0

WHOLESALE AND RETAIL PRICE TRENDS OF

SELECT COMMODITIES– DO THEY CONVERGE?

-

M.C. SINGHI

Views expressed in this paper are those of the author(s) and may not be

1

TABLE OF CONTENTS

Sl.No. Item

Page No.

1

Introduction

1

2

Recent trends in Wholesale and Retail Prices at Commodity

level

5

3

Trends in WPI and RPI at commodity level – Food gains

8

4

Trends in WPI and RPI at commodity level – Edible oils

11

5

Trends in WPI and RPI at commodity level – Other

commodities

13

2

WHOLESALE AND RETAIL PRICE TRENDS OF SELECT COMMODITIES– DO THEY CONVERGE?

Inflation is a general measure of price changes that takes place between two periods. When the measure of price rise widens beyond a commodity or a commodity group to a heterogeneous mix of products/services, price indices are constructed to get a single measure expressing in aggregate an inflation number. The domain of inflation index, however, may differ depending upon the set of economic agents or institutional units or set of commodities and transactions.

1.2 In India, a variety of inflation indices are being construction. The WPI is used extensively for short-term policy measures because it is the only index that is available on a weekly basis with a time lag of two weeks from the reference week and covers commodities across the entire real sector. A number of Consumer Priced Indices are also constructed, which are class specific, like Consumer Price Index for Industrial Workers (CPI-IW), Agricultural Labourers (CPI-AL), Rural Labourers (CPI-RL) and Urban Non-Manual Employees (CPI-UNME). All these indices are available on a monthly basis with a time lag of 3-4 weeks and with commodity composition/weights consistent with relative importance in expenditure of the respective class/group. One comprehensive measure of inflation comes as an implicit price deflector of gross domestic product (GDP). This is available on a quarterly basis with a time lag of about a quarter.

1.3 In addition to the comprehensive price indices, monitoring of prices is also undertaken by respective administrative Ministries/Departments for the commodities within their domain. Department of Agricultural Cooperation monitors the prices of agricultural commodities, Department of Chemical and Petrochemicals monitors the prices of Drugs and Pharmaceuticals, Ministry of Petroleum and Natural Gas monitors the prices of crude and related products,

3

and so on. The Department of Consumer Affairs monitors the prices of 14 commodities identified as essential commodities from the point of view of their impact on vulnerable sections and as a measure of the cost of living of the common people.

1.4 One major different between the price indices and prices monitored by the administrative Departments is that while the former is a single aggregate number, prices at the administrative Department level is for a single or multiple products without any higher order aggregation. Both WPI and CPI, however, are also amenable to be compiled at commodity and group level, but they also permit higher order aggregation thorough specially constructed weights. In the CPIs, the weights are assigned on the basis of the relative importance of the item in the consumer expenditure of the class of consumers to which the index pertains. In case of WPI, the weighting diagram follows more or less a similar process, but weights are in terms of relative transaction in the economy. The weighting diagram of WPI, however, is not drawn on the basis of value added which is a concept in GDP. The weights are derived on the basis of turnover or value of output. The ratio of value added to value of output differs significantly in the real sectors. While this ratio is around 85% in primary sectors comprising agriculture and mining, it is close to 21% in the manufacturing sector. Assigned weights to sectors/groups in WPI which are in terms of relative turnover, therefore, are not related to the relative share of primary or manufactured products in GDP. A three stage approach has been adopted in deciding weights of commodities in WPI.

a. At the first stage, the weights of three major groups (Primary Articles, Fuel & Power and Manufactured Products) are decided on the basis of the value of transaction. The value of transaction has been worked out on the basis of value of output as obtained from National Accounts and adjusted for international trade. The weights so assigned

4

are in proportion of the value of transactions and are, therefore, imposed from above.

b. In second stage, the weights of the items at the broad group level are decided. Within the three major groups, for the Primary Articles, the weights for food articles, non-food articles and minerals; for the Fuel group, weights for coal, minerals, oils and electricity; and for Manufactured Products, weights at the two digit NIC classification of the industrial groups level, are again imposed from above and are in proportion of the value of transactions.

c. At the third stage, weights at commodity level are decided based on the relative output of the selected commodities in such a manner that the total weights of the commodities within a group would be equal to the weights assigned at the broad group level.

1.5 For the agricultural commodities within the Primary Articles, weights of the items are based on the presumed marketed surplus. While it is difficult to say the share of the selected commodities to the total turnover of the broad/major group, it is generally exhaustive. In the manufacturing group, in the current series (1993-94) a traded value threshold of Rs.120 crore was set as the parameter for selection of a commodity/product.

1.6 Given that the commodity basket and weights of commodities in WPI and CPIs differ, it may not be uncommon for these indices to have different inflation numbers. But since these measure (and generally believed as indicating the level of prices and price rise), the difference in the inflation base of these indices creates credibility gaps and apprehensions about the information system. Further, the first point prices (or the prices at the wholesale level) often are likely to lead the prices at the ultimate level of transaction (at retail level). If the difference between two is due to margins and other services getting imbedded into it, widening of divergence could be

5

considered as being arising due to hoarding or profiteering. There have, therefore, been concerns that the wholesale and retail prices not only differ in their levels but also in the direction and intensity. This paper, therefore, makes an attempt, for the first time, to look at the wholesale and retail prices of the 14 essential commodities covered by the Department of Consumer Affairs. Geographic coverage of these commodities by DCA is also fairly extensive and 17 locations are covered by daily price monitoring system.

1.7 The broad methodology followed as summarized below-

i) Both the retail and wholesale prices of 14 commodities have been converted to a common base of 2004-05= 100. While wholesale prices are average of the weeks, retail prices are of the month end. As in the case of WPI, equal weights have been attached to all the responses from17 locations. The issue to differences in quality/variety has been ignored. Price relatives have, however, been computed for each commodity/location for generating a commodity/location specific RPI. In WPI also, each response is given equal weights and index of a commodity is a simple arithmetic average of price relatives of all responses.

ii) The commodities in retail price index have been assigned the same weight as are being currently allocated in WPI 1993-94 series. This has been done for a better comparison. Further, it may be capturing the relative importance of these commodities. Weights that get assigned to the commodity groups are: food grains (including atta)- 30.6 per cent; edible oils- 10.2 per cent; and others- 49.2 per cent.

iii) A relative index is computed of the retail prices with reference to the WPI to ascertain the divergence/convergence between WPI and RPI.

iv) A comparison in the Retail Price Index (RPI) and WPI is made both at commodity level and at the location level, besides the comparison at the aggregate level of 14 commodities.

v) Relative index is also computed at the commodity level and at location level for the retail prices with the WPI as the base.

