Fair Value Considerations during the Current Financial Crisis

Associate Professor Banu Esra Aslanertik, PhD Dokuz Eylül University, Turkey esra.aslanertik@deu.edu.tr

Abstract: In the current economic conditions, accounting applications seem to face new and complex challenges. Especially, these challenges are on the basis of fair value. Recent crisis has highlighted the complexity and difficulty of valuing financial instruments when market information is not available or not sufficient to give better economic decisions. FASB 157 “Fair Value Accounting” became effective by January 1, 2008 for most U.S. companies and some believe that this caused the problem. Oppositely, a wider group of interested parties and investors believe that fair value increases transparency and give relevant information for decision making. Depending on the financial reporting framework and the going concern assumption, this paper investigates the process for determining fair value measurements and its in-depth effects in financial reports. Also, the paper will try to highlight the question: “Can fair value be really the main reason of the global financial crisis?” from the aspect of an accounting academician.

Keywords: Fair Value; Accounting; Crisis JEL Classification: M1, M41

1. Introduction

Within the last decade, it is obvious that there is a move toward principle-based accounting standards based on an improved conceptual framework. The objective of the financial statements is to provide more transparent and useful information by reducing the complexity through main qualitative characteristics such as understandability, relevance, reliability and comparability. The Sarbanes Oxley Act of 2002 required also SEC to incorporate the principle-based standards and in 2004 FASB agreed to converge to International Accounting Standards. The studies indicate that progress has been made nearly in all areas but a more detailed work is needed to meet the original goals of principle-based standards.

The primary goal of principle-based standards is to provide broad guidance so that the standard can be applicable to many different situations. This means that when

the situation can not be covered in all aspects, the preparers will turn to principles. This will require the principles to be clearly stated in such a way that they can be easily understandable and not buried with the rules and exceptions to those rules (Greenspan, Hartwell, 2009).

The current financial crisis in US has turned into a big liquidity crisis and financial market meltdown. In recent years, financial innovation brought a group of new financial products into the markets such as Collateralized Debt Obligations and Credit Default Swaps. These instruments were mainly used for speculation instead of hedging purposes (Deloitte Canada, 2009). In respect of these new financial instruments, the causes of the crisis become clearer. In the heart of the crisis lies extreme amount of debts which are created imprudently and much of it in the form of credit securitizations that were held off-balance sheet. The high default risk of some of these financial assets and uncertainty about the losses made the creditors reluctant to create more credit. Then the liquid markets became illiquid and the assets could not be priced reasonably. Within these difficulties another major concern comes into stage which is “valuation”. Financial reporting standards offers key measures for valuations, income and cash flows. In recent years, fair value issues increased for the valuation of some assets and liabilities. Especially, valuation of financial instruments require market values that are available from a liquid market in order to represent information that is useful to all types of contracting parties to facilitate investment and credit decisions. In the absence of reliable market prices, this fair value concerns also caused a problem within the merits of the trend.

This paper includes the review of the events that causes the crisis and accounting complexities in areas such as determination of fair value and off-balance sheet structuring.

2. Fair Value Accounting

Fair value measurement has been an important part of Generally Accepted Accounting Principles and the Financial Reporting Standards for many years. As stated by Young (Robinson 2008), the determination of fair value is one of the oldest debates in accounting in comparison to historical cost. Within the financial reporting standards fair value defined as “the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm's length transaction. US Accounting Standard FAS 157 defines fair value as “the

price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Both definitions concentrate on the “value in use” between market participants that refers to the companies' solvency which is an important aspect of the current crisis. The discussion of historical cost versus market value is not new but a challenging subject. This is due to how the value can be best represented; the value at which it was purchased or the value in the current market. Table 1 briefly shows the key features of historical cost and fair value.

