He Said / She Said: How Shoppers and

Retailers View the 21

st

Century In-store

Experience

A 360 Degree View

Nikki Baird and Paula Rosenblum, Managing Partners May 2011

Executive Summary

Retailers have spent the last half-century off-loading more and more tasks associated with product investigation, comparison and selection to their customers. “Unassisted selling” has become the status quo. In many cases, the retailer’s role has been defined as providing indirect service via effective merchandising, and even that has been standardized and homogenized. We have reached the point where consumers feel they are swimming in a sea of sameness, and retailers know it. However, consumers are resourceful people and are moving to digital channels to service themselves. It’s just more convenient.

But is that enough? Imagine a world where every retailer's un-service profile is exactly the same. What's the point of differentiation then? How do you compete? Not on price: price has become transparent. Not on location: the digital channels are everywhere. Not even on product – the vast majority of products can be had from another retailer, anywhere, anytime. This raises an important question for Retailers: What's your BRAND?

The opportunity is in wrapping customized SERVICE around product offerings. But the consumer’s mind is no longer an empty slate just waiting to be written on - consumers know so much more than they used to, and perhaps more than retailers do about the products they sell. The one thing they don't have is time - and that's the dimension where service could really help. That's NOT “customer intimacy” but it is about trust. Consumers are willing and actually anxious to outsource some of their time-intensive tasks to someone they can trust to get the job done.

That can be the retailer’s differentiating value - the BRAND.

RSR and NCR separately surveyed retailers and consumers in the Americas to discover whether their perceptions of the in-store customer experience were similar, or if retailers were missing the mark. We analyzed responses across five dimensions: loyalty programs, product mix, customer service, the impact of cross-channel, and social media and mobility. Retailer responses were culled from several RSR surveys, detailed in Appendix A. NCR commissioned a separate consumer study in 2011 and received responses from more than 2,365 consumers across the Americas. Following is an overview of our findings:

Loyalty Programs: Loyalty Must be Earned and Cannot be Bought

Loyalty programs are not an end in themselves. Consumers become loyal when retailers get the basics of price, product and service right. Then they are far more open to communication about their favorite products, the latest hot promotions, and new offerings that are similar to items they have bought before. This is quite different from the desire retailers have to build “deep relationships” with their customers. We know retailers have been unable to take advantage of the data they do collect. Most retailers and consumers agree that retailers don’t really know who their best shoppers are. If retailers can get the basics right, loyalty programs will become more effective again.

Products: Focus on What I Buy, Not Your Guesses on Who I Am

Web-based commerce and the explosion of social media have brought retailers a wealth of information most never had before – information on their current and potential customers. Retailers have embraced this data, almost to a fault. More than 70% of retailers report customer data is more important than sales data in helping understand demand trends. Recent economic events have also had a different impact on

ii

on managing deviations from sales forecasts. In the future, retailers either need to focus on earning trust through relevancy - a subtle, yet completely different result than personalization - or they simply need to stop guessing and start asking consumers what they want.

Service: Consumers Have Few Expectations of Getting Help in Stores

Retailers’ emphasis on making their in-store employees more productive has put their focus on tasks, rather than people but store employees need to be more than just “warm bodies” on the selling floor, or harried workers who are too busy to help. We believe that consumers have learned to fend for themselves, finding too-busy, uneducated employees more of a hindrance than a help. Interestingly, those same consumers would be far more open to “technology-empowered” employees. Sadly, the Store Manager is a virtual non-entity to many consumers, as he is so rarely available on the selling floor. Even if they could find better service from employees, consumers are also interested in technologies that help them help themselves like self-checkout and kiosks. These technologies remain very important across the Americas.

The Converged Customer Experience across Channels

Not surprisingly, both retailers and consumers recognize the importance of giving consumers what they want, where they want it, to take delivery in the channel of their choice. There is, however, some disagreement on pricing strategies. Consumers expect product information and price consistency across channels. Retailers still have not gained a full appreciation of the impact of price transparency, and remain stuck in zone and channel-specific pricing models.

