Saving in ISAs

Final Report 22/10/07

Research Study conducted for

HMRC

By Suzanne Hall, Nick Pettigrew and Stephen Bell

Disclaimer

List of contents

Publication of data

1

Acknowledgements

Glossary

Summary of findings

1. Introduction

!

3. Barriers to saving

" #

$ %

$ % % & '

'

' (

) *

4. Sources of Information

+ & ,

*

-. % .

* 0 1 23 )

! " # $

" $

' " & % 4 "

! "

#

% $

& $ '

$ )

' " # $

) ' 4 #

$

%&

Appendices

( ) '

( ) * + '

% + )

Publication of data

Acknowledgements

Glossary

ISAs Individual Savings Accounts

HMRC Her Majesty’s Revenue and Customs

DWP Department for Work and Pensions

Summary of findings

Introduction

This report contains the findings from qualitative research among ISA and non ISA savers. This research was undertaken by the Ipsos MORI Social Research Institute on behalf of Her Majesty’s Revenue and Customs (HMRC) and was designed to explore what motivates people to save in an ISA and how they are used by individuals.

The research comprised of 50 in-depth interviews - 35 with ISA Savers and 15 with non-ISA Savers. Participants were also recruited according to age, income and work status.

More generally, saving is perceived as a good idea, even amongst those who do not save, or save irregularly. The tax-advantages with all ISAs are

perceived as attractive, as are the higher rates of interest associated with these products in comparison to other available non-stock market-based savings products. Many interviewees who use cash ISAs state that they are a good encouragement to continue saving.

However, this report highlights importantly that savings behaviours,

motivations and barriers are not often associated with ISAs specifically, but are located in the (financial) goals and challenges which people face more generally in day-to-day life. Different attitudes to saving and financial

management are also important influences. Other findings are outlined below.

Saving Behaviour

Savers used a variety of savings products to meet their savings needs. In addition to interest rates, saving product choice is based on an assessment relating to risk and accessibility in relation to their savings goals.

There were examples of non savers and savers just using a current account through to savers with multiple short and long-term savings products

(including money invested in riskier stock-market related savings products) meeting multiple savings goals. Older participants who had earned a salary which enabled regular savings tended to have more diverse investments.

Key influences on saving behaviour included role models and habits

generated during childhood, a partner or spouse who was more careful with money, as well as friends and other family members.

Barriers to saving

Barriers to saving prevent people from saving at all, as well as hindering participants’ ability to save during various stages of life. Barriers to savings are not specific to ISAs but relate to savings more generally and other factors in people’s day-to-day lives. Consequently, this research indicates that the introduction of ISAs as an alternative savings product has had little impact on overcoming these barriers amongst non-savers as these barriers remain unchanged.1

Barriers included a real and perceived inaffordability to save, as well as a lack of trust in the financial sector, and a lack of knowledge and understanding of different savings opportunities. Changing personal and financial

circumstances impacted on saving behaviours, especially: getting on the property ladder and associated short and long term costs of buying and improving a new home; having children; and changing jobs, redundancy and retirement. Attitudinal differences which promoted spending and inhibited saving led to differing saving behaviours, as did influence during childhood, and from partners/spouse.

Sources of Information

Interviewees obtained information about different savings products from a variety of sources. These included newspapers and magazines, banks and building societies, friends, families and colleagues, as well as the internet.

These information sources had an array of advantages and disadvantages. Newspapers and magazines and internet websites were seen as trusted sources of information on saving products as they were not thought to have an ‘agenda’ and, as a consequence, could be considered impartial. However, at the same time, perceptions of accessibility of the information provided varied, as some thought the financial terminology and jargon was difficult to understand.

Family and friends were perceived as an extremely useful source of information and advice, especially amongst younger participants. In

comparison with other sources of information and advice, these people were seen as more approachable and trustworthy. Independent financial advisors with whom relationships had been developed were also seen as trustworthy.

In contrast, employees in banks and building societies were viewed as untrustworthy, unapproachable and intimidating. Perceptions varied amongst those who had been banking with the same institution for some time, where trust had been built up over time.

Interviewees indicated that changes were necessary in the provision of information, especially with regard to the (dis)advantages of different products, the stock market, and the provision of more personalised information through financial check ups. There were mixed views about whether HMRC should be providing information on saving and saving products.

Awareness and understanding of ISAs

General awareness of the basic principles relating to ISAs was good amongst savers, though even basic knowledge was variable amongst non savers and irregular savers.

Attitudes to cash and stocks and shares ISAs varied considerably. Cash ISAs were liked because they are tax-advantaged, risk-free, easy to understand and offer better savings opportunities than other non stock-based savings products. When ISAs are offered by trusted providers with whom savers have other products, this trust is transferred to their decision to invest in cash ISAs as a saving product. Investing in cash ISAs promotes saving - for some of the products available, interviewees perceived that access is limited or slightly more restricted than other savings accounts.2 There is varied evidence that

investing in cash ISAs leads to the development of improved financial

management skills. For example, whilst some savers monitored their savings, many savers were not aware of how long these accounts had been open for, and how much money was saved.

In contrast, awareness of stocks and shares ISAs was limited. Amongst those who do not have a stocks and shares ISA, they are perceived as risky with an unreliable return. Some savers had experienced loss on money invested in stocks and shares ISAs. However, those using these ISAs believe that they offer a better rate of return, and provide an introduction to and flexibility in investing in the stock market. Improved financial literacy was experienced amongst only those who chose how this money would be invested in the stock market.

Opening and Managing an ISA

The process of opening an ISA is perceived as relatively straight forward, and very similar to initiating other savings products. The challenging aspect of the process was learning about ISAs and finding accessible information sources before choosing which one to invest in. Where problems were encountered in

this process it related to opening up an account with a new provider, but this is not a problem that is unique to ISAs.

Use of cash and stocks and shares ISAs varied. Use of cash ISAs varied between those who perceived them as something which they should not touch in order to enable their savings to grow, to those who used it as a higher interest savings account which they dipped into regularly. Stocks and shares ISAs were generally perceived and treated as a long-term investment which was inaccessible and would grow over time.

Managing investment in cash ISAs involved either one lump payment or regular direct debits from a current account. Alternatively, stocks and shares ISAs tended to involve one initial lump payment more often, with fewer savers contributing on a regular basis. There was little acknowledgement of

managing ISAs beyond this, and ongoing monitoring of savings was also minimal.

Changes to ISAs

There was limited awareness of the changes to ISAs amongst both savers and non savers, as well as being unsure as to how these changes would affect their savings habits. There was general criticism about how limited communication had been about these changes, as well as a willingness that more jargon-free information was provided.