6

Recent trends in Wholesale and Retail Prices at Commodity level

2.1 An aggregated RPI of 14 commodities increased from an average of 100 in 2004-05 to 144.1 in July 2009 recording a monthly increase of 0.56 per cent (or an annualized inflation of 6.71 per cent). WPI of these commodities increased to 136.9 in July 2009, giving an average monthly increase of 0.45 per cent (or an annualized inflation of 5.37 per cent). Not only the overall RPI increase was higher, the spread between the two indices continued to widen. Average annual inflation of RPI was consistently higher than WPI, except in the current year (first four months). (Table 1)

Table 1: Wholesale and Retail Price Indices and Inflation

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009

Retail and Wholesale Price Indices 2004-05=100

RPI 100.0 105.1 112.4 115.8 130.1 125.0 141.3 144.1

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation (year on year per cent)

RPI 5.1 7.0 3.0 12.4 12.2 13.0 0.56$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (Index and year on year Inflation)

Relative RPI 100.0 101.1 102.4 103.1 106.3 106.2 105.6 105.3

Relative Inflation 1.1 1.3 0.7 3.2 4.6 -0.6 0.11$

$ Average monthly build up of prices

2.2 RPI relative to WPI increased to 105.3 in July 2009 indicating the cumulative divergence in last little over 5 years. Relative index was less than 100 in 2004 and peaked in August 2008 and reached 108.8. Average monthly rate of divergence in two indices was 0.11 per cent. Average annual index indicated above, however, masks the inter month changes in the two indices. Until around June 2007, both RPI and WPI have generally been close (though a moderate shift became visible from June 2005) and then start to drift. Year on year inflation measured either by RPI or by WPI were lowest during May-December 2007 before witnessing an upsurge. Inflation reached double digit

7

levels in recent months. In April-July 2009, WPI inflation overtook inflation measured in terms of retail prices. (Chart 1 and 2)

Monthly RPI and WPI

90 100 110 120 130 140 150 A p r-0 4 J u l-0 4 O c t-0 4 J a n -0 5 A p r-0 5 J u l-0 5 O c t-0 5 J a n -0 6 A p r-0 6 J u l-0 6 O c t-0 6 J a n -0 7 A p r-0 7 J u l-0 7 O c t-0 7 J a n -0 8 A p r-0 8 J u l-0 8 O c t-0 8 J a n -0 9 A p r-0 9 J u l-0 9

All Commodities RPI All Commodities WPI

Year on year inflation (per cent)

0 2 4 6 8 10 12 14 16 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9 RPI WPI

2.3 There could be three reasons for widening of spread between RPI and WPI of these 14 commodities. First, it could be because of an increase in the transaction costs, like transportation. Second, it could be because of greater services getting embedded into retail price, like home delivery, packaging, cleaning, etc. Third, it could be due to institutional factors, covering regulations, competition, entry restriction, etc. Directorate of Economics and

8

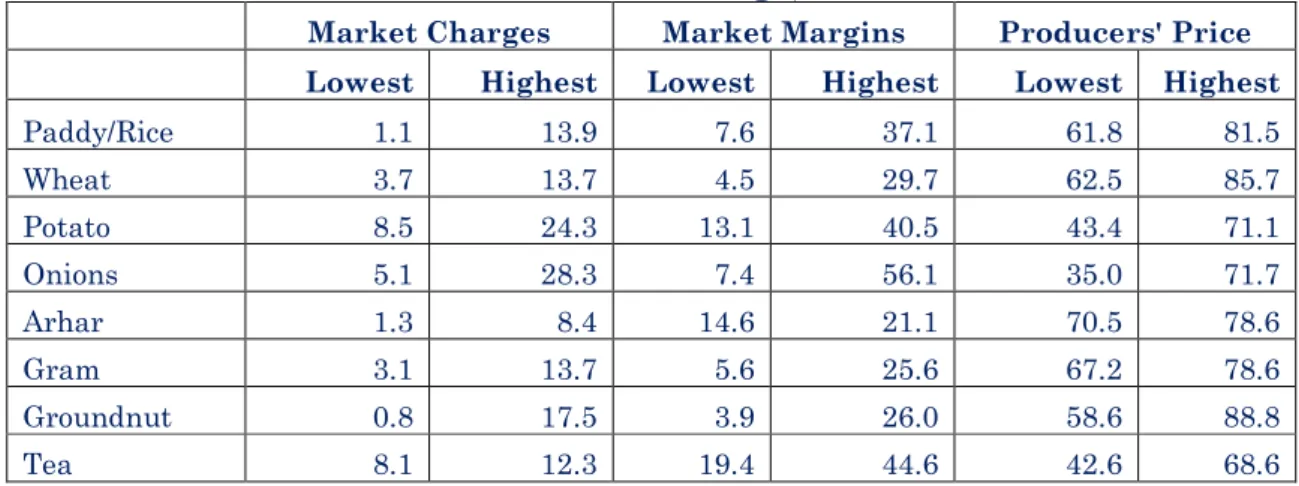

Statistics, Ministry of Agriculture had conducted a study of marketing margins of agricultural produce in 2004-05 to see the share of producers in prices paid by the consumers. The study observed wide state and inter-product variations in marketing margins and share of producers in retail prices (Table 2). The study being a one time study does not provide any evidence of increase in the spread. US Department of Agriculture, however, have observed that the index of difference between the retail value and farm value (1982-84=100) increased from 246.2 in 2006 to 282.2 in March 2009 (USDA- Agri Outlook Tables, July 2009). A study commissioned by the Office of Economic Adviser for generating Trade Services Price Index observed that the trade service price index for unorganized retail trade (excluding motor vehicles) was flat between December 2007 and February 2008. The study however observed increase in the index for organized retail during this period by 13.8 per cent.

Table 2: Market Margins, Market Charges and Producers price in consumer prices (as per cent of consumer prices- Lowest and Highest

State wise range)

Market Charges Market Margins Producers' Price

Lowest Highest Lowest Highest Lowest Highest

Paddy/Rice 1.1 13.9 7.6 37.1 61.8 81.5 Wheat 3.7 13.7 4.5 29.7 62.5 85.7 Potato 8.5 24.3 13.1 40.5 43.4 71.1 Onions 5.1 28.3 7.4 56.1 35.0 71.7 Arhar 1.3 8.4 14.6 21.1 70.5 78.6 Gram 3.1 13.7 5.6 25.6 67.2 78.6 Groundnut 0.8 17.5 3.9 26.0 58.6 88.8 Tea 8.1 12.3 19.4 44.6 42.6 68.6

2.4 Increase in the spread between wholesale and retail prices beginning 2007-08 could also be attributed to increasing in “holding gains” and increase in transaction costs. Increase in the domestic and international prices of “food, fat and fuels” during this period was associated with tightening of monetary

9

policy (creeping increase in policy rates since October 2005 and until August 2008) and quantity restriction on stocks (since August 2006). Hardening of interest rates necessitated the need for increasing the holding gains while the quantitative stock restrictions requiring more frequent replenishment of stocks increased transaction costs of business.

2.5 Measurement of distribution services could follow the National Accounts framework. SNA 1993 framework states “although retailers actually buy and sell goods, the goods purchased are not treated as part of their intermediate consumption when they are resold with only minimal processing such as grading, cleaning, packaging, etc. Wholesalers and retailers are treated as supplying services rather than goods to their customers by storing and displaying a selection of goods in convenient locations and making them easily available to buy. Their output is measured by the total value of trade margins realized on goods purchased for resale”. Share of “trade, hotels and restaurants” in GDP, though has more than doubled from around 8 per cent in 1950-51 to 16 per cent in 2007-08, it has remained flat at 16 per cent during 2003-2008. As proportion to real sector GDP, it increased from 38 per cent in 2003-04 to 43 per cent in 2007-08. It is, however, difficult to say whether this is due to greater services getting embedded into retail trade or increase in margins per se.

Trends in WPI and RPI at commodity level Food grains

3.0 Retail prices of cereals and pulses, accounting for a weight of 30.6 per cent in the comparable basket, grew faster than their respective wholesale prices. Average monthly increase in retail prices during April 2005 to July 2009 was around 0.8 per cent for cereals (including atta), 0.9 per cent for gram dal 1.02 per cent for arhar. There were significant inter month and inter year variations in the price changes. While grand al and wheat were the leading contributors to inflation in 2005-07, arhar and rice witnesses a spurt in prices

10

in 2007-08 and 2008-09. Increase in wholesale prices of these products was lower, though inter year and inter month variations followed more or less a similar pattern. Average monthly increase in wholesale prices for these 5 commodities was, however, higher compared to increase at the aggregate level of the comparable basket. A significant part of the increase in WPI could be attributed to an increase in the minimum support price (MSP) of these commodities. The MSP, by definition, sets the floor that is guaranteed to the farmers. The index of MSP in 2008-09 with 2004-05 as the base was 152 for paddy (common variety) and 159 for wheat and both RPI and WPI were in line with the index of MSP.

