Financial Services

Certificate III in Financial Services

(FNS30111)

based on the Financial Services Training Package

(FNS10) version 5.1

Effective from 2012

Date published 14 October 2011

Original published version updated:

February 2014 – Training Package reference updated to version 5.1 (no changes to document content) September 2013 – updated to FNS10v5 (Official notice: BOS42/13)

October 2012 – updated to FNS10v3.1 (Official notice: BOS42/12)

© 2014 Copyright Board of Studies, Teaching and Educational Standards NSW for and on behalf of the Crown in right of the State of New South Wales.

This document contains Material prepared by the Board of Studies, Teaching and Educational Standards NSW for and on behalf of the Crown in right of the State of New South Wales. The Material is protected by Crown copyright.

All rights reserved. No part of the Material may be reproduced in Australia or in any other country by any process, electronic or otherwise, in any material form, or transmitted to any other person or stored electronically in any form without the prior written permission of the Board of Studies, Teaching and Educational Standards NSW, except as permitted by the Copyright Act 1968.

When you access the Material you agree:

to use the Material for information purposes only

to reproduce a single copy for personal bona fide study use only and not to reproduce any major extract or the entire Material without the prior permission of the Board of Studies, Teaching and Educational Standards NSW

to acknowledge that the Material is provided by the Board of Studies, Teaching and Educational Standards NSW

to include this copyright notice in any copy made

not to modify the Material or any part of the Material without the express prior written permission of the Board of Studies, Teaching and Educational Standards NSW.

The Material may contain third-party copyright materials such as photos, diagrams, quotations, cartoons and artworks. These materials are protected by Australian and international copyright laws and may not be reproduced or transmitted in any format without the copyright owner’s specific permission. Unauthorised reproduction, transmission or commercial use of such copyright materials may result in prosecution.

The Board of Studies, Teaching and Educational Standards NSW has made all reasonable attempts to locate owners of third-party copyright material and invites anyone from whom permission has not been sought to contact the Copyright Officer. Phone (02) 9367 8289

Fax on (02) 9279 1482

Email: mila.buraga@bostes.nsw.edu.au

Acknowledgements

Units of competency from the FNS10 Financial Services Training Package in this syllabus are © Commonwealth of Australia. Reproduced with permission.

The following copyright warning applies to the material from the Training Package:

All rights reserved. This work has been produced initially with the assistance of funding provided by the Commonwealth Government through DIICCSRTE. This work is copyright, but permission is given to trainers and teachers to make copies by photocopying or other duplicating processes for use with their own training organisations or in a workplace where the training is being conducted. This permission does not extend to the making of copies for use outside the immediate training environment for which they are made, nor the making of copies for hire or resale to third parties. The views expressed in this version of the work do not necessarily represent the views of DIICCSRTE. DIICCSRTE does not give warranty nor accept any liability.

Published by

Board of Studies, Teaching and Educational Standards NSW GPO Box 5300

Sydney NSW 2001 Australia

www.bostes.nsw.edu.au

20110743 20121274 20130603 20140040

Contents

Introduction to the Financial Services Curriculum Framework

The Financial Services Curriculum Framework and Certificate III in Financial Services

Status of units of competency for the Financial Services HSC courses and Certificate III in Financial Services

Minimum requirements for Certificate III in Financial Services (FNS30111)

Financial Services – Certificate III in Financial Services (FNS30111)

The Financial Services Curriculum Framework includes the following documentation: the syllabus associated documents support materials.

All of the Framework documentation is available on the Board’s website at www.boardofstudies.nsw.edu.au/syllabus_hsc/financial-services.html.

This document, Financial Services – Certificate III in Financial Services (FNS30111), should be read in conjunction with the Financial Services Curriculum Framework Stage 6 Syllabus.

Introduction to the Financial Services Curriculum Framework

The Financial Services Curriculum Framework is a Board Developed HSC syllabus based on the national Financial Services Training Package (FNS10) and includes pathways to:

Certificate III in Accounts Administration (FNS30311) Certificate III in Financial Services (FNS30111) Certificate II in Financial Services (FNS20111).

