Bachelor's Thesis (15 ECTS credits)

Boat insurance from a customer perspective

- A study on what aspects private policyholders value

most in Swedish insurance companies.

Author: Divina Nouri Supervisor: Mosad Zineldin Examiner: Joachim Timlon Semester: VT15

Subject: Business Administration Level: First level

Abstract

Background

People play a major role in the marketing of services, due to the fact services are intangible, and customers look for ways to determine the quality of services. Since services differ from physical goods, service providers need to understand how they affect their organizations. Furthermore, the criterion for satisfaction is different and the customer participates in the process, hence the interest to study this more thoroughly.

Purpose

There are cultural differences regarding what customers prioritise and demand in different countries (Johnson et al, 2002). It is important for companies to recognize of what contributes to increased customer satisfaction in the country in which it operates (Johnson, Hermann, Gustafsson, 2002, and Liljander and Strandvik, 1995). In view of this, there should be an interest in analysing what factors private insurance customers value the most in the insurance companies in Sweden.

The purpose of this thesis is to analyse what aspects private policyholders value most during a boat insurance claim process in Sweden, analysing customers’ expectations and perceptions

of service quality.

Methodology

An abductive reasoning technique with a qualitative method has been used for writing this thesis. By conducting telephone interviews with the assistance of a computer has enabled to achieve the investigative purpose of this thesis.

Conclusion

The findings concerns qualities that private policyholders value the most by the service encounter in the insurance sector.

The findings indicate that there is a correlation between customer communication, trust, loyalty and customer satisfaction. Customer satisfaction becomes a dependent variable and its value is determined by the functional variables, expectations, and perception, trust, and loyalty, communication. Customer satisfaction is a consequence of trust and good communication, and engagement provided by the service personnel.

The findings are supported by previous research that has been conducted by scholars and goes in line with the theoretical analysis drawn. The conclusions that were drawn concerns the dimensions of service quality such as empathy being strongly related to customer satisfaction and reliability was strongly related to customer satisfaction. Responsiveness was not that much related to customer satisfaction and service quality was strongly related to customer satisfaction. Trust and satisfaction leads ultimately to customer loyalty. Trust is derived and created in the presence of communication, and communication seems to affect all of the aspects that are addressed in the research. The last variable “recommendation” in the telephone survey revealed the respondents’ overall satisfaction and the respondents’ satisfaction level was strongly correlated with the treatment by service personnel. The majority of the respondents addressed competence as being an important factor of the claim process. Many respondents felt that the claim adjuster lacked competence. Competence in turn indicated impacting the level of trust the respondent had for the insurance company. Some customers had switched insurance company due to different reasons, but one stood out, in which the majority seemed to agree upon, which was the overall service they received from the claim adjuster. Here are some examples that were in focus and addressed by the

respondents: Poor engagement in the claim process, and poor service personnel, bad attitude and the feeling of distrust from the adjuster, and poor treatment and courtesy. What also made the final results stronger and in line what has already been stated in presented material and research was supported by the statement by the majority of the respondents, The respondents meant that if they were receiving better treatment by service personnel, and the sense of empathy and engagement from the claim adjuster could have made them to stay within same insurance company and therefore they would have not switched. This indicates that service quality is strongly related to loyalty. The claim adjuster’s ability to fulfil a promise accurately

was very important for the majority of the respondents; this impacted the reliability for the company and subsequently impacted their trust for the company.

When asked the question what the most important factor was during their claim process, the majority emphasised treatment by service personnel, in which service personnel equals courtesy, competence, time process, solution, trust and communication. In turn,

communication, competence, treatment by service personnel, trust equals customer satisfaction and in turn into customer loyalty in which it derives into recommendation.

Keywords:Insurance company, insurance industry, policyholders, claim adjuster, insurance related factors, service quality, customer communication, customer expectations, customer perception, trust, customer satisfaction, customer loyalty

Forward and acknowledgements

This thesis is written as completion to the bachelor-marketing programme, at the Linnaeus University Växjö. The bachelor programme focuses on international marketing strategy,

customers’ needs and creating, communicating and delivering value for the customer, a

product, a service or an experience. The subject of this thesis takes the view of the customers’

perspective on insurance companies, and it falls within the scope of the bachelor’s field of marketing.

The research was conducted and completed in cooperation with an insurance company in Sweden. Due to the request of the insurance company, I will not mention the name of the company in which the research was conducted for.

I would like to thank my supervisor Mosad Zineldin, who during the process of my thesis given me the necessary, specific and clear guidance and constructive criticism. They have also been very good roles in the exchange of ideas and thoughts during the process of writing my thesis.

been a great party in the guidance of my research.

I would also like to thank all the respondents who took the time to participate in the survey. You have directly been necessary for the analysis of this research and thus very much contributed and made it possible for the completion of this thesis.

In conclusion, I would like to thank the insurance company who gave me this assignment and my coach who was a great support throughout the entire methodical investigation.

Vaxjo, June 2015

Table of content

1. Introduction

1

1.1 Overview 1 1.2 Background 1 1.3 Problem discussion 3 1.4 Purpose 7 1.5 Research questions 7 1.6 Disposition 8 1.7 Delimitation 92. Theory

10

2.1 Overview 102.2 Choice of theoretical framework 10

2.3 Insurance in the industry 11

2.3.1 Claims 11

2.3.2 Boat insurance 11

2.4 Determinants of customer satisfaction 12

2.5 Definitions of service 12

2.6 Service quality concepts 14

2.6.1 Service quality (customer side) 14

2.6.2 Technical and functional quality 16

2.6.3 A5 Qs model 17 2.7 Customer communication 20 2.8 Customer expectations 21 2.9 Customer perceptions 24 2.10 Trust 26 2.11 Theoretical summary 27

3. Methodology

29

3.1 Overview 29

3.2 Research philosophy 29

3.3 Scientific approaches 30

3.4 Qualitative and or quantitative method 31

3.5 Research strategy 32

3.6 Advantages and disadvantages of telephone survey 32

3.7 Reasons for chosen research method 34

3.8 Data collection method 34

3.8.1 Sample selection 34

3.8.2 Non-response 35

3.8.3 Implementation of the telephone survey 35

3.9 Operationalization 37

3.10 Sources 42

3.11Validity 43

3.12 Reliability 44

3.13 Analysis of the qualitative data from the telephone interviews 45

3.14 Limitations of the research method 46

3.15 Ethical considerations 46

4. Empirical data

47

4.1 Overview 47

4.2 Empirical background 47

4.3 Empirical findings 49

4.3.1 Number of participants and type of damage claims 49

4.4 Analysis of the empirical findings 54

4.4.1 Satisfied with timescale 54

4.4.2 Treatment by service personnel 54

4.4.3 Concrete and clear answers 56

4.4.4 Trust 56

4.4.5 Best possible solution 57

4.4.6 Recommendation 57

4.4.7 Conclusion and charts 58

4.5 Operationalization analysis 58

4.5.2 Technical and functional model 62 4.5.3 A5 Qs model 63 4.5.4 Customer communication 63 4.5.5 Customer expectations 65 4.5.6 Customer perception 66 4.5.7 Trust 67

5. Conclusion and discussion

68

5.1 Overview 68 5.2 Conclusion 68 5.2.1 Aim 68 5.2.2 Research question 1 68 5.2.3 Research question 2 69 5.2.4 Research question 3 71 5.2.5 Research question 4 71 5.3 Summary 71 5.4 Discussion 73

5.5 Practical and theoretical implications 74

5.6 Suggestions for further research 74

6. List of References

76

7. Appendixes

86

Appendix 1 86 Appendix 2 87 Appendix 3 88 Appendix 4 89 Appendix 5 90 Appendix 6 91 Appendix 7 92 Appendix 8 93 Appendix 9 941. Introduction

1.1 Overview

The initial stage in this chapter provides the background to the problem, followed by the problematization, which in turn leads to the research question. In the introductory chapter you will find the purpose of the research, delimitation, and the overall disposition.