Table 3: RPI and WPI of Cereals and Pulses

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009

Retail Price Index 2004-05=100

Rice 100.0 103.9 109.6 124.8 150.5 145.7 154.7 155.7

Wheat 100.0 107.8 133.5 138.2 147.0 145.0 151.7 156.7

Gram Dal 100.0 115.2 161.9 153.3 158.8 160.4 154.2 162.9

Arhar 100.0 97.9 105.5 125.5 145.0 134.3 214.7 228.6

Atta 100.0 108.5 131.7 139.5 146.5 145.3 149.8 150.5

Wholesale Price Index 2004-05=100

Rice 100.0 103.8 106.8 114.0 126.7 119.9 139.1 140.5

Wheat 100.0 104.0 117.6 122.6 130.1 127.7 134.9 135.1

Gram Dal 100.0 114.5 152.2 145.9 152.7 152.5 146.5 149.0

Arhar 100.0 95.3 101.5 115.7 127.5 121.3 162.0 183.0

Atta 100.0 105.4 125.0 129.4 134.4 134.3 133.3 133.0

Inflation year on year in per cent based on RPI

Rice 3.9 5.5 13.7 20.9 25.1 6.3 0.84$

Wheat 7.8 24.0 3.8 6.4 8.8 4.6 0.83$

Gram Dal 15.2 40.5 -4.0 3.7 6.0 -3.9 0.90$

Arhar -2.0 7.8 19.0 15.5 13.3 59.9 1.02$

Atta 8.4 21.4 6.4 5.0 6.7 3.1 0.81$

Inflation year on year in per cent based on WPI

Rice 3.8 2.9 6.8 11.0 8.0 16.0 0.52$

Wheat 4.0 13.0 4.5 6.2 7.5 5.7 0.58$

Gram Dal 14.5 32.9 -3.1 4.7 5.6 -3.9 0.81$

Arhar -4.5 6.6 14.0 10.2 10.1 33.5 0.70$

Atta 5.4 18.4 4.2 3.9 6.2 -0.7 0.63$

11

3.1 Higher increase in retail prices of wheat and rice have also been due to inclusion PDS in WPI. The current series of WPI has 8 responses for PDS rice and 7 responses for PDS wheat out of total responses of 37 and 26 for rice and wheat, respectively. PDS prices have remained unchanged since July 2002 and have moderated the increase in prices of wheat and rice to the extent of proportion of PDS responses in WPI. Exclusion of the PDS component from WPI considerably narrows the gap between WPI and RPI in both rice and wheat. We are not looking at the issue of the treatment of subsidized items in a price index, whether WPI or RPI, but simply looking at the comparability of the two indices for the subsidized products. (Charts 4 and 5)

12

3.2 As expected the RPI relative to WPI has consistently been above 100 for all the five commodities. Persistent and increasing divergence between RPI and WPI was, however, observed for rice and arhar. Relative RPI for wheat and gram dal peaked in 2006-07 resulting in relative inflation getting moderated in last three years. Moderation in relative inflation of wheat is largely due an upsurge in retail prices in 2006-07 on account of a poor crop in 2004-06. An increase in production from around 69 million tones in 2004-06 to over 75 million tones in each of the successive three years kept a lid over the retail prices. (Table 4)

Table 4: RPI relative to WPI and relative inflation

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

RPI relative to WPI (2004-05=100)

Rice 100.0 100.1 102.6 109.3 119.0 121.5 111.2

Wheat 100.0 103.5 113.6 112.7 112.9 113.5 112.4

Gram Dal 100.0 100.6 106.3 105.1 104.0 105.1 105.2

Arhar 100.0 102.8 103.9 108.4 113.7 110.8 132.7

Atta 100.0 102.8 105.5 107.8 109.0 108.2 112.4

Inflation year on year in per cent

Rice 0.1 2.5 6.5 9.2 15.9 -8.4 Wheat 3.6 9.7 -0.7 0.2 1.3 -1.0 Gram Dal 0.6 5.6 -0.9 -1.0 0.4 0.1 Arhar 2.7 1.1 4.4 4.9 2.9 19.8 Atta 2.8 2.7 2.2 1.1 0.4 3.9 Edible oils

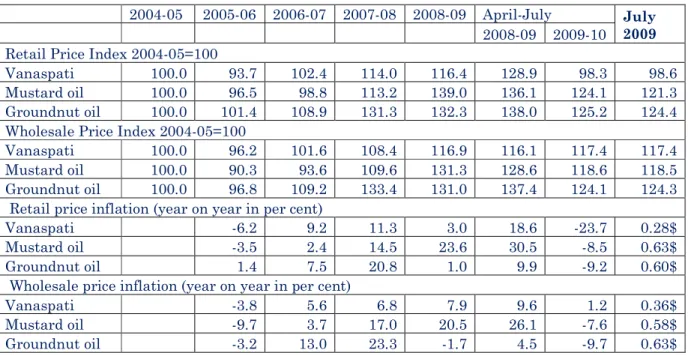

4.0 Three edible oils forming part of the comparable basket accounted for a 10.2 per cent of the total weights. In edible oils, WPI and RPI generally appear to be converging for mustard and ground nut oils. In case of vanaspati, however, while RPI shows a decline in price levels from its peak in July 2008, WPI is sticky. Inter month variations in both RPI and WPI as also the inflation rates has been quite significant for edible oils. Both RPI and WPI have been volatile. In case of edible oils, nearly half of the domestic consumption is met through imports. Except for 2008-09 when Government

13

introduced a scheme of 1 million tones of imported edible oils at a subsidy of Rs 15 per Kg, edible oils have had a market determined price regime. Impact on domestic price of global price upsurge in 2007-09 was moderated through a reduction of customs duties.

4.1 Average monthly increase in retail prices of edible oils varied from 0.3 per cent for Vanaspati to 0.6 per cent for mustard and groundnut oils. In case of wholesale prices also, average monthly increase at 0.36 per cent was lower compared to an increase of 0.6 per cent for mustard and groundnut oils. Retail prices of edible oils started moderating from July 2008 onwards while moderation in wholesale prices started happening a little later. Both for WPI and RPI, the price levels in July 2009 were significantly lower than their peaks. (Table 5)

Table 5: RPI and WPI of Edible oils

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009

Retail Price Index 2004-05=100

Vanaspati 100.0 93.7 102.4 114.0 116.4 128.9 98.3 98.6

Mustard oil 100.0 96.5 98.8 113.2 139.0 136.1 124.1 121.3

Groundnut oil 100.0 101.4 108.9 131.3 132.3 138.0 125.2 124.4

Wholesale Price Index 2004-05=100

Vanaspati 100.0 96.2 101.6 108.4 116.9 116.1 117.4 117.4

Mustard oil 100.0 90.3 93.6 109.6 131.3 128.6 118.6 118.5

Groundnut oil 100.0 96.8 109.2 133.4 131.0 137.4 124.1 124.3

Retail price inflation (year on year in per cent)

Vanaspati -6.2 9.2 11.3 3.0 18.6 -23.7 0.28$

Mustard oil -3.5 2.4 14.5 23.6 30.5 -8.5 0.63$

Groundnut oil 1.4 7.5 20.8 1.0 9.9 -9.2 0.60$

Wholesale price inflation (year on year in per cent)

Vanaspati -3.8 5.6 6.8 7.9 9.6 1.2 0.36$

Mustard oil -9.7 3.7 17.0 20.5 26.1 -7.6 0.58$

Groundnut oil -3.2 13.0 23.3 -1.7 4.5 -9.7 0.63$

$ Average monthly build up of prices

4.2 Unlike the food grains, the RPI of edible oils relative to their respective WPIs shows reasonable stability. Relative index in 2008-09 declines below 100 for Vanaspati. Near stability of RPI relative to wholesale prices is because

