the computation of VIX index using not only just at-the-money call and put option but also

out-of-money call and put options of the underlying index

S&P 500. In this case, valuation model was not necessary for the computation of VI, thus, it is called model-free methodology. Following the footsteps of CBOE, many financial markets introduced their own implied VI for instance Eurozone markets constructed VDAX, VCAC, VSMI, VEL and many more.. This index is often termed

as “investor fear gauge” as it indicates expected future stock volatility. Further, a negative contemporaneous relationship between underlying index and changes in

the volatility index has been reported in the literature

for different financial markets. Thus, market participants consider VIX as a world’s premier barometer of investor

sentiment and market volatility.

The purpose of this study is to provide new evidence on the stock market integration by examining the spillover

and transmission of the newly developed implied VI in the Asian markets i.e. Indian Volatility Index (hereafter

IVIX) on the VIX, VDAX, VCAC and VSMI. This study

is motivated by earlier stock market studies on volatility transmission using historical volatility (Koutmos and

Booth, 1995; and Cifarelli and Paladino, 2005); stock

market integration based on the realized volatility, realized returns and implied volatilities (Hamao et al,

1990; Koutmos, 1996; and Nikkinen and Sahlström, 2004); and dynamic behavior of implied volatility

transmission across the markets (Wagner and Szimayer,

2004; Skiadopoulos, 2004; Äjiö, 2008; Badshah, 2009 and Nousianinen, 2010).

Thus, the paper contributes to the existing market volatility literature by focusing on the newly developed

VI of India. In this study, the prior literature is extended in

the three important ways. Firstly, the asymmetric effects in the residual conditional variances for the international equity markets are examined. Secondly, the implied volatility spillovers and transmission effects in the India

VI vis-à-vis the international volatility indices, using the

BEKK-GARCH model are captured. Finally, the dynamic

conditional correlations and volatilities (variance equation) between the volatility indices are examined. The study is

in similar spirit with the work of Nousiainen, 2010 who

analyzed the implied volatility spillover and asymmetric

volatility effects for the four financial markets.

The paper is organized as follows. In the first section the review of literature on implied VIs and the research gap identified is given. Section two describes the research methodology including objectives, model specification

and data adopted in the study. Section three is devoted to the empirical analysis and results of the study. Finally,

Section four throws light on findings, conclusion and

policy implication of the study.

2. Review of Literature

The primary research on Volatility Indices (VI) is based on

explaining its uses, information content and characteristics.

Earlier, the implied VI was merely a theoretical idea

used in option pricing and risk management. But with

the development of derivative based products of VI, it

has become an important tool for hedging and portfolio

management. A brief review on journey of VI is divided

into two sections:

2.1 Volatility Indices Related Research

The earlyproposals which used VI as an underlying asset

for trading volatility goes back to Gastineau (1977), Galai (1979), and Brenner and Gali (1993). Whaley (1993)

showed how volatility derivative can be used by option market makers, portfolio managers and covered call writers for hedging the market volatility risk. Thus, in

1993, Chicago Board Options Exchange (CBOE) officially introduced its first implied VI, ticker symbol VIX, which

has become the benchmark for risk measurement of the

US Equity markets. Flemming et al (1995) investigated

a strong contemporaneous negative correlation between

the index returns and VIX changes. Whaley (2000) found that VIX as an indicator of expected future stock market

volatility and hence termed it as “The Investors Fear gauge”.

Moraux et al. (1999), Gazda and Výrost (2003), Skiadoploulos (2004), Duestche Borse (2005), Maghrebi et al (2007), Siriopoulos and Fassas (2008), SIX Swiss Exchange Ltd (2010) studied the volatility indices of the French , Slovakia, Greek, European, Korean, London and

Swiss stock markets respectively and examined their in-formation content and forecasting abilities.

Giot (2005) dealt with the information content of the VXO, VXN and VIX and found future stock returns are positive

and negative after high (low) levels of implied volatility

index. Carr and Wu (2006) defined the new methodology of VIX and showed that the VIX can predict movements

in the future realized variance when compared to the historic estimation of GARCH volatilities.

Fernandes et al. (2007) gave the parametric and

semi-parametric heterogeneous autoregressive (HAR)

processes for modelling and forecasting VIX. Similarly, Ahoniemi (2008) found that ARIMA (1,1,1) can be used for forecasting the direction of change in VIX correctly. Degiannakis (2008) used fractionally integrated ARIMA model for forecasting VIX. Gonazàlez and Novales (2009) and Sarwar, 2010 provide evidence for negative

and changes in the VI. A new dimension of relationship

between fear gauge index and gold price in US markets

was explored by Cohen and Qadan (2010).

