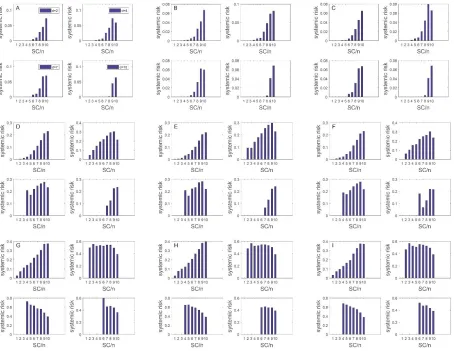

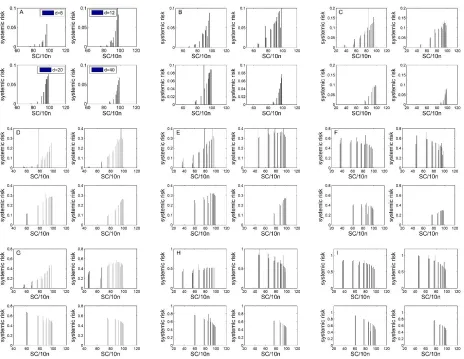

Portfolio Homogenization and Systemic Risk of Financial Network

Full text

Figure

Related documents

We strive to provide best service, best quality and best prices for our clients and also try to provide you with the most useful industry and market

Freshly prepared zobo drink was aseptically dispensed into 25 cl of the 3 different sterile packaging materials, glass bottles, plastic bottles and polythene sachets

Both groups show the share of families in this group declining from 1989 to 1992 and then rising substantially by 2001, with faster growth for African Americans from a much

bocaRaton,HumanResourseManagement,McGraw

jurisdiction over a child custody modification proceeding because an action concerning the issue was pending in a Florida court that the Hempe court determined was

[r]

The specimens were preheated to a prescribed temperature which is 60 o C placed in the special test head and the load was applied at a constant stain (2 in/min).