Strategic Plan

Table of Contents

Executive Summary ...4

Strategic Analysis ...5

Market Assessment ...5

Current Industry Situation ...5

Competitive Variable Model – Porter’s Five Forces ...6

Threat of Rivalry ...6

Table 1: Market Concentration (C4) Measured by Market Share ...7

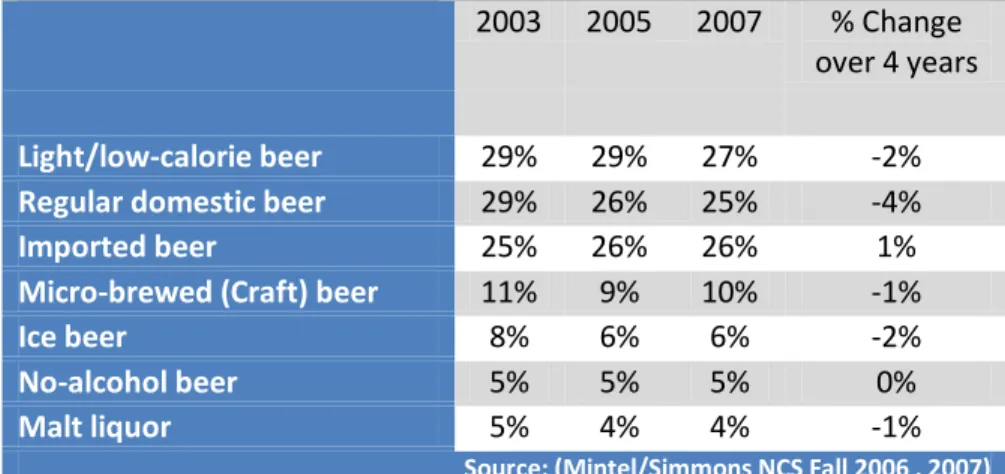

Table 2: Incidence of personal beer consumption, 2003-07 ...8

Threat of Substitute Goods ...8

Threat of New Entrants...9

Power of Suppliers ...10

Power of Buyers ...11

Strategic Mapping ...11

Figure 1: Strategic Group Map of Brewing Industry ...12

Major Competitors ...13

SABMiller ...13

Molson Coors ...14

MillerCoors ...14

Leap Growth Opportunities ...15

Value Innovation ...15

Factors Industry Take for Granted ...15

Factors Taken for Granted and the Value to Customers ...17

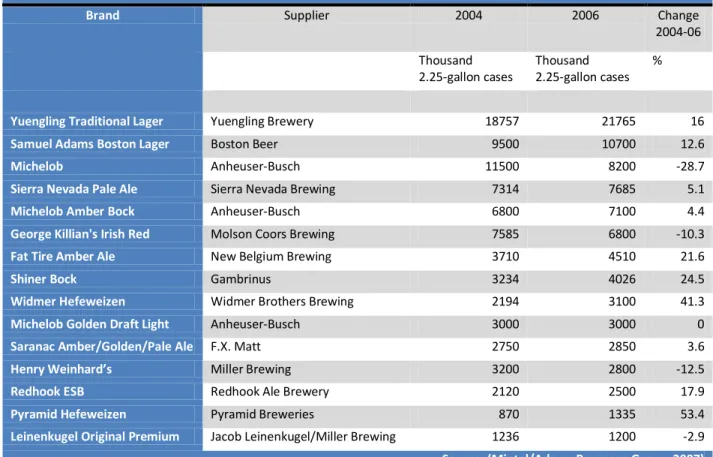

Table 3: Top 15 super-premium and craft beer brands, 2004 and 2006 ...18

Table 4: Top 10 regular imported beer brands, 2004 and 2006 ...19

Industry Offerings Consumers do Not Need ...19

Customer Wants Not Addressed ...20

Customer Needs Not Addressed ...20

Diamond Mining ...21

Long-term Value – Sophisticated Customers ...22

Short-term Value – Unsophisticated Customers ...23

Discontinuities...24

Economic ...24

Chart 1: Weighted Average of Currency Exchange Rates ...26

Political/Legal ...27

Technological ...28

Social ...29

Demographic ...31

Table 5: Personal consumption of beer by race/ethnicity, May 2006-June 2007 ...31

Table 6: Personal consumption of beer by household income May 2006-June 2007 ...32

Table 7: Incidence of personal consumption of beer by age May 2006-June 2007 ...33

International ...34

Critical Industry Value Drivers ...35

Firm Analysis ...37

Mission Statement ...37

Value-Chain Analysis ...38

Analysis of Primary Activities ...38

Inbound Logistics ...38

Operations ...39

Outbound Logistics ...39

Marketing and Sales ...40

After Sales Service ...41

Analysis of Secondary Activities ...42

Firm Infrastructure ...42 Management Profile ...42 Planning ...42 Scanning ...43 Culture ...43 Financial Analysis ...44

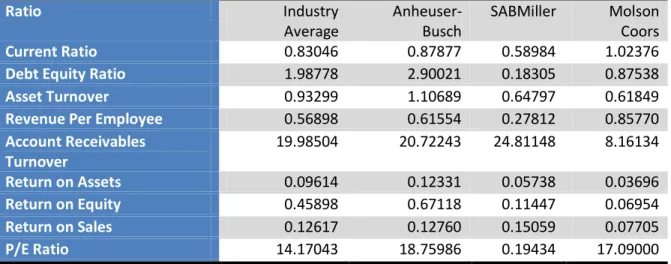

Table 8: Financial Ratios of the Top Three Brewers Compared to Industry in 2007 ...44

Table 9: Anheuser-Busch Ratio Comparison 2003 - 2007 ...47

Legal ...48

Quality ...49

Human Resource Development ...49

Technology Development ...49

Procurement...50

Analysis of Current Strategies ...51

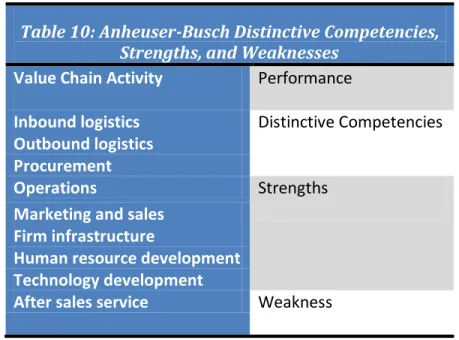

Critical Strategic Strengths and Weaknesses ...53

Table 10: Anheuser-Busch Distinctive Competencies, Strengths, and Weaknesses ...53

Business Plan ...56

Recommendation – Craft Brew Market ...56

Justification ...56

Table 11: Purchase Price of Craft Brew Firms ...57

Table 12: Projected Cash Flows over 5 years for Craft Beer Strategy ...58

Implementation...59

Timeline ...60

Chart 2: Timeline for Brewing Industry ...60

Recommendation – A-BNation.com ...61

Justification ...61

Table 13: Projected Cash Flows Over Project Life (5 years) for A-BNation.com Strategy.62 Implementation...62

Timeline ...64

Chart 3: Timeline for “A-BNation.com” ...64

Recommendation – Recycling...65

Justification ...65

Table 14: Projected Cash Flows Over Project Life (5 years) of Recycling Strategy ...66

Implementation...66

Timeline ...68

Chart 4: Timeline for Recycling ...68

Appendices ...69

Appendix 1 – Craft Brew Estimates ...69

Executive Summary

In the brewing industry the hot trends in the market today come from mergers and acquisitions, marketing, and imports and craft beer. The first trend is larger payers in the market have been merging for the last few years to combat the leader in the market, Anheuser-Busch. The second trend is marketing changes; companies are going back to the core brands and messages that made the core brands the best sellers. The final trend is in the craft beer and imports market; craft beer has continued its double digit growth, in 2007 it was 14%. The competitive environment of the brewing industry is high and therefore may not be as profitable. Increased threat in the market from craft beer, lack of after sales service, and rising costs from suppliers have cut into the profit of the company. All three of these areas are consistent with current trends in the market and therefore need to be addressed by Anheuser-Busch.

