Agenda Item No: 7

Report To: CABINET

Date: 8th May 2014

Report Title: Welfare Reforms – Update, including review of local impacts 2013-2014

Portfolio Holder: Councillor Neil Shorter, and chairman of the Council Tax and Welfare Reform Task Group

Report Author: Paul Naylor, Deputy Chief Executive

on behalf of the Council Tax and Welfare Reform Task Group

Summary: This report introduces the appended welfare reform impacts paper that provides a local perspective of the government’s reforms as measured over the last financial year. It also updates members of progress made over the last year by the council and our partner organisations. The report provides a further update about the government’s timetable for

introducing Universal Credit and the potential role for councils in supporting its delivery, and includes advice about a recent announcement confirming the transfer of benefit fraud

investigation work to a new Single Fraud Investigation Service (SFIS).

Key Decision: NO Affected Wards: All

Recommendations: The Cabinet is recommended to resolve to:

1. Note the appended welfare reform impacts paper and agree this for publication, and that a further report be presented in 12 months’ time.

2. Note the current position in relation to the

implementation of Universal Credit and agree that the council take up the opportunity proposed by

government and lead locally on creating a pilot working partnership to develop arrangements

designed to support the delivery of Universal Credit when fully implemented.

3. Note the advice concerning the government’s

proposals and timescales for the transfer of housing benefit fraud investigation work to the DWP.

4. Agree that the Council Tax and Welfare Reform Task Group continues to monitor impacts, including overseeing any Universal Credit pilot partnership involving the council and the impacts of the transfer of benefit fraud work to the Department for Work and Pensions.

Policy Overview: The government’s welfare reforms has introduced a series of the most fundamental changes to the benefits system in over 60 years. The key concept is to create a fairer and simpler system by creating the right incentives to

encourage households to take up work whilst protecting the most vulnerable in society. While this council has had to respond to supporting the reforms in a variety of ways, our response has also been consistent with the council’s own policy objectives relating to employment growth, meeting housing needs, and providing good quality services.

Financial Implications:

So far the financial implications of the welfare reforms have been managed without material impacts for the council’s budget. Welfare reform implementation has been supported through some government grants, as well as grants from the major precepting authorities in respect of the added

workloads involved with introducing local council tax support schemes. This update report does not give rise to any further material costs that may impact on the council’s budget.

Risk Assessment One of the principal purposes for the council taking a proactive stance on this issue has been to manage service demand and financial pressures that would occur without mitigation plans. Managing risk remains an important focus for the council’s ongoing work.

Community impact assessment

Not applicable for this report. Impact assessments were reported in 2013 relating to policy amendments to support the welfare reforms, including the introduction and first review of the council’s local council tax support scheme.

Other Material Implications:

The full impact review paper attached with this report discusses the various local impacts and implications of the reforms. Universal Credit implementation, in due course, and the implementation of the government’s Single Fraud

Investigation Service will have further service impacts. These will be the subject of reports to the Cabinet at the appropriate times.

Background Papers:

None

Agenda Item No.7

Report Title:

Purpose of the report

1. This report introduces the welfare reform impacts paper that provides a local perspective of the government’s reforms as measured over the last financial year. It also updates on progress made by the council and our partner organisations. The report provides a further update about the government’s timetable for introducing Universal Credit and the potential role for councils in supporting its delivery, and includes advice about a recent announcement confirming the transfer of benefit fraud investigation work to a new Single Fraud Investigation Service (SFIS).

Decision Required

2. The report asks members to note the welfare reform impacts paper and agree this should be published online. The report also asks Cabinet to support the council working formally in partnership with relevant other organisations

(including Job Centre Plus and local Department for Work and Pensions - DWP) on a pilot to develop support services in preparation for the introduction of

Universal Credit in 2016.

Background

3. Last May the Cabinet received a report summarising the main implications of the government’s welfare reforms. At that time Cabinet agreed some necessary policy and administrative changes so that our operational arrangements adjusted to help support the reforms. This includes revisions to policies governing the operation of debt management, and the administration of the ‘discretionary housing payment’ scheme – exceptional payments to residents needing further support beyond the limit of housing benefits available. Cabinet also agreed a welfare reform action plan to provide a focus for work over 2013-2014.

4. During 2013-2014 impacts were monitored by a cabinet task group – the Council Tax and Welfare Reform Task Group – under the chairmanship of Councillor Neil Shorter, portfolio holder for core services and resources. The task group met on six occasions supported by several officers from a cross-section of services and attended also by representatives from local DWP/Job Centre Plus (JCP).

5. Two multi-partner workshops were held where representatives from the council (including members), KCC, local registered housing providers, the voluntary sector and local JCP met to discuss impacts, with a particular focus on the next big change; the planned introduction of Universal Credit. The Local Government Association (LGA) supported the first of these two events, which was also

attended by a senior officer from central DWP. The LGA commented that the event showed signs of a positive and encouraging lead by the council on an issue, which apart from the formal national pilots, is not typical of the experience elsewhere.

6. In the early phase a number of impact awareness and mitigation measures were developed to handle greater demand for advice and guidance from residents most affected and reduce the need for greater staff resources. This included introducing self-help customer enquiry technology, and converting two existing benefits and customer services staff posts to pilot two new ‘welfare intervention’

support roles. During the first phase there was intense focus by members and officers on introducing the first local council tax support scheme, reviewing its progress over the year and recommending to Cabinet some revisions to the scheme for the second year. Council tax support schemes replaced the national scheme of council tax benefit with the requirement for councils to agree local schemes, but within lower and fixed levels of funding from government.

7. Given the reforms’ emphasis on seeking to reduce benefit dependency and encourage claimants to seek employment, our work also focused on agreeing a service level agreement with our local JCP partners. The agreement, initially designed by JCP, is aimed at securing an operational focus to support the return to work and jobs growth objectives of the council and JCP.

8. More recently there has been a focus on the future welfare reform impacts given the major change of Universal Credit is still in its design and development phase.

