CREDIT UNION TRENDS REPORT

Full text

Figure

Related documents

Heritage Family Credit Union offers Home Equity Loans and Home Equity Lines of Credit (HELOCs) to our members at super-competitive rates.. Do you know the difference between

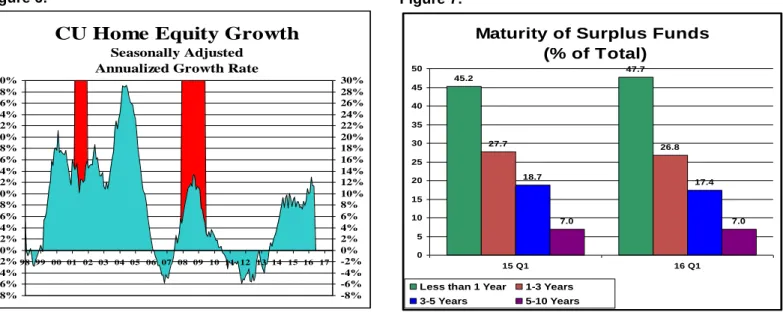

However, credit union home equity loan balances grew at a 7.6% seasonally-adjusted annualized growth rate in March, see Figure 6, due to rising home prices, the improving job

loan interest rate with automatic deduction payments from any Webster Checking account Home Equity Credit Lines. A home equity line of credit 2 is a

Choosing the right home equity product 4 Citizens Bank home equity products at a glance 5 Choosing a fixed rate or variable rate 7 Qualifying for a home equity line of credit or

(M) THE LOAN MAY NOT CLOSE BEFORE 12 DAYS AFTER YOU SUBMIT A LOAN APPLICATION TO THE LENDER OR BEFORE 12 DAYS AFTER YOU RECEIVE THIS NOTICE, WHICHEVER DATE IS LATER; AND MAY

(6) IF THE PRINCIPAL BALANCE UNDER THE LINE OF CREDIT AT ANY TIME EXCEEDS 50 PERCENT OF THE FAIR MARKET VALUE OF YOUR HOME, AS DETERMINED ON THE DATE THE LINE OF CREDIT

(6) IF THE PRINCIPAL BALANCE UNDER THE LINE OF CREDIT AT ANY TIME EXCEEDS 50 PERCENT OF THE FAIR MARKET VALUE OF YOUR HOME, AS DETERMINED ON THE DATE THE LINE OF CREDIT

1001, at SE.; (2) the loan requested pursuant to this application (the “Loan”) will be secured by a mortgage or deed of trust on the property described herein; (3) the property will