The Financial Services Curriculum Framework contains the following HSC VET courses (detailed in Section 2 of the Syllabus):

Financial Services (120 indicative hours) Financial Services (240 indicative hours)

Financial Services Specialisation Study (60 indicative hours).

HSC VET courses are dual accredited. Students can gain credit towards: the NSW Higher School Certificate (HSC)

As a result of the dual accreditation, HSC VET courses are governed by two sets of rules: HSC unit credit requirements determined by:

HSC course requirements (detailed in Section 2 of the Syllabus)

the requirements for satisfactory course completion – outlined in the Board of Studies

Assessment, Certification and Examination (ACE) Manual

AQF VET qualification requirements specified in:

the qualification packaging rules for Certificate III in Financial Services – defined in the Financial Services Training Package (detailed on pp 13–16 of this document) RTO policies.

It is important to note that the rules and structure of HSC VET courses are not identical to the qualification packaging rules.

HSC VET courses can only be delivered by a Registered Training Organisation (RTO) who must:

deliver the HSC VET course in accordance with Board of Studies’ requirements meet the requirements of the VET Quality Framework [formerly referred to as the

Australian Quality Training Framework (AQTF)] meet the Training Package requirements.

The Financial Services Curriculum Framework and Certificate III in Financial Services

The Financial Services Training Package qualification packaging rules for Certificate III in

Financial Services (FNS30111) requires the achievement of: a set of 4 core units of competency

plus 9 elective units of competency.

(Refer to pp 13–16 of this document for further detail.)

To achieve Certificate III in Financial Services as a part of the HSC, students will generally complete the following HSC VET courses from the Financial Services Curriculum

Framework:

Financial Services (240 indicative hours) – 4 HSC credit units

Financial Services Specialisation Study (60 indicative hours) – 1 HSC credit unit. To be eligible for the award of the HSC, students must satisfactorily complete a pattern of study that includes 22 HSC credit units (refer to the Assessment, Certification and

Examination (ACE) Manual for further detail).

Students undertaking Certificate III in Financial Services (FNS30111) through the Financial Services (240 indicative hours) course plus the Financial Services Specialisation Study (60 indicative hours) will be eligible for 5 HSC credit units towards the 22 HSC credit units required for the award of their HSC.

Students who only undertake the Financial Services (240 indicative hours) course will be eligible for 4 HSC credit units and a Statement of Attainment towards Certificate III in Accounts Administration.

Financial Services HSC course requirements Certificate III in Financial Services Refer to pp 9–12 of this document and Section 2 of the Syllabus for further detail.

Financial Services (240 indicative hours) Students must undertake:

Certificate III in Financial Services Students must achieve 13 units of competency – 4 core plus 9 electives five mandatory units of competency

(110 HSC indicative hours) made up of three core and two electives four Financial Services stream

units of competency

(75 HSC indicative hours)

made up of four electives

HSC Content

(four mandatory focus areas plus the Financial Services stream focus area)

HSC elective units of competency to a minimum of

55 HSC indicative hours

(from the streams not already undertaken and/or the HSC elective pool)

minimum of 70 hours of mandatory work placement

Financial Services Specialisation Study (60 indicative hours)

Students must undertake: 60 HSC indicative hours worth of units of competency not previously undertaken from the streams and/or

the HSC elective pool

to be able to achieve Certificate III in Financial Services

the remaining units of competency need to include:

remaining core unit of competency for the qualification

3 elective units of competency for the qualification HSC course requirements AQF VET qualification requirements

Work placement is a mandatory HSC VET course requirement with minimum hours assigned to each HSC VET course. Non-completion of work placement means the student has not met the HSC VET course requirements and cannot count the HSC credit units for the course towards the award of their HSC. They would still be credentialled for the AQF VET qualification outcome.

The minimum work placement requirement for students undertaking Certificate III in Financial Services (FNS30111) is:

Financial Services (240 indicative hours) – 70 hours

Financial Services Specialisation Study (60 indicative hours) – no additional hours required

Work placement is to be undertaken in an appropriate financial services work environment. Appropriate work placements may be in the financial services industry or in related industry areas and include a mix of financial services-specific and more general workplace

experiences.

Refer to the Work Placement in Financial Services document for further information, including industry-specific advice regarding work placement in financial services.