Welfare Reform Impact Paper

9. One year on the impacts of the various welfare reforms coupled with our monitoring of more general local economic impacts for employment levels and benefit caseload have been reviewed by the Task Group. The appended impact paper is a summary of the evidence gathered, including data passed to us from Citizens Advice and local JCP partners.

10. Although it is too early to draw final conclusions the evidence suggests the impacts have been managed successfully, with signs overall of a gradual easing, reflecting the improvement in economic conditions more generally. Of particular note is that long-term unemployment has declined steadily throughout the year. Over the last six months, those claiming Jobseekers’ Allowance for longer than six months decreased by around 12%, with an even larger fall amongst younger people (16-24) where the number was cut by around a fifth. The annual fall has been 20% for all and 33% for young people so slightly more than half for each was achieved in the last six months. This is mirrored by a steady decline in benefit claimant caseload, which reached its highest ever point during 2013.

11. There is one category, however, where pressures remain relatively high and this is the demand for discretionary housing payments (DHP), where councils have received significant grants from government to allocate to claimants who have needs for assistance beyond the limits of housing benefit payments. DHP is now designed by the council for shorter term transitional support, therefore supporting the return to work objectives where this is reasonable . In exceptional instances, however, DHP may continue for longer periods.

Universal Credit The role for councils

12. The plans for Universal Credit (UC) have been well publicised by government, as has the delay. UC is now timetabled for local roll-out starting in 2016. In some small pilot areas elsewhere in the country roll-out is commencing this year, with the emphasis on the North West region.

13. Last December the Welfare Minister, Lord Freud, confirmed councils would have a delivery role in UC and announced further plans to encourage councils to begin planning to develop support roles in partnership with relevant local organisations.

14. Actual processing of UC applications is not a role for councils, as this activity will mostly be performed and verified online, but with back-office processing carried out by DWP. Councils will have a support role in the following areas:

a) Provision of basic advice and information to help someone claim UC b) Online access support

c) Assisted digital claiming

d) Intermediary support, particularly communication aids and complex needs support

e) Financial inclusion

f) Money advice and budgeting support

g) Identifying cases appropriate for alternative payment arrangements (direct payments to landlords)

Why work in partnership from now to pilot the UC support role? 14. The rationale for taking the opportunity now given to create and lead a

partnership focus this year is:-

a) Local government has fought hard for a UC role and this is now agreed by government and set out (in outline) by the Welfare Minister and DWP last year. It makes sense to carry forward the opportunity now, otherwise momentum and the ability for local government at operational level to influence the future shape of UC support may be weakened or lost.

b) With the council on notice to prepare downsizing plans for its housing benefit and customer services operations, and staff aware of the likelihood of some redundancies at some point, there is a responsibility to staff to develop plans at the earliest opportunity. On current UC plans, by late 2015 we can expect the need to serve ‘at risk’ notices.

c) Part of the strategy to minimise the loss of skills and staff is to explore the potential for and develop the UC support; a role that, in part, is likely to build on the current role of our welfare intervention officers.

d) Partnership development and then working with our partners (local

JCP/DWP, KCC, the voluntary sector and registered housing providers) is likely to require some re-engineering of customer support working

arrangements; developing this takes time. A delivery partnership is likely to involve creating efficient and cost effective customer service solutions as we can expect government grant support to be constrained compared to current housing benefit administration grants. We should expect information

technology to play a full part. Again developing the necessary blueprint and then making changes will take time, even though much of the operational change will not be implemented until later in 2015 and early 2016. We should plan to avoid the risk of there being too little time; after all

government would argue that councils have had plenty of time to prepare. e) Working in partnership this year helps reduce the risk that our partners

develop their own plans in isolation.

15. Following consultation with partner organisations and the Task Group the scope for initial partnership work would cover:

a) A welfare advice activity mapping exercise across partner organisations with an emphasis on those benefit types that will be rolled into UC. The purpose of such an exercise would be to identify the type of engagement that

claimants have with our respective organisations, and identify how those interactions are performed.

b) Once evidence is gathered and evaluated then conclusions drawn about the extent to which interactions can be streamlined, improved, and joined up, all with a focus on the potential support role for UC.

c) Conclusions would be expected to lead to proposals to re-engineer how some services are adapted, with conclusions also identifying how IT may best support a future UC support role.

e) Conclusions should identify how claimant self-help can be designed and how communication methods with claimants and across partner organisations should be tailored, particularly for supporting those with more complex needs.

f) Conclusions should help to identify potential development and operating costs, including staff and skills implications. This is important so we can help to inform DWP’s design work from a local perspective.

16. A mapping exercise may need external support, particularly to assess the work of the voluntary and community sector. The CAB has received a ‘transforming service’ grant from government which may assist with this. We would also aim to use the balance of DWP grants available to the council for supporting the welfare reforms.

17. While mapping work and subsequent evaluation is a process activity and should not involve large amounts of effort and resource, managing this through a

partnership will build commitment, maintain focus and develop shared learning. It is equally important to maintain a constructive dialogue with partners on this whole topic, given the time between now and when final announcements about UC implementation locally are expected (late 2015). The partnership would also keep a watching brief on other similar work elsewhere in the country, to ensure we learn from others too.

Single Fraud Investigation Service – transfer of responsibility for benefit fraud investigation to DWP

18. At the time government announced its plans for Universal Credit about three years ago, government also announced plans to transfer responsibility for investigating housing benefit fraud from local authorities to a new ‘single fraud investigation service’ (SFIS) under the control of the Department for Work and

Pensions (DWP). Despite much speculation since it was only recently that councils were informed of the government’s timetable and approach to give effect to the transfer. The transfer affects over 350 local authorities.

Starting with a small number of pilot councils SFIS will begin to be created later this year. Once outcomes are evaluated the full transfer process for all councils will commence later in 2014 and run until March 2016.

19. Meanwhile DWP has requested detailed information about the staff resources each council has that is devoted to housing benefit counter-fraud work.