Social Media and Mobility: Looking Ahead to the Future of Engagement

The impact of Social Media currently exceeds that of mobility. While we find a lot of “noise” around the use of mobile price check applications, the data does not prove out in aggregate. It may well be that the next cycle of phone replacements will give more consumers the option to use their phones in this way. Retailers are wisely preparing for that cycle.

Table of Contents

Executive Summary ... i

Loyalty: Should You Know Me or Should You Know What I Buy? ... 1

You Don’t Know Me ... 1

What Consumers Want ... 1

You Don’t Need to Know Me ... 2

You Haven’t Proven That You Know Me ... 3

Products: What Do I Buy? ... 4

Focus on What I Buy, Not on Who I Am ... 4

Economy Impacts Shopping Behavior, but Not as Much As Retailers Think ... 4

In Most Other Feelings about Products, We Find Confluence ... 6

Service: Should You Help Me? Should You Help Me Help Myself? ... 7

Do Employees Matter? What’s the Best Use of Their Time? ... 7

What is the Job of the Store Manager? ... 8

Do Self-service Technologies Matter? ... 8

Summary of the Opportunity ... 9

The Converged Customer Experience Across Channels ... 10

The Cross-Channel Imperative ... 10

Social Media and Mobility ... 12

Emerging Opportunities, Emerging Challenges ... 12

Social Media... 12

Mobile Shopping ... 12

Conclusion: What Does This Mean for Retailers? ... 14

Loyalty Programs: Loyalty Must be Earned and Cannot be Bought ... 14

Products: Customers Expect Personalization to Begin with Their Purchases ... 14

Service: Consumers Have Few Expectations of Getting Help in Stores ... 14

The Converged Customer Experience across Channels ... 14

Social Media and Mobility: Looking Ahead to the Future of Engagement ... 14

Three-Hundred Sixty Degrees of Perspective ... 14 Appendix A: Research Methodology ... a Appendix B: About NCR ... b Appendix C: About RSR Research ... c

Figures

Figure 1: Consumers don’t care about loyalty programs nearly as much as retailers ... 1

Figure 2: Retailers Do Well on Price and Product ... 2

Figure 3: Consumers Give Personalization and Relationships the Cold Shoulder ... 2

Figure 4: No Confidence in Customer Insights - All Around ... 3

Figure 5: Consumers Prefer Products ... 4

Figure 6: A Majority of Consumers Change Shopping Behaviors ... 5

Figure 7: Retailers Must Adjust to Uncertainty ... 5

Figure 8: Consumers: South Americans Prize Service Most Highly ... 7

Figure 9: Self-service: A Newer Experience for South American Consumers ... 8

Figure 10: Self-service and Self-checkout Contribute to a Positive Experience ... 9

Figure 11: Retailers Want Consistency, But Fulfillment is Lower on That List ... 10

Figure 12: Social Pre-Shopping... 12

Figure 13: Consumers More Often Use Smartphones Before the Store Trip ... 13

Loyalty: Should You Know Me or Should You Know What I Buy?

You Don’t Know Me

Retailers have long been conflicted about loyalty programs: they feel like they need them in order to collect the data they use to gain insight into their customers, but also feel like the programs themselves rarely deliver on their promises - to retailers or to shoppers.

Consumers agree. While a near-majority of retailers indicate that a loyalty program is the primary way that they pursue customer loyalty, shoppers indicate the results are less than enticing (Figure 1).

Figure 1: Consumers don’t care about loyalty programs nearly as much as retailers

Source: RSR Research and NCR, May 2011 Not only do shoppers give little credit to retailers that have loyalty programs, only 9% of consumers surveyed said that their favorite retailer knows them and caters to their needs. South American shoppers are much more likely to feel like their favorite retailer knows them well - 18% vs. 5% of North American consumers.

What Consumers Want

Where consumers do give retailers credit is on the basics: price, product, and service. Sixty-nine percent of consumers surveyed indicate that good prices win their loyalty, and another 66% said product selection wins the day (Figure 2).

