Regulation of debt collection companies

Standard Note: SN/HA/5138 Last updated: 27 July 2009

Author: Lorraine Conway Section Home Affairs Section

This note considers the current regulation of private debt collectors. Specifically, it outlines the regulation of consumer credit licence holders involved in debt collection by the Office of Fair Trading (OFT) under the powers given to the OFT by the Consumer Credit Act 1974. In the process, this note also considers the effectiveness of formal OFT guidelines for the debt collection industry. It also looks at current statistics on the scale of debt recovery in the UK. This note also considers the regulation of those private debt collection agencies who are members of the Credit Services Association (CSA). Members of the CSA are required to adhere to a Code of practice and to follow a formal complaints procedure.

This information is provided to Members of Parliament in support of their parliamentary duties and is not intended to address the specific circumstances of any particular individual. It should not be relied upon as being up to date; the law or policies may have changed since it was last updated; and it should not be relied upon as legal or professional advice or as a substitute for it. A suitably qualified professional should be consulted if specific advice or information is required.

Contents

1 Statistics on debt 2

2 Regulation 3

2.1 Office of Fair Trading and the Consumer Credit Act 1974 3 2.2 OFT published guidance for debt collection agencies 4 2.3 Review of debt collection guidance 4 3 The Credit Services Association (CSA) 4

1 Statistics

on

debt

The starting position is that creditors may use a debt collection agency to help recover payment of a debt or they can ‘sell’ the debt at a discount to a debt recovery company. However, private debt collectors are not court officials and they do not have the same powers as bailiffs; they cannot enter the debtor’s home (or the debtor’s last known address) or seize possessions.

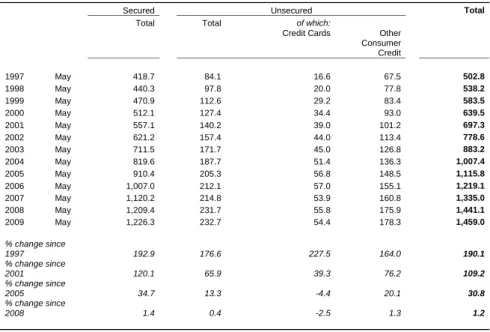

Table 1 below shows that total net lending to individuals in the UK stood at £1,459 billion at the end of May 2009, an increase of 109% compared with 2001. However over the last year net lending outstanding has increased by only 1.2%. Significantly, 84% of lending to individuals relates to secured lending or mortgages. The growth in unsecured lending has been lower than in secured lending in recent years; total unsecured lending at the end of May 2009 was £233 billion. Lending on credit cards has been relatively stable since 2005; prior to this it had seen significant growth.

The Credit Services Association (see paragraph 3 below) estimates that in 2007, £21 billion of debt was passed to debt collection agencies; the number of cases handled was around 20 million.1

Table 1 - Total net lending outstanding, 1997-2009

£ billions, monthly data, seasonally adjusted

Secured Unsecured Total

Total Total of which:

Credit Cards Other Consumer Credit 1997 May 418.7 84.1 16.6 67.5 502.8 1998 May 440.3 97.8 20.0 77.8 538.2 1999 May 470.9 112.6 29.2 83.4 583.5 2000 May 512.1 127.4 34.4 93.0 639.5 2001 May 557.1 140.2 39.0 101.2 697.3 2002 May 621.2 157.4 44.0 113.4 778.6 2003 May 711.5 171.7 45.0 126.8 883.2 2004 May 819.6 187.7 51.4 136.3 1,007.4 2005 May 910.4 205.3 56.8 148.5 1,115.8 2006 May 1,007.0 212.1 57.0 155.1 1,219.1 2007 May 1,120.2 214.8 53.9 160.8 1,335.0 2008 May 1,209.4 231.7 55.8 175.9 1,441.1 2009 May 1,226.3 232.7 54.4 178.3 1,459.0 % change since 1997 192.9 176.6 227.5 164.0 190.1 % change since 2001 120.1 65.9 39.3 76.2 109.2 % change since 2005 34.7 13.3 -4.4 20.1 30.8 % change since 2008 1.4 0.4 -2.5 1.3 1.2

Note: Series are subject to adjustment following transfers with non-resident companies

Source: Bank of England, series: VTXC,VTXK,VZRI,VZRJ,VZRK

2 Regulation

2.1 Office of Fair Trading and the Consumer Credit Act 1974

The Office of Fair Trading (OFT) plays a role in regulating private debt collecting companies. This is because it regulates consumer credit licence holders involved in debt collection. The Consumer Credit 1974 (the ‘CCA 1974’) established a licensing system to protect the interests of consumers. The OFT has a duty under the Act to ensure that licences are only given and retained by those who are fit to hold them. The Act provides that the OFT may take into account any circumstances which appear relevant and in particular any evidence that an applicant, licensee, or their employees, agents or business associates have:

• committed offences involving fraud or other dishonesty, or violence

• failed to comply with the requirements of the Act or other consumer legislation

• practised discrimination in connection with their business, or

• engaged in business practices appearing to be deceitful, oppressive or otherwise unfair or improper (whether unlawful or not).