To combat the growth of the craft brew market Anheuser-Busch must purchase more independent craft brewers. Four brewers have been targeted for growth over the next year based on the region where they operate. We will purchase brewers in the Northeast, Southeast, Midwest, and West Coast. Over the course of five years as the companies are integrated into the Anheuser-Busch family growth of these brands will increase by 50% over what they are today. The purchase price is $4.7 million with a Net Present Value of $170,000. Currently, there is no after sales service in the brewing industry; firms do not reach out to consumers to measure attitudes, behaviors, or satisfaction. In order to grow the customer base, it is recommended that Anheuser-Busch create a new portal which will allow the entire family of brands to be marketed to consumers. The portal will replace the existing product websites and allow consumers to have one place for all things Anheuser-Busch including the

entertainment division. The cost of producing this portal will be $52,000 with a Net Present Value of $122,000.

Finally, Anheuser-Busch needs to combat rising costs of materials to the firm for packaging. We plan to utilize an existing resource, Anheuser-Busch Recycling Corporation, and expand the scope of the business to include paper, plastic, and glass. This will help lower threats from suppliers and costs of procurement. Collection sites will be set up at local distributors and liquor stores with Anheuser-Busch branded collection bins. The collection of recyclables will give consumers the impression that Anheuser-Busch is a greener company than the

Strategic Analysis

Market Assessment

Current Industry Situation

In the brewing industry today, there is high competition between the top three or four largest firms. The firms produce a variety of beer which includes: light beer, premium beer, popular beer, super-premium, ice beer, malt liquor, and flavored malt beverages (Scopes and Themes, 2007). In addition to the products listed above, new players are entering the market in the form of craft beers which are typically made in smaller batches and are often seasonal. The current trends include: consolidated companies, changes in marketing, addition of craft beers and imports.

In the brewing industry one current trend is to merge operations under a few larger brands (Hoover's Industry Snapshots, 2008). Hoover’s Industry Snapshot states, “Although it is in a close race with wine, beer remains the industry's top seller, and major brands are growing slowly. As a result, many global brewers are merging operations to reduce costs and gain market share” (Hoover's Industry Snapshots, 2008). In recent months SABMiller PLC has started joint venture with Molson Coors Brewing Company in hopes to “create more competition for beer industry leader Anheuser-Busch” (SABMiller-Molson Venture Clears Hurdle, 2008). Furthermore, Anheuser-Busch was just presented an offer of purchase from InBev, one of the world’s largest brewers, in the amount of $46 billion (Sorkin & Merced, 2008).

Another trend comes in the form of marketing; firms are starting to alter marketing of their brands to better appeal to newer customers or to get lost customers back. Coors Brewing Company has altered its own marketing strategies from the former “T&A-driven effort that

starred the ‘Coors Twins’” (Mullman, Coors soars as consistent Cold Train steams ahead, 2008) which did not help the company gain ground on market competitors, therefore Coors has returned to more traditional advertising that helped them become a larger player in the domestic beer market; they now focus on technological innovations and how the product is made.

Other trends include growth in imports and craft beer which has helped the market grow (Market Size and Trends, 2007). According to Mintel, “Domestic beer has consistently lost share to other alcoholic beverages, including distilled spirits, wine, and even imported beer” (Market Size and Trends, 2007). Furthermore, seasonal beers have taken a strong hold in the beer market. Craft beers are better able to adapt to this market however, larger brewers have also jumped on the bandwagon but the results for larger breweries have not been as successful as those of craft beer. “Clearly, innovation is on the side of smaller players, many of which are at the forefront of experimenting with beer styles and pushing the taste envelope forward” (Market Size and Trends, 2007). To compete in the market today larger breweries need to be more innovative and introduce products that make people believe they are getting a craft beer. Competitive Variable Model – Porter’s Five Forces

Threat of Rivalry

Threat of rivalry is high in the brewing industry.

Threat of rivalry can be measured on two dimensions: market concentration and

demand for product. Market concentration can be measured by the C4 Ratio (or top four firms) in which a market is considered to be concentrated if the C4 Ratio is 50% or higher. As a result

of high market concentration significant interdependence exists between firms in the industry. Additionally, if demand for a product is low the rivalry is high.

In the brewing industry, the C4 ratio has been relatively constant over the last decade (see Table 1 below). Currently, the top four firms control 80.9% of the market while the largest player controls 48.2% of the market. Furthermore, the remaining three companies only control 32.7% of the remaining market.

With market concentration extremely high, brewers are interdependent on one

another. Due to the high market concentration and interdependences of the firms, if one firm launches a new advertising campaign, others will follow. Similarly due to the interdependency, if one firm launches a new beverage, others will try to copy that beverage. This can be seen in the 2007 launch of the new Miller Chill, a lime infused beer produced by SABMiller. Anheuser-Busch recently introduced a new Bud Light Lime in April 2008 (Bud Light Lime Makes a Splash With Refreshing Twist, 2008).

Demand in the brewing industry for traditional brews is regaining ground as gas prices rise; and consumers look for ways to reduce their expenses, however, it is still lower than that of micro and craft beer. As is shown in Table 2 on the following page, over the last four years

Table 1: Market Concentration (C4) Measured by Market Share

Firm 1998 2003 2004 2005 2006

Anheuser-Busch 51.6% 49.5% 49.4% 48.6% 48.2%

SABMiller 19.0% 18.4% 18.5% 18.4% 17.8%

Coors 10.2% 10.8% 10.6% 10.6% 10.9%

Pabst No Data 3.9% 3.6% Approx. 2.1% Approx. 2.0%

Heineken USA No Data Approx. 2.1% Approx. 2.2% 3.6% 4.0%

Sources: (Lazich, 2000), (Bossons-Martines, S & P Industry Surveys, 2006), (Bossons-Martines, S & P Industry Surveys, 2007), (Bossons-Martines, S & P Industry Surveys, 2007)

consumption of domestic beer has dropped by 4% while consumption of imported beer has increased by 1% and consumption of craft beer has decreased by 1%. In a recent article, Miller Brewing Company stated that “People are still willing to pay a premium to have [high-end brands] but we've also seen a recent spike in our economy brands” (Fackler, 2008). Molson Coors stated in a recent press release that “April sales to retailers…are up at a high single-digit rate” (Reuters, 2008).

Furthermore, Standard & Poor’s reports that, “we think we may see some modest trading down by consumers from spirits and wine to beer as incomes are pressured in

a softer economic environment” (Esther Kwon, 2008). As a result, as the economy weakens, demand for domestic beer may have started an upward trend.

The results of the extremely high market concentration and low demand provide evidence that rivalry between firms is high.

Threat of Substitute Goods

Threat of substitute goods is high in the brewing industry.

