Procedia - Social and Behavioral Sciences 211 ( 2015 ) 1043 – 1048

ScienceDirect

1877-0428 © 2015 The Authors. Published by Elsevier Ltd. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/).

Peer-review under responsibility of the Organizing Committee of the 2nd GCBSS-2015 doi: 10.1016/j.sbspro.2015.11.139

2nd Global Conference on Business and Social Science-2015, GCBSS-2015, 17-18 September

2015, Bali, Indonesia

Role of women in achieving shared prosperity: An impact study of

Islamic microfinance in Malaysia

Muhamad Badri Othman*

Faculty of Economics and Muamalat, Universiti Sains Islam Malaysia, 71800 Nilai, Negeri Sembilan, Malaysia

Abstract

This paper aims, at the very minimum, to examine the role of women in achieving shared prosperity through Islamic microfinance in Malaysia. It will also examine and study the impact of Islamic microfinance, as a catalyst for women in achieving shared prosperity and hence boost the economy. Whilst there are many researches conducted by scholars on the impact of the Islamic microfinance in promoting inclusive growth, reducing inequality and accelerating poverty reduction, this paper attempts to explore the current impact of the Islamic microfinance particularly on women involvement in entrepreneurial activity in Malaysia to achieve shared prosperity.

© 2015 The Authors. Published by Elsevier Ltd.

Peer-review under responsibility of the Organizing Committee of the 2nd GCBSS-2015.

Keywords: Islamic microfinance; shared prosperity; poverty reduction; women entrepreneurship

1.Introduction

The total women population in Malaysia, which constitutes half of total population, makes them very important in the economic development agenda of Malaysian government. Women involvement in economic sectors ranging from agriculture, plantations, manufacturing, corporate, private as well as government sectors, play an important role to boost the Malaysian economy after independence. In fact, even before independence, they have, directly and indirectly, fought together with men for independence. In this regards, the Malaysian government acknowledges and appreciates the involvement of women in the economy sector by providing various facilities for them to be actively

* Corresponding author. Tel.: +6016-2239404.

E-mail address: muhamadbadri.othman@yahoo.com

© 2015 The Authors. Published by Elsevier Ltd. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/).

involved in the development of the country to achieve a minimum standard of living by becoming micro-entrepreneurs. This includes the availability of various schemes and micro financings offered by various financial institutions especially the Islamic financial institutions (IFI) and non-financial institutions such as Amanah Ikhtiar Malaysia (AIM), TEKUN Nasional etc. for them to participate in the fast growing economic in achieving shared prosperity.

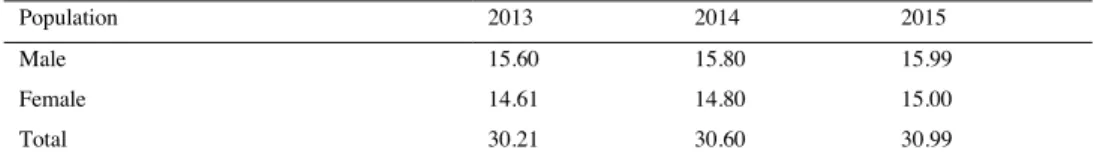

Table 1: Total population (million)

Population 2013 2014 2015

Male 15.60 15.80 15.99

Female 14.61 14.80 15.00

Total 30.21 30.60 30.99

Source; Department of Statistics Malaysia

The role of women has changed over the decades in helping themselves and their loved ones in achieving shared prosperity to improve their socio-economic status as a way to escape from poverty and vulnerability. As a result of the government initiatives, policies and plans to see and promote more women involvement and participation in the economy, we can see nowadays that women are becoming successful micro-entrepreneurs in small and medium enterprises (SMEs) and holding various high positions in government and private sectors.

