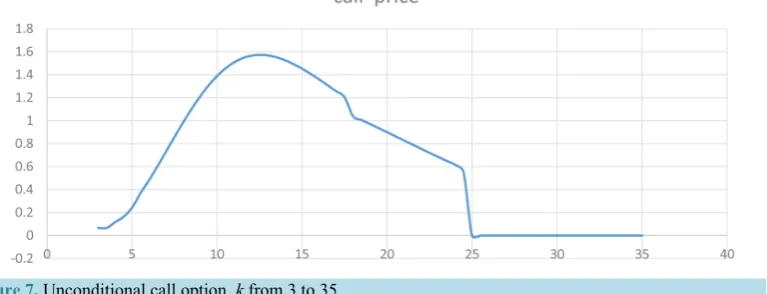

A Linear Regression Approach for Determining Explicit Expressions for Option Prices for Equity Option Pricing Models with Dependent Volatility and Return Processes

Full text

Figure

Related documents

Fourth, Racket comes with a library that supports the programmatic creation of lexers and parsers [34]. It is thus possible for a language implementation to transform

• If there are incomplete findings discovered during the Partial CAP monitoring, those findings are forwarded to BPS and the QMEU Statewide Coordinator even though the entire CAP

The capital projects estimated to be completed in 2014-2015 include West Evergreen Park, Del Monte Park (Phase I), Roberto Antonio Balermino Park, Steinbeck School Soccer

FANTUZZI Marco & TSAGALIS Christos (eds), The Greek Epic Cycle and its Ancient Reception: A Companion , Cambridge, Cambridge University Press,

2 A non-linear relationship with threshold effect between plasma HDL-C concentrations and EBB-induced bleeding risk in the smooth curve fitting after adjusting the potential

อาจารย์ประจําสาขาวิชาพยาบาลศาสตรบัณฑิต 1.1 อาจารย์ประจํากลุ่มวิชาการพยาบาลผู้ใหญ่และผู้สูงอายุ 1.2 อาจารย์ประจํากลุ่มวิชาการพยาบาลสุขภาพจิต

administrative/executive board member of pedagogical or teaching associations/ institutes, supervision of Master or MBA thesis, presentations with pedagogical content for

Procedures and methods of site investigations are described in Regulatory Guide 1.132, “Site Investigations for Foundations of Nuclear Power Plants.” Guidelines for laboratory