1.2 Background

Service marketing management is about servicing people and entails understanding, creating and delivering value for the customer. Services come in several different definitions; one of them is defined as the customers’ buying behaviour, and aims to provide solutions to

customers. Furthermore, services are about the relationship between the service provider and the customer, this relationship is dependent on several factors in order to maintain a long-term customer relationship that creates customer satisfaction. Knowledge, skills and capacity of the service provider are a dependent factor that can decide a good, long-term, sustainable

customer relationship (Kasper et al, 2006).

Moving forward, as a part of service management, in means of delivering value and creating satisfaction, it becomes important for organisations to pay attention to customer expectations and how they perceive quality. By gaining more knowledge about customers’ expectations and perceptions of service quality, organisations can mainly benefit and use the data and information by growing their customer relationships, creating mutual trust and ultimately gain the customer’s long-term loyalty and extend their customer base. This is evidential from many previous studies that have been conducted. Uncovering the voice and mind of the customer, reveal great areas of improvement, which gives the company the opportunity to improve and profit. Research by Stone, Woodcock, and Machtynger (2000) illustrates that if an

organisation bring its customer management on line with customers’ needs it will reduce the customer loss rate by at least 25 per cent; one in four customers is lost for simple service reasons. Furthermore organisations maintain their customers longer, and maintain and improve margins with existing customers. When analysing customers’ views about their relationship with an organisation, it is important to understand that the period during which the customers consider themselves to be in a relationship with the company may be quite long. This period can be utilized as an opportunity for the organisation to strengthen the relationship, before, during and after the transaction with the customer (Stone, Woodcock, Machtynger, 2000).

Firstly, expectations are dealing with the fact that customers should know in advance what the service organisation could do for them. In this case, communication becomes a vital part of the process, since the service provider is the one whom will set the level of appropriate expectations that the customer should hold, in order to avoid that the customers expectations’ cannot be met. It is providing honest and fair information to the customers; otherwise wrong or unjustified expectations will lead to dissatisfaction. Dissatisfaction can lead to brand switching, complaining or negative word-of-mouth communication. The subject of quality perception is important because the customer’s evaluation is determined, to a large extent, by the service employee’s behaviour (Kasper et al, 2006).

There have been researched that despite the many similarities, there are some differences between the banking and insurance industries. A significant difference formal sector is how the contact between the company staff and customers tend to look like. Bank customers value the personal contact at the bank greatly, while policyholders generally do not put any more emphasis on this aspect (Zineldin, 1996 a; Cummins & Doherty, 2006). It has previously been conducted much research in the world regarding what customers value in different financial sectors, and particularly in the banking sector which, among others, Hazra (2013) and Johnson, Herrmann and Gustafsson (2002) equates with the insurance industry. What are the factors that are highly valued and sought after in the insurance industry is, however, not explored to the same extent.

According to Johnson et al (2002) and Liljander and Strandvik (1995), it is important to take into account cultural differences that exist between different countries and areas. They therefore argue that the findings made cannot be generalized too widely and can only be

correctly applied to nearby regions where the same culture and way of life prevails. Johnson et al (2002) prevailed in research in which they conducted that insurance customers in Europe were asking for other factors in the insurance service against insurance customers in the United States.

1.3 Problem discussion

Cummins and Doherty (2006) argue that the insurance service is in its nature very complex. This complexity is characterized in that there is no physical product to investigate and that the contact between the policyholder and the insurance company is often very limited. Many policyholders never need to do use the services subscribed for, which Emons (1997) argues contributes to most customers never get any great knowledge or perception of its quality. It is thus possible to argue that insurance customers have difficulty understanding how the whole insurance service works, which are supported by Kahneman (2013) who argue that customers generally find it difficult to understand the details of various agreements.

In today's competitive harsh society, customers tend to submit their insurance companies when there is a ch rust is the defining element between relational interactions that are in nature and those interactions that are primarily functional (Garbarino & Johnson, 1999). Trust is the defining element between relational interactions that are in nature and those interactions that are primarily functional (Garbarino & Johnson, 1999). Trust is the defining element between relational interactions that are in nature and those interactions that are primarily functional (Garbarino & Johnson, 1999). Today's insurance customers are more difficult to satisfy in relation to earlier, since they become smarter, more cost-conscious and has better track of offers from other insurers (Butt et al, 2012). There are a lot of factors that could explain how customers think in their choice of companies both in general and in insurance. That policyholders tend to switch companies largely depends mainly on the substitutes are similar and that many insurance companies offer the same services (Khurana, 2013). By knowing what insurance customers value in the selection of insurance companies are thus good prospects for insurance companies to increase their customer base and increase their opportunities for success through long-term customer relationships that generate revenue in the long term (Fraering & Minor, 2013; Tsoukatos & Rand, 2006; Foster & Cadogan, 2000).

For many customers, it is not enough with just a good product; you can get the same product from a different company. It also requires a good service. Good service also brings loyalty and this in turn contributes to increased profitability from returning customers. Loyal customers are also more tolerant of price increases, as they are willing to pay a little extra if they believe that the benefits of customer care and customer service are greater than the disadvantages of an increase in price. Loyal customers also results in reduced costs, an example of this might be that an increase in marketing (costs) or reduced prices might be needed to attract new customers. A satisfied customer often speaks highly of their supplier or vendor, which leads to a good reputation (Verma, 2012; Bergman, Klefsjö, 2010).