2.Literature Review

Microfinance refers to the provision of financial services to low income clients in solidarity lending groups including consumers and the self-employed who have limited access to financing and banking related services (Zabidah, 2012). According to Brooks (2013), microfinance refers to an array of financial services, including loans, savings and insurance, available to poor entrepreneurs and small business owners who have no collateral and would not otherwise qualify for a standard bank loan. Microfinance is very much related to achieving shared prosperity since it enables the poor segment of population the access to financing services to gain financial freedom with any income generating economic activities, such as to foster small-scale entrepreneurial activities, thus reducing the inequality in socio-economic well-being of a country. Obaidullah and Khan (2008, pp. 1) argue that ‘access to services such as, credit, venture capital, savings, insurance, remittance is provided on a micro-scale enabling participation of those with severely limited financial means. The provision and access of financial services to the poor helps to increase household income and economic security, build assets and reduce vulnerability; creates demand for other goods and services (especially nutrition, education, and health care); and stimulates local economies’.

A review of literature has shown that microfinance is capable of being an effective tool to reduce and alleviate poverty. Many researches have been done on the effects of micro-financing as the effective tool to alleviate poverty in rural areas in several countries around the world (Norma, 2012). It has strong potential to be enhanced and promoted as the most suitable scheme to cater the need of clients in rural area to combat and alleviate poverty. According to Ferro (2005), funding microfinance projects has become a priority for investors and donors including government, private sector and non-governmental organization (NGO). A study conducted by Afrane (2002) on the impact of two microfinance interventions in Ghana and South Africa in 1997 and 1998 found that the microfinance interventions has shown a significant improvement on the level of clients’ condition such as economic, social, access to facilities, spiritual and empowerment particularly to women. Morduch (as cited by Norma and Jarita, 2010) studies the impact of microfinance in Bangladesh and found that the household served by microfinance programmes are better than controlled households.

3.Shared prosperity through microfinancing

growth of bottom 40 per cent in every country. It is measured by annualized growth in average real per capita consumption or income of the bottom 40 per cent. According to Narayan, Jaime and Sailesh (2013), promoting shared prosperity is about ensuring that everyone in the society today as well as future generations participates in a dynamic process of continuing welfare improvement. In order to achieve this, government has to plan and produce various sustainable income generating economic activities for the citizen to participate so that people could live in a better standard of living for their future endeavors. As such, Malaysia as a developing country towards becoming a high value added and high income nation by the year 2020 is focusing on poverty eradication particularly in rural areas through various schemes including offering microfinancing to the citizens especially to women to start and venture into a small business and becoming micro-entrepreneurs on their own. In supporting this initiative, Bank Negara Malaysia (BNM) has come up with Financial Sector Blueprint which documents various steps and recommendations for Malaysia to take action in order to become a high value added and high income nation. One of the key initiatives is to create and provide financial inclusion for greater shared prosperity. “Pursuing the financial inclusion agenda, where all members of society have the opportunity to participate in the formal financial system, will continue to be a key component of Malaysia’s inclusive growth strategy. Financial inclusion will enable all citizens, including the low-income and rural residents, to have the opportunity to undertake financial transactions, generate low-income, accumulate assets and protect themselves financially against unexpected adverse events, thereby enabling them to benefit from economic progress. This will in turn contribute to balanced and sustainable economic growth and development” (Bank Negara Malaysia, 2011). Under this noble initiative, a few recommendations were made such as:

1. To strengthen the institutional arrangements to provide financial services to all citizens, including the underserved and build capacity of practitioners in an effective and sustainable manner. This includes:

i. Strengthening the financial inclusion role of specialised DFIs which mobilize savings of small Malaysian savers and enhance micro financing to micro enterprises. This is achieved by having appropriate key performance indicators for financial inclusion, adequate representation on the board with expertise in financial inclusion, as well as improved potential for innovative product development.

ii. Encouraging financial training providers to offer structured and cost-effective financial inclusion training for professionals from financial institutions, cooperatives, microfinance institutions and non-governmental organizations (NGOs) in Malaysia, which can be extended to the region to draw on the sharing of experience from different jurisdictions.