©Ipsos MORI/J29510

Checked & Approved:

Nick Pettigrew Checked & Approved:

Suzanne Hall Checked & Approved:

1. Introduction

This report contains the findings from qualitative research among ISA and non ISA savers. This research was undertaken by the Ipsos MORI Social Research Institute on behalf of Her Majesty’s Revenue and Customs (HMRC). This chapter sets out the background to the research, discusses the research objectives in detail and outlines how the remainder of the report is structured.

1.1 Research Background

The barriers to saving are well documented; rising levels of personal debt; the high cost of living; distrust in financial products and financial providers; and, a cultural shift towards a ‘spend now, pay later’ mindset all impact on people’s propensity to save.

In order to help encourage people to save more, in 1999 Government launched a new package of instant-access, tax-advantaged savings

accounts. These Individual Savings Accounts (referred to as ISAs hereafter) were intended to simplify the savings process by offering easy access to products through all major high street banks, building societies and more recently supermarkets and, enabling people to save in cash, stocks and shares in a tax-advantaged account. ISAs currently offer individuals the opportunity to save up to £7,000 per year; £3,000 of which can be saved as cash.

ISAs are also aimed at encouraging those with existing cash savings to consider more medium-term savings products, such as equity-based

investment products, where over time they have the potential to benefit from greater growth in their savings.

Latest figures suggest that there are currently over 17 million ISAs held across the UK with the greatest proportion being cash ISAs. In 2006, the Government announced a package of reforms to ISAs, with the intention of making ISAs more understandable and flexible for savers. ISAs will be a permanent feature of the savings market. Other changes were also announced including removing the Mini/Maxi distinction within ISAs and merging Personal Equity Plans (PEPs) with ISAs.

1.2 Study objectives

The qualitative research was specifically designed to tackle the following objectives:

To explore in depth attitudes to savings and investments generally – how people perceive savings, the value of them and, aligned to this, their views towards risk in general;

To understand why people choose to save in ISAs and, beyond this, the reasons for choosing the type of ISA they do;

To determine how ISAs compare when set against other savings and investments products available;

To understand the extent of people’s knowledge of ISAs; what they know of them, how they have uncovered this information and how, in turn, this knowledge has had an impact on their saving behaviour;

To ascertain why some choose not to save in an ISA – whether this is due to a lack of information, misinformation or other

socio-demographic factors;

To explore how ISAs are used and managed by savers, for example, the extent to which they deposit and withdraw their

savings/investments from ISAs and the reasons behind this; and,

To analyse how having access to an ISA has impacted on other saving behaviour, for example, has it prompted people to invest in other products and, if so, which ones and the reasons for this.

1.3 Methodology

The research adopted a wholly qualitative methodology of single and paired depth face-to-face interviews. Single depth interviews involve a one-to-one approach; the moderator discusses saving in a ISA with an individual. Paired depth interviews involve the moderator speaking with a couple of participants; this related to either co-habiting or married partners as financial decisions are often taken as couple.

It was thought that this approach would be most suited to this study given that qualitative research is an interactive process; it not only identifies what people think, but why they do so. The in-depth single and paired interviews used in this project are ideal for exploring complex issues and to elicit a full range of possible answers.

The real value of a qualitative approach in this research is that it allows insight into the attitudes and beliefs of individuals with regard to saving in an ISA, which could not be examined in as much depth using a structured quantitative questionnaire. Furthermore, it is well suited to discussing

a good rapport and level of trust with the participant due to the face-to-face nature of the approach.

All interviews were structured by the use of a discussion guide. A discussion guide is intended to stimulate, rather than lead, conversation but did ensure that there were areas of commonality between all the interviews. We

developed two discussion guides, one for ISA holders and one for non-ISA holders, in close consultation with HMRC. Please see the Appendix for more details.

50 depth interviews were carried out - 35 as single depths and 15 as paired depths. 35 in-depth interviews were with ISA Savers and15 in-depth

interviews were with non-ISA Savers, split across the single and paired depths. Participants were also recruited according to age, income and work status. The interviews lasted between 40 minutes and 1½ hours.

The interviews were split across three case study areas:

Birmingham;

London;

North West.

Interviews were conducted during March and April 2007.

Qualitative researchers from the Ipsos MORI Social Research Institute moderated all the depth interviews. All discussions were tape-recorded and transcribed with permission from the participants.

An opt-out letter (see Appendix A3) was sent to a sample of ISA and non ISA savers and they were given a fortnight to inform us if they did not wish to participate. All those who did not want to take part were removed from the sample before we contacted potential participants by telephone to ensure that we met the quotas set and to secure appointments.

1.4 Definitions, presentation and interpretation of the

data

While qualitative research was the most appropriate methodological approach for this study, it is important to bear in mind that it utilises smaller samples that are chosen purposively, to ensure representation of a full range of views within the sample.

Throughout the report we have made use of verbatim comments to exemplify a particular viewpoint. It is important to be aware that these views do not necessarily represent the views of all participants. Where verbatim comments have been used, the participant’s attributes are given in the following order: ISA saver, gender; location; and age.

1.5 Analysis

Each of the depth interviews were recorded and transcribed for analysis purposes. This was supplemented by numerous ‘brainstorms’, which helped to channel the key themes arising from the research and direct the report towards a coherent structure.

1.6 Report outline

Following this introduction, this report is divided into five main sections:

Understanding saving behaviour and motivation;

Barriers to saving;

Sources of Information;

Awareness and understanding of ISAs; and

2. Understanding saving behaviour and

motivation

Summary box: Understanding saving behaviour and motivation

Savers used a variety of savings products to meet their savings needs. In addition to interest rates, saving product choice is based on an assessment relating to risk and accessibility in relation to their savings goals.

There were examples of non savers and savers just using a current account through to savers with multiple short and long-term savings products

(including money invested in riskier stock-market related savings products) meeting multiple savings goals. Older participants who had earned a salary which enabled regular savings tended to have more diverse investments.

Saving motivations varied according to shorter and longer term goals, and according to life stage. Shorter and more medium term goals, such as holidays, home improvement and getting on to the property ladder were common, and this promoted the use of shorter-term investments, including Cash ISAs. Longer term goals, including saving for children’s futures, for a rainy day and for a comfortable retirement, were more common amongst participants who were more settled financially, at home and in their jobs.

Key influences on saving behaviour included role models and habits

generated during childhood, a partner or spouse who was more careful with money, as well as friends and other family members.