HSC Content

The HSC Content for this Framework is organised into focus areas. Each focus area prescribes the scope of learning for the HSC. This is drawn from the associated units of competency (outlined in Table 1 below).

Students undertaking the Financial Services (240 indicative hours) course must address: all of the mandatory focus areas:

Financial operations Industry context Work

Safety

one stream focus area:

Financial Services (for Certificate III in Financial Services).

The content description for each focus area is detailed in Section 3 of the Syllabus.

The HSC examination in Financial Services is based on the HSC Content and employability skills for the Certificate III qualifications in this Framework (refer to Section 4 of the Syllabus).

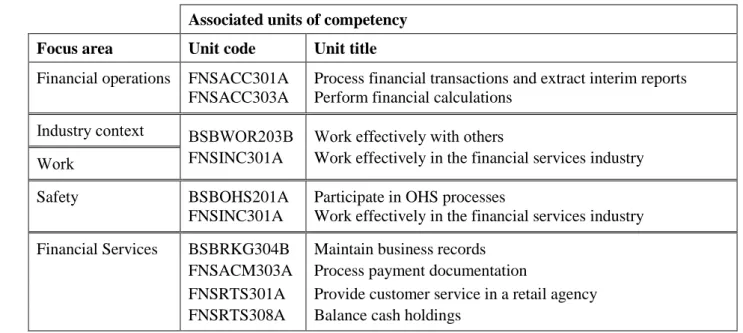

Table 1 Focus areas and associated units of competency for Certificate III in Financial Services (FNS30111)

Associated units of competency

Focus area Unit code Unit title

Financial operations FNSACC301A Process financial transactions and extract interim reports FNSACC303A Perform financial calculations

Industry context BSBWOR203B Work effectively with others

Work FNSINC301A Work effectively in the financial services industry

Safety BSBOHS201A Participate in OHS processes

FNSINC301A Work effectively in the financial services industry Financial Services BSBRKG304B Maintain business records

FNSACM303A Process payment documentation

FNSRTS301A Provide customer service in a retail agency FNSRTS308A Balance cash holdings

HSC examination

The Financial Services Curriculum Framework includes an HSC examination which provides the opportunity for students to have their HSC mark contribute to the calculation of their Australian Tertiary Admission Rank (ATAR).

Students who have completed the Financial Services (240 indicative hours) course are eligible to sit for the Financial Services HSC examination.

Students who want to sit for the Financial Services HSC examination must be entered for both the Financial Services course and the Financial Services examination on Schools Online (Administration). It is the responsibility of the home school to enter students into VET Framework courses and VET HSC examinations when the course is studied at a TAFE NSW Institute.

Students will sit for the Financial Services HSC examination at the same HSC examination centre where they sit all of their other written HSC examinations (usually at their home school).

The Financial Services HSC examination is based on the HSC Content (refer to Section 3 of the Syllabus) and employability skills for the Certificate III qualifications in this Framework (refer to p 16 of this document and the Employability Skills in Financial Services document).

The Financial Services HSC examination is a written exam independent of the competency-based assessment undertaken during the course and has no impact on student eligibility for Certificate III in Financial Services (FNS30111).

HSC examination specifications

The HSC examination specifications, which describe the format of the Financial Services HSC examination, are contained in the Assessment and Reporting in Financial Services Stage 6 document.

The Financial Services HSC examination will consist of a 2-hour written paper. The paper will consist of four sections:

Section I – objective response questions to the value of 15 marks Section II – short-answer questions to the value of 30 marks

Section III – one extended response question to the value of 15 marks

Section IV – three structured extended response questions (one for each of the stream focus areas: Accounting, Financial Services, and Financial Markets and Systems) each to the value of 20 marks. Candidates will be required to answer the question on the stream they have studied.

The Financial Services HSC examination is based on the HSC Content (focus areas) and employability skills for the Certificate III qualifications:

Sections I, II and III are based on the mandatory focus areas

Section IV is based on the stream focus areas and can also draw from the mandatory focus areas. Students undertaking Certificate III in Financial Services will answer the Financial Services structured extended response question in Section IV.