2.2 Volatility Transmission and Spillovers:

Aboura (2003)

Initiated the research on international volatility transmission by using VIs (VX1, VDAX and VIX). The interactions between implied volatility of different markets were captured using the multivariate-GARCH

framework and mean-reverting jump diffusion model.

Wagner and Szimayer (2004) investigated the transmission of shocks for the US and German implied volatility indices using mean reversion model that allows for the Poisson

jumps. Äjiö, (2007) present the stock market integration

by examining the implied volatility term structures

between the VDAX, VSMI and VSTOXX volatility

indices. The correlation structures indicated that they are

closely related to each other. In 2009, Badshah examined the dynamic implied volatility transmission across the VIs (VIX, VXN, VDAX and VSTOXX) using the Granger

Causality, generalized impulse response functions and the variance decomposition method.

2.3 Research Gap

The insight to the past literature lays the foundation for

present study. The India VIX being a newly developed

index in the Asian markets, not much attention is given to this index. Till now studies have focused on the implied

VI of the American and European countries. To the best of the knowledge no significant work is done to examine

the volatility spillovers and transmission effects between the implied volatility indices of Indian stock markets and international equity markets.

3. RESEARCH METHODOLOGY

3.1 Objectives of the Study

The objective of the study is to examine the implied

volatility spillover and transmission for the emerging (India) and the mature stock markets (US, France, Germany and Switzerland) as measured by their respective implied

volatility indices i.e. IVIX, VIX, VCAC, VDAX and VSMI. In the present study, the volatility spillovers and

transmission effects in the Indian markets are examined with respect to the US, France, Germany and Swiss markets.

The following hypotheses are formulated for the purpose of research:

Hypothesis I: Asymmetries exist in the volatility indices.

Hypothesis II: There are implied volatility and shock spillovers between Indian and the selected international markets volatility indices.

Hypothesis III: To account for the possibilities that volatilities and the correlation are dynamically changing over the time, for the Indian markets w.r.t. to international markets.

3.2 Model Specifications

3.2.1. Asymmetries in Volatility

The Engle and Ng (1993) sign and size bias test is applied

to assess the asymmetric response of the variance to the past information. This test is based on studying the error

terms generated from the standard GARCH (1,1) model:

where

(i)

(ii) where, is mean, y is return series at time t, is the squared conditional volatility at time t, and is the lagged and the square error terms of the mean equation,

which are normally distributed with zero mean. The α and β are the non-negative coefficients, with α+β < 1 condition. Then the Engle-Ng-test is applied on the error

terms is:

and TR2 (3) (iii)

Where, are the before mentioned error terms, are

the coefficients, and are the dummies

for the negative and positive error terms and is the

existence of sign bias, which signifies that the return

volatility is larger in the bearish phase as compared to

the bullish period. Whereas, significant

reveals the (negative) positive size bias which means that magnitude of shocks have differing impacts.

3.2.2. BEKK-GARCH Model

To investigate the volatility spillovers, the BEKK (Baba, Engle, Kraft and Kroner) representation of multivariate GARCH (p,q) proposed by Engle and Kroner (1995) is applied. The BEKK (1, 1) representation is of the

following form:

(iv) Where, is the k×k lower triangular matrix and

are the parameter matrices. The diagonal elements in matrices A and G measures the effect of the lagged volatility on its conditional volatility. The off-diagonal elements in matrices A(aij) and G(gij) capture the cross-market effects of shocks and volatility spillovers.

3.2.3. Dynamic Conditional Correlation Models

Bollerslev (1990) introduced a class of multivariate

GARCH model based on the assumption of constant conditional correlations (CCC). A generalization of CCC

model was proposed by Engle and Sheppard (2001); Engle

(2002) and Tse amd Tsui (2002) in which the conditional correlation matrix is time dependent. This model is known

as Dynamic conditional correlation (DCC).

The DCC model of Engle (2002) computes the

time-variant conditional correlation matrix can be expressed as:

(v)

(vi) Where, , is a k×k symmetric positive unconditional variance matrix, is k×k diagonal matrix with time-varying standard estimated by univariate GARCH model applied to individual time series and is the

standardized residuals defined as

and are the non-negative scalar

parameters satisfying the condition < 1. Whereas, Tse and Tsui (2002) proposed a slightly different formulation:

Table 1: Market Data

Volatility Index Name Underlying Stock index

Market Market Description

IVIX (Indian Volatility Index) S&P CNX

Nifty India Largest emerging market and among world largest stock exchange in terms of market capitalization based on 50 major

-stocks

CBOE Volatility Index, or VIX S&P 500 USA Largest US option exchange, first organized market to began trading in options

CAC 40 Volatility Index, or VCAC CAC 40 France (Paris) One of the main national indices of the pan-European stock

exchange group Euronext, index represents capitalization weighted measure of 40 most significant stock among top 100 active stocks.