14

movement of index and inflation in both the series is generally on a similar trend. (Table 6)

Table 6: RPI relative to WPI and relative inflation

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

RPI relative to WPI (2004-05=100)

Vanaspati 100.0 97.5 100.8 105.1 99.6 111.1 83.8

Mustard 100.1 106.9 105.8 103.3 105.9 105.8 104.6

Groundnut 100.1 104.8 100.1 98.4 101.0 100.4 100.9

Inflation year on year in per cent

Vanaspati -2.5 3.5 4.2 -4.8 8.2 -24.6

Mustard 6.8 -1.0 -2.2 2.5 3.6 -1.1

Groundnut 4.8 -4.4 -1.4 2.7 5.2 0.5

Other commodities

5.0 The other six commodities under the price monitoring mechanism of Department of Consumer Affairs are a heterogeneous mix. The price trends of these commodities are also a heterogeneous mix. These commodities have a weight of 59.2 per cent in the comparable basket. For three commodities, sugar, milk and salt, average monthly increase in prices was higher for retail prices. For the other three commodities, tea, potato and onions, average monthly increase in prices was higher for wholesale prices.

5.1 RPI of sugar, potato and onions was most volatile. In case of sugar, RPI reached a low of 88.2 in June 2007 before witnessing a continuous increase to peak 147.3 in July 2009. Potato prices also fluctuated reaching a low of 75.7 in February 2005 to a peak of 206.8 in July 2009. In fact, retail prices witnessed an increase of over 100 per cent from February 2009 to July 2009 (RPI was 93.2 in February 2009). Onion prices were equally volatile and moved from a low of 85.0 in April 2005 to a peak of 242.3 in October 2007. The movement of wholesale prices over months was not altogether different. WPI of sugar remained below 100 from May 2007 to March 2008 before a rally to reach the current level of 136.5. Volatility in potato and onion prices was even sharper. Movement of WPI of tea was also erratic. (Table 7)

15

Table 7: RPI and WPI of other commodities

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009

Retail Price Index 2004-05=100

Sugar 100.0 111.3 111.0 90.0 110.1 95.8 144.8 147.3 Milk 100.0 101.6 108.3 119.6 129.8 127.9 132.9 135.1 Salt 100.0 106.6 115.4 125.0 134.4 128.7 145.3 147.8 Tea 100.0 102.2 102.4 106.5 118.5 111.6 130.0 131.6 Potato 100.0 113.2 124.3 138.6 106.4 103.4 172.7 206.8 Onions 100.0 122.6 112.8 157.8 156.0 105.7 151.1 161.2

Wholesale Price Index 2004-05=100

Sugar 100.0 110.7 111.3 96.3 108.3 100.7 133.4 136.5 Milk 100.0 100.3 106.7 115.7 124.4 121.5 129.3 132.7 Salt 100.0 122.0 115.4 115.2 131.2 120.2 141.3 138.6 Tea 100.0 89.1 105.9 99.5 142.2 134.6 179.8 176.5 Potato 100.0 117.5 138.4 151.1 127.0 128.3 180.7 224.2 Onions 100.0 123.8 117.4 171.0 170.0 123.0 169.4 169.5

Retail price inflation (year on year in per cent)

Sugar 11.4 0.1 -18.3 22.2 7.6 51.1 0.19$ Milk 1.6 6.6 10.4 8.6 10.5 3.9 0.56$ Salt 6.6 8.5 8.3 7.6 6.5 12.9 0.64$ Tea 2.2 0.3 4.0 11.2 6.9 16.5 0.38$ Potato 15.8 10.0 11.7 -21.8 -22.6 66.1 0.43$ Onions 19.7 5.1 53.5 8.6 -21.3 44.9 0.94$

Wholesale price inflation (year on year in per cent)

Sugar 10.9 0.8 -13.2 12.4 4.0 32.5 0.16$ Milk 0.3 6.4 8.4 7.5 8.2 6.4 0.49$ Salt 24.5 -5.4 0.3 13.9 6.3 17.6 0.46$ Tea -10.1 19.1 -5.7 43.1 34.3 33.5 0.81$ Potato 22.7 17.7 12.3 -15.4 -8.8 40.7 0.69$ Onions 22.6 6.8 56.2 8.6 -12.5 38.3 1.15$

$ Average monthly build up of prices

5.2 Average monthly increase in retail prices varied from a low of 0.19 per cent for sugar (though in the first four months of the current year sugar prices increased by 51.1 per cent, low average monthly increase is due to the price volatility) to 0.94 per cent for onions. Average monthly increase in wholesale prices varied from a low of 0.16 per cent for sugar to a high of 1.15 per cent for onions. (Table 7) Output and output expectations primarily contributed to price volatility of these products. In case of sugar, global prices and availability also increased the price volatility. Such volatility in agricultural of agro based

16

consumer products is not unusual, it is however, difficult to separate the effect of output/output expectations and other factors on wholesale and retail prices. It is also difficult to say whether the MSP of sugarcane and a regulated release mechanism of sugar contributed to a generally uniform trend in wholesale and retail sugar prices. Prices of milk, both at the wholesale and retail level witnessed a steady increase.

5.3 RPI relative to the commodity specific WPI (Table 8) indicates that for potato and onions, relative index has remained below 100 consistently since 2005-06. For tea also relative index declined below 100 in 2008-09. In case of sugar, overall relative index was flat with relative monthly average inflation (adjusted for increase in the wholesale prices of sugar) being 0.03 per cent.

Table 8: RPI relative to WPI and relative inflation

Commodity:

Rice 2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

RPI relative to WPI (2004-05=100)

Sugar 100.0 100.5 99.6 93.4 101.5 95.2 108.6 Milk 100.0 101.3 101.5 103.3 104.3 105.2 102.8 Salt 101.8 87.5 100.4 108.5 102.8 107.1 102.8 Tea 100.7 114.8 97.1 107.2 83.9 83.0 72.8 Potato 101.3 96.3 91.8 91.6 84.5 80.6 95.3 Onions 100.1 99.1 95.2 92.4 90.8 85.7 89.2

Relative Inflation year on year in per cent

Sugar 0.5 -0.9 -6.1 8.6 3.5 14.1 Milk 1.3 0.2 1.8 0.9 2.1 -2.3 Salt -11.5 15.0 8.5 -5.1 0.2 -4.0 Tea 15.2 -15.2 10.7 -21.7 -20.3 -12.3 Potato -4.2 -4.6 1.0 -7.1 -14.9 18.3 Onions -0.4 -3.1 -2.6 -0.9 -9.2 4.7

5.4 Average monthly increase in retail prices generally exceeded the wholesale prices, though divergence between the two rates differed across the selected commodities. In general difference between these two rates of inflation was higher for food grains and lower for edible oils and other commodities. Price rise for 5 of the 14 commodities was higher in wholesale

17

segment compared to their retail prices. Month wise index of retail and wholesale prices for each of the 14 commodities are indicated in Appendix 1.

