News Media Coverage of Corporate Tax Avoidance and Corporate Tax Reporting

Full text

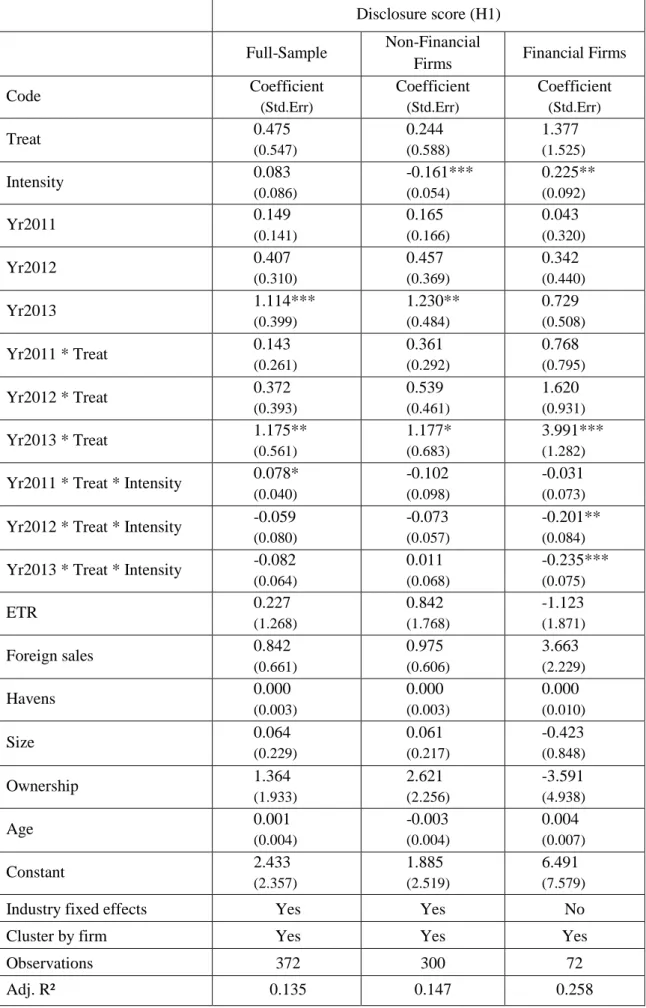

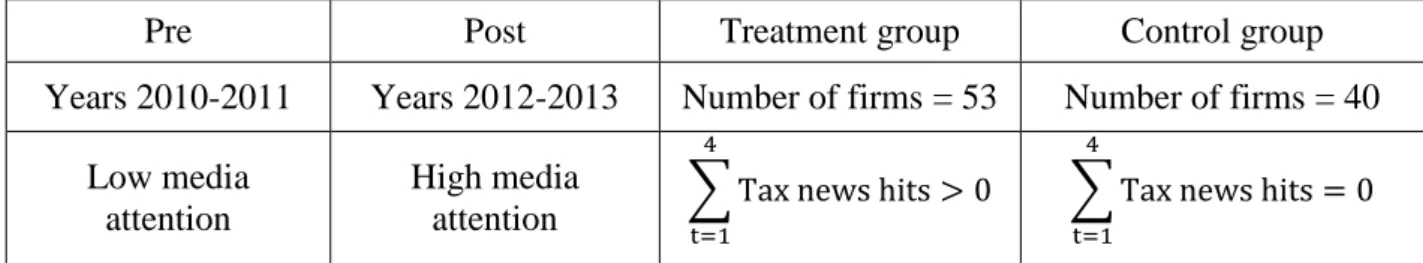

Figure

Related documents

Research on tax avoidance has been conducted in Indonesia related to the cost of debt, firm value, time of the announcement of the company’s annual financial statements, and

In order to ensure that the entire annual deemed distribution income (DDI) for all reporting share classes within the legal reporting period is reported, we recommend that

For testing the relation with the fi rst measure of corporate image (i.e., the percentage of positive mentions for the sample of 33 fi rms), we used the same articles as

Given the fact that the governance mechanism has an interactive effect to moderate the relationship between tax avoidance and firm value, this study will investigate further on

The purpose of this study is to determine the influence of firm size, leverage, profitability and capital intensity ratio on tax avoidance in manufacture companies listed on the

Research results show that the tax avoidance behavior has a mixed impact on the firm leverage of companies listed on the Vietnam stock market.. This conclusion confirms the

We investigate whether social capital affects tax avoidance activities. Using a sample of 52,962 firm-year observations over the 1990-2014 period, we document that social

In the case of a tax- payer participating in the filing of a consolidated Federal return, a corrected report shall be filed by the taxpayer if, had the taxpayer reported to the