Table 1. Key Features of Historical Cost and Fair Value

HISTORICAL COST FAIR VALUE

Stewardship Investment Decisions

Income Statement Balance Sheet

Exclusion of unrealized profit Inclusion of unrealized profit

Confirmatory value (transaction based) Predictive value (present value, models, estimates)

Disclosures Source: Fujioka, Seko, Hoontrakul, 2008

International Financial Reporting Standards (IFRS) are the standards that are used all over the world including nearly all Europe. Formerly, these standards were known as International Accounting Standards (IAS). IAS 32, IAS 39 and IFRS 7 prescribe the accounting and disclosure for financial instruments. IAS 32 covers how to present the financial instruments by setting out definitions, accounting classifications of instruments and specifically addressing the accounting treatment for these instruments. IAS 39 includes when to recognize or derecognize a financial instrument, and how the different types of financial instruments are measured especially for derivatives. IAS 39 requires financial assets to be classified as follows:

• At Fair Value through Profit and Loss (FVTPL); • Held-to-Maturity (HTM);

• Available for Sale (AFS); • Loans and Receivables (LR).

The recognition and measurement differs for each category of financial asset. The first category FVTPL has also two subcategories as held for trading and fair value option. FVTPL and AFS type of assets are measured at fair value while the other two (HTM and LR) are measured at amortized cost using the effective interest method. IAS 39 sets out three key areas for determining the fair value:

• An active market with quoted prices; • No active market: valuation technique; • No active market: equity instruments.

Quoted prices are the prices that are readily and regularly available from a dealer, broker or pricing agencies. Also bid or ask prices for assets to be acquired or liabilities to be held can be considered as quoted prices. If there is no active market then the company determines the fair value by using an acceptable valuation technique which incorporates all factors that market participants would consider in setting a price, is consistent with accepted economic methodologies for pricing financial instruments, and relies as little as possible on entity-specific inputs (Deloitte, 2008). When there is no active market for an equity instrument or derivatives that are linked to it and the estimates cannot be made reliably then the equity instrument must be measured at its cost less any impairment. This complex and well structured standard IAS 39 offers a more favorable treatment than US GAAP offers.

Statement of Financial Accounting Standard (SFAS) 157 “Fair Value Measurements” was issued in 2006 to be effective for fiscal year 2008, starting from November 15, 2007. FAS 157 provides three different levels for determining the fair value of an asset or a liability (Rossi, 2009; Fujioka, Seko, Hoontrakul, 2008):

− Level 1: Quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

similar items, interest rates, yield curves, volatilities, prepayment speeds, credit risks, foreign exchange rates, published indexes. Level 2 inputs might not be directly observable for the item being valued, but they might be derived from observable inputs. Level 2 inputs include:

(a) Quoted prices for similar assets or liabilities in active markets;

(b) Quoted prices for identical or similar assets or liabilities in markets that are not active, that is, markets in which there are few transactions for the asset or liability, the prices are not current, or price quotations vary substantially either over time or among market makers (i.e. some brokered markets), or in which little information is released publicly (i.e. a principal-to principal market);

(c) Inputs other than quoted prices that are observable for the asset or liability (i.e. interest rates and yield curves observable at commonly quoted intervals, volatilities, prepayment speeds, loss severities, credit risks, and default rates);

(d) Inputs that are derived principally from or corroborated by observable market data by correlation or other means (market-corroborated inputs).

− Level 3: Inputs that are not observable in the marketplace, but are developed by the entity and are not derived from, or corroborated by, market inputs. Level 3 is subject to special disclosure requirements, including information in the annual financial statements, about the valuation techniques used. Unobservable inputs for the asset or liability reflect the reporting entity's own assumptions about what market participants would use to price the asset or liability and especially developed using the best information available according to FASB. Unobservable inputs shall be used to measure fair value to the extent that observable inputs are not available, or there is little, for the asset or liability at the measurement date.