For retailers, 37% indicate that they don’t use loyalty programs; they focus instead on those things that consumers say they hold dear: price, product, and service. But there’s a warning here as well, which we will explore in other sections of this report, and that warning centers on customer service. Only 36% of consumers said that their favorite retailer provides good customer service - about half as many as value price or product.

46%

22%

9%

Retailers: Customer loyalty is something we actively pursue through loyalty

programs

Consumers: My favorite retailer has a

good loyalty program Consumers: My favorite retailer knowsme and caters to my needs

2

Figure 2: Retailers Do Well on Price and Product

Source: RSR Research and NCR, May 2011 There are consumer differences to keep in mind. North American consumers are much more likely to give credit for price and product - 76% of North American consumers agree that their favorite retailers offer good prices, and another 71% say the same about product selection. South American consumers are a little more subdued: 56% say their favorite retailer offers good prices, and 54% say the same about products. But 42% of South Americans say that their favorite retailer offers good service, vs. 34% of North American consumers.

You Don’t Need to Know Me

No one - retailers or consumers - really believes that retailers know who their best customers are. Only 30% of retailer respondents expressed confidence here, along with 20% of consumers. But where retailers and consumers really diverge is around what should be done about this (Figure 3).

Figure 3: Consumers Give Personalization and Relationships the Cold Shoulder

Source: RSR Research, May 2011

37%

69% 66%

36%

Retailers: Customer loyalty is the natural result of having the right products,

prices, and good service

Consumers: My favorite

retailer offers good prices retailer has products that IConsumers: My favorite like

Consumers: My favorite retailer provides good

customer service

Customer loyalty as a function of price, product, and service

30%

20%

Retailers Consumers

Retailers know who their

best shoppers are

("Strongly Agree")

67% 14% Retailers ConsumersBuilding deeper

relationships with

customers is key to

retailer success

("Strongly Agree")

57% 16% Retailers ConsumersPersonalized

communications are

critical for winning and

keeping customers

("Strongly Agree")

For retailers, the clear desire is to get to know customers better and to act on that knowledge through personalized communications. Consumers disagree, reporting little value to stronger “relationships” and more personalized communications. South American consumers are the exception in one area: personalized communications. Perhaps because they already have higher expectations from their favorite retailers (3 times as many South American consumers as North American report their favorite retailer knows them well, above), 23% strongly agree that they can be won over with personalized communications vs. only 9% of their more jaded northern peers.

You Haven’t Proven That You Know Me

Why do consumers seem to be against personalization and retailer activities based on shopper insights? Perhaps it is because retailers simply have not demonstrated that they do a good job taking advantage of the customer data they collect to provide more relevant offers (Figure 4).

Figure 4: No Confidence in Customer Insights - All Around

Source: RSR Research and NCR, May 2011 Fully 72% of retailers report that they are capable only of basic analysis - either time or tools get in the way of anything more in-depth. Ironically, only 7% of retail respondents say that they are drowning in data, despite the fact that they hardly do anything with the customer data they collect. And only 19% of retailers say they can do repeatable, in-depth analysis.

It shows in consumer perceptions: 20% of consumers surveyed say that their favorite retailer does a good job using their purchase history to serve them better. Roughly one-third agree that their favorite retailer does basic things like target promotions based on purchase history. Another 10% believe their favorite retailer knows them well but doesn’t act on the information it collects, and fully 36% believe their favorite retailer doesn’t know their purchase history at all.

19% 72% 7% We are capable of repeatable in-depth analysis We are capable of basic analysis, but don't have the tools or time for more

in-depth

We are drowning in data

Retailers' ability to derive insights from

customer data

20% 33% 10% 36% Knows me well and uses my purchase history to serve me better Does basic things with my purchase history Knows me well but rarely actson the information

Doesn't know my purchase

history

Consumers' perception of retailers'

ability to derive insights from their data

4

Products: What Do I Buy?

