INTERNAL AND EXTERNAL FACTORS AFFECTING TAXPAYER COMPLIANCE OF TAX AMNESTY PARTICIPANTS

Full text

Figure

Related documents

– Penalty applies only if taxpayer fails to show a reasonable basis for the position taken on the tax return.. Taxpayer Penalties (slide 4 of 9) Taxpayer Penalties (slide 4

libraries a binary links to – this can also be used to detect a corrupted binary.. The following screenshot shows

“contest[ing] or support[ing] any other Person in contesting, in any proceeding (including any Insolvency or Liquidation Proceeding), the priority, validity, perfection

Where the change in the log of Subscribers, in each state during each semi-annual time period t, (Jan-Jun and July to Dec) is a function of a common and cross sectional fixed

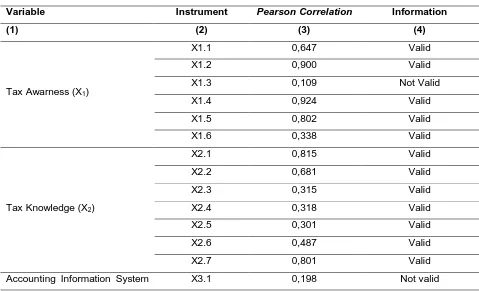

Knowledge taxation, self assessment system and tax awareness both simultaneously and partially significant effect on taxpayer compliance in Banda Aceh

To explore the perceptions of faculty and management of selected Pakistani business schools about the impact of Technological advancements on five dimensions of

They and other researchers (Arts Education Partnership, 2004; Baker, 2002; Catterall, 2002; Rand, 2004) call for future research in arts education to explore more deeply the nature

In this chapter I will discuss image and sound; structure and montage; movement and time; sensation and lived experience and narratives of space in filmic and architectural terms..