FAS 157 and so fair value accounting was stated as the main reason of the financial crisis. Most of the critics argue that mark to market in an inactive market distorts the financial results because fair values derived from an inactive market cannot be the representative of the true value of the assets. This is relevant especially for level 2 and level 3 inputs for fair value determination. Despite all these concerns, SEC advised that “the suspension of fair value accounting by historical based measures would likely increase investor uncertainty”. On September 2008, SEC

released the amendment of FAS 157 where the main attention was on level 3 inputs. The amendment states that: “When an active market does not exist, the use of management estimates that incorporate current market participant expectations of future cash flows, and include appropriate risk premiums is acceptable. In some cases, multiple inputs from different sources may collectively provide the best evidence of fair value. In these cases, expected cash flows would be considered alongside other relevant information. The weighting of the inputs in the fair value estimate will depend on the extent to which they provide information about the value of an asset or liability and are relevant in developing a reasonable estimate”. In response to the amendment of FAS 157, IASB also declared the amendments of IAS 39 and for additional disclosures IFRS 7. The scope of the amendments include that: “The amendments will only permit reclassification of certain non-derivative financial assets recognized in accordance with IAS 39. Financial liabilities, derivatives and financial assets that are designated as at FVTPL on initial recognition under the ‘fair value option’ cannot be reclassified. The amendments therefore only permit reclassification of debt and equity financial assets subject to meeting specified criteria”. The other issues clarified by IAS 39 are as follows (Fujioka, Seko, Hoontrakul, 2008):

Using own assumptions when relevant market inputs do not exist;

In an inactive market it is justifiable to use own assumptions for future cash flows and discount rates that are adjusted for various market risks;

Broker Quotes;

Broker quotes cannot be the representative of fair value in an inactive market if they do not reflect the transactions in that market.

Forced transactions and distressed sales.

Due to involuntary liquidations and distressed sales market becomes illiquid. In such markets it is not appropriate to use the inputs derived from involuntary transactions or distressed sales for determining the fair value.

In parallel to the amendments to IAS 39 and to make reclassifications more transparent additional disclosures were required within IFRS 7:

the amount reclassified into and out of each category;

for each reporting period until derecognition, the carrying amounts and fair values of all financial assets reclassified in the current or previous reporting

periods;

if the financial asset has been reclassified based on the ‘rare circumstances’ exception, details of those circumstances – including the factors that indicated that the situation was rare;

the fair value gain or loss recognized in profit or loss or OCI for the reporting period in which reclassification occurs and in the previous period;

in the period of reclassification and in subsequent periods until the financial asset is derecognized, the gain or loss that would have been recognized in profit or loss or OCI had the financial asset not been reclassified, and the actual gain, loss, income and expense recognized in profit or loss; and

the effective interest rate and estimated cash flows the entity expects to recover as at the date of reclassification of the financial asset.

3. Fair Value and the Crisis

In the context of fundamental changes in the world economy and in financial markets the causes of the crisis can be easily understood. The roots of the crisis are basically the mortgage defaults but in fact it is only a symptom or a component of a deeper financial storm. In fact, the main problem are the financial instruments which are derived from the mortgages such as mortgage backed securities (MBSs), Collateralized debt obligations(CDOs) and Credit Default Swaps (CDSs).

Home loans which are the basis for MBSs in 2008 were divided into too many parts and spread across financial markets. MBSs were restructured into a wide variety of financial instruments with different levels of risk. If interest rates increase security bring profit but if falls brings loss (Clark, 2008). (MBS bring down the US Economy)CDOs are a type of structured asset backed security (ABS) or mortgage-backed security (MBS) whose value and payments are derived from a portfolio of fixed-income underlying assets. CDOs are assigned different risk classes, or parts, whereby "senior" parts are considered the safest securities. Interest and principal payments are made in order of seniority, so that junior tranches offer higher coupon payments (and interest rates) or lower prices to compensate for additional default risk. Some CDOs do not own cash assets like bonds or loans. Instead, they gain credit exposure to a portfolio of fixed income assets without owning those assets through the use of credit default swaps, a derivatives instrument. Under such a swap, the credit protection seller, the CDO,

receives periodic cash payments, called premiums, in exchange for agreeing to assume the risk of loss on a specific asset in the event that asset experiences a default or other credit event (Vink, Thibeault, 2008).

In order to protect themselves institutions especially banks created CDSs. Credit swaps are generally the most favorite of the all other types of credit derivatives. In such swaps, payment to the buyer is triggered by an event which is included in the contract. To highlight the mechanism and the role in the crisis, credit default swap tried to be explained by an example.

