Research

Publication Date: 5 August 2009 ID Number: G00168694

© 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved. Reproduction and distribution of this publication in any form without prior written permission is forbidden. The information contained herein has been obtained from sources believed to be reliable. Gartner disclaims all warranties as to the accuracy, completeness or adequacy of such information. Although Gartner's research may discuss legal issues related to the information technology business, Gartner does not provide legal advice or services and its research should not be construed or used as such. Gartner shall have no liability for errors, omissions or inadequacies in the information contained herein or for interpretations thereof. The opinions expressed herein are subject to change without notice.

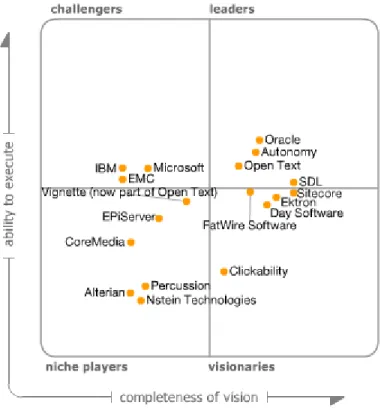

Magic Quadrant for Web Content Management

Mick MacComascaigh, Toby Bell, Mark R. GilbertOrganizations see Web content management as a pivotal solution component in driving new business value. Use this Magic Quadrant to understand the fresh vitality in the WCM market and how Gartner rates the leading vendors and their packaged products.

Publication Date: 5 August 2009/ID Number: G00168694 Page 2 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

WHAT YOU NEED TO KNOW

In 2008, we used a Gartner MarketScope to describe the competitive landscape for providers of Web content management (WCM) solutions. In the past year, the market has experienced dynamic, evolutionary trends that once again warrant its coverage in a Gartner Magic Quadrant. The market is changing, and the criteria for selecting and ranking vendors continue to evolve. Our assessments take into account the vendors' current product offerings and overall strategies, as well as their future initiatives and product road maps. We also factor in how well vendors are driving market changes, or at least adapting to changing market requirements.

In more than 80% of inquiries Gartner received about WCM in the past year, the focus was on efforts to derive higher business value from an existing or planned Web presence. Some companies upgrade an incumbent WCM offering. However, Gartner is observing that many organizations are choosing to replace their existing technology and invest in this market to gain higher returns from the Web channel. In some cases, this replacement is necessary to allow interoperability with other components of their Web solution, such as Web analytics or an e-commerce engine.

This Magic Quadrant will help CIOs, and business and IT leaders that are analyzing their Web strategies to assess whether they have the right WCM offering to support them. Because the technology has changed so much in recent years, we strongly advise organizations that have WCM technology that is more than four years old to re-evaluate their WCM strategies. Use this Magic Quadrant to understand the WCM market and how Gartner rates the leading vendors and their packaged products. Draw on this research to evaluate vendors based on a customized set of objective criteria. Gartner advises organizations against simply selecting vendors that appear in the Leaders quadrant. All selections should be buyer-specific, and vendors from the

Challengers, Niche Players or Visionaries quadrants could be better matches for your business goals and solution requirements.

Publication Date: 5 August 2009/ID Number: G00168694 Page 3 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

MAGIC QUADRANT

Figure 1. Magic Quadrant for Web Content Management

Source: Gartner (August 2009)

Market Overview

The WCM market has some fascinating properties that have contributed to its vibrancy and dynamism in the past year. The role of WCM as a potential driver of greater strategic initiatives has resonated strongly in the market, and is one of the factors that led to Autonomy's acquisition of Interwoven in March 2009 and Open Text's acquisition of Vignette in July 2009. It is because the market is so dynamic — the Vignette acquisition occurred during the production of this Magic Quadrant — that we have treated Vignette and Open Text as separate entities in this analysis. We believe this reflects how the market is likely to view these vendors in the coming months. The market's dynamism is likely to continue to drive its growth and evolution, and Gartner also expects acquisition-related interest from vendors in adjacent markets where WCM would provide a complementary solution component.

However, this is only part of the picture. Gartner considers WCM to be a subset of the enterprise content management (ECM) market, which had a value of nearly $3.3 billion in 2008 (see "Market Trends: Enterprise Content Management, Worldwide, 2007-2012"). With a value of more than $860 million in worldwide total software revenue in the same period, WCM represents one of the fastest-growing areas of ECM and now accounts for more than 25% of the ECM software market. WCM offers synergies with other ECM components, such as digital asset management (DAM), content-centric collaboration, records management and document management (DM).

Publication Date: 5 August 2009/ID Number: G00168694 Page 4 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

WCM is also likely to be part of organizations' longer-term enterprise information management (EIM) initiatives. WCM goes beyond the literal management of Web content and offers tools that allow a company to manage and make money from its Web presence, especially in areas such as building a customer-centric Web strategy, marketing, e-commerce and the media. Typically, organizations augment such tools with capabilities including multivariate testing, search engine optimization, ad-insertion, search and recommendation technology to help achieve the desired results from the overall Web presence. The potential value of such capabilities has led to the inclusion of chief marketing officers (CMOs) as a strong buying influence, as the investment in Web channel technology becomes directly linked to marketing communications and returns in areas such as improved customer loyalty, better lead generation and more effective campaign targeting through their Web presence.

Market Drivers

The economic climate in 2009 is forcing businesses to make difficult choices in terms of staff reduction and cutbacks. Yet there exists a competing pressure to succeed and be ready for growth as soon as a turnaround occurs. WCM offers a solution to this conundrum. More user-friendly WCM offerings are allowing some internal departments to author and edit some of, or all, the content they need for their competitive marketing efforts.

The WCM market continues to provide attractive opportunities to consolidate or rationalize certain components of the WCM approach. The maturity of some WCM offerings means it may now be feasible to consolidate the number of solutions and find a single vendor to address fundamental WCM needs.

Web 2.0 is also breathing new life into the WCM market, as new ideas spawn regarding how to "monetize" all aspects of these developments, including those of a cultural, technological and platform nature. In addition, organizations that were once satisfied with homegrown, custom-made systems are now acutely aware of the risk that they might miss out on opportunities if they don't act now. Their actions are leading to an influx of revenue into commercial software that is more adept at leveraging Web 2.0 capabilities.

Market Inhibitors

Although the current economic climate is providing the impetus for change in some scenarios, it is also making decision makers increasingly cautious. Gartner has noticed an increased

requirement for thorough business cases with strong, well-supported return on investment (ROI) arguments. This will prevent any spikes in expenditure, but could help sustain the growth of the WCM market in the coming couple of years as organizations realize and communicate internally the more tangible benefits of WCM solutions.