According to Hassan, S., Abdul Rahman, R., Abu Bakar, N., Mohd, R. and Muhammad, A.D (2013), “these strategies are to ensure financial inclusiveness whereby the financial sector meets the needs of all segments of society, fair and equitable practice with empowered and educated consumers”. The access to financing for poor people or ‘non-bankable’ segment of the society is channelled through microfinance schemes from various institutions or organizations. Microfinance scheme is available through microfinance institutions (MFI), which range from small non-profit organizations (non-bank MFI) to larger banks.The list of non-bank MFIs is as per below:

x Amanah Ikhtiar Malaysia (AIM) x Yayasan Usaha Maju

x Koperasi Kredit Rakyat x Koperasi Kredit Pekerja x Partners in Enterprise Malaysia

x Tabung Ekonomi Kumpulan Usaha Niaga (TEKUN Nasional) x Council of Trust to Bumiputera (MARA)

x Malaysia Building Society Berhad (MBSB) x Sabah Credit Corporation

The most well-known and by far the largest micro-financing provider in the country is Amanah Ikhtiar Malaysia (AIM), a non-governmental organization which was established in 1987. It is a private trust that serves as microfinance institution (MFI) which provides micro-financing for women from poor and low income household. It replicates the

model of Grameen Bank of Bangladesh with close supervision on the members, with the objective as an agent of government for poverty eradication programme under the National Development Policy (Nor Fazidah 2011). As of February 2015, AIM has disbursed a total of RM12.15 billion financings to 356, 458 clients throughout the country. Another well-known micro-financing provider in Malaysia is TEKUN Nasional which was established in 1998, a government agency microfinance provider, with its mission is to provide easy and quick micro-financing to Bumiputera entrepreneurs for micro enterprise or business capital. The financing amount is from as low as RM500 and up to RM50000 with the profit rate of 4 percent per annum to support Bumiputera entrepreneurs to set up and run small business. Since its establishment, TEKUN Nasional has disbursed a total amount of RM2.98 billion financings to 347, 225 customers around the country as of March 2014 and the number is growing. Out of this amount, a total of RM1.44 billion financings with 183, 218 customers are women (Ministry of Women, Family and Community Development [MWFCD], 2014). This constitutes almost half of the TEKUN Nasional’s total financings is for women and this illustrates a huge potential for women to be given more access to financing for any income generating economic activities, such as food production (snack, bakery, fast food, traditional food, basic food ingredients), textiles, agriculture (coconut, paddy, oil palm, banana, rubber vegetables, fruits), sewing/ tailoring, jewellery, handicraft, poultry, fishing, ceramic, women accessories, cosmetic, groceries, and many more.

In supporting the development of microfinance industry as a catalyst for greater financial inclusion and shared prosperity, the government through National SME Development Council (NSDC) has approved a comprehensive microfinance institutional framework proposed by BNM in August 2006. This is crucial for broader financial inclusion and access since almost 80 percent of the SMEs in Malaysia are micro enterprise and to ensure that the micro enterprise has adequate source and access to financing (Jasman, T., S. Junaidi, S.M. and Rosalan, A., 2011). They further argue that this commercially-driven microfinance framework will complement the existing government sponsored programmes and in turn, will have broader outreach through banking sectors with extensive branches nationwide besides the non-bank MFIs.

4.Women and entrepreneurship

Women and entrepreneurship cannot be separated. They cannot be left out from the pie chart of the economic development and growth of a country because women have the natural talent and ability to become a successful entrepreneur thus creating more jobs for others. With this god gifted entrepreneurial talent, women play an important role to boost the economy of a country. Sarfaraz, Faghih and Majd (2014, p. 1) argue that ‘there is consensus among scholars that women can play key role in the entrepreneurial phenomenon’. Verheul et al. (as cited by Sarfaraz, Faghih and Majd 2014) states that countries with high total entrepreneurial activity rates are also associated with high female entrepreneurial activity rates. There are a few factors influencing the involvement of women in entrepreneurship. Abu Bakar, T., Md Ali, A., Omar, R., Md Som, H. and Muktar, S.N. (2007) conducted a research to investigate the factors influencing women’s involvement in entrepreneurship in Johor. They conducted a survey on 215 women entrepreneurs and the survey reveals that there are basically three main factors influencing women’s involvement in entrepreneurship which are interest, ambition and independence. They would like to be seen as independent without having to burden their spouses in earning a living for their loved ones. “Poor women in particular benefit from microfinance services. Such women, often the most disadvantaged group in a society, tend to be good credit risks. Increasing women’s access to microfinance has wide ranging benefits, not just for their well-being but also for the welfare of their families, the communities in which they live and for society at large” (UNDP, 2008).