Table 9: Summary of average monthly inflation of commodities

RPI relative to Wholesale Prices

Retail Prices

Wholesale

Prices No time lag

1 month lag 3 Months lag All Commodities 0.56 0.45 0.11 0.13 0.15 Rice 0.84 0.52 0.32 0.34 0.39 Wheat 0.83 0.58 0.24 0.24 0.23 Gram Dal 0.90 0.81 0.09 0.06 0.00 Arhar 1.02 0.70 0.33 0.39 0.49 Atta 0.81 0.63 0.18 0.18 0.15 Vanaspati 0.28 0.36 -0.08 -0.07 -0.05 Mustard 0.63 0.58 0.05 0.06 0.08 Groundnut 0.60 0.63 -0.03 -0.04 -0.06 Sugar 0.19 0.16 0.03 0.05 0.09 Milk 0.56 0.49 0.07 0.08 0.10 Salt 0.64 0.46 0.18 0.19 0.23 Tea 0.38 0.81 -0.43 -0.39 -0.27 Potato 0.43 0.69 -0.26 -0.23 -0.19 Onions 0.94 1.15 -0.20 -0.21 -0.26 NPDS Rice 0.84 0.67 0.18 0.18 0.25 NPDS Wheat 0.83 0.76 0.07 0.07 0.05 WPI* 0.56 0.49 0.07 0.07 0.11

* WPI reconstructed using Non PDS Rice and Wheat Index

5.5 Having examined the retail and wholesale prices for a common basket of commodities, it may be important to look at whether WPI is a predictor of retail prices. In order to test whether WPI is a good predictor, an attempt has been made to construct RPIs relative to WPI such that the impact of price rise in WPI will get reflected in RPI with a lag of 1 and 3 months. (Table 9) The results, though mixed, show that average monthly increase in RPIs relative to WPI increases with introduction of lag effect for some commodities and decline for others. Reconstructed WPI increases monthly average inflation and narrows the gap between retail and wholesale price build up. We also perform the statistical Granger causality test. The result of pair wise causality test is presented in Annex 1. The statistical test is generally consistent with our

18

earlier observation that WPI did not cause retail prices during the study period 2004(April) to 2009 (July).

Spatial situation of WPI and RPI at select locations

6.0 An attempt has also been made to look at the retail and wholesale prices at 17 different locations monitored by the Department of Consumer Affairs. The methodology adopted for the comparison of retail and wholesale prices at different locations is similar to the methodology adopted for comparison at the commodity level. It has however been observed that Department of Consumer Affairs does not get price responses for all commodities at all locations, particularly wheat, groundnut oil and mustard oil are perhaps not covered at certain location due to consumer preferences. A separate wholesale price index has, therefore, been constructed for each location covering the commodities for which retail prices are available and as such the two series are generally comparable. As in case of the commodities, an attempt has also been made to construct the retail price index relative to the reconstructed WPI, which is location specific, and the overall RPI for all commodities (an average of all locations). Location wise results are presented in the following section.

Shimla

6.1 The average monthly increase of retail prices in Shimla at 0.57per cent was higher than the average monthly inflation measured in terms of WPI for the comparable commodities. Though there were significant inter-month variations in rate of inflation on annual basis, the inflation measured in terms of RPI continued to be higher in most part of the study period (except 2007-08). The rate of inflation in Shimla, however, was more or less in conformity with the overall inflation measured in terms of RPI as an average of the 17 locations. The relative index continued to remain below 100 in 2005-08 and average monthly increase in the relative price index was virtually zero.

19

Table 11: Retail and Wholesale Price Index and Inflation at Shimala

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10 July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 104.9 111.0 111.9 130.9 124.5 145.8 148.7

WPI 100.0 103.9 109.0 111.2 121.5 116.6 133.7 137.1

Inflation year on year in per cent

RPI 4.9 5.9 0.9 17.0 16.5 17.1 0.57$

WPI 3.9 4.9 2.1 9.2 7.3 14.7 0.43$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 101.0 101.8 100.6 107.7 106.8 109.0 108.5

RPI (A) 100 99.8 98.7 96.7 100.7 99.6 103.2 103.2

$ Average monthly build up of prices Lucknow

6.2 The average monthly rate of inflation measured in terms of retail prices at Lucknow was 0.64 per cent as against the overall inflation measured in terms of WPI averaging 0.45 per cent. Retail price inflation consistently remained above the inflation measured in terms of WPI. Lucknow also witnessed inflation higher than the inflation for all locations with monthly average rate of increase in the relative index (relative to overall RPI). On an average, monthly price rise at Lucknow exceeded overall RPI inflation by 0.08 per cent. RPI relative to both WPI and in relation to the aggregate RPI consistently remained above 100.

Table 12: Retail and Wholesale Price Index and Inflation at Lucknow

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10 July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 105.3 113.4 116.8 133.9 125.8 151.3 148.1

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation year on year in per cent

RPI 5.3 7.7 3.0 14.6 12.4 20.4 0.64$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 101.3 103.3 104.0 109.5 106.9 113.1 108.2

RPI (A) 100 100.2 100.9 100.9 103.0 100.6 107.1 102.8

20

Delhi

6.3 Average monthly rate of inflation for Delhi measured in terms of RPI at 0.67 per cent higher than WPI. The inflation measured in terms of WPI for a common commodity basket was 0.45 per cent, nearly two thirds of the monthly increase of RPI. Inter-year variations of inflation also indicate that RPI inflation continued to remain higher during the entire period. Further, the RPI relative to the comparable WPI and aggregate RPI also remained above 100. Increase in retail prices in Delhi was 0.11per cent higher on a monthly basis relative to the overall increase in retail prices.

Table 13: Retail and Wholesale Price Index and Inflation at Delhi

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 104.3 113.7 119.5 136.6 129.1 146.3 148.7

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation year on year in per cent

RPI 4.3 9.1 5.1 14.4 13.5 13.4 0.67$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 100.4 103.6 106.4 111.7 109.7 109.3 108.6

RPI (A) 100 99.3 101.1 103.2 105.0 103.2 103.6 103.2

$ Average monthly build up of prices Ahmedabad

6.4 The Ahmedabad was one of the few locations where inflation measured in terms of RPI at 0.44 per cent (average monthly built up) was close to the average monthly built up of WPI (0.45per cent). Until 2008-09, RPI at Ahmedabad was lower than WPI. Average annual inflation also turned negative in 2007-08. However, from November 2008, retail prices started witnessing a sharper increase and by July 2009, RPI was higher than WPI by around 4 per cent. Compared to the overall RPI, inflation in Ahmedabad was also lower with relative inflation (relative to the overall RPI) being -0.12 per cent.

21

Table 14: Retail and Wholesale Price Index and Inflation at Ahmedabad

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 107.5 113.3 109.7 123.6 115.9 138.4 141.0

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation year on year in per cent

RPI 7.6 5.4 -3.0 12.7 10.4 19.4 0.44$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 103.5 103.2 97.7 101.1 98.5 103.4 103.0

RPI (A) 100 102.3 100.8 94.8 95.0 92.7 97.9 97.8

$ Average monthly build up of prices Bhopal

6.5 Bhopal witnessed an increase in retail price, which at 0.67 per cent on an average per month during April 2004-July 2009 were higher than the rate of increase in wholesale prices for the comparable basket. Inflation also remained consistently higher than WPI throughout this period. The city also experienced retail price inflation, which was not only higher than the comparable WPI, but it was also higher compared to the overall RPI. The average monthly increase in RPI relative to the overall inflation was 0.11per cent, indicating that the city witnessed a monthly built up of inflation which was nearly 20 per cent more than the overall inflation in the country.

Table 15: Retail and Wholesale Price Index and Inflation at Bhopal

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 105.5 113.8 117.2 137.9 130.5 149.6 153.2

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation year on year in per cent

RPI 5.7 8.0 3.0 17.8 14.5 14.6 0.67$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 101.5 103.7 104.3 112.7 110.9 111.8 111.9

RPI (A) 100 100.4 101.3 101.2 106.0 104.4 105.9 106.3

22

Mumbai

6.6 Though the inflation in Mumbai, measured in terms of retail prices remained higher than the inflation measured in terms of comparable basket of WPI, average monthly build up of inflation was lower when compared with Delhi and Bhopal. The retail price inflation, however, remained consistently higher than the inflation measured in terms of WPI. Relative to the overall increase in retail prices, Mumbai witnessed an inflation which was 0.08 per cent higher month on month. RPI relative to WPI and relative an average of all locations remained above 100 throughout this period indicating inflation remaining persistently higher than WPI and RPI at most locations.