Focus on What I Buy, Not on Who I Am

Much to our surprise, we discovered consumers prefer retailers to understand their purchase patterns, rather than their identities, likes and dislikes. Almost half of all consumers surveyed expressed a preference for this, with South American consumers most emphatic. Retailers on the other hand, have become almost universally obsessed with learning more about their customers (Figure 5).

Figure 5: Consumers Prefer Products

Source: RSR Research and NCR, May 2011 Put another way, a majority of retailers believe customer data is far more important than product sales data in helping them understand demand trends.

Why? RSR believes retailers are data junkies, and for the first time (for most), the web and other technologies have given them mounds of new data about their customers. Formerly anonymous shoppers and buyers are now giving all kinds of information in reviews, social media, through loyalty cards and via web buys. Retailers are enamored; their customers, not so much.

Customers, for their part, understand the current loyalty bargain: they are willing to trade their personal information to get discounts. But as few retailers have demonstrated to them that they know what to do with that personal information, the majority prefers retailers to just put the right product in front of them.

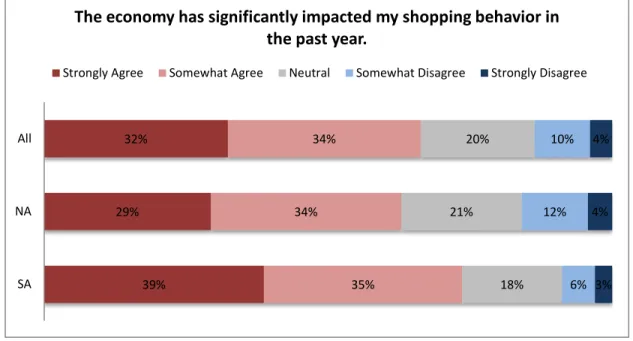

Economy Impacts Shopping Behavior, but Not as Much As Retailers Think

The recent great recession certainly impacted Retailers’ top line sales. Retailers found themselves over-stocked and under-inventoried. And conventional wisdom had consumers trading down in “Walmart Time” (including Walmart executives). But a funny thing happened: Walmart did not show increased top-line sales. Consumers mostly tended to just buy less, and as the economy improved, overall comparable store sales increased accordingly. Figure 6 shows the impact on consumers in the Americas.

11% 17% 12% 27%

16%

30%

30%

32%

Retailers: Product sales data is more important than

customer data for understanding demand

trends

Consumers: It's more important for a retailer to

know what I buy, rather than who I am

NA Consumers SA Consumers

It's more important for a retailer to know what a customer buys than

who they are

Figure 6: A Majority of Consumers Change Shopping Behaviors

Source: RSR Research and NCR, May 2011 Even as the economy has affected consumers, retailers are having a hard time figuring out how to manage deviations from their expectations. On the one hand, less than half of retailers surveyed have substantially changed their customer segmentation strategy, but on the other hand, as we can see below, they acknowledge the need to improve their responsiveness: fully 95% report it’s important to adjust to deviations from sales forecasts (Figure 7).

Figure 7: Retailers Must Adjust to Uncertainty

Source: RSR Research, May 2011

39% 29% 32% 35% 34% 34% 18% 21% 20% 6% 12% 10% 3% 4% 4% SA NA All

The economy has significantly impacted my shopping behavior in

the past year.

Strongly Agree Somewhat Agree Neutral Somewhat Disagree Strongly Disagree

57%

38%

5%

Very Important Somewhat Important Little to No Importance

Impact on Retailers: Improving our ability to adjust to deviations

from sales forecasts

6

In Most Other Feelings about Products, We Find Confluence

We’ve highlighted differences in retailers’ and consumers’ feelings about products, but in many ways, their respective opinions are in alignment:

• There is general agreement on the importance of product selection, with 88% of all consumers finding selection at least somewhat valuable (South Americans were slightly more emphatic, with 91% citing selection at least somewhat valuable), and 81% of retailers believing product selection as an important opportunity for them,

• Retailers and consumers both agree that purchasing patterns tend to shift over a three year period. Again, South Americans are more emphatic about shifts in buying patterns (73% agreeing that their purchasing patterns have changed over the past three years vs. 64% of North American consumers). Seventy-nine percent of retailers refresh and re-evaluate their customer segments every three years.