With a multitude of vendors claiming that they offer WCM, it is sometimes difficult to separate an offering that can support an organization's WCM strategy from one that offers only the more commoditized, basic functions of the overall WCM capability set. This confusion concerning the breadth and relevance of available software is slowing the uptake of the latest wave of WCM offerings.

Key Trends in the Market

The main trends shaping the WCM market are:

• Enhanced usability for nontechnical target audiences: It is now the norm that the interface for internal contributors must be easy to use. More and more capabilities are becoming easier to access and use, including a vast array of modular functionalities that can be turned on or off as required.

Publication Date: 5 August 2009/ID Number: G00168694 Page 5 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

• Increased popularity and traction for open-source offerings: This is manifesting itself in a number of ways, from the growing popularity of open-source projects to the inclusion of open-source concepts and features in commercial offerings. Many vendors adopting a community-based approach to support and development claim to provide some of the benefits of open source while maintaining their core, commercial strategy. Open source still accounts for less than 4% of the revenue by which Gartner defines the size of the WCM market. This percentage is growing slowly, based on the inherent licensing models used for the offerings. This year, no vendors offering open-source software (OSS) have reached the revenue threshold for inclusion in our formal analysis. Gartner will, therefore, publish separate research to address OSS and WCM.

• Greater interest in software-as-a-service (SaaS) offerings: As budgets become tighter and capital expenditure endures greater scrutiny, some organizations are turning to SaaS as a delivery model and finding other key differentiating benefits, such as greater control over the desired outcome, ease of functionality updates, elasticity of use, shorter times to solution and measurably higher ROI over shorter periods of time.

• Growing importance ofdynamic contextualized delivery: The idea of an "intelligent Web presence" that allows targeted content to be served to visitors is slowly gaining credible traction in the market. Arguments about enhanced effectiveness of delivery grounded in results-oriented and measurably successful Web solutions will drive the next wave of competition in the WCM market. In this area, organizations will need to seek synergies with adjacent technologies, such as recommendation and Web analytics. Boundaries with these technologies and their respective markets will blur, as some of the WCM vendors begin to provide some of these capabilities in their own offerings.

Market Definition/Description

Gartner defines WCM as the process of controlling the content of a website through the use of specific management tools based on a core repository. These tools may be commercial products, open-source tools or hosted service offerings. Product functionality goes beyond simply

managing HTML pages to include:

• Content creation functions, such as templating, workflow and change management.

• WCM repositories that contain content or metadata about the content.

• Library services, such as check-in/check-out, version control and security.

• Content deployment functions that deliver prepackaged or on-demand content to Web servers.

We exclude products such as portals and e-commerce engines. There are overlapping

requirements with these technologies in areas such as personalization, content management and content delivery. But such products fundamentally comprise complementary technologies, so we consider the standards, strategies and respective vendors to occupy separate markets. See "Magic Quadrant for Horizontal Portal Products" and "Magic Quadrant for E-Commerce" for more detail.

Inclusion and Exclusion Criteria

WCM vendors need to meet all the following inclusion criteria to qualify for the formal analysis in this Magic Quadrant:

Publication Date: 5 August 2009/ID Number: G00168694 Page 6 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

• Revenue: WCM total software revenue (including new licenses, updates, maintenance and/or subscriptions, SaaS, hosting and technical support) for 2008 must exceed $8 million. The software must be available as a stand-alone product or offering.

• References: The WCM software must be commercially available and the vendor must have active references that use the software in production scenarios. Some of these references should be of enterprise scale, with the number of contributing authors exceeding 50 and the average monthly number of page views comfortably exceeding 500,000. (We gave a higher rating to deployments supporting larger numbers of users.)

• Vendor presence and geographic reach: The vendor must have been in business for more than five years, with a multigeographic presence for at least a year and a strategy that supports further geographic expansion. It must actively market its WCM offering in at least two major regions, such as North America and Europe, the Middle East and Africa (EMEA).

• Required functionality: At a minimum, the vendor must offer:

• A content repository with basic library services, such as check-in/check-out and versioning.

• Authentication of users (that is, authors, editors and reviewers), with the ability to delegate and assign permissions.

• Content authoring, through browser-based templates or via conversion from a word processing application.

• Workflow sufficient to support content review and approval.

• Conversion of content to (Extensible) HTML or XML and support of templates for Web rendering.

• Managed deployment and delivery of content to Web servers or site management systems.

• Capabilities for multisite and multilanguage management.

• Web analytics and reporting capabilities.

• Design capabilities accessible to nontechnical users.

There are many WCM vendors but most do not meet the above criteria. Some vendors provide a range of functionality, but have limited geographical reach or support only narrow, departmental implementations. Some meet all the functional, deployment and geographic requirements but not the revenue cutoff for the current analysis. Others are newer entrants beginning to gain visibility in the market but lack a significant customer base. The following lists some of the vendors Gartner clients might consider alongside those appearing in the Magic Quadrant when

deployment needs align with their specific capabilities. The list is not exhaustive; it comprises a sample of some of the vendors that have met at least a subset of the inclusion criteria.

Acquia, Andover, Massachusetts, U.S. (www.acquia.com ). A commercial OSS company that provides products, services and technical support for the open-source Drupal social publishing system.

Adobe, San Jose, California, U.S. (www.adobe.com ). Its Contribute product is a popular offering and has server-based functionality that provides Web authoring, staging and deployment

Publication Date: 5 August 2009/ID Number: G00168694 Page 7 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

management, as well as Really Simple Syndication (RSS) notification services and business activity logs. But these functions do not surround a core WCM repository.

Alfresco, Maidenhead, U.K. (www.alfresco.com ). This open-source provider of ECM software has benefited from the increased interest in OSS in the past year and is likely to be one of the first such providers to meet all inclusion criteria in the medium term.

Alkacon Software, Cologne, Germany (www.alkacon.com ). Provides its customers with support, training and consulting services for OpenCms.

Atex, Reading, U.K. (www.atex.com ). Through its 2008 acquisition of Swedish-based Polopoly, Atex offers an integrated WCM and advertising platform for print and online media, higher education, retail, public and corporate customers.

Bridgeline Software, Woburn, Massachusetts, U.S. (www.bridgelinesw.com ). Provides SaaS-based WCM capabilities through its flagship iAPPS framework and product suite, in addition to marketing, Web analytics and e-commerce functionality.

CrownPeak, Los Angeles, California, U.S. (www.crownpeak.com ). As a reliable and acceptable route for websites with modest requirements, this SaaS vendor is poised to benefit from the growing interest in SaaS and its increasing adoption in the WCM market.