There are many substitutes for the brewing industry ranging from other alcoholic beverages such as wine and liquor to non-alcoholic beverages such as soft drinks, bottled

Table 2: Incidence of personal beer consumption, 2003-07 2003 2005 2007 % Change

over 4 years Light/low-calorie beer 29% 29% 27% -2% Regular domestic beer 29% 26% 25% -4%

Imported beer 25% 26% 26% 1%

Micro-brewed (Craft) beer 11% 9% 10% -1%

Ice beer 8% 6% 6% -2%

No-alcohol beer 5% 5% 5% 0%

Malt liquor 5% 4% 4% -1%

water, and fruit juice. One article stated, “Beer is losing market share to other beverages, to spirits and especially wine” (Strenk, 2008, p. 83). Many liquor manufacturers are producing more pre-mixed bottle beverages. For example, Smirnoff Vodka has created new cocktails using their vodka. Additionally, Smirnoff now produces a beverage called Smirnoff Ice which is a malt beverage which comes in a variety of flavors (Smirnoff Ice, 2008). It is clear with the quantity of substitute goods in the market beer faces a larger threat from substitutes. Threat of New Entrants

Threat of new entrants is high in the brewing industry.

Threat of new entrants can be measured by demand for the product and entry barriers. Demand for domestic beer is relativly low, as compared to import beer and craft beer because many consumers tastes and preferences have changed along with the income level. One Standard & Poors article stated that “consumption trends for imported beers and craft beers will also benefit from higher disposable incomes, as consumers ‘trade up’ to better beers” (Esther Kwon, 2008). With the advent of craft beers, it is no longer difficult for smaller companies to enter the brewing industry. However, with the rise of costs from materials, the trend toward introducing new craft brews into the market may start to drop. As a result of the emerging craft and micro brew industry and the import beer industry, the threat of new

Power of Suppliers

Power of suppliers is moderately high in the brewing industry.

Power of suppliers is measured on two factors: product differentiation and potential of vertical integration. In the brewing industry there is little product differentiation on the ingredients used and the type of packaging used. Furthermore, larger firms can afford to, and have, backwardly integrate into the packaging and growing of key ingredients.

According to an article in The Wall Street Journal, “The costs of virtually every commodity needed to make and market beer, from grains to aluminum, have been skyrocketing” (2008, p. B8). Furthermore, in the United States, “some U.S. farmers have reduced acreage, converted hops fields to other crops, or sold their farms to developers” (Angrisani, 2008, p. 27). Finally, this article goes on to state that rising fuel prices have had an impact on ingredient costs.

As for vertical integration, Coors had developed joint ventures for production of items such as aluminum and glass bottles to transportation (Molson Coors Brewing Company Form 10-K, 2007). Anheuser-Busch has operations that include: raw materials, packaging,

transportation, and recycling (Anheuser-Busch Business Units, 2007). It is evident that brewers recognize that suppliers have control due to the backward integration techniques that these two companies have undertaken.

As a result of increased costs from suppliers and the lack of vertical integration on the part of most breweries, it is clear that suppliers do have control in the brewing industry.

However, by vertically integrating, Coors and Anheuser-Busch have attempted to lower the threat of suppliers.

Power of Buyers

Power of buyers is high in the brewing industry.

Bargaining power of buyers can be measured by three factors: value cognizance, product differentiation, and demand characteristics. Value cognizance in the brewing industry for consumers is high because consumers recognize the brand differences of the key players of the industry. However, product differentiation in the brewing industry is relatively low; the three largest firms all make the same basic product. Furthermore, the rate of demand is still relatively low, as compared to craft brews, but has started an upward trend. Currently, one could infer that the power of the buyer is high due to high value cognizance, low

differentiation, and low demand. Consumers could easily switch to a different brand if their preferred beer was not available or if the preferred brewer drastically altered the brew.

Taking all five forces into consideration, the competitive nature in the industry is high; as a result, the industry may not be attractive or profitable. Furthermore, it may be difficult for current companies to compete unless they can counter the threats.

Strategic Mapping

Looking at the strateic groups located in Figure 1 on the next page, there are six distinct groups in the brewery industry based on price and quailty and three categories based on geographic region. The first category is local brews, which are produced in small batches and typically are not sold out of the home city; as Figure 1 shows in green, local brews typically only

compete in one group based on price and quality. The second category is regional brews, which are produced in relatively small batches and typically are not sold outside a specific region; as Figure 1 shows in yellow, regional beers compete in two different groups based on price and quality. Finally, there are national brews which are produced in larger batches and sold through out the United States; as Figure 1 shows in blue, in the national brew category the companies compete on three different group based on price and quality.

The top three domestic beer manufacturers are relatively consistent in following the medium and high price/quality and national coverage catagories. However, where they are missing opportunities falls in the regional and local markets where they would have to compete head-to-head with craft brews and micro-brews. For example, if they were to produce a low to medium priced beer in the Pennsylvania to Ohio region they would have to compete head-to-head with the Pittsburgh Brewing Company which produces Iron City beer.

Michelob Leinenkugel Miller Bud Light Coors Colt 45 Boont Amber Ale

Iron City Shiner Bock High Regional National Medium Low Pr ic e/ Qu al ity Geographic Region Local

Major Competitors

In the domestic brewing industry there are three key players: two of these players compete head to head with Anheuser-Busch. SABMiller was formed when South African brewery SBA purchased Miller in 2002 (Our History 2000 - 2008, 2008). Molson Coors was formed when Canadian brewery Molson and American brewery Coors joined forces in 2005. SABMiller

The second place brewery based on Market Share is SABMiller. SABMiller’s corporate office is located in Woking, Surry; SABMiller is currently traded on two stock exchanges; London and Johannesburg. Over the last year the stock price has lost ground at -15.90% (Share Price Chart, 2008). A further analysis of the financial statements is presented in the Firm Analysis section.

SABMiller has a broad range of product lines with 29 different products under nine different brands. The spectrum includes offerings on the national level with price points low to high range. SABMiller also competes globally in several countries.

The company’s strategic goals include: “Creating a balanced and global spread of business, Developing strong, relevant brand portfolios in the local market, Constantly raising the performance of local businesses, and Leveraging our global scale” (Our strategic priorities, 2008). SABMiller currently serves the majority of developed nations and a few that are

developing. It is clear that SABMiller has clear goals set for the company; each of the strategies has a clear definition for the company to follow.

Molson Coors

The third place brewery based on Market Share is Molson Coors. Molson Coors corporate office is located in Toronto, Canada; Molson Coors is currently traded on the New York Stock Exchange. Over the last year the stock price has gained ground at around 1.19% (New York Stock Exchange, 2008). A further analysis of the financial statements is presented in the Firm Analysis section.

As the third place brewery based on market share in the United States, Molson Coors has a narrow range of product lines with 12 different products under seven brands. The spectrum includes offerings on the national level with price points in the mid to high range. Molson Coors also serves several international markets.

The company’s strategic vision states, “Our vision is to be a top performing brewer winning through inspired employees and great brands. As an innovative, brand-led company, we will drive growth, deliver results, reinvest in productivity, and build a winning, value-based culture” (Molson Coors Corporate Responsibility, 2008). Molson Coors has a strong vision; however, there are no clear measurable attributes defining how the company plans to achieve this vision.

MillerCoors

In June 2008 SABMiller and Molson Coors entered into a joint venture to merge companies in the United States. As a result, this merger will give the combined company approximately 30% of market share. Further, “SABMiller and MCBC expect that the enhanced brand portfolio, scale and combined management strength of the joint venture will allow their

businesses to compete more vigorously in the aggressive and rapidly changing U.S. marketplace and thus improve the standalone operational and financial performance” (2007, p. 4). At this time it is not possible to assess the impact of the joint venture on the industry and should be re-evaluated over the course of the next year to measure the impact.

Leap Growth Opportunities

Value Innovation

Factors Industry Take for Granted

In the brewing industry the factors that the larger breweries take for granted include: brand image, craft brews, growing import beer markets, and pairing beer with food.