Table 16: Retail and Wholesale Price Index and Inflation at Mumbai

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 106.7 118.1 122.6 134.6 130.2 146.5 152.0

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation year on year in per cent

RPI 6.7 10.8 3.8 9.9 11.5 12.5 0.64$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 102.7 107.6 109.2 110.0 110.6 109.5 111.1

RPI (A) 100 101.5 105.1 105.9 103.5 104.1 103.7 105.5

$ Average monthly build up of prices Jaipur

6.7 Both the retail and wholesale prices for the 14 commodities generally moved in tandem in Jaipur. The overall RPI and WPI nearly converged and there were no noticeable inter-year variations in the index, though average annual rate of change in prices continued to differ. Further, the inflation was lower compared to the overall inflation across all locations. The RPI of Jaipur relative to the RPI of all locations remained consistently below 100 throughout the period average monthly rate of inflation based on this relative index was (-) 0.1 per cent.

23

Table 17: Retail and Wholesale Price Index and Inflation at Jaipur

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 100.6 107.8 110.4 122.0 118.0 135.2 133.8

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation year on year in per cent

RPI 0.7 7.2 2.4 10.6 11.5 14.7 0.46$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 96.8 98.2 98.3 99.7 100.3 101.0 97.7

RPI (A) 100 95.8 95.9 95.3 93.8 94.4 95.7 92.8

$ Average monthly build up of prices Guwahaty

6.8 The price monitoring cell of Department of Consumer affairs captured movement of retail prices of 12 of the 14 commodities. The prices of wheat and groundnut oil were not being monitored may be because the consumer preferences. For the comparable commodity basket, however, the average monthly increase in retail prices at 0.54 per cent was higher than the average monthly increase in the wholesale prices (0.43 per cent). In the first four months of the current year, however, WPI inflation exceeded RPI inflation by a wide margin. This narrowed the gap between the two indices in July 2009. The RPI relative to WPI ass also the RPI relative to overall RPI also declined during this period pulling down the average monthly increase in relative index to below 100.

Table 18: Retail and Wholesale Price Index and Inflation at Guwahaty

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 105.5 113.2 114.2 131.6 124.9 136.3 139.0

WPI 100.0 104.0 109.0 110.9 121.4 116.3 133.8 137.2

Inflation year on year in per cent

RPI 5.5 7.4 0.9 15.3 14.3 9.1 0.54$

WPI 4.0 4.8 1.8 9.4 7.3 15.1 0.43$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 101.5 103.9 103.0 108.4 107.4 101.8 101.3

RPI (A) 100 100.4 100.7 98.6 101.2 99.9 96.5 96.5

24

Shillong

6.9 As in the case of Guwahaty, wheat and groundnut oil did not figure in the commodity basket of retail prices in Shillong. While the WPI remained consistently lower than RPI, near stable retail prices during October 2008 to May 2009, narrowed the gap between the two indices. Average monthly increase in retail prices at 0.52 per cent exceeded the increase recorded by wholesale prices. The inflation measured in terms of RPI except for the current year remained higher than WPI. As in the case of Guwahaty, Shillong also witnessed overall inflation in retail prices lower than the inflation for all locations with relative RPI remaining below 100 or close to that for most part of 2004-09.

Table 19: Retail and Wholesale Price Index and Inflation at Shillong

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 105.9 112.4 116.1 128.7 123.6 136.2 139.0

WPI 100.0 104.0 109.0 110.9 121.4 116.3 133.8 137.2

Inflation year on year in per cent

RPI 5.9 6.2 3.3 10.9 9.7 10.2 0.52$

WPI 4.0 4.8 1.8 9.4 7.3 15.1 0.43$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 101.8 103.2 104.7 106.0 106.3 101.7 101.3

RPI (A) 100 100.8 100.0 100.3 98.9 98.9 96.4 96.5

$ Average monthly build up of prices Aizawl

6.10 At Aizawl, the RPI did not include the prices of wheat, groundnut oil and gram dal. The overall inflation measured in terms of RPI in Aizawl was, however, one of the lowest with a negative spread of (-) 0.15 per cent between average monthly retail and wholesale prices. The inflation relative to other locations, therefore, was also in negative territory. RPI relative to both WPI (comparable commodities) and average RPI remained below 100 for most part of this period.

25

Table 20: Retail and Wholesale Price Index and Inflation at Aizawl

2004-05 2005-06 2006-07 2007-08 2008-09 April- July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 105.4 106.3 107.6 114.8 112.3 119.5 121.7

WPI 100.0 103.8 108.2 110.3 120.8 115.7 133.6 137.0

Inflation year on year in per cent

RPI 5.4 0.8 1.2 6.8 7.6 6.4 0.27$

WPI 3.8 4.3 1.9 9.5 7.4 15.5 0.42$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 101.6 98.2 97.5 95.0 97.1 89.4 88.8

RPI (A) 100 100.3 94.5 92.9 88.3 89.9 84.6 84.5

$ Average monthly build up of prices Patna

6.11 Average monthly rate of retail price increase at 0.68 per cent in Patna was the highest of all the locations and nearly 2.5 times the average monthly increase observed at Aizawl. It was only in the second half of 2008-09 and first four months of the current year, rate of increase in retail prices was lower than WPI and that narrowed the gap between RPI and WPI at Patna as also the gap between its own RPI with the other locations. Relative RPI consistently remained above 100.

Table 21: Retail and Wholesale Price Index and Inflation at Patna

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10 July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 107.0 114.5 125.7 136.3 134.0 146.9 150.8

WPI 100.0 104.0 109.8 112.0 122.2 117.4 134.3 137.0

Inflation year on year in per cent

RPI 7.2 7.0 9.7 8.6 12.5 9.7 0.68$

WPI 4.0 5.6 2.0 9.1 7.4 14.4 0.44$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100.0 102.9 104.3 112.1 111.6 114.2 109.4 110.0

RPI (A) 100.0 101.9 101.8 108.5 104.9 107.2 104.0 104.6

26

Bhubaneswar

6.12 The commodity composition in Bhubaneswar for RPI was comparable with the commodity composition in other locations in North-East Region. Prices of wheat and groundnut oil were not being covered in view of the consumer preferences. Bhubaneswar, however, witnessed a sharper increase in retail prices compared to the increase in terms of WPI of the comparable basket and also when compared with the increase in retail prices at other locations in this region. Except for the 4 months of 2009-10 and 2004-05, the retail prices grew at a rate higher than WPI. Relative to the other locations (aggregated for all) inflation in Bhubaneswar was higher by 0.06 per cent on average per month.

Table 22: Retail and Wholesale Price Index and Inflation at Bhubaneswar

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 102.0 107.5 115.0 132.7 127.7 144.0 147.5

WPI 100.0 104.0 109.0 110.9 121.4 116.3 133.8 137.2

Inflation year on year in per cent

RPI 2.0 5.4 6.9 15.4 15.0 12.8 0.62$

WPI 4.0 4.8 1.8 9.4 7.3 15.1 0.43$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 98.1 98.6 103.7 109.3 109.8 107.6 107.5

RPI (A) 100 97.1 95.6 99.3 102.0 102.1 101.9 102.4

$ Average monthly build up of prices Kolkata

6.13 The commodity basket of retail prices did not include wheat at Kolkata. A decline in the retail prices of the commodity basket during April-December 2008 considerably narrowed the gap between RPI and WPI. The inflation measured in terms of RPI which was consistently higher than the WPI until around April 2008 started ruling below the inflation measured in terms of WPI in the recent period. The RPI relative to WPI and also relative to the overall

27

RPI declined below 100 in the first four months of 2009-10. While average monthly increase of inflation measured in terms of RPI and WPI was virtually close, relative inflation compared to aggregate RPI witnessed a decline at an average rate of 0.11 per cent per month indicating that the changes in retail prices at Kolkata were marginally lower than other locations.