DotNetNuke, San Mateo, California, U.S. (www.dotnetnuke.com ). Offers a framework for building websites and Web applications on Microsoft ASP.NET. DotNetNuke provides this framework in both "Community" and "Professional" editions.

Dynamicweb Software, Aarhus, Denmark (www.dynamicweb-cms.com ). This vendor markets products that focus on WCM and e-commerce, and focuses largely on the small or midsize business (SMB) market in northern Europe.

Escenic, Oslo, Norway (www.escenic.com ). Primarily known for its Escenic Content Engine, it provides strategic content management software primarily for digital media publishing.

eZ Systems, Skien, Norway (http://ez.no ). Offers an OSS content management system (CMS) that is available as a free download or as an enterprise solution with support, guarantees and maintenance.

Hannon Hill, Atlanta, Georgia, U.S. (www.hannonhill.com ). Provides WCM solutions for organizations in sectors such as higher education, government and technology based on Cascade Server, its primary software solution.

Ingeniux, Seattle, Washington, U.S. (www.ingeniux.com ). Provides a CMS platform for managing websites, online media and team collaboration.

Jahia, Geneva, Switzerland (www.jahia.org ). A proven, community-driven and sustainable OSS development model delivering Web content integration software by combining enterprise WCM with document and portal management features.

Joomla, New York, New York, U.S. (www.joomla.org ). This is an OSS CMS for building websites, in addition to enterprise-class online applications.

Lyris Hot Banana, Emeryville, California, U.S. (www.hotbanana.com ). Offers SaaS or licensed (ColdFusion CMS) WCM products that focus on the convergence of WCM, website optimization and marketing automation.

Publication Date: 5 August 2009/ID Number: G00168694 Page 8 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Magnolia, Basel, Switzerland (www.magnolia-cms.com ). Provides an open-source CMS. Magnolia powers digital communication for customers from governments to leading Fortune 500 enterprises in more than 100 countries.

PaperThin, Quincy, Massachusetts, U.S. (www.paperthin.com ). Primarily targets the midmarket with its flagship product CommonSpot, based on ColdFusion.

SAP, Walldorf, Germany (www.sap.com ). Provides WCM capabilities as part of its NetWeaver offering, but Gartner does not see these capabilities being sold as a stand-alone offering.

Squiz, Leichhardt, Australia (www.squiz.net ). Provides its OSS MySource Matrix as a supported version complete with service-level agreement or as a free version under General Public License (GPL).

Systems Alliance, Sparks, Maryland, U.S. (www.systemsalliance.com ). Focuses primarily on SMBs with its flagship product SiteExecutive, currently in its fourth major release.

Terminalfour, Dublin, Republic of Ireland (www.terminalfour.com ). This vendor has been operational since 2001 and has gathered notable references with its Site Manager product in the government and higher education sectors.

TYPO3 Association, Baar, Switzerland (http://association.typo3.org ). Provides an offering based on PHP. Its client base is predominantly in Europe.

Vyre, London, U.K. (www.vyre.com ). Offers Unify, a content management platform based on Java Platform, Enterprise Edition (Java EE), now in its fourth major release.

Gartner will continue to monitor the status of these and other vendors for possible inclusion in future updates of the Magic Quadrant for WCM.

Evaluation Criteria

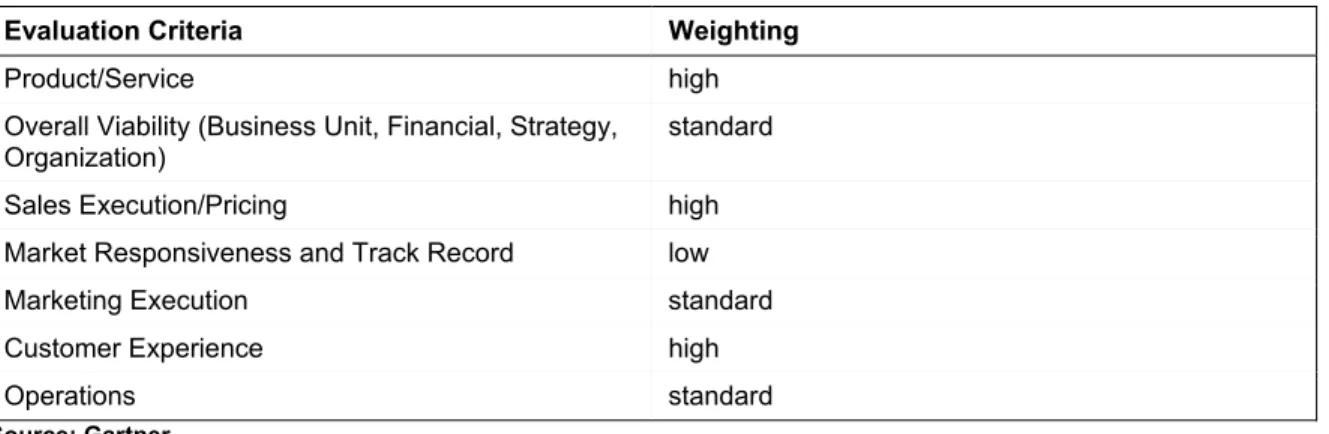

Ability to Execute

Ability to Execute measures how well a vendor sells and supports its WCM products and services on a global basis. In addition to rating product capabilities, we evaluated each vendor's viability, installed base, pricing, customer support and satisfaction, and product migrations from one major release to another. The following list provides more details on the specific evaluation criteria we used to assess Ability to Execute in this document, together with weightings for these criteria in accordance with the current market.

Product/service evaluates product function in areas such as capabilities for multisite and multilanguage management, Web analytics and reporting capabilities, design capabilities, and content modeling and metadata management.

Overall viability includes an assessment of the organization's financial health, the financial and practical success of the company overall, and the likelihood of the business unit to continue to invest in the product.

Sales execution/pricing evaluates the technology provider's success in the WCM market and its capabilities in presales activities. This includes WCM revenue and the installed base, pricing, presales support and the overall effectiveness of the sales channel. The level of interest from Gartner clients is also considered.

Market responsiveness and track record evaluates how well the WCM offering matches buyers' solution and functional requirements at acquisition time. We assess the vendor's track

Publication Date: 5 August 2009/ID Number: G00168694 Page 9 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

record in delivering new functions when the market needs them. We also consider how the vendor differentiates its offerings from those of its major competitors.

Marketing execution evaluates the clarity, quality, creativity and efficacy of the vendor's efforts to market its WCM offerings. We examine aspects such as thought leadership, word of mouth and sales activities.