The customer’s relationship requirement will usually vary according to what he or she consider to be important in each transaction or meeting with the company and of the overall relationship. Stone, et al (2000) defines different levels of relationship among those are; the media by means of which the contacts take place such as mail, telephone, face to face meetings etc another type of relationship level is the frequency of contacts, timing can, for example, be seen as an important element. Another level is who each contact is with, which part of the company or which individual. The information exchanged in each contact and the outcomes of each contact are also defined as levels of a relationship between an organisation and a customer. Kasper, Helsdingen and Gabbot (2006) define a relationship implemented by an organisation as the exchanges that are mutual, committed and long-standing. They define these as attributes to be beneficial both for organisations and customers. To the customer the benefits are social benefits associated with recognition and familiarity, knowledge benefits that are associated with knowing what to expect and how to optimize their own use of the service. Furthermore it carries transactional benefits that are associated with customization, priority and more targeted communication among others. To the organisation the benefits are, for example, associated with loyalty, positive word of mouth, and lower marketing costs (Kasper, Helsdingen and Gabbot, 2006). Positive relationships that develops between the individual customer and service personnel and that are enduring tend to grow customer satisfaction. And in turn, these satisfied customers tended to be more loyal to the service organisation, recommended the organisation to others, and tend to be more forgiving of service failures. Being aware of this, customer satisfaction was a key prevailing stage between interactions all positive benefits associated with long-term relationships. Customer

satisfaction is motivated to a large degree by the outcome of interactions between customers and service providers (Kasper, et al 2006). Overall, what Kasper, et al (2006) conclude is that

organisations should focus on developing long-term customer relationships in order to achieve profitable results and acquire satisfied and loyal customers. Bergeron (2001) shares the same opinion, and states that the key for organisations to survive and acquire competitive advantage in the market and become successful is building and sustaining strong customer relationships. Furthermore, research by Po-Young Chu, Gin-Yuan Lee, Yu Chao (2012) state that focusing on service quality is a condition to confirm customer satisfaction, trust and loyalty.

Kotler (2002) refer to customer satisfaction as the ”measure of the extent to which a service’s perceived performance matches the buyer’s expectations”.

Customers always measure their expectations against actual service received. Accordingly, the result of this evaluation process is what Grönroos (1984) refers to as ‘perceived quality of the service’. He highlights the importance for organisations to manage perceived service quality to improve customer satisfaction. But it can still be challenging for organisations to find the best approach in matching customers’ expected service against perceived service, hence knowing what customers think becomes critical for organisations. They need to pinpoint the criteria customers’ use when they evaluate the quality of the service.

Consequently, understanding how these criteria can satisfy the customers and make turning their behavioural indentations positive towards company services is significant (Grönroos, 1984). Customers expect certain things when they are in contact with businesses or

organizations that want to remain competitive and profitable. For business or organization to keep customers loyal they need to know how to identify these expectations and meet them to the customer's satisfaction. Competiveness and profitability are maximized in the long run by doing best what matters most to customers. A customer satisfaction measurement will

therefore enable organizations to understand how customers perceive an organization and whether their performance meets their expectations. Furthermore, it enables to identify PFIs (priorities for improvement), areas where improvements in performance will produce the greatest gain in customer satisfaction. Pinpoint “understanding gaps” where the staffs have a misunderstanding of customers’ priorities or their ability to meet customers ‘needs. Customer satisfaction management will reveal how the organization’s “total product” performs in relation to a set of customer requirements (Hill, Nigel et al, 1999).

According to Colgate and Lang (2001) much of the previous research deals with on how customer satisfaction is created within the existing customer base as well as why customers leave their companies. Selnes (1993) argue that it is important to identify what potential

customers value. Nelson (1970) and Ngai (2005) agree and believe that knowledge of what the current client base value is of great importance, but considering that companies must not lose focus on attracting new customers. To grow as a company new customer need to be attained, and thus it is of great interest to know what customers value when choosing companies (Carmen & Pop, 2012; Verhoef & Donkers, 2001).

Cummins and Doherty (2006) argue that insurance customers face a difficult choice, when it comes to choosing an insurance company. It is therefore important for insurers to know the factors of what potential customers value to thus be able to attract customers to the company. A good relationship between the company and its existing customers is a factor that is

generally valued even by outside customers and thus leads to increased opportunities for the insurance company to obtain new customers by the fact that good corporate reputation arises (Zineldin, 1996 a; Gummesson, 2002; Tsoukatos & Rand, 2006; Chen & Mau, 2009)

Zineldin (1996 a) has in a study identified what Swedish individuals consider to be the most important factors when choosing a bank. The result of the study was that Swedish individuals felt that friendly and helpful staff was the most important factor. Hazra (2013) have studied how satisfied customers are created in the Indian banking sector mean that more research should be done on the same area in such areas as insurance to see if customers ask for the same type of service or if other factors are present. Can these findings be also presumed to exist in the Swedish insurance industry?

1.4 Purpose

There are cultural differences regarding what customers prioritise and demand in different countries (Johnson et al, 2002). Johnson et al (2002) and Liljander and Strandvik (1995) underlines additionally the importance for companies to be aware of what contributes to increased customer satisfaction in the country in which it operates. Hence, analysing what factors policyholders of boat insurances value the most in Sweden is of interest.

The purpose of this thesis is to analyse what aspects private policyholders value most during a boat insurance claim process in Sweden, analysing customers’ expectations and perceptions

1.5 Research questions

1. What are the policyholders' expectations in contact with claim adjusters?

2. How do insurance policyholders perceive the service they receive in contact with a claim adjuster of the property damage?

3. Is trust important for customer loyalty and customer satisfaction?

4. A friendly service personnel is the most important factor in the meeting between the customer and the insurance company?

1.6 Disposition

Chapter 1: Introduction:

This chapter presents the background to the problem, followed by problematization, which in turn leads to research of matter. Finally, in the introductory chapter are the purpose, its boundaries, and the overall disposition.

Chapter 2: Theory:

And the further turning pages in the chapter discusses relevant models and theories to explain the factors that may have an impact on policyholders in the choice of insurance companies, what expectations and perceptions policyholder hold of the insurance company and what they think of the overall personnel treatment they receive and what factors they find most

important in the contact with a claim adjuster. Service quality may take a large space through the entire paper and is the main branch.

Chapter 3: Methodology:

This chapter contains discussions about the scientific approaches. Even the choice between quantitative and qualitative methods are explained and justified. The meaning of primary and secondary data is being clarified and differences between these will be discussed. The chapter also includes how the choice of data collection has been processed and implemented, the design of the survey, as well as advantages - and disadvantages of this approach are being addressed. And ethical considerations are also being addressed here in the final pages of the chapter.

Chapter 4: Empirical data:

This chapter presents material from the data collection. Initially presents some descriptive statistics. Furthermore, also the calculation and analysis of the paper and approach are explained. The theories and data are tested regularly and finally summarized in the analysis chapter.

Chapter 5: Conclusions and discussion

The final chapter presents main conclusions of the findings. Initially given a summary of the paper and then answer the research questions given. Some implications contained in the paper are addressed and finally presents suggestions for future research.

1.7 Delimitation

The research provided opportunities to generalize, however, the results that are obtained only gives indication of Swedish private customers, and hence generalization of the results does not apply to the whole world. There are a lot of factors that could explain how customers think in their choice of companies both generally and within the insurance area. According to Johnson et al (2002) and Liljander and Strandvik (1995), it is important to take into account cultural differences that exist between different countries and areas. They therefore argue that the findings made cannot be generalized too widely and can only be correctly finds to nearby regions where the same culture and way of life prevails. Johnson et al (2002) provides an example in which of those insurance customers in Europe asking for other factors in the insurance service against insurance customers in the United States. Hence, the research is delimited in Sweden and aims to focus on private customers, non-life insurance

policyholders; this also increases the validity and reliability of the paper.

