Mutual Fund Performance and Expense Ratios

A study of U.S. domestic diversified equity mutual funds

Master Thesis

Tilburg School of Economics and Management Department of Finance

Student name: Aitenov Sanzhar ANR number: 622862

Date: 23 August 2013

Supervisor name: Dr.J.C. Rodriguez Chairperson name: Prof. M. van Bremen

2

Acknowledgments

The author wishes to thank several people. First, I would like to thank my friend and fellow student Stergios Axiotis for his invaluable help, guidance and patience that he showed helping throughout this one of the most academically challenging works I have ever done. Without the unconditional support, both financially and emotionally, of my family it would have been impossible to study at this university. Furthermore, I would like to express my gratitude to my supervisor professor Juan Carlos Rodriguez for his assistance and allowing me to present this edition for my thesis. I would also like to thank my friends who made this year unforgettable in many different ways, without their encouragement and support it would have been much tougher to pass this entire program.

3

Contents

1 .Introduction ... 4

2. Hypothesis Development ... 7

2.1 Mutual fund fee structure ... 7

2.2 Literature Review ... 8

3. Data ... 13

3.1 Sample Description ... 13

3.2 Cleaning Procedures ... 13

4. Empirical Methodology and Results ... 16

4.1 Mutual Fund Performance Estimation ... 18

4.2 The Relation between Fees and Performance ... 22

4.3 Determinants of Expense Ratio ... 25

5. Conclusion ... 30

References ... 32

4

Abstract

This thesis examines the relationship between different characteristics of funds and the expense ratios they charge. Expense ratio is an annual charge by a mutual fund which is used to pay for investment advisory services, distribution and marketing, and other operational expenses. I find that size, age, performance and having a front-end load have a negative impact on the expense ratio, whereas turnover, volatility of the returns, being a non-surviving fund increases the expense ratio. In addition to this, I also investigate the performance of U.S.-domiciled diversified equity mutual funds. I demonstrate that, on average, mutual funds underperform compared to a market.

Keywords: Mutual Fund; Expense Ratio; Performance

1 .Introduction

Investment companies, most noticeably in the last decades, started to play an important role in the development of world financial markets and economies of many countries. By offering low cost exposure to equity markets, professionally managed and picked diversified portfolios, mutual funds evolved as leading investment vehicles for a vast amount of households and individuals. The United States having world’s most developed capital market and largest stock market plays a leading role in the innovation and development of financial products and instruments. Laderman and Smith (1993) report that there was a tremendous increase in assets under US mutual funds management from less than $50 billion in 1977 to $1.6 trillion in 1993. However, more recent data reveals even more astonishing information. Out of the $26.8 trillion in mutual fund assets worldwide, the U.S. mutual fund market with $13 trillion in assets under management at year-end 2012 remained the largest in the world, accounting for 49 percent.1 Moreover, it is not only the fact of the growth of assets under management but also the constituents of such an immense increase. According to Kennickell et al. (2000), the proportion of US families possessing any type of mutual fund, except for money market funds or funds owned through different kinds of managed accounts, grew by 4.2 percentage points to 16.5 percent from 1995 to 1998. In its latest version of a yearly handbook Investment Company

5

Institute (the national association of US investment companies) reports that there were 53.8 million households, or 44.4 percent of all U.S. households that owned mutual funds in 2012 (ICI 2013). If we think of it in individual terms, this makes 92.4 million people or almost 1/3 of the population of the U.S. Considering how many people’s personal wealth can be affected by the decisions taken by mutual fund managers, the issue of mutual fund performance and the fees charged by them would be an interesting topic to a research on.

Mutual fund is an investment company that pools money of individual investors and invests this money in stocks, bonds and other securities in an attempt to generate capital gains to their clients. Investments are done in accordance with the fund’s investment objective stated in its prospectus. By buying mutual funds investors obtain cost-effective way to invest their money across numerous asset classes. Otherwise, by buying individual stocks and other type of securities individuals forego the opportunity to diversify their portfolio holdings, unless they buy large enough amount of assets to diversify away non-systematic risk. However, even in this case individuals will have to devote vast amount of time monitoring those stocks. This is of course not to mention enormous costs associated with the purchase and sale of these assets. Thus by buying a mutual fund an individual achieves a portfolio diversification at a substantially lower cost that he would pay himself since the economies of scales lowers the transaction costs for institutional investors. Another apparent benefit of mutual fund is professional management since portfolio managers are professionals and can use sophisticated trading strategies otherwise not available to normal people.

There has been much academic literature written on different aspects of mutual funds and their performance. Early studies, such as the ones made by Sharpe (1966) and Jensen (1968) found that mutual funds, on average, net of expenses are not able to produce positive risk-adjusted returns, thereby refuting the notion that fund managers can produce positive abnormal returns. On the contrary, Grinblatt and Titman (1992) found that there are not only fund managers who outperform the market, but there is also performance persistence. In addition to this, Goetzmann and Ibbotson (1994) concluded in their study that future performance can be inferred from the past returns, that is past “winners” and “losers” are likely to repeat their performance. Most of the studies on mutual funds have been dedicated to the ability of mutual funds to beat the

6

market consistently, ability of fund managers to time the market and pick winning stocks. However, not so much attention has been drawn to the topic of the fees these funds charge their clients. Carhart (1997) in his work argues that mutual fund expenses can be used forecast performance. Moreover, the relation between the performance and expenses is negative, that is mutual funds with high expenses perform worse than low expense funds. These findings are in contrast to Ippolito (1989) who finds that mutual funds with higher expenses earn adequate return to offset the expenses.

Taking these conflicting opinions into consideration, I investigate whether mutual funds can outperform the market and if yes what kind of funds are able to do so. Following, the body of articles studying the performance of mutual funds, I conduct the analysis using 3 different estimation methods: Capital Asset Pricing Model (CAPM), Fama-French (1993) three-factor model and Carhart’s (1997) four-factor model. I find that, on average, domestic diversified equity mutual funds underperform to carefully assigned benchmark. However, at the risk of giving away a punch line early, I will tell you that open-end mutual funds performed differently depending on the investment objective.

Secondly, I try to test if fees charged by mutual funds make difference in determination of returns generated. As it was mentioned earlier, the main function of mutual funds is professional management of the wealth they have been granted. Assuming that mutual funds charge their fees based on their ability to produce positive returns, I conjecture that a relationship between before-fee risk-adjusted return and before-fees charged is positive and the slope coefficient is equal to one. As I show later, this relationship is positive, statistically significant but less than one which means that after-fee returns are lower than that produced by market.

To check the validity of the negative relation between risk-adjusted return and expense ratio, I try to identify the effect of performance and various fund features on determination of the expense ratio. I find that funds with better performance, larger size and longer history of existence charge lower fees, whereas funds with higher turnover, bigger standard deviation have higher expense ratios.

7

This thesis is organized as follows. In Section 2, I first describe the structure of mutual fund expenses and then give information on the prior researches done on related topic. In Section 3, I describe the data set I use in my analysis and the detailed procedures I used to obtain my final sample. In Section 4, I discuss and test empirically the hypotheses developed. Section 5 concludes.

2. Hypothesis Development

Equity mutual funds have undergone dramatic changes with respect to the types of fees they charge investors (Dellva and Ollson, 1998). Mutual funds vary not only in their investment objectives but also in the fees they have. In this section I will elaborate on the different components of fees and their effects on performance and expense ratio.

2.1 Mutual fund fee structure

Investors willing to invest in mutual funds, as in any other transaction, must pay fees and incur cost associated with buying and selling, managing the accounts and just simply gathering the information. Depending on their preferences investors can choose the fee structure that they find more suitable for them.