Customer experience is an evaluation of product function or service within production

environments. The evaluation includes ease of deployment, operation, administration, stability, scalability and vendor support capabilities. We assess this criterion via qualitative interviews with vendor-provided reference customers. We also use feedback from Gartner clients and other sources that are using, or have completed competitive evaluations of, the WCM offering.

Operations is an evaluation of the organization's service, support and sales capabilities.

Table 1. Ability to Execute Evaluation Criteria

Evaluation Criteria Weighting

Product/Service high Overall Viability (Business Unit, Financial, Strategy,

Organization)

standard Sales Execution/Pricing high Market Responsiveness and Track Record low Marketing Execution standard Customer Experience high

Operations standard

Source: Gartner

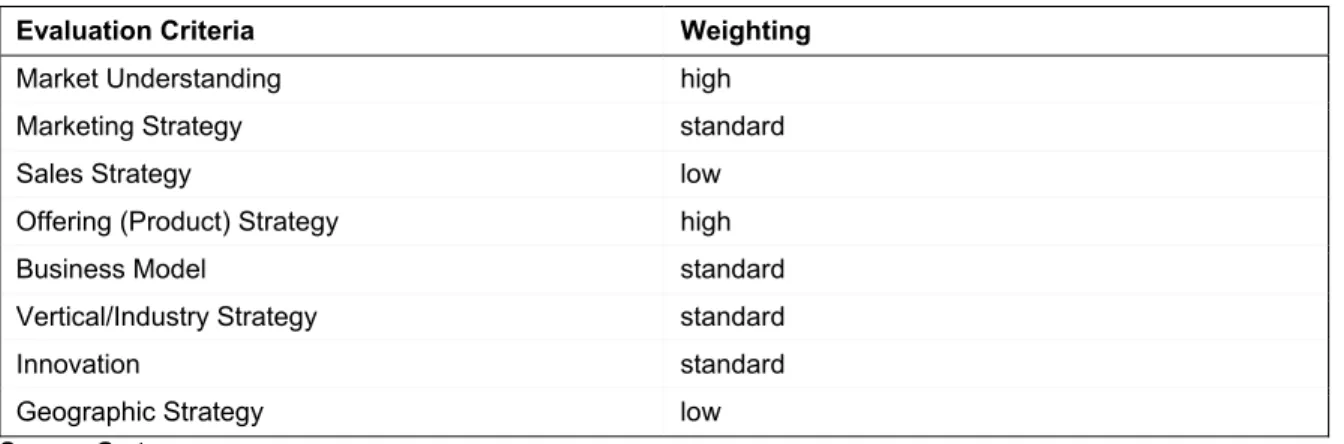

Completeness of Vision

Completeness of Vision focuses on the vendor's potential and points to its future likelihood of success. A vendor can succeed financially in the short term, but won't become a Leader without a clearly defined vision or strategic plan. A vendor with average vision will anticipate and respond to change by accurately perceiving market trends and exploiting technology. A vendor with superior vision can anticipate, direct and initiate market trends, particularly if it integrates its vision into a broad range of areas, and capitalizes on product and service development. The following list provides details of the specific evaluation criteria we used to assess Completeness of Vision in this document, together with weightings for each criterion in accordance with the current market.

Market understanding evaluates the ability of the vendor to understand buyers' needs and translate those needs into WCM solutions (vertical and horizontal), products and services. Vendors that show the highest degree of vision listen and understand buyers' wants and needs, and can shape or enhance those wants with their added vision. WCM vendors that show the highest degree of market understanding are adapting to customer solution requirements in areas such as SaaS, dynamic contextualized delivery and ease of use for nontechnical staff.

Marketing strategy evaluates the extent to which the vendor maintains and articulates a clear, differentiated set of messages, consistently communicated throughout the organization and externalized through the website, advertising, customer programs and positioning statements, as well as statements of direction and product road map.

Publication Date: 5 August 2009/ID Number: G00168694 Page 10 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Sales strategy evaluates the vendor's use of direct and indirect sales, marketing, service and communications affiliates to extend the scope and depth of market reach.

Offering (product) strategy is the vendor's approach to product development and delivery that emphasizes functionality and feature set as they map to current requirements for WCM. We also evaluate development plans for the next 12 to 18 months.

Business model evaluates the soundness and logic of the vendor's underlying business

proposition and whether this offers synergies with other ECM components, such as DAM, records management and DM.

Vertical/industry strategy evaluates how the WCM vendor uses its direct resources, skills and offerings — for example, SaaS — to meet the specific needs of individual market segments, such as the media industry.

Innovation evaluates the vendor's development and delivery of differentiated WCM technology that uniquely solves critical customer requirements. We evaluate product capabilities and

customer use in areas such as templating, workflow and change management, WCM repositories and library services. We also look at other capabilities that are product-specific, and that are needed and deployed by customers.

Geographic strategy evaluates how the vendor meets the specific needs of geographic regions outside its home territory. We look at the vendor's partners, channels and subsidiaries and assess whether they are appropriate for those regions.

Table 2. Completeness of Vision Evaluation Criteria Evaluation Criteria Weighting

Market Understanding high Marketing Strategy standard

Sales Strategy low

Offering (Product) Strategy high Business Model standard

Vertical/Industry Strategy standard

Innovation standard Geographic Strategy low

Source: Gartner

Leaders

Leaders can, and should, drive market transformation. Leaders have the highest combined scores for Ability to Execute and Completeness of Vision. They are doing well and are prepared for the future with a clearly articulated vision. In the context of content management, they have strong channel partners, a presence in multiple regions, consistent financial performance, broad platform support and good customer support. In addition, they dominate in one or more

technologies or vertical markets. Leaders are "environmentally aware" of the solution "ecosystem" into which their own offerings need to fit. Leaders can: demonstrate enterprise deployments; offer integration with other business applications and content repositories; incorporate Web 2.0 and XML capabilities; and provide a vertical-process or horizontal-solution focus.

Publication Date: 5 August 2009/ID Number: G00168694 Page 11 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Challengers

Challengers are very solid vendors today and can perform well for many enterprises. The important question is: "Do they have the vision to succeed tomorrow?" A Challenger may have a very strong WCM product, but may demonstrate a weaker understanding of market trends, such as the increasing importance of contextualized delivery personalization, multichannel output or the need to have a solution focus.

Visionaries

Visionaries are very forward-thinking and technically focused. For example, their products may have unique multilingual capabilities or be driving the inherent direction of the market through their innovation and product development. To become Leaders, they need to work on some of the core aspects of their offerings and increase their Ability to Execute. They may need to build financial strength, functional breadth, service and support, geographical coverage or sales and distribution channels. Their evolution may hinge on the acceptance of a new technology, or on the development of partnerships that complement their strengths.