An original objective in commissioning this research and report was to understand what motivates people to save in ISAs. More generally, saving is perceived as a good idea, even amongst those who do not save, or save irregularly. However, this report highlights importantly that savings behaviours, motivations and barriers are not often associated with ISAs specifically, but are located in the (financial) goals and challenges which people face more generally in day-to-day life. Different attitudes to saving and financial management are also important influences. Whilst this is a

prominent finding, where there are research findings specific to ISAs, these will be highlighted through this report.

2.1 Saving products

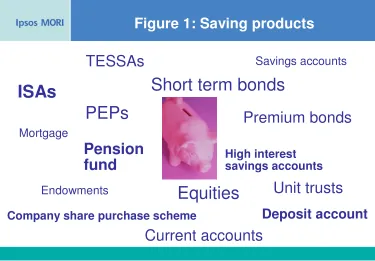

Figure 1 illustrates that ISAs were just one of many products that participants chose, or had previously chosen, to use as a saving tool.

[image:19.595.108.483.139.400.2]7

Figure 1: Saving products

TESSAs

Equities

Unit trusts

Premium bonds

Short term bonds

ISAs

Endowments

High interest savings accounts

Current accounts

Mortgage

Deposit account

Savings accounts

PEPs

Company share purchase scheme

Pension

fund

ISAs were mentioned regularly as products that savers chose to invest in primarily because ISAs are the current product being promoted the most by banks and building societies, as well as because they offer tax -advantaged savings. However, amongst savers who have been saving for some time, they are seen as an equivalent to PEPs and TESSAs, which were also invested in because they were being marketed well at the time they were willing to invest.

8

Figure 2: Perceptions of saving products

Safe Risky

Accessible Inaccessible

Cash ISA

Stocks and Shares ISA

Current/Savings account

Pension fund

Premium bonds

Mortgage

Endowments Stocks and

Shares

Savings products were perceived as safe and accessible on one hand, or as risky and inaccessible on the other. Current and savings accounts which were more commonly used, were perceived as safe and accessible. Premium bonds were an example which were perceived as slightly less accessible due to the procedures required to gain access to this money once invested.

Products that fell into the second category included pension funds, mortgages, endowments, and investment in stocks and shares. Risk was associated with these because they were long term investments with no full guarantee on growth. Furthermore, media coverage added to perceptions of risk. Coverage of crashes in the stock market (such as that which occurred after 9September 2001), variable interest rates on mortgages and a potential house price crash, as well as poor performance on endowments and

pensions are all examples.

Cash and stocks and shares ISAs were viewed differently. Cash ISAs were perceived as both accessible and safe, and were categorised along with current and savings accounts offered by high street banks and building societies. Investment in Cash ISAs was much more common. In contrast, stocks and shares ISAs were viewed as inaccessible and risky. These were associated with other savings products including endowments, pension funds and stocks and shares. They were used by those who were comfortable with taking risk in investments, who could afford to take risks with their money, and who were able to put the money away for a longer period of time and leave it to ride the ‘ups and downs‘ of the stock market. Risk is one of several

Diversification of savings products

Figure 3 illustrates a saving products diversification continuum, outlining the variety of saving approaches with non savers at one end and savers with many different investments at the other.

[image:21.595.112.480.153.416.2]9

Figure 3: Saving product diversification

Non Saver

Saver with a

current account Saver with current

and savings accounts Saver with current and savings accounts

and a cash ISA

Saver with current and savings accounts, multiple ISAs and other

products

Saving products

become increas

ingly diverse

Saver with current/ savings accounts as

well as a cash and stocks and shares ISA

The number of different savings products that each participant used varied. This was associated with the different perceptions of the various savings options, but also depended on age, and perceived financial ability to save.

Non-savers are at one end of the spectrum, and their barriers to saving are outlined in detail in Chapter 3. Next along the continuum include those who use their current account as the only product in which to invest money. There was little awareness of different savings options amongst these savers, as well as a tendency to stay with those products which are familiar and comfortable.

Next are those who use both savings and current accounts, as well as those who also have a cash ISA. Amongst these participants, current and savings accounts tended to be used for more day-to-day financial management. Cash ISAs were generally used to help save for a particular item or target, or to generate a financial safety net for a ‘rainy day’. As explained in greater detail in Section 2.3 (entitled saving motivations), this might include saving for a car or a holiday, planning for children’s education, or to help build up the initial deposit to get on the property ladder.

We’ve got some equities, we’ve got some unit trusts, some of which are in ISAs, but those are only the ISAs that the financial advisor

recommended, because when I retired some cash that I had, and also the amount that I took out of the pension fund on the advice of a financial advisor, I made certain investments, OK, some of which are unit trusts, ISAs, others are unit trusts or bonds. There’s a whole variety of them. I have, do you remember PEPs?

ISA saver, Male, Birmingham, 66-79

These savers used a fairly complex system of savings products. This included one or more current accounts for their daily financial management, regularly transferring money to savings accounts which offered better interest rates. Savings accounts, including cash ISAs, tended to be used as easy access emergency money pots, or as a place to save for something specific, such as a holiday. These savers also tended to have money tied up in a variety of long-term savings products as illustrated above in Figure 1. These products were characterised as limited access to money invested over a longer term, as well as higher potential growth rates.

Savers with multiple products recognised the risk on return of some

investments, particularly those linked to the stock market. Risk was a primary reason why savers at this end of the continuum opted to invest in a number of different products at one time. They wanted to minimise risk whilst maximising the potential for growth. This was achieved through refusing to place all their ‘eggs in one basket’: loss in certain risky savings products, including stocks and shares ISAs, were covered by a ‘guaranteed’ gain in other more fixed rate savings accounts, including cash ISAs.

There was minimal evidence of a relationship between investment in cash ISAs building confidence in managing financial affairs, and therefore leading to investment in stocks and shares ISAs. Instead, participants’ age and life stage, as well as willingness and financial ability to take risks were more important in explaining an individual’s decision to diversify their savings in different products. Younger participants were more likely to have fewer savings products, and tended to invest in current accounts, savings accounts and cash ISAs. Older participants who had managed to save were more likely to have diversified their savings products, particularly during their paid

careers.

2.2 Saving regularity

Figure 4 illustrates the main reasons for varied saving frequencies amongst participants.

[image:23.595.111.486.138.393.2]10

Figure 4: Regularity of saving

Regularity of saving

Never!

