Oil Prices and African Stock Markets Co movement: A Time and Frequency Analysis

Full text

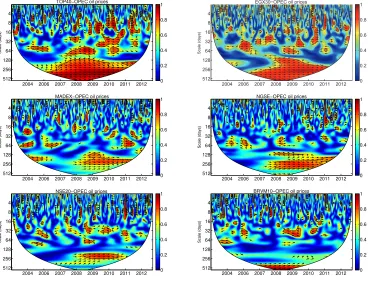

Figure

Related documents

For the Kuwaiti market only negative oil shocks impinge significantly Kuwaiti stock log returns, while, in the Saudi market, both positive and negative changes in oil

The approach taken in this paper is to use a SVAR to model the dynamic relationship between real oil prices, an exchange rate index for major currencies, emerging market stock

In the short run and long run during the 2008 finan- cial crisis, the spillovers from developed stock markets rise in the African financial market confirming the immediate impact

It is equally important to stress that, compared to oil-importing countries where the expected relation of oil to stock markets is negative (i.e., oil price increases

On the other hand, investors in world oil markets should look at changes in the Saudi stock market because theses changes significantly affect oil

A Threshold Cointegration Analysis of Asymmetric Adjustment of OPEC and non-OPEC Monthly Crude Oil Prices.. Ghassan,

For example, unidirectional volatility spillovers from equity markets to foreign exchange markets are found using a multivariate GARCH analysis in a South African context

A Model of West African Millet Prices in Rural Markets.. Molly Brown, Nathaniel Higgins and