VDAX-NEW Volatility Index DAX Germany

(Frankfurt)

30 major German companies trading on the Frankfurt Stock Exchange, main European continental market

VSMI Volatility Index SMI Switzerland Developed country market away from the hubs, the underly

-ing index comprises 50 largest and most liquid stocks in the

Swiss equity market.

(vii) Where, is the time-invariant positive definitive

parametric matrix with unit diagonal element and is k×k is sample correlation matrix of the past standardized residuals. The log-likelihood estimator can be written as:

(viii)

3.3 DATA

3.3.1 Data Collected

The daily closing values of implied VI running from 1 Nov, 2007 to 30 Oct, 2011 for the countries mentioned in

Table I is used for the purpose of research. The problem of non-synchronies in the daily data is mitigated by converting it into weekly data. The average of the daily data of each week is taken to synchronise the series of different countries. The data is extracted from the respective authentic websites of various market indices.

3.3.2 Properties of Data

The innovations (changes) in the weekly data of the volatility indices are calculated by:

(ix)

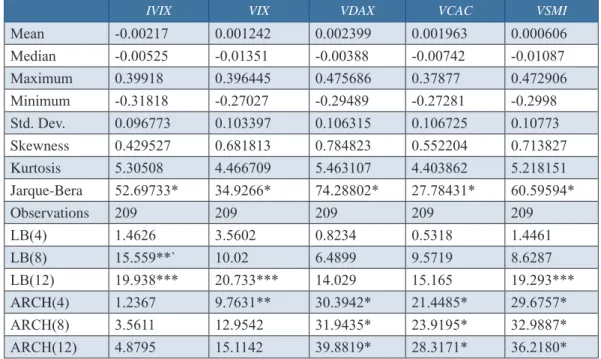

Descriptive Statistics: The descriptive statistics for the

changes in weekly univariate VI series are presented in the Table 2. The mean values for the changes in the VIs

are positive and small. All distributions are positively

skewed where the IVIX and VSMI have the lowest and highest values respectively and leptokurtic where VCAC and VDAX have the lowest and highest values. The results

of Jarque-Bera statistics indicates that the series are

non-normally distributed. The joint Ljung-Box Q-statistics with

different lags reveals weak evidence of autocorrelations

and heteroscedasitictiy for IVIX at 8 and 12 lags whereas for the VIX and VSMI is shown at 12 lag. The ARCH LM

test for the autocorrelations in the standardized residuals

reveals ARCH effects exist for VDAX, VCAC and VSMI at 1% significance level for different lags. There is weak evidence for the presence of ARCH-effects in the VIX

and no ARCH-effect or heteroscedasticities is determined

in the Indian VI, the latter finding of which is surprising.

Table 2: Descriptive Statistics of innovations in VI

IVIX VIX VDAX VCAC VSMI

Mean -0.00217 0.001242 0.002399 0.001963 0.000606 Median -0.00525 -0.01351 -0.00388 -0.00742 -0.01087 Maximum 0.39918 0.396445 0.475686 0.37877 0.472906 Minimum -0.31818 -0.27027 -0.29489 -0.27281 -0.2998 Std. Dev. 0.096773 0.103397 0.106315 0.106725 0.10773 Skewness 0.429527 0.681813 0.784823 0.552204 0.713827 Kurtosis 5.30508 4.466709 5.463107 4.403862 5.218151 Jarque-Bera 52.69733* 34.9266* 74.28802* 27.78431* 60.59594* Observations 209 209 209 209 209 LB(4) 1.4626 3.5602 0.8234 0.5318 1.4461 LB(8) 15.559**` 10.02 6.4899 9.5719 8.6287 LB(12) 19.938*** 20.733*** 14.029 15.165 19.293*** ARCH(4) 1.2367 9.7631** 30.3942* 21.4485* 29.6757* ARCH(8) 3.5611 12.9542 31.9435* 23.9195* 32.9887* ARCH(12) 4.8795 15.1142 39.8819* 28.3171* 36.2180*