The council’s counter-fraud team is made up of three posts, though one post is held vacant because of the potential transfer. The counter-fraud team’s work extends beyond housing benefit and includes investigation and prosecution work connected with housing tenancy fraud (on behalf of and charged to the HRA), the council tax support scheme, and will soon expand into investigating business rates issues on a larger scale. Cabinet, the Audit Committee and Management Team have previously supported the further development of our counter-fraud work to cover other activities including supporting other services’ enforcement work (for example licensing).

20. DWP has informed councils that any transfer of staff will be made through a statutory instrument and not under the normal Transfer of Undertakings regulations (TUPE). However it is also understood, though not confirmed, that DWP will not force a transfer where councils wish to retain staff, but will require workload transferred. Councils can anticipate grant funding to be cut once the transfer of responsibility takes effect, regardless of whether staff are transferred or not. The proposed form of transfer is not wholly supported by the LGA, and is contested by Unison. Consultation has now closed; the council has responded with a response supporting the LGA’s view. Further, Councillor Shorter (portfolio holder) after consulting the Leader, has sent a letter to the welfare minister, Lord Freud, questioning, not the SFIS concept as such, but the apparent absence of a commitment to co-operate with councils where multi-fraud types arise (note councils will continue to investigate council tax support fraud, often this is coupled with housing benefit fraud). At present co-operation operates and is effective for both parties and the taxpayer generally. Our representations seek a commitment for joint co-operation to be a formal commitment within the SFIS framework

Next Steps

21. Assuming the recommendations are agreed it is proposed the Council Tax and Welfare Reform Group continues to monitor impacts. Further, the Task Group could oversee the formal partnership work undertaken in respect of UC, and also monitor the position of the SFIS transfer. When a definitive date is set for this

council's transfer to SFIS and the detailed implications known a further report to Cabinet will be submitted.

Contact:

Paul Naylor, Deputy Chief Executive

Welfare reform – Impacts report

Presented to cabinet 8th May 2014

This report provides an overview of how the council has worked to support the principles behind the government’s welfare reforms.

The government’s changes were implemented at a time of national austerity. Therefore, the

report must be considered firmly in its strategic context, and the now improving economic

situation, to be interpreted appropriately.

As early as the summer of 2012, council officers began working together to look at the

potential impacts (on both our residents and our own services) of the introduction of these

reforms. Their work has been informed by also working with the Council Tax and Welfare

Reform Task Group, Jobcentre Plus and the Citizen Advice Bureau, among others. Members will appreciate that this is not just about administering reductions in housing

benefit. Work around welfare reform has related closely to work on job growth and the

availability of social housing, as well as debt management advice.

Members are asked to note the contents of the report and the early conclusions drawn.

RETURNING TO WORK

INDIVIDUAL RESPONSIBILITY

EARL

Y INTER

VENTION

COUNCIL TAX SUPPORT

HOUSING OPTIONS

PARTNERSHIP WORKING

ARREARS

DEB

T

BUDGETING

2 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

Introduction

As a council we have been very proactive in working on the government’s welfare reform agenda from an early stage. From the outset we have supported the principles behind the government’s changes and have closely monitored all relevant service areas to ensure that we have been able to:

• Support residents

• Modify our services (such as in the introduction of two intervention officer posts and changes in our homelessness approach)

• Provide additional support to the Citizen Advice Bureau This information is presented to members to share the early impacts of the coalition government’s welfare reforms and to demonstrate that while it may be too early to accurately assess the impacts fully, there is an indication that from our perspective welfare reform is under control, but is something we must retain a keen focus on.

The full impact of these changes will only become apparent in time. For example, it has taken eight months from the introduction of council tax support for someone to be taken to court for non-payment, given the more measured approach we have taken

towards debtors specifically affected by the first year of the localised scheme. Therefore, with other changes being introduced or delayed, it will be the summer or even beyond that where we begin to see meaningful trends.

Also, these statistics and figures about welfare reform cannot be viewed entirely in isolation. The economic situation across the country appears to be improving and so the reduction in numbers of people in receipt of benefits, for instance, may not solely be attributable to the welfare reform changes.

However, these figures, including statistics from Jobcentre Plus that show how many people are claiming jobseekers’ allowance (JSA), and illustrative graphics, are provided with some commentary that will hopefully guide and inform you as to where the council, and our affected residents, are at the current time with the changes that have been made.

Obviously further changes are being introduced in due course. The headlines about welfare reform to date though are below:

Council tax support

• The council is paying less benefit than under the previous scheme to working-age people, incentivising work – this may be an obvious statement but it is an important point

• The impact has been negligible on our collection rates – we are on target for a collection rate in excess of 98% for this financial year, which is what was achieved in the last financial year

“

Our work has

“

been consistent

with the changes

driven by the

3

• Generally speaking the 8.5% reduction in support for people of working age (in the 2013-14 scheme) and the 5% reduction for those claimants who are non-residential carers or who are disabled was manageable and we anticipate that the 10% reduction in the 2014-15 scheme will also be • The introduction of council tax support has caused fewer negative

impacts than the council anticipated

Discretionary housing payments (DHP)

• The council was given a much bigger budget this year by central

government, to account for the anticipated increase in applications as a result of the welfare reform changes and the council has assessed each application carefully and has broadly spent in proportion to the budget it has received

• The budget allocated to us appears to have been about right, with DHP plugging the gap for benefit cap and under-occupation cases where otherwise there may have been a shortfall (in rent payments, for example) • We are now approaching the point of renewal on many of the cases in

which DHP has been awarded, so it is too early to determine whether those applicants have been able to gain employment or resolve their housing situation in that time – there have been some second awards but the full impact will become more evident in the coming months

• There has been and continues to be a resource implication for the council team that deals with DHP applications

• DHPs have been a positive thing for the council in order to mitigate against the threat of homelessness or a dramatic fall in the collection of council tax etc

• The welfare reform intervention officers (WRIOs) will continue to engage with people after their DHP awards have lapsed

Housing

• An initial increase in the use of temporary accommodation, which coincided with the introduction of welfare reform changes, has now reduced, as a result of some effective changes implemented by the housing options team

• This coincided with a 78% increase in approaches to the council for advice (reported to cabinet in July 2013)

• Rent arrears have reduced as a result of early intervention by officers and the ongoing support of the welfare reform intervention officers

• Mutual exchanges increased slightly as tenants sought to resolve their under-occupancy situation

Welfare reform intervention officer (WRIO) work

• The WRIOs have helped over 200 people

• Higher utility bills may cause higher levels of debt

• There are occasions when customers will not engage with the WRIO team and it is only when they have received notice to seek possession or when a bailiff is on their doorstep that they will engage

Our work has

been consistent

with the changes

driven by the

government

“

It is still too

“

early to accurately

assess the true

impact of the

changes

4 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

Discretionary housing payments (DHPs)

In addition to the information provided in the introduction to this report, the team that assesses these applications took a random sample of 20 received, specifically to check and consider the levels of debt in those households applying for DHP.