Relationship of the Financial Services (240 indicative hours) course structure to the Financial Services HSC examination

HSC units of

competency HSC Content

HSC Examination one common examination

Mandatory units of competency

Mandatory focus areas Financial Operations

Industry Context

Work

Safety

Section I

15 objective response questions

Stream units of competency Accounting

or

Financial Services or

Financial Markets and Systems

Stream focus areas Accounting or

Financial Services or

Financial Markets and Systems

Section II short answer questions

Section III

one extended response question

Section IV

three structured extended response questions

one question for each stream – Accounting, Financial Services and Financial Markets and Systems

students answer the question on the stream they have studied

HSC elective

Status of units of competency for the Financial Services HSC courses and Certificate III in Financial Services

To achieve Certificate III in Financial Services (FNS30111) the Financial Services Training Package requires students to achieve 13 units of competency: 4 core units of competency

9 elective units of competency.

To achieve Certificate III in Financial Services (FNS30111) as a part of the HSC, students will generally do the following HSC VET courses: Financial Services (240 indicative hours)

Financial Services Specialisation Study (60 indicative hours).

To meet HSC course requirements, students completing the Financial Services (240 indicative hours) course must undertake five mandatory and four stream units of competency (3 core and 6 electives for Certificate III in Financial Services) plus 55 HSC indicative hours of HSC elective units of competency.

Students who are also completing the Financial Services Specialisation Study (60 indicative hours) course must undertake an additional 60 HSC indicative hours of units of competency.

Status in Financial Services Curriculum Framework

HSC indicative

hours

Unit code Unit title

Certificate III in Financial Services

4 core & 9 electives

min 6 listed electives

max 3 ‘other’ electives

mandatory 15 BSBOHS201A Participate in OHS processes core

mandatory 15 BSBWOR203B Work effectively with others core

mandatory 45 FNSACC301A Process financial transactions and extract interim reports listed elective

mandatory 10 FNSACC303A Perform financial calculations listed elective

mandatory 25 FNSINC301A Work effectively in the financial services industry core

financial services stream 20 BSBRKG304B Maintain business records listed elective

financial services stream 20 FNSACM303A Process payment documentation listed elective

financial services stream 20 FNSRTS301A Provide customer service in a retail agency listed elective

financial services stream 15 FNSRTS308A Balance cash holdings listed elective

sub-total HSC indicative hours –

To achieve Certificate III in Financial Services (FNS30111) students must undertake the remaining core units of competency.

Status in Financial Services Curriculum Framework

HSC indicative

hours

Unit code Unit title

Certificate III in Financial Services

4 core & 9 electives

min 6 listed electives

max 3 ‘other’ electives

elective 15 BSBWOR204A Use business technology core

sub-total HSC indicative hours – mandatory, stream and core units of competency

200

For the HSC students must undertake a further 100 HSC indicative hours of units of competency [40 HSC indicative hours to meet the requirements of the Financial Services (240 indicative hours) course plus 60 HSC indicative hours to meet the requirements of the Financial Services Specialisation Study (60 indicative hours) course].

To achieve Certificate III in Financial Services (FNS30111), these need to include 3 more units of competency that are elective for the qualification.

Status in Financial Services Curriculum Framework

HSC indicative

hours

Unit code Unit title

Certificate III in Financial Services

4 core & 9 electives

min 6 listed electives

max 3 ‘other’ electives

elective 10 FNSACM302A Prepare, match and process receipts listed elective

elective 20 FNSCRD301A Process applications for credit listed elective

elective 20 FNSCRD302A Monitor and control accounts receivable listed elective

elective 25 FNSCRD405A Manage overdue customer accounts listed elective

elective 25 FNSCUS402A Resolve disputes listed elective

elective 25 FNSIAD301A Provide general advice on financial products and services listed elective

elective 20 FNSPRT301A Establish entitlements to an intestate estate listed elective