Figure 1: Logarithms of Volatility Indices 2.6 2.8 3.0 3.2 3.4 3.6 3.8 4.0 4.2 4.4 2008 2009 2010 2011 LIVIX 2.4 2.8 3.2 3.6 4.0 4.4 2008 2009 2010 2011 LVIX 2.4 2.8 3.2 3.6 4.0 4.4 2008 2009 2010 2011 LVDAX 2.8 3.0 3.2 3.4 3.6 3.8 4.0 4.2 4.4 2008 2009 2010 2011 LVCAC 2.4 2.8 3.2 3.6 4.0 4.4 2008 2009 2010 2011 LVSMI Source: Authors

Figure 2: Graph showing Changes/Innovations in Volatility Indices -.4 -.3 -.2 -.1 .0 .1 .2 .3 .4 .5 2008 2009 2010 2011 IVIX -.3 -.2 -.1 .0 .1 .2 .3 .4 .5 2008 2009 2010 2011 VIX -.4 -.3 -.2 -.1 .0 .1 .2 .3 .4 .5 2008 2009 2010 2011 VDAX -.3 -.2 -.1 .0 .1 .2 .3 .4 2008 2009 2010 2011 VCAC -.4 -.3 -.2 -.1 .0 .1 .2 .3 .4 .5 2008 2009 2010 2011 VSMI Source: Authors

3.3.3 Unconditional Correlations

The unconditional correlations (Table 3) of the change in

VIs show that the American and European markets are

highly correlated whereas Indian markets have shown low level of correlation with the other four markets. The

main European markets i.e. German-French markets (0.895) and German- Swiss markets (0.926) are the most

correlated. The Indian market has shown least correlation

with the American market (0.408) and with European markets also the range of correlation is 0.421-0.488.

Table 3: Unconditional Correlations of change in Volatility Indices

IVIX VIX VDAX VCAC VSMI

IVIX 1 VIX 0.408* 1 VDAX 0.488* 0.845* 1 VCAC 0.421* 0.823* 0.895* 1 VSMI 0.479* 0.832* 0.926* 0.878* 1 Source: Authors

Note: *=1% level of significance

Thezse properties of volatility indices can be also seen

graphically. As the Figure 1 show that the overall counters

of the logarithms-level VIs are almost identical, showing

similar patterns during the bullish and bearish phase, as in the beginning and end of time series. The Figure 2 shows

the innovations/ changes in the VIs.

3.3.4 Unit Root Tests

The unit root tests are applied to examine the potential diversions of the time series data from the stability. The

standard Augmented Dickey-Fuller (ADF) (Dickey and Fuller, 1981) in addition with the Phillips-Perron (Phillips and Perron, 1988) and KPSS (Kwiatkowski et al., 1992) test are applied to change in implied volatility indices examine stationarity (unit root) of the data series. Table 4, represents the results of three unit root test. The results for

the ADF and PP-test denote that all first difference data series are stationary at 1% level of significance. Further, the KPSS test confirms that data series are stationary at first difference, as the null hypothesis for stationary series

is accepted for all data series.

3.3.5 Asymmetries in the data

The potential asymmetries in volatilities are detected

using Engle-Ng (1993) sign and size bias test (Table 5). There are existent traces of joint asymmetry in implied

Table 4: Unit root test statistics of changes in implied VIs

Test/ Series ADF PP KPSS

1 2 3 1 2 3 1 2 IVIX -7.750(5)* -7.721(5)* -7.767(5)* -13.365(2)* -13.332(2)* -13.392(2)* 0.033(1) 0.032(1) VIX -9.159(1)* -9.140(1)* -9.182(1)* -13.805(2)* -13.773(2)* -13.837(2)* 0.057(2) 0.057(2) VDAX -9.480(1)* -9.457(1)* -9.499(1)* -13.986(1)* -13.952(1)* -14.015(1)* 0.062(1) 0.062(1) VCAC -10.425(1)* -10.401(1)* -10.449(1)* -14.066(2)* -14.032(2)* -14.099(2)* 0.048(2) 0.048(2) VSMI -9.559(1)* -9.535(1)* -9.583(1)* -13.527(3)* -13.495(3)* -13.560(3)* 0.056(3) 0.051(4)

Asymptotic critical values

1% level -3.463 -4.004 -2.576 -3.462 -4.003 -2.576 0.739 0.216

5% level -2.876 -3.432 -1.942 -2.875 -3.432 -1.942 0.463 0.146

10% level -2.574 -3.140 -1.616 -2.574 -3.139 -1.616 0.347 0.119

Source: Authors

Note: ADF is the Augmented Dickey-Fuller, PP is the Phillips-Perron, and KPSS is Kwiatkowski, Phillips, Schmidt, and Shin test.