Of this sample, nine households declared debts on their application forms, which made a combined total of £15,856.04 (an average debt of £1,761.78 per household).

These debts were to payday lenders and credit card providers – the figures do not include any debts to utility companies.

None of the 20 households checked had any savings. As a result, even the smallest problems, such as the washing machine breaking down or car repair bills, can place families in a very difficult financial situation and with no alternative but to use the high-interest loans from payday lenders that are

all too readily available.

DHP benefit cap cases

Since July 2013 Ashford Borough Council has applied the benefit cap to 57 households. This is something that the council has to do on instruction from the Department for Work and Pensions (DWP) that an individual or a family are exceeding the maximum entitlement limit.

Of these 57, in 25 cases DHP has been awarded, totalling £23,734 (an average award of £950 per household). A further seven applications have been refused.

Due to the cap being implemented in July 2013 in Ashford, we are only now at the point where we may begin to receive repeat claims. Awards have usually been for six months or lump sum awards. At this stage we do not have enough information to identify a trend.

“

Their debts

“

were to payday

lenders and credit

card providers

Figure 1. DHP in 2013-14DHP expenditure 2013-14

Fund £199,777 Net Paid £176,150 Committed £15,892 Unallocated £4,734 Total applications 760 Total awards 3815

Examples

Miss X, a lone parent with three children

Miss X was previously placed by the council in bed-and-breakfast (B&B) accommodation before she was housed in June 2013 in short-term

accommodation, where she is currently charged rent of £262.50 per week. She is in receipt of income support, child tax credit and child benefit. Her housing benefit entitlement is capped at £208.74, leaving her £53.76 to pay towards her rent. Since moving from B&B Miss X has had to purchase a number of white goods and other household items. With no other access to credit, these have been purchased through a high-street based pay-weekly goods provider and are being repaid at £30 per week. Miss X also has a payday loan, which is being repaid at £10 per week. She has ongoing deductions from her income support entitlement for a social fund loan and deductions are also being made for water rates arrears. DHP of £53.76 is being paid weekly to ensure Miss X is able to sustain her tenancy and provide a secure environment for her three children who are all under six years of age.

Mrs Y, a student with five children aged two to 13

Mrs Y currently rents a four-bed property with a rent of £850 per month. The local housing allowance rate is £219.23 per week for a four-bed property but the rent charged, £196.15 per week, is less than the market rent. However, due to income from child tax credit and child benefit Mrs Y has £44.88 to pay towards her rent due to the benefit cap. As her children are young it is unlikely that Mrs Y will be looking for employment at present. She has no savings and has borrowed money from a friend, which she is trying to repay. Mrs Y is currently being supported by DHP to ensure her tenancy is sustained so she can provide a stable environment for children in a property that is suitable and at a reasonable rent for the household. If the family were to be evicted the weekly cost for B&B accommodation would be £665 per week, of which £116 would be paid by housing benefit, leaving £549 to be picked up by the council.

Mr Z and Miss Z, a couple with six children

They are currently renting a council property with a rent of £105.67 per week. Due to the benefit cap they only receive the minimum housing benefit payment of £0.50, leaving £105.17 of their rent for them to pay. Mr Z is hoping to start his own business and is seeing advisers from the DWP with a business plan and applying for a start-up grant, but has to pay for public transport to Canterbury to see the advisors. Mr Z currently has over £1,000 water rates arrears and is paying these at £10 per week deducted from his JSA. Deductions from JSA are also being made for the TV licence and fine – where there is £300 owing. Mr Z has two payday loans that are being repaid at £10 and £15 per week. With no savings or access to credit, household goods have been purchased from a high-street based pay-weekly goods provider at £47 per week. DHP of £680 has been awarded since October 2013 to support this family.

6 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

Localised council tax support (CTS) scheme

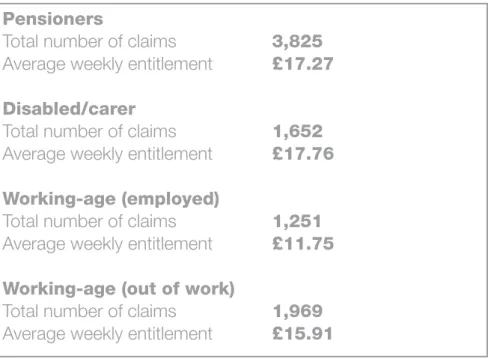

As at year-end (31st March), CTS awarded in the 2013-14 financial year was £7,470,183 (this compares to £7,897,983 in respect of council tax benefit in 2012-13), so a reduction of £427,800. Expenditure in the past quarter has fallen slightly due to a continued drop in caseload. CTS caseload at year-end stood at 8,697 (breakdown shown below in Figure 2), and the expenditure for the year was slightly better than forecast. This would be slightly better than the original forecast. For comparison, this compares to a Council Tax Benefit caseload of 9,012 a year ago, i.e. as at 31st March 2013.

In terms of the impact ‘on the ground’ for customers, the majority (about 72%) of the 2,500 CTS claimants who were being asked

to pay council tax for the first time in 2013-14 have been making payments – some as a result of reminder letters sent to them.