Irregularly

Monthly

When receive lump sum When receive

small amounts

Birthday

Christmas

Work bonus

Inheritance

Perceived/actual affordability

Attitude

Redundancy Parental

savings

Salary

There were three distinct types of savers: those that never save, regular

savers and irregular savers. Differences in attitudes towards whether saving

is important or not, as well as people’s perceived and actual ability to save, explain why some interviewees do not save at all and why some save on a regular basis. Some interviewees explained that saving was not important to them currently, while others believed that it was always important to put money aside for a rainy day. Furthermore, different people had different priorities and needs with regard to spending money, so while two people might be earning the same salary, one might think they can save less than the other. Actual ability to save was dependent on an individual’s income and their necessary, unavoidable outgoings such as rent or mortgage payments.

Regular savers tended to be higher earners, or perceived that they were able to save a regular amount from their salaries. They tended to save monthly, with money deducted on pay day or at the end of each month, and transferred into another account automatically by direct debit. Regular savers also tended to be in relationships where saving was perceived as a joint effort and

responsibility. Furthermore, as discussed in Section 2.3, some regular savers were scared of getting into debt, and wanted to put money away ‘just in case’.

Regularity of saving was also associated with different financial

responsibilities at various life stages. This issue is explored in more detail in section 3.4.

Other irregular savers were generally less cautious regarding their personal financial management, and have not started saving, or have never considered it to be important. Barriers to saving amongst non-savers, irregular savers, and those who classify themselves as regular savers but who have taken breaks in saving, are discussed in detail in Chapter 3.

2.3 Saving motivations

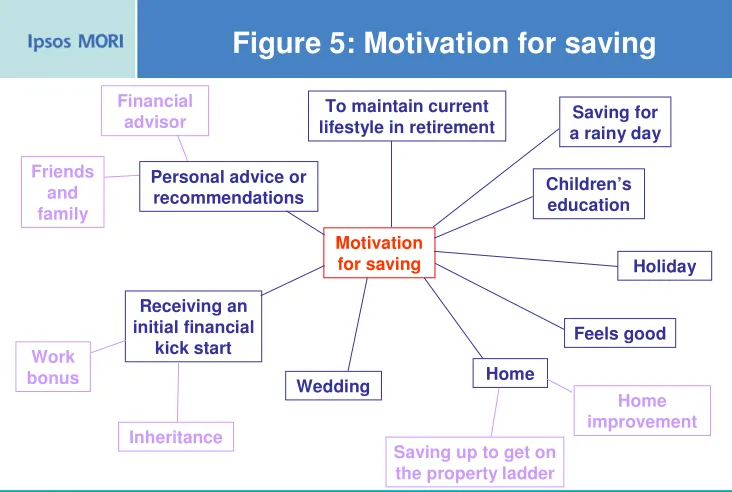

Figure 5 highlights various examples which participants mentioned as motivations for saving.

[image:24.595.110.476.278.524.2]11

Figure 5: Motivation for saving

Motivation for saving

Receiving an initial financial

kick start

Personal advice or recommendations

Saving for a rainy day

Home

Feels good To maintain current

lifestyle in retirement

Saving up to get on the property ladder

Home improvement Wedding Work bonus Inheritance Friends and family Financial advisor Children’s education Holiday

More generally, saving is perceived as a good idea, even amongst those who do not save, or save irregularly. The tax-advantage benefits with ISAs are perceived as attractive, as are the higher rates of interest associated with these products in comparison to other available non-stock market-based savings products. Many interviewees who use cash ISAs state that they are a good encouragement to continue saving, and the key drivers are that saving makes people feel good, as well as the knowledge that their money is growing.

Discussion about motivation for, and the barriers to, saving regularly

cited as inhibiting their ability to save on a regular basis. This section focuses on different motivators for saving, whereas Chapter 3 explores barriers to saving.

Shorter, medium term and longer-term financial goals

Both short and long-term financial goals were important factors for saving. Examples of shorter term aims included holidays, home improvement and DIY, whereas examples of longer term goals ranged from saving to get onto the property ladder, for marriage, to put children through education, or in order to maintain their current lifestyle into retirement. Amongst grandparents, investing for their grandchildren’s future was also a frequently cited long-term savings motivation.

Whilst there were evident distinctions between short and long-term goals, there were sometimes a range of mid-term goals that participants wanted to meet sooner rather than later, such as buying a house, in comparison to the longer terms goals of supporting children and saving for retirement. In terms of the balance between longer and shorter-term savers, there is a greater tendency to invest for shorter-term goals amongst younger people who are yet to be established financially, in jobs and at home.

These different approaches to saving required different savings products. For example, in order to meet long term goals listed above, participants tended to opt for investments with better interest rates but that were also relatively inaccessible. The amount invested is often left untouched in a savings account for a long period of time.

Yeah, like I say, we have a joint savings account for holidays or, spending money for holidays, but when it came to buying our house or, we’ve saved to do the bathroom or kitchen, we’ll put it into the ISA and so it makes us money as well as not costing us anything like tax wise… Or when we decide there’s a job to be done, we’ll say, right by the time the summer comes we want the garden done so what we’ll have to do is start putting some money aside now, we’ll put it into the ISA because then we know we won’t touch it.

ISA Saver, Female, Surrey, 18-30

In contrast, those saving for short-term goals required saving products that allowed regular access to invest and withdraw money, with a reasonable interest rate to ensure their money grows. Higher interest savings accounts and cash ISAs were cited as the main savings products used to fulfil these requirements, particularly when the amount of money saved did not reach the £3,000 annual ceiling investment.

Future security

There were also participants who saved for a rainy day, to ensure that if any unknown, unexpected expenditures occurred they could be covered, as well as securing the lifestyle they wanted in retirement. Explanations given included people living longer beyond the age of retirement without earning a salary. People also explained that savings were seen as an important investment to acting as a substitute for pensions which may not provide as much as originally expected, as well as those which were taken late and will not provide the financial support necessary to support a standard of living which people have become accustomed to. Many regular savers were

concerned about living in debt, and were keen to support themselves and live within their means. As a result they put money away ‘just in case’ because:

they had experienced debt before, and have had problems paying back larger credit card or store card bills, loans and overdrafts;

they were aware of media stories about rising levels of debt and did not want to be in this position.

[My self-employed husband] actually tries to give himself [money], I know he gives himself an allowance like I do. He gives me an allowance, he has an allowance and he’ll try and save things like put money away for

holidays. He likes to know that he’s got money if the heating goes up, for a rainy day. He’s very good like that, let’s say the car broke down or something like that, he’s good like that, at putting money away.

ISA Saver, Female, Manchester, 31-50

2.4 Key saving influences

There were several important influences on participants’ savings habits.