Furthermore to secure the quality of the paper, it only takes the viewpoint of the customer. To be able to manage the telephone interview and to increase the respondent’s will to

participate it was kept short and simple, consisting by five questions and structured by rating scale, of which two were of qualitative questions.

2. Theory

2.1

Overview

The theoretical framework has been a means for analysing the data, refining the research questions, vehicle for deeper knowledge and understanding for the topic, and a facilitator for the ongoing process of identifying the topic, methodology, and context and research direction. The following provides a review of relevant literature on the tenets required to find answers, connect to the research questions and justify the suggestion. Claims and boat insurance will be briefly reviewed, since it is what the paper is focused on.

2.2 Choice of theoretical framework

Financial services are a broad range of businesses that manage money and the insurance industry is one of them. It deals with not only insurance but also people and therefore which includes an interactive dialogue between a company and its customers (Kotler, Hayes and Bloom, 2002). Providing services according to customers’ expectations, insurance companies need to uncover and recognize how customers perceive service quality. Consequently, the company can identify priorities for improvement, that is to say areas where improvements in performance will produce the greatest gain in customer satisfaction (Hill, Brierley,

MacDougall, 1999). Furthermore, there are associations between customer expectations and perception, trust, loyalty, communication and service quality. All of these aspects that connects to service quality is in its own way unique and central relationships for marketing theory and practice. Hence, to increase our understanding of the relations between the concepts in marketing, the theoretical framework is developed based for the purpose of the research and the collected empirical data. Research question one relates to the concept of perception, research question two relates to the concept of expectations, research question three relates to the concept of trust, and research question four relates to the concepts of service quality.

2.3 Insurance service in the industry

The insurance industry as any other industry depends on the expertise of many individuals such as claim adjusters and carries much different type of insurances in their field such as boat insurance.

2.3.1 Claims

Claims and loss handling is the actual “product” paid for. To be able to receive full compensation for loss the policyholder must follow Company A’s duty of care. These include, where appropriate, for each damage event in terms, in the insurance policy in the insurance contract otherwise. In addition, apply as a general duty of care the policyholder must manage the property in a manner that minimizes the risk of injury or loss.

Furthermore, as the duty of care that you must follow provisions of the law, regulation, or regulations issued by the authority to prevent or limit damage. The policyholder must also observe the manufacturer, supplier or installer the rules and regulations. If you do not follow, prudential requirements may be reduced. Compensation may also be reduced, on damage other than damage claims, you or else with your state use the boat or its accessories caused under the influence of alcohol, drugs or other intoxicants. Rules for the reduction are, where appropriate, under each occasion and in section Insurance Policy (trygghansa.se).

2.3.2 Boat Insurance

Boat insurance covers different types of accidents, injuries and incidents. Exactly what is included in boat insurance is difficult to say because insurance companies all have their own variants with specific conditions and policies (allt-om-försäkringar.com). For this specific insurance company (Company A) the insurance covers only burrow boat with their engines as specified in the insuranc policy letter. The boat shall have homeport and be winter kept in Sweden

The insurance applies in Sweden, Norway, Denmark, Finland and their territorial waters. It applies in the Baltic Sea with neighbouring seas and bays, Kattegat and Skagerrak east of the line Hanstolm - Lindesnes. If a person wants a larger range of validity he/she needs to fully comprehensively insure the boat and have the additional insurance ”Advanced Yacht”. The insurance covers the boat written in the insurance policy with their engines. The boat should have its homeport in Sweden. The insurance applies to those who own and use the boat for private use. It also covers personal property, such as clothing, fishing gear and other personal items (trygghansa.se)

Customer satisfaction has been considered being based on the customer’s experience on a particular service encounter, (Cronin & Taylor, 1992) it goes in line with the fact that service quality is a determinant of customer satisfaction, because service quality comes from the outcome of the services from service providers in organisations, such in the insurance industry. This goes also in line with a research made by Po-Young Chu, Gin-Yuan Lee, Yu Chao (2012) who state that focusing on service quality is a condition to confirm customer satisfaction, trust and loyalty. Furthermore, it is generally accepted by most researchers that service quality relates to the customer’s perception of the service performance, this goes also in line with Grönroos and Edvardsson’s research (Grönroos, 2009, Edvardsson, 2005;

Edvardsson, et al, 2005), who state that service quality is an important determinant of customer satisfaction that have both cognitive and perceptual aspects beyond just cognitive evaluation. In order to ensure better service quality, organisations need to identify quality determinants and manage customer expectations (Grönroos, 1997).

2.5 Definition of services

Services come in many definitions, but there are some common explanations. First and foremost, services are intangible, which means that it is difficult to hold or to stock services (Kasper, Helsdingen, Gabbott, 2006). Furthermore, the buying of these services does not result in the ownership of a physical object. Instead, it creates a bundle of benefits during, or after the interaction between the service provider and the customer, that results into an

experience for the customer. Services also refer to activities provided by the service provider, often times in contact with the customer. Kasper, Helsdingen and Gabbott (2006) conclude that services are originally intangible and relatively quickly perishable activities whose buying do not always lead to material possession and takes place in an interactive process aimed at creating customer satisfaction. Kotler, Hayes and Bloom (2002) define service simiraly, “ A service is a deed, a performance, or an act that is essentially intangible and does not necessarily result in the ownership of anything. Its creation may or may not be tied to a physical product” (Kotler, Hayes, Bloom, 2002, p 237).

They differ services from products by defining services as intangible in the sense of it cannot be seen, tasted or felt, inseparability in which services cannot be separated from the service

provider. Moreover, they define services as variable (variability) in which that the quality of services provided to customers can vary. Services are also perishable according to the authors; they cannot namely be stored for later sale or use. Bergman and Klefsjö (2010) differs

services from products in a similar way, they define services as intangible and hence it may be difficult to specify and measure the contents of a service, and they highlight the customer as playing an active role in the creation of the service, which consist of activities and made up of a system, of sub series, but the customer receive it as a bundle of a package, rather than in separate sub services. As one highlights the quality of goods, Bergman and Klefsjö (2010) highlights the quality of services which is made of several dimensions, and they relate some those dimensions to the customer’s confidence in those providing the service (Bergman, Klefsjö, 2010). Another difficulty in measuring service quality, this is due to the fact that customers demand different service expectations. Service cannot namely be delivered in the same way due to their intangibility and variability. Therefore, managing customers’

expectations in a fair way, or fairly as possible, so they fall in the customers’ zone of tolerance (Mittal & Sheth, 1996 p 137-140). Service quality is considered as a

multidimensional concept with several variables and in order for a company to be able to improve their services, one need to measure it. Using the SERVQUAL as a scale enables to measure the different quality dimensions (Berry et al., 1992).