Service: Should You Help Me? Should You Help Me Help Myself?

The service element is particularly intriguing in light of a recent survey on Customer Service of North American consumers by the Temkin Group.1 Consumers were asked to rate service across three dimensions: functional, accessible and emotional. We’re talking about “service” which generally implies personal attention, yet the number one company was Amazon.com, a retailer one almost never has any kind of human interaction with. Another three of the top ten were warehouse clubs. If you asked the founders of these three retailers if their core competency was customer service, they’d most likely say no – their value proposition is about tonnage products at great prices. In this survey, we looked at the service element across three different dimensions: employees, managers, and self-service options.Do Employees Matter? What’s the Best Use of Their Time?

Our “he said/she said” survey gave us some surprising answers. North American consumers find attention from employees less valuable than the retailers who attempt to serve them, whereas South American consumers are more likely to desire that level of interaction (Figure 8).

Figure 8: Consumers: South Americans Prize Service Most Highly

Source: RSR Research and NCR, May 2011 While Retailers profess this belief, they also want their employees to be more productive – essentially, they want them to do more tasks rather than provide more help. Fifty-eight percent of North American Retailers report they see significant opportunities in finding ways to make their employees more productive. In fact, given the continued fall in payroll-to-sales ratios, it appears as though their actions revolve around productivity, rather than service. Consumers are clearly learning to fend for themselves, with harried help considered less useful than no help at all.

It seems consumers don’t find employees valuable because they’re just not knowledgeable enough. Consumers would prefer to have “technology-empowered” employees. Fifty-six percent of North American and a whopping 81% of South American consumers find these employees very or extremely valuable, while only 47% of all North and South retailers believe it is very important to empower their in-store employees using technology. This, combined with the Temkin results should serve as a wake-up call to Retailers. Consumers prefer no service to poor service, and ultimately, that will drive them online.

54%

25%

16%

45%

Retailers Consumers NA Consumers SA Consumers

Very Valuable: More personalized attention from store employees

8

The future of the store as a viable entity depends on retailers improving the skill sets of their in-store employees.

What is the Job of the Store Manager?

The Store Manager is expected to be all things to all people. He is responsible for everything from making payroll schedules, to setting the look of the store, hiring and firing, and making sure all assigned tasks are completed. But more importantly, the store manager sets the tone for store employees. If the Store Manager is sitting in his office, printing or reading reports, or chatting with others, employees tend to cluster in out-of-the-way areas, out of the reach of customers. We were surprised to discover that North American consumers have become so used to this situation that only 34% found personalized attention from the Manager to be at least “very valuable.” South Americans, on the other hand, still understand what an engaged Store Manager can bring to the table. Seventy-three percent rate this personalized attention as at least very valuable.

Retailers for their part are lukewarm about providing localized direction to their Store Managers, with only 37% of North American Retailers finding this very important. We believe the Manager may well be the least utilized person in the store today. He finds himself with a choice between reading his “numbers” at his desk or walking on the floor to talk to customers who likely know more about his products than he does.

We believe it is time to reinvent and reinvigorate the Store Manager’s job. The linchpin to this reinvention is mobility, which has proven consistently lacking in stores. We are hopeful that the explosion of smart phone usage around the world will inspire the 60% of retailers who do not support wireless for their managers and employees to finally add that support. The Store Manager cannot be forced to choose between being informed and being helpful. It’s a prescription for failure.

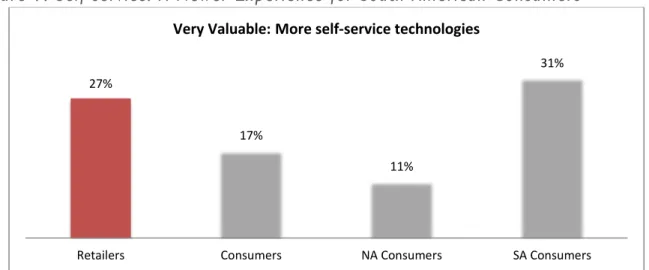

Do Self-service Technologies Matter?