The cost that an investor incurs is either an expense ratio calculated on the regular yearly basis, or a load fee which is levied only once. There are two major types of loads: front-end load and back-end load. Front-end load is a type of a load which is paid directly at the time of a purchase of unit of a fund and a back-end load is a load paid at the time of either redemption or sale of this unit. Whereas, expense ratio is calculated and deducted as a fixed percentage of fund’s average total net assets, and is paid indirectly. In spite of the fact that there are many funds offering various fee plans, it is also not a rare case that funds simultaneously have both types of these expenses. Mutual funds’ annual expense ratio consists of management fee, distribution (or 12b-1) fee and other administrative expenses. Let me first discuss them one by one.

Since one of the functions is professional management of an investment portfolio, the first and the major expense is a management fee paid to a fund’s management company for advisory

8

services. This fee is used to pay for the expenses associated with managing a portfolio, hiring a fund manager, compensating him/her for the research and analysis performed.

Introduced in 1980 as solution to a redemption problem in the late 1970s the 12b-1 fee allows mutual funds to charge distribution expenses against the assets of the fund. Mutual funds are using this 12b-1 fee to pay for marketing and selling fund shares, such as compensating brokers and others who sell fund shares, and paying for advertising, the printing and mailing of prospectuses to new investors, and the printing and mailing of sales literature2. Even though the Securities and Exchange Commission (SEC) does not impose any specific limit on the 12b-1 fees that funds can pay, according to the Financial Industry Regulatory Authority (FINRA) the size of the 12b-1 fee used to pay for marketing and distribution expenses cannot exceed 0.75 percent of a fund’s average total net assets. Proponents of the 12b-1 fee argued that introducing this plan would result in the increased fund size and thereby would induce funds to lower their expense ratios. However, the opponents of the fee claimed that funds which do not charge any loads would de facto become load-charging fees since the purpose of it to the large extent is the same. Studies by Ferris and Chance (1987) and McLeod and Malhotra (1994) conclude that 12b-1 plans raise expense ratios and are a deadweight cost to investors.

The rest of the expenses not included in the management fees and 12b-1 fees are operating and shareholder servicing costs. These costs include legal, accounting, custodial and other administrative expenses associated with running the fund.

Front-end-load and back-end-load fees are used to pay for brokerage services if a fund is sold indirectly. Dellva and Olson (1998) in their work document that there are only a few funds with this kind of fees which can justify them.

2.2 Literature Review

In spite of the already existent large number of papers on mutual funds, in the last several decades the topic of mutual funds has received a substantial amount of attention in the academic sphere. Researches are still reaching contradictory results concerning out/underperformance of funds and their characteristics which can have an impact on their results.

2 Information from the Securities and Exchange Commission website, available at

9

One of the first attempts to find the patterns in the mutual fund returns and predict them was made by famous Nobel Prize winner William Sharpe. In his work Sharpe (1966) examined the returns of 34 open-end mutual funds generated over the ten year horizon, from 1954 to 1963. Studying the ex-post returns he states that return differences are either due to the differences in objectives, resulting in different return variation, or due to the inability of some managers to select “good” securities. He concludes that cross-sectional differences in returns between the funds are to be explained by the variations in their investment styles and objectives. Thus, funds taking more risk, on average, produce higher returns than those taking less risk. However, Sharpe (1966) also notes that a part of return differential among the funds can explained by the expense ratios they charge. Particularly, he argues that an average mutual fund manager earns comparable with a benchmark pre-cost return, and the reason some mutual fund manager cannot beat the market is a high expense ratio. All other things being equal, the funds that have lower expense ratios are able to deliver positive risk adjusted returns to their shareholders whereas size does not have any explanatory power. Sharpe (1966) justifies the viewpoint of the efficient market hypothesis that no underpricing or overpricing is possible, consequently funds contributing large part of their resources to finding mispriced assets are just exhibiting futile efforts.

Grinblatt and Titman (1992) in their 10 year study of 279 mutual funds’ risk-adjusted returns argue that there are fund managers who are able to earn positive returns; moreover there is also outperformance persistence. One of the main conclusions they reached to is that there are persistent differences in the fees and transaction costs mutual funds have and thus these differences contribute to one of the groups of funds being “winners” and other “losers”. Even though Grinblatt and Titman (1992) admit that these are not all the factors that make some funds perform better and other worse, still there can be some information extracted from a history of returns.

Wermers (2000) in his study of the U.S. diversified equity mutual funds covered the period from 1975 to 1994. He concluded that mutual funds hold stock portfolios that outperformed their benchmarks by 130 basis points or 1.3 percent a year. However, their net return underperforms, and the difference between their net and raw returns is 230 basis points a year. Out of this difference 160 basis points or 1.6 percent is attributable to the expense ratio and

10

transaction costs and the remainder, 70 basis points, is due to the lower average return of nonstock holdings. Thus, there is an evidence of stock-picking ability of portfolio managers, but is not enough to cover their expenses. Additionally, Wermers (2000) reported that mutual funds with higher turnover outperform low turnover funds; however this also leads to a higher expense ratio and results in a larger underperformance compared to the benchmark.

Large part of the literature published on the mutual funds (including ones reported here) focused on the identification of the fund managers who are able to produce superior performance. Given the discrepant results produced in the works studying different time periods, it proved to be a challenging task to come with a proper model to assess mutual funds’ performance. Therefore, one of the purposes of my thesis is to assess the efficiency of mutual funds. I hypothesize that, on average, U.S.-domiciled diversified equity mutual funds underperform compared to a market.

In his renowned paper, Carhart (1997) using a sample of diversified equity mutual funds for the period of 1962 to 1993, documented a strong underperformance persistence in worst-return mutual funds. Thus, he provides evidence that there is no support for the theory which assumed the existence of skilled and informed mutual fund managers. Moreover, he concludes that the expenses that funds incur managing portfolio can explain this persistence and thereby can be used as a reliable predictor in mutual funds returns. Importantly, he also found that the investment costs of expense ratios, transaction costs and load fees have direct and significantly negative impact on returns funds generate. To be more specific, one of the main conclusions we can draw from his study is that, on average, most of the fund underperform by the size of their expense ratios. That is the negative relation between performance and expense ratios is nearly one-to-one.

On the contrary, Ippolito (1989) in his study of 143 mutual funds existent from 1965-1984 found that these funds on a risk-adjusted basis managed to outperform the market. His results are consistent with efficient market hypothesis with presence of costly information, where mutual funds earn sufficiently enough risk-adjusted returns to offset the costs incurred for gathering and implementing the strategies they follow. In addition to this, Ippolito (1989) found no evidence of

11

any correlation between turnover and inferior performance, so turnover played no role in determination of the return earned.

A research conducted by Gil-Bazo and Ruiz-Verdu (2009) supports the view that performance and expenses are negatively correlated. The main purpose of their work was to define the relation between prices and performance in mutual fund industry. Gil-Bazo and Ruiz-Verdu (2009) based their study on the US open-end mutual funds investing only in domestic equities with a dataset from 1961 to 2005. They hypothesized that since the main function of mutual funds is professional management of the portfolios, the fees should be positively related with fund’s before-fee risk adjusted returns. Surprisingly, the conclusion that they got to, did not seem to prove this notion – funds with worse before-fee performance charge higher fees. In an attempt to provide an explanation to this puzzling phenomenon, they first came up with a number of hypotheses that could shed light on what determines the fees they observe. Their interpretation of this phenomenon is that poorly performing funds when faced with less performance-sensitive investors charge higher marketing fees, which are part of the expense ratio reported, thereby increasing overall fund inflows.