2.6 Service Quality Concepts

2.6.1 Service quality (customer side)

Service quality is a measure of how well the service delivered by a company matches

customer perceptions or expectations (Baron et al., 2009). Therefore, in order to understand how the respondents perceive the quality of services is by measuring service quality and to identify service quality gaps. One way is to operationalize with the use of the RATER model introduced by Zeithaml, Parasuraman & Berry (1990), consisted of ten dimensions but later reduced to five major dimensions; reliability, assurance, tangible, empathy, and

responsiveness.

of the quality dimensions.

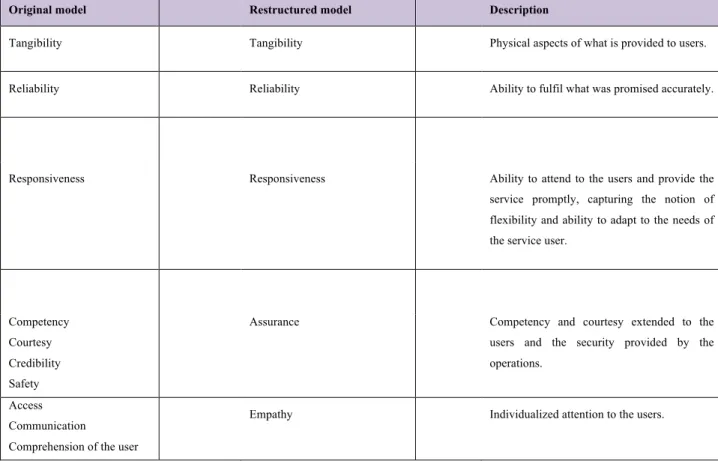

Original model Restructured model Description

Tangibility Tangibility Physical aspects of what is provided to users.

Reliability Reliability Ability to fulfil what was promised accurately.

Responsiveness Responsiveness Ability to attend to the users and provide the

service promptly, capturing the notion of flexibility and ability to adapt to the needs of the service user.

Competency Courtesy Credibility Safety

Assurance Competency and courtesy extended to the

users and the security provided by the operations.

Access Communication

Comprehension of the user

Empathy Individualized attention to the users.

Source: Marshall G, Murdoch I (2001)

Figure 1. Original model compared to the restructured model of the five dimensions of service quality by Parasurman, Zeithhaml, and Berry

The five dimensions of service quality are:

Reliability: is describedas the consistency of performance of the organisation; the supplier must live up to its promise, without the need for rework (Parasurman, Zeithhaml, Berry, 1985; Brink, Berndt, 2004; Bergman, Klefsjö, 2010). Brink and Berndt (2004) also highlight the importance of delivering service within a specific time frame if such was promised to the customer.

Assurance: is referred to the employees’ behaviour in which they must be courteous and have enough of product and or service knowledge to respond to customer enquiries and their ability to convey trust (Parasurman et al, 1985; Brink, Berndt, 2004).

Tangibles: refers to the physical facilities, equipment, personnel and materials that can be perceived by the five human senses (Parasurman, et al, 1985)

Empathy: Refers it to the service provider’s ability to understand the customer’s situation, to show interest and attention. Accessibility, sensitivity and effort are included here

(Parasurman, et al, 1985).

Responsiveness: refers to the willingness of the supplier to help the customer, providing service in a prompt manner with precision and speed of response.

In conclusion all of the dimensions are related to the customer’s confidence in those providing the service. It is also important to keep in mind that the importance and prioritization for an organisation for each of these dimensions differs, depending on what branch, product or service is provided by the specific organisation (Bergman, Klefsjö, 2010).

2.6.2 Technical and functional quality

Another proposed dimensions of quality that affect the experience are illustrated by Grönroos (2008), he believes that the quality of a customer experience has two basic dimensions: a technical quality dimension and a functional quality dimension. The technical dimension is based on the results that come out of a company's business, which is what a customer receives when the interaction with the company is over.

Grönroos (2008) points out that a company can no longer compete with purely technical solutions as customers take these for granted, and instead value the other things in the service delivery. Such things belong to the functional dimension of quality, a process-related

dimension, which concerns how the company delivers a service during the interaction with the customer. This dimension is greater than the technical a subjective experience that is dependent on the service provider's behaviour in interactions with customers. In the functional quality dimension is thus the moment of truth important.

The two qualities dimensions Grönroos (2008) highlights, is the foundation of how quality is built. Moreover, there are additional factors that influence the customer's perception of quality, and that may belong to either the technical or functional quality dimension (Gröönroos 2008).

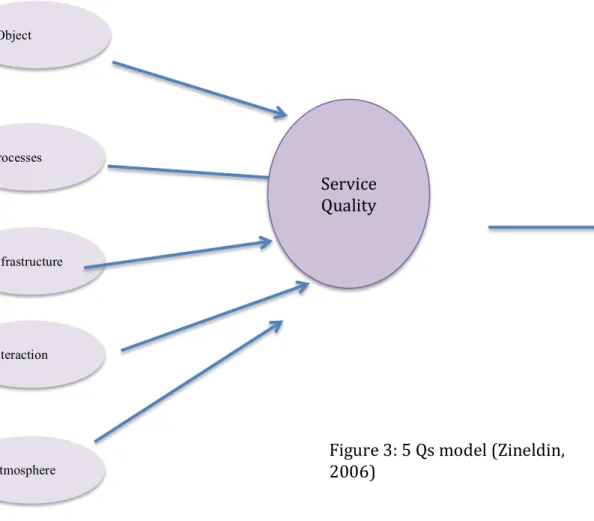

2.6.3 A5 Qs Model

Grönroos, (2006) two-dimensional (technical and functional) model on quality as described in previous page, is well known in the quality theory (Zineldin et al, 2011; Zineldin, 2011; 2006; 2006 b). Zineldin (2000a) developed a comprehensive model regarding patient satisfaction from health care providers, the 5 Qs model. This model is an expansion of the technical-functional and SERVQUAL models, and consist five quality dimensions, which consist of quality of Object, quality of Process, quality of Infrastructure, quality of Interaction and quality of Atmosphere (Zineldin, 2006a) (see figure 2). The 5 Qs model is now considered as an effective model to measure patient satisfaction regarding service quality.

Although, Zineldin (2011) argues that the technical and functional qualities are important when measuring customer satisfaction, he believes that there is more to it than that. He states that the atmosphere where the firm operate in, affect the customer’s perception of satisfaction. The interaction and information exchange between customers and company and the

infrastructure, the basic resources that are needed to deliver the product/service.

The 5Qs model can be viewed as a broader model, in which it assures relevance, validity and reliability as it in the same time are change oriented. Although, other models such as the SERVQUAl model can interpret many variables, they do lack of essential and

multidimensional attributes (Zineldin et al., 2011; Zineldin, 2011; 2006a; 2006b).