South American consumers clearly want it all. Along with expecting more help from store employees, these same consumers are interested in seeing more North American-type self-service technologies in the store. In fact, Retailers continue purchasing self-service customer facing technology devices, but particularly in North America, they have already hit a critical mass in establishing value (Figure 9).

Figure 9: Self-service: A Newer Experience for South American Consumers

Source: RSR Research and NCR, May 2011

27%

17%

11%

31%

Retailers Consumers NA Consumers SA Consumers

Very Valuable: More self-service technologies

In fact, we can even see South American consumers also interested in self-checkout as a contributor to a positive shopping experience. While North Americans are somewhat less enthusiastic, 38% still view these self-service devices as at least very important to their shopping experience (Figure 10).

Figure 10: Self-service and Self-checkout Contribute to a Positive Experience

Source: NCR, April 2011

Summary of the Opportunity

The store remains the moment of truth in most customers’ retail experience, and as we have seen, retailers are generally missing the point. Consumers, most especially South American consumers, want choice. They expect assistance from knowledgeable store employees, and also expect to have opportunities to help themselves. They have lost any perception of the value of the Store Manager to their shopping experience. We are concerned that the store is slipping into irrelevancy. While many will note that it remains the source of 90% of aggregate retailer revenue, we will also note that in the United States, while overall comparable store sales increased approximately 4% in the 2010 holiday season, online sales increased at rates ranging from 15-18%. This is a significant shift, and we expect it to accelerate.

In the next section, we will embark on a discussion of the proliferation of selling channels and go into depth on its impact on the in-store experience.

21% 10% 14% 44% 28% 33% 27% 36% 33% 6% 16% 13% 2% 10% 8% SA NA All

Contribution to a positive shopping experience: Ability to use

self-service kiosks or self-checkout if desired

10

The Converged Customer Experience Across Channels

The Cross-Channel Imperative

Retailers are currently laser-focused on channel. Throughout RSR’s research, we find that cross-channel consistency is either a top challenge or a top opportunity - depending on how you look at it. However, there is something of a disconnect between retailers’ desire for cross-channel consistency, and their desire to enable that consistency all the way down to fulfillment (Figure 11).

Figure 11: Retailers Want Consistency, But Fulfillment is Lower on That List

Source: RSR Research, May 2011 Fully 81% of retailers strongly agree - and 95% of retailers overall agree - that they need to create a single brand identity across channels. But that number drops off when you ask retailers specifically about fulfillment - 63% of retail respondents strongly agree that they need to be able to enable flexible cross-channel fulfillment, and 55% strongly agree that inventory should be able to be leveraged across channels.

While it is a drop-off, these are still significant numbers, especially when you consider that making these kinds of fulfillment and inventory changes create enormous disruptive pressures internal to retailers. However, consumers provide a few guideposts for navigating the cross-channel journey.

First, they are more likely to say they value cross-channel price consistency than cross-channel product information consistency. This seems like something that might be self-evident, but an amazing number of retailers operate a different price strategy for online than for stores - and cross-channel shopping exposes the conflict. The lesson for retailers is actually two-fold here: one, address price before product when it comes to cross-channel information, but two, take it with a grain of salt. While 75% of

30% 27% 81% 45% 40% 14% Consumers: Consistent prices across channels Consumers: Consistent information across

channels Retailers: Create a single brand identity

across channels

The Importance of Cross-Channel

Consistency

Strongly Agree Somewhat Agree

28% 18% 16% 63% 55% 42% 28% 33% 29% 38%

Consumers: Ability to buy, take delivery, or return products

across channels Consumers: Ability to buy in

stores for delivery to home Consumers: Ability to buy online,

pick-up in stores Retailers: Allow customers to

purchase, take delivery, or return products through the… Retailers: Allow inventory allocated for one channel to be

