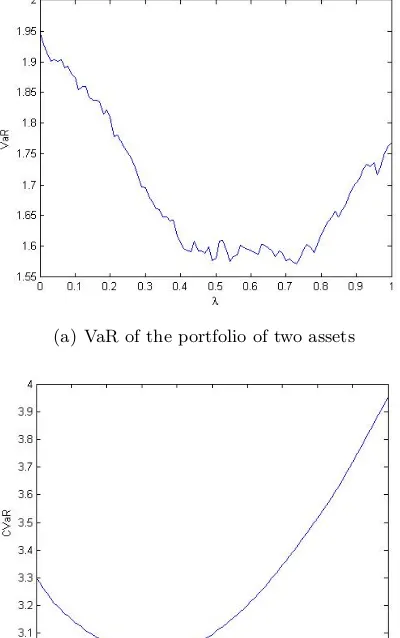

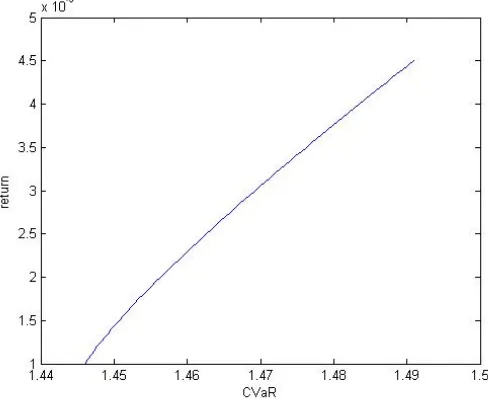

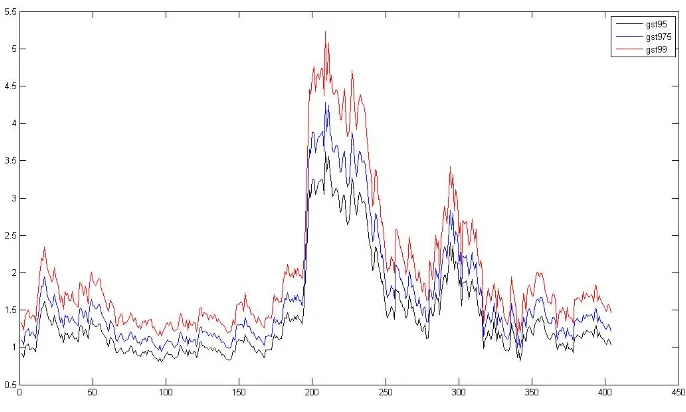

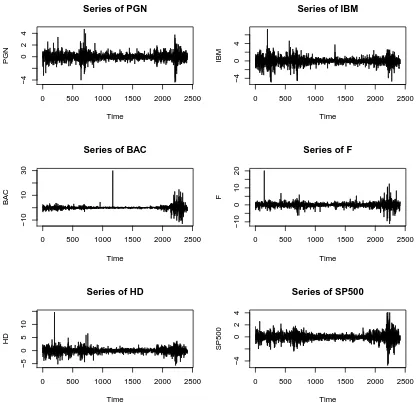

Financial Risk Management: Portfolio Optimization.

Full text

Figure

Related documents

Still, we can confirm our initial hypothesis that it is possible to discriminate driver frustration from a neutral affective state using facial muscle activity and cortical

Where duty payment is applicable, permit applicant should pay the duty at any branch of Bank of China (Hong Kong) Limited, Nanyang Commercial Bank Limited or Chiyu Banking

observations of output growth are achievable relative to the single-vintage AR model, and that data revisions to less mature in‡ation data are predictable note that KK models with q

In this study, despite the fact 69 (76.7%) reported they had special training in pressure ulcer prevention, 58 (64.4%) had adequate knowledge on pressure ulcer etiology,

Internalizing behaviour (anxiety/depression) was associated with a reduced rate of smoking at the 14 and 21 year follow-ups but externalizing behaviour and attention problems at 14

Thousands of people migrate to these cities to look for work.. However, many of the cities cannot provide housing for

1 Department of Basic Medical Sciences (BMS), Faculty of Medicine (FOM), International Islamic University Malaysia (IIUM), Indera Mahkota Campus, 25200 Kuantan, Malaysia..

in inflammatory CNS conditions with clinical optic nerve involvement may provide the opportunity to study the relationship between damage to the anterior (optic nerves, chiasm,