Table 23: Retail and Wholesale Price Index and Inflation at Kolkata

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 109.9 118.5 124.3 124.3 129.1 130.4 135.2

WPI 100.0 103.9 109.0 111.2 121.5 116.6 133.7 137.1

Inflation year on year in per cent

RPI 9.9 7.8 5.0 0.2 9.0 1.1 0.45$

WPI 3.9 4.9 2.1 9.2 7.3 14.7 0.43$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 105.8 108.8 111.8 102.3 110.7 97.5 98.6

RPI (A) 100 104.6 105.4 107.4 95.5 103.2 92.3 93.8

$ Average monthly build up of prices Agartala

6.14 Agartala has the most restricted commodity basket of RPI as wheat, groundnut oil and milk did not figure in the retail commodity basket covered under price monitoring. While the exclusion of wheat and groundnut oil may be on account of consumer preferences, the exclusion of milk may be linked to the availability issue. For the comparable basket, however, rate of inflation averaged 0.40 per cent per month for both the indices. In July 2009, RPI was in fact lower than WPI by 6 points. The RPI relative to WPI and also as compared with the RPI at other locations, however, consistently remained below 100 indicating t5hat the average monthly build up of inflation in Agartala was 0.16 per cent lower than the built up across all locations. This may partly be due to the restricted commodity basket as average monthly increase in retail prices for wheat and groundnut oil was higher than the average of 14 commodities.

28

Table 24: Retail and Wholesale Price Index and Inflation at Agartala

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 103.0 107.5 108.3 119.6 114.8 132.3 133.7

WPI 100.0 105.8 110.1 108.4 119.8 113.6 136.2 139.6

Inflation year on year in per cent

RPI 3.0 4.6 0.9 10.4 10.5 15.3 0.40$

WPI 5.9 4.1 -1.5 10.5 6.9 19.9 0.40$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 97.3 97.6 99.9 99.8 101.1 97.2 95.8

RPI (A) 100 98.0 95.6 93.6 91.9 91.8 93.7 92.7

$ Average monthly build up of prices Hyderabad

6.15 Average increase in the retail prices of 14 commodities in Hyderabad was 0.56 per cent per month as against an increase of 0.45 per cent for these commodities in the wholesale markets. Inter-year variations in inflation indicate that while the wholesale prices rose faster during 2006-08, retail prices, however, witnessed upsurge in 2008-09 and in the first four months of 2009-10. RPI in Hyderabad relative to WPI and the RPI for all locations continued to fluctuate but increased sharply in the first four months of the current year. Overall average monthly increase in retail prices relative to other locations, however, remained negative because of some initial advantages.

Table 25: Retail and Wholesale Price Index and Inflation at Hyderabad

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 104.9 108.7 109.0 126.3 119.0 144.8 152.3

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation year on year in per cent

RPI 4.9 3.8 0.4 15.9 12.9 21.7 0.51$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 100.9 99.0 97.1 103.2 101.1 108.2 111.2

RPI (A) 100 99.8 96.7 94.2 97.1 95.2 102.5 105.7

29

Bengaluru

6.16 The index of wholesale and retail prices in Bengaluru continue to be close until around 2007-08. However, in the next 16 months, there was a sharp increase in the retail prices widening the gap between two indices. With that the rate of inflation which virtually was close in both the series started drifting. Average monthly increase in retail price index was 0.52 per cent compared to an increase of 0.44 per cent in case of WPI. However, notwithstanding the higher increase in RPI relative to WPI, average monthly increase in the RPI, relative to the overall retail prices showed a lower growth and relative index remained below or close to that throughout this period. In most recent 16 months, however, RPI relative to other location increased by 3.5 per cent.

Table 26: Retail and Wholesale Price Index and Inflation at Bengaluru

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 105.2 111.1 112.2 127.8 120.1 141.7 144.4

WPI 100.0 104.4 110.4 112.4 122.0 117.3 134.4 136.9

Inflation year on year in per cent

RPI 5.2 5.7 1.0 13.9 9.3 18.1 0.52$

WPI 4.4 5.8 1.8 8.6 6.7 14.6 0.44$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 100.8 100.7 99.8 104.8 102.4 105.5 105.0

RPI (A) 100 100.1 98.9 96.9 98.3 96.1 100.3 100.2

$ Average monthly build up of prices Trivandrum

6.17 Increase in retail prices were relatively higher in Trivandrum compared to the cities in the neighboring States and at other locations. Retail prices started drifting away from WPI since 2007-08. The RPI relative to WPI and RPI of other locations averaged 108.4 and 102.7 respectively in April–July 2009 indicating persistent higher rate of price rise.

30

Table 27: Retail and Wholesale Price Index and Inflation at Trivandrum

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 104.3 109.8 115.3 133.6 129.0 145.1 146.8

WPI 100.0 103.9 109.8 112.3 122.3 117.7 133.8 136.9

Inflation year on year in per cent

RPI 4.3 5.4 5.0 15.8 16.6 12.5 0.61$

WPI 3.9 5.7 2.3 8.9 7.3 13.7 0.45$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 100.4 100.0 102.7 109.2 109.7 108.4 107.2

RPI (A) 100 99.3 97.7 99.6 102.7 103.2 102.7 101.8

$ Average monthly build up of prices Chennai

6.18 Average monthly increase in the retail prices at Chennai was 0.60 per cent compared to an increase of 0.44 per cent in the wholesale prices. Rate of increase in retail prices remained higher than WPI beginning 2007-08. The RPI at Chennai relative to WPI and RPI of other locations averaged 108.1 and 102.8 respectively in April- July 2009.

Table 28: Retail and Wholesale Price Index and Inflation at Chennai

2004-05 2005-06 2006-07 2007-08 2008-09 April-July

2008-09 2009-10

July 2009 Retail and Wholesale Price Index (2004-05=100)

RPI 100.0 104.0 109.3 113.8 132.5 126.3 145.2 146.7

WPI 100.0 104.4 110.4 112.4 122.0 117.3 134.4 137.5

Inflation year on year in per cent

RPI 4.0 5.2 4.1 16.5 14.4 15.0 0.60$

WPI 4.4 5.8 1.8 8.6 6.7 14.6 0.44$

RPI relative to WPI (2004-05=100) and aggregated RPI

WPI 100 99.7 99.1 101.3 108.6 107.7 108.1 106.7

RPI (A) 100 99.0 97.3 98.3 101.9 101.0 102.8 101.8

$ Average monthly build up of prices

6.19 Table 29 sums up the location wise average monthly increase in retail and wholesale prices and also the increase in RPI at each of these 17 locations relative to their comparable WPI (reconstructed with a comparable basket) and average of the RPIs at these locations.