In an efficient mutual fund market, expense ratios should be positively correlated with the performance. That is, in a perfect market condition funds should earn back their expense and have a risk-adjusted performance equal to zero. Otherwise, as Berk and Green (2004) state there would be excess demand for best-performing funds and excess supply for worst-performing funds. Based on these assumptions I hypothesize that the slope coefficient of the relation between before-fee risk-adjusted return and expense ratio should be equal to one.

Some of the studies that attempted to find the determinants of expense ratios are of a particular interest for my work. One of those is the study by Ferris and Chance (1987) which specifically tried to define the impact of 12b-1 expense on the expense ratio, since it was not so long ago after the introduction of this fee. Their claim particularly based on the point that 12b-1 plan is only a sales incentive and thus should have no impact on the management and returns of the funds. This is the reason they assumed if 12b-1 increases the overall expense ratio it is an extra cost for the shareholders of the funds which decreases the investment benefits. Wermers (2000) also proposes that age, size, objective and the fact if the fund is a load-fund or not can be

12

additional components of the expense ratio. In fact, he concluded that size had a negative and significant coefficient, suggesting the presence of economies of scale. Age variable had a significant coefficient in one period but loses it in the second, thus he could not make a univocal conclusion. Sign of the objective variable suggested significant cross-sectional differences in the expense ratios charged by the funds following investment strategies. Load variable was negative and significant, meaning that funds that charge loads, on average, have lower expenses. The variable of interest, 12b-1 fee, had a positive and significant coefficient, which means it contributed to the increase in the expense but did not result in an improved performance. Thereby, Ferris and Chance concluded that 12b-1 plan is a deadweight cost to the investors.

McLeod and Malhotra (1994) support the notion that 12b-1 plan is deadweight cost. Their sample consists of 929 mutual funds from 1988 to 1999 and use size, age, dummies for funds having income and growth objectives, dummy for a fund imposing loads and the 12b-1 fee itself. Their findings are consistent with those of Ferris and Chance (1987), due to the economies of scale larger funds had lower expense ratio. However, dummies for load, income and growth were found to be insignificant and did not carry any explanatory power. 12b-1 fee funds had higher expense ratio than those who did not.

In their later study Malhotra and McLeod (1997) re-examined the effect of 12b-1 plan and studied cross-sectional differences in the expenses across mutual fund industry. One distinguishing feature of this research compared to the one mentioned earlier is that this time they studied both equity and bond mutual funds. In addition to that, there were new variables of interest introduced: beta, yield and fund complex size. Turnover and 12b-1 fee were found to be positively and statistically significantly correlated with the expense ratio, whereas size, age, no-load status and fund complex size were associated with lower expense ratio.

Given the limited number of the literature on the determinant of expense ratio, I intend to identify what can be driving the change in expense ratios. This has a direct impact on the performance and on the wealth of the investor, since it is them whose money is being managed. Therefore, employing the findings of the previous researches I hypothesize that turnover and 12b-1 plan are associated with the higher expense ratio, whereas age, size of the fund have negative. In my analysis I also introduce two separate variables for front-end load and back-end load funds.

13

I expect funds with front-end loads to have lower average expense ratio, since they already charged distribution fee and they should have no 12b-1 plan at all. Funds with back-end load should have higher expense ratio, because the load is intended to keep investors and prevent revenue loss from preliminary redemptions.

3. Data

3.1 Sample Description

I obtain my equity mutual fund data, including performance information and fund characteristics from the Center for Research in Security Prices (CRSP) Survivor-Bias Free U.S. Mutual Fund Database provides monthly information on equity funds’ returns, total net assets, turnovers, expenses and objectives for the period from January 1999 to January 2013. The initial sample consists of all open-end mutual funds that existed in the 1999 to 2013 period. Since my study is restricted to the analysis of diversified U.S. equity mutual fund, I follow Gil-Bazo and Ruiz-Verdu (2009) procedure to “clean” my data and exclude fund which I cannot characterize as diversified domestic equity mutual funds.

3.2 Cleaning Procedures

First, I start with very broad categories. To have the dataset of mutual funds which are open to individual investors and are not imposed in any way, like being part of a retirement plan program, I exclude a fund if it was an institutional fund, had an indicator that it is not open to investors, for example such as the ones restricted to the employees of a particular company or only to one particular religious group. The funds which cannot be classified as retail funds are also excluded from the sample, even though they are open to investors, they have implicit restrictions, like high initial investment requirement which makes it available only to high net worth individuals. Another important criterion that should have been met is whether a fund is variable-annuity fund. The peculiarity of this kind of funds is that they are offered by insurance companies and through retirement accounts. That is why if a fund was a part of a variable-annuity program, it was also excluded from the analysis. To guarantee that my sample includes only

14

actively-managed funds and to avoid making erroneous conclusions due to the structural differences between passively-managed funds and the rest of my dataset, I exclude index funds and ETFs.

Second, I remove all funds which I cannot classify as domestic diversified equity funds. Thus, I exclude money market, bond and income, hybrid funds (balanced and asset-allocation funds), and all specialty mutual funds, such as those focusing only on one sector or industry (for example utilities, medicine, industrials, etc).

My next step was to exclude non-traditional mutual funds, since this can result in spurious conclusions. While still being subject to a tighter regulation and offering higher liquidity, this kind of funds are trying to replicate hedge fund strategies by employing leverage, futures contracts, options and swaps to achieve a desired objective. Thus, I exclude inverse, market-neutral and leveraged mutual funds. Inverse mutual funds are the funds that are trying to achieve an opposite performance to that of the benchmark they are following. That is they are trying to have a “short” position on the market by using different derivative instruments such as swaps and futures. Market-neutral funds are trying to minimize their exposure to a market to the minimum amount possible, that is, to have a market “beta” of 0, which should enable them to earn consistent returns regardless of the market. Leveraged funds are the funds which are usually trying to earn a multiple of the daily index returns. They do this by taking “long” position which is two, three, two-and-a-half time bigger than the market itself. I do this procedure by finding the funds which contain one of the following strings: “1.5x”, “2x”, “2.5”, “Neutral”, “Short”, “-1.5x”, “-2x”, “-2.5x”. The same procedure is applied to absolute return and arbitrage funds. Absolute return funds are the funds that are just trying to produce positive returns and do not compare them to any benchmark, this is also a hedge fund-like strategy. I also exclude the funds which have “Arbitrage”, “Event”, “Merger” words in their names, after looking into their prospectuses I found out that these funds are mainly following event-driven strategies, for example mergers and acquisition arbitrage where they are trying to benefit from the possible synergy.

Moreover, the funds or share class whose name contains the strings “Life Cycle” and “Target-Date” were also excluded from the analysis. An obvious reason for this is that these

15

funds have objectives that differ from the objectives of other funds in the sample. Target-date and life cycle funds are type of the funds that change their asset composition depending on the investment horizon of the client, with larger equity holdings in the beginning, but as the time passes the portfolio becomes more conservative with a larger proportion of fixed income securities, so they cannot be classified as a diversified equity fund.

Despite the detailed information on fund objectives and characteristics provided by CRSP database, there are still lots of inconsistencies and missing data. To obtain my final sample I still had to search for the funds manually to exclude the ones which do not fit my research purpose. For instance, in spite of the fact of already removing institutional funds before, I had also to utilize the technique mentioned earlier. The funds with strings “Institutional” or those which had class “Y” or class “I” shares had to be dropped manually. The same method was used for the funds investing in governmental securities and corporate bonds, thus names with “Municipal”, “Treasury”, “Yield”, “Bond” and “Government”. Strings as “Restricted”, “Retirement”, “class R” were also excluded from the sample.