The first factor the big three breweries take for granted is brand image. The marketing campaigns are designed to give the consumer the impression that drinking their brand will provided them with a certain lifestyle. They have forgotten about brand attributes that consumers are looking for in the form of taste the increasing importance of this factor is indicated by the finding that the fastest growing segment of beer is in craft brew. In fact, the growth in the craft brew segment for 2007 was eight times the amount of domestic beer (Theodore, 2008).

The second factor that big three breweries take for granted comes in the form of craft brews. In the craft beer markets, larger breweries have been slow to respond to the increased pressure from these smaller companies. One article stated, “there’s a lot of potential in the craft beer phenomenon…it’s a real opportunity for big brewers to widen their product portfolio and reach a new customer” (Strenk, 2008, p. 83). One company has reacted; Molson Coors has

produced Blue Moon starting in 1995 and most people do not know that it is produced by Coors (Strenk, 2008). The craft beer market had an increase of 12% in consumption over the industry standard of 1.5% for domestic beer (Theodore, 2008).

The third factor the big three breweries take for granted comes from the import beer market. In the beer market, sales were up according to one industry report 1.5%; domestic beer was up 1.5% while import beer was up 1.4% in 2007 (Theodore, 2008). However, this article goes on to state that “I’m still seeing signs of trading up as the top five performing beer brands were all high end” (Theodore, 2008, p. 14). Anheuser-Busch has tried to take a stab at the import market by entering into a joint venture with InBev to distribute its top brands in the United States. However, for Anheuser-Busch the addition of craft and import beers has hurt

the company; “The number one U.S. brewer-which holds about 49% of the market-stumbled

last year as it absorbed dozens of new import and craft brands into its wholesaler network. “There were supply-chain woes and marketing stumbles” (Mullman, Brewing Battle, 2008) according to one article.

The final factor the big three breweries take for granted is in the food and beer pairing arena. It has long been tradition for diners to order wine with Veal Marsala at their local Italian restaurant. Restaurants such as Ruth Chris Steak House will suggest wine to go with your dinner. Pizza restaurants have started to suggest beer with dinner to improve the dining experience, providing diners the best beverage to complement their meal. However, the big three are missing out! When looking at industry trade magazines they all discuss pairing craft

brews with a meal and since the big three are lacking in this area they are losing sales to these craft brews.

Factors Taken for Granted and the Value to Customers

Factors that the big three breweries take for granted are: craft beer, brand image, and import beer. The big three provide no value for consumers even though one firm has tried to enter this market. Brand image is a place that consumers find value but the big three take this for granted when developing advertising campaigns and sell a lifestyle rather than the product. Finally, the big three take for granted the impact of the import beer market in hopes that the products they sell will carry the company and consumers will not switch.

In the craft beer segment the big three breweries provide no value for customers. Miller, Anheuser-Busch, and Coors are lacking products that fall into the craft beer segment. As a result, the big three are missing out on an important segment of the market. Coors has attempted to add a craft beer with Blue Moon and it has been successful; however, as Mintel/Adams Beverage Group reports it is not in the Top 15 Super-premium and craft beer brands, as can be seen in Table 3 on the next page. Furthermore, Anheuser-Busch, Coors, and SBAMiller have products in the top 15 (Michelob, Michelob Amber Bock, Michelob Golden Draft, George Killian’s Irish Red, and Leinenkugel Original Premium); however, these brands are considered super-premium and not craft beers.

Table 3: Top 15 super-premium and craft beer brands, 2004 and 2006

Brand Supplier 2004 2006 Change

2004-06 Thousand 2.25-gallon cases Thousand 2.25-gallon cases %

Yuengling Traditional Lager Yuengling Brewery 18757 21765 16

Samuel Adams Boston Lager Boston Beer 9500 10700 12.6

Michelob Anheuser-Busch 11500 8200 -28.7

Sierra Nevada Pale Ale Sierra Nevada Brewing 7314 7685 5.1

Michelob Amber Bock Anheuser-Busch 6800 7100 4.4

George Killian's Irish Red Molson Coors Brewing 7585 6800 -10.3

Fat Tire Amber Ale New Belgium Brewing 3710 4510 21.6

Shiner Bock Gambrinus 3234 4026 24.5

Widmer Hefeweizen Widmer Brothers Brewing 2194 3100 41.3

Michelob Golden Draft Light Anheuser-Busch 3000 3000 0

Saranac Amber/Golden/Pale Ale F.X. Matt 2750 2850 3.6

Henry Weinhard’s Miller Brewing 3200 2800 -12.5

Redhook ESB Redhook Ale Brewery 2120 2500 17.9

Pyramid Hefeweizen Pyramid Breweries 870 1335 53.4

Leinenkugel Original Premium Jacob Leinenkugel/Miller Brewing 1236 1200 -2.9

Source: (Mintel/Adams Beverage Group, 2007)

Value for customers comes from the image that their preferred brand compromises. Some brewers advertise more heavily during sporting events even going as far as to sponsor events; while other brewers advertise lifestyles. As a result, manufacturers are starting to alter the messages they send through advertisements. One article states, “Miller Genuine Draft will snag more TV time with a test of two ad messages--one tactic presenting MGD as the beer for consumers with higher standards” (Beirne, 2008). On another front, Anheuser-Busch has decided to start looking for marketing to appeal to “non-sports fans” (Beirne, 2008).

In the import beer segment, the big three are also lacking, as shown in Table 4 below, the top performers are foreign owned companies. As a result, the big three are missing out on an important segment of the market. Only one company has a division in the United States, Heineken USA whose parent company is based in the Netherlands. In order to compete in the international beer market, domestic breweries need to purchase or develop joint ventures that will allow for importation of these international beers.

Table 4: Top 10 regular imported beer brands, 2004 and 2006

Brand Supplier 2004 2006 Change

2004-06 Thousand 2.25-gallon cases Thousand 2.25-gallon cases %

Corona Extra Grupo Modelo 97,930 116,218 18.7

Heineken Heineken USA 63,125 68,500 8.5

Modelo Especial Grupo Modelo 10,951 19,616 79.1

Tecate Heineken USA 14,569 17,775 22

Labatt Blue InBev 14,196 12,800 -9.8

Guinness Stout Diageo-Guinness 10,774 11,753 9.1

Beck’s InBev 7,602 7,700 1.3

Dos Equis Heineken USA 5,865 7,500 27.9

Stella Artois InBev 2,359 6,250 164.9

Bass InBev 6,285 5,650 -10.1

Source: (Table listing for Imported Beer and Flavored Alcoholic Beverages - US - December 2007, 2007)

Industry Offerings Consumers do Not Need

When it comes to beer consumers do not really find value in innovation based on

trends. In an article found in Beverage World, the author stated, “During the low-carb trend we saw a host of beverages aimed squarely at the low-carb consumer. Some of them had

successful debuts, but time has shown it to be a weak platform on which to build a brand” (Foote, 2005). The article goes on to state that the rise of Light beer “were not reactions to a

consumer consumption fad; they were harbingers of change in the American diet. They addressed consumer needs, not trends” (Foote, 2005).

Customer Wants Not Addressed

The customer want not being addressed by the big three breweries in the United States is craft beer.

The largest want that consumers have that is not being addressed by the big three is in the form of craft beer. Anheuser-Busch tried and has not succeeded in the manufacture and marketing of the craft beer brands they purchased. In Cheers to Craft the author states, “Consumers are trading up to products with more character, taste and variety and just more history, heritage and tradition vs. mass marketed products” (Furman, 2005). This further supports that the big three are underperforming in the area of customer wants.

Customer Needs Not Addressed

The consumer need not being addressed by the big three in the United States is substitute goods.