In this regard, the government takes various initiatives under the purview of Ministry of Women, Family and Community Development to undertake the responsibility to promote and encourage women participation in entrepreneurship programmes to boost the economy of the country. The programmes include the collaboration with AIM and TEKUN Nasional to provide quick and easy micro-financing to eligible women to venture into business especially to those single mothers nationwide. According to SME Corporation Malaysia (SMECorp), in 2011, there are only 19.7 percent out of total 645,000 micro-enterprises and small and medium enterprise (SME) is owned by women. This figure excludes those women micro entrepreneurs who do not register their businesses with SME Corp due to certain reasons i.e. tax issues etc. SME Corp is targeting to have at least 30 percent of total SMEs and

micro-enterprises owner is women by 2020 (Farus Khan, F.Z. 2013). This target is achievable by urging the women entrepreneurs who do not register with SME Corp to do register so that any helps in terms of training and financing could be easily rendered to them in the future for business growth and expansion.

Acknowledging women as an important aspect of entrepreneurial development in a developing country in creating growth and shared prosperity, various projects and programmes have been developed and designed by government agencies to create awareness among women micro entrepreneurs about the available source of micro-financing for them to nurture, create and promote more women entrepreneurs, in line with the National Key Result Area (NKRA). For example, the UNDP Malaysia has undertaken a project namely The UNDP Entrepreneurial Skills: Empowering Women in 2006 in Terengganu, Kelantan, Kedah and Penang. The objective of this project is to empower women through education, tools and skills required to become successful entrepreneurs. Continuous education and training on soft skills in terms of management, marketing and other aspects of business should be provided for women to excel in their businesses. On top of that, women should be nurtured and educated on how to pay back their financing so that others would benefit from the fund which will be available for other borrowers. This is in line with the study conducted by Norma and Jarita (2010) on the determinants of economic performance on the microfinance clients. The study shows that the education level of the clients of AIM is important to determine the level of repayment of financings to AIM. As such, Institut Keusahawanan Negara (INSKEN) has been entrusted as a focal point to conduct various training programmes for skills enhancement to educate and create awareness among the clients in all aspects of business as well as on the matters of financing repayment.

5.Conclusion

The role of women in achieving shared prosperity has gained recognition and acknowledgement in economic development in Malaysia. Their ability, skill and talent in entrepreneurial activities make them as important as men’s role in developing the country into the next level towards becoming a high value- added and high-income nation by the year 2020. To achieve this, various programmes, plans and schemes have been introduced by the government through various organizations and departments lead by the Ministry of Women, Family and Community Development to attract more women’s participation in income generating economic activities so that they could be independent for their well-being. Microfinance is one of the ways to promote shared prosperity for better financial inclusiveness for all segments of the society so that poverty could be alleviated for a better future.

Acknowledgement

Special thanks and appreciation rendered to the Secretary General, Ministry of Women, Family and Community Development (MWFCD), YBhg. Dato’ Sabariah Hassan and Baitulmal Majlis Agama Islam Wilayah Persekutuan (MAIWP) for their approval for sponsorship to make the presentation of this small research a reality.

References

Abu Bakar, T., Md Ali, A., Omar, R., Md Som, H. and Muktar, S.N. (2007). Women’s Involvement In Entrepreneurship In Johor: A Study About Critical Factors In Achievement And Failure In Handling Business. Retrieved from http://eprints.utm.my/5803/1/75087.pdf

Amanah Ikhtiar Malaysia (2015). Retrieved from http://www.aim.gov.my/

Afrane, S. (2002). Impact Assessment of Microfinance Interventions in Ghana and South Africa, A Synthesis of Major Impacts and Lessons.

