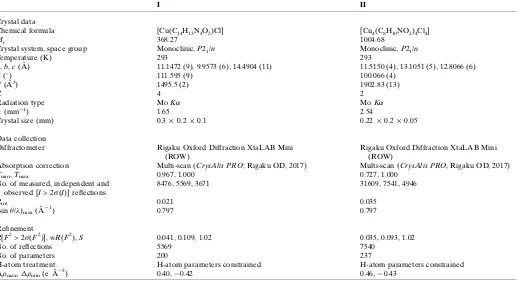

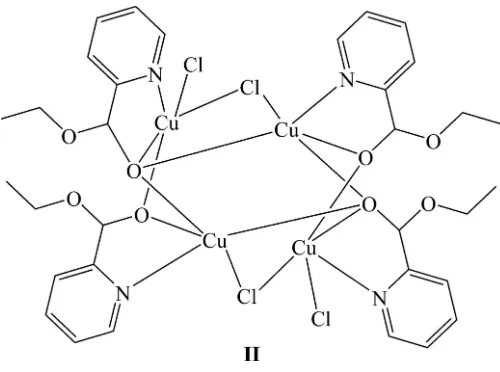

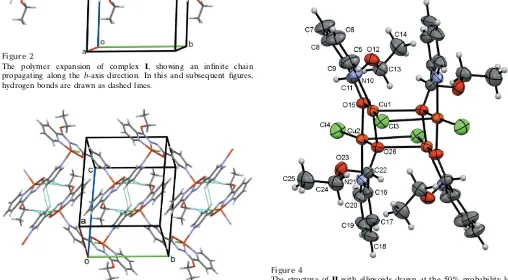

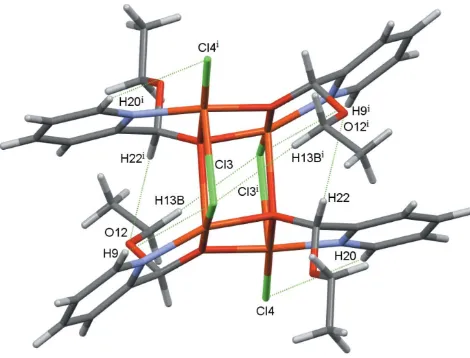

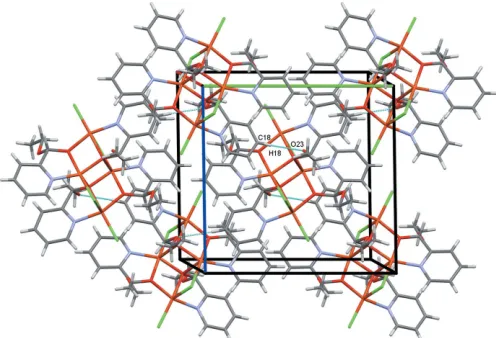

Crystal structures of two CuII compounds: catena poly[[chloridocopper(II)] μ N [ethoxy(pyridin 2 yl)methylidene] N′ [oxido(pyridin 3 yl)methylidene]hydrazine κ4N,N′,O:N′′] and di μ chlorido 1:4κ2Cl:Cl 2:3κ2Cl:Cl dichlorido 2κCl,4κCl bis[μ3 etho

Full text

Figure

Related documents

A dual for a nonlinear programming problem in the presence of equality and inequality constraints which represent many realistic situation, is formulated which uses Fritz

Preliminary Experience with Stent-Assisted Coiling of Aneurysms Arising from Small (<2.5 mm) Cerebral Vessels Using The Low-Profile Visualized Intraluminal Support Device..

Although there is no doubt that China signed an international treaty with Russia during the Kangxi emperor Period of Qing dynasty, careful consideration reveals that it was

In our study, 32 patients by MRCP and 26 patients by ERCP were detected to have dilated bile ducts that could not be explained by any ob- structive pathology such as stones or

the response to the question: “Approximately what portion of your firm’s IT budget is devoted to cybersecurity related activities?” IC refers to the level of (dis)agreement to

context of subsidy, the final distribution of the benefit of a subsidy does not depend on who actually receives the subsidy [4]. The tax and subsidy equivalence theorem is

4,7,9 When FLAIR images were compared with catheter angiograms obtained in ⬍ 6 hours of the MR imaging acquisi- tion, FVHs were noted in areas of retrograde leptomeningeal

The study results show that there is the peer effect as listed companies in the same industry make unrelated M&As deci- sion and the M&As experience of company and