The area of consumer needs not addressed by the big three breweries comes in the form of substitute goods. Of the big three, none of them offer any substitute goods to replace beer in the United States. For example, SABMiller has purchased two facilities in Zambia which bottles and distributes Coca-Cola (SAB buys into Coca-Cola in Zambia, 2002). This purchase not only gives SABMiller alternatives to beer but will also allow the company access to the beer market in Zambia.

Diamond Mining

In the beer industry, the big three breweries have advantages that they could utilize in other markets. These advantages are: recycling, production, and packaging.

The first advantage the big three could use in other markets is in the area of recycling. Anheuser-Busch currently owns and operates an aluminum recycling center. They could expand this division of the company to include other items such as paper, glass, and plastic. If they were to expand this area of the business they could cut their operating costs related to purchases of raw materials to make packages for the products they sell. Additionally, the company would be able to advertise, using green marketing, they are helping the environment by cutting waste. Furthermore, as more and more companies are looking for lower cost options, Anheuser-Busch could leverage this division and expand further into other areas of recycling. For example, they could benchmark Caterpillar’s efforts through Progressive Rail Services and find ways to recycle materials like steel (Caterpillar, Inc. Businesses & Brands, 2008).

The second area of advantage for the big three breweries comes to production of the final product. They are in a position to leverage these advantages into other markets; for example, soft drinks, bottled water, and bottled juice. As previously pointed out, SABMiller owns and operates two Coca-Cola facilities in Zambia which has given them access to markets that were previously unattainable. The big three could expand their product lines by either acquiring a current beverage company or by developing their own beverages. Furthermore, the breweries are in a position to enter into the craft beer and local beer markets by either

purchase or new product innovation on a smaller more regional scale. The results of either entering into the soft drink market or entering into the craft brew market would help to further diversify the companies. Additionally, entering into the soft drink market would give the

companies access to markets that have previously been unavailable to them.

The final area the big three could use to their advantage comes in the form of packaging. Currently both Coors and Anheuser-Busch, either through joint venture or

ownership, operate their own manufacturing facilities for bottles. The companies could expand this portion of the business and create divisions solely responsible for package manufacturing which would include: glass and plastic bottles, cans, cardboard boxes, etc. By leveraging the size of the company they could capture a new market and help to lower the cost of raw materials for their own needs.

Market Segmentation

Long-term Value – Sophisticated Customers

In order to keep current sophisticated customers, firms need to accomplish two things: enter the craft beer market and enter the import market.

Sophisticated customers seek out craft brews; domestic beer market leaders must get into the craft brew market which will allow them to remain the market leaders. The upscale customer is looking for more option when considering alcoholic beverages, in particular beer. This can be seen in the growth of the craft beer market. Firms need to figure out a way to enter these markets, not on a large scale but on more regional/local scale. To accomplish this, firms could purchase or create craft brews based on regions throughout the United States.

Furthermore, domestic beer manufacturers need to enter the import beer market. These firms need to utilize their power and purchase international companies and get the imports cleared through the government to add to the product mix already being sold in the United States. By getting into the import market, firms will continue to cater to the upscale customers.

Short-term Value – Unsophisticated Customers

For firms to continue to create value for themselves it is important to move

unsophisticated customers into the sophisticated customer segment. In order to accomplish the domestic firms must educate these customers through marketing. There are two types of unsophisticated customer. The first is the customer that continually goes after the same type of beer; for example, those customers that drink only Budweiser; we will call these customers bottom of the keg. The second type of unsophisticated customer is the customer that typically drinks craft beer with dinner and does not realize that there are domestic beers that will complement the meal just as nice as a craft brew; we will call these customers top of the keg. By educating unsophisticated customers, firms will be better positioned to offer more specialty beer.

To convince the bottom of the keg consumers to trade up the domestic breweries need to look at marketing. One way that domestic beer brewers can educate the bottom of the keg customer is through a sampling program at local bars. Wine bars typically have wine tastings to educate customers in hopes that customers will trade up to more expensive blends. Domestic beer manufacturers can learn from the marketing efforts of the wine country. A second way

that domestic beer companies can get bottom of the keg drinkers to trade up is to implement some form of contest around the more expensive products.

In order for domestic beer companies to get the top of the keg consumer to trade up is through marketing. These consumers will not respond to traditional marketing of

advertisements; however, if domestic firms partnered with casual dining restaurants to pair beer selections with their meal, similar to wine pairings, the top of the keg drinker will respond. For example, Anheuser-Busch could partner with Applebee’s Grill and Bar and get

recommended beers listed on the menu under the food selections.

Discontinuities

Economic

There are several economic issues that breweries operating in the United States need to be aware of when forming strategies. First, there has been an increase of mergers and

acquisitions resulting in larger conglomerates that compete based on economies of scale. Second, the economy is softening; therefore, consumers have less money to spend on luxury items. Third, the cost of goods to manufacturers is increasing making producing goods more expensive. Finally, the value of the dollar as compared to other countries is falling thereby making it cheaper to import goods into the country and increasing demand for these imports.

In recent times, large domestic beer companies have merged to better compete in an ever increasing market. SABMiller and Molson Coors recently announced they are joining forces to better compete with Anheuser-Busch. The CEO of Molson Coors was quoted on the SABMiller website stating, “This combination of our two highly complementary U.S. businesses

creates a stronger brewer and allows us to compete better” (SABMiller and Molson Coors sign definitive agreement to form MillerCoors U.S. Joint Venture, 2007). This statement is obviously in relation to the 49% market share of Anheuser-Busch. InBev, the world’s largest brewer offered Anheuser-Busch $46 billion for the purchase of the company. Anheuser-Busch studied the offer and ultimately decided against the buy out on the basis that the bid was not high enough (Birnbaum, 2008).

Currently, the economy in the United States is trending downward and the Fed has warned about inflation (What's News, 2008). With gas prices on the rise, brewers need to be aware that consumers are starting switch to lower costs beverages as income shrinks.

Additionally, consumers are seeing that there money is buying less and as a result luxury items like beer may no longer be a top of the mind purchase. SABMiller reported that they have seen more demand for lower priced beer since January (The Associated Press, 2008). Furthermore, brewers will be better able to position domestic beer as a replacement for craft brews and international beers. Breweries need to keep in mind that consumers’ income is not going to stretch as far and should promote that their products are less expensive than import and craft beers.

As was previously stated, one of the biggest issues that brewers face is the increase in cost of goods for manufacture i.e. aluminum and grains. As the Wall Street Journal reported in April 2008, prices for all inputs are on the rise due to economic pressures in the market and crops being changed by farmers to other forms of grains (Anheuser-Busch Profit Slips 1.3% as Costs Rise, 2008). Additionally, the rising cost of gas has impacted transportation costs for

brewers. The larger brewers can take advantage of their economies of scale to purchase larger quantities which could lead to volume discounts for these items.

The final economic factor affecting the brewing industry is the value of the dollar as compared to other countries. Exchange rates of the Dollar as compared to other countries directly affect the import and export of beer. For example, if the US Dollar is at 1.4234 as compared to the Euro it will take 1.4234 Dollars to get 1 Euro. As Chart 1, below, points out, since January 2000 the exchange rate of the dollar as compared to other currencies is falling. The trend make imports cheaper to bring into the United States allowing beer import

companies to better compete in the market. As a result, brewers who export their products need to position themselves in foreign markets as a premium beer.