Dimensions of service quality in 5Qs model.

5Q dimensions Definitions

receives), for example, it focuses on the technical accuracy of procedures. This dimension of service quality measures the treatment itself.

Quality of process This dimension concerns the functional quality; how the organisation provides the core service (the technical). This dimension measures how well activities are

implemented practically. It includes waiting times by the customers and speed of

performing the activities by the staff. These indicators can be used to identify problems in service delivery and to suggest specific solutions.

Quality of infrastructure This dimension of service quality measures the essential and basic resources that are needed to perform the services. This includes the quality of the internal competence and skills, know-how, experience, motivation, attitudes, technology, internal relationships, internal resources and activities among others.

Quality of interactions This dimension concerns

communication/interaction between the staff and the customers. This dimension of service quality measures the quality of

Information and social exchange etc. Perceived quality of interaction and

communication reflects a customer’s level of overall satisfaction.

Quality of atmosphere This dimension is concerned with the relationship and interaction process between

the two parties is influenced by the quality of the atmosphere in a specific environment where they cooperate and operate (Zineldin 2006).

Source Figure 2.

The figure below illustrates the 5 Qs model; the service quality is a function of Q1-Q5. The model consists of five dimensions, and all five are a function of service quality in which all of the five can affect the level of customer satisfaction, according to Zineldin (2006) (see figure 3). Object Processes Infrastructure Interaction Atmosphere Service

Quality Satisfaction Customer

Figure 3: 5 Qs model (Zineldin, 2006)

2.7 Customer communication

Customer communication refers to all communication between a company and buyers about what it has to offer (Ottesen, 2001). The word "communication" originally comes from the Latin communis, common, through Communicare, making common (Nilsson, Waldemarson, 2007). The authors state that people’s lives are based on relationships with other people and communication is the foundation for these relationships. Communication is therefore the basis for identity and meetings with other people (Nilsson, Waldemarson, 2007).

Robbins (2003) has also described a similar communication model. He states that before communication occurs, a purpose is necessary, expressed as a message that is to be mediated. This message is conveyed between a sender and a receiver. Robbins (2003) argues that the sender initiates the communication by encoding a thought and to create a message. He describes four conditions that impact the encoding of the message. These conditions are the sender’s skills, attitude, knowledge and the sociocultural system in which the sender lives in. Robbins states that the message is the physical result of the encoded thought (Robbins, 2003).

Kotler, et al (2002) explains response as the reaction of the receiver when he receives the message, and they define noises as unplanned obstacles in the communication process. The result of these noises can lead to that the receiver gets a changed or a different message than what the sender intended to send. The last component in Robbins (2003) communication model is feedback. He claims that if one gets response and the sender returns the message, the risk for misunderstandings decreases. Here, the sender can control that the message has passed through and been decoded in the right way (Robbins, 2003).

According to these theories mentioned, communication is important in the service industry, one reason is to decrease misunderstandings between the service provider and the consumer and another is to convey and Kotler et al (2002) considers communication to be equally important in all industries and hence the communication between an insurance company and customer is no exception (Kotler, et al 2002). Zineldin and Jonsson (2003) also share this concept in which they believe that communication and interaction is the essence of a

relationship where at least two partners are in contact with each other. Furthermore, Zineldin argues that it is communication that links individuals and businesses together. The result of an intensive communication becomes an important level of customer satisfaction (Zineldin,

Jonsson, 2003). Zineldin (1998) argues that in order to have a successful relationship, communication with trust is required. This will create mutual benefit and lead to customer satisfaction is achieved.

2.8 Customer expectations

To enable the measurement of customer satisfaction, one need to define and understand what satisfaction is (Hill, Brierley, Macdougall, 1999). The authors define customer satisfaction as a measure of how an organisation’s total product performs in relation to a set of customer requirements (Hill, Brierley, Macdougall, 1999).

Many others consider service quality as the result by making a comparison between

comparing customer perceptions and expectations. Expectations is described by Parasuraman, Zeithaml and Berry (1988) as predictions made by consumers on what probably will occur during a pending transaction, which means that the customer already has already formed an idea of what the service is going to be like. On the other hand, according to the expectation-confirmation theory customer satisfaction depends on how well the customer’s prior expectations are covered (Ferrer, 2009, Vol 1. No 1).

Bergman and Klefsjö (2010) relates customer satisfaction to the needs and expectations of the customer, which are in turn affected by several factors; previous personal experience of the company, the reputation of the company or product or service, what the company has promised, and to some degree the price. Bergman and Klefsjö (2010) also state the

importance of identifying the needs of customers, since it is ultimately customers’ different needs that determines whether or not satisfaction is fulfilled. They define customer

satisfaction as the ultimate measurement of quality. They highlight the Kano model as conceptual model to illustrate three different types of customer needs. Basic, expected and excitement needs are needs that are necessary to identify in order to then satisfying them. By finding such dimensions, a company can gain competitive advantage over its competitors, and attain loyal customers. By satisfying basic needs, which are needs that are obvious to the customer and unmentioned by the customer if asked: must-be quality is created. By satisfying expected needs, which the customer is aware of and are mentioned if asked, expected quality

is achieved. Satisfying excitement needs, which the customer is not always aware of, attains attractive quality. And therefore would lead to great competitive advantage if a company managed to uncover them, and in that way may lead to delighted and loyal customers (Bergman and Klefsjö, 2010).

When expectations are not met, it can mean two things, either that the customer holds a perception of high service quality or a lack of service quality (Kasper, Helsdingen and Gabbott, 2006). This type of scenario is defined as disconfirmation, in which it can lead to a positive experience, when actual experiences exceed expectations or a negative a negative disconfirmation, when expectations are above actual experiences ((Kasper, et al 2006). Acoording to Gröönroos (1983), customer experiences depend on two concepts, “what” quality, what services have been provided and “how” quality, how the services have been provided (Grönroos, 1983).

2.9 Customer perception

It is difficult to find out what customers perceive as great service, since their perception often is based on past experiences. Perceptions have different meanings and can be defined as the process of receiving, organising and assigning meaning to information understood by the customer’s five senses that it gives meaning to the world that surrounds the customer.

Perceptions can also be described as the “end” result of several observations. On a time scale, service expectations are commonly generated at the beginning of the service encounter, and that service perceptions are generated during and after the exposure to the service. It is important to take into account the fact that perceptions are dynamic and change with time, consequently what a customer expect today, is not the same next year, which in turn also influences the perceptions of the customer (Kasper, Helsdingen, Gabbot, 2006).

Customers perceive services in terms of quality of service and how they are provided and how satisfied they are. Hence, companies put focus on measuring service quality and customer satisfaction, due to the belief that they can differentiate themselves and thereof obtain and retain customers (Kasper, et al 2006).