Childhood savings habits

How savings habits were established during childhood was an important factor. Most regular savers had saved since a young age.

some money away, each week or something like that… we were always encouraged to put that away and things like that. You came from a family where you weren't encouraged

M No if you’ve got it, blow it, that was the motto…

ISA Savers, Paired interview, Birmingham, 31-65

Participants explained that family members were influential in contributing to building savings habits during childhood. These included parents and other members of the extended family, such as aunts, uncles and grandparents. The most frequent reference to childhood savings related to money received for birthdays and at Christmas. Often this money was invested in a post office savings account.

I had a Post Office account as a kid, but it would be that like my uncles and aunts would give me money and my parents would put it in. …my parents had always taught me to save a portion of your money, don’t just fritter it away.

Non-ISA Saver, Female, Kingston, 18-30

I did when I was a child. Yes, I remember having a Post Office account. Yeah I did, yeah… I think that was the tradition though wasn’t it? That when you were a child you had your Post Office savings.

ISA saver, Female, Manchester, 31-50

Another influence during childhood was financial management classes at secondary school, where participants had been encouraged to develop a savings plan.

Such exposure to money and financial issues from childhood in families and in schools taught participants the principles of basic money management which they have carried over into adulthood. Many were grateful for this, and explained the importance of helping their own children to become literate with financial issues from an early age too.

An influential partner or spouse

A partner or spouse played several important roles in influencing savings habits. A common occurrence was that one partner was more careful with finances than the other, and helped encourage more careful financial management skills and savings habits.

mortgage, she will look into that and change it around every two years or so, if need be.

ISA saver, Male, Surrey, 31-50

I was absolutely horrendous with money. I'm probably the worst person. She turned my life around with regards to money… she has always been the most sensible one… She's never wrong, this woman is never, ever, ever, I’ve not in 20 years ever turned round to you and said you're wrong, have I? She's always right.

ISA Saver, Male, Manchester, 31-50

3. Barriers to saving

Summary box: Barriers to saving

Barriers to saving prevent people from saving at all, as well as hindering participants’ ability to save during various stages of life. Barriers to savings are not specific to ISAs but relate to savings more generally and other factors in people’s day-to-day lives. Consequently, this research indicates that the introduction of ISAs as an alternative savings product has had little impact on overcoming these barriers amongst non-savers as these barriers remain unchanged.

Barriers included a real and perceived inaffordability to save, as well as a lack of trust in the financial sector, and a lack of knowledge and understanding of different savings opportunities. Changing personal and financial

circumstances impacted on saving behaviours, especially: getting on the property ladder and associated short and long-term costs of buying and improving a new home; having children; and changing jobs, redundancy and retirement. Attitudinal differences which promoted spending and inhibited saving led to differing saving behaviours, as did influence during childhood, and from partners/spouse.

Participants raised numerous reasons as to why they were not saving, or were less likely to save. These relate to saving habits more generally, and the opportunity to invest in an ISA did not reduce the impact of these barriers. In this sense, understanding why people choose to invest in ISAs or not needs to be understood in the context of their day-to-day lives.

Barriers included:

Insufficient finances due to perceived inaffordability, actual financial inability to save, and prioritising different financial commitments;

Lack of faith in the financial sector due to bad experiences (personal and second hand), and caution about risk and the ability for banks to invest money sensibly; and

Lack of knowledge and understanding of ISAs and other savings products, as well as being confused by the information provided.

In addition to this, savings habits were variable according to:

Stage of life cycle;

Personal attitude; and

Time of year.

3.1 Affordability

Many non-savers, particularly those on lower incomes, did not think they had money to spare. Their income is accounted for and spent on ‘essentials’, though this term often included what other people regard as luxuries as well.

Furthermore, as illustrated in examples throughout this chapter, people prioritised different expenditures as important. The assessment of ‘essential’ expenditure and ‘luxury’ expenditure is highly subjective. For example, many participants referred to paying the mortgage and the household bills as key essential payments. However, there were also participants who considered taking one or more holidays each year as essential. A focus on these types of expenditures leads to a savings approach favouring short term goals leading to investment in savings accounts or cash ISAs due to accessibility.

3.2 Lack of faith in financial sector

A lack of trust in the financial sector was an important barrier to saving. Distrust developed from bad personal and second-hand experiences with different representatives from the financial sector.

It’s distrust of the financial institutions isn’t it? We had one stocks and shares ISA, I can’t remember how long back, and that was abysmal on returns. So we just stuck to the cash one.

ISA Saver, Female, London, 31-50

This was our money. This I was what we were going to use to pay off the mortgage. We’d invested it for two years so we could then pay off the mortgage. And after two years it was worth considerably less. And when [my

husband] came to check up what the bond was worth they said ‘didn’t they tell you it was a long-term investment? …We told him we needed it, we would need to pay off the mortgage in two years, and he put it into this bond. And so we made a complaint to the Ombudsman. …We got financial compensation.

ISA Saver, Female, Birmingham, 51-65

General distrust also develops from negative media coverage and word of mouth. Reports of financial mis-selling, unprofitable pension funds and crashing stock markets all lead to a lack of confidence in longer-term higher risk savings products.

There’s so many banks that have gone bust or companies that all of a.. some pensions now are going to pot, people aren’t getting paid of what they’ve earned and everything. No I don’t trust them.

3.3 Lack of knowledge and understanding

A lack of knowledge and understanding about financial issues, as well as a failure to understand the information available, acted as a barrier to saving.

I've read stuff and that and like what? It just makes no sense… so I just no, it doesn’t make sense and I’ll stay away from it… You do hear and see people saying, oh this is deemed as one of the best ones, and then you look at small print and it starts going into jargon that you don’t understand and like. So it does put you off anyway.

Non-ISA saver, Male, Birmingham, 31-50

This misunderstanding and confusion tended to arise from:

a lack of awareness of financial issues and savings opportunities;

the perceived inaccessible written language in which financial information is presented;

not knowing where to find financial information;

a lack of time and enthusiasm to find and learn about savings products; and

perceived confusing information from bank and building society representatives.

These barriers inhibit non-savers’ motivations to start saving, as well as their confidence to seek and make a decision on which saving product to choose. Further analysis about participants’ perceptions about sources of information, and gaps in information is discussed in more detail in Chapter 4.

