Property Tax Capitalization within a National Historic District versus Property Tax Capitalization outside that National Historic District: Another Application of the Tiebout Hypothesis

Full text

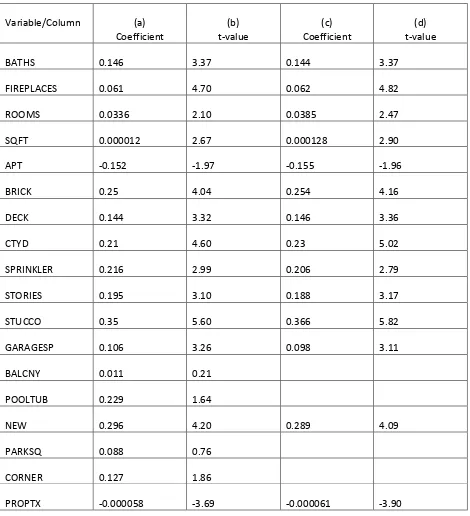

Figure

Related documents

• Authors careful to note that their analysis is at the prepaid debit card level as they cannot identify if a cardholder has more than one card in the data and nor do they

The divergence in conceptions about treaty derives from the contrasting worldviews of the British and Indigenous peoples, where land and the use of land are regarded in

The Board of Directors of the District hereby approves the CID Real Property Tax for 2019 (also referred to herein as the District's real property tax levy rate

Finally, if we partition the Spread ( pre ) data in Table 1 by bank monitoring status, we find that, for bank-monitored firms over days [ 45, 3] relative to the initial Section

A sports multiplier was developed by the authors to help determine the indirect benefits created by the construction of the stadium (Siegfried & Zimbalist, 2000) The multiplier

All Solos, Duets/Trios, Small Groups, Large Groups and Lines, in each age division are eligible for High Score Awards and will be presented with a special award for receiving

The VN partitioning heuristic accounts for the resource interdependence and the resulting price variation (i.e. the collateral cost of creating/removing inter-InP links when