Index funds had also been paid particular attention to. Even though, CRSP has a specific variable indicating if the fund is an index, the data is inconsistent throughout the whole sample. So, for example the same fund can have a sign indicating that it is an index fund for one year but for another year it can have no such sign. To be consistent in my judgment, I eliminate the funds with the strings “Index”, ”S&P”, “500”, “Nasdaq”, “NASDAQ” ,“Dow” in their names.

As the last step, I eliminate observations with missing data on expenses and monthly returns. Given the large size of the database, I winsorize my sample at the 99th percentile, to avoid the effect of extreme values on returns and expenses.

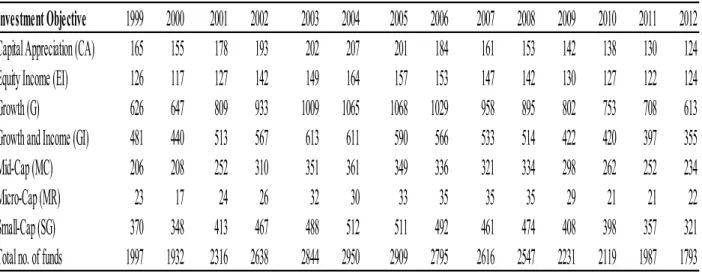

After all the procedures the dataset was still not uniform, to create a final sample I combined all the information on fund investment objectives provided by Lipper Investment Services and CRSP. The final sample consists of 3654 funds with 7 Lipper investment objectives presented: capital appreciation, equity income, growth, growth and income, mid-cap funds, micro-cap funds and small-cap funds. Table 1 provides information on these 7 investment objectives and states the number of funds in each category from 1999 to 2012. It can be seen that

16

the composition of the funds remained fairly unchanged over the whole sample period, with the growth category being the most popular and small-cap funds being least popular.

TABLE 1. Funds by investment objectives

This table provides information on the number of funds by investment objectives and the total number of funds according Lipper Investment Services for the sample period of 1999-2012.

Description of investment objectives: CA – funds that aim at maximum capital appreciation, frequently by means of

100% or more portfolio turnover, leveraging, purchasing unregistered securities, purchasing options, etc. EI - Funds that, by prospectus language and portfolio practice, seek relatively high current income and growth of income by investing primarily in dividend-paying equity securities. G - Funds that normally invest in companies with long-term earnings expected to grow significantly faster than the earnings of the stocks represented in the major unmanaged stock indices. GI - Funds that combine a growth-of-earnings orientation and an income requirement for level and/or rising dividends. MC - Funds that by prospectus or portfolio practice invest primarily in companies with market capitalizations less than $5 billion at the time of purchase. MR - Funds that by prospectus or portfolio practice invest primarily in companies with market capitalizations less than $300 million at the time of purchase. SG - Funds that by prospectus or portfolio practice invest primarily in companies with market capitalizations less than $1 billion at the time of purchase.

4. Empirical Methodology and Results

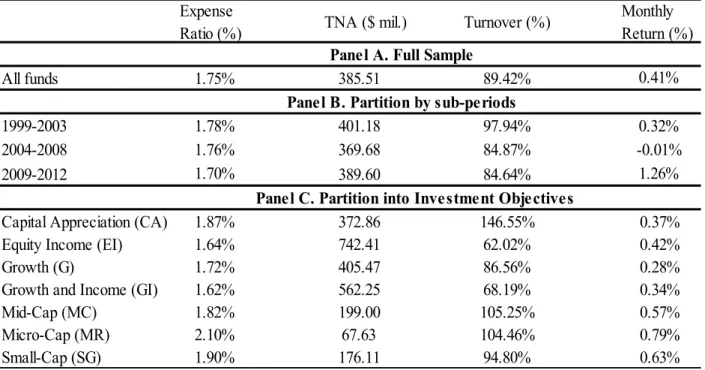

Before proceeding to the main part of this section let me first present some summary statistics of the variables that I find important and that will be used in the analysis. Table 2 provides means of expense ratios, total net assets, turnover ratios and monthly returns for the funds in the sample.

Investment Objective

1999 2000 2001 2002

2003 2004

2005 2006 2007 2008 2009 2010 2011 2012

Capital Appreciation (CA)

165 155

178 193

202 207

201 184

161 153 142 138 130 124

Equity Income (EI)

126 117

127 142

149 164

157 153

147 142 130 127 122 124

Growth (G)

626 647

809 933

1009 1065

1068 1029

958 895 802 753 708 613

Growth and Income (GI)

481 440

513 567

613 611

590 566

533 514 422 420 397 355

Mid-Cap (MC)

206 208

252 310

351 361

349 336

321 334 298 262 252 234

Micro-Cap (MR)

23

17

24

26

32

30

33

35

35

35

29

21

21

22

Small-Cap (SG)

370 348

413 467

488 512

511 492

461 474 408 398 357 321

17

In the panel A, I present the results for the overall sample, while panel B contrasts the results for 3 different periods: from 1999 to 2003, from 2004 to 2008 and from 2009 to 2012. We can see that there is a decreasing trend in the average expense ratio funds charge. While being above average from 1999 till 2008 the expense ratio for the last 4 years became 1.70% which is 0.05% lower than the overall average. It can also be noticed that there is no uniform trend in the average size of the, whereas there is an obvious decrease in the turnover ratio. It should also be mentioned that, on the basis of raw returns, in the last period mutual funds performed better than they did previously.

Panel C of Table 2 compares the mutual funds according to their investment objectives. Funds that specialize in investing in the funds with capitalization of less than 300 million dollars charge the highest expense ratio, 2.1% of the assets under management, however they also generate the highest return. The second largest expense ratio is that of the small capitalization funds, their expense is 1.9%, moreover they also produce the highest return after micro

TABLE 2. Summary Statistics, 1999-2012

The table presents the averages expense ratio, total net assets, turnover ratio and monthly retun. In panel A, full sample is presented. In panel B, data is divided and presented for 3 periods: 2 five year periods and 1 four year period. Panel C presents the data for different investment objective funds, based on Lipper Investment Services classification.

Expense

Ratio (%) TNA ($ mil.) Turnover (%)

Monthly Return (%) All funds 1.75% 385.51 89.42% 0.41% 1999-2003 1.78% 401.18 97.94% 0.32% 2004-2008 1.76% 369.68 84.87% -0.01% 2009-2012 1.70% 389.60 84.64% 1.26%

Panel C. Partition into Investment Objectives

Capital Appreciation (CA) 1.87% 372.86 146.55% 0.37%

Equity Income (EI) 1.64% 742.41 62.02% 0.42%

Growth (G) 1.72% 405.47 86.56% 0.28%

Growth and Income (GI) 1.62% 562.25 68.19% 0.34%

Mid-Cap (MC) 1.82% 199.00 105.25% 0.57%

Micro-Cap (MR) 2.10% 67.63 104.46% 0.79%

Small-Cap (SG) 1.90% 176.11 94.80% 0.63%

Panel B. Partition by sub-periods Panel A. Full Sample

18

capitalization funds. So, maybe there is, in fact, a positive relation between the funds’ expenses and returns as argued by Ippolito (1989) or maybe it is just a result of the scarcity of such small and micro capitalization firms and because of their relative illiquidity investors should pay premium to purchase them. Two smallest sizes also belong to these investment objective funds, indirectly supporting my theory of the scarce number of the companies which meet the criteria of small/micro-cap oriented funds. The largest size of the equity income funds can be explained by the desire of individual investors to have steady income which is provided by the dividend-paying firms. We can also see that the funds that concentrate on the value creation by the means of investing in small companies or in any other risky investment options turn over their holdings more than 100%. This can be justified by their desire to find undervalued securities and reap a premium. From the last column we can conclude that depending on the investment objective funds produced varying average monthly returns. Overall, we can say that this univariate analysis gives a quick overview of the mutual fund industry but at the same time provides some food for thought and a field for a further research.