Niche Players

Niche Players focus on a particular segment of the client base, as defined by characteristics such as size and vertical and project complexity. This narrow focus can affect their ability to outperform or be more innovative. Niche Players typically concentrate on particular market segments and often support only those applications that apply to those targeted segments.

Vendor Strengths and Cautions

Alterian

Originally a provider of marketing resource management and enterprise marketing management software, Alterian purchased Mediasurface in July 2008.

Strengths

• Alterian has a high potential to leverage its portfolio of marketing and WCM products in a market in which the combination of these capabilities is increasingly the focus for new initiatives. Alterian has already made strides toward achieving an "integrated marketing platform," which is likely to compete well. Success in this area requires good access to the CMO and it should, in many cases, already have this relationship in place.

• Alterian Content Management is the new branding for the popular Morello product acquired with Mediasurface. This product remains a top-class WCM product and its impressive application of Ajax in its Web client lends itself to easy adoption by business users. Alterian has divested the Pepperio product and made steps toward achieving a more consistent technology platform for WCM.

Cautions

• Client conversations with Gartner suggest the lack of a clear, well-communicated road map for how the respective components of Alterian's diverse portfolio can interact synergistically. This uncertainty is compromising the first-mover advantage Alterian gained through its acquisition of Mediasurface.

• Alterian needs to expand its presence in North America to compete more successfully against other European vendors that are gaining market share rapidly in that region.

Publication Date: 5 August 2009/ID Number: G00168694 Page 12 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Autonomy

Autonomy acquired Interwoven in March 2009. Autonomy's Interwoven WCM offering offers support for dynamic and compelling websites and the ability to deliver highly targeted content.

Strengths

• Autonomy Interwoven is addressing the needs of marketers with capabilities in website optimization, targeting and segmentation, and dynamic delivery of targeted, highly personalized content. The set of products available to Autonomy through its acquisition of Interwoven has been leading the WCM market in recent years.

• Autonomy has invested heavily in marketing and was quick to announce the integration of Intelligent Data Operating Layer (IDOL) with TeamSite following the acquisition. If it executes on its vision, the value for prospects could be very high.

Cautions

• Initial reports to Gartner suggest that the lack of a detailed road map following the acquisition is causing concern among users of TeamSite. Gartner has observed an increase in inquiries and questions from customers. Although most of Interwoven's revenue came from WCM, Autonomy is likely to target gains in other markets, such as e-discovery and governance, risk and compliance (GRC), in the short and medium term.

• The acquisition may put Autonomy under pressure to show "quick wins" to investors and delay important efforts of a less visible nature, such as a thorough examination of the underlying code base for the acquired software to identify potential for deeper integrations with its own products.

Clickability

Founded in 1999, Clickability provides a Java offering based on open-source components. Clickability is a pure SaaS WCM vendor.

Strengths

• Clickability has been able to push the perceived boundaries of SaaS WCM by being the foundation of some complex, enterprise-class sites in areas such as media, technology, manufacturing and financial services. Its platform is the strongest SaaS offering in terms of vision, marketing effectiveness and enterprise capability. The addition of another data center sufficiently different geographically from its headquarters in California allows it to promote the quality and reliability of its disaster recovery capabilities. This argument adds to more traditional advantages associated with SaaS, such as the pricing model and elasticity of use.

• A combination of results-oriented marketing messages and a growing customer base is helping to solidify its reputation in the market as a strong alternative to on-premises WCM software.

Cautions

• Despite some international success in addition to success in its U.S. home market, it needs to aggressively leverage the inherent model of SaaS to extend its geographic reach faster than the pace typically achievable with on-premises software. As it is increasing its focus on enterprise prospects, this currently poses difficulties in terms of its ability to execute in other regions, such as EMEA.

Publication Date: 5 August 2009/ID Number: G00168694 Page 13 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

• Enterprise trust in smaller SaaS vendors remains largely untested. Despite presence in some verticals, solutions definition and delivery remain unproven. Open-source

components can be risky if code forks or new development distracts the community.

CoreMedia

With its headquarters in Hamburg, Germany, CoreMedia originally focused on the media sector. However, with additional offices now in Singapore, Chicago and London, it has extended its reach, both regionally and in terms of the verticals for which it can provide solutions.

Strengths

• CoreMedia has a solid reputation and proven ability to execute in its traditional "sweet spot" in the media and entertainment sectors.

• Its regional presence is strong. Even in broader Western European markets, CoreMedia has a presence and a reputation for good engineering.

Cautions

• CoreMedia has customers in different regions, but needs to develop its organization in North America more strongly and aggressively.

• As with many engineering-focused developers, its marketing and promotion currently lag behind its technical proficiency. But recent changes in management appear to signal an intent to focus more on marketing and global expansion.

Day Software

Day Software was founded in Switzerland in 1993. Its flagship Communiqué offering, which is based on Java EE, is now in its fifth major release.

Strengths

• Day Software has a good, forward-looking management team with a healthy focus on standards, technology vision and an ability to leverage the OSS culture through its support of Apache Jackrabbit, an open-source Content Repository for Java Technology Application Programming Interface (JCR) based on the JSR 170/283 standard.

• The release of Communiqué 5 in late 2008 has allowed it to address the high usability requirements demanded by the market, such as full in-context editing, ease of page design for nontechnical users and the incorporation of rich Internet application components such as Ajax into the interface to enhance the user experience.

Cautions

• Day's financial reports for 2008 were mixed, with one-off organizational and accounting measures requiring some write-offs and affecting profitability. But Day's performance in 1H09 suggests that remedial measures already taken may be leading to stronger growth and improved profitability. Prospects should examine Day's midyear report closely to ensure key milestones in maintaining and building on this progress are being

comfortably met.

• Day's relationships with other technology and services partners, such as IBM and HP, may dwindle, as competition and cross-promotion force it into competition rather than "co-opetition."

Publication Date: 5 August 2009/ID Number: G00168694 Page 14 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Ektron

Ektron was founded in 1998 and its flagship product, CMS400.NET, is currently in its seventh major release.

Strengths

• Ektron has made great strides in extending its "SMB" reputation to include some enterprise capabilities and larger customers in its portfolio. It has made good, solid efforts to expand its WCM offering to a level where it is being considered more often for enterprise-class deployments, while still offering it at a price that is reasonable for the current market.