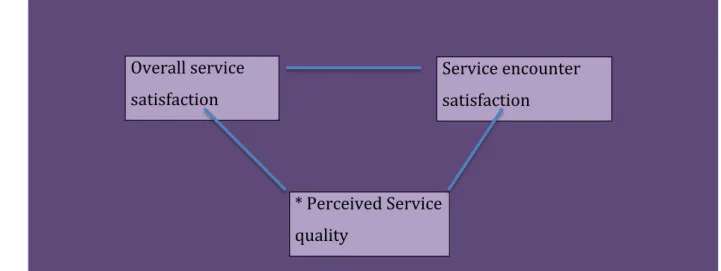

The following model illustrates the relationship between the variables and it also helps to explain the survey results that indicate different levels of satisfaction of the service provided by the claim adjuster that one individual may experience (see figure 2).

Overall service satisfaction Service encounter satisfaction * Perceived Service quality

Figure 2. Model of two levels of satisfaction and perceived service quality (based on a study by Bitner, Hubbert, 1994).

* denotes a stronger correlation between those constructs.

Chang et al (2013) mentions when consumers perceive functional service quality superior, the service providers or the staff of a service company are more trusted. Foster has also confirmed this, in which he states that perceived service quality will greatly and positively influence customer trust. Service quality is considered as an important initial factor to customer trust. Chang, Chang Wong and Sohal have also pointed out that service quality has a positive and a major influence on relationship quality (trust, satisfaction and commitment). There are a lot of evidentially conducted research towards the fact that trust influences customer satisfaction, and the fact that it is an important factor to maintain customer satisfaction (Chang et al. 2013, 13:22).

2.10 Trust

As just mentioned in previous chapter, trust is considered as another factor that can lead to satisfaction. It is a very important influence, which builds and establishes through continuous improvement in overall service quality and organizational reputation (Thom et al., 2004, p. 125). Kotler, et al (2002) also address the importance of trust and defines it as something by which an individual cannot touch, see, feel or inspect, and something that cannot be given out easily. Moorman, Deshpandé and Zaltman (1992, 1993), defines trust as comprised of beliefs about an exchange partner’s kindness, competence, honesty, and predictability, and is viewed as an essential element of successful relationships. Garbarino and Johnson (1999) highlight trust as a determining element between interactions and those relations are naturally

functional. Parasuraman, Zeithaml, and Berry, (1988) state that a customer observing

employees’ knowledge and responsiveness generates trust in the service industry. Moreover, Kotler, et al (2002) explain trust as a two-way street, meaning that both of the parties, the service provider, and the service recipient need to display mutual trust in the relationship. One of several ways for a company to build trust is through helping customers by guiding them and referring them to the right resources, providing free services and overall simplifying the process for them and providing them with useful solutions, even though it, in some cases, can mean that the service provider refer them to another business, or providing services that might not be his/her obligation to do so. By doing so the company not only builds a trust between him and the customer, but can enhance it as well (Kotler, Hayes, Bloom, 2002).

2.11 Theoretical Summary

The criteria for customer satisfaction are different because services have distinct

characteristics compared to physical products. Service is namely intangible, inseparable, variable and perishable and professional service providers must fully understand these

differences and how they affect their organisation by measuring customer satisfaction in terms of service quality (Kotler et al, 2002). This is due to customers perceive services in terms of quality and consequently it impacts the level of customer satisfaction (Brink, Berndt, 2004). There are several models that can capture the understanding of customer satisfaction and that outlines determinants of customer satisfaction, such as the SERVQUAL model,

Technical-functional model and A5 Qs model. These three models share many similarities in such that they outline different factors that impacts customer satisfaction thorough several dimensions, where variables are being interpret and measured. When comparing the models, one can notice the difference lying in the extensiveness of each concept, for example the A5 Qs model captures and emphasises the Quality of the atmosphere, and the two other models do not. As stated, the models address different determinants such as perception, trust, and

communication and illustrate how they are correlated to one and another and how they affect service quality, and customer satisfaction (Zineldin et al., 2011; Zineldin, 2011; 2006a; 2006b). Moreover the concepts do not only display the difficulty of identifying the different attributes of a service, but they also illustrate the importance of understanding customers’ expectations of service performance (Dean, 2002).

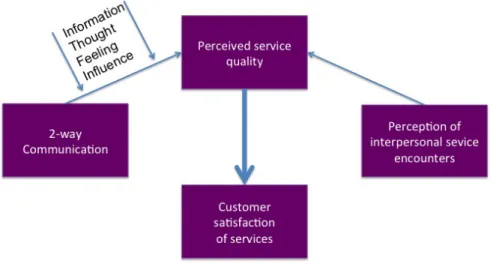

For example, perception is correlated to several factors; perception of interpersonal service encounters impacts service quality and satisfaction. Perception of service quality among customers can positively influence their trust. And perception of trust among customers can positively impact their satisfaction (Ching-Shang, 2013, 13:22). One of the main factors that influences customer perception of service quality is the way the service provider manages effectively to communicate. Hence, communication becomes an important process during a personnel service encounter. As a part of communication is information, thought, feeling and influence, a way to validate identity and to show how one experiences those whom is in communication with (Nilsson, Waldermarson, 2007). One way of delivering service quality that is to the satisfaction of is by communicating well and see it as a two way communication street, a dialogue, rather than a monolog. It reduces the risk of misunderstandings and

strengthens the customer relationship (Kotler, Hayes, Bloom, 2002).

Each of the theories outlined above is intertwined and impacts and influences one another (see figure 3).

Figure 3. Conceptual model illustrating what influences customer satisfaction of services.

3. Methodology

3.1 Overview

This section describes the methods, methodological problems and data collection used in this work. The section concludes with a description of the approach used.

3.2 Research philosophy

Much of the previous research in the insurance industry has had existing customers in attention with a focus how value is created for them.

The purpose of this study is to analyse which factors are most important to policyholders in the meeting with the claim adjuster. This can also be used as bases to acquire new customers, which is also an important factor for a business in order to grow (Gummesson, 2002; Fraering and Minor, 2013).

In accordance with the above purpose of this thesis, a positivist approach has been taken. A positivist tries according to Denscombe (2009) finding patterns and regular units in the social world. Positivism is about existing field theories are used to create hypotheses and possibly leading to new theories, which is then possible to generalize (ibid). In addition positivism is also the hermeneutic research process and in this approach interpretation is in focus (Ödman, 2007). Furthermore, the hermeneutic draws conclusions from data collection, without any generalisation (Ödman, 2007). This approach will then be denied since a goal of this study is to some extent be able to generalize the results.

Taking into account cultural differences in the world, generalization will mainly to be done in Sweden and in nearby regions with similar cultures.

The studies that have been previously analysed about how customers think and act in the insurance industry have in most cases a positivistic approach. Tsoukatos and Rand (2006), Butt et al (2012), Pezhman, Javadi, Shahin (2013), Nwankwo and Durowoju (2011), Khurana (2013) and Chen and Mau (2009) uses the existing field of theories by testing hypotheses in the empirical data that are inherently generalized. In accordance with Denscombe (2009) and previous research a positivistic philosophy has thus been chosen for this research.

