Multiple time scales analysis of global stock markets spillovers effects in African stock markets

Full text

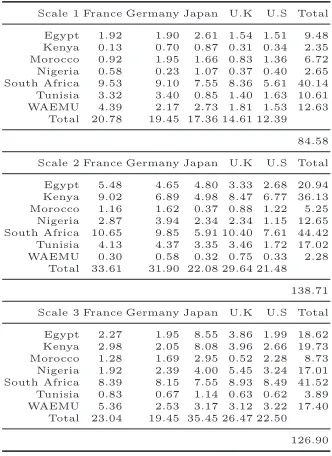

Figure

Related documents

Figure 5 below shows the dynamic portfolio weights that should be held in Nigerian and South African stock markets for global financial investors seeking optimal portfolio

The empirical results also indicate that the South African stock market is integrated with the developed markets represented by the US, German and Japan.. This shows that there

Hence, despite the sharp increase in oil price due to higher demand, stock markets in emerging countries didn’t face sharp correction s because negative impacts from.. higher

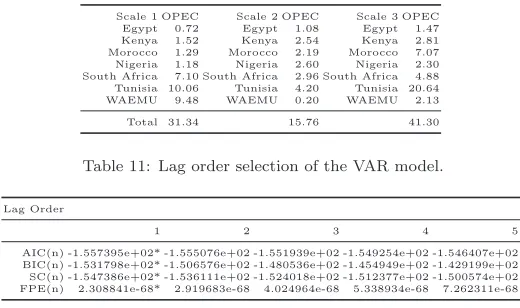

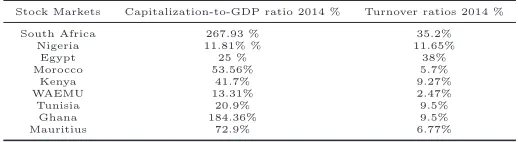

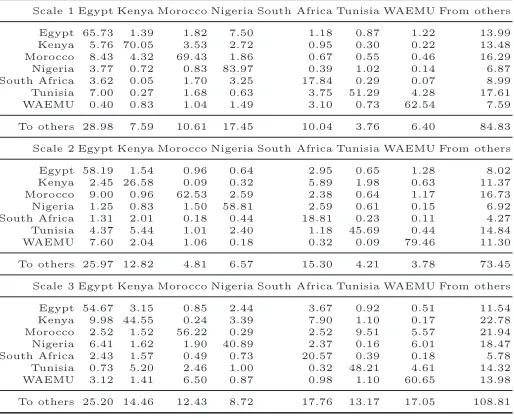

We examine the way in which the degree of regional (seven African markets combined), global (China, France, Germany, Japan, the UK and the US), commodity (gold and petroleum),

Raj and Dhal (2008) examine the integration of Indian stock market with stock markets and find that evidence of international integration when Indian stock

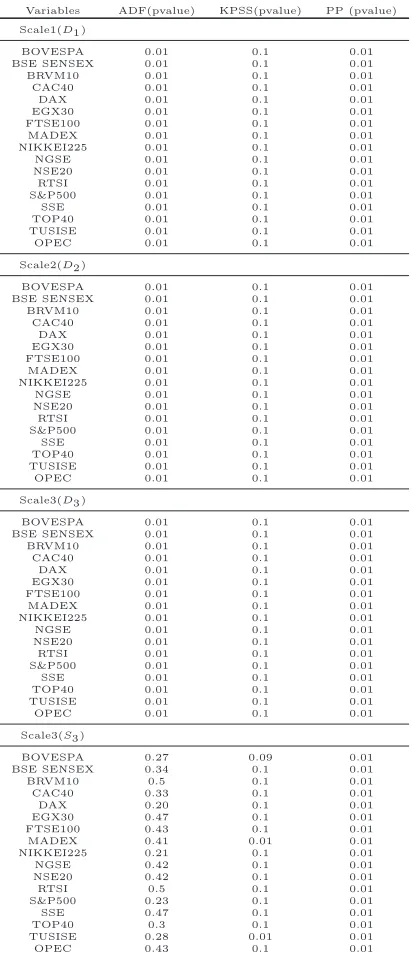

In this paper we revisit the issue of integration of emerging stock markets with each other and with the developed markets over different time horizons using weekly stock indices

Raj and Dhal (2008) examine the integration of Indian stock market with stock markets and find that evidence of international integration when Indian stock

However, unlike net oil importing countries where the expected link between oil prices and stock markets is negative, the transmission mechanism of oil price shocks to