used for another

Importance of Cross-Channel Fulfillment

Strongly Agree Somewhat Agreeconsumers agree that price consistency is important, only 30% strongly agree. There’s a little bit of room to move in that number - as long as differences in prices can be explained to a shopper’s satisfaction. The second guidepost that consumers provide has to do with cross-channel fulfillment. Consumers are generally positive about the ability to buy online and pick-up in store or buy in store to have it delivered to their home, but they are much more interested in a more flexible fulfillment model overall. (South American consumers had one major exception: 38% strongly agreed that home delivery was very valuable, vs. only 9% of North American consumers and 18% overall). The lesson for retailers: enabling buy online/pick-up in store will buy you some time, but ultimately, “buy anywhere, get anywhere” may well be required to satisfy consumers’ expectations.

12

Social Media and Mobility

Emerging Opportunities, Emerging Challenges

Between social media and mobility, arguably two of the hottest topics in retail today, mobile typically emerges as the leader in impact on the in-store experience. Nothing can send a store manager or employee into a panic faster than a customer looking to price-compare on her mobile phone while standing at the shelf. However, retailers should not discount social media’s influence on the store experience - as consumers relate in this survey.

Social Media

Social media does better as a pre-shopping activity, and it’s clear that consumers are really starting to settle in, particularly on Facebook. While consumers are not nearly as active on social sites while in stores, the fact that they are an important starting point for a shopping experience that may well end in stores means retailers should pay attention to how their social media presence helps facilitate the store experience. Also, the social networks themselves are working hard to add the kinds of features that encourage consumers to check in while on the go. To their credit, retailers are at least considering these possibilities, even in advance of consumer interest in the activity (Figure 12).

Figure 12: Social Pre-Shopping

Source: RSR Research and NCR, May 2011

Mobile Shopping

Mobile also does better as a pre-shopping activity, with more consumers reporting that they use mobile apps or SMS before they leave on a shopping trip than they say they use while in stores. Retailers are well-matched with consumers’ interests when it comes to pre-shopping activities, but are well ahead of consumers on in-store activities that leverage smartphones (Figure 13).

3% 2% 10% 19% 11% 25%

Consumers: Use Facebook Consumers: Use Twitter Retailers: Presence on social networks "very valuable"

Use of Social Media

Figure 13: Consumers More Often Use Smartphones Before the Store Trip

Source: RSR Research and NCR, May 2011 But mobile activities aren’t limited to mobile-specific applications, and here, consumers show much more interest (Figure 14). For, if they are checking a comparison shopping engine while in a store, what device are they using to do that? It’s not likely to be a desktop computer.

Figure 14: Online Sites Show Up In Stores

Source: RSR Research and NCR, May 2011 Retailers are smart to try to stay ahead of the curve of consumer interest - with phone replacement cycles generally thought to be about 18 months, the smartphone revolution could be on a retailer’s store doorstep before they have even begun to formulate a strategy, let alone a detailed response. But retailers embarking on the mobile journey should beware: although it is a very uncomfortable place to be, retailers that are developing mobile solutions should know that for the most part they live in a world where they must “build it and they [consumers] will come.”

4% 4% 4% 12% 13% 11% 13% 17%

Consumers: Use Retailer's SMS Consumers: Use Non-Retailer mobile app Consumers: Use Retailer's app Retailers: Smartphones are "very valuable"

Smartphone Use

Pre-Shopping In-Store

10% 9%

10%

Use Retailer's website while out or in-store Use coupon/discount sites while out or in-store Use comparison shopping sites while out or in-store

14

Conclusion: What Does This Mean for Retailers?

Loyalty Programs: Loyalty Must be Earned and Cannot be Bought

Retailers obviously cannot just eliminate loyalty programs. They are valuable sources of information. However, they need a significant refresh to establish value to customers. As they stand today, they represent little more than a discount mechanism to consumers.

