Oil Price fluctuations and it impact on Economic Growth: A DSGE approach

Full text

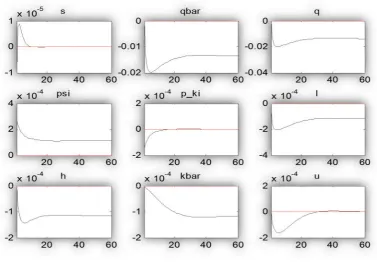

Figure

Related documents

Impact of Oil Price Shocks on Output, Inflation and the Real Exchange Rate: Evidence from Selected ASEAN Countries. (2013), « Time-Varying Effects of Oil

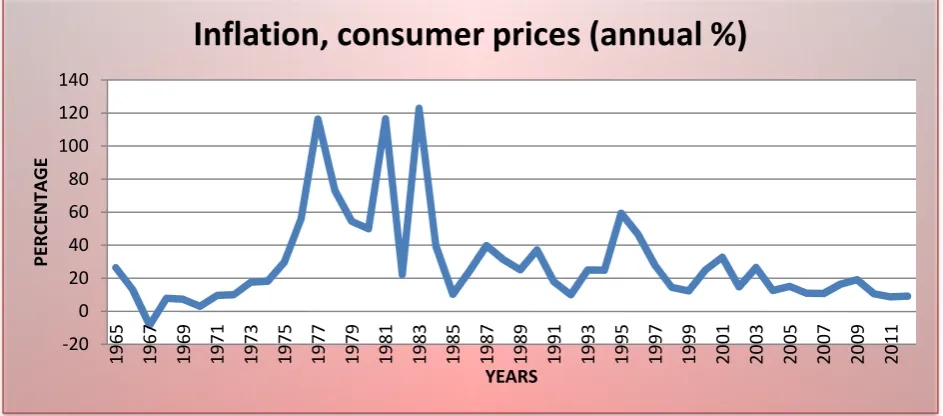

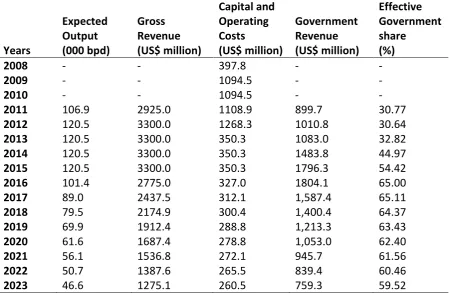

The result shows that oil price volatility (OPV) has negative effect on the economic growth while other variables such as crude oil price, oil reserves and oil revenue have

Interestingly, both oil supply and demand shocks have a negative (i.e., appreciating) effects on the real exchange rate of South Korea, while a positive global demand shock causes

On the other hand, if exchange rate increases (positive) and economic openness is negative, then RGDP will be negative because increased exchange rate will result in

Granger causality tests (Table 7) show that the oil price negative variations (VBN) and the oil price net decreases (VBN4) cause the log difference of money market rate (MMR)

Findings further show that oil price shock and appreciation in the level of exchange rate exert positive impact on real economic growth in Nigeria.. The paper recommends

The regression results also show that total number of staff, total number of members, ratio of microenterprises credit, total assets, total loan, total deposit and broad money

Indeed, the supply shock contributes to the fluctuation in the rate of real GDP growth between the first to the fourth period, while that from the latter the effect exerted by