As a result of no payments being made despite a number of reminder letters being sent, on 4th September 2013 a total of 691 CTS customers (about 28% of the total CTS claimants being asked to pay for the first time in 2013-14) were referred to the two bailiff companies we use for council tax enforcement (but in this instance they would act in the capacity of debt collection agencies, not bailiffs) in order to try to prompt payments.

£427,800

The

reduction

in CTS

awarded

in 2013-14

compared

with

2012-13

PensionersTotal number of claims 3,825

Average weekly entitlement £17.27 Disabled/carer

Total number of claims 1,652

Average weekly entitlement £17.76 Working-age (employed)

Total number of claims 1,251

Average weekly entitlement £11.75 Working-age (out of work)

Total number of claims 1,969

Average weekly entitlement £15.91

Figure 2. Breakdown of CTS claimants caseload as at 31st March 2014

7

This work was completed in early November with the following collection results:

Bailiff A

358 cases issued

191 accounts returned to ABC with no contact / no arrangement made 2 gone away

89 paid in full direct to ABC / returned at our request 64 paid in full to bailiff

12 have an arrangement

Bailiff B

333 cases issued 1 gone away

63 paid in full direct to ABC / returned at our request 56 paid in full to bailiff

53 cases have an arrangement in place

9 cases have broken arrangements with no subsequent contact 144 still have made no contact or payment

7 cases have made contact but no payment

In summary, this resulted in a collection percentage for Bailiff A of 24% and 32% for Bailiff B. Following this, in December 2013 a total of 566 summonses were issued to CTS claimants who had not made any payments (this number represents about 1 in 10 of those affected by the changes). This action prompted payments from some CTS claimants, and on 24th January 2014 a total of 412 liability orders were obtained from the court in respect of CTS claimants who had not made any payments. Recovery action is now under way in respect of these customers – the most likely recovery method will be a reduction from their benefit entitlement.

72%

of first-time payers are paying95%

The level of protection for disabled/non-residential carers)

10%

The reduction in CTS for 2014-1528%

of first-time payers are notpaying

8,697

Total

caseload

8 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

2014-15 CTS scheme

In terms of the CTS scheme for 2014-15 financial year, the working-age

reduction is 10% (which is lower than the 17.5% previously agreed for 2013-14 and 2014-15 but higher than the final 8.5% that was set for 2013-14 with the help of transitional funding from the government). Partial protection for disabled persons and carers remains at 95%. Pensioners will remain protected from any reduction.

Again, the scheme protects those who are genuinely likely to find it more difficult to return to work – as stated, those with a disability. Indeed, the council remains the only authority in the county to offer disabled people additional support. However, the guiding principle of the government – that those people of working age should be incentivised to return to work if they are able to do so – is one that the council supports strongly, and has adopted in its approach.

Other housing benefit reforms

The benefit cap was introduced from 15th July 2013. In the latest scan from the DWP, we now have 57 households identified as being affected by the cap. The social size criteria restriction for social housing tenants was introduced from 1st April 2013 onwards. We currently have 645 households affected by this restriction, in either local authority properties or housing association properties. An exemption to this restriction recently came to light and as a result 48 households (of the 645) are in fact exempt from the restriction from 1st April 2013. However, this is only a temporary reprieve, as from 3rd March 2014 onwards these 48 households will once again be subject to the restriction as the government has amended the legislation.

9

welfar

e r

eform intr

oduced on 01/04/2013

Housing benefit more generally

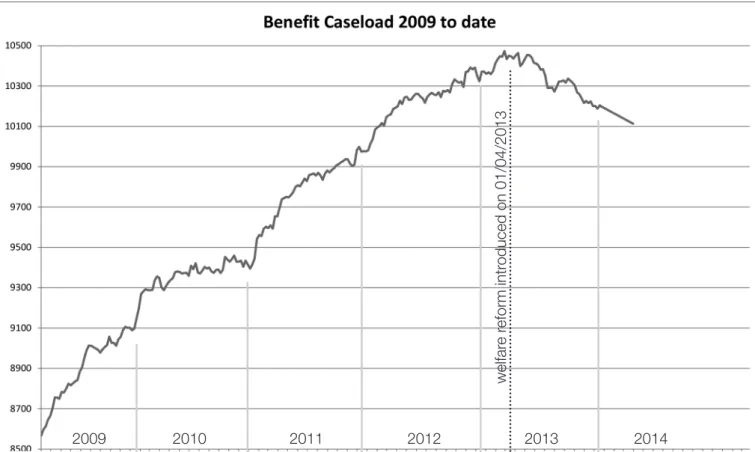

Figure 3 shows clearly the council’s caseload (note, this is not necessarily the same as expenditure as some of these applications will be turned down. However, it gives an indicative view of the increase and decrease in claims. This may be for reasons relating to welfare reform, the economic downturn and recovery, and possibly where people who were in receipt of housing benefit but not in work have been assessed as fit to work and are no longer in the council’s caseload numbers).