Journal of Microfinance, 4(1), 37-58. Retrieved from https://ojs.lib.byu.edu/spc/index.php/ESR/article/view/1423

Bank Negara Malaysia. (2011). Financial Sector Blueprint 2011 - 2020. Strengthening our future – Strong, Stable, Sustainable.. Retrieved from http://www.bnm.gov.my/index.php?ch=en_publication_catalogue&pg=en_publication_blueprint&ac=7&lang=en

Chad, Brooks. (2013) Business News Daily. What is Microfinance? Retrieved from http://www.businessnewsdaily.com/4286-microfinance.html Dang, Hai-Anh and Lanjouw, Peter F., Toward a New Definition of Shared Prosperity: A Dynamic Perspective from Three Countries (June 8,

2015). World Bank Policy Research Paper No. 7294. Available at SSRN: http://ssrn.com/abstract=2616065

Department of Statistics Malaysia. (2015). Malaysia @ a Glance. Retrieved from https://www.statistics.gov.my/index.php?r=column/cone&menu_id=dDM2enNvM09oTGtQemZPVzRTWENmZz09

Farus Khan, F.Z. (2013, April 11). Wanita mampu kuasai PKS. Sinar Harian. Retrieved from http://www.sinarharian.com.my/bisnes/wanita-mampu-kuasai-pks-1.148765

Available at SSRN: http://ssrn.com/abstract=755447 or http://dx.doi.org/10.2139/ssrn.755447

Global Database of Shared Prosperity. The World Bank (2013). Retrieved from http://www.worldbank.org/en/topic/poverty/brief/global-database-of-shared-prosperity

Hassan, S., Abdul Rahman, R., Abu Bakar, N., Mohd, R. and Muhammad, A.D. (2013). Designing Islamic Microfinance Products for Islamic Banks in Malaysia. Middle-East Journal of Scientific Research 17 (3): 359-366

Jasman, T., S. Junaidi, S.M. and Rosalan, A. (2011). The Role of Microfinance in Development of Micro Enterprise in Malaysia. Business & Management Quarterly Review, 2(3), 47-57

Kadri, Nor Fazidah. (2011). The Role of Microfinance in Poverty Alleviation: AIM’s Experience. The 2nd Working Group on The Development of

Islamic Financial Service Industry. November 2011. Jakarta

Leyla Sarfaraz, Nezameddin Faghih and Armaghan Asadi Majd (2014). The relationship between women entrepreneurship and gender equality. Journal of Global Entrepreneurship Research 2014, 2:6. Retrieved from http://www.journal-jger.com/content/pdf/2251-7316-2-6.pdf

Ministry of Women, Family and Community Development. (2014). Quick Facts KPWKM 2014. Retrieved from http://www.kpwkm.gov.my/documents/10156/9169c437-cce2-4d33-95dc-d3eb8aa14dd6

Narayan, Ambar; Saavedra-Chanduvi, Jaime; Tiwari, Sailesh. (2013). Shared prosperity : links to growth, inequality and inequality of opportunity. Policy Research working paper ; no. WPS 6649. Washington, DC: World Bank. Retrieved from http://documents.worldbank.org/curated/en/2013/10/18376904/shared-prosperity-links-growth-inequality-inequality-opportunity

Norma Md Saad, (2012). Microfinance and Prospect for Islamic Microfinance Products: The Case of Amanah Ikhtiar Malaysia.Advances in Social Science. Vol. 1, No. 1, March 2012.

Norma Md Saad and Jarita Duasa. (2010). Determinants of Economic Performance of Micro-Credit Clients and Prospects for Islamic Microfinance in Malaysia. ISRA International Journal of Islamic Finance. Vol 2. Issue 1

Obaidullah, Mohammed and Khan, Tariqullah, (2008). Islamic Microfinance Development: Challenges and Initiatives. Islamic Research & Training Institute Policy Dialogue Paper No. 2. Available at SSRN:http://ssrn.com/abstract=1506073 or http://dx.doi.org/10.2139/ssrn.1506073

SMEinfo. (2015) Women Entrepreneurs. Retrieved from http://www.smeinfo.com.my/index.php?option=com_content&view=article&id=1154&Itemid=1112

TEKUN Nasional. (2015) Retrieved from http://www.tekun.gov.my/web/guest/home

UNDP. (2008). Malaysia Nurturing Women Entrepreneurs. Retrieved from http://www.my.undp.org/content/dam/malaysia/docs/WomenE/UNDP_Malaysia_NurturingWomenEntrepreneurs_publication.pdf

Zabidah Ismail. (2012). The Role of Microfinance in Poverty Alleviation: AIM’s Experiences. Islamic Microfinance an Instrument for Poverty Alleviation. Retrieved from http://wief.org/wp-content/uploads/2012/04/Datuk-Hajah-Zabidah-Ismail.pdf