4.1 Mutual Fund Performance Estimation

Consistent with the extant literature on the mutual funds in this section I will try to identify if mutual fund indeed can outperform the market and produce positive risk-adjusted return. In order, to do this I will use 3 different measures of performance. These include:

1. Capital Asset Pricing Model (CAPM) 2. Fama-French (1993) three-factor model 3. Carhart’s (1997) four-factor model

More formally I will measure performance from the following equations:

( ) (1) ( ) (2) ( ) (3)

19

where is fund ’s return in month , is return on thirty day risk-free rate, is excess return of a market – proxied by CRSP value-weighted market portfolio consisting of all U.S. companies listed on the NYSE, AMEX and NASDAQ, is a return differential between small size and large size firms in month , is return differential between high and low book-to-market firms in month , is return differential between firms with high and low returns in the previous year3, – represent sensitivity of a fund to the market, size and value and momentum factors respectively, - intercepts from the model mentioned above, they represent risk-adjusted returns obtained from CAPM, 3 factor and 4 factor model and

represents an error term in the regression.

In this paper I will emphasize the results and use the intercept obtained from the equation (3). I do this to capture the most variation and get the most precise estimate of the alpha. Utilizing this model also allows me to capture well documented historical fact of outperformance by small and value stocks. By including momentum factor I also want to account for passive momentum strategies employed by mutual funds.

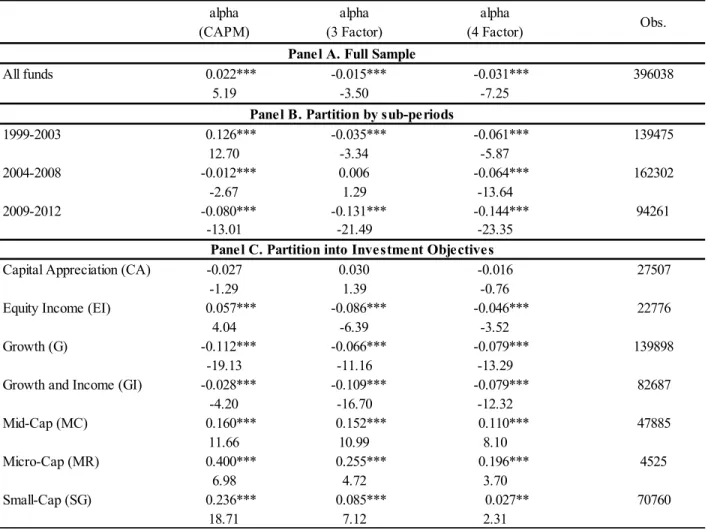

I start by examining the average performance of mutual funds using equations (1), (2) and (3). Table 3 presents the monthly performance of the average mutual fund in the sample for the years 1999-2012, 3 different investment periods and performance of the funds following different investment objective.

3 Data is downloaded from Kenneth French’s web site,

20

Panel A of Table 3 provides monthly percentage risk-adjusted return estimates obtained from pooled OLS regression for the full sampling period of 14 years, from 1999 to 2012. If we look at the alpha estimate from the CAPM, we can see that, on average, diversified equity mutual funds outperformed the market and produced positive excess return of 0.264 percent per year, the coefficient is significant at 1 percent level. However, if we use Fama-French (1993) three-factor model, we can see that the alpha coefficient becomes negative and statistically significant at 1 percent level, mutual funds underperformed the market by 18 basis points a year. Moreover, using 4 factor model yields even more negative average

alpha

(CAPM) (3 Factor)alpha (4 Factor)alpha Obs.

All funds 0.022*** -0.015*** -0.031*** 396038 5.19 -3.50 -7.25 1999-2003 0.126*** -0.035*** -0.061*** 139475 12.70 -3.34 -5.87 2004-2008 -0.012*** 0.006 -0.064*** 162302 -2.67 1.29 -13.64 2009-2012 -0.080*** -0.131*** -0.144*** 94261 -13.01 -21.49 -23.35

Capital Appreciation (CA) -0.027 0.030 -0.016 27507

-1.29 1.39 -0.76

Equity Income (EI) 0.057*** -0.086*** -0.046*** 22776

4.04 -6.39 -3.52

Growth (G) -0.112*** -0.066*** -0.079*** 139898

-19.13 -11.16 -13.29

Growth and Income (GI) -0.028*** -0.109*** -0.079*** 82687

-4.20 -16.70 -12.32 Mid-Cap (MC) 0.160*** 0.152*** 0.110*** 47885 11.66 10.99 8.10 Micro-Cap (MR) 0.400*** 0.255*** 0.196*** 4525 6.98 4.72 3.70 Small-Cap (SG) 0.236*** 0.085*** 0.027** 70760 18.71 7.12 2.31

TABLE 3. Average Monthly Performance, 1999-2012

and Carhart's 4 factor models. The sample consists of 3654 mutual funds. In panel A, alpha's from 3 model mentioned above are

Panel B. Partition by sub-periods Panel A. Full Sample

Panel C. Partition into Investment Objectives

The table shows the average realized monthly percentage risk-adjusted retun from the CAPM, Fama-French three-factor model presented for a whole sample. In panel B, alpha's are repoted for 3 periods: 2 five year periods and 1 four year period. Panel C shows alpha's for different investment objective funds, based on Lipper Investment Services classification. *,**,*** indicate statistical significance at 10%, 5% and 1% levels respectively. T-statistics is reported below the coefficients.

21

annualized monthly alpha of -37.2 basis points. First, by introducing 3-factor model and then 4-factor model completely erodes the positive abnormal return produced by mutual funds, and later by taking momentum into account we can see that mutual funds’ performance is reduced by more than 2 times compared to the estimate from Fama-French model (1993).

Panel B evaluates the performance of U.S. equity mutual funds in 3 different time periods. For the first period from January 1999 till December 2003, alpha estimate from CAPM shows that mutual funds produced positive return in excess of the market. It equals to 1.512 percent annually. Estimating risk-adjusted return for the same period with 3 factor model on the contrary yields negative estimate of 42 basis points per year. Carhart’s (1997) four-factor model gives even more negative performance of 0.732 percent a year. Looking at the second period from January 2004 to December 2008 yields an interesting result. Even when I estimate alpha from simple CAPM, it produces negative coefficient of 0.012 percent a month or 0.144 percent a year. In order to investigate what could be a reason for this and get more accurate results I run 3-factor and 4-factor model regressions for the same period. Fama-French (1993) three-factor model yields positive return of 0.072 percent a year; however this coefficient is not statistically significant. The point estimate from 4 factor model is negative 76.8 basis points a year and statistically significant at 1 percent level. The sign and the significance of the alpha coefficient from 4-factor model are as expected which means that U.S.-domiciled diversified equity mutual funds underperformed compared to the market but this fact is not captured by 3-factor model alone. Evaluating the performance of mutual funds in the last estimation period from January 2009 until December 2012 yields following results: alpha from the CAPM is negative and significant, the underperformance is equal to 96 basis points a year; riskadjusted performance from FamaFrench (1993) threefactor model is -1.57 percent annually. Finally, 4 factor alpha estimate is even bigger, -1.73 percent. Looking at the time trend, I can conclude that beating the market became a more challenging and difficult task to achieve.