Model Specification: 1.Intercept, 2. Intercept+trend, 3.None. The Null hypothesis for ADF and PP test: H0 = Variable is

non-stationary and for KPSS: H0 = Variable is stationary.

*, ** and *** indicate the rejection of the null hypothesis at the 1%, 5% and 10% significance levels, respectively. The proper lag

order for ADF test is chosen by considering Akaike Information Criteria, representing in parenthesis.

For KPSS and PP tests, the bandwidth is chosen using Newey–West method and spectral estimation uses Bartlett kernel, representing in parenthesis.

volatility indices of the India (12.93, significant at 1% level), America (7.36, significant at 10% level) and French (7.87, significant at 5% level) volatility indices, therefore,

accepting the null Hypothesis I for these markets. The

coefficient of S-t-1 is significant for the American, German

and Swiss markets, implying that, negative magnitude effect exist in these markets. This means that past events is

of importance and confirmed by the preliminary findings of Carr and Wu (2006). The asymmetries in the volatilities

of implied volatility indices could be the consequence of the leverage effect of the underlying stock indices.

4. EMPIRICAL RESULTS AND ANALYSIS

4.1 Spillover Effect Analysis

Table 6 summarizes the estimation results of bivariate-BEKK GARCH for the Indian markets with American and European markets in a pair wise manner. The matrices A

and G reported in the equation (iv) are useful in examining the relationship in terms of volatility. The diagonal

elements of the matrices A and G capture the ARCH and GARCH (also termed volatility persistence) effects. In

the Table 6, out of 8 estimated diagonal parameters a11 and

a22 in the each pair, 7 are statistically significant at 1% and 5% level except of a22 in the IVIX/VIX group implying

the presence of strong ARCH effects in the stock markets of India, Switzerland, Germany and France. Whereas, the diagonal elements g11 is significant in 3 cases out

of 4 suggesting the presence of GARCH effects in the Indian markets when analyzed with American, Swiss and French markets. The other diagonal parameter g22 is statistically significant for the stock markets of Germany,

France and Switzerland, thus indicating that GARCH

(1,1) process is driving the conditional variances of the

three stock markets. This implies that the conditional variances of India, Germany, French and Switzerland in the implied volatility series are strongly affected by their

own past shocks and volatility effects. Thus, implied VI is

dependent on its own volatility in the past.

Table 5: Engle-Ng (1993) Sign and Size Bias test

Variable IVIX VIX VDAX VCAC VSMI

C 1.13* (0.34) 1.25* (0.31) 0.81* (-0.26) 1.27* (0.25) 0.80* (0.25) S-t-1 -0.49 (0.35) -0.25 (0.37) 0.41 (0.37) -0.59** (0.32) 0.41 (0.41) S-t-1 ut-1 0.07 (0.09) 0.38** (0.18) 0.48* (0.27) 0.03 (0.28) 0.49*** (0.29) S+t-1 ut-1 0.46 (0.33) 0.03 (0.30) 0.36 (0.28) 0.05 (0.21) 0.36 (0.27)

Joint - x2x2 12.93* 7.36*** 6.04 7.87** 5.98

Note: Standard errors are presented in the parentheses and the levels of significance with asterisks (* = 1%, ** = 5% and *** =

10%). Estimated method is OLS with Newey-West correction for heteroscedasticity and autocorrelation. The joint test follows chi-square distribution with critical values (***1% = 11.345, **5% = 7.815 and *10% = 6.251)

Table 6: Parameter estimates for the BEKK-GARCH (1,1) Model

IVIX/VIX IVIX/VSMI IVIX/VDAX IVIX/VCAC

c11 5.311* (5.950) 6.395* (6.433) 7.393* (10.250) 6.349* (7.017) c21 -2.546 (-1.072) -1.351 (-0.636) 0.112 (0.085) -1.373 (-1.165) c22 5.988* (2.578) 2.878 (0.824) 3.468* (2.975) 0.000 (0.000) a11 0.502* (5.733) 0.328** (2.045) 0.351** (2.119) 0.530* (4.183) a12 0.237** (2.552) -0.286** (-2.321) -0.129 (-0.985) -0.249*** (-1.914) a21 -0.143 (-1.109) 0.232* (3.005) 0.216* (2.618) 0.130** (2.105) a22 0.321 (1.513) 0.586* (6.471) 0.470* (7.037) 0.485* (5.571) g11 0.619* (2.618) 0.519** (2.266) 0.263 (1.009) 0.253** (2.068) g12 0.550* (1.976) 0.458*** (1.931) 0.197 (0.626) 0.741* (18.645) g21 0.208 (0.613) 0.118 (0.759) 0.236 (1.418) 0.365* (14.565) g22 0.025 (0.070) 0.517* (4.067) 0.742* (4.601) 0.342* (10.232) Log-Likelihood -1521.250 -1513.564 -1514.424 -1523.245