• Ektron bases its offering on .NET and provides good integration with Microsoft Office SharePoint Server 2007 (SharePoint). In addition, CMS400.NET is well-known for its intuitive user interface and consequent ease of use. The company's eWebEditPro is a popular OEM inclusion in WCM offerings from several other vendors featured in this Magic Quadrant.

Cautions

• Ektron's growth into the enterprise segment is still a work in progress, including recent investments in building its own professional services division. Any organization considering Ektron for a large enterprisewide deployment should, therefore, seek references from Ektron, or one of its partners, that prove Ektron can deliver on a project similar in scope to the planned WCM initiative.

• Ektron's offering may be perceived as only marginally better than SharePoint itself, despite the benefits of international language and synchronization support. Web

analytics and a broader marketing focus on Web-channel technologies might leave .NET WCM vendors at risk from both the more scalable platforms, as well as portals.

EMC

EMC introduced WCM capabilities to its portfolio through its acquisition of Documentum in 2003. Traditionally having only a modest offering, EMC has managed to improve its product's

capabilities with the release of EMC Documentum ECM 6.5.

Strengths

• EMC has greatly improved its WCM offering from the 5x version by enhancing its core capabilities and through the intelligent inclusion of technology acquired from X-Hive, an XML database and dynamic delivery environment, and from Document Sciences to enhance its content delivery functionality. Version 6.5 represents a marked improvement over earlier versions, particularly in the areas of usability and page design.

• The WCM offering has good, solid integrations with other components of its ECM suite. This is particularly attractive for those considering WCM as a solution component in the broader ECM context that may include DAM or records management of Web content.

Cautions

• EMC's clarity of message and overall strategy needs to be improved. Though

considered by Gartner to be a Leader in the broader ECM market, EMC still needs to leverage this experience to help guide and shape the direction of WCM. Gartner rarely sees EMC's WCM offering being bought independently of other components in its ECM

Publication Date: 5 August 2009/ID Number: G00168694 Page 15 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

portfolio. The superior quality of some of the best-of-breed competitors typically excludes EMC from shortlists, except where there is a strong emphasis on extended content infrastructure.

• Users need to assess and clarify upgrade paths carefully before embarking on a switch to v.6.5. The additional functionality and expanded solution scope of the latest version require this extra analysis upfront.

EPiServer

Swedish company EPiServer was founded in 1994. Its flagship CMS offering has been on the market for 10 years and is in its fifth major release.

Strengths

• EPiServer has proven very agile and has made intelligent advances with its WCM offering in the past 12 months. The base product is well-architected with modules that cater for collaboration, community and real-time analytics via the impressive EPiTrace. CMS is an attractive platform for current and prospective partners on which to build solutions, and Gartner has observed a continuing and healthy growth of this partner ecosystem in the past year.

• In the current economic climate, the lower investment required for a deployment will be attractive, especially in the midmarket.

Cautions

• Though having sufficient multigeographical success to qualify for inclusion in this Magic Quadrant, EPiServer is only beginning to expand its presence outside Europe, where more than 90% of its revenue originates. This is likely to inhibit its ability to serve and execute with larger, enterprise-class deployments in the short to medium term.

• EPiServer's North American marketing arm is constrained by stiff competition, low brand recognition and a reliance on the partner channel.

FatWire Software

FatWire Software has evolved from selling "yet another" Java-based WCM publishing platform technology to reinvigorating its solution focus, especially in the area of marketing and financial services.

Strengths

• With its flagship product, Content Server 7.5, FatWire has been energetically establishing the basis for a solid WCM marketing solution with some success.

• FatWire's focus on collaboration, analytics and content integration matches market demand for social media, richer experience management and more available information.

Cautions

• FatWire has been a fast follower in terms of its marketing strategy, but its technical ability to interoperate smoothly with adjacent technology lags behind the market — costly customizations are a likely requirement to address this deficit.

Publication Date: 5 August 2009/ID Number: G00168694 Page 16 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

• FatWire has fluctuations in performance and visibility in the market and faces stiff competition from other WCM and portal vendors.

IBM

IBM Lotus WCM (LWCM) is IBM's selected WCM solution for all new customers and is currently available in version 6.1.

Strengths

• LWCM is a robust, scalable and enterprise-class product likely to be shortlisted by organizations that already have a significant investment in IBM WebSphere Portal. This will help the growth of LWCM sales to be at least in line with development in the overall WCM market in the next two to three years.

• IBM has a strong vertical focus. This presents it with the potential to produce applications and solutions of specific interest to those verticals.

Cautions

• Gartner has observed an increasing reliance on IBM WebSphere Portal to gain traction for its WCM offering. This development is consistent with Gartner's belief that such linking is core to IBM's fundamental strategy. Therefore, companies not using the IBM portal offering may find the value proposition of IBM's WCM offering not as compelling.

• Feedback to Gartner from some IBM customers shows that LWCM still lags behind other WCM offerings in the market in terms of vision, overall ease of use and deployment. IBM's vision and strategy are focused on a portal-centric view of WCM, together with the provision of capabilities to enable an improvement of the overall Web experience for its client base. However, despite its otherwise positive reputation for "best of brand" solutions, this capability has not fully permeated its WCM strategy in terms of vertical focus or the availability of WCM-driven content-enabled vertical applications (CEVAs). In addition, IBM's reconciliation of WebSphere, Lotus and FileNet products is still unclear to a market interested in a seamless integration of WCM with a more extensive ECM strategy. While IBM has a very strong ECM portfolio overall, its WCM functionality remains a weaker component.

Microsoft

Since the release of SharePoint in November 2006, Gartner has seen a steady and significant increase in the adoption of the overall platform.

Strengths

• Gartner receives a large number of inquiries about SharePoint's WCM capabilities and this reflects the continued adoption of SharePoint in the past year. This, coupled with the vision that Microsoft has laid out for the continuing development of SharePoint, has resulted in a powerful partner ecosystem that provides both enhanced capabilities for the platform and the required resources to implement them. This, in turn, will continue to provide opportunities for building extended Web solutions on SharePoint that include Microsoft's own complementary technologies, such as e-commerce, Web analytics and search.

• A significant strength is its application in the intranet domain, where the combination of its portal, Web 2.0, DM capabilities and ease of use is very compelling for many companies.

Publication Date: 5 August 2009/ID Number: G00168694 Page 17 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Cautions

• Feedback to Gartner from users of SharePoint points to the high costs/pricing model causing reticence to adopt it for external websites. The long software development life cycle for SharePoint compounds the effect on the total cost of ownership. This is because it may result in the need for costly customizations at a deployment level for capabilities that may be available "out of the box" from competing WCM offerings.