A Basic Credit Swap

On November 15, 2008 Bank A used credit from Bank C of $1.000.000, with an interest LIBOR+1%, for 6 months. At the same time, Bank A enters into a swap contract with Bank Z, $1.000.000, fixed interest rate 7.25%, for 6 moths and will get premium from Bank Z LIBOR+0.25%.

First case: 31.12.2008 LIBOR = 6% 1.000.000 x 0.0625 x 45/360 = 7812.5 1.000.000 x 0.0725 x 45/360 = 9062.5 $1250 LOSS Second case: 31.12.2008LIBOR = 7.5% 1.000.000 x 0.0775 x 45/360 = 9687.5 1.000.000 x 0.0725 x 45/360 = 9062.5 $625 PROFIT

In this event, Bank A pays Bank Z a fixed amount. The most common form of credit swap is called a default swap. A would pay Z, if termination triggered by the default of Bank C, an amount that is the difference between face value and the market value of a designated note issued by Bank C. In the current crisis, this designated notes usually derived from instruments like Mortgage-Backed- Securities (MBSs). When borrowers had difficulty in making payments on the mortgages MBSs began to perform poorly. As CDOs were comprised of subprime mortgages they began to lose value and the banks began to write-down huge losses depending on mark-to-market applications. Many of these banks own CDSs on their subprime securities. Swaps didn’t work out as the one side of the contract

failed. Then the exchange of money stopped which caused “The Credit Crunch” (Mizen, 2008).

The difference between the mortgage crisis and the CDS crisis is that if you depend on a mortgage and if the borrower defaults on a loan, the bank still can cover the loss by selling the house but CDSs are based on actions or events especially credit ratings which is something intangible, this means there is no source or funding to cover the losses (Clark, 2008). Additionally, under distressed sales and illiquid market conditions financial instruments were fair valued in a market where the prices do not reflect the real and accurate cash flows that can be derived from the realized sales of these instruments. Forced sales cannot be the valid determinants of market prices because the accounting frameworks presume that a reporting entitity is a going-concern that does not need to liquidate its assets (Scarlata, J., Novoa., A., Sole, J., 2008). As banks are holders of these financial instruments which are valued under these circumstances, losses have been passed through the banks’ capital. The weak capital structure of these banks then directly affected the whole financial system.

Currently, it is obvious that there is a perfect storm which brings the question whether this is because of the fair value or not. In fact, the causes of the crisis are clear enough; newly created complex structured securities that are sold widely at the same time transferring the risk of borrowers’ default to the buyers as a result of the new “originate and distribute” concept of banking system.

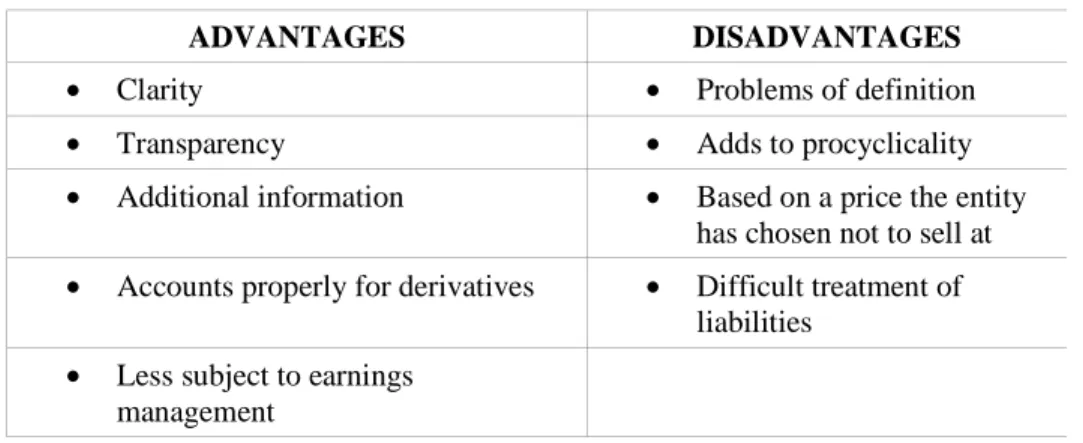

Table 2 indicates the advantages and disadvantages of fair value.