The off-diagonal elements of matrices A and G capture the cross-market effects such as shock and volatility

spillover among the five stock markets. Firstly, according to the statistics in the Table 6, evidence of bidirectional shock transmission exists in IVIX/VSMI and IVIX/ VCAC, as the pairs of off-diagonal parameters a12 and

a21 are statistically significant in these stock markets.

The two-way shock spillover is an indication of strong connection between the implied volatility indices of Indian-French markets and Indian-Swiss markets. The bidirectional cross-markets shock spillover indicates that shock related news in one stock exchange effects the volatility in the other stock market and vice-versa. There

are traces of unidirectional shock spillover from IVIX to VIX and VDAX to IVIX as their respective a12 and a21 are significant (their counterparts are insignificant) in BEKK-GARCH Model for IVIX/VIX and IVIX/VDAX.

Secondly, the evidence of bidirectional volatility linkages is found only between the Indian and French markets as their g coefficients are statistically significant at 1 level. These bidirectional volatility linkages imply that a strong connection between them, as the conditional variance of

one implied VI depends on the past volatility of the IV

index of other country. In the meanwhile, there exists

unidirectional volatility spillover from IVIX to VIX and IVIX to VSMI. Thus, the null hypothesis II that there exist

implied volatility and shock spillovers between the Indian and international markets are accepted, when the ARCH (a11, a12, a22, and a21) and GARCH (g11, g12, g21 and g22)

parameters are significant.

4.2 Dynamic Conditional Correlations

The dynamic conditional correlations (DCC) table 7 and figure 3 are moderate and stable. The mean DCC is smallest between the IVIX-VIX and largest between the IVIX-VDAX. The mean and median of the DCC are

coinciding for each group of countries and the standard

deviations is also small. The DCC for the Indian markets

versus global markets varies widely. The range between

different volatility indices are: IVIX-VIX (0.05-0.703), IVIX-VDAX (-0.01913 to 0.75), IVIX-VCAC (-0.063 to 0.752) and from IVIX-VSMI (-0.036 to .740). These

graphs show the possible existence of variations and structural breaks in the dynamic correlations. Thus, the null hypothesis III is accepted, the dynamic correlations

between India and global markets are significantly

changing over the time period, and exhibit high and low level of correlations at different time periods in the various markets.

The time-varying correlations during the period of study

are positive for majority of the time, thus, indicating that

Indian markets move in tandem with the American and

the European markets. Further, most of the correlations

have the tendency to fall more, than to grow, in the face of sub-prime crisis, which started with the American

risk-based mortgage crisis in 2007. The European sovereign debt crisis in the start of 2010 and recent downgrade in the credit rating of US economy are the major events

which affected the market’s volatility across the world. Thus, a high level of conditional correlations (ranging

between 0.70-0.75 in the period post 2010) for the implied

volatility indices of Indian markets versus the American, German, French and Swiss market is observed.

Table 7: Descriptive Statistics of the Dynamic Conditional Correlations

CORRELATIONS

IVIX-VIX IVIX-VDAX IVIX-VCAC IVIX-VSMI

Mean 0.384 0.458 0.404 0.450 Median 0.391 0.462 0.407 0.478 Maximum 0.703 0.750 0.752 0.740 Minimum 0.051 -0.019 -0.063 -0.036 Std. Dev. 0.131 0.154 0.167 0.162 Skewness -0.095 -0.690 -0.354 -0.744 Kurtosis 2.865 3.588 2.927 3.326 Jarque-Bera 0.469 19.587 4.402 20.204 Probability 0.791 0.000 0.111 0.000 Observations 209 209 209 209

5. FINDINGS, CONCLUSIONS AND POLICY

IMPLICATIONS

The study investigated the nature of financial integration

among the emerging (Indian) and mature economies (America, Germany, France and Swiss markets) in using the implied volatility indices. The results describe the wider international systematic behaviour of the underlying