Source: (United States Federal Reserve, 2007) -20.0000 40.0000 60.0000 80.0000 100.0000 120.0000 Jan -00 A ug -00 Mar -01 O ct -01 May -02 D ec -02 Jul -03 Fe b -04 Se p -04 A pr -05 Nov -05 Jun -06 Jan -07 A ug -07 Mar -08 R at e Month/Year

Weighted Average of Currency Exchange Rates

January 2000 - July 2008

Month/Year Rate

Linear (Month/Year Rate)

Chart 1: Weighted Average of Currency Exchange Rates

Political/Legal

Domestic brewing companies face a great deal of political and legal pressure from the community. Breweries operating in the United States face several political and legal issues ranging from underage drinking to drunk driving. However, there are other issues that these companies need to take into account. The first issue comes in the form of marketing energy drinks based with alcohol added. Next, there has been a rise of issues surrounding online content and it being accessible to underage drinkers. Finally, there are increased pressures for companies to lower heath care costs by charging employees premiums based on behavior.

One of the more recent issues has been the addition of caffeine to energy drinks. A suit was filed by several state attorney generals to stop the sale of caffeinated energy drinks based on the type of marketing they pursue (Alcoholic Energy Drinks Under Scrutiny, 2008). As a result, Anheuser-Busch pulled their energy drinks this month (Anheuser-Busch To Stop Selling Alcoholic Energy Drinks As Part of Legal Settlement, 2008).

Another legal issue surrounding the domestic beer brewers is online content. Recently beer manufacturers have been under fire saying that the web presence does not do enough for keeping underage people out of their web sites. For example, Anheuser-Busch has faced increased pressure to do more after the launch of its’ Bud.tv web site (Mullman, A-B Lowers its expectations for Bud.TV, 2007).

The final legal issue surrounding domestic beer brewers is the potential for companies to crack down on drinking as they have done with smoking to promote a healthier work environment. In a recent article, Whirlpool suspended workers who it claims misrepresented

themselves on their health benefits forms saying that they were non-smokers. This was apparently done to get around paying a surcharge that the company imposes on smokers (Marquez, 2008). The result for breweries is increased pressure to lower the cost of healthcare to better compete could force companies to begin to include drinking alcoholic beverages in this type of program.

Technological

In the brewing industry there is not a high amount of technological innovation. The first area is innovations with the type of brewing equipment and packaging in the form of aluminum bottles and green packaging. The second area comes in the form of micro-breweries. Micro-breweries have impacted the market because smaller companies can enter the market and compete and tend to innovate more often than larger breweries.

The first form of technological innovation is found in equipment and packaging. There are more efficient machines that require less labor to run and provide better energy efficiency which performs the job better than traditional labor while saving the company valuable labor costs (Saunders, 2007). Furthermore, consumers are seeking out greener products and there is a new bottle for packaging beer; aluminum bottles. Aluminum bottles are slowly replacing glass as consumers become greener. In the article, Designing a Green World it states, “People are interested in using that technology, stretching the boundaries of shaping and decorating the bottle” (Scott, 2008, p. 32).

The second form of technology comes from the advent of micro-breweries.

Micro-brewers typically push innovation in beer. According to one website, “Craft brewers are an

innovative lot. Often, innovation means taking old or established ideas and applying them in new ways” (Rabin, 2008). The article then goes on to discuss a brewery in Colorado that created a new system for pasteurizing beer that involves a tunnel built underground.

Furthermore, micro-brewers typically experiment with adding different flavors to beer such as one brewery that crafted a beer using lavender.

Social

The main social issues in the alcoholic beverage industry come in the form of

advertising. The first issue from advertising comes in the form of whether the advertisement is designed for people of drinking age or not. The second issue from advertising comes in the form of imagery and copy, the text used in the advertisement. The third issue from advertising comes from the impact of responsible drinking campaigns. Finally, the fourth issue comes from the way social status around healthy lifestyles

The first issue deals with advertisements aimed at people of drinking age. Often, these advertisements come into question as to whether or not they are actually aimed at underage consumers. Beer manufacturers claim that they put the warnings in place to discourage underage drinking. In a 1998 study, teens viewing print and television advertisements eye movements were tracked. The article compares Diet Coke and Miller Light viewing by teens and the length of time spent looking at the advertisement. The end result was that the teens spent more time looking at the Miller Light advertisement than the Diet Coke advertisement.

One conclusion stated, “About one third of those students did not look at the cautionary statement think when you drink” (Fox, Krugman, Fletcher, & Fisher, 1998, p. 67). From this study, one can argue that beer advertisements need to pay attention to the imagery that is used and the message context that is being sent.

The second issue in the social area comes in the form of visual imagery and wording used in advertisements. One recent billboard advertisement featured a popular Mexican beer with the slogan ‘Finally, A Cold Latina’, as you can imagine this advertisement caused an uproar in the Latina population. As a result, one can assume that the advertisement had damaged the image of the company in the consumers eyes (Martinez, 2007). It is clear that the industry executives that approved this advertisement had not taken the cultural issues surrounding stereo types into consideration.

The third issue from advertising is the push of responsible drinking campaigns. Over the years government groups, political groups, and social groups have increased pressure on

alcoholic beverage makers to include some form of warning in advertisements about responsible drinking. Then there are groups like Mothers against Drunk Driving who have started advertising using fear tactics about driving drunk. Some states have even started requiring the use of specialized equipment in cars for DUI offenders that measures the

blood/alcohol content and will keep the car from starting if the level is over the state mandated levels.

The fourth issue comes in the pressures to lead a healthy lifestyle. In response to the growth of the healthy lifestyle, the alcoholic beverage industry has started making various versions of low-fat, low-carb beer drinks; this trend can be seen in any local grocery or package store. As was discussed earlier, these fads may not be a good source to build a brand on and that the introduction of light beer was based on the change of the diet in the United States. Demographic

Demographic trends in the United States are shifting; nationalities, income levels, and age play a major factor in beer preferences. As more and more foreign born people come to call the United States home, breweries need to be prepared to alter the current offerings. Income levels will continue to rise (or fall); breweries need to be prepared to change marketing strategies on a moment’s notice and introduce premium beverages that appeal to people with higher incomes. With the aging population, breweries need to respond by catering to this market that has higher disposable income while keeping in mind the young professionals.

The first area of concern in demographics come from the shift in demographics in the United States; the

beer industry needs to pay attention to the product offering to ensure that they have “flavor profiles

that go with ethnic cuisine” (Mergers, acquisitions and changing demographics, 2007).

Table 5: Personal consumption of beer by race/ethnicity, May 2006-June 2007

Any Light Regular domestic Microbrew Ice

% % % % % Race/ethnicity: White 47 29 26 11 5 Black 38 17 24 3 11 Asians 34 17 25 6 4 Hispanics 46 25 22 5 7 Source: (Mintel/Simmons NCS, 2007)

Demographic trends in the United States are shifting toward a more diverse culture and with that shift beer consumption is shifting right along. Table 5, on the previous page, shows that in the area of regular domestic beer Hispanics and Asians make up almost 50% in the category that the big three breweries compete in heaviest. In the light beer category, Hispanics and Asians make up 42% of the population.

The second issue in demographics that a brewer needs to consider comes from income levels. In most industries, income plays a factor in marketing and innovation. As the economy worsens the beer industry needs to keep in mind they need to be able to shift marketing strategies based on lower incomes due to the shrinking wallet in the United States. More importantly, the beer industry needs to keep in mind that as income increases so do beer preferences. One article stated, “The primary drivers of trading up are growth in real income…and the

composition of income”

(Cioletti, 2006). The article then goes on to point out, as a result

of this trend companies in the alcoholic beverage industry have seen an increase in profits over the years (Cioletti, 2006). To further support this notion of increased income equals higher consumption of premium beer see Table 6 above. As is shown in the Microbrew category, as

Table 6: Personal consumption of beer by household income May 2006-June 2007

Any Light Regular domestic Microbrew Ice

% % % % % Income: Under $25K 34 17 20 4 8 $25K-49.9K 41 23 23 5 7 $50K-74.9K 46 28 24 10 6 $75K-99.9K 50 34 28 12 5 $100K+ 55 34 31 18 5 Source: (Mintel/Simmons NCS, 2007)

income increases from $25,000 to $100,000 or higher there is a shift of 14 percentage points in the consumption of microbrew. However, one can not discount the fact that in the light and regular categories there is also an increase but the increase is not as great.

