Brent prices and oil stock behaviors: evidence from Nigerian listed oil stocks

Full text

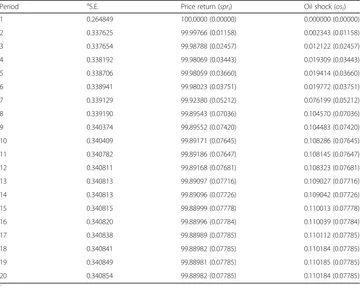

Figure

Related documents

Since in our view conventional lot sizing and scheduling models do not sufficiently reflect the conditions given in industrial production systems we propose an alternate

However, Jumbe (2004) found bi-directional causality between electricity consumption and eco- nomic growth but a unidirectional causality running from non-agricultural GDP to

12 This model development is relevant to what John Barrell (2007: 3) suggests that PBL (problem Based Learning) can be defined as an inquiry process that resolves

Inside Sales gives you the power & knowledge that you are the smartest person and company in your business... The Driving Factors

The fact that no specific course was required in all programs also means that the focus of the concentration can change significantly depending on the individual school and

The predicted response variable was the daily stock price of BHP Billi- ton Ltd (BHP.AX). The sentiment scoring construction was very similar to the previ- ous approach. The model

ATFT employs mechanisms concep- tually similar to those in BitTorrent tit-for-tat (TFT), a well-known protocol providing incentives for resource contributions in content-exchange

When looking at the value, corn exports will increase in the three-year forecast period, which will certainly be positive for the development of markets and new directions in