3.4 Stage of life cycle

20

Figure 6: Impact of life stage on savings

Young Old Lack of parental savings influence

Generate ‘live for the day’ attitude when young BUY HOUSE Mortgage payments Increasing mortgage interest rates Job/salary change CHILDREN Maternity leave, child care, single salary University education Increasing domestic expenditure Retirement Inheritance tax as a long-term disincentive Changing

financial advice and information

As indicated earlier, some of these examples, such as buying a house and having children, acted as motivators as well as barriers to saving at different stages of the life cycle. Having children and buying a house were important periods when individuals perceived they did not have enough money to save due to other more immediate outgoings. The different examples raised by interviewees that relate to buying a house and having children have been grouped together in Figure 6. This section focuses on the reason why such financial commitments, as well as other factors, become saving barriers. In order to elaborate in more detail, we focus below on several key examples that arose regularly during interviews.

Buying a house

The financial commitment of buying a house was raised frequently amongst participants as a barrier to saving. There were three main areas of impact. Firstly, whilst initially acting as a motivator for saving, the outlay of savings to cover the deposit and other associated costs means that savings tended to be spent in one go.

Well we haven’t got much left at the moment because we’ve just used it all for the house, but we’ve raided every account, so. But we’ve still got, we’ve still got them open and there’s still bits in there but not a great deal.

ISA Saver, Male, Surrey, 31-50

Case Study: Wendy

Wendy is 28, and is currently living in a mortgaged house in Surrey with her partner. Wendy and her partner had saved since childhood and had been able to save on a monthly basis from their combined annual salary of around £65,000. However, she explained that the purchase of their house had drained their savings, and that recently increasing mortgage interest rates have prevented her from saving:

“The rates meant our mortgage changed. When we first moved in we didn’t have much money so we was interest only and then after two years, we got ourselves on our feet so we changed to a repayment mortgage. Soon as we went to the repayment mortgage, the interest rates went up as well, so what we were putting aside had to then start being paid back to the mortgage company, a bit more and a bit more each month and it’s gone up.”

Thirdly, getting used to new household bills, as well as making decoration and building changes to new homes impacted on participants’ ability to save. Similarly to the mortgage repayments, these financial commitments impacted on potential to save over a longer-term period, and at times can be

unpredictable. Specific reference was made to variable fuel bills.

Having children

Many participants explained that having children, associated increasing household costs and supporting them through education impacted

significantly on their ability to save. The loss of a salary as one parent, usually the mother, stayed at home to look after children also reduced the ability to save regularly. During this time, participants also discussed delving into savings to fund themselves.

I think because I used to work and now I don’t work, it’s harder to save. Because I haven’t, it’s basically because my son’s just gone to

school… I used to have an ISA but had to stop it as no more money coming in. …I’d stopped working so I kept on taking that money out till really I had none in it anymore.

ISA Saver, Female, Manchester, 31-50

Savings disincentives

Perceived changes at government level relating to rules and regulations regarding tax and savings were mentioned by participants as disincentives for saving. Participants complained that ‘changing goalposts’ in savings products and tax systems reduced the amount gained when trying to save. There were also frequent comments about the government penalising those who save.

sum. Well that ain’t worked out. …The whole thing is a disincentive for me to have any money put away because if I try and get rid of it I have to realise the asset to give it away, pay capital gains tax. If I don’t give it away, inheritance tax. Sod saving money, what’s the point?…So even though I’ve got stocks and shares ISAs and some have done quite well, in some respects they make the problem worse because they all go into your inheritance pot and if you’re above a certain figure, most of which is the house, you’re going to get whacked at 40% for it, it’s a great incentive to save money isn’t it?

ISA Saver, Male, Surrey, 66-79

3.5 Personal attitude

Attitudes towards saving, often generated since childhood and through following parental example, can act as barriers to savings. Non-savers, as well as irregular savers, often referred to themselves as lazy or as ‘happy-go-lucky’, or as preferring to live for the day. Non-savers tended to be more impulsive and did not like to plan in advance, and this attitude often translated into their financial management.

Case Study: Gary

Gary is a 39 year old single man living in Birmingham. He earns a salary of £15,000 per annum, but when starting his new job in children’s care recently, he changed from a weekly to a monthly salary for the first time. He spends what he earns on his six children as well as his part-time DJ business and clubbing, and has no savings. During the interview he repeatedly stated that he ‘lives for the day’ and has done since he was young:

“I don’t know because I've always had the sort of, even from a young age, I've always had the, you never know what’s happening tomorrow, so enjoy it. I’ve got this fairly happy go lucky spirit as well, which probably isn’t an excuse, I know it’s not, it’s how I am. I’d rather spend and enjoy than save and not enjoy. Do you know what I mean, if that makes sense?”

However, some participants acknowledged that this mindset was not a sufficient excuse for not saving, as they understood what the benefits of saving are and what it could mean for them.

3.6 Time of year

Non-savers regularly reduced savings at different times of the year when other financial commitments hampered their ability to save. These tended to be focussed around buying gifts at Christmas and for birthdays, as well as quarterly bills:

make the school wait, so I can sort out the children and the nieces and nephews and everything. So it’s usually leading up to Christmas. That three month period of November, December, January, where it’s always, you can’t do that.

4. Sources of Information

Summary Box: Sources of Information

Interviewees obtained information about different savings products from a variety of sources. These included newspapers and magazines, banks and building societies, friends, families and colleagues, as well as the internet

These information sources had an array of advantages and disadvantages. Newspapers and magazines and internet websites were seen as trusted sources of information on saving products as they were not thought to have an ‘agenda’ and, as a consequence, could be considered impartial. However, at the same time, perceptions of accessibility of the information provided varied, as some thought the financial terminology and jargon was difficult to understand.

Family and friends were perceived as an extremely useful source of information and advice, especially amongst younger participants. In

comparison with other sources of information and advice, these people were seen as more approachable and trustworthy. Independent financial advisors with whom relationships had been developed were also seen as trustworthy.

In contrast, employees in banks and building societies were viewed as untrustworthy, unapproachable and intimidating. Perceptions varied amongst those who had been banking with the same institution for some time, where trust had been built up over time.

Interviewees indicated that changes were necessary in the provision of information, especially with regard to the (dis)advantages of different products, the stock market, and the provision of more personalised information through financial check ups. There were mixed views about whether HMRC should be providing information on saving and saving products.

25

Figure 7: Sources of Information

Magazines & Newspapers

Banks & Building Societies Informal sources

Internet www.moneysupermarket.com

Which?