Asian-Pacific and Western stock markets. The results obtained from the bivariate BEKK-GARCH model are

surprising as volatility spillovers are outwards from the emerging to developed markets. But in the real world, the

mature markets are the dominant players and the financial

events happening in these markets affects the developing

Figure 3: Dynamic Conditional Correlations for the Implied Volatility Indices .0 .1 .2 .3 .4 .5 .6 .7 .8 2008 2009 2010 2011

Correlation of IVIX with VIX

-.1 .0 .1 .2 .3 .4 .5 .6 .7 .8 2008 2009 2010 2011

Correlation of IVIX with VDAX

-.1 .0 .1 .2 .3 .4 .5 .6 .7 .8 2008 2009 2010 2011

Correlation of IVIX with VCAC

-.1 .0 .1 .2 .3 .4 .5 .6 .7 .8 2008 2009 2010 2011

Correlation of IVIX with VSMI

complex phenomenon is observed as a consequence of

increased level of financial globalization.

The results of DCC-model shows that there is moderate

level of correlation in the volatility indices of the international markets with Indian markets and carry a

unified message of uncertainty in respective markets in

the long run. These results also imply that theoretically

there is possibility that of yielding diversification benefits

in short-run by making investment in the volatility indices of Indian stock markets in combination with westerns markets.

In the light of the above findings, in short-run VIs of

respective countries can be used for the international

portfolio diversification, for cash protection and hedging through local market index would bring greatest efficiency.

The fast changes in the volatility indices with respect to

the underlying indices provide an efficient picture of the

information dissemination in the markets. These facts

support important properties of VI being used as a market

indicator and market timing tool. Finally, the information transmission and spillovers are running unidirectional from Indian markets to US markets and German markets to Indian markets and bidirectional between the Indian and French markets.

5.1. Policy Implications and Future Research

The results of the present study can be used by the portfolio managers and market participant for yielding

the diversification benefits in short-run including implied

volatility indices as an asset in portfolio. The investors could also hedge their portfolios against volatility with an

This also indicates that same methodology can be applied to the volatility indices of the other countries

in the Asian and Western world, Euro currency areas

in order to compare their results with this one. It would be interesting to conduct similar study on the volatility derivative products. Finally, it would be worth studying the impact of the leverage effect in the underlying index

on the volatilities of the VI.

References

Aboura, S. (2003). International Transmission of Volatility: A Study on the Volatility Indexes VX1, VDAX and VIX. Working Paper: ESSEC Business School. Ahoniemi, K. (2008). Modelling and Forecasting the VIX

Index. Retrieved 25 August, 2010 from http://ssrn.

com/sol3/papers.cfm?abstract_id=1033812

Äjiö, J. (2007). Implied Volatility Term Structure Linkages between VDAX, VSMI and VSTOXX Volatility Indices. Global Finance Journal, 18, pp. 290-302. Badshah, I. U. (2010). Asymmetric Return-Volatility

Relation, Volatility Transmission and Implied Volatility Indices. Working Paper New Zealand:

Auckland University of Technology.

Blair, B., Poon, S. H. & Taylor, S. (2001). Forecasting S&P 100 Volatility: The Incremental Information Content of Implied Volatilities and High Frequency Index Returns. Journal of Econometrics, 105, pp. 5-27.

Bollerslev, T. (1990). Modeling the Coherence in Short-Run Nominal Exchange Rates: A Multivariate Generalized ARCH Model. Review of Economics and Statistics, 72, pp. 498-505.

Brenner, M. & Galai, D. (1993). Hedging Volatility in Foreign Currencies. The Journal of Derivatives, 1, pp. 53-59.

Carr, P. & Wu, L. (2006). A Tale of Two Indices. Journal of Derivatives, 13, pp. 13-29.

Christenssen, B. & Prabbala, N. (1998). The Relation between Implied and Realized Volatility. Journal of Financial Economics, 50, pp. 125-150.

Cohen, G. & Qadan, M. (2010). Is Gold Still a Shelter to Fear? American Journal of Social and Management Sciences, 1, pp. 39-43.

D.Börse. (2005). Guide to The Volatility Indices of Deutche Börse, Version 2.0.

Degiannakis, S. A. (2008). Forecasting VIX. Journal of Money, Investment and Banking, 4, pp. 5-19.

Dickey, D. A. & Fuller, W. A. (1981). Likelihood Ratio

Statistics for Autoregressive Time Series with A Unit

Root. Econometrica, 49, pp. 1057-72.

Engle, R. F. (2002). Dynamic Conditional Correlation: A Simple Class of Multivariate Generalized

Autoregressive Conditional Heteroskedasticity

Models. Journal of Business and Economic Statistics, 20, pp. 339-350.