2009 2010 2011 2012 2013 2014

10 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

Homelessness and housing options

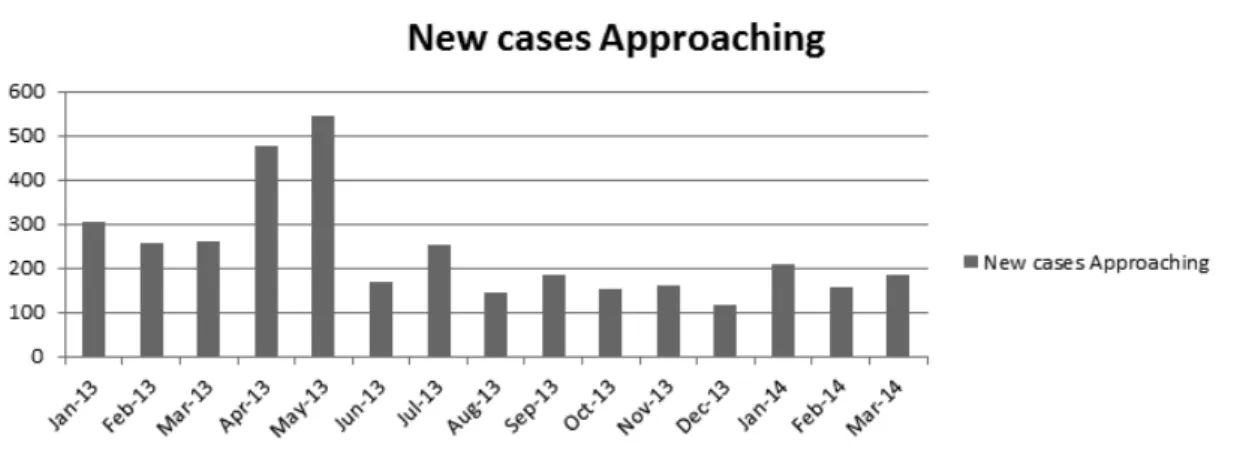

Figure 4 shows the number of households in B&B accommodation. It can be seen that the number peaked in August 2013 at 40 households. However, the action plan presented to members at cabinet in July 2013 to address this pressure has been put into place and numbers have reduced significantly to 19 households as at the end of December 2013. This is lower than the same time last year. This can be attributed to the actions taken by the team to prevent homelessness and to take a robust approach in dealing with applications as well as the success of the social lettings agency (ABC Lettings) and the council’s other proactive work with private landlords. Figures 5 and 6 show the figures and trends in numbers approaching the homelessness / housing options service. As can be seen there was a sharp rise in numbers in April and May, which caused a significant pressure on the service and contributed to the higher numbers in B&B accommodation as the housing options officers struggled to cope with the number of people presenting as homeless.

Figure 4. Numbers in B&B accommodation 2013-14 compared with 2012-13

Figure 5. Numbers approaching the council as homeless in the 2013-14 financial year

Numbers approaching from March

2013 to March 2014 Oct Nov Dec Jan Feb Mar Daily Face to Face Appointments 26 14 8 29 24 20 Home Visits 113 54 39 43 30 45 Housing Options Telephone Triage 154 159 115 209 157 184 Numbers approaching from March

2013 to March 2014 March April May June July Aug Sept Daily Face to Face Appointments 34 67 42 47 38 39 23 Home Visits 0 63 55 50 45 37 64 Housing Options Telephone Triage 261 478 545 169 253 145 186

11

The numbers here relate to all homelessness and cannot be attributed solely

to welfare reform. However, often affordability is a key issue and the causes of homelessness are complex. We have reviewed our approach and offer all those approaching us for the first time a telephone triage appointment, which enables the team to identify the priority cases more readily and deliver quick turn round advice. This in turn has allowed time for the officers to undertake home visits during which they can conduct much more thorough assessments and understand the household’s position more quickly. These measures currently seem to have brought numbers back under control.

Figure 6. Numbers approaching the council as homeless in 2013 (trends illustrating the figures in Figure 5) 0 100 200 300 400 500 600

March April May June July Aug Sept Oct Nov Dec

Daily Face to Face Appointments Home Visits

Housing Opons Telephone Triage

Jan Feb Mar

0 100 200 300 400 500 600

March April May June July Aug Sept Oct Nov

Daily Face to Face Appointments Home Visits

12 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

The number of households approaching us as threatened with homelessness seems to have stabilised in the second half of 2013-14, as can be seen clearly from Figure 7 and Figure 8. This, together with the robust approach in dealing with applications, had reduced numbers to 19 in B&B accommodation as at the end of March.

At the time of writing (14th April) the numbers in B&B have reduced further to 12 households. This indicates that the investment in the prevention of

homelessness and the decisions taken by cabinet, on officer recommendation, are working.

Month Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 New cases

Approaching 303 258 261 478 545 169 253 145 Month Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14

New cases

Approaching 186 154 159 115 209 157 184

Figure 7. New homelessness cases approaching the council

13

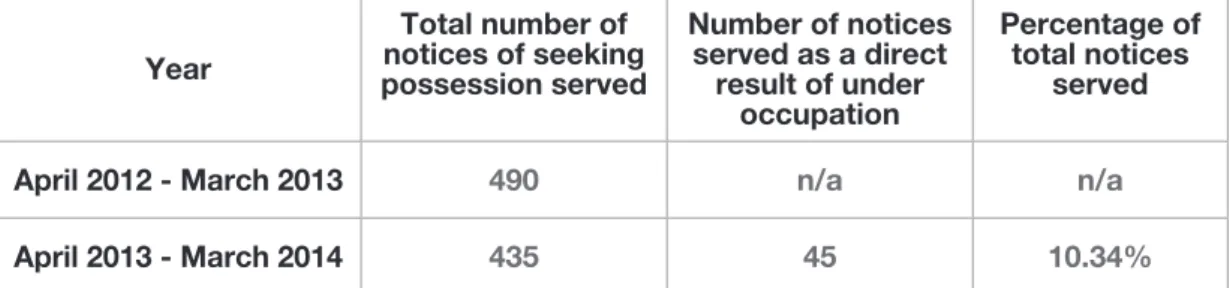

Rent arrears

Year Total number of notices of seeking possession served Number of notices served as a direct result of under occupation Percentage of total notices served April 2012 - March 2013 490 n/a n/aApril 2013 - March 2014 435 45 10.34%

Figure 9. Notices seeking possession of council properties in 2012 and 2013

Figure 9 above gives the total number of notices seeking possession that were served by the council in 2012-13 and 2013-14. They demonstrate a significant drop in 2013-14, particularly when excluding the notices served only for the impact of welfare reform in that period.

The figures show that early intervention, which has been one of the council’s key messages and aims, can prevent arrears accruing and saves our tenants the worry of having the threat of court action hanging over them, along with the instability that can bring to their household.

Council officers were proactive in their work before April 2013 and anticipated the potential issues. Indeed the council’s cabinet members’ decision to appoint two Welfare Reform Intervention Officers, whose successful work is detailed later in this report, has been beneficial to all.