The OFT can, where it has evidence, take formal action to refuse, revoke or suspend the credit licences of those who engage in unfair practices and who are deemed to be unfit. The OFT can be contacted in writing at:

Enquiries and Reporting Centre Office of Fair Trading

Fleetbank House 2-6 Salisbury Square London

EC4Y 8JX.

Email: http://www.oft.gov.uk/contactus

2.2 OFT published guidance for debt collection agencies

In July 2003, the OFT issued formal guidance on debt collection, this guidance applies to all consumer credit licence holders and applicants, The OFT expect licensees to abide by the spirit as well as the letter of its guidance. The guidance does not apply to the routine collection of repayments as they fall due; it applies only to the collection of debt once an account is in default (i.e. the debtor has failed to keep up with repayments).

Debt collectors are expected to deal fairly with debtors and the guidance sets out minimum standards that the OFT expect of licence holders in collecting consumer debts. Importantly, the guidance sets out the type of behaviour the OFT considers to fall within the category of ‘unfair business practices’ which, in turn, will call into question fitness to retain or be given a licence.

The guidance can be viewed in full on the OFT website at:

http://www.oft.gov.uk/advice_and_resources/resource_base/legal/cca/debt-collection

2.3 Review of debt collection guidance

On 11 December 2006, the OFT published the findings of its review into how guidance to debt collectors had changed behaviour within the sector and raised awareness. The OFT found that:

• the guidance was a success in terms of content;

• awareness had increased among collectors of debts, individual debtors and consumer advisers;

• there had been positive changes in industry behaviour; but

• more still needed to be done to improve levels of compliance.

This OFT review can be viewed in full at: http://www.oft.gov.uk/news/press/2006/172-06

According to statistics provided by the OFT, between April 2004 and August 2006, the OFT investigated 262 licensees for alleged breaches of guidance. This resulted in the OFT issuing ‘minded to revoke notices’ to nine licensed debt collectors; three retained their licences and six surrendered their licences. The OFT took informal action against 92 debt collectors. In 77 cases, advice or warning letters secured immediate compliance.2

3

TheCredit Services Association (CSA)

The Credit Services Association (CSA) is the national association in the UK for companies active in relation to unpaid credit accounts; debt recovery agencies, tracing and allied professional services.

According to the CSA, there are approximately 500 debt collection businesses in the UK of which 200 are members of the CSA. All members of the CSA are required to adhere to a code of practice which outlines the obligations of its members. A declaration of compliance is required to be signed by members on an annual basis. The code of practice can be viewed in full at: http://www.csa-uk.com/csa/complaints-procedure.php

However, by way of illustration, the code states that members of the association should:

• not use oppressive or intrusive collection procedures

• not bring unreasonable pressure to bear on the debtor in default of payment

• not act in a manner in public intended to embarrass the debtor

• be circumspect and discreet when attempting to contact the debtor by telephone, SMA, email or by personal visit – with due regard to the Data Protection Act (DPA 1998) and OFT guidance.

In respect of attempts to trace a debtor, the guidelines state that each member shall act with full regard to the DPA 1998and comply with the Trace Guidance issued by the CSA. In addition, members should:

• not misrepresent their position and remain transparent

• take all reasonable steps to verify that the person traced is, in fact, the subject

• where it becomes apparent that the located person is not the subject, update all appropriate records accordingly

The CSA operates its own formal complaint procedure. If an individual is unable to resolve the issue directly with the company, or if they are unhappy with the resolution they have obtained, they may make a formal written complaint to the CSA, accompanied by copies of all documentation and correspondence. The CSA complaint form can be downloaded from its web site at: http://www.csa-uk.com/csa/complaints-procedure.php

The CSA can be contacted at the following address: Credit Services Association

Wingrove House 2nd Floor East Ponteland Road Newcastle upon Tyne NE5 3AJ

Tel. No. 0191 286 5656