Engle, R. F. & Kroner, K. F. (1995). Multivariate Simultaneous Generalized ARCH. Economic Theory, 11, pp. 122-150.

Engle, R. F. & Ng, V. K. (1993). Measuring and Testing the Impact of News on Volatility. Journal of Finance, 48, pp. 1749-1801.

Engle, R. F. & Sheppard, K. (2001). Theoretical and Empirical Properties of Dynamic Conditional Correlation Multivariate GARCH. NBER Working Paper Series, 8554.

Fernandes, M., Medeiros, M. C. & Scharth, M. (2007). Modelling and Predicting the CBOE Market Volatility Index. Retrieved 25 August, 2011 from http://www.econ.puc-rio.br/PDF/td548.pdf

Fleming, J., Ostdiek, B. & Whaley, R. E. (1995). Predicting Stock Market Volatility: A New Measure. Journal of Futures Markets, 15, pp. 265-302.

Fleming, J., Ostdiek, B. & Whaley, R. (1995). Predicting Stock Market Volatility: A New Measure. Journal of Futures Markets, 15, pp. 265-302.

Galai, D. (1979). A Proposal for Indexes for Traded Call Options. Journal of Finance, 34, pp. 1157-72. Gastineau, G. (1977). An Index of Listed Option Premiums.

Financial Analyst’s Journal, 33, pp. 70-75.

Gazda, V. & Výrost, T. (2003). Application Of GARCH Models In Forecasting The Volatility of The Slovak Share Index (Sax). BIATEC, pp. 11, 17-20.

Giot, P. (2005). Relationships between Implied Volatility

Indices and Stock Index Returns. Journal of Portfolio

Management, 31, pp. 92-100.

Gonz´alez, M. T. & Novales, A. (2009). Are Volatility Indices in International Stock Markets Forward Looking? RACSAM Rev. R. Acad. Cien. Serie A. Mat. (Applied Mathematics), pp. 103, pp. 339-352. Hamao, Y., Masulis, R. & Ng, V. (1990). Correlation in

Price Changes and Volatility across International Stock Markets. Review of Financial Studies, 3, pp. 281-307.

Koutmos, G. (1996). Modeling the Dynamic Interdependence of Major European Stock Markets.

Journal of Business Finance and Accounting, 23, pp. 975-988.

Kwiatkowski, D., Phillips, P. C. B., Schmidt, P. & Shin, Y. (1992). Testing the Null Hypothesis of Trend Stationarity. Journal of Econometrics, 54, pp. 159-178.

Maghrebi, N., Kim, M. S. & Nishina, K. (2007). The KOSPI200 Implied Volatility Index: Evidence of Regime Switches in Volatility Expectations. Asia-Pacific Journal of Financial Studies, 36, pp. 163-187.

Mayhew, S. (1995). Implied Volatility. Financial Analyst Journal, July-August, pp. 8-20.

Moraux, F., Navatte, P. & Villa, C. (1999). The Predictive Power of the French Market Volatility Index: A Multi Horzon Study. European Finance Review, 2, pp. 303-320.

Nikkinen, J. & Sahlström, P. (2004). International

Transmission of Uncertainty Implicit in Stock Index

Option Prices. Global Finance Journal, 15, pp. 1-15. Phillips, R. C. B. & Perron. (1988). Testing for a Unit

Root in Time Series Regression. Biometrika, 75, pp.

335-346.

Sarwar, G. (2010). The VIX Market Volatility Index and

U.S. Stock Index Returns. International Journal of

Business Research, 10, pp. 166-176.

SIX Swiss Exchange Ltd. (2010). Guide Governing Volatility Index VSMI®. .

Skiadopoulos, G. (2004). The Greek Implied Volatility

Index: Construction and Properties. Applied

Financial Economics, 14, pp. 187-1196.

Tse, Y. K. & Tsui, A. K. C. (2002). A Multivariate GARCH Model with Time-Varying Correlations. Journal of Business and Economic Statistics, 20, pp. 351-362. Wagner, N. & Szimayer, A. (2004). Local and Spillover

Shocks in Implied Market Volatility: Evidence for

the U.S. and Germany. Research in International

Business and Finance, 18, pp. 237-251.

Whaley, R. E. (1993). Derivatives on Market Volatility: Hedging Tools Long Overdue. Journal of Derivatives, 1, pp. 71-84.

Whaley, R. E. (2000). The Investor Fear Gauge. Journal