FT Sunday Papers

Annual financial “health check”

At cashier’s desk

Adverts Friends

Colleagues

Family

Information about savings products

4.1 Newspapers and magazines

A range of newspapers and magazines were mentioned by participants as good sources of information on saving products. These included the personal finance pages of the Sunday papers and the Financial Times during the week. While a few mentioned the tabloid papers as a source of information, with the exception of publications such as the Mail or the Express, these were not considered to go into the necessary depth that was felt to be needed to make financial decisions. However, some did state that they served to provide a useful, basic introduction to the subject. Some participants mentioned the ‘Which’ guides which compared returns on different saving products. Beyond this though, there was little awareness of other magazine titles that they could turn to, to find out more.

These newspapers and magazines were seen as a trusted source of

information on saving products as they were not thought to have an ‘agenda’ and as a consequence, could be considered impartial.

4.2 The internet

Participants believed that the internet was becoming an increasingly good source of information about saving products, in particular product comparison sites such as www.moneysupermarket.com. Again, the internet was felt to have similar advantages and disadvantages to newspapers - it was seen as an impartial source, but one that needed a certain level of knowledge to understand and interpret its contents.

Much of what appealed about the internet as a source of information was its convenience; participants stated that they could search for articles and sites as and when suited them.

Furthermore, for some, the internet appealed as they did not have to speak with someone about financial matters; a subject which they considered to be daunting. In this sense, the remoteness of the internet was seen as an advantage.

However, by those that were less experienced or confident with regard to savings and investment, the internet was seen as a daunting source of information. This was largely due to the fact that they did not believe that they had the necessary knowledge to refine their search terms when seeking information. Consequently, many different sites were returned to them and they had difficulties deciding which to look at in more detail and which could be trusted.

Alongside this, the fact that participants were unable to clarify issues over which they were unsure was cited as a negative factor regarding this channel of information.

4.3 Friends and family

Family and friends were felt to be an extremely useful source of information and advice, especially amongst younger participants. They felt that they were able to benefit from those who were older, who tended to have more

experience of financial products. Furthermore, in comparison with other sources of information and advice, friends and family were seen as more approachable and trustworthy.

Some participants had family or friends working in financial institutions or in a financial profession such as an accountant. Again these were seen as good and ‘free’ sources of information and advice.

With my brother working in the bank it does help because he can advise me on bits and bobs as time goes on. Obviously I ask him where’s the best place, what’s the best thing to do with X, Y and Z if I’ve got it, and he advises me

accordingly.… As long as I’ve got the

They’ll always give me advice whatever happens; they’ve been around me for a while.

ISA Saver, Female, London, 18-30

Friends were thought to motivate people to save in the first place, through informal conversations about recent financial decisions which they have taken.

I wasn’t planning about it but in conversation with friends you think, I ought to be doing something about this, you know? I’ve got spare money, I’ve got money I could save and all the time you don’t, you spend it, don’t you?

ISA Saver, Female, Surrey, 51-65

4.4 Banks and Building Societies

Many participants admitted to being intimidated by banks and building societies. This was a result of the information provided by these

organisations, which was felt to be full of jargon and accompanied by plenty of small print. Participants often felt confused by this, describing it as off-putting and irrelevant. They did not just focus on written information here- both face to face and telephone contact was also sometimes difficult to understand.

However, there were participants who were more positive about banks as a source of information. These tended to be longer term customers who had an existing relationship with the bank or building society, often of many years standing. They also recalled experiences of banks and building societies helping them in the past and could not see any reason to doubt the

information provided more recently. These participants also tended to have good control over their financial situation and were confident in approaching the bank for advice.

Newer customers, on the other hand, tended to think that banks and building societies were dominated by ‘pushy and flashy’ salespeople who were

selective in the information they provided. These salespeople were perceived to have little overall knowledge of saving products and in some cases would mis-inform customers about the product features.

When we were thinking about taking the ISA out, we had somebody, a financial advisor come from the xxx. …They were only talking about xxx, and they firmly wanted us to do the stocks and shares because it was a better return. …I looked her straight in the eye and I said, you’re telling me all the benefits but you’re not saying what I could lose. And she didn’t answer at first, so I said, so you’re saying I could lose money then? And she says, well yes.

To illustrate, a few customers perceived that the repayment programmes on loans were not clearly explained to them beforehand while others stated they were confused about the APR on their credit cards and how this affected what they owed. These customers also thought that banks and building societies would only sell their own products, without considering what is right for the customer.

I think it’s not knowing where to put the money, to be honest. It’s, we’ve discussed yes we need to save but haven’t actually got round to doing anything because I don’t think we specifically know, and then if we do go and get financial advice it’s all quite confusing and I’m not very OK with all that kind of thing.

Non-ISA Saver, Female, Birmingham, 31-50

4.5 Other sources of information

Some of the self employed interviewed used an accountant for their business matters and approached them to help with deciding on a saving product. Others also had independent financial advisers (IFAs) that they approached for advice.

These sources of information were often seen as trusted because previous relationships had been built up over time. In the first instance, accountants and, in particular, IFAs were often recommended to participants by friends, family or business associates and this acted as a strong incentive to trust their advice.

Beyond this though, the fact that they charged for their advice meant that their recommendations were believed to be credible. It was believed that, out of a desire to protect their own reputation, they would not advise their clients to invest in a product that would not meet their needs.

4.6 Obtaining more information

31

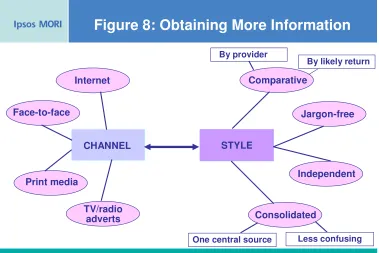

Figure 8: Obtaining More Information

Internet

Face-to-face

Print media

TV/radio adverts

CHANNEL STYLE

Comparative

Jargon-free

Independent

Consolidated By provider

By likely return

One central source Less confusing

In particular, there were calls for:

The provision of information on advantages and disadvantages of different financial products;

Information about the performance of the stock market and how to go about investing money in it and the types of stock that can be invested in;

Free financial health checks to examine the current state of the individual’s finances and how it could be improved.

Underpinning these suggestions was a requirement for more personalised information that could tell participants what impact a saving product would have on their own financial situation.

I don’t understand what an ISA is. …I find that in the building societies, the adverts, the ISAs, they don’t explain things to you, so where are you supposed to get the information? I'm busy, busy, busy. I come home, I don’t want to have to find out information, I’d rather it be there to hand. And sometimes it’s hard to find out information about different savings.

Non-ISA saver, Female, Manchester, 51-65

Participants also wanted comparative information by both providers and by likely return.

In practice, what they meant by this was showing how an example investment might accumulate over a given period if the money were left untouched. The subject of most interest to participants was how any given investment might accumulate and, as such, it was this issue on which they wanted clear, and comprehensible, information.