For the sake of being more concise and accurate, I will report the differences in four-factor alpha for various investment objectives. As we can see from the table 3 panel C, there are some categories of funds which are able to add value and produce positive risk-adjusted

22

return. The most “successful” funds in my sample are the funds with micro capitalization objectives, they, on average, are able to produce 2.35 percent a year in excess of a market. The second category of funds which also beats the market is the group of funds that mainly concentrates on investing in the companies with less than $5 billion in capitalization. Their average abnormal return is 1.32 percent a year. During the sampling period, small-capitalizations specialized funds were also to outperform the market and earn 32.4 basis points a year. The coefficients for micro-cap and mid-cap funds are statistically significant at 1 percent level and the coefficient for small-cap fund is significant at 5 percent level. At the same time both growth and growth and income fund categories underperform compared to the market by the same 94.8 basis points a year. Moreover, the funds that mainly specialize in investing in dividend-paying stocks also were not able to beat the market and produced negative risk-adjusted return of 0.046 percent a month which equivalent to approximately 0.55 percent a year. The last investment objective that has not been still discussed is the capital appreciation. These funds did produce negative return of 19.2 basis points a year, but the significance level does not allow me assert this is the case.

My results indicate that even though there are some mutual fund categories which are able to add value, on average, diversified equity mutual funds underperform compared to market by 37.2 basis points per year. Average expense ratio for my sample is 175 basis points. It can be concluded from these numbers that mutual funds produce extra return but this the expenses they charge are much more than they can produce.

4.2 The Relation between Fees and Performance

In an efficient market conditions fees which mutual funds charge to their clients should be positively correlated with the before-fee risk-adjusted returns produced. According to Berk and Green (2004), if market is frictionless, there should no positive or negative performance and all funds should produce zero risk-adjusted return. Otherwise, they claim there would be excess demand for funds with positive after-fee risk-adjusted return and excess supply of funds with negative after-fee risk-adjusted return. This means that if we subtract fees from alpha, the difference should be equal to 0. That is the slope of the fees when plotted against before-fee risk-adjusted return should be increasing with coefficient of one.

23

To explore if the relationship between the before-fee risk-adjusted return of the fund and its fees is equal to one, I follow Gil-Bazo and Ruiz-Verdu (2009) and employ pooled ordinary least squares (OLS) regression. If the relationship holds and it is linear, the equation should be written like this:

(4) where is the fund ’s yearly before-fee risk-adjusted return4 estimated from the 4 factor model, is the same fund’s expense ratio and is a random error term.

As mentioned earlier, if the relationship is linear and in the absence of any market frictions, and should be equal zero, so that they do not have any explanatory power in the equation (4).

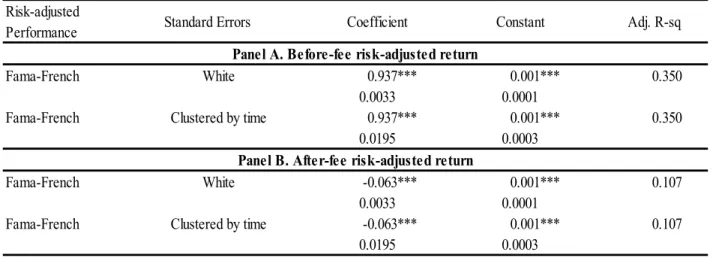

Table 4 presented below reports the slope coefficient estimates and constant of the equation (4) on both before-fee risk-adjusted return and after-fee risk-adjusted return. The first row of Panel A reports slope coefficient and White’s (1980) heteroskedasticity-robust standard error estimated using the whole sample of diversified actively managed equity mutual funds. The regression includes year dummies to ensure that slope coefficient captures the cross-sectional differences in relation between risk-adjusted returns and fees. Otherwise, it could result in not correct coefficients that would capture the effect of potential correlated terms in those variables. The estimated slope coefficient is equal to 0.97 and statistically significant at 1 percent level. The constant is as small as 0.001 and significantly different from zero. Thus, I cannot confirm the hypothesis of a unit slope, but this is close to hypothesized one-to-one relation.

Since now we can reject the notion of a frictionless market with a slope of one, we can assume three other possible relations between the expense ratio and risk-adjusted performance.

4

I approximate before-fee risk-adjusted performance by adding back annual expense ratio to an annual after-fee risk adjusted performance

24

One of them is that the slope coefficient is negative which would mean that for every increase in the expense ratio before-fee risk-adjusted return would decrease by the slope coefficient. However, this is very unlikely case, because the estimated slope coefficient is positive and significantly different from zero. Another feasible explanation could be that slope coefficient is more than one, meaning that funds with higher expense ratio would reap higher before-fee risk-adjusted return. The last situation is that the slope is equal to zero, but this condition can also be rejected at any possible significance level.

The second row of Table 4 provides the slope coefficient estimated using clustered standard errors. I do clustering by year to account for possible cross-sectional correlation of residuals. As we can notice robust standard errors clustered by year are eight times bigger than White’s heteroskedasticity-consistent standard errors which suggest presence of cross-sectional correlation in residuals (Petersen, 2009). Therefore, in all of the following regressions I will use clustering by time option, unless I mention a different choice.

To check if the relationship holds and still positive, I run the regression (4) for the after-fee risk-adjusted return and expense ratio. Panel B reports the slope coefficient estimates of this

Risk-adjusted

Performance Standard Errors Coefficient Constant Adj. R-sq

Carhart White 0.970*** 0.001*** 0.409

0.0032 0.0001

Carhart Clustered by time 0.970*** 0.001*** 0.409 0.0261 0.0004

Carhart White -0.030*** 0.001*** 0.152

0.0032 0.0001

Carhart Clustered by time -0.030 0.001*** 0.152

0.0261 0.0004

Panel A. Before-fee risk-adjusted return

Panel B. After-fee risk-adjusted return TABLE 4. Before-Fee and After-Fee Performance and Expense Ratios

The table shows estimated slope coefficients and constants for the OLS regressions of funds' yearly before-fee and after-fee risk-adjusted risk-adjusted return on yearly expense ratios from January 1999 and December 2012. Risk-adjusted performance is estimated using 4 factor model. Standard errors are reported below the coefficients and adjusted R-squared statistics in decimal form. *,**,*** indicate statistical significance at 10%, 5% and 1% levels respectively. The number of observations is 396038.

25

relationship. As it can be noticed, the slope coefficients estimated using both White’s heteroskedasticity-robust standard errors and standard errors clustered by time yield consistently negative coefficient. In the case of White standard errors the relationship is significant at 1 percent level, however in the case of clustered standard errors - it is not significantly different from zero. This might mean that the negative risk-adjusted performance produced can be accounted for the specific market condition in a given year where it produced inferior return. However, there can also be a problem with my result; it can be influenced by the well performing funds investing in micro, small and mid-cap companies. As it was seen from the Tables 2 and 3, these funds produced positive risk-adjusted return which is also significantly different from zero but at the same time these funds charged the highest fees. So, it can be that the negative insignificant slope coefficient observed reflects the effect of superior performance by small, micro and mid-cap funds. If this is the explanation for the coefficient produced, it is still a situation where, on average, all other funds after subtracting fees mutual funds are unable to add value and charge unjustifiably high fees. One explanation I can think of is that, on average, mutual funds are purchasing stocks which do not outperform market largely enough to recover their costs or the stocks that they purchase do not produce abnormal returns at all and individual investors are just wasting money paying for active management. If this is the case, they would have been better of just buying index fund and incur much less costs. It can also be the case that mutual funds are just buying attention-grabbing stocks, so that when they have to report their holdings, it looks as if they have “good” stocks.