Table 2. Advantages and Disadvantages of Fair Value

ADVANTAGES DISADVANTAGES

• Clarity • Problems of definition

• Transparency • Adds to procyclicality

• Additional information • Based on a price the entity

has chosen not to sell at • Accounts properly for derivatives • Difficult treatment of

liabilities • Less subject to earnings

management

The current developments of derivative contracts led to criticism that under historical cost system a wide range of assets and liabilities were not on the balance sheet as they were created with no or little cost, though they gain or lose value as interest rates, exchange rates, libor rates, etc...changed. In these circumstances fair value accounting offers the most appropriate way to bring these transactions into the balance sheet and fully disclose (ACCA, 2008).

4. Conclusion

Achieving understandable, comparable, relevant and reliable financial reports will always be the most important objective for the fully informed financial markets. The recent crisis have raised two different situation:

1. Increased financing costs;

2. Difficulty in the valuation of debt securities.

The second situation also brings the problem with the fair value. It is true that fair value tends to increase procyclicality and make valuation difficult in case of illiquid markets. The main problem in fact are those financial instruments that the banks hold trading in an active market but then the market disappeared which makes the valuation more difficult not the fair value.

Additionally, within the global convergence and harmonization, fair value plays a very important role because investors appreciate the transparency provided by the fair value. Despite its disadvantages, fair value seems the most effective method that reflects the economic realities best in comparison to historical cost applications ignoring the current market values of financial instruments. Fair value, as a market based approach, results with more transparent and additional information that best fits to the following accounting objectives:

− Accurately reflect the current situation of a company which can be stated as “true and fair view”.

− Comparable and understandable financial reports

Financial reports with the most reliable, objective and relevant information.

The use of fair value seems to be criticized widely and continuously. Within the current crisis, it was well understood the risks of using unreliable values. From the crisis many have learned that the way of judgment for valuation should be changed

and the risks should be handled more carefully. Overall, this is not an accounting crisis rather it is a credit crunch.

References

Wade, R. (2008). The First World Debt Crisis of 2007-2010 in Global Perspective. Challenge. Vol. 51. No. 4, July-August, pp. 23-54.

Darrell, D. (1999). Credit Swap Valuation. Financial Analysts Journal, January-February, pp. 73-87. Murphy, A. (2009). An Analysis of the Financial Crisis of 2008: Causes and Solutions. Http://www.ssrn.com/abstract=1295344.

ACCA (2009). Fair Value: An ACCA Policy Paper. http://www.accaglobal.com/economy. Deloitte (2008). Amendments to IAS 39 and IFRS 7. http://www.iasplus.com. October.

Mizen, P. (2008). The Credit Crunch of 2007-2008: A Discussion of the Background, Market Reactions, and Policy Responses. Federal Reserve Bank of St. Louis Review. September-October. 90(5). pp. 531-67.

Greenspan, J., Hartwell, C.L. (2009). Are FASB Statements Becoming More Understandable?. CPA

Journal. January. New York.

Deloitte Canada (2009). Derivatives Gone Wild. Http://www.deloitte.com/article.

Robinson, D. (2008). Fair Value Issues and the Sub Prime Crisis. Prepared for the 13th Melbourne money and Finance Conference. June.

Fujioka, T., Seko, S., Hoontrakul, P. (2008). The State of Fair Value Accounting, Global Financial

Crisis and Implications to Thailand. Http://www.ssrn.com/abstract=1303351

Rossi, J. (2009). Weighing Your Financials: A Look At the Impact of Fair Value. Pennsylvania CPA

Journal. Spring.

Vink, D. & Thibeault, A. (2008). ABS, MBS and CDO Compared: An Empirical Analysis. The

Journal of Structured Finance.

Clark, J. (2008). What Are Credit Default Swaps. http://www.howstuffworks.com/swap.htm. Scarlata, J.; Novoa., A. & Sole, J. (2008). Fair Value Accounting and Procyclicality, IMF Global Financial Stability Report, Chapter 3, www.imf.org/external/pubs/ft/gfsr/2008/02/pdf/chap3.pdf.