The council’s ongoing diligence in ensuring that those affected by welfare reform are given relevant advice at the earliest opportunity has been instrumental in helping us achieve the figures you see here.

Date Total rent arrears > £0.01 Number of tenants in arrears June 2012 £425,838.90 1,688 Sept 2012 £466,408.90 1,727 Dec 2012 £374,191.65* 1,476 Mar 2013 £420,207.62 1,413 Jun 2013 £495,960.28 2,027 Sept 2013 £530,913.66 2,047 Dec 2013 £394,548.40** 1,692 March 2014 £308,022.42 1,257

14 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

Historically, arrears outstanding are always at their lowest in the first week of January, following the period with the two rent free weeks. So, the December 2012* and December 2013** figures shown in Figure 10 are key.

The number of tenants in arrears has increased year on year but the average amount owed per tenant has decreased. However, the March 2014 figures shown here are dramatically lower than any previously presented to the Task Group and represent the result of several key factors:

• There was an extra rent free week at the end of March, which may not have registered so keenly with many of our tenants as the Christmas ones do

• Forty-one of our tenants who had been resident at their current address since 1st January 1996 and who had been in continuous receipt of housing benefit, qualified under the DWP loophole and were eligible for backdated housing benefit awards

• Most significantly, many of our tenants were awarded bulk DHPs, some of more than £2,000,

towards their rent arrears in the final weeks of the financial year

The last bullet point is most definitely a one-off statistic and does not conclusively reflect the ability of tenants to pay their rent following changes brought about by welfare reform.

Figure 11 shows comparative rent collection rates. These figures represent rates of collection for current rent and all charges (service, heating, supporting people, cesspool and cleaning) but do not include rent arrears brought forward. Rates of collection for December 2012-13 and 2013-14 are exactly the same. End of year figures will be available for a subsequent report.

In March we submitted one court application for rent arrears caused solely by the introduction of the under-occupation

charge but we have not evicted anyone solely for under-occupancy.

It is worth noting that, for the financial year 2012-13, six tenants were evicted for rent arrears. In 2013-14, 16 tenants have been evicted. This is a marked increase but, as mentioned above, no evictions have taken place solely for under-occupation and, therefore, it is reasonable to assume other factors are determining our tenants’ ability to pay.

At 31st March 2014, 113 households had mutually exchanged homes in the financial year 2013-14 compared with 104 for the financial year 2012-13. This is not a major increase but 75 of the 113 exchanged within the first six months, which may suggest an initial reaction to the changes brought about by welfare reform and advice offered by housing staff.

“

“

No one affected

solely by

under-occupancy has

been evicted

DATE COLLECTION RATE June 2012 ... 98.66% September 2012 ... 98.89% December 2012 ... 99.70% March 2013 ... 99.91% June 2013 ... 99.01% September 2013 ... 99.22% December 2013 ... 99.70%

Figure 11. Collection rates for council rent

15

Welfare reform intervention officers’ report

(July 2013 – March 2014)

The council introduced two Welfare Reform Intervention Officers (WRIOs), Paula Wright and Tracey James (both internal posts), at the beginning of June 2013. They have been able to mitigate the impact of welfare reform through targeted interventions with those customers who are affected and willing to engage. They offer practical advice and, where possible, try to encourage people to return to work or increase their working hours.

They continue to make all reasonable attempts to contact all customers who have not yet spoken to the council about their unpaid debt.

Caseloads

Since July 2013 the WRIOs have been involved with 300 cases. These cases can be categorised into the following groups:

• Under occupation 122

• Council tax support 42

• Benefits cap 65

• Universal credit 1

• Other 70

One hundred and eleven of these cases have had an associated application for discretionary housing payment (DHP) involved, with which the WRIOs have assisted the applicant.

16 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

Examples – positive

Example – negative

Referred by benefits officer as affected by the benefit cap

The customer received an eviction notice and called the WRIO team. A DHP application was completed and an arrangement made regarding council tax and rent. The resident agreed to face up to and sort out numerous other debts. They are in arrears on their rent account (though this is less than it was at the start of intervention work). Council tax arrears are decreasing. They were awarded a DHP of £1,000 to clear the majority of the arrears to prevent eviction and £60 per week for 13 weeks to help get themselves sorted. The customer has asked Jobcentre Plus to consider a fork-lift truck refresher course for an agency job that is available. They will also attend a one-day workshop with the Chamber of Commerce about starting their own business.

Referral from housing services due to rent arrears

Customer, female, age 57, lives in a two-bedroom property but only has a one-bed need and has to pay council tax for the first time since 1st April 2013. The rent arrears at the start of intervention work on 30th July was £296.37. The rent arrears by the week ending 30th October was £509.04. Initially the lady engaged with the WRIO and was provided help in applying for DHP. The application was declined due to excess income and the customer did not then pay any weekly due rent or anything towards their arrears. They then stopped engaging with the WRIO and now owe £171.53 council tax, for which they have been summonsed, for the current financial year and the rent arrears stand at £585.23.

Referral from housing services due to rent arrears

Rent arrears at start of intervention (8th July) was £490.58. By the week ending 30th October they were £12 in credit. The resident applied for DHP and was awarded £30 per week for 26 weeks. Following advice to increase their working hours, the customer now qualifies for working tax credits, which provides them with the ability to afford their rent and council tax without any DHP assistance or housing benefit. The customer now has direct debits set up for both rent and council tax. This customer has actively engaged with the WRIO from the first day of contact and is also engaging with the Citizen Advice Bureau to reduce debt and manage their own financial affairs.