4.3 Determinants of Expense Ratio

After identifying that expense ratio is negatively correlated with the after-fee risk-adjusted performance, it would be of a particular interest to identify what are the factors that mutual fund management companies take into account when setting a particular fee structure. Additionally, in order for the investors to make best possible decision regarding the allocation of their personal wealth, they ought to be sure what are the characteristics of the funds that charge lowest fees.

Prior attempts by Ferris and Chance (1987), Malhotra and McLeod (1997), Wermers (2000) claimed that age, size, 12b-1 plans and turnover have an impact on the overall expense ratio. More specifically, Ferris and Chance propose that there is a “learning curve” effect which

26

allows older funds to charge lower fees. Moreover, larger funds may experience economies of scale, allowing them to charge lower fees per person. Wermers (2000) contends that because of the extra costs associated with the funds that turn over their portfolio too often, the coefficient for turnover should be positive and contribute to higher expense ratio.

To test and identify the effects of different types of variables on mutual fund expense ratio, I employ the following equation:

( ( )) ( ) ( ) ( ) ( )

(5) where is the fund ’s expense ratio expressed as a percentage of total net assets,

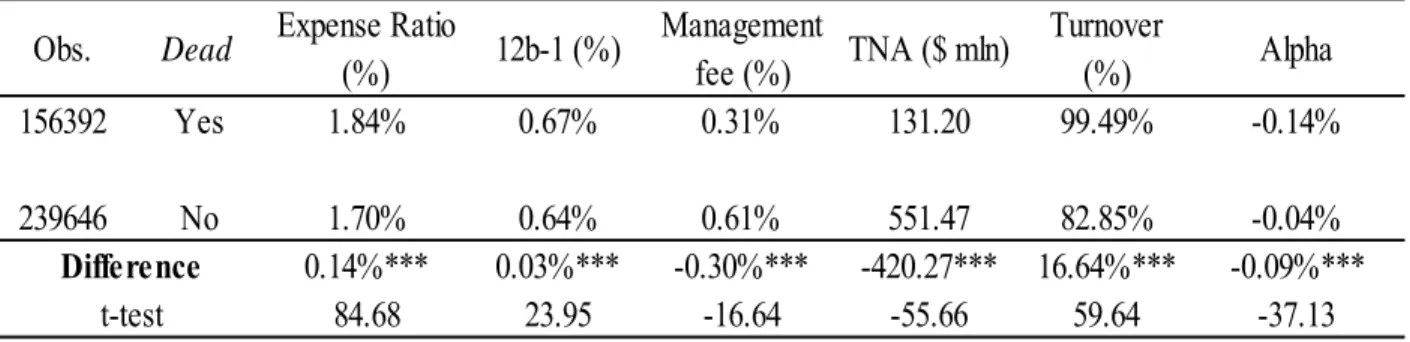

( ) is a natural logarithm of monthly net assets in a period , is an turnover ratio of a fund in a period , is a fund’s age since its inception, is an standard deviation of fund ’s monthly return in a period , is a fund ’s risk-adjusted return from the 4 factor model in a period , is a dummy variable which is equal to 1 if a fund has an front-end load, is a dummy variable that is equal to 1 if a fund has a back-end load, is dummy variable which equals 1 if a fund ceased to exist during the analysis or being non-existent anymore was included in the sample to avoid survivorship bias.

I use the lagged values of the explanatory variables to account for the time effect, where both the clients and mutual fund management company still cannot observe the expense ratio and use all the information available at that point in time. This explanation, of course, holds if the determination of the fees can only explained by the costs incurred to operate it. If low expense ratio is associated with superior after-fee risk-adjusted performance, then a univariate regression would result in a negative sign for expense ratio coefficient estimate

Table 5 provides the results of the model specified by the equation (5) for the years 1999-2012.

27

Column (1) in the Table 5 presents the results of the equation (5). As it can be seen from the statistically significant and negative coefficient of size, proxied by the natural logarithm of year-end total net asset value, the economies of scale are present in the mutual fund industry. This result means that the clients of larger funds, on average, incur lower costs. In contrast to Ferris and Chance (1987) who found that the age variable for one of the years studied was not

(1) (2) (3) (4) ln mtnat-1 -0.054*** -0.055*** -0.050*** -0.048*** -15.90 -16.40 -22.95 -13.5 turnovert-1 0.074*** 0.075*** 0.075*** 0.066*** 12.68 13.46 12.80 8.00 aget-1 -0.003*** -0.003*** 0.000 0.001* -5.61 -5.40 1.02 1.7 αt-1 -2.460** -2.430** -1.710* -1.630*** -2.46 -2.46 -1.81 -4.37 σt-1 4.410** 4.450*** 4.770** 2.830*** 3.80 3.87 3.79 4.49 front-load -0.296*** -0.106*** 0.007 0.003 -44.55 -4.95 0.37 0.09 end-load 0.295*** 0.465*** 0.069*** 0.043 67.77 22.29 4.58 1.45

front and back -0.240*** -0.063** -0.048

9.59 3.12 1.54 dead 0.026** 0.020* 0.024** 0.031*** 2.17 1.72 2.49 2.68 12b-1t-1 83.567*** 85.874*** 105.94 35.04 mgmt feet-1 0.329%*** 0.318%** 2.71 2.56 Obs. 347226 347226 347226 347226 Adj.R-sq 0.392 0.399 0.548 0.569 Expense Ratio

total net assets., σ is the standard deviation of fund's monthly return in a year t, α is the risk-adjusted return obtained using 4 factor model. The table also reports t-statistics below the coefficients. Standard errors in columns 1 through 3 are clustered regression are reported at the bottom of the table. *,**,*** indicate statistical significance at 10%, 5% and 1% levels

TABLE 5. Mutual Fund Fee Determinants

The table presents estimated percentage coefficients for yearly regression of funds' expense ratios on selected fund characteristics in 1999 to 2012 period. The dependent variable in columns 1 to 4 is annual expense ratio. All coefficients are estimated by pooled OLS regression and include year dummies. Size of the fund is represented by the natural logaritm of

by time. Column 4 standard errors are clustered by fund. The total number of observations and adjusted R-squared of the respectively.

28

significantly different from zero and did not affect expense ratio, the age variable in my sample is negative and statistically significant at 1 percent level indicating that the older the fund is the more likely that its expenses are going to be lower than of the younger ones. This can be the result of so-called “learning curve” which can be due to either technological advancement, standardization or an experience from managing and running the fund previously. As conjectured before the turnover has a positive and statistically significant impact on the expense ratio meaning that the more mutual funds buy and sell in the search of mispriced securities, the more transaction cost they incur thereby increasing the overall expense ratio. The coefficient of the risk-adjusted return proposes that better-performing funds charge less to their clients. This observation is in line with my hypothesis that the expense ratio and the performance measured as the after-fee abnormal return are negatively correlated. In addition, the result obtained for the presence of front-end load indicates that funds charging purchase fees tend to have lower expense ratios. Significance and positive coefficients of the dummy variable indicating if the fund has a back-end load and the variable of the standard deviation of fund’s monthly returns imply that funds experiencing higher volatility and charging redemption fees have higher expense ratios. An important point to mention is that the coefficient estimate for dead demonstrates that funds which ceased to exist had higher expense ratios.