4.7 The role of HMRC in providing information on

saving

There were mixed views about whether HMRC should be providing information on saving and saving products. On the positive side, it was thought that any information it would provide would be credible, independent and trusted – at least more than other sources such as banks who were often perceived as selling their own products to make money.

However, some participants believed that HMRC should only provide ‘background’ information on savings - such as product definitions and the advantages of savings, rather than advice on differences between providers’ products.

Others questioned HMRC’s and, more generally, the Government’s ability to provide sound, financial information. Past problems such as endowments and the recent issues over whether the provision of information on pensions was accurate were cited as illustrations of this.

Other participants could not see why HMRC would provide information on saving. Participants thought that, as a tax collecting organisation, it was not the department’s role to provide such information and probably did not have the organisational capability anyway.

5. Awareness and Understanding of

ISAs

Summary box: Awareness and understanding of ISAs

General awareness of the basic principles relating to ISAs was good amongst savers, though even basic knowledge was variable amongst non savers and irregular savers.

Attitudes to cash and stocks and shares ISAs varied considerably. Cash ISAs were liked because they are tax-advantaged, risk-free, easy to understand and offering better savings opportunities than other non stock-based savings products. When ISAs are offered by trusted providers with whom savers have other products, this trust is transferred to their decision to invest in cash ISAs as a saving product. Investing in cash ISAs promotes saving - for some of the products available, access is perceived to be limited or slightly more restricted than other savings accounts. There is varied evidence that investing in cash ISAs leads to the development of improved financial management skills. For example, whilst some savers monitored their savings, many savers were not aware of how long these accounts had been open for, and how much money was saved.

In contrast, awareness of stocks and shares ISAs was limited. Amongst those who do not have an stocks and shares ISA, they are perceived as risky with an unreliable return. Some savers had experienced loss on money invested in stocks and shares ISAs. However, those using these ISAs believe that they offer a better rate of return, and provide an introduction to and flexibility in investing in the stock market. Improved financial literacy was experienced amongst only those who chose how this money would be invested in the stock market.

This chapter compares perceptions and awareness of cash ISAs on one hand, and stocks and shares ISAs on the other. Generally savers using these products had a better understanding about ISAs than non or irregular savers. Cash ISAs were more popular than stocks and shares ISAs.

5.1 General awareness of ISAs

Most savers were aware that ISAs are saving products with set limits on how much can be invested each financial year, though this knowledge was more variable amongst those who do not save regularly. Among the savers, there were also good levels of awareness that the limit for investment ran to the same dates as the tax year and not the calendar year.

There was generally high awareness that ISAs are tax -advantaged saving products, although again, even this basic knowledge was variable amongst non-savers. Beyond this, there was uncertainty about what the different types of ISAs are and, although participants were aware of terms such as a Mini and Maxi ISA, unless they were savers in them there was uncertainty as to what this meant. Only a few made the point that ISAs had, in effect, replaced PEPs. This knowledge was limited to those that had been saving for some time.

Few participants made any links between ISAs and the role of HMRC. They were simply seen as a financial product, which had little to do with the government. The fact that they were a government-supported product made minimal impact on whether individuals chose to invest in them. While

government is not trusted entirely, it is trusted more than other private

companies and banks in particular, so some suggested that emphasising the links between the government and ISAs would have a positive impact.

5.2 Attitudes towards cash ISAs

As illustrated in Figure 9, there were a number of attitudes towards cash ISAs.

36

Figure 9: Attitudes to cash ISAs

Risk free

Easy to understand

Easy to access – when you need to

Flexible

Higher rates of interest than with other savings

Tax free

Maximum levels of investmentEncourages financial management

You are in control

Certainty over return

These included:

Risk free. Much of what appealed about Cash ISAs were that they were seen as a risk free investment. This was due to the fact that the return was seen as being dependent on interest rates alone – which were not believed to fluctuate too much – and not on the stock market. Participants often talked about how they had lost out on saving

products and investments in the past such as pensions and

endowments. As a consequence they wanted a financial product they could trust. Additionally cash ISAs provide a savings option over which savers had some control;

Offered by providers well known to them. Positive perceptions of the provider tended to help to increase trust in ISAs, though trust tended to be associated with the provider rather than the product itself. Many participants opted for Cash ISAs offered by their local building societies rather than large banks, as they were believed to be more local and more likely to act in the interests of customers. Others took out ISAs with other financial institutions, most notably insurance providers, with whom they already had a relationship (most household contents insurance);

Easy to understand. The terms and conditions of cash ISAs were thought to be easy to understand once interviewees had read up about them, or had had them explained. As many participants lacked confidence and believed they did not have the skills, experience and knowledge when it came to financial matters, a product they could make sense of was appreciated. For example, many recalled there was a maximum level of investment of around £3,000 per annum as this was an easy figure to remember;

Better than other saving products. Cash ISAs were perceived to offer and provide higher rates of interest than other saving products. For some this was only when the tax-advantage was taken into account, but others noted that rates of interest are often better on cash ISAs, even when not allowing for this. Amongst savers who had numerous diversified savings products, the cash ISA fulfilled the role of a higher interest savings account supplementing other higher growth investments;

5.3 Attitudes towards stocks and shares ISAs

As highlighted in Figure 10, in comparison to cash ISAs, awareness and attitudes towards stocks and shares ISAs differed considerably.

41

Figure 10: Perceptions of stocks and

shares ISAs

High risk

Unsure of return

Only for the financially astute

Loss of control

Too much choice

Worth the risk

Individual decisions

Increases financial literacy

Can play it safe

and spread the

risk

Knowledge and awareness of stocks and shares ISAs was much lower than cash ISAs. To highlight, many participants did not know they could use ISAs to invest in stocks and shares – including current savers in cash ISAs. Moreover, those that felt able to speak in more depth on stocks and shares ISAs still displayed some confusion with some participants perceiving that the term ‘wrapper’ was a feature of stocks and shares ISAs alone and one which was not applicable to cash ISAs.

However, there were a number of features associated with stocks and shares ISAs.

More flexibility. Stocks and shares ISA savers appreciated the choice that was afforded to them through the product. They liked the fact they were able to choose what stocks and shares to invest in, and as a consequence felt more in control of their money.

Increases financial literacy. For some savers, being able to choose which stocks and shares to invest in also allowed stocks and shares ISA savers to become more knowledgeable about financial matters. They also tended to read up on the financial pages in newspapers, which in turn allowed them to get a better sense of what they should invest in. However, there were also savers who enjoyed being a