3.3 Scientific approaches

There are three main scientific approaches, which are called deduction, induction and

abduction (Alvehus, 2013). Deduction is characterized by the researchers based on theoretical hypotheses and uses empirical data to test these claims.

A deduction approach requires that researchers are independent of the analysis (ibid). The deductive approach is mostly associated with quantitative data gathering and the greatest value of the approach is that researchers are able to make use of previous researchers work (Ali and Birley, 1998).

But the inductive approach has the empirical material as a starting point and without

theoretical preconceptions performed for conclusions (ibid). Induction is characterized for the qualitative research (Boolsen, 2007). The third approach, abduction is a combination between empirical and theoretical reflection (Ali and Birley, 1998). Since this thesis has both the empirical material and theoretical concepts for conclusions, it excludes a deductive and an

inductive approach. The American philosopher Charles Sanders Pierce (1839-1914)

introduced the term and the idea of abduction. By this he meant the process by which we form an intuitive idea of something in our environment. The statement "if it is raining then the grass is wet" is an abduction. It is based on some form of experience and in particular the experience of it tends to be so. One can also say that abduction is almost a synonym for guessing or so-called "an educated guess" (Trost, 2010).

On the basis of the description of the different approaches and the overall outline of this paper, the analysis and how theoretical part has emerged, an abductive approach is thus found as suitable for this thesis.

3.4 Qualitative and or quantitative method?

It is the purpose of the study that determines for which kind of method you should use. Both qualitative and quantitative studies are considered to be precursors, i.e. feasibility studies for the "real" studies. (Trost, 2010)

If you want to enter frequencies or numbers, then a quantitative study is more appropriate, i.e., if one is interested to be able to enter a certain percentage of the population's preference for a certain specific topic, for example if the issue is how often, how many, or how common. Then the sample must also be representative in a statistical sense (Trost, 2010).

However, if you are interested in such as trying to understand human behaviour, a qualitative study is more reasonable, for example, if the question is how and or why you are experiencing a specific event, etc. (Trost, 2010). The method can refer to people's lives, experiences,

behaviours, emotions, and even organisational function, social patterns, cultural phenomena and interaction between nations. Some of the information may be measurable, but the core of the analysis is interpretable (Strauss, Corbin, 1998). It becomes more of a deepening of the

question and requires a deeper reflection and response, more than a "yes and no" answer (Trost, 2010).

A study is therefore reasonable for the purpose of the essay and research issues and the nature of the research problem. In addition to the method's chance to get a specialization in the subject, it also allows the investigator to measure the qualitative data statistically (Strauss, Corbin, 1998). This, thus becomes an even more advantageous to select this choice of

research method for this study. A quantitative study of this thesis is therefore not appropriate and will be rejected.

Qualitative studies over the years have become increasingly popular, not only of the reason for the development of new theories, but also to gain a greater understanding and knowledge of the subject (Strauss, Corbin, 1998). The method is described as a grounded theory where the received data is systematically collected and analysed throughout the study. In this method, data collection, analysis and potential theory are closely related to each other

(Strauss, Corbin, 1998), which constitutes this paper. Theories have for this thesis emerged as where the paper has initiated the research topic and the theoretical part has thus emerged based on the data.

According to Strauss and Corbin (1998), this method, which theory arises from data, is probably more like "reality" than letting theory emerge through speculation or a series of different concepts that are based on experience. More over, a qualitative study is based on both critical and creative thinking and is collaboration between the investigator and data. It is both science and art (Strauss, Corbin, 1998).

3.5 Research strategy

To achieve the purpose for this thesis, telephone interviews of a qualitative nature have been conducted. The substance of the thesis is based on the results of the telephone interviews and the choice of the method is due to the absence of opinion from customers’ point of view. In a situation when a company want to increase knowledge of a problem or area, such as when there is uncertainty of the precise nature of the problem, it is useful to carry out a study of the exploratory nature (Saunders, Lewis, Thornhill, 2007).

The survey that was conducted was evaluated and confirmed by the marketing department at Company A, before it was implemented for use. This was performed to ensure quality and

relevance of the study and making sure that the questions were aligned with the purpose of the survey (Bryman, Bell, 2011).

3.6 Advantages and disadvantages of telephone surveys

A telephone survey is considered to be one of the easiest and cost-effective methods used in collecting data either from the general population or from a specific target population. One of the main advantages of telephone survey is the high accessibility; the majority of the

population has a phone. A telephone survey gives the interviewer the opportunity to observe and analyse behaviour or attitudes of respondents toward controversial issues; hence it allows good quality control. It provides anonymity for respondents, which simplifies accuracy in responses, especially in sensitive topics. Furthermore, telephone survey allows a quick process of data and handling, since the telephone usually is assisted with a computer, and thereof the interviewer can handle, store and gather the data smoothly from the telephone interview. This allows to access real-time and past time data (Bryman, Bell, 2011).

The disadvantages of telephone survey is the fact that it is time-constrained, and it might disturb the private time of the respondents, and therefore interviews via telephone should not be kept no longer than 5-10 minutes. This therefore requires a single open-ended question and a few close-ended questions. Furthermore it can be hard to reach respondents, since some might not accept an unexpected call (Gray, 2009).

Geographically speaking, telephone interviews are advantageous to conduct, it is cheaper, easier and quicker to administrate, since there is no need for travelling to reach the

respondent. But telephone interview takes time, and the hired researcher has to be paid, but the overall cost carried with it, is still lower compared to a personal interview. Furthermore, a telephone interview is easier to supervise than a personal interview. Another advantage

regards the evidence that suggests that the respondents do not get affected by the interviewer, which would mean giving dishonest answers. This can occur in a personal interview, where the respondents can be affected by the interviewer’s characteristics, and gives false answers. Consequently, a telephone interview removes the potential source of bias to a large extent (Gray, 2009).

Telephone interviews also bring some limitations that make the interview impossible to carry out, such as people who do not own or who are not contactable by telephone. The length of a telephone interview is short, whereas personal interviews can last longer. There is little evidence to state whether the response rate is higher or lower in a telephone interview compared to a personal one. Some evidence is though revealed to suggest that a telephone interview is working well when asking sensitive questions, since there is no personal contact involved. This indicates though that a telephone interview cannot engage in observation, for example being able to respond to signs of puzzlement. Another issue is that it is difficult to secure that the interview is completed with the right person by a telephone interview, and the interviewer cannot use visual object, such as showing diagrams etc (Gray, 2009).

3.7 Reasons for chosen research method

A telephone survey was chosen for convenience and accessibility reasons, timing was one of the main reasons; furthermore, it allowed direct contact with the customers and more control of collecting data and information under a specific time frame. The survey questions focused on what and how customers perceive service quality and the overall process of their claim.

3.8 Data collection method

3.8.1 Sample selection

The target group is private policyholders of small boats, which was selected forehand by Company A. The list contained private policyholders with damage claims during the year of 2012. The list is chronologically organized starting with the most recent damage claims and ending with the oldest ones.