Products: Customers Expect Personalization to Begin with Their Purchases

Retailers clearly desire a deeper relationship with their customers; however, their definition of “personalization” may differ significantly from what consumers expect. Retailers might be better served focusing on customers’ purchase history rather than the demographics and psychographics of any individual or groups - or at a minimum actually ask their customers what they want, instead of trying to guess it based on demographics. For consumers, product selection remains very important, and any retailer efforts to reduce the breadth of product assortment should be done with great care.

Service: Consumers Have Few Expectations of Getting Help in Stores

On the one hand, retailers might be heartened to know that customer expectations of personalized service are low in stores. On the other hand, this leaves them prey to any online retailer with a lower price and more convenient shopping experience. It behooves retailers to empower their employees with technology so they can add value to the in-store experience. In the meanwhile, helping customers help themselves remains a cogent strategy.

The Converged Customer Experience across Channels

Cross-channel fulfillment options are obvious and retailers accept and understand what they have to do. However, the problem of price transparency has yet to be fully internalized. Different retailing departments and channel heads must make decisions on what they want their web price to be relative to stores, even if it means crossing internal organizational boundaries.

Social Media and Mobility: Looking Ahead to the Future of Engagement

In stores, the mobile-enabled shopper is getting all of the attention, both as a disruptor (with at-the-shelf price comparisons) and as a target - for mobile apps, coupons, shopping lists, and other ways of providing in-store engagement. However, in the rush to manage the impact of the mobile shopper, retailers are potentially leaving social media opportunities on the table - both in terms of facilitating a connection to the store and in engaging shoppers once they arrive. With social networks rapidly getting into the “location” game, retailers need to pay equal attention to both opportunities for its impact on the shopping experience, particularly the in-store experience.

Three-Hundred Sixty Degrees of Perspective

Every retailer feels like their business is different - they have different products, different positioning, different customers that expect different things from them. True or not, there is always something to be gained from taking a look around, not only at what your peers are doing, but how receptive consumers are to the general trends of the industry. In these disrupted times, any indicators of any sort are helpful and we hope that our perspective on the trends we outlined here help you.

Appendix A: Research Methodology

RSR used data from several retail industry benchmark reports published over the years 2010 and 2011. All surveys were filled out on-line.

They include:

• The Customer-centric Store 2010: How Retailers Engage Tech-enabled Customers, June 2010

• The Cross-channel Wake-up Call: Benchmark 2010, July 2010

• The State of Personalization in Retail: Benchmark 2010, August 2010

• Defining 21st Century Merchandising: Benchmark 2010, September 2010

• Optimizing Price in a Transparent World: Benchmark 2011, April 2011 These reports can be accessed at RSR’s website, www.retailsystemsresearch.com.

We also used data from a survey commissioned by NCR in early 2011. The research was conducted by consumer market research firm NPD. Across the Americas 2,365 consumers were surveyed by phone. There were 1,608 North American consumers surveyed and 757 South Americans surveyed.

b

Appendix B: About NCR

NCR Corporation is a global technology company leading how the world connects, interacts and transacts with business. NCR offers retail solutions that optimize efficiencies, enhance the customer experience and transform businesses, along with services that make life easier. Additionally, consumers are time starved, digitally enabled and in control, requiring a new approach from retailers.. NCR is igniting its converged retailing – c-tailing™ – revolution, ushering retailers into a new realm of consumer interaction based on presence and preference. For more information, email retail@ncr.com or visit http://www.ncr.com.

Appendix C: About RSR Research

Retail Systems Research (“RSR”) is the only research company run by retailers for the retail industry. RSR provides insight into business and technology challenges facing the extended retail industry, providing thought leadership and advice on navigating these challenges for specific companies and the industry at large. We do this by:

• Identifying information that helps retailers and their trading partners to build more efficient and profitable businesses;

• Identifying industry issues that solutions providers must address to be relevant in the extended retail industry;

• Providing insight and analysis about a broad spectrum of issues and trends in the Extended Retail Industry.

Copyright© 2011 by Retail Systems Research LLC • All rights reserved.

No part of the contents of this document may be reproduced or transmitted in any form or by any means without the permission of the publisher. Contact research@rsrresearch.com for more information.