• SharePoint still needs to mature as a WCM offering, particularly in areas such as ease of content reuse, multisite management, workflow and enterprise-level federation capabilities, such as replication and multifarm synchronization. Numerous users of SharePoint suggest that third-party technology is often necessary to achieve their core WCM requirements.

Nstein Technologies

Nstein Technologies has traditionally had success with its text-mining technologies and, since 2006, it has managed to successfully augment its portfolio to include WCM.

Strengths

• Nstein has been able to leverage its positive reputation in digital publishing for the media and entertainment sectors to introduce WCM to its portfolio.

• Nstein's WCM-related revenue has increased significantly in the past three years, accounting for more than a third of its total revenue in 2008. The combination of its WCM offering and its text-mining capabilities provides Nstein with a strong potential for differentiation within its target market segments.

Cautions

• It is still relatively new to WCM and is judiciously concentrating on key focus sectors. This is limiting its reach significantly and will place the company at a disadvantage when trying to catch up with other vendors in the market that also have a compelling message in media and entertainment and are already having success in adjacent sectors.

• With more than 70% of its WCM revenue coming from North America, Nstein needs to expand its reach through a more developed partner program if it is to compete and gain a stronger foothold in other regions.

Open Text

Open Text, which is one of the top three ECM vendors and the largest pure-play content

management vendor, is best known for Livelink, its collaborative document management offering. The company completed its acquisition of Vignette in July 2009.

Strengths

• Open Text has made great strides in integrating its Web Solutions offering (formerly RedDot) into its overall ECM strategy and social-networking capabilities. Traditionally sold as a more isolated component, version 9 of its WCM offering now comes with tighter integrations with its Artesia (DAM) and Livelink products.

• The latest release of Web Solutions brings with it a marked improvement in overall usability, with more intuitive capabilities for content editing, multisite management, integration of Web 2.0 features and multichannel delivery.

Publication Date: 5 August 2009/ID Number: G00168694 Page 18 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Cautions

• Open Text's acquisition of Vignette may confuse users of Gauss and Obtree that Open Text has already encouraged to migrate to Web Solutions. This, and other related uncertainties, such as product direction and road map, will undermine the progress Open Text has made in the past year to clarify its overall WCM strategy.

• Gartner expects Open Text to continue struggling in its attempt to gain market share on the back of the increasing popularity of SharePoint, despite recent improvements in the vendor's offering and its close partnership with Microsoft. The biggest threat will continue to emerge from .NET-based competitors.

Oracle

The purchase of Stellent in 2007 provided Oracle with excellent WCM capabilities. Oracle has also invested wisely to integrate the acquired capability into its Oracle Fusion Middleware strategy. Its WCM offering is an integral component of Universal Content Management (UCM), which is now at the version designated 10gR4, with 11g planned for release in 2009.

Strengths

• Oracle's primary strength and differentiation lies in its ability to integrate UCM well with its own suite of business applications through "productized" integrations and its Application Integration Architecture (AIA) strategy. In addition, its adoption of service-oriented architecture (SOA) promotes easier integration with third-party components through a standardized interface.

• Gartner believes Oracle is well-positioned to exploit some of the key trends in the WCM market. These are likely to include tighter integrations with its recommendation engine and other technologies, such as its CRM business application. One important trend is the requirement for greater usability, and Oracle has built on the ease of use that helped drive the original success of Stellent. This extends beyond content authoring to template development, workflow design, multichannel delivery and multisite management.

Cautions

• Oracle remains largely technology focused with its WCM strategy and needs to exploit its potential better to produce both horizontal WCM solutions, such as for marketing, and WCM CEVAs for individual market sectors.

• The economic climate has introduced a degree of caution among prospects faced with potential license fees and implementation costs from Oracle that are much higher than those of many of the best-of-breed offerings in the market. Given that the business departments choosing the WCM offering are often those faced simultaneously with budget cuts, Oracle is likely to be excluded from shortlists where a more comprehensive enterprise strategy is not a high priority in the relevant business case.

Percussion

Founded in 1994, Percussion has offices in the U.S. and the U.K. It markets the Percussion Approach, a combination of its CMS, solutions and services.

Publication Date: 5 August 2009/ID Number: G00168694 Page 19 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Strengths

• Percussion still offers a strong product with a good XML strategy and a robust and scalable platform that can handle a lot of development. This makes it a sound alternative for those wishing to build their own solution but without starting from the very beginning.

• The recently released CM System 6.6 reflects a good understanding of market trends and improves greatly on previous versions, especially in making the interface more accessible and easy to use for nontechnical users.

Cautions

• Despite the improvements in the latest version of its product, Percussion is struggling to maintain pace with growth in the WCM market and has lost market share in the past year.

• Percussion has faced challenges in keeping up with the rate of growth in the WCM market and also in building a stronger partner ecosystem around its technology and solutions. Though it is making strides to address this, the transition is ongoing and users should assess available resources as part of the vendor selection process.

SDL

SDL acquired Tridion in 2007. Since then, it has managed the product competitively despite limited WCM management experience, in part by retaining a strong team.

Strengths

• SDL Tridion's multisite management continues to be strong, as are the multilingual and multichannel capabilities of the current SDL Tridion 2009 version through its integration of SDL technology in the WCM offering. The XML basis — from Darwin Information Typing Architecture (DITA) in Trisoft to delivery in Tridion — is central to its overall strategy, and componentized dynamic content is a core competency.

• SDL Tridion is poised to continue its strong growth through the ease with which it integrates with SharePoint and the capability to augment such solutions with best-of-breed functionalities, ease of use and ease of development.

Cautions

• SDL's messaging to the WCM market is, at times, fragmented and it has yet to capitalize fully on its potential to solve the problem of content localization — there is high demand for such a solution. SDL needs to do more to bundle its technology acquisitions toward comprehensive and inexpensive vertical solutions. Its focus on marketing leadership is appropriate, but its services and support need to improve to fulfill market expectations.

• Although Gartner has seen improvements in the past year, SDL still has a strong focus on translation technology and does not yet leverage the full potential of its content management technology.

Sitecore

Denmark-based Sitecore was founded in 1999. Its flagship CMS product is currently in its sixth major release. It has a .NET-based solution and is a Microsoft Gold Certified Partner.

Publication Date: 5 August 2009/ID Number: G00168694 Page 20 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Strengths

• The usability of Sitecore's interface for authors and editors continues to be best in class. In conversations with Gartner, developers praise the easily customized interfaces.

• Close alignment with Microsoft technology will continue to make this an attractive add-on to SharePoint for external websites. Gartner has received feedback that points to improved handling with the inclusion of Sitecore, particularly with regard to page assembly, content reuse, multisite management and multichannel delivery.