17

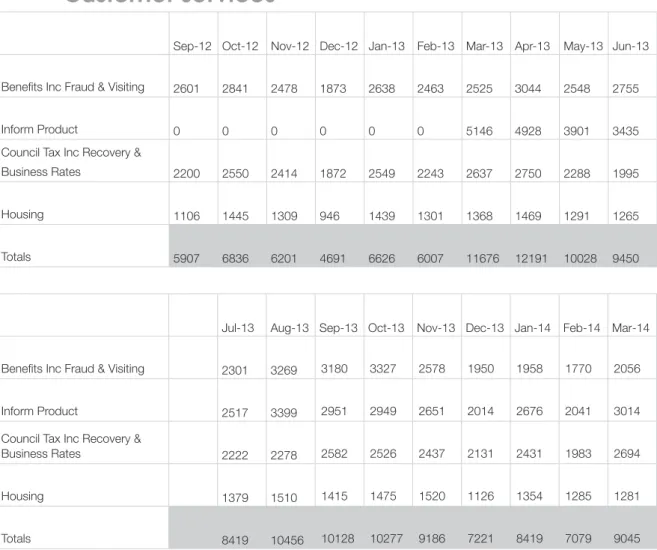

Customer services

Although it is not possible to determine what each query relating to council tax and benefits relates to, Figure 12 does provide a snapshot of the level of interactions the council has had on welfare reform-related subjects. You will also note that the council’s Inform self-service phone facility product, where customers can receive information through the automated phone facility by entering a specific ‘hot key’ number (this service was promoted through leaflets and the press) has handled thousands of calls. This is an accurate number of people being helped by the automated service, and does not include occasions where people hang up on the system.

The numbers listed as having their calls resolved by Inform relate to all people who contacted the council using the automated line about money matters, not specifically welfare reform alone. However, the numbers will include those who have called about DHP, rent etc

Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14

Benefits Inc Fraud & Visiting 2301 3269 3180 3327 2578 1950 1958 1770 2056

Inform Product 2517 3399 2951 2949 2651 2014 2676 2041 3014

Council Tax Inc Recovery &

Business Rates 2222 2278 2582 2526 2437 2131 2431 1983 2694

Housing 1379 1510 1415 1475 1520 1126 1354 1285 1281

Totals 8419 10456 10128 10277 9186 7221 8419 7079 9045

Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13

Benefits Inc Fraud & Visiting 2601 2841 2478 1873 2638 2463 2525 3044 2548 2755

Inform Product 0 0 0 0 0 0 5146 4928 3901 3435

Council Tax Inc Recovery &

Business Rates 2200 2550 2414 1872 2549 2243 2637 2750 2288 1995

Housing 1106 1445 1309 946 1439 1301 1368 1469 1291 1265

Totals 5907 6836 6201 4691 6626 6007 11676 12191 10028 9450

Figure 12. Callers/visitors to the council/Gateway by query (including those who used the Inform self-service phone facility product)

18 ashford.gov.uk • twitter.com/ashfordcouncil • facebook.com/AshfordBoroughCouncil

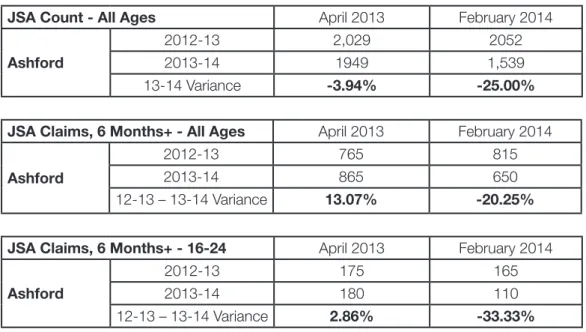

Jobseekers’ allowance (JSA)

The figures below show the number of people claiming JSA in Ashford. Again, while there may be other factors attributable to the variation in figures, such as an improved economic situation, the figures do show that the number of people claiming JSA in Ashford is falling.

JSA Count - All Ages April 2013 February 2014

Ashford

2012-13 2,029 2052

2013-14 1949 1,539

13-14 Variance -3.94% -25.00% JSA Claims, 6 Months+ - All Ages April 2013 February 2014

Ashford

2012-13 765 815

2013-14 865 650

12-13 – 13-14 Variance 13.07% -20.25% JSA Claims, 6 Months+ - 16-24 April 2013 February 2014

Ashford

2012-13 175 165

2013-14 180 110

12-13 – 13-14 Variance 2.86% -33.33%

Figure 13. Numbers claiming jobseekers’ allowance and the difference between the 2012-13 and the 2013-14 financial years

These statistics give you a comparison of how many people were claiming JSA in the 2012-13 and 2013-14 financial years. Principally they show: Interestingly, when the figures are broken down a little further, Jobcentre Plus work to reduce the number of unemployed people aged 18-24 in Stanhope has worked. A reduction in 11% has been achieved in that ward.

However, in Ashford as a whole between April 2012-13 and February 2013-14 there has been a:

Long-term unemployment has declined steadily throughout the year. Over the last six months, those claiming Jobseekers’ Allowance for longer than six months decreased by around 12%, with an even larger fall amongst younger people (16-24) where the number was cut by around a fifth.

25%

reduction in people claiming JSA20%

reduction in people claiming JSA for more thansix months

33%

reduction in people aged 16-24 claiming JSA for more than19

Citizen Advice Bureau (CAB)

The council is currently promoting the CAB’s debt advice management service, which we are helping to fund.

The service is promoted as offering independent advice that is available to people who do not want to talk to someone from the council about debt issues.

Below are figures from the CAB regarding approaches to them about debt, housing and welfare benefits from late September 2013 until February 2014. The statistics from the CAB below provide an indication of demand. The CAB operates as a drop-in at the Ashford Gateway or on the basis of referrals from our WRIOs.

Debt cases 318

Housing Benefit cases 161

Rent arrears cases 182

Negotiation re remain in private 127

sector accommodation cases

Mortgage arrears intervention/mortgage rescue cases 151

At the moment, the approximate timescale for dealing with referrals is one working day, as the helpdesk is checked at least once a day.

Also, the approximate timescale for providing appointments is currently three working days. There may be a slight delay over the Easter holiday closure, however.

All clients are offered follow-up appointments within ten working days and where clients provide all necessary documents, financial statements are produced within seven working days after the financial assessment interview. Taking data from its September 2013 to November 2013 and from its

December 2013 to February 2014 reports there is an increase in PIP cases, Fuel debts, overpayments of housing benefit and council tax support, debt relief orders and bankruptcy cases.