Leverage, Debt Maturity and Corporate Performance: Evidence from Chinese Listed Companies

Full text

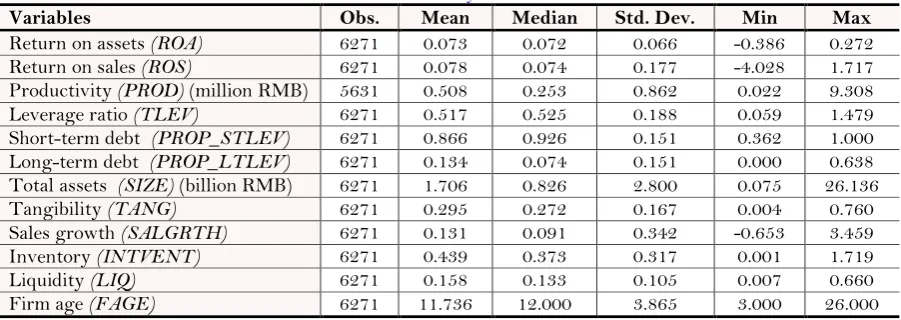

Figure

Related documents

Module 1 Concepts of Information and Communication Technology (ICT) requires the candidate to understand the main concepts of ICT at a general level, and to know about

There is evidence to support a positive association between auditor-provided tax services and audit quality (Kinney et al ., 2004; Robinson, 2008), although no association with

Thus, our results reveal the following tendencies: On the one hand, a penetration pricing strategy is always necessary if a software vendor wants to enter a market with an

Unlike many existing session based meth- ods, our PCC employs matrix factorisation, a completely separate traditional RS to model the user’s general preference, rather than using

More specifically, we use a 3-step analysis where we employ (i) SURADF panel integration analysis, which seems to be the first empirical application in the context of

technology product design past papers a level everyday practical electronics may 2009 basic electronics for engineers and scientists simple projects related to electronics

The problem of protein superfamily classification can be mapped as a pattern classification problem. The long strings of amino acid sequence represent a pattern from which many

As the basic compositions of life, proteins play a central role in most cellular functions such as gene regulation, metabolism and cell proliferation. In order to interpret the