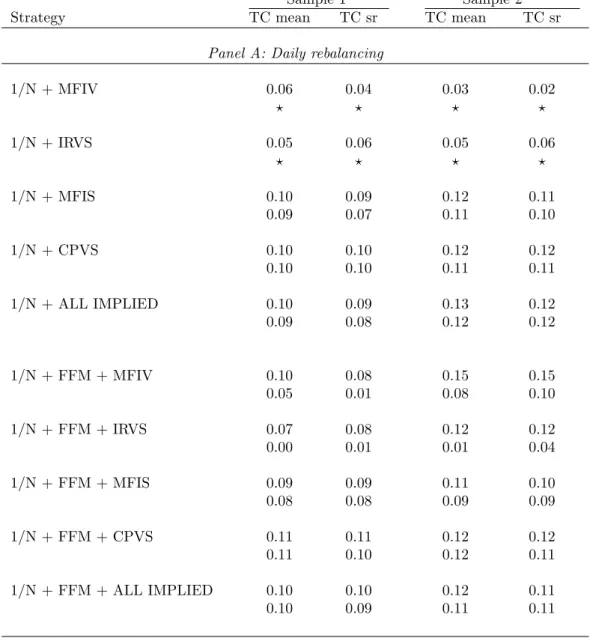

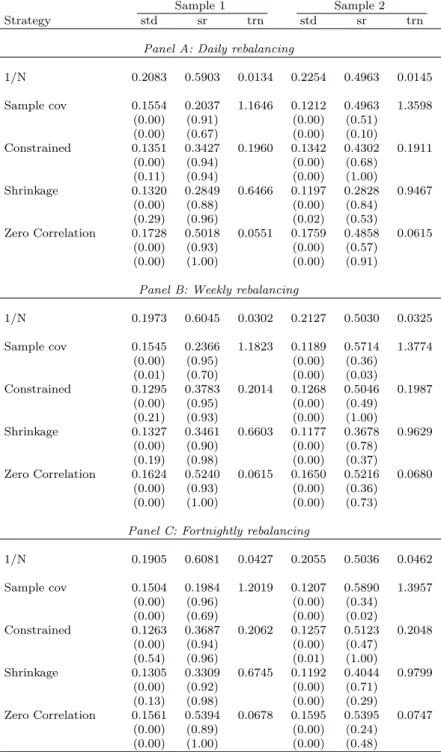

Improving Portfolio Selection Using Option-Implied Volatility and Skewness

Full text

Figure

Related documents

The mentioned resolution is not related to the accuracy of the signal.. If only driver card 2 is present, a delimiter followed by parameter driver 2 identification and the

pathogen of soybean in the United States. Annual yield losses from SCN are estimated to be over $2 billion worldwide. However, SCN virulence or the ability of a nematode to grow

The study was limited to students who had participated in the Leadership Studies Certificate Program coursework through the Department of Leadership Studies at Fort Hays

Figure 5: Diagram of important findings demonstrate (A) heterogeneous population of cancer cells are composed of tumor cells and CSCs upon iBET762 displacement of histone H4; (B)

The study reports a significant difference between an expected equal distribution and observed distribution of birth dates by year half, quartile and month in amateur boxing..

z Use small knife with child nearby 95 z Imaginal exposure: stabbing child 90 z Walk with child near the balcony at the mall 85 z Stand near window on high floor with child 80

For example, in order to define a Service Level Agreement, the company needs to know how active the customer was in terms of sales, support, etc.. so it can define its support