The third issue in demographics that brewers need to consider comes from age. With the aging population in the United States, brewers need to keep in mind that consumer tastes may change as well. The “Baby Boomer” population has more disposable income when they retire than their parents had and with that comes more discretionary spending on luxury items like beer. As Table 7 below points out, at this time, age does not really play a major factor in beer consumption as do both demographics and income. However, breweries still need to plan for the shift. On the other hand, younger people are turning to microbrews so breweries need to plan accordingly to appeal to this segment of the market.

Table 7: Incidence of personal consumption of beer by age May 2006-June 2007

Any Light Regular domestic Microbrew Ice

% % % % % Age: 21-24 49 31 29 11 12 25-34 50 31 28 13 8 35-44 52 33 28 12 7 45-54 48 28 27 12 6 55-64 43 25 25 8 4 65+ 31 16 17 3 2 Source: (Mintel/Simmons NCS, 2007)

International

The first international issue that the brewing industry faces comes from mergers and acquisitions which have created massive changes. Miller and SAB, a South African brewery, merged into one company in 2002. Coors and Molson, a Canadian brewery, joined forces in 2005; more recently in 2008, SBAMiller and Molson Coors created a joint venture in the United States to better compete with Anheuser-Busch. InBev, the world’s largest brewery announced in June 2008 that they wanted to buy Anheuser-Busch. These mergers and acquisitions have done nothing to help the three breweries to compete with international beers; instead, it is creating a more concentrated market. In order to better compete in the industry, the big three (or now big two) need to think about purchasing international breweries to add to the product mix in the United States.

The second international area of concern for brewers comes from trade barriers. In 1993 a report was written that discusses the trade barriers between the United States and Canada. Domestic companies complained that because Canada had restrictions on beer imports that in order to compete domestically; the US Government needed to put tariffs on beer imported from Canada (Wickens & Lowther, 1993). Not only are trade barriers affecting the import market but also the export market. Many brewers are trying to grab a piece of the pie in India. An article about beer trends in India it states that beer consumption is one of the lowest in the world. According to the article, “Brewers must contend with a dizzying list of bureaucratic restrictions that make it tough and expensive to win customers and to build a national footprint. Steep tariffs render imports uncompetitive. And state excise taxes of as

much as 150% can push the price of a pint of domestic brew up to more than $3, or about triple what a shot of local whisky might cost” (Lakshman & Carter, 2007, p. 50). Brewers need to keep in mind these emerging markets and how profitable they may become as time goes on.

The third international issue that breweries need to consider comes from emerging markets. India is a very attractive market in most consumer goods; however, as was pointed out above, it ranks in the bottom of consumption for the world. Even though it ranks in the bottom, companies are setting up joint ventures with Indian companies to produce domestic beer internationally. Another up and coming emerging market is China where Craft Brews have already started to enter. Molson was the first beer importer to China according to one article (Mills, 1994). In order to compete, domestic brewers need to introduce their own craft brews and consider joint ventures to get their product to market.

Critical Industry Value Drivers

In the area of critical value drivers for the brewing industry there are a few things that the big three can do to incrementally increase their share of the market and a few things they can do to achieve larger growth. To incrementally increase the market companies can: develop substitute goods, develop or purchase craft brews, and purchase international beer breweries. To achieve larger (leap) growth the big three need to: use existing facilities to enter new

industries.

The first incremental increase comes in the form of substitute goods. These beverages would be alternative alcoholic beverages to compete head to head with pre-mixed cocktails

that are offered by manufacturers such as Bacardi. This form of entrance will capture the portion of the market that does not regularly consume beer.

The second incremental increase comes in the form of craft brews. The craft brew market is growing faster than domestic beer; therefore, the big three should either create their own blends or purchase regional or local craft breweries to help capture this portion of the market.

The final area of incremental increase comes in the form of international beer. With the shift in demographics and the fact that more Americans are trading up to imports the big three need to increase this area of their business. The increase in import beer would help the

companies capture shifts in demographics and also help to capture the portion of the beer market that turns to imported beer.

The area that firms need to tackle in the leap growth area comes in the form of diamond mining. Currently, the big three have access to business units that produce packaging,

recycling, and top of the line production processes. If the firms leveraged the packaging component they could enter into the package market and make bottles, cans, and boxes for other drink manufacturing companies. The firms could then leverage the aluminum recycling component to further expand the business. By benchmarking other recycling firms, the big three could help create a greener world and then promote this key fact. Furthermore, these companies could use their technology to expand into the soft drink, water, or juice industry.

Firm Analysis

Mission Statement

The Anheuser-Busch mission statement as quoted from the customer service department is (Lisa, 2008):

“Our Mission:

Be the world's beer company.

Enrich and entertain a global audience. Deliver superior returns to our shareholders.”

Upon reading the mission statement it is clear that Anheuser-Busch needs to

re-evaluate the mission of the company. A mission statement should include the definition of the business, statement of core values, and major goals and objectives (Hill & Jones, 2004). The statement above does not include core values or major goals and objectives. The definition of the company, “Be the world’s beer company” is weak and does not include who are the customers, what needs are being satisfied, and how the needs will be addressed; instead it is focused on the product of the company (Hill & Jones, 2004). The core values statement should include values, norms, and standards of which the firm was founded (Hill & Jones, 2004). The goals and objectives of the firm should focus on mid to long-term goals (Hill & Jones, 2004). Any organization not including these three components in the mission statement does not provide clear guidance to its stakeholders. Furthermore, the mission statement is a core part of the business and should be accessible on the company website and included in the annual report; Anheuser-Busch does neither of these, the mission statement had to be requested from the Customer Service Department through e-mail.

Value-Chain Analysis

Value-Chain analysis provides a unique look into the inner-operations of the company. We look at both Primary Activities of the company and Secondary Activities of the company. There are three types of outcomes in the value-chain analysis Distinctive Competencies, Strengths, and Weaknesses. Distinctive competencies are areas in which the company outperforms the competition. Strengths are areas in which the company performs well but does not outperform the competition; instead the company is in line with the industry norms. Weaknesses are areas in which the company is underperforming as compared to the

competition or areas where the company or industry does not perform. Analysis of Primary Activities

Inbound Logistics

As compared to the other competitors, inbound logistics is a distinctive competency for Anheuser-Busch. Anheuser-Busch owns and operates Manufacturers Railway Company which “operates a fleet of insulated beverage railcars and grain hopper cars” (Anheuser-Busch Business Units, 2007). Additionally, Anheuser-Busch also owns its own farms which “Produces and enhances the quality of raw materials for the company's beers” (Anheuser-Busch Business Units, 2007); located in Bonners Ferry, Idaho and Huell, Germany (Anheuser-Busch Business Units Major Operations, 2007). In addition to these two areas, Anheuser-Busch also has operations in grain elevators, mills, and seed. The competitors do not have these types of operations and has to outsource these areas.