31

Table 29: Average monthly increase in retail and wholesale prices (per cent)

RPI WPI RPI relative to WPI RPI relative to overall RPI Patna 0.68 0.44 0.23 0.12 Delhi 0.67 0.45 0.22 0.11 Bhopal 0.67 0.45 0.22 0.11 Lucknow 0.64 0.45 0.19 0.08 Mumbai 0.64 0.45 0.19 0.08 Bhubaneswar 0.62 0.43 0.19 0.06 Trivandrum 0.61 0.45 0.16 0.05 Chennai 0.60 0.44 0.15 0.04 Shimla 0.57 0.43 0.14 0.01 Guwahaty 0.54 0.43 0.11 -0.02 Shillong 0.52 0.43 0.09 -0.04 Bengaluru 0.52 0.44 0.08 -0.04 Hyderabad 0.51 0.45 0.06 -0.05 Jaipur 0.46 0.45 0.01 -0.10 Kolkata 0.45 0.43 0.02 -0.11 Ahmedabad 0.44 0.45 -0.01 -0.12 Agartala 0.40 0.40 0.00 -0.16 Aizawl 0.27 0.42 -0.15 -0.29 All Locations 0.56 0.45 0.11 -

6.20 There are some interesting observations. Average monthly increase in retail prices ranged between 0.27 per cent for Aizawl to 0.68 per cent at Patna. The relative inflation in retail prices, relative to their respective WPIs had the same pattern. There was hardly any difference in retail and wholesale prices (in terms of an average monthly build up) at 5 locations and surprisingly two of these were in the extreme north east region. Compared to the average RPI, increase in retail prices were lower at 8 locations, with locations in north east again dominating. While it is difficult to say that this is because the distances of the consumption centers from producing centers have become less important, but it does indicate some easing of supply bottlenecks, which indeed are policy induced.

32

Annex A Granger Causality Tests

Null Hypothesis Observations F Statistics Probability Observations

With one Month lag

WPI does not Granger Cause RPI 63 0.604 0.440

ARHAR_W does not Granger Cause ARHAR_R 63 68.504 0.000

ATTA_W does not Granger Cause ATTA_R 63 1.159 0.286

GRAMDAL_W does not Granger Cause GRAMDAL_R 63 5.462 0.023

GROUNDNUT_W does not Granger Cause GROUNDNUT_R 63 10.707 0.002

MILK_W does not Granger Cause MILK_R 63 2.230 0.141

MUSTARD_W does not Granger Cause MUSTARD_R 63 0.080 0.779

ONIONS_W does not Granger Cause ONIONS_R 63 4.468 0.039

POTATO_W does not Granger Cause POTATO_R 63 0.000 0.996

RICE_W does not Granger Cause RICE_R 63 2.217 0.142

SALT_W does not Granger Cause SALT_R 63 2.489 0.120

SUGAR_W does not Granger Cause SUGAR_R 63 3.737 0.058

TEA_W does not Granger Cause TEA_R 63 8.518 0.005

VANASPATI_W does not Granger Cause VANASPATI_R 63 1.637 0.206

33

Pair wise Granger Causality Tests for WPI and RPI year on year inflation

Null Hypothesis: Obs

F-Statistic Prob Obs

F-Statistic Prob

RPI does not Granger Cause WPI 50 1.98 0.17 49 3.35 0.04

WPI does not Granger Cause RPI 0.55 0.46 0.50 0.61

ARHAR_W does not Granger Cause

ARHAR_R 50 14.75 0.00 49 3.85 0.03

ARHAR_R does not Granger Cause

ARHAR_W 2.95 0.09 2.29 0.11

ATTA_W does not Granger Cause ATTA_R 50 1.83 0.18 49 7.13 0.00

ATTA_R does not Granger Cause ATTA_W 12.73 0.00 7.28 0.00

GRAMDAL_W does not Granger Cause

GRAMDAL_R 50 0.52 0.47 49 0.64 0.53

GRAMDAL_R does not Granger Cause

GRAMDAL_W 16.02 0.00 7.90 0.00

GROUNDNUT_W does not Granger Cause

GROUNDNUT_R 50 11.37 0.00 49 6.32 0.00

GROUNDNUT_R does not Granger Cause

GROUNDNUT_W 6.95 0.01 2.79 0.07

MILK_W does not Granger Cause MILK_R 50 7.12 0.01 49 5.60 0.01

MILK_R does not Granger Cause MILK_W 0.76 0.39 1.88 0.17

MUSTARD_W does not Granger Cause

MUSTARD_R 50 0.37 0.55 49 0.37 0.69

MUSTARD_R does not Granger Cause

MUSTARD_W 0.39 0.54 4.47 0.02

ONIONS_W does not Granger Cause

ONIONS_R 50 16.68 0.00 49 4.60 0.02

ONIONS_R does not Granger Cause

ONIONS_W 42.99 0.00 13.05 0.00

POTATO_W does not Granger Cause

POTATO_R 50 9.63 0.00 49 5.72 0.01

POTATO_R does not Granger Cause

POTATO_W 15.97 0.00 12.11 0.00

RICE_W does not Granger Cause RICE_R 50 12.32 0.00 49 3.89 0.03

RICE_R does not Granger Cause RICE_W 1.48 0.23 0.99 0.38

SALT_W does not Granger Cause SALT_R 50 1.47 0.23 49 1.81 0.18

SALT_R does not Granger Cause SALT_W 3.43 0.07 1.17 0.32

SUGAR_W does not Granger Cause

SUGAR_R 50 2.87 0.10 49 0.47 0.63

SUGAR_R does not Granger Cause

SUGAR_W 22.27 0.00 5.90 0.01

TEA_W does not Granger Cause TEA_R 50 4.55 0.04 49 7.80 0.00

TEA_R does not Granger Cause TEA_W 0.10 0.75 1.41 0.26

VANASPATI_W does not Granger Cause

VANASPATI_R 50 6.97 0.01 49 2.39 0.10

VANASPATI_R does not Granger Cause

VANASPATI_W 6.92 0.01 3.82 0.03

WHEAT_W does not Granger Cause

WHEAT_R 50 8.45 0.01 49 3.57 0.04

WHEAT_R does not Granger Cause

34 All Commodities 90.0 100.0 110.0 120.0 130.0 140.0 150.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Retail Price Index Wholesale Price Index

Retail Price Index (Relative to WPI)

Rice 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Retail Price Index Wholesale Price Index

35 Wheat 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Retail Price Index Wholesale Price Index

Retail Price Index (Relative to WPI)

Gram Dal 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Retail Price Index Wholesale Price Index

36 Arhar 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 220.0 230.0 240.0 250.0 260.0 270.0 280.0 290.0 300.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Retail Price Index Wholesale Price Index

Retail Price Index (Relative to WPI)

Atta 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Atta Retail Price Index Atta Wholesale Price Index

37 Vanaspati 80.0 85.0 90.0 95.0 100.0 105.0 110.0 115.0 120.0 125.0 130.0 135.0 140.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Vanaspati Retail Price Index Vanaspati Wholesale Price Index

Vanaspati Retail Price Index (Relative to WPI)

Mustard 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Mustard Retail Price Index Mustard Wholesale Price Index Mustard Retail Price Index (Relative to WPI)

38 Groundnut 90.0 100.0 110.0 120.0 130.0 140.0 150.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Groundnut Retail Price Index Groundnut Wholesale Price Index

Groundnut Retail Price Index (Relative to WPI)

Sugar 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Sugar Retail Price Index Sugar Wholesale Price Index

39 Milk 90.0 95.0 100.0 105.0 110.0 115.0 120.0 125.0 130.0 135.0 140.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Milk Retail Price Index Milk Wholesale Price Index

Milk Retail Price Index (Relative to WPI)

Salt 70.0 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 A p r-0 4 J u n -0 4 A u g -0 4 O c t-0 4 D e c -0 4 F e b -0 5 A p r-0 5 J u n -0 5 A u g -0 5 O c t-0 5 D e c -0 5 F e b -0 6 A p r-0 6 J u n -0 6 A u g -0 6 O c t-0 6 D e c -0 6 F e b -0 7 A p r-0 7 J u n -0 7 A u g -0 7 O c t-0 7 D e c -0 7 F e b -0 8 A p r-0 8 J u n -0 8 A u g -0 8 O c t-0 8 D e c -0 8 F e b -0 9 A p r-0 9 J u n -0 9

Salt Retail Price Index Salt Wholesale Price Index