Status in Financial Services Curriculum Framework

HSC indicative

hours

Unit code Unit title

Certificate III in Financial Services

4 core & 9 electives

min 6 listed electives

max 3 ‘other’ electives

elective 20 FNSPRT303A Administer a non-complex trust listed elective

elective 25 FNSRTS302A Handle foreign currency transactions listed elective

elective 20 FNSRTS303A Balance retail transactions listed elective

elective 20 FNSRTS304A Administer debit card services listed elective

elective 30 FNSRTS305A Process customer accounts listed elective

elective 30 FNSRTS306A Process customer transactions listed elective

elective 10 FNSRTS307A Maintain Automatic Teller Machine (ATM) services listed elective

elective 20 FNSRTS309A Maintain main bank account listed elective

elective 25 FNSRTS401A Manage credit card services listed elective

elective 30 FNSRTS402A Prepare government returns and reports listed elective

elective 20 BSBCCO203A Conduct customer contact listed elective

elective 25 BSBCCO304C Provide sales solutions to customers listed elective

elective 20 BSBCMM301B Process customer complaints listed elective

elective 20 BSBCUS301B Deliver and monitor a service to customers listed elective

elective 20 BSBCUS403B Implement customer service standards listed elective

elective 20 BSBITU304A Produce spreadsheets listed elective

elective 15 BSBITU305A Conduct online transactions listed elective

elective 25 BSBITU306A Design and produce business documents listed elective

Status in Financial Services Curriculum Framework

HSC indicative

hours

Unit code Unit title

Certificate III in Financial Services

4 core & 9 electives

min 6 listed electives

max 3 ‘other’ electives

elective 20 BSBWOR301B Organise personal work priorities and development listed elective

accounting stream 35 FNSACC302A Administer subsidiary accounts and ledgers ‘other’ elective (max 3)

elective 40 FNSACC406A Set up and operate a computerised accounting system ‘other’ elective (max 3)

elective 15 FNSACM301A Administer financial accounts ‘other’ elective (max 3)

elective 30 FNSBKG405A Establish and maintain a payroll system ‘other’ elective (max 3)

elective 40 FNSINC401A Apply principles of professional practice to work in the financial

services industry ‘other’ elective (max 3)

elective 20 FNSORG301A Administer fixed asset register ‘other’ elective (max 3)

elective 20 FNSSAM301A Identify opportunities for cross-selling products and services ‘other’ elective (max 3)

elective 15 BSBDIV301A Work effectively with diversity ‘other’ elective (max 3)

elective 30 BSBFIA302A Process payroll ‘other’ elective (max 3)

accounting stream 40 BSBFIA401A Prepare financial reports ‘other’ elective (max 3)

elective 30 BSBSUS301A Implement and monitor environmentally sustainable work practices ‘other’ elective (max 3)

Minimum requirements for Certificate III in Financial Services (FNS30111) The following pages outline the qualification packaging rules for the AQF VET qualification FNS30111. This information is reproduced directly from the Financial Services Training Package (FNS10). It is included so that the minimum requirements for achieving the industry qualification are clear. Students who meet these requirements will be eligible for the relevant AQF VET Certificate, whether or not they have met the additional requirements of the HSC course.

A Statement of Attainment will be issued for achievement of single or multiple units of competency. At a later date, a person can undertake further skill development or training and be assessed against additional competencies until they have achieved all the competencies required for an AQF VET qualification. RTOs must recognise and give credit for the competencies recorded on a Statement of Attainment.

Please note: Only the shaded units of competency are available in the Financial Services Curriculum Framework. HSC course requirements are outlined in Section 2 of the Syllabus.

FNS30111 Certificate III in Financial Services

This qualification is designed to reflect the job role of entry level employees working across the entire financial services industry who perform duties such as:

responding to customer enquiries

sales and service

maintaining financial records

performing clerical duties

applying fundamental skills in banking, credit management, insurance and retail financial services.

Qualification Pathway

The primary pathway from this qualification is entry level employment in a range of financial services sectors.

Depending on the sector entered specialist FNS10 Financial Services Training Package qualifications at Certificate III and IV would support career progression.

Work functions in the occupational areas where this qualification may be used are subject to regulatory requirements. You should refer to the IBSA website (www.ibsa.org.au under Training Packages/Industry) or the relevant regulator for specific guidance on requirements.

Packaging rules

13 units must be achieved: 4 core units

plus9 elective units.

6 elective units must be selected from the electives listed below.