Operations

As compared to the other competitors, operations are a strength for Anheuser-Busch. Anheuser-Busch “Produces more than 100 beers, flavored alcohol beverage and non-alcohol brews at 12 breweries in the United States and 15 around the world and imports other beers for distribution in the United States” (Anheuser-Busch Business Units Major Operations, 2007). Anheuser-Busch practices productivity programs to help cut operating costs. “In 2007, this included a new program to achieve additional operating cost efficiencies” (Anheuser-Busch 2007 Annual Report, 2007). In the brewing industry, all three of the major brewers are operating at or near the same area on experience curves and economies of scale; therefore these two areas do not provide a competitive advantage to Anheuser-Busch. When compared to the competition, this is an area that they all perform well in and it must be maintained in order to compete.

Outbound Logistics

As compared to other competitors, outbound logistics is a distinctive competency for Anheuser-Busch. Manufacturers Railway Company allows for delivery of beer to four breweries (Anheuser-Busch Business Units, 2007). Additionally, Anheuser-Busch owns and operates the St. Louis Refrigerated Car Company which “Manages rail/truck transload operation and other properties in St. Louis” (Anheuser-Busch Business Units, 2007). This unit of the business gives Busch strength in getting the product to the end consumer. Furthermore, Anheuser-Busch has a network of distributors where it “sells nearly 70 percent of the company’s volume through exclusive wholesalers” (Anheuser-Busch Business Units Major Operations, 2007).

Moreover, Anheuser-Busch “operates 13 company-owned distributors” (Anheuser-Busch Business Units Major Operations, 2007). The competitors do not have the outbound

transportation and has to outsource this operation to get the product to the end consumer. Further, the competitors have distribution networks in place but none are of the scale that Anheuser-Busch maintains.

Marketing and Sales

As compared to the competitors, marketing and sales is considered a strength for Anheuser-Busch. Anheuser-Busch is a market leader in advertising through innovation of ideas and campaigns. Promotion, channel selection, pricing, and product mix for Anheuser-Busch are industry norms.

Anheuser-Busch was the first brewery to utilize a themed advertising campaign in the 1880’s (Anheuser-Busch, 2008). Early on the founder realized that different consumers had different tastes and therefore created a family of brands each one geared to a different consumer. In 2008 Anheuser-Busch “celebrated its 10th consecutive USA TODAY ‘Ad Meter’ victory. The USA TODAY ‘Ad Meter’ is a real-time consumer poll that ranks Super Bowl ads throughout the game” (Anheuser-Busch, 2008). In addition to being a trend setter through advertising, Anheuser-Busch has decided that to increase its advertising spending this year in order to try and get consumers to switch after the merger of SABMiller and Molson Coors in the United States (Mullman, A-B primes marketing pump, looks to take advantage of turmoil in '08, 2008). It is clear that Anheuser-Busch is the leader and the rest of the brewery industry follows their lead in advertising.

Advertising is where the strength ends for Anheuser-Busch; promotion, channel selection, and pricing fall into line with the rest of the industry. All of the major competitors sponsor events and programming in order to ensure their product is seen by the masses. The channel selections for marketing that are typically used include event sponsorship, team

sponsorship, and magazine and internet advertising. Furthermore, pricing within the industry is relatively constant due to the high level of industry concentration. As a result, Anheuser-Busch is following the industry trends and needs to think outside the box to push the boundaries of promotion, channel selection, and pricing which would give them a distinctive competency in this area.

After Sales Service

In the brewing industry there is little to no after sales service; as a result this is a

weakness that Anheuser-Busch faces. The company could encourage consumers to visit the

internet site and register to become part of the “Anheuser-Busch family”. As part of this, the company could send out periodical surveys to gain input from consumers on product related issues.

Analysis of Secondary Activities Firm Infrastructure

As compared to the competitors, firm infrastructure is considered a strength for Anheuser-Busch.

Management Profile

The Board of Directors at Anheuser-Busch has a high level of experience in the brewing industry. From the Chairman of the Executive Committee, August A. Busch, III with 45 years of experience on the board to the newest member August A. Busch, IV with two years experience on the board. The entire board has a combined 202 years of experience on the board;

however, the company may want to consider rotating some of the members to gain new perspectives. The board has a good mix of outsiders to the company as compared to insiders, people who work for Anheuser-Busch. As for decision making, there are no records of

management performance therefore the analysis of the top management of the firm cannot be completed. To further complicate matters, there are no bio’s of the directors therefore one cannot asses the diversity of the board. As compared to the competition, Anheuser-Busch fails! SABMiller and Molson Coors both have Bio’s of the board and also how each board is operated. Anheuser-Busch could simply add the bio’s of the board and top management to the website. Planning

Anheuser-Busch does not plan well for the business and as a result, net income has slipped. The company underwent some changes in 2006 altering the scope of the business. As a result, net income has increased. One of these changes included getting into the craft beer

segment of the market. As was previously mentioned, craft beer grew at a rate of 14% in 2007. To answer this issue, Anheuser-Busch “developed its own specialty beers and forged

partnerships with several craft brewers” (Anheuser-Busch 2007 Annual Report, 2007). This area is one that Anheuser-Busch needs to pay attention to improve its firm infrastructure. Scanning

Anheuser-Busch dose scan the market well and as a result, however, competitors are at times able to introduce products that consumers want faster. In 2007 SABMiller introduced Miller Chill, a lime infused beer and in 2008 Anheuser-Busch introduced Bud Light Lime. Nevertheless, they continue to introduce new items to the market faster; for example, in 2007 Anheuser-Busch noticed that Hispanics put tomato juice in their beer so Anheuser-Busch introduced Budweiser and Bud Light that has tomato juice included (Anheuser-Busch 2007 Annual Report, 2007). This is another area that Anheuser-Busch needs to focus on to improve the firm infrastructure.

Culture

Anheuser-Busch culture is one of diversity and community. On the employment website it states, “When you become a part of our family, your input, ideas and insights are accepted and valued” (Busch Careers, 2008). The company also sponsors several different programs ranging from education of African Americans to Hispanic scholarships for college (Anheuser-Busch Community Diversity, 2007). The company also takes part in various other initiatives including Teach for America, Susan G. Komen Race for the Cure, Habitat for Humanity, and United Way just to name a few. Furthermore, Anheuser-Busch has several employee groups

supporting different groups of employees. In comparing them to the competition, they are similar with differing employee groups, program sponsorships, and initiatives.

Financial Analysis

Anheuser-Busch is a leader in the brewing industry from market share to product innovation. How do they stack up against the competitors based on financial results? Table 8 below shows several financial ratios and companies with the industry standard. The industry standard was calculated as a weighted average based on the market share for the top three competitors.

Table 8: Financial Ratios of the Top Three Brewers Compared to Industry in 2007

Ratio Industry Average Anheuser-Busch SABMiller Molson Coors Current Ratio 0.83046 0.87877 0.58984 1.02376 Debt Equity Ratio 1.98778 2.90021 0.18305 0.87538 Asset Turnover 0.93299 1.10689 0.64797 0.61849 Revenue Per Employee 0.56898 0.61554 0.27812 0.85770 Account Receivables Turnover 19.98504 20.72243 24.81148 8.16134 Return on Assets 0.09614 0.12331 0.05738 0.03696 Return on Equity 0.45898 0.67118 0.11447 0.06954 Return on Sales 0.12617 0.12760 0.15059 0.07705 P/E Ratio 14.17043 18.75986 0.19434 17.09000

Current Ratio measures the ability of a firm to pay off its debt in the short term using cash, inventory, and accounts receivables. A ratio of less than one implies that a company could not pay off its debt. Both SABMiller and Anheuser-Busch fall in this category, see Table 8 above. However, Anheuser-Busch is over the industry average and Molson Coors is over the average and would be able to pay off debt in the short term.