Cautions

• The close alignment with Microsoft (and its competing product, SharePoint) may undermine Sitecore's value proposition. But Sitecore offers developers a stronger platform for e-business-ready solutions, even if there's a higher price and level of complexity associated with it.

• Sitecore is still small and relies on technical differentiation to distinguish it from a large group of .NET WCM vendors.

Vignette (now part of Open Text)

Vignette was one of the stronger WCM vendors during the dot-com boom. It enhanced its portfolio to a high level of quality but failed to take advantage of the steady growth of the WCM market. In July 2009, Vignette was acquired by Open Text.

Strengths

• Vignette still has thousands of consumer-facing sites under management, and Vignette developers continue to see strong demand for their skills.

• Vignette offered strong content, collaboration and portal functionality when few in the market saw the synergies. Its emphasis on Web experience management is one that finds resonance in verticals such as media and entertainment, as well as in a more horizontal context, such as marketing and communications.

Cautions

• The company's acquisition by Open Text may confuse both prospects and the existing customer base with regard to the technology developments to which Open Text is likely to commit.

• Since the introduction of Vignette Content Management 7 in 2003, Vignette has struggled to motivate its installed base to carry out the required migration from earlier versions and to reduce complaints about the time, development skills and costs required to move from "out of the box" to "out on the Web." Despite recent improvements, its complexity continues to draw complaints.

RECOMMENDED READING

"Magic Quadrants and MarketScopes: How Gartner Evaluates Vendors Within a Market" "Magic Quadrant for Enterprise Content Management"

Publication Date: 5 August 2009/ID Number: G00168694 Page 21 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

"Magic Quadrant for E-Commerce"

"Market Trends: Enterprise Content Management, Worldwide, 2007-2012"

"Toolkit: How to Design and Create an RFP for Your Web Content Management Solution" "Tactical Guidelines for Narrowing Your Choices When Evaluating WCM Vendors"

"Toolkit: Workshop Materials to Help You Narrow Your Choices When Evaluating WCM Vendors"

Vendors Added or Dropped

We review and adjust our inclusion criteria for Magic Quadrants and MarketScopes as markets change. As a result of these adjustments, the mix of vendors in any Magic Quadrant or

MarketScope may change over time. A vendor appearing in a Magic Quadrant or MarketScope one year and not the next does not necessarily indicate that we have changed our opinion of that vendor. This may be a reflection of a change in the market and, therefore, changed evaluation criteria, or a change of focus by a vendor.

Evaluation Criteria Definitions

Ability to Execute

Product/Service: Core goods and services offered by the vendor that compete in/serve the defined market. This includes current product/service capabilities, quality, feature sets and skills, whether offered natively or through OEM agreements/partnerships as defined in the market definition and detailed in the subcriteria.

Overall Viability (Business Unit, Financial, Strategy, Organization): Viability includes an assessment of the overall organization's financial health, the financial and practical success of the business unit, and the likelihood that the individual business unit will continue investing in the product, will continue offering the product and will advance the state of the art within the

organization's portfolio of products.

Sales Execution/Pricing: The vendor's capabilities in all presales activities and the structure that supports them. This includes deal management, pricing and negotiation, presales support and the overall effectiveness of the sales channel.

Market Responsiveness and Track Record: Ability to respond, change direction, be flexible and achieve competitive success as opportunities develop, competitors act, customer needs evolve and market dynamics change. This criterion also considers the vendor's history of responsiveness.

Marketing Execution: The clarity, quality, creativity and efficacy of programs designed to deliver the organization's message to influence the market, promote the brand and business, increase awareness of the products, and establish a positive identification with the product/brand and organization in the minds of buyers. This "mind share" can be driven by a combination of publicity, promotional initiatives, thought leadership, word of mouth and sales activities.

Customer Experience: Relationships, products and services/programs that enable clients to be successful with the products evaluated. Specifically, this includes the ways customers receive technical support or account support. This can also include ancillary tools, customer support

Publication Date: 5 August 2009/ID Number: G00168694 Page 22 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

programs (and the quality thereof), availability of user groups, service-level agreements and so on.

Operations: The ability of the organization to meet its goals and commitments. Factors include the quality of the organizational structure, including skills, experiences, programs, systems and other vehicles that enable the organization to operate effectively and efficiently on an ongoing basis.

Completeness of Vision

Market Understanding: Ability of the vendor to understand buyers' wants and needs and to translate those into products and services. Vendors that show the highest degree of vision listen to and understand buyers' wants and needs, and can shape or enhance those with their added vision.

Marketing Strategy: A clear, differentiated set of messages consistently communicated throughout the organization and externalized through the website, advertising, customer programs and positioning statements.

Sales Strategy: The strategy for selling products that uses the appropriate network of direct and indirect sales, marketing, service and communication affiliates that extend the scope and depth of market reach, skills, expertise, technologies, services and the customer base.

Offering (Product) Strategy: The vendor's approach to product development and delivery that emphasizes differentiation, functionality, methodology and feature sets as they map to current and future requirements.

Business Model: The soundness and logic of the vendor's underlying business proposition.

Vertical/Industry Strategy: The vendor's strategy to direct resources, skills and offerings to meet the specific needs of individual market segments, including vertical markets.

Innovation: Direct, related, complementary and synergistic layouts of resources, expertise or capital for investment, consolidation, defensive or pre-emptive purposes.

Geographic Strategy: The vendor's strategy to direct resources, skills and offerings to meet the specific needs of geographies outside the "home" or native geography, either directly or through partners, channels and subsidiaries as appropriate for that geography and market.

Publication Date: 5 August 2009/ID Number: G00168694 Page 23 of 23 © 2009 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

REGIONAL HEADQUARTERS Corporate Headquarters

56 Top Gallant Road Stamford, CT 06902-7700 U.S.A. +1 203 964 0096 European Headquarters Tamesis The Glanty Egham Surrey, TW20 9AW UNITED KINGDOM +44 1784 431611 Asia/Pacific Headquarters

Gartner Australasia Pty. Ltd. Level 9, 141 Walker Street North Sydney

New South Wales 2060 AUSTRALIA +61 2 9459 4600 Japan Headquarters Gartner Japan Ltd. Aobadai Hills, 6F 7-7, Aobadai, 4-chome Meguro-ku, Tokyo 153-0042 JAPAN +81 3 3481 3670

Latin America Headquarters

Gartner do Brazil

Av. das Nações Unidas, 12551 9° andar—World Trade Center 04578-903—São Paulo SP BRAZIL