The remaining 3 elective units may be selected from the elective units listed below, any endorsed Training Package or accredited course. Elective units may be selected from a Certificate III or Certificate IV qualification.

Elective units must be relevant to the work outcome, local industry requirements and the qualification level.

Core units of competency:

FNSINC301A Work effectively in the financial services industry BSBOHS201A Participate in OHS processes

BSBWOR203B Work effectively with others BSBWOR204A Use business technology

Elective units of competency:

FNSACC301A Process financial transactions and extract interim reports FNSACC303A Perform financial calculations

FNSACM302A Prepare, match and process receipts FNSACM303A Process payment documentation

FNSASIC301C Establish client relationship and analyse needs FNSASIC302C Develop, present and negotiate client solutions

FNSASIC303A Provide advice on First Home Saver Account Deposit Products and Non-cash Payments

FNSASIC305A Provide Tier 2 personal advice in general insurance FNSCRD301A Process applications for credit

FNSCRD302A Monitor and control accounts receivable FNSCRD405A Manage overdue customer accounts FSNCUS402A Resolve disputes

FNSIAD301A Provide general advice on financial products and services FNSILF302A Process a life insurance application

FNSILF303A Issue a life insurance policy

FNSPRT302A Administer a non-complex estate FNSPRT303A Administer a non-complex trust

FNSRTS301A Provide customer service in a retail agency FNSRTS302A Handle foreign currency transactions FNSRTS303A Balance retail transactions

FNSRTS304A Administer debit card services FNSRTS305A Process customer accounts FNSRTS306A Process customer transactions

FNSRTS307A Maintain Automatic Teller Machine (ATM) services FNSRTS308A Balance cash holdings

FNSRTS309A Maintain main bank account FNSRTS401A Manage credit card services

FNSRTS402A Prepare government returns and reports FNSSUP301A Process superannuation fund payments

FNSSUP302A Establish, maintain and process superannuation records FNSSUP303A Process superannuation contributions

FNSSUP304A Process superannuation rollover benefits FNSSUP305A Implement member investment instructions FNSSUP306A Terminate superannuation plans

BSBCCO203A Conduct customer contact

BSBCCO304C Provide sales solutions to customers BSBCMM301B Process customer complaints

BSBCUS301B Deliver and monitor a service to customers BSBCUS403B Implement customer service standards BSBITU304A Produce spreadsheets

BSBITU305A Conduct online transactions

BSBITU306A Design and produce business documents BSBRKG303B Retrieve information from records BSBRKG304B Maintain business records

BSBWOR301B Organise personal work priorities and development TAEDEL404A Mentor in the workplace

Employability Skills Qualification Summary

Employability Skill Industry/enterprise requirements for this qualification include: Communication conducting research to collect and analyse information and present it

in report form

having the ability to question, clarify and evaluate information

investigating and negotiating to resolve disputes

liaising with internal and external personnel with an ability to ‘read’ verbal and non-verbal body language

using a range of techniques and sales skills to elicit feedback from customers

using specialist language in written and oral communication

writing in a range of styles to suit different audiences Teamwork receiving feedback on performance

referring matters to nominated person as required

working as a member of a team and applying knowledge of one’s own role to achieve team goals

Problem-solving collecting, comparing and contrasting data in order to create reports

using problem-solving tools and techniques to balance and reconcile amounts

Initiative and enterprise contributing to solutions to workplace challenges

contributing to the design and preparation of reports to effectively present workplace information

identifying cross-selling opportunities

Planning and organising contributing to the planning process by researching and validating information relating to estates

planning work considering resources, time and other constraints

processing routine documents and maintaining files, managing information, and scheduling and coordinating competing tasks Self-management managing own time and priorities and dealing with contingencies

operating within industry and organisational codes of practice, legislation and regulations

taking responsibility as required by work role and ensuring all organisational policies and procedures are followed

Learning acquiring and applying knowledge of services and organisational policies and procedures

asking questions to clarify instructions

seeking advice on technical issues

using online help and manuals to solve basic technology problems Technology using electronic communication devices and processes such as

internet, software packages and email, to produce written correspondence and reports

using technology to assist the management of information and to assist the planning process