Column (2) presents the results for the equation (5) with an exception that I introduced one more variable which is equal to 1 if the fund had both front and back-end loads and 0 otherwise to check if the relationship still holds. As we can see from the table introducing this variable decreased significance of dead and decreased the coefficient estimate of front-load variable. At the same time, the slope coefficient for the introduced variable itself is negative and statistically, so investors are better off buying units of the funds with this kind of load and they should not be avoided contrary to the popular opinion.

The results from the column (3) produce the results that contrast to the ones obtained in the previous two regressions. Turnover and size still produce the same results which are consistent with the prior researches done on this topic. However, now the age variable became positive but nothing can be implied from this result since the coefficient s indistinguishable from zero. Secondly, front-end load dummy became insignificant and positive representing the fact

29

that it can no longer be stated that funds charging this marketing fee have lower expense ratios. Risk-adjusted return, as in the previous analysis, still suggests that best performing funds charge lower fees. Positive and statistically significant coefficient for standard deviation could mean that after observing high volatility in their stock holdings funds try to get rid of them, thereby increasing turnover and thus contributing to an increased expense ratio. The variables introduced in this specification of the equation (5) are management fee and 12b-1 fee. In addition to the increase in the explanatory power of the model, which can be witnessed from the substantial increase in R-squared, they also confirm the existing literature on the effect of marketing and distribution fees. The slope coefficient of 12b-1 is close 1 implies the large impact of selling expenses on the overall expense ratio. This finding is in contrast with the proponents of 12b-1 fee plan - the expense ratio is higher for funds with this marketing charge. This fee increases the expense ratio more than any other benefit produced by the economies of scale and possible reduction in other operational expenses. The results of the tests provided in the appendix show that funds with 12b-1 fee have higher expenses and the risk-adjusted return is much lower than of the funds not having this charge. The effect of management is not so stark as the one of the 12b-1. Effects of the remaining dummy load variables still remain unchanged.

To check the robustness model in the column (4) in addition to year dummies I also introduce dummies for the investment objectives to capture the cross-sectional differences in the relationship between expense ratio and independent variables which are different across investment objectives. Moreover, I also cluster standard errors by fund to account for possible serial correlation of residuals. The introduction of investment objective dummies completely erodes all the explanatory power of load dummy variables, suggesting that investment objective variables influence directly influence the determination fund fees and thereby performance. Furthermore, age variable changes its sign to positive and becomes statistically significant; representing the fact that older fund can also charge higher fees. I would assume that older funds realizing that they have already a “loyal” list of clients incrementally increase their fees. Coefficients for risk-adjusted performance, volatility and dead still retain their “right” signs and significance. Load dummies are insignificant which suggests that despite the advertising and claims that load-charging funds have lower expense ratios, my findings show that, on average, this statement does not hold.

30

5. Conclusion

This thesis has examined the performance of the U.S.-domiciled diversified equity mutual funds, their expense ratios and the relation between them. It distinguishes itself by using comprehensive and integrated approach to the examination of fund performance. In addition to using more recent survivor-bias-free data which covers the period of the extensive expansion in mutual fund industry, I also used three models to assess mutual fund performance: CAPM, Fama-French (1993) three-factor model and Carhart’s (1997) four-factor model. Examination includes the division of my sample into three periods and division into seven different investment objective groups. I show that each additional factor in the models stated above explains the variation in the returns better than the previous, for instance the intercept from one-factor model changes its sign from positive to negative with the employment of a more comprehensive model. I also update the existing literature by showing not only the relation between before-fee performance and expenses but also the relation between after-fee performance and expense ratio.

I document that, on average, domestic diversified equity mutual funds underperform compared to the market. I use the CRSP value-weighted market portfolio consisting of all U.S. companies listed on the NYSE, AMEX and NASDAQ which allows for the inclusion of more companies, but also corrects for the possible biases due to a benchmark error. Moreover, this underperformance only aggravates in the later period. Important conclusion based on my analysis is that there is a significant variation in abnormal return between investments objectives specified.

My results also demonstrate that there is negative relation between after-fee performance and expense ratio. I also support this finding by examining the determinants of the expense ratio and including performance variable itself. The coefficient for performance survives the robustness check and is negative and statistically significant. In many aspects my findings are similar to the previous studies discussed in this paper. The signs of the turnover, size and performance are in line with them. I also introduce the variable of the volatility of the monthly fund returns and it is positive and significant in all of the regressions employed. Suggesting that, on average, funds with high expense ratios experience higher variability in their returns.

31

However, in the age variable did not survive the robustness check and the result contradicts the finding of Chance and Ferris (1991) who found negative effect of the age.

A possible problem with my research can be that the CRSP database may have an omission bias and thus it imposes limitation on my study and results produced. According Elton et al. (2001) in spite of the fact that CRSP mutual fund database includes almost all the funds in existence during the period of investigation, the return data is missing for some of them and their fund characteristics differ from those in the general population. Thus, by dropping these funds from my sample might result in upward bias in the result. Secondly, there can also be a problem of the performance-attribution model, since estimated risk-adjusted returns contain funds’ true abnormal return but they also include estimation error. Such as for example the residuals of the performance estimation may not be correct and thus it can affect my result by decreasing the probability of finding significant relationship.

A further research can be conducted on the effect on the age on the expense ratio. In two of the regressions employed the coefficient for it was negative and significant. However, when accounting for possible serial correlation of the residuals, the age variable changes it sign and proposes an interesting fact. This phenomenon can be further investigated in the papers to follow. Moreover, a further study can also be conducted on the effect of different fees and charges on the performance. There is no uniform way of calculating the loads and incorporating them in the “overall” expense ratio; it can also be a challenging topic to do a research on.

I showed that investors are better off choosing the funds with lower expense ratio, since beating a market is not an easy endeavor incurring extra costs while receiving the same or inferior return does not seem to be a sensible decision. However, the absence of any fees and too low expense ratios cannot be and should not be interpreted as a sign of a superior performance.

32

References

Berk, J.B., & Green, R.C. (2004). Mutual fund flows and performance in rational markets. Journal of Political Economy, 112, 1269-1295.

Carhart, M.M. (1997). On persistence in mutual fund performance. Journal of Finance, 52(1), 57-82.

Chance, D., & Ferris, S. (1991). Mutual fund distribution fees: an empirical analysis of the impact of deregulation. Journal of Financial Services Research, 5, 25–42.

Dellva, W.L., & Olson, G.T. (1998). The relationship between mutual fund fees and expenses and their effects on performance. The Financial Review, 33, 85-104.

Elton, E.J., Gruber, J., & Blake, C.R. (2001). A first look at the accuracy of CRSP mutual fund database and a comparison of the CRSP and Morningstar mutual fund databases. Journal of Finance, 56, 2415–2430.

Fama, E.F., & French, K.R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3—56.

Ferris S. P., & Chance, D. M. (1987).The effect of 12b-1 plans on mutual expense ratios: a note. Journal of Finance, 42, 1077-1082.

Gil-Bazo, J. & Ruiz-Verdu, P. (2009). The relation between price and performance in the mutual fund industry. Journal of Finance, 64, 2153–2183.

Goetzmann, W.N. & Ibbotson, R.G. (1994). Do winners repeat? Patterns in mutual fund performance. Journal of Portfolio Management, 20, 9–17.

Grinblatt, M., & Titman, S. (1992). The persistence of mutual fund performance. Journal of Finance, 47, 1977–1984.

Investment Company Institute. (2013). Investment Company Fact Book. Washington DC. Investment Company Institute.