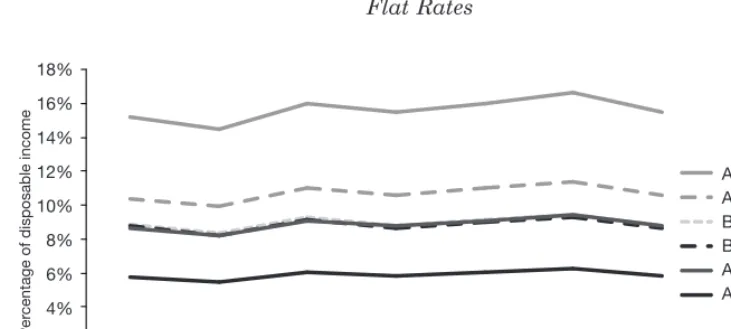

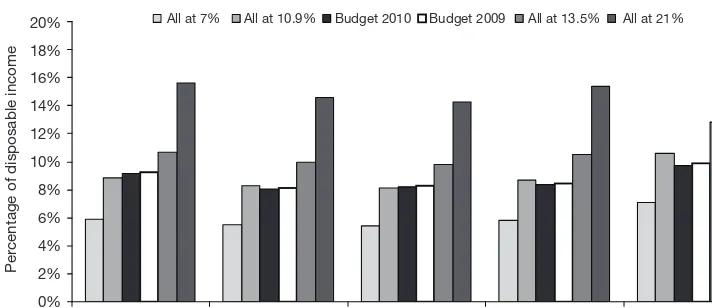

The Distributional Effects of Value Added Tax in Ireland

Full text

Figure

Related documents

Learning local image descriptors with deep siamese and triplet convolutional net- works by minimising global loss functions.. Deeper

On the other hand, the processing method and ingredients used in the production of bread was learnt in order to yield high quality of bread that satisfy the needs of

type IDREF audioProgrammeName type string audioProgrammeLanguage type language strart type adm:timecodeType end type adm:timecodeType typeLabel type sting typeDefinition type

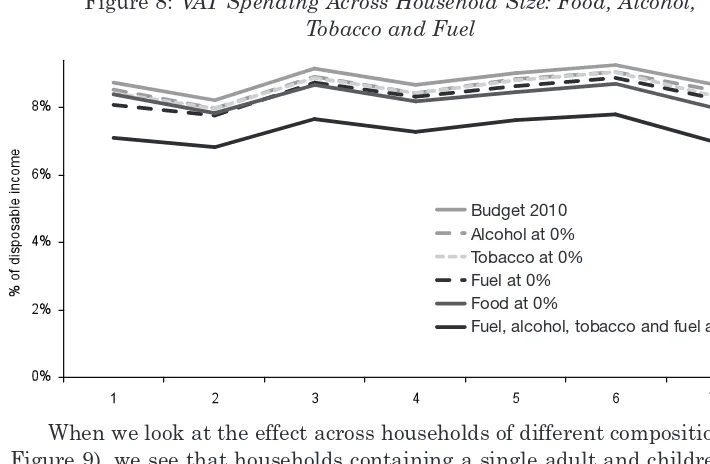

In conclusion, all three groups examined in this study, namely people living in households with three or more children, in households that have at least one member with income

Sustainable Economics – The research focus of this programme includes studies on interrelationship between economic growth and development with environment, economic development and

In case of satellite broadcasts it is possible to record the sessions and make the recordings available at the regional centres for students unable to participate at the

Because the Sig F (p-value) is much smaller than 0.05, this regression model reflects that independent variables (sensory experience, emotional